Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - CVR ENERGY INC | d275307d8k.htm |

Deutsche Bank US Independent Refining Conference

January 5, 2012

Exhibit 99.1 |

1

1

1

1

1

Forward-Looking Statements

This

presentation

should

be

reviewed

in

conjunction

with

CVR

Energy,

Inc.’s

Third

Quarter

earnings

conference

call

held

on

November

3,

2011.

The

following

information

contains

forward-looking

statements

based

on

management’s

current

expectations

and

beliefs,

as

well

as

a

number

of

assumptions

concerning

future

events.

These

statements

are

subject

to

risks,

uncertainties,

assumptions

and

other

important

factors.

You

are

cautioned

not

to

put

undue

reliance

on

such

forward-looking

statements

(including

forecasts

and

projections

regarding

our

future

performance)

because

actual

results

may

vary

materially

from

those

expressed

or

implied

as

a

result

of

various

factors,

including,

but

not

limited

to

(i)

those

set

forth

under

“Risk

Factors”

in

CVR

Energy,

Inc.’s

Annual

Report

on

Form

10-K,

Quarterly

Reports

on

Form

10-Q

and

any

other

filings

CVR

Energy,

Inc.

makes

with

the

Securities

and

Exchange

Commission,

and

(ii)

those

set

forth

under

“Risk

Factors”

and

“Cautionary

Note

Regarding

Forward-Looking

Statements”

in

the

CVR

Partners,

LP

Prospectus

and

any

other

filings

CVR

Partners,

LP

makes

with

the

Securities

and

Exchange

Commission.

CVR

Energy,

Inc.

assumes

no

obligation

to,

and

expressly

disclaims

any

obligation

to,

update

or

revise

any

forward-looking

statements,

whether

as

a

result

of

new

information,

future

events

or

otherwise.

TM |

2

2

2

2

2

Management Attendees

Jack Lipinski

Chief Executive Officer

Ed Morgan

Executive Vice President of Investor Relations

Jay Finks

Director of Finance

TM |

Gary-Williams Acquisition Summary |

4

4

4

4

4

Transaction Overview

CVR Energy, Inc. acquired Gary-Williams Energy Corporation for $607

million including working capital

Gary-Williams’

primary asset is a 70,000 barrels-per-day (“bpd”) refinery

located in Wynnewood, Oklahoma

–

Complexity rating of 9.3

We funded the transaction primarily with cash, combined with

approximately $200 million of senior secured financing

–

$643 million in balance sheet cash at Coffeyville Resources as of

September 30, 2011

(a)

We increased our existing asset based credit facility to $400 million

Transaction closed December 15th

(a)

$643 million is net of cash at CVR Partners, LP.

TM |

5

5

5

5

5

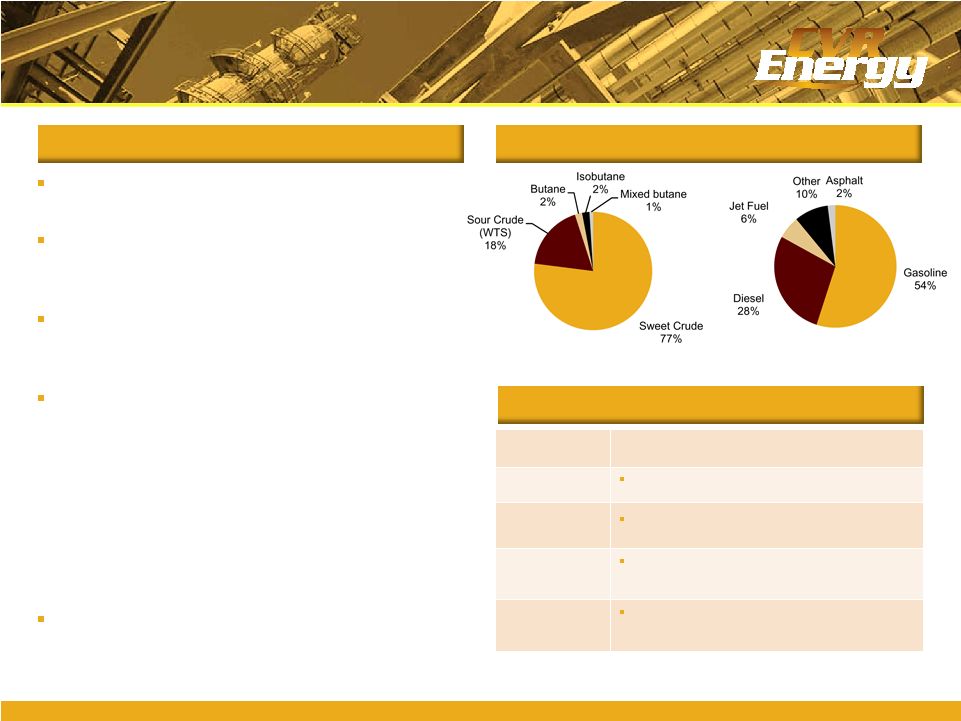

Summary

LTM Feedstock and Product Slate

Asset Improvement Opportunities

Wynnewood Refinery Overview

Note: LTM as of September 30, 2011.

70,000 bpd of crude throughput capacity

–

9.3 complexity

Produces a full slate of gasoline, diesel,

asphalt, jet fuel, LPG and specialty products

–

97.5% liquid product yield

Strategically located in Group III of PADD II

–

Access to cost-advantaged, WTI

price-linked crude oils

Approximately 60% of products sold directly

into the local Oklahoma market

–

Approximately 12,000 bpd of gasoline and

ULSD sold via truck rack

–

Approximately 4,000 bpd of JP-8 sold via

truck rack

–

Remaining volumes distributed

throughout Mid-Continent region via

Magellan Pipeline

Over $100 million invested to upgrade and

optimize the facility since 2007

Project

Opportunity

Logistics

Opportunity to share feedstocks based on unit

economics

Crude slate

Optimize crudes to improve consumed crude

differentials and improve realized refining margin

Rail options

Wynnewood connected to a BNSF main line

–

Property can accommodate new track and

off-take infrastructure

Storage options

Currently 2 million barrels of storage

–

Sufficient land for significant additional

storage / blending tanks

TM |

6

6

6

6

6

Acquisition Rationale

High quality asset increases CVR’s scale and operational diversity

–

Pro forma company will have approximately 185,000 bpd of throughput capacity

and weighted average complexity of approximately 11.5

Strategically positioned in attractive Mid-Continent region

–

Located in the highly fragmented and historically underserved Group III, PADD II

region (same as CVR)

Significant opportunities to enhance consolidated operations

–

Ability to expand CVR’s existing crude oil gathering business, diversify

GWEC’s crude slate, leverage our marketing capabilities, reduce

duplicative SG&A Enhances financial strength and flexibility

–

Improves credit profile by expanding processing capacity and diversifying asset

base (CVR will no longer be a single asset refiner)

Favorable spread environment and positive industry outlook

–

WTI/LLS and WTI/Brent pricing dynamics continue to provide favorable Mid-

Continent

refining

environment

due

to

the

limited

crude

pipeline

capacity

to

Gulf

Coast (even post Seaway reversal)

TM |

7

7

7

7

7

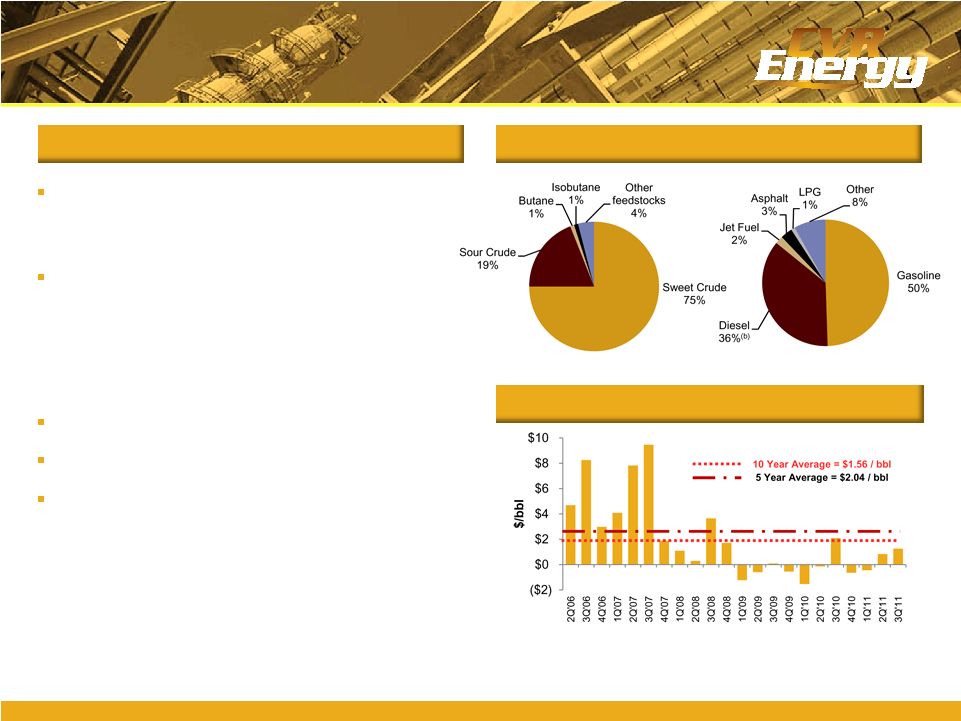

Pro Forma Company Overview

Two top-tier Mid-Continent refineries

–

115,000 bpd Coffeyville, Kansas refinery

–

70,000 bpd Wynnewood, Oklahoma Refinery

A nitrogen fertilizer plant using pet coke

gasification

–

Rated capacity of 1,225 tpd ammonia; 2,025 tpd

UAN Nitrogen

–

Current $100.0 million expansion ongoing to

increase UAN capacity by 400,000 tons

Operates in higher margin markets

Logistics assets supporting both businesses

Financial flexibility

Pro Forma LTM Feedstock & Product Slate

(a)

PADD II –

Group 3 Basis

CVR Energy: About Us

Note: LTM as of September 30, 2011.

(a)

Pro forma based on weighted average of refinery capacity.

(b)

CVR distillate assumed to be diesel for pro forma.

TM |

8

8

8

8

8

(a)

100%

of

capacity

in

Wood

River,

IL

refinery

JV

consolidated

(50%

ownership

interest).

(b)

Includes 50% interest in JV in Toledo, OH refinery.

Source: EIA and Wall Street research

PADD

II

Consolidated

Refinery

Statistics

–

By

Owner

“Top Quartile”

Consolidated Asset Profile

PADD II Refiners

Well Positioned to Compete in

Underserved PADD II Region

TM |

9

9

9

9

9

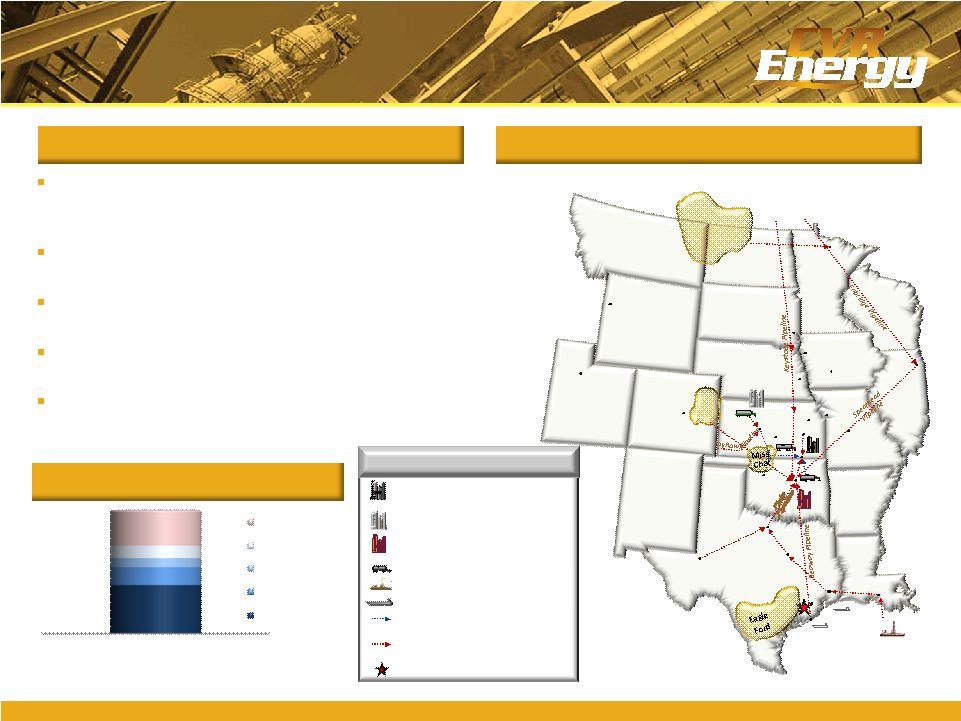

Consolidated Supply Network

Consolidated Marketing Network

Extensive Crude Oil Supply and

Product Distribution Network

Major Canadian Crude Oil Pipelines

Terminals

Third-Party Refined Product Pipelines

Wynnewood Refinery

Coffeyville Resources Refining &

Marketing and Nitrogen Fertilizer

Wynnewood Exchange Terminals

CVR Crude Oil Pipelines

Third-Party Crude Oil Pipelines

Wynnewood Related Pipelines

CVR Headquarters

TM |

10

10

10

10

10

2.7

1.0

0.5

0.7

2.0

GWEC assets

Refinery

Gathering

Cushing Owned(a)

Cushing Leased

Logistics Overview

Operations Map

Logistics Drives Profitability

(a)

Under construction.

Located 100 miles from the global crude hub of

Cushing, CVR has access to global crudes with

storage to optimize purchasing and crude slates

Shipper status of 35,000 bpd on Spearhead and

Keystone Pipelines

37,000+ bpd crude oil gathering system serving

Kansas, Oklahoma, Missouri and Nebraska

145,000 bpd proprietary pipeline system to

transport crude to the Coffeyville refinery

Currently constructing an additional one million

barrel storage facility in Cushing

Coffeyville Resources

Refining & Marketing and Nitrogen

Fertilizer

Coffeyville Resources Refined Fuel

Products / Asphalt Terminal

Wynnewood Refinery

Coffeyville Resources Crude

Transportation

Offshore Deepwater Crude

Foreign Crude

Coffeyville Resources Crude Oil

Pipeline

Third-Party Crude Oil Pipeline

CVR Energy Headquarters

Legend

Total 6.9 mm bbls

Canada

Texas

Louisiana

Arkansas

Oklahoma

Missouri

Iowa

Nebraska

South Dakota

North Dakota

Wyoming

Montana

Utah

Minnesota

Illinois

Houston

Freeport

Shidler

Kansas City

Cushing

Bartlesville

Corsicana

Nederland

Sugar Land

Houma

Midland

Broome

Humboldt

Columbia

Des

Moines

Sioux Falls

Sioux City

Omaha

Oklahoma City

Tulsa

Topeka

Coffeyville

Plains

Pipeline

Wichita Falls

Colorado

Kansas

Winfield

Valley Center

Wichita

Plainville

Phillipsburg

Denver

Clearbrook

Flanagan

New Mexico

Bakken

Wisconsin

DJ

Basin

Salt Lake City

Jackson

PF Crude Storage Owned / Leased

TM |

11

11

11

11

11

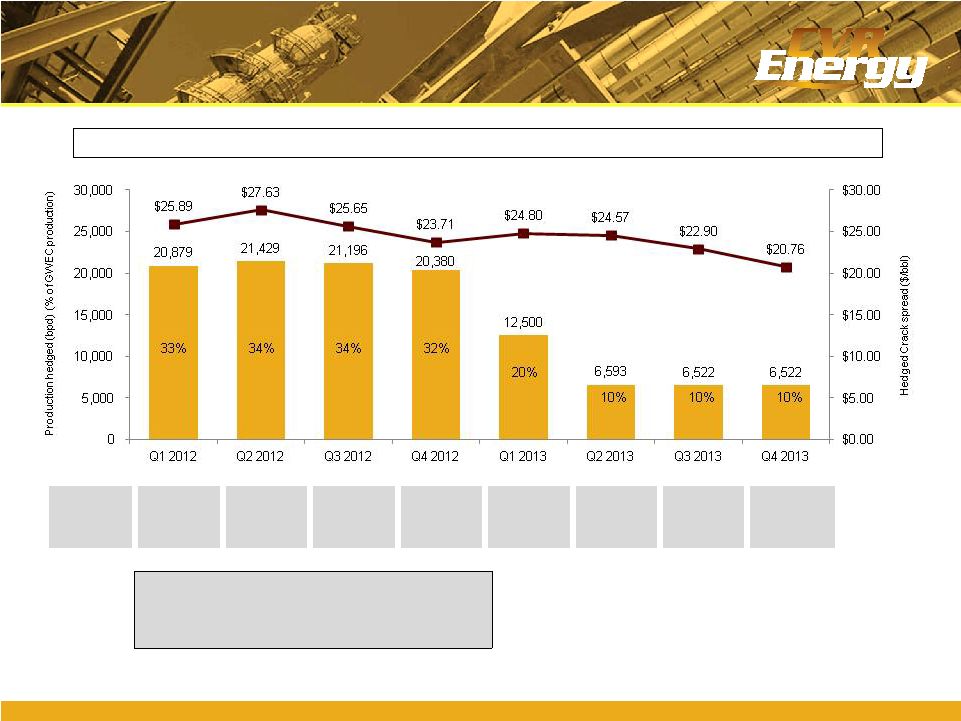

Hedging Activity

Note:

Based on 11/28 market data.

Locked

Gross

Margin

$49.2

$53.9

$50.0

$44.5

$27.9

$14.7

$13.7

$12.5

2012 Total Locked Gross Margin

$197.5

2012 Total Locked Margin per Barrel

$3.42

CVR has an estimated $50.9 million unrealized gain based on 11/28 market data

TM |

12

12

12

12

12

Post-closing Value Enhancement

Initiatives

Integrate and optimize operations with existing businesses

–

Expand existing crude oil gathering business to supply lower cost, local

crude to Wynnewood refinery

–

Proximity of plant is a benefit to managing feedstocks

Increase ability to optimize Sour / Heavy Sour processing

–

CVR has 35,000 barrels per day capacity on pipelines from Canada

–

Ability to substitute Heavy Canadian Sour for Domestic US Sour

–

All crudes priced off WTI

SG&A synergies exist

TM |

13

13

13

13

13

Projected Synergies and Improvements

(a)

Assumes realization at beginning of year.

Synergies

Assumptions

Amount ($mm)

(a)

Crude Rate Increase

4,000 bpd to 67,000 bpd in non turnaround years

$16.3

Overall Crude Differential

$0.50/bbl on crude rate

7.9

Reduce Trucked Crude Freight

$0.50/bbl on 10,000 bpd

0.9

Product & Feedstock Optimization Between Refineries

Assumes improvement of $1.50/bbl on 2,000 bpd

1.1

SG&A Improvements / Optimizations

Shared services, personnel realignment & general savings

5.0

Miscellaneous

Sum of small improvements & optimizations

1.2

Total

$32.4

2012E Projected Synergies

TM |

Coffeyville Overview |

15

15

15

15

15

Summary

LTM Feedstock & Product Slate

(a)

Management’s Proven Track Record

Coffeyville Refinery Overview

(a)

LTM as of September 30, 2011.

115,000 bpd of crude throughput capacity

–

12.9 complexity

High complexity refinery producing gasoline,

distillates, specialty products and petroleum coke

Strategically located in Group III of PADD II

–

Access to cost-advantaged, WTI price-linked

crude oils

–

100 miles from Cushing, Oklahoma

Sales and distribution

–

Rack marketing division supplies products

through tanker trucks

–

Bulk sales into Mid-Continent markets via

Magellan and into Colorado and other

destinations via product pipelines owned by

Magellan, Enterprise Products Partners and

NuStar

$521 million invested in refinery between 2005

and

2009

Two-phase turnaround complete in Q1 2012

2005 (Acquisition year)

Current

Operational

Upgrades

Launched $521 million of

upgrades

Now, most flexible

Mid-Con refinery

Crude and

Feedstock

Throughput (bpd)

98,300

115,140

(a)

Feedstock

flexibility

No heavy sour

Up to 25k bpd

Complexity

9.5

12.9

Gathered Barrels

Capacity (bpd)

~7,000

37,000+

TM |

16

16

16

16

16

Overview

Historical & Projected Canadian Production

Historical & Projected Bakken Crude Production

Access to WTI Priced Crudes

(a)

Source: Canadian Association of Petroleum Producers June 2011 publication.

Source: Wood Mackenzie Upstream Service database

Both refineries benefit from the current WTI-Brent spread

WTI price-linked crudes are currently trading at

historically wide discounts to crudes, such as Brent

and

LLS

Growing production from the U.S. Bakken and Canada

flowing into Cushing, OK is contributing to this

differential

Expected pipeline capacity (Seaway reversal) necessary

to move production from Cushing to the Gulf Coast

projected to move only 400k bpd by 2013

87.6

102.1

132.7

142.3

201.8

262.9

313.1

340.0

362.4

0

100

200

300

400

2006

2007

2008

2009

2010

2011

2012

2013

2014

Bakken Crude Production

(thousand barrels per day)

Historical WTI-Brent Spread ($/bbl)

TM |

17

17

17

17

17

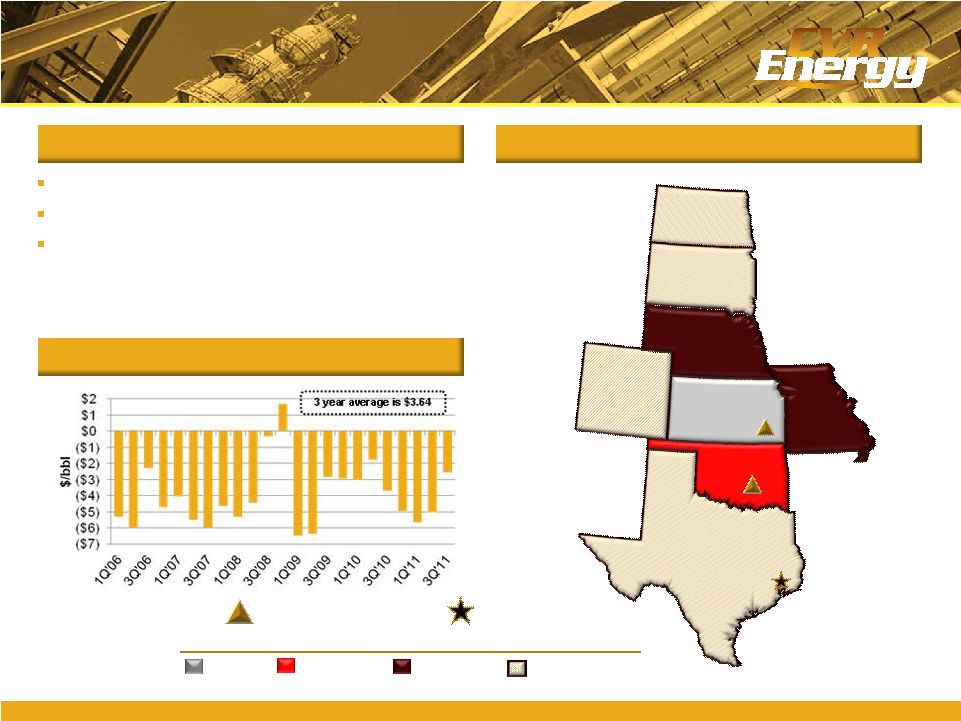

Overview

Asset Map

Total Consumed Crude Discount to WTI

Crude Gathering

Gathered 7,000 bpd in 2005

Today gathering 37,000+ bpd

Growth

target

10%

–

20%

per

year

for

the

next

2

–

5

years

Texas

Oklahoma

Missouri

Nebraska

Kansas

Colorado

South Dakota

North Dakota

Barrels Gathered Per Day –

LTM Q3 2011

15,000+

Up to 10,000

Up to 1,000

Refining Operations

Corporate

Headquarters

Growth Prospects

TM |

Nitrogen Fertilizer MLP |

19

19

19

19

19

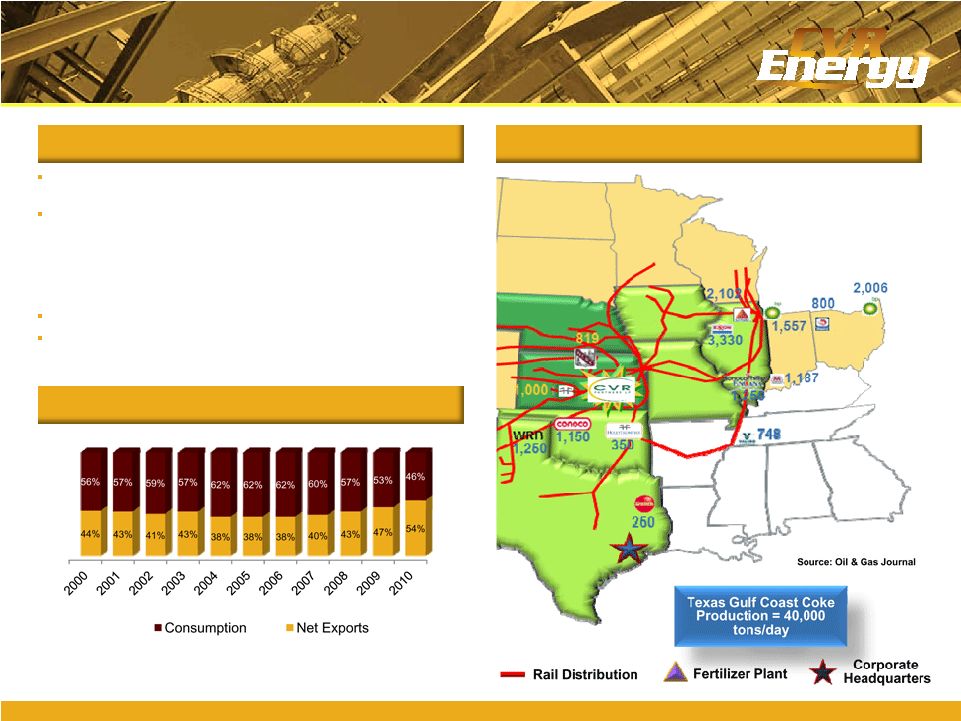

Overview

Fertilizer Operations

Strategically Located Assets and Logistics

Located in the corn belt

(on Union

Pacific

mainline)

45% of corn planted in

2010 was within $35/UAN

ton freight rate of our

plant

$25/ton transportation

advantage to corn belt vs.

US Gulf

Coast

No intermediate transfer,

storage, barge freight or

pipeline freight charges

Rail Distribution

LTM Q3 2011 Tons Sold by State

100,000+

10,000 to 100,000

Up to 10,000

Corporate

Headquarters

Fertilizer Plant

LTM Q3 2011 Total Tons Sold ~ 731,500

TM |

20

20

20

20

20

Overview

Abundant Supply of Third-party Pet Coke

US Pet Coke Exports and Consumption

Stable & Economic Feedstock

Source: EIA

CVR Partners LP 2008 –

2010 average daily coke demand ~ 1,378

tons/day

Coke gasification technology uses petroleum coke as a feedstock

–

Pet coke costs lower than natural gas costs per ton of ammonia

produced, and pet coke prices are significantly more stable than

natural gas prices

–

Over 70% of pet coke supplied by refinery through long-term

contract

Dual train gasifier configuration ensures reliability

Ammonia synthesis loop and UAN synthesis use same processes as

natural gas based producers

TM |

21

21

21

21

21

Market Fundamentals

Farmer Profitability Supports Fertilizer Pricing

Corn consumes the largest amount of nitrogen fertilizer

Farmers are expected to generate substantial proceeds at currently forecasted corn

prices Farmers are still incentivized to apply nitrogen fertilizer at corn

prices lower than current spot Nitrogen fertilizer represents a small

percentage of a farmer’s input costs Note: Fixed Costs include labor,

machinery, land, taxes, insurance, and other. *As of Dec. 20, 2011

Source: CIQ

*As of Dec .20, 2011

Source: CIQ, USDA

TM |

22

22

22

22

22

Market Fundamentals

Strong Pricing Environment

($ per Ton)

Historical U.S. Nitrogen Fertilizer Prices

0

100

200

300

400

500

600

700

800

900

1,000

1999

2000

2001

2002

2004

2005

2006

2007

2009

2010

2011

Ammonia

$686

UAN

$352

Southern Plains

Ammonia

Corn Belt UAN

5-Yr Average Southern

Plains Ammonia

Source:

Green Markets Data, Fertecon

5 Yr. Avg.

UAN $163

5-Yr Average

Corn Belt UAN

5 Yr. Avg.

Ammonia $283

5 Yr. Avg.

Ammonia $493

5 Yr. Avg.

UAN $312

TM |

Financial Highlights |

24

24

24

24

24

EBITDA by Operating Segment ($mm)

Capital Expenditures ($mm)

Refining Margins and Expenses ($/bbl)

Fertilizer Prices ($/Ton)

Key Historical Financial Statistics

CVR Energy Standalone

Note:

Adjusted Petroleum EBITDA represents petroleum operating income adjusted for FIFO

impacts, share-based compensation, loss on disposal of fixed assets, major

scheduled turnaround expenses, realized gain and losses on derivatives, net,

depreciation and amortization and other income or expenses. Adjusted Fertilizer EBITDA

represents nitrogen fertilizer operating income adjusted for share-based

compensation, loss of disposal of fixed assets, major scheduled turnaround expenses,

depreciation and amortization and other income or expenses.

(a)

Direct opex per barrel excludes turnaround.

TM |

25

25

25

25

25

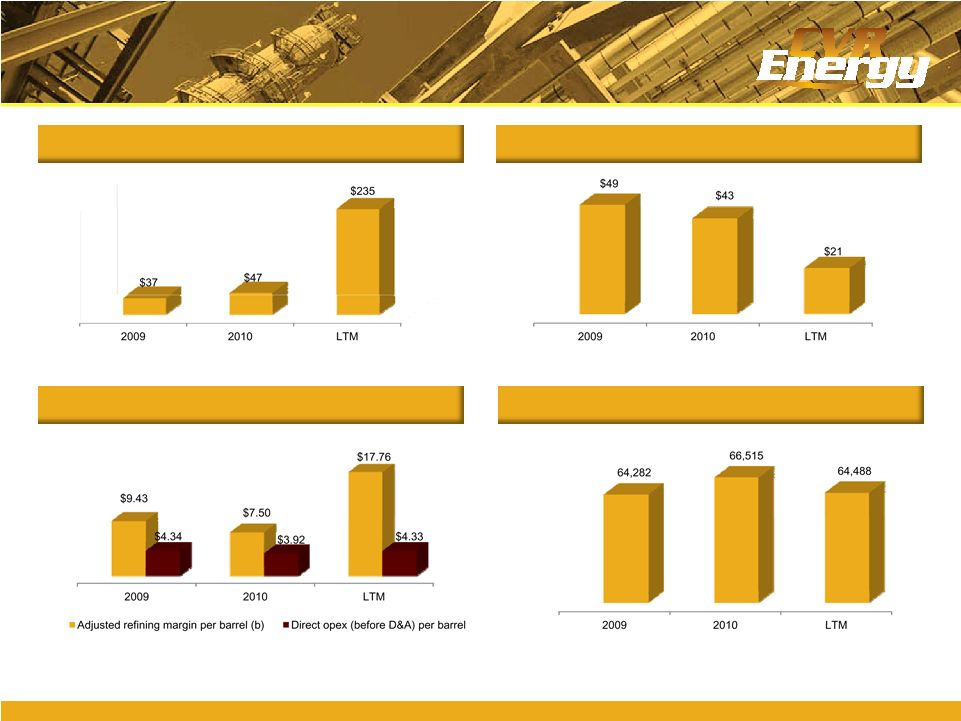

Adjusted EBITDA ($mm)

(a)

Capital Expenditures ($mm)

Refining Margins and Expenses ($/bbl)

Total Throughput (bpd)

Key Historical Financial Statistics

Gary Williams Standalone

(a)

Adjusted EBITDA represents GWEC operating income adjusted for FIFO impacts, major

scheduled turnaround expenses, realized gain and losses on derivatives, net,

depreciation and amortization and other income or expenses.

(b)

Adjusted refining margin per barrel is equal to gross operating margin adjusted for

FIFO inventory gains or losses divided by crude throughput. TM

|

26

26

26

26

26

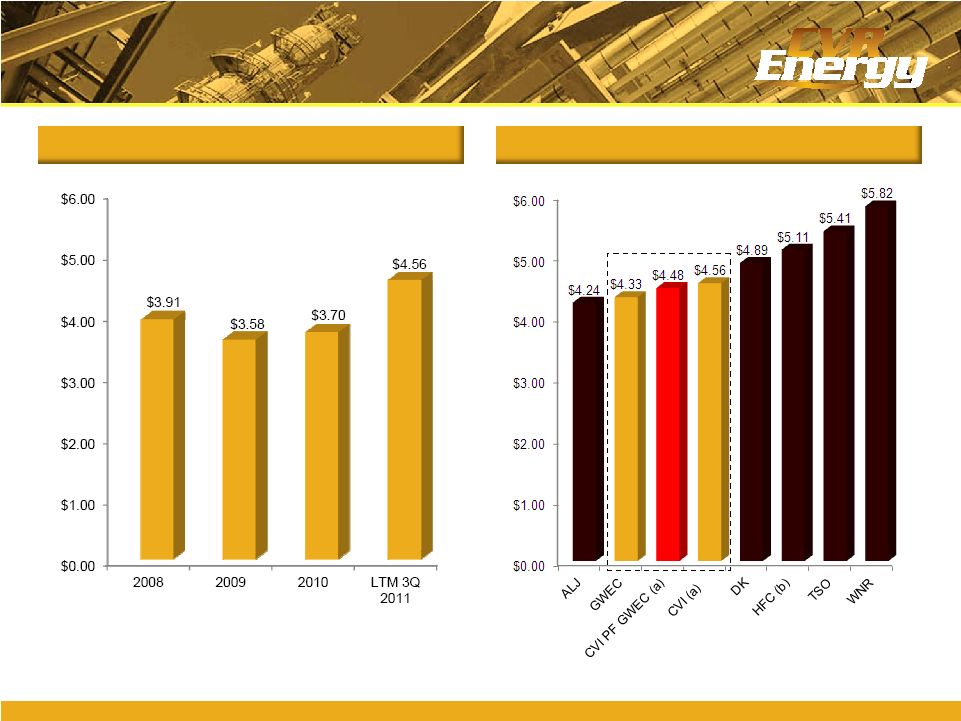

CVI Operating Expenses

(a)

($/bbl)

Q3’11 LTM Operating Expense ($/bbl)

Combined Company –

Controlled Operating Expenses

(a)

Excludes

turnaround.

CVI

PF

GWEC

based

on

weighted

average

crude

throughput.

(b)

HFC combined results from legacy companies 3Q 2011 report.

TM |

Appendix |

28

28

28

28

28

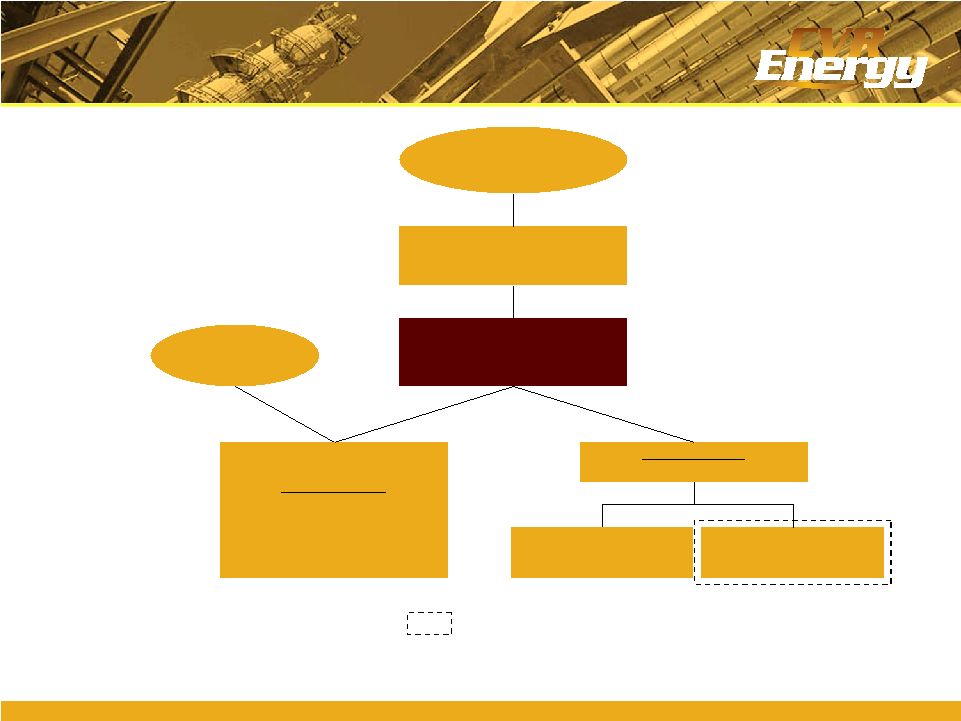

Pro Forma Organizational Structure

CVR Energy, Inc.

NYSE: CVI

Market cap: ~$2.2 bn

Coffeyville Resources, LLC

Fertilizer business

CVR Partners, LP

NYSE: UAN

Market cap: ~$1.8 bn

Refining business

~$809 mm LTM EBITDA

Public shareholders

Public unitholders

100%

100%

100% GP

69.7% LP

30.3% LP

Wynnewood Refinery (GWEC)

(Wynnewood, OK)

Coffeyville Refinery

(Coffeyville, KS)

100%

100%

Represents Acquisition

TM |

29

29

29

29

29

Non-GAAP Financial Measures

To

supplement

the

actual

results

in

accordance

with

U.S.

generally

accepted

accounting

principles

(GAAP),

for

the

applicable

periods,

the

Company

also

uses

certain

non-GAAP

financial

measures

as

discussed

below,

which

are

adjusted

for

GAAP-based

results.

The

use

of

non-GAAP

adjustments

are

not

in

accordance

with

or

an

alternative

for

GAAP.

The

adjustments

are

provided

to

enhance

the

overall

understanding

of

the

Company’s

financial

performance

for

the

applicable

periods

and

are

also

indicators

that

management

utilizes

for

planning

and

forecasting

future

periods.

The

non-GAAP

measures

utilized

by

the

Company

are

not

necessarily

comparable

to

similarly

titled

measures

of

other

companies.

The

Company

believes

that

the

presentation

of

non-GAAP

financial

measures

provides

useful

information

to

investors

regarding

the

Company’s

financial

condition

and

results

of

operations

because

these

measures,

when

used

in

conjunction

with

related

GAAP

financial

measures

(i)

together

provide

a

more

comprehensive

view

of

the

Company’s

core

operations

and

ability

to

generate

cash

flow,

(ii)

provide

investors

with

the

financial

analytical

framework

upon

which

management

bases

financial

and

operational

planning

decisions,

and

(iii)

presents

measurements

that

investors

and

rating

agencies

have

indicated

to

management

are

useful

to

them

in

assessing

the

Company

and

its

results

of

operations.

TM |

30

30

30

30

30

Non-GAAP Financial Measures (cont’d)

EBITDA:

EBITDA

represents

net

income

before

the

effect

of

interest

expense,

interest

income,

income

tax

expense

(benefit)

and

depreciation

and

amortization.

EBITDA

is

not

a

calculation

based

upon

GAAP;

however,

the

amounts

included

in

EBITDA

are

derived

from

amounts

included

in

the

consolidated

statement

of

operations

of

the

Company.

Adjusted

EBITDA

by

operating

segment

results

from

operating

income

by

segment

adjusted

for

items

that

the

company

believes

are

needed

in

order

to

evaluate

results

in

a

more

comparative

analysis

from

period

to

period.

Additional

adjustments

to

EBITDA

include

major

scheduled

turnaround

expense,

the

impact

of

the

Company’s

use

of

accounting

for

its

inventory

under

first-in,

first-out

(FIFO),

net

unrealized

gains/losses

on

derivative

activities,

share-based

compensation

expense,

loss

on

extinguishment

of

debt,

and

other

income

(expense).

Adjusted

EBITDA

is

not

a

recognized

term

under

GAAP

and

should

not

be

substituted

for

operating

income

or

net

income

as

a

measure

of

performance

but

should

be

utilized

as

a

supplemental

measure

of

financial

performance

in

evaluating

our

business.

First-in,

first-out

(FIFO):

The

Company’s

basis

for

determining

inventory

value

on

a

GAAP

basis.

Changes

in

crude

oil

prices

can

cause

fluctuations

in

the

inventory

valuation

of

our

crude

oil,

work

in

process

and

finished

goods,

thereby

resulting

in

favorable

FIFO

impacts

when

crude

oil

prices

increase

and

unfavorable

FIFO

impacts

when

crude

oil

prices

decrease.

The

FIFO

impact

is

calculated

based

upon

inventory

values

at

the

beginning

of

the

accounting

period

and

at

the

end

of

the

accounting

period.

TM |

31

31

31

31

31

Non-GAAP Financial Measures (cont’d)

CVR 9/30/11 LTM Adjusted EBITDA ($mm)

LTM 9/30/2011

Consolidated Net Income

$282.2

Interest expense, net of interest income

53.8

Depreciation and amortization

88.1

Income tax expense

181.5

EBITDA adjustments included in NCI

(3.4)

Unrealized (gain)/loss on derivatives

9.8

Loss on disposal of fixed assets

2.9

FIFO impact (favorable), unfavorable

(30.4)

Share based compensation

52.4

Loss on extinguishment of debt

3.6

Major turnaround expense

16.5

Other non-cash expenses

-

Consolidated Adjusted EBITDA

$657.0

Fertilizer Adjusted EBITDA

121.7

Adjusted EBITDA excl. Fertilizer

$535.3

TM |

32

32

32

32

32

Non-GAAP Financial Measures (cont’d)

CVR Adjusted EBITDA ($mm)

Petroleum:

2008

2009

2010

LTM 9/30/2011

Petroleum operating income

$31.9

$170.2

$104.6

$529.5

FIFO impact (favorable) unfavorable

102.5

(67.9)

(31.7)

(30.4)

Share-based compensation

(10.8)

(3.7)

11.5

17.1

Loss on disposal of fixed assets

-

-

1.3

1.5

Major scheduled turnaround

-

-

1.2

12.8

Realized gain (loss) on derivatives, net

(121.0)

(21.0)

0.7

(24.7)

Goodwill impairment

42.8

-

-

-

Depreciation and amortization

62.7

64.4

66.4

67.8

Other income (expense)

1.0

0.3

0.7

0.5

Adjusted EBITDA

$109.1

$142.3

$154.7

$574.1

Fertilizer:

2008

2009

2010

LTM 9/30/2011

Fertilizer operating income

$116.8

$48.9

$20.4

$84.0

Share-based compensation

(10.6)

3.2

9.0

14.1

Loss on disposal of fixed assets

2.3

-

1.4

1.4

Major scheduled turnaround

3.3

-

3.5

3.5

Depreciation and amortization

18.0

18.7

18.5

18.5

Other income (expense)

0.1

-

-

0.2

Adjusted EBITDA

$129.9

$70.8

$52.8

$121.7

TM |

33

33

33

33

33

Non-GAAP Financial Measures (cont’d)

(a)

Includes disposal of assets, asset impairments, discontinued operations and fire

related adjustments. GWEC Adjusted EBITDA ($mm)

GWEC:

2009

2010

LTM 9/30/2011

Net income (loss)

$52.5

$16.1

$161.6

Income taxes

-

-

-

Interest expense (net)

12.9

22.4

28.6

Depreciation and amortization

13.8

14.7

17.2

Hedge mark to market loss (gain)

-

-

37.9

Turnaround amortization

15.4

13.8

13.1

Non-cash inventory loss (gain)

(57.9)

(19.6)

(23.1)

Other unusual or non-recurring items

(a)

0.1

-

(0.2)

Adjusted EBITDA

$36.8

$47.4

$235.1

TM |