Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - SYNAGEVA BIOPHARMA CORP | d275119d8k.htm |

| EX-10.1 - AMENDED AND RESTATED REGISTRATION RIGHTS AGREEMENT - SYNAGEVA BIOPHARMA CORP | d275119dex101.htm |

| EX-99.2 - UNAUDITED FINANCIAL STATEMENTS OF PRIVATE SYNAGEVA - SYNAGEVA BIOPHARMA CORP | d275119dex992.htm |

Exhibit 99.1

SYNAGEVA’S BUSINESS

Overview

Synageva BioPharma Corp. (“Synageva”) is a clinical stage biopharmaceutical company focused on the discovery, development and commercialization of therapeutic products for patients with life-threatening rare diseases and unmet medical needs. Synageva’s management team is experienced in the development and commercialization of drugs for diseases with small patient populations, including clinical and translational research, working with payors to establish reimbursement and designing and building commercial organizations to reach highly specialized physicians to facilitate patient identification. The rare disease field has smaller patient populations and a close community of experts. Members of the Synageva management team have long-standing relationships with many of these experts based on prior leadership roles on most of the novel protein therapeutics marketed for ultra-rare diseases, including Cerezyme, Myozyme, Fabrazyme, Aldurazyme, and Soliris. Based on these relationships, these experts are working with Synageva on clinical development initiatives to advance SBC-102 and its other pipeline programs, which are a prerequisite to commercial success.

Product development in the rare disease space has several potential advantages over other areas of pharmaceutical development. Often rare diseases have no or very limited therapeutic alternatives and thus represent significant unmet medical need. Many rare diseases are a result of specific genetic mutations that impact the expression or function of a specific protein. As a result, animal models of these diseases are very relevant, and the translation of a product’s effects in animal models to effects in human patients has been very high. In addition, the genetic basis of many of these rare disorders can aid in a definitive diagnosis through the identification of specific mutations in human patients, and the care of these patients is usually handled by a small number of specialized physicians. The rapidly evolving field of human genetics and DNA sequencing technology is expected to further facilitate efforts to identify patients in the future. All of these factors can help provide comfort to regulatory agencies, and thus clinical development timelines for rare diseases are often significantly shorter and less expensive than for other more common diseases.

One factor that has been a significant limitation to the development of treatments for some of these rare diseases has been the ability to manufacture and supply proteins with the necessary post-translational modifications required for their uptake in appropriate cells to correct the protein deficiency using existing conventional protein manufacturing systems. Synageva believes that its proprietary protein production platform has the ability to address some of these difficulties and potentially provides a unique opportunity for Synageva in the rare disease space.

SBC-102, recombinant human lysosomal acid lipase (“LAL”), is Synageva’s most advanced program in the rare disease space. Synageva believes that this lead program will offer patients and health care practitioners a unique therapy to treat LAL Deficiency, which is a rare, devastating genetic disease that causes significant morbidity and mortality. There are currently no approved treatments for LAL Deficiency. LAL Deficiency is an autosomal recessive lysosomal storage disorder that is caused by a marked decrease or almost complete absence of the LAL enzyme. Although a single disease, LAL Deficiency presents as a clinical continuum with two major phenotypes, early onset LAL Deficiency, frequently referred to as Wolman Disease, and late onset LAL Deficiency, frequently referred to as CESD. The marked reduction of LAL activity in patients with LAL Deficiency leads to the accumulation of lipids in various tissues and cell types. This leads to a range of abnormalities, including enlargement of the liver and spleen, severe liver dysfunction, liver fibrosis, cirrhosis, and ultimately hepatic failure as well as severe malabsorption. Early onset LAL Deficiency is characterized by malabsorption, significant growth failure, and hepatic failure and is usually fatal within the first year of life. In late onset LAL Deficiency, liver involvement and type II hyperlipidemia (high cholesterol and triglycerides) dominate the clinical picture. Sandro Muntoni, an Italian physician who performed a genotyping study in Western Europe (published in 2007 in Arteriosclerosis, Thrombosis, and Vascular Biology) (the “Muntoni Study”), concluded that approximately 25 individuals per million lives are affected by the genetic abnormality associated with LAL Deficiency. This incidence rate is comparable to Gaucher Disease, Fabry Disease and Pompe Disease, which are also lysosomal storage disorders. In addition, as evidenced in a research article by Livia Pisciotta, et al., published in Mol Genetic Metab in 2009 (the “Pisciotta Article”), cases of late onset LAL Deficiency with at least one copy of a common genetic mutation that is associated with a majority of published cases of late onset LAL Deficiency have been reported from a number of different countries.

As a therapeutic approach, the medical value and long-term safety of enzyme replacement therapy established initially for Gaucher Disease has now been demonstrated for other lysosomal storage disorders, including Pompe Disease and Fabry Disease and MPS I, II and VI. In addition, it is generally accepted that preclinical proof of concept in the relevant genetic model for enzyme replacement therapies for lysosomal storage disorders is highly predictive of clinical effectiveness. Published examples of preclinical efficacy data in an animal model of a lysosomal storage disorder predicting clinical efficacy for products that have been subsequently approved include articles by Schull, et al., in Medical Sciences in 1994 regarding Aldurazyme (the “Schull Article”), Byers, et al., in Pediatrics Research in 2000 regarding Naglazyme (the “Byers Article”), Kikuchi, et al., in The Journal of Clinical Investigation in 1998 regarding Myozyme (the “Kikuchi Article”), and Ioannou, et al., in The American Journal of Human Genetics in 2001 regarding Fabrazyme (the “Ioannou Article”). In a rat model of LAL Deficiency that demonstrates many of the abnormalities of the human disease, including elevated liver enzymes, organomegaly, and growth failure leading to rapidly premature death, SBC-102 has demonstrated significant efficacy.

SBC-102 has been granted orphan drug designations (“Orphan Drug Designations”) by the U.S. Food and Drug Administration (“FDA”) and European Medicines Agency (“EMA”) and a Fast Track Designation by the FDA, and Synageva has received regulatory clearance in the U.S. and EU to conduct clinical trials in patients with LAL Deficiency. In February 2011, Synageva initiated Phase I/II clinical trials for SBC-102 and in May 2011 began enrolling patients into its Phase I/II studies to evaluate the safety and tolerability of SBC-102 in adult patients with liver dysfunction due to late onset LAL Deficiency and its Phase I/II study in children with growth failure due to early onset LAL Deficiency. SBC-102 is currently being dosed in humans as part of its global clinical development plan. Synageva also plans to initiate a global trial to evaluate the long-term safety and efficacy of SBC-102 in both adults and children with the late onset form of LAL Deficiency. Additionally, Synageva has initiated natural history studies in approximately 20 countries. These studies will be used to investigate and characterize key aspects of the clinical course of LAL Deficiency to inform the evaluation and care of affected patients and to provide a reference for pivotal studies of SBC-102 by identifying appropriate clinical endpoints.

In addition to the patients with LAL Deficiency enrolled in clinical trials, an infant with the disease has received treatment with SBC-102 on a compassionate use basis. The infant, who presented with growth failure, anemia and progressively increasing serum transaminases prior to beginning treatment, has now received weekly infusions for 4.5 months. The infant continues to receive SBC-102, and is demonstrating substantial improvements in growth rate, liver function tests (reduction in serum transaminases), and other disease-related abnormalities consistent with Synageva’s preclinical data for SBC-102.

In addition to SBC-102, Synageva is also progressing protein therapeutic programs for other rare diseases, which are at various stages of preclinical development. These include two enzyme replacement therapies for other lysosomal storage disorders and two programs for other rare life-threatening conditions. These protein therapeutic programs were selected based on scientific rationale, unmet medical need within the patient population, potential to substantially impact disease course, and strategic alignment with Synageva’s corporate and commercial efforts, including a potentially significant commercial opportunity. Synageva believes its other programs, SBC-103, 104, 105, and 106, also have the potential to present patients and health care practitioners with effective therapies to treat the rare and devastating diseases targeted by these programs. Like LAL Deficiency, these diseases are characterized by significant morbidity and mortality, currently have high unmet medical need and are conditions in which protein replacement treatment has the potential to have a meaningful impact on disease progression.

The most advanced of these additional programs is SBC-103, an enzyme replacement therapy for MPS IIIB. This enzyme is a recombinant form of human NAGLU. There is currently no approved therapy available for MPS IIIB. Similar to LAL Deficiency, MPS IIIB is an autosomal recessive lysosomal storage disease that may affect as many as eight individuals per million lives. While initially appearing unaffected, children born with MPS IIIB usually present with a slowing of development and/or behavioral problems around two years of age, followed by progressive intellectual decline and immobility with complete dependency on care providers. The life-span of an affected child does not usually extend beyond late teens to early twenties. Preliminary characterization of the enzyme produced using Synageva’s production platform demonstrates favorable uptake properties compared to previously published attempts to produce this enzyme using standard cell culture based approaches. Synageva has not yet received approval to market this product, and is not currently commercializing any other products.

Synageva’s business focus on products for rare diseases was established in 2008 with the appointment of Sanj K. Patel as President and Chief Executive Officer and his redirection of the company. This change represented a substantial shift in the business strategy of the original company, AviGenics, inc., which was founded in 1996 and was focused on the development of a novel protein production technology. Today, Synageva’s protein therapeutics are produced using this proprietary expression system based on over 15 years of research and clinical development. Synageva’s proprietary expression technology is highly capital efficient, thus allowing the rapid initiation and simultaneous advancement of multiple programs, enabling Synageva to cost-effectively perform initial investigations of programs in additional disease areas. The proprietary expression system has allowed Synageva to create the current pipeline of product candidates and provides the ongoing opportunity to renew and expand its portfolio with additional products at a rate that far outpaces what would be possible using existing protein expression technologies.

Synageva’s Strategy

Synageva’s goal is to develop and market therapies for patients with life-threatening rare diseases. Key elements of its strategy include:

| • | Advance SBC-102 toward regulatory approval and successful commercialization for the treatment of LAL Deficiency. No treatments are approved for this severe and life-threatening lysosomal storage disorder, and Synageva’s most important near-term objective is to advance its first-mover SBC-102 program toward regulatory approval and successful commercialization. Synageva has established a medical affairs effort to assist in identifying and enrolling patients and to build upon the existing connections it has within the physician community. This group will take on medical education support upon SBC-102 marketing approval. Synageva has also established an initial commercial team that, in addition to supporting the efforts of medical affairs, is focused on laying the groundwork necessary for the successful launch of an ultra-orphan product. Upon approval, Synageva expects to market SBC-102 globally with initial focus on the U.S., EU, Japan, and Brazil. |

| • | Continue to develop other pipeline programs. Synageva believes that it is important to maintain a diverse pipeline of product candidates to sustain future growth. Synageva plans to advance current pipeline programs and in addition has the ability to efficiently add new research programs targeting other rare life-threatening conditions. |

| • | Enter into strategic partnerships to generate capital and supplement Synageva’s internal resources. When establishing strategic collaborations, Synageva seeks to leverage its expertise in both product development for rare diseases and its production technology. Synageva will consider collaborations in rare diseases at appropriate stages in the drug development process. In addition, in selective instances Synageva may also consider collaborations to provide access to the company’s proprietary expression platform to other companies interested in the development of products outside of Synageva’s areas of interest. |

In order to achieve these strategic objectives, Synageva has, and will remain, focused on hiring and retaining a highly skilled management team that has extensive experience and specific skill sets relating to the selection, development and commercialization of therapies for life-threatening rare diseases. Members of the current management team have prior leadership responsibility for most of the protein therapeutics approved for ultra-rare diseases to date. Synageva intends to continue its efforts to build and expand this team as it aggressively grows its business. This strategy is intended to allow Synageva to build medical and financial value for patients and stockholders, respectively, by capitalizing on its translational and drug development capabilities and commercial expertise in rare diseases and by leveraging its robust manufacturing platform and supply capabilities.

SBC-102

Disease Overview

LAL Deficiency is an autosomal recessive lysosomal storage disorder caused by a marked decrease in the activity of the native LAL enzyme, which plays a key role in the degradation and metabolism of cholesteryl esters and triglycerides. The significant reduction of LAL activity in these patients leads to the accumulation of these lipids in various tissues and cell types. The organ most affected by the disease is the liver, leading to substantial enlargement and dysfunction with progression to liver failure. Other affected organs include the spleen, as well as the small intestine, leading to profound malabsorption. Similar to other lysosomal storage diseases such as Pompe Disease, LAL Deficiency is a single disease that presents as a clinical continuum with two major phenotypes, early onset LAL Deficiency, frequently referred to as Wolman Disease, and late onset LAL Deficiency, frequently referred to as CESD. Early onset LAL Deficiency is characterized by malabsorption, growth failure, and hepatic failure and is usually fatal within the first year of life. In late onset LAL Deficiency, liver involvement and type II hyperlipidemia dominate the clinical picture. As described above, the Muntoni Study concluded that approximately 25 individuals per million lives are affected by known genetic abnormalities that lead to LAL Deficiency. In addition, as evidenced in the Pisciotta Article, cases of late onset LAL Deficiency with at least one copy of a common genetic mutation that is associated with a majority of published cases of late onset LAL Deficiency have been reported from a number of different countries. This incidence rate is comparable to that of Gaucher Disease, Fabry Disease, and Pompe Disease, which are other lysosomal storage disorders for which enzyme replacement therapies have been approved and successfully marketed. There are currently no approved treatments for LAL Deficiency.

SBC-102 has demonstrated efficacy in a highly relevant disease model and it is generally accepted that proof of concept for enzyme replacement therapies for lysosomal storage disorders is highly predictive of clinical effectiveness. For most other diseases, preclinical models are recognized as having limited value in assessing the probability of clinical efficacy in humans. The situation is different in enzyme replacement therapies for lysosomal storage disorders. In these storage diseases, where animal models have been developed, the missing protein performs a similar function in the animal as it does in humans and replacement of the missing enzyme corrects the disease-related abnormalities. Published examples of preclinical efficacy data in an animal model of a lysosomal storage disorder predicting clinical efficacy for products that have been subsequently approved include the Schull Article, the Byers Article, the Kikuchi Article, and the Ioannou Article. SBC-102 has also demonstrated such efficacy in a highly relevant in vivo disease model and is currently being dosed in humans as part of its global clinical development plan. In addition, the medical value and long-term safety of enzyme replacement therapy first established for Gaucher Disease has now been extended to a broader range of disorders, including Pompe Disease, Fabry Disease, and MPS I, II, and VI.

SBC-102 has been granted Orphan Drug Designations by the FDA and EMA, and Synageva has received regulatory clearance in the U.S. and EU to conduct clinical trials in patients with late and early onset LAL Deficiency. Additionally, due to the severity of LAL Deficiency, the FDA granted SBC-102 Fast Track Designation which allows for an expedited regulatory review for the product. In February 2011, Synageva initiated Phase I/II clinical trials for SBC-102 and in May 2011 began enrolling patients in two Phase I/II studies to evaluate the safety and tolerability of SBC-102 in adult patients with liver dysfunction due to late onset LAL Deficiency and in children with growth failure due to early onset LAL Deficiency. Synageva also plans to initiate a global trial to evaluate the long-term safety and efficacy of SBC-102 in both adults and children with the late onset form of LAL Deficiency. Additionally, Synageva has initiated natural history studies in approximately 20 countries for LAL Deficiency. These studies will be used to investigate and characterize key aspects of the clinical course of the disease to inform the evaluation and care of affected patients and to provide a reference for pivotal studies of SBC-102 by identifying appropriate clinical endpoints.

Early Onset LAL Deficiency

According to an article by Meikle, PJ, et al., in the Journal of the American Medical Association in 1999, early onset LAL Deficiency presents shortly after birth with predominant gastrointestinal and liver involvement and has an estimated incidence of approximately two individuals per million lives. This form of the disease is the most rapidly fatal of LAL Deficiency and is characterized by growth failure, malabsorption, steatorrhea, and liver enlargement. These patients usually die within the first year of life. In this form of LAL Deficiency, growth failure, which is caused by a number of mechanisms, including a marked reduction in the capacity of the gastrointestinal tract to absorb nutrients, is the predominant clinical feature and a key contributor to the early mortality. Hepatic involvement, as evidenced by liver enlargement and elevation of transaminases, is also common and is very similar to that described in other patients across the LAL Deficiency continuum.

In the absence of approved therapies for LAL Deficiency, supportive therapies are used in an attempt to mitigate some of the effects of this rapidly fatal disease. Although some stabilization of the clinical condition has been described with nutritional support, these interventions are not believed to substantially modify the outcome in affected patients. As there is presently no effective treatment (including enzyme replacement therapy) for LAL Deficiency, patients with early onset LAL Deficiency are sometimes offered experimental therapy with hematopoietic stem cell transplantation. Based on information, presented in a chapter by Assmann, G. and Seedorf, U. in the The Metabolic and Molecular Bases of Inherited Disease edited by A. Beaudet et al., early onset LAL Deficiency remains almost universally fatal.

Late Onset LAL Deficiency

Late onset LAL Deficiency presents with predominant liver involvement and type II hyperlipidemia (high cholesterol and triglycerides), and is the more common form of LAL Deficiency with an estimated incidence of 25 individuals per million lives. The liver and spleen are the most severely affected organs with marked organ enlargement, elevation of transaminases and severe liver fibrosis progressing to cirrhosis. Cardiovascular involvement is characterized by dyslipidemia (high cholesterol, high triglycerides and low high-density lipoprotein) with early onset vascular disease due to accumulation of lipid deposits in artery walls. The presentation of late onset LAL Deficiency is highly variable with some patients going undiagnosed until complications manifest in late adulthood, while others can present with liver dysfunction in early childhood. Late onset LAL Deficiency is associated with significant ill health and while the natural history is not well described, there is evidence that life expectancy is reduced with premature death due to liver, cardiovascular and vascular complications including strokes. This evidence includes case reports described by Beaudet, A, et al., in The Journal of Pediatrics in 1977, Cagel, et al., in American Journal of Medical Genetics in 1986, Elleder, et al., in Journal of Hepatology in 2000, and Riva, et al., in Digestive and Liver Disease in 2008.

Although no approved therapies are available for treatment of LAL Deficiency, palliative care is sometimes used to try to mitigate some of the effects of the disease. These treatments are mainly focused on control of plasma lipid levels through diets that exclude foods rich in cholesterol and triglycerides and suppression of cholesterol synthesis and apolipoprotein B production through administration of statins and other lipid lowering therapies. As described in the medical literature, including in the case study by Di Bisceglie, A., et al., published in Hepatology, Volume 11, Issue 5, 1990, although some improvement may be seen in serum lipid levels, the underlying disease manifestations persist and disease progression still occurs. As the disease progresses, this can lead to a need for liver transplantation or death.

SBC-102 Pharmacology

SBC-102 is a recombinant human LAL. This enzyme is responsible for the metabolism of cholesteryl esters and triglycerides that are delivered to lysosomes by a variety of routes, including low-density lipoprotein receptor mediated endocytosis. SBC-102 is produced by recombinant DNA technology in egg white (“EW”) using Synageva’s proprietary protein manufacturing platform. The protein contains glycan structures which are specifically recognized and internalized via receptors into key target cells. LAL Deficiency has parallels with Gaucher Disease, as both require effective macrophage targeting. Unlike certain other approved enzyme replacement therapies, however, SBC-102 does not require additional processes during manufacturing to either modify glycan synthesis or remove terminal glycans to allow for the correct glycan ligands for macrophage uptake. In addition, levels of mannose-6-phosphate that enable efficient uptake into other cell types are higher in SBC-102 than described in other forms of recombinant LAL produced using cell culture based manufacturing platforms. In November 2010, Synageva reported data from preclinical studies of SBC-102 demonstrating uptake and localization to lysosomes into key cell types, including macrophages and fibroblasts.

Preclinical Development

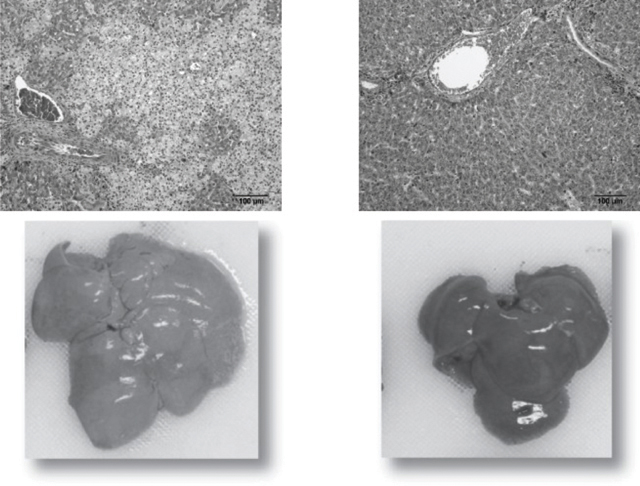

Synageva reported data from preclinical studies of SBC-102 at the American Society of Human Genetics meeting in November 2010, which demonstrated SBC-102’s efficacy in a disease model of LAL Deficiency. SBC-102 reduced lipid substrate levels in diseased tissues and corrected disease-related abnormalities associated with LAL enzyme deficiency, including growth failure and

liver pathology. The liver histology and gross pathology pictures shown below in Figure 1 are representative of the data presented. The photomicrograph of the untreated liver on the left shows marked disruption of liver structure due to the abnormal accumulation of lipids in the Kupffer cells. The significant expansion of these cells results in the pale, mottled appearance of the tissue. There is also damage to the tissue around the periportal tract resulting in fibrosis. The tissue abnormalities are also seen in the picture of the whole untreated liver on the left. It is enlarged and pale in color due to the accumulated lipids. In the photomicrograph of the SBC-102 treated liver on the lower right, the pathological abnormalities have been corrected and normal liver architecture has been restored. This is demonstrated by the smooth, uniform appearance of the tissue. The picture of the whole SBC-102 treated liver on the right is consistent with the histological findings with a normal appearance due to the reduction in the lipid accumulation.

|

| ||

| Untreated liver histology and gross pathology showing tissue abnormality due to lipid accumulation |

SBC-102 treated liver histology and whole organ showing normalization of tissue structure | |

Figure 1. Effect of SBC-102 on liver morphology

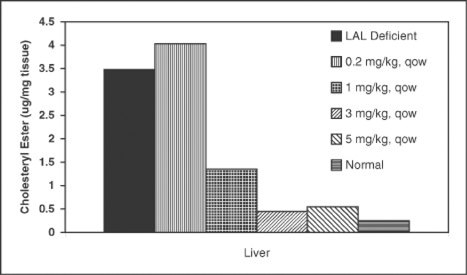

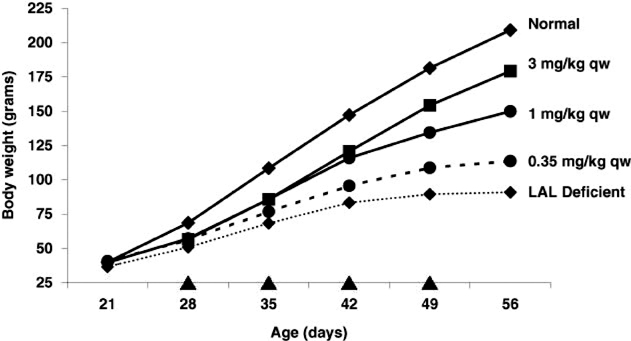

Additional data was reported at the European Society for the Study of Liver Disease meeting in March 2011 and the European Society for Pediatric Gastroenterology, Hepatology and Nutrition meeting in May 2011. These studies reported that weekly (“qw”) and every other week (“qow”) administration of SBC-102 improved growth, decreased LAL substrate content in affected organs and normalized liver pathology in association with decreases in liver size and in serum transaminases and reversal of liver histopathologic findings. As shown in the figures below, detailed dose response analysis in a LAL deficient animal model has established a range of effective qw and qow doses supporting dose selection in clinical studies. These data demonstrate that doses equal to or greater than 1 mg/kg qow are highly effective in reducing lipid accumulation in the liver, which is the organ predominantly affected in late onset LAL Deficiency. For growth failure, which is characteristic of patients with early onset LAL Deficiency, maximum efficacy is seen at doses equal to or greater than 3 mg/kg qw.

Figure 2. SBC-102 dose dependent reduction of cholesteryl esters from the liver in a LAL deficient animal model

Figure 3. SBC-102 dose dependent restoration of growth in a LAL deficient animal model, qw dosing

These studies establish proof of concept for SBC-102 as an enzyme replacement therapy for LAL Deficiency. In contrast to preclinical testing of most other experimental therapies, it is generally accepted that efficacy for this class of therapies in lysosomal storage disorder disease models is highly predictive of clinical effectiveness. In these storage diseases, where animal models have been developed, the missing protein performs a similar function in the animal as it does in humans and replacement of the missing enzyme corrects the disease-related abnormalities. Published examples of preclinical efficacy data in an animal model of a lysosomal storage disorder predicting clinical efficacy for products that have been subsequently approved include the Schull Article, the Byers Article, the Kikuchi Article, and the Ioannou Article.

Synageva has also conducted toxicology studies to support initiation of human dosing. There were no meaningful toxicological findings in four-week repeat dose toxicology studies in the rat and monkey administered intravenous (“IV”) infusions of SBC-102 at doses up to 50 mg/kg once weekly. In a six-month repeated dose toxicity study in monkeys administered once-weekly IV infusions of SBC-102 at doses of 3 mg/kg, 10 mg/kg or 30 mg/kg (five males and five females per dose group), or placebo infusions (five males, five females), SBC-102 was well tolerated in monkeys at dose levels up to 30mg/kg per dose, which suggests a lack of safety concerns for long-term dosing with SBC-102.

Clinical Development

Synageva is pursuing a development strategy for SBC-102 that includes clinical trials in patients with both early and late onset LAL Deficiency. The overall goals of the program are to assess safety and tolerability in a broad population of patients, including infants, children, and adults, and to demonstrate clinically meaningful effects on the medical complications of LAL Deficiency. Consistent with study protocols for marketed products for other rare diseases such as Fabrazyme and Myozyme, Synageva anticipates that the patient numbers required for the SBC-102 clinical program will be small. Synageva has gained Fast Track Designation for the Biologic License Application (“BLA”) for SBC-102 that it intends to file with the FDA if clinical trials are successful.

In December 2010, Synageva filed an IND application with the FDA for late onset LAL Deficiency and submitted clinical trial applications for both late and early onset LAL Deficiency with the UK Medicines and Healthcare Products Regulatory Agency in January 2011. Clinical studies for these indications have now been initiated and enrollment of patients has begun.

Unlike most common diseases where clinical familiarity exists, many aspects of the clinical presentation, disease progression (including mortality and key morbidities) and response to treatment are poorly understood for rare diseases. Two key factors are responsible for these differences. First, the rarity of the disease often limits a physician’s clinical experience to a single case. Secondly, the historical absence of any effective therapy reduces the interest and research funding available to support coordinated investigation of the disease. The development of a new potential therapy requires accurate knowledge of the natural course of a disease to support patient diagnosis, endpoint selection and to provide historical data on mortality and morbidity. These are required to inform the evaluation and care of affected patients and to provide a reference for efficacy studies of enzyme replacement or other novel therapies. In order to generate this historical context for LAL Deficiency in support of the SBC-102 development program, Synageva is currently running two clinical study protocols in approximately 20 countries requiring case record review of patients with early and late onset LAL Deficiency. These natural history studies will be used to investigate and characterize key aspects of the clinical course of the disease, to inform the evaluation and care of affected patients and to provide a reference for efficacy studies of SBC-102 by identifying appropriate clinical endpoints.

In addition to the patients with LAL Deficiency enrolled in clinical trials, an infant with the disease has received treatment with SBC-102 on a compassionate use basis due to the life-threatening nature of the disease. Prior to treatment, the infant exhibited the classic symptoms of Wolman Disease (early onset LAL Deficiency), including anemia, increasingly abnormal liver function tests, and growth failure. The infant began receiving SBC-102 in April 2011 at the age of four months and the patient has so far received 4.5 months of treatment with no complications and continues to receive treatment with SBC-102. The infant is demonstrating substantial improvements in growth rate, liver function tests (reduction in serum transaminases), and other disease-related abnormalities consistent with Synageva’s preclinical data for SBC-102. It is anticipated that this patient will be enrolled into an extension study as part of the clinical trial program.

The current and planned clinical trials for SBC-102 are:

| • | Phase I/II Open Label Dose Escalation Study in Adult Patients with Liver Dysfunction Due to LAL Deficiency. In May 2011, Synageva initiated a four week study to evaluate the safety and tolerability of SBC-102 administered weekly in patients with liver dysfunction due to late onset LAL Deficiency. This study will also characterize the pharmacokinetics of SBC-102 delivered by IV infusion. The study is expected to enroll a total of approximately nine patients at multiple centers in the U.S. and Europe. |

| • | Phase I/II O pen Label Repeat Dose Escalation Study in Children with Growth Failure Due to LAL Deficiency. In 2011, Synageva also initiated a 16 week study to evaluate the safety and tolerability of SBC-102 in children with growth failure due to early onset LAL Deficiency. This study will also determine the effect of SBC-102 on growth and explore pharmacokinetics of SBC-102 and change in pharmacodynamics markers in this population. This study is expected to enroll a total of approximately eight patients at multiple centers in the U.S. and Europe. U.S. sites are expected to join this study once the adult safety and tolerability study has been reviewed by the FDA. As early onset LAL Deficiency has nearly a zero percent survival rate at one year of age, enrollment in this study is contingent on timely identification of newly diagnosed cases. |

| • | Planned Study in Subjects with Liver Dysfunction due to LAL Deficiency. Synageva is planning to initiate a trial to evaluate the safety and efficacy of SBC-102 in both adults and children with late onset LAL Deficiency. In this study, Synageva plans to investigate two doses of SBC-102 to define dosing requirements for approval and commercialization. The study is expected to enroll patients at multiple centers in the U.S. and Europe. Currently, Synageva expects to initiate this study in the second half of 2012. |

Synageva has currently enrolled a total of four patients in its Phase I/II studies of SBC-102. In addition to these trials, extension studies are planned for all patients enrolled into the SBC-102 development program in order to support requirements for long-term safety and to provide patients ongoing access to drug product. Patients in these extension studies will continue on therapy until BLA approval of SBC-102, if received.

Regulatory

SBC-102 has been granted Orphan Drug Designation by the FDA, and Synageva has received regulatory clearance in the U.S. to conduct clinical trials in adult patients with LAL Deficiency. U.S. Orphan Drug Designation is granted to a product that treats a rare disease, a condition that affects fewer than 200,000 Americans. As a result of the Orphan Drug Designation, Synageva is eligible to receive a number of benefits, including access to grant funding for clinical trials, tax credits, waiver of the FDA filing and registration fees, and seven years of market exclusivity if approval is received. Additionally, due to the severity of LAL Deficiency, the FDA granted SBC-102 Fast Track Designation which allows for an expedited regulatory review for the product.

SBC-102 has also been granted Orphan Drug Designation by the EMA, and Synageva has received regulatory clearance in key countries in the EU to conduct clinical trials in patients with late and early onset LAL Deficiency. The EMA’s Orphan Drug Designation is given to therapies that treat rare diseases, defined as conditions that affect no more than five in 10,000 persons in the EU. As a result of the EMA Orphan Drug Designation, Synageva is eligible to receive access to protocol assistance, direct access to centralized marketing authorization, up to 10 years of marketing exclusivity if approval is received, fee reductions or exemptions, and other national incentives. Under the EU Pediatric Regulations established in 2007, SBC-102 may be eligible for an additional two years of market exclusivity.

Commercialization

LAL Deficiency is a lysosomal storage disorder, and like other storage diseases such as Gaucher Disease, Fabry Disease, and Pompe Disease, affects a very small patient population hallmarked by unmet medical need, substantial morbidity and increased risk of mortality. As indicated in the table below, Cerezyme, Fabrazyme, Myozyme and Soliris are ultra-orphan drugs that provide precedent for the ability to commercialize a breakthrough treatment for an ultra-rare medical condition. Members of Synageva’s management team have previously held leadership roles in the successful development and commercialization for all four of these precedent products.

| Drug | SBC-102 | Cerezyme | Fabrazyme | Myozyme | Soliris | |||||

| Indication |

LAL Deficiency | Type I Gaucher Disease |

Fabry Disease |

Pompe Disease |

PNH | |||||

| Estimated Prevalence |

1 in 40,000 | 1 in 59,000 to 86,000 |

1 in 40,000 to 476,000 |

1 in 40,000 to 146,000 |

1 in ~77,000 | |||||

| Reported 2010 Revenue ($M) |

Significant Unmet Need |

$719.6 | $188.2 | $411.8 | $540.9 | |||||

Table 1. A sampling of ultra-orphan products and their associated incidence and revenue

(The revenue numbers above are not necessarily predictive of the commercial potential for SBC-102)

LAL Deficiency is an ultra-rare disorder that falls within the scope of metabolic specialists and hepatologists. Liver complications such as fibrosis, cirrhosis and liver failure dominate the late onset form, and patients may resemble those with other, more common diseases such as non-alcoholic fatty liver disease or non-alcoholic steatohepatitis. Similar to other lysosomal storage disorders, increased disease awareness and improvements in diagnosis supported by the patient and physician communities are critical for identifying patients and facilitating treatment. Synageva is in the process of engaging the physician and patient communities to establish a registry that will encourage involvement of all parties to raise awareness of and interest in LAL Deficiency. These include metabolic, hepatic, and lipid physician specialists and the LAL Solace, National Organization for Rare Disorders, Eurordis and CLIMB patient groups.

The diagnosis of late onset LAL Deficiency patients is anticipated to begin with the hepatologists’ clinical diagnosis aided by the use of differentiating biochemical markers, including abnormal lipid profile and confirmed by a simple blood test for the LAL enzyme. Synageva makes available to individuals information regarding which laboratories perform these tests and the procedures required for submitting a specimen. Adrenal calcification noted during investigations for gastrointestinal symptoms and growth failure allows for the rapid diagnosis of early onset LAL Deficiency patients. Presently, early onset patients usually receive care in a tertiary academic medical center.

Synageva’s commercial strategy for SBC-102 focuses on four imperatives: (i) facilitating diagnosis, (ii) generating prescriptions, (iii) supporting treatment, and (iv) ensuring coverage. By aligning resources against these imperatives, Synageva believes that its commercial footprint will be efficient and scaled to a highly specialized market niche. Similar to other companies with such specialized call points, Synageva’s current plans for resourcing the commercialization effort for SBC-102 include a small number of highly specialized field-based representatives supported by a specialized organization in-house. The past experience of members of Synageva’s management team in leading commercial efforts for ultra-rare products highlights the value of recruiting professionals who have experience with these specialized and focused physician and patient communities. The planned commercial organization is being developed to initially address the needs and opportunities for the North American, European, Latin American, and Asia Pacific regions.

Other Programs

In addition to SBC-102, Synageva is also progressing protein therapeutic programs for other rare diseases, which are at different stages of preclinical development. These include two enzyme replacement therapies for other lysosomal storage disorders and two programs for other rare life-threatening conditions. These protein therapeutic programs are selected based on scientific rationale, unmet medical need within the patient population, potential to substantially impact disease course, and strategic alignment with Synageva’s corporate and commercial efforts, including a potentially significant commercial opportunity.

Synageva believes its other programs, SBC-103 through 106, also have the potential to present patients and health care practitioners with effective therapies to treat the rare and devastating diseases targeted by these programs, which, like LAL Deficiency, are characterized by significant morbidity and mortality. The most advanced of these additional programs is SBC-103, an enzyme replacement therapy for MPS IIIB. This enzyme is a recombinant form of NAGLU. Similar to LAL Deficiency, MPS IIIB is an autosomal recessive lysosomal storage disease that may affect as many as eight individuals per million lives. While initially appearing unaffected, children born with MPS IIIB usually present with a slowing of development and/or behavioral problems around two years of age, followed by progressive intellectual decline and immobility with complete dependency on care providers. The life-span of an affected child does not usually extend beyond late teens to early twenties. Recent systematic studies using mutation based approaches have also revealed that MPS IIIB can demonstrate a large variability in the course of the disease, with a substantial number of additional patients with an attenuated phenotype with longer lasting, stable intellectual disability followed by regression later in life. Preliminary characterization of the enzyme produced using Synageva’s production platform demonstrates favorable uptake properties compared to previously published attempts to produce this enzyme using cell culture based approaches. There is currently no approved therapy available for MPS IIIB.

The following table describes Synageva’s product candidate pipeline:

| Program | SBC-102 (rhLAL) |

SBC-103 (rhNAGLU) |

SBC-104 | SBC-105 | SBC-106 | |||||

| Therapeutic |

Recombinant Lysosomal Acid Lipase |

Recombinant a-N-acetyl- |

Extra Cellular Protein |

Enzyme Replacement Therapy |

Enzyme Replacement Therapy | |||||

| Disease |

LAL Deficiency (LSD) |

MPS IIIB/ Sanfilippo B (LSD) |

Severe Genetic Condition |

Severe Metabolic Disorder |

Severe Genetic Condition | |||||

| Development Status |

Clinical | Preclinical | Preclinical | Preclinical | Preclinical | |||||

| Regulatory Opportunity |

Orphan Designation Granted U.S. Granted EU Fast Track |

Qualify for Orphan Designation & Potential Fast Track Designation |

Qualify for Orphan Designation & Potential Fast Track Designation |

Qualify for Orphan Designation & Potential Fast Track Designation |

Qualify for Orphan Designation & Potential Fast Track Designation |

Table 2. Synageva’s pipeline programs.

SBC-104 is an extracellular protein that targets a severe, rare genetic condition. There are no approved therapies for this disease, which is devastatingly debilitating and frequently results in early death. SBC-104 is being developed as a protein replacement therapy.

SBC-105 is an enzyme replacement therapy being developed to treat a severe, rare metabolic disorder. Synageva believes this program has opportunity in a number of related rare diseases with similar underlying biology.

SBC-106 is a protein therapy that targets a severe and rare genetic condition.

Synageva’s Expression Platform

Overview

In mid-2008, Sanj K. Patel was appointed President, Chief Executive Officer and Director of Synageva, after nearly a decade at Genzyme Corporation where he led, at different times, both Clinical and Commercial Operations for Genzyme’s rare disease franchise. Synageva’s business focus on products for rare diseases was established in 2008 with Mr. Patel’s appointment and his redirection of the company. This change represented a substantial shift in the business strategy of the original company, AviGenics, inc., which was founded in 1996 to develop a technology for expressing protein therapeutics in EW with the intention of creating follow-on biologics, including both biosimilar and biobetter products. With the change in business strategy, the expression platform was switched to a focus on the manufacture of protein therapeutics for rare diseases with unmet medical need.

Synageva’s proprietary expression platform remains a key element of Synageva’s business, and is an important contributor to Synageva’s current pipeline of rare disease therapeutics. Synageva’s expression platform is an integrated approach using recombinant DNA technology for the creation, optimization and commercial production of protein therapeutics. This mature platform, encompassing over 15 years of research and clinical development, is distinct from cell culture based approaches for protein therapeutic manufacturing and has a number of potential advantages which include:

| • | Reduced capital investment; |

| • | Very high and competitive protein expression levels; |

| • | Flexibility and consistency during scale-up; and |

| • | Human-like glycosylation patterns that can be tailored for the application. |

Synageva believes that this system will avoid the scale-up and inconsistency issues often associated with cell culture-based manufacturing of many types of therapeutic proteins. The ability to manufacture its products in-house and the important advantages of its manufacturing platform is a key element of Synageva’s business. This capability decreases the financial requirements for progressing a protein therapeutic into clinical development and allows Synageva to retain control over manufacturing of the commercial product.

Biology

The foundation of Synageva’s platform is an integrated system of proprietary vectors and methods that allow the generation of transgenic lines of hens which produce high levels of therapeutic protein in EW, a protein friendly matrix. Expression is achieved using Synageva’s proprietary vectors which allow targeted expression in EW-producing cells, and results in high expression levels of therapeutic proteins. The EW matrix facilitates bulk storage of unpurified EW prior to purification for prolonged periods and is one of a number of manufacturing advantages of the Synageva platform over traditional protein manufacturing technologies. In contrast to mammalian cell culture based approaches which utilize immortalized cell lines with high genetic and epigenetic instability, Synageva’s proprietary vectors allow incorporation of the gene of interest into the genome of normal cells of an avian (Gallus) with selective expression of the resulting protein in the oviduct tissues and secretion into EW. The importance of this cellular environment for therapeutic protein expression is highlighted by the tight consistency of post-translational modification, including glycosylation, seen in proteins manufactured using the Synageva platform compared to cell culture produced material. Furthermore, Synageva’s expression system yields consistent expression levels and quality of protein within production lines and through multiple generations. Synageva believes that its platform is the only approach for creating transgenic hens that produce a therapeutic protein which has been used successfully in clinical trials and which can enable commercial scale manufacturing.

Synageva’s proprietary technology allows for the production of proteins with glycosylation patterns that are suitable for many different diseases without a requirement for additional processes either during manufacturing (inhibition specific glycosylation enzymes) or post purification (enzymatic removal of terminal sugars) to modify terminal glycan structures impacting biodistribution. Furthermore, unlike some alternative expression platforms, Synageva’s expression system produces proteins with ‘human like’ glycan structures and does not incorporate non-human sugars into glycans.

Manufacturing and Supply

Synageva has demonstrated the platform’s ability to successfully produce a wide array of therapeutic proteins, including therapeutic enzymes, cytokines, monoclonal antibodies and fusion proteins. Furthermore, from 2004 to 2008, AviGenics, inc. manufactured investigational products using its expression system to supply Phase I and Phase II multinational clinical studies run in the U.S., EU, and India, which included more than 250 patients. The regulatory clearance for these studies included detailed considerations related to the manufacturing platform and there is good regulatory familiarity with the expression system. The largest study conducted was a multinational Phase II study of glycosylated recombinant human granulocyte colony stimulating factor (“G-CSF”) in 189 breast cancer patients with chemotherapy induced neutropenia. The overall safety and efficacy profile was comparable to the characteristics of Neupogen® (filgrastim) and no patient dosed with recombinant human G-CSF showed evidence of G-CSF antibody seroconversion during extended follow-up out to 12 months after initiation of dosing.

Finally, this platform is covered by a comprehensive intellectual property portfolio owned or exclusively licensed by Synageva and, as Synageva believes, provides expanded freedom to operate compared to other systems.

Cytovance Biologics LLC (“Cytovance”) is currently Synageva’s sole supplier of clinical trial material for SBC-102 from protein provided by Synageva and has provided manufacturing services to Synageva since December 2010. Synageva’s agreement with Cytovance will remain in effect until Cytovance completes the projects mutually agreed to by the parties in the agreement. Synageva may terminate its agreement with Cytovance upon 60 days’ written notice, but Cytovance may only terminate the agreement in the event of a material uncured breach by Synageva.

Patents and Proprietary Rights

Synageva actively seeks to aggressively protect the proprietary technology that is important to its business, including pursuing patents that cover its product candidates and compositions, their methods of use and the processes for their manufacture, as well as any other relevant inventions and improvements that are commercially important to the development of its business. Synageva also relies on trade secrets and other know-how that may be important to the development of its business.

Synageva’s patent portfolio is currently composed of 78 issued patents and 64 patent applications in the major territories, including the U.S., Europe, Brazil, Japan, China, Canada, India, and Australia, and includes patents and patent applications that Synageva owns as well as licenses from other parties. These patents and patent applications cover various aspects of Synageva’s manufacturing expression platform, product candidate pipeline and other product candidates that Synageva is no longer developing. Patents covering aspects of Synageva’s manufacturing expression platform will expire between 2016 and 2026. If they were to issue, current patent applications covering the expression platform will expire between 2018 and 2032 and current patent applications covering SBC-102 will expire between 2031 and 2032.

In addition, Synageva’s own pending applications contain claims directed to compositions and improved methods for expression of therapeutic proteins, with expirations between 2018 and 2032. Synageva continues to develop new intellectual property based on ongoing research to improve and enhance its expression platform.

University of Georgia Research Foundation

Synageva’s patent rights include the patent rights owned by University of Georgia Research Foundation (“UGARF”) subject to an exclusive, worldwide, sublicensable license granted to Synageva to develop, make, use and commercialize the avian transgenesis technology. Under the license, which was initially executed in 1996 and amended in 2008, Synageva paid UGARF an upfront license fee and issued shares of Synageva common stock in return for worldwide exclusive rights under the license. Additionally, UGARF is eligible to receive low single digit royalties on net sales of products covered under the license. This license agreement covers 21 patents and 18 patent applications worldwide that are the basis of Synageva’s expression platform. The UGARF license is effective until the last to expire of the licensed patents. Patents exclusively licensed from UGARF covering key aspects of Synageva’s expression platform will expire between 2018 and 2021. UGARF can terminate the license or, at UGARF’s discretion, convert the license into a non-exclusive license, if Synageva materially breaches the agreement, makes any materially false reports to UGARF, or fails to pay any required consideration under the agreement. Synageva has the right to terminate the agreement upon 60 days’ prior written notice to UGARF.

University of Minnesota

In 2009, Synageva entered into an exclusive license agreement, with the right to grant sublicenses, with the University of Minnesota that relates to compositions and methods useful for generating transgenic Gallus. In exchange for the license, which is effective until the last to expire of the licensed patents, Synageva paid the University of Minnesota an upfront license fee. In addition, University of Minnesota is entitled to minimal annual royalties which are creditable against low single digit royalties on net sales of products covered under the license. The 18 patents included in this license agreement expire by 2016. The University of Minnesota may terminate the agreement for Synageva’s failure to timely cure any material breach or failure to perform any obligations under the agreement. Synageva may terminate the agreement at any time after the third anniversary of the agreement.

Pangenix

The patents included in Synageva’s non-exclusive, sublicensable license agreement entered into with Pangenix in 2000 also cover compositions and methods useful for generating transgenic Gallus. In exchange for the license granted by Pangenix, which is effective until the last to expire of the licensed patents, Pangenix received an upfront license fee and is entitled to receive minimum annual royalties creditable against low single digit royalties on net sales of products covered under the license. The patents included in this license agreement are set to expire in 2015. Pangenix may terminate the agreement for Synageva’s failure to timely cure any material breach or failure to perform its obligations under the agreement. Synageva may terminate upon 60 days’ notice to Pangenix.

While there can be no assurance that patent applications relating to Synageva’s product candidates will ultimately issue or what the scope of the claims of such patent applications will cover if they were to issue, Synageva expects to rely heavily on orphan drug exclusivity for its product candidates, including SBC-102, which grants seven years of marketing exclusivity under the Federal Food, Drug, and Cosmetic Act, and up to 10 years of marketing exclusivity in Europe. In addition, Synageva continues to aggressively pursue intellectual property protection for its product candidates in the form of patent applications that have been and will continue to be filed in the U.S. and internationally.

The term of individual patents depends upon the legal term of the patents in the countries in which they are obtained. In most countries in which Synageva files, the patent term is 20 years from the date of filing the non-provisional application. In the U.S., a patent’s term may be lengthened by patent term adjustment, which compensates a patentee for administrative delays by the U.S. Patent and Trademark Office in granting a patent, or may be shortened if a patent is terminally disclaimed over an earlier-filed patent. Additional patent extension can be granted for time spent in development and regulatory review in certain jurisdictions as well.

Sales and Marketing

Synageva is currently developing marketing, sales and distribution capabilities to support commercialization for SBC-102. Similar to other companies with such specialized call points, Synageva’s current plans for commercialization resources include limited field-based customer-facing representatives supported by a specialized in-house organization to address the needs and opportunities for the North American, European, Latin American, and Asia Pacific regions.

With respect to pipeline products and other product candidates, Synageva may elect to utilize its own commercial capabilities to market and sell a product for which it obtains regulatory approval.

Competition

Synageva’s industry is highly competitive and subject to rapid and significant technological change. Synageva’s potential competitors include large pharmaceutical and biotechnology companies and specialty pharmaceutical companies, academic institutions, government agencies, and research institutions. The market for enzyme replacement therapies is becoming increasingly competitive. However, Synageva’s products, upon approval, will be focused, at least initially, on specific orphan markets characterized by high unmet medical need. Key competitive factors affecting the commercial success of Synageva’s product candidates are likely to be efficacy, safety and tolerability profile, reliability and durability of response, convenience of dosing, and price and reimbursement.

Government Regulation

The preclinical studies and clinical testing, manufacture, labeling, storage, record keeping, advertising, promotion, export, and marketing, among other things, of Synageva’s product candidates and future products, are subject to extensive regulation by governmental authorities in the U.S. and other countries. In the U.S., pharmaceutical products are regulated by the FDA under the Federal Food, Drug, and Cosmetic Act and other laws, including, in the case of biologics, the Public Health Service Act. Synageva expects SBC-102 to be regulated by the FDA as a biologic. Biologics require the submission of a BLA and approval by the FDA prior to being marketed in the U.S. Manufacturers of biologics may also be subject to state regulation. Failure to comply with FDA requirements, both before and after product approval, may subject Synageva and/or its partners, contract manufacturers, and suppliers to administrative or judicial sanctions, including FDA refusal to approve applications, warning letters, product recalls, product seizures, total or partial suspension of production or distribution, fines and/or criminal prosecution.

The steps required before a biologic may be approved for marketing of an indication in the U.S. generally include:

| • | preclinical laboratory tests and animal tests; |

| • | submission to the FDA of an IND for human clinical testing, which must become effective before human clinical trials may commence; |

| • | adequate and well-controlled human clinical trials to establish the safety and efficacy of the product; |

| • | submission to the FDA of a BLA or supplemental BLA; |

| • | FDA pre-approval inspection of product manufacturers; and |

| • | FDA review and approval of the BLA or supplemental BLA. |

Preclinical studies include laboratory evaluation, as well as animal studies to assess the potential safety and efficacy of the product candidate. Preclinical safety tests must be conducted in compliance with FDA regulations regarding good laboratory practices. The results of the preclinical tests, together with manufacturing information and analytical data, are submitted to the FDA as part of an IND, which must become effective before human clinical trials may be commenced. The IND will automatically become effective 30 days after receipt by the FDA, unless the FDA before that time raises concerns about the drug candidate or the conduct of the trials as outlined in the IND. The IND sponsor and the FDA must resolve any outstanding concerns before clinical trials can proceed. Submission of an IND does not guarantee FDA authorization to commence clinical trials.

Clinical trials involve the administration of the investigational product to healthy volunteers or to patients, under the supervision of qualified principal investigators. Each clinical study at each clinical site must be reviewed and approved by an independent institutional review board prior to the recruitment of subjects.

Clinical trials are typically conducted in three sequential phases, but the phases may overlap and different trials may be initiated with the same drug candidate within the same phase of development in similar or differing patient populations. Phase I studies may be conducted in a limited number of patients, but are usually conducted in healthy volunteer subjects. The drug is usually tested for safety and, as appropriate, for absorption, metabolism, distribution, excretion, pharmaco-dynamics and pharmaco-kinetics.

Phase II usually involves studies in a larger, but still limited, patient population to evaluate preliminarily the efficacy of the drug candidate for specific, targeted indications to determine dosage tolerance and optimal dosage and to identify possible short-term adverse effects and safety risks.

Phase III trials are undertaken to further evaluate clinical efficacy of a specific endpoint and to test further for safety within an expanded patient population at geographically dispersed clinical study sites. Phase I, Phase II, or Phase III testing might not be completed successfully within any specific time period, if at all, with respect to any of Synageva’s product candidates. Results from one trial are not necessarily predictive of results from later trials. Furthermore, the FDA may suspend clinical trials at any time on various grounds, including a finding that the subjects or patients are being exposed to an unacceptable health risk.

The results of the preclinical studies and clinical trials, together with other detailed information, including information on the manufacture and composition of the product, are submitted to the FDA as part of a BLA requesting approval to market the product candidate for a proposed indication. Under the Prescription Drug User Fee Act, as amended, the fees payable to the FDA for reviewing a BLA, as well as annual fees for commercial manufacturing establishments and for approved products, can be substantial. The BLA review fee alone can exceed $500,000, subject to certain limited deferrals, waivers, and reductions that may be available. Each BLA submitted to the FDA for approval is typically reviewed for administrative completeness and reviewability within 45 to 60 days following submission of the application. If found complete, the FDA will “accept” the BLA, thus triggering a full review of the application. The FDA may refuse to file any BLA that it deems incomplete or not properly reviewable at the time of submission. The FDA’s established goal is to review 90% of priority BLA applications in six months and 90% of standard BLA applications in 10 months, whereupon a review decision is to be made. The FDA, however, may not approve a drug within these established goals and its review goals are subject to change from time to time. Further, the outcome of the review, even if generally favorable, may not be an actual approval but an “action letter” that describes additional work that must be done before the application can be approved. Before approving a BLA, the FDA may inspect the facilities at which the product is manufactured and will not approve the product unless compliance with cGMP is satisfactory. The FDA may deny approval of a BLA if applicable statutory or regulatory criteria are not satisfied, or may require additional testing or information, which can delay the approval process. FDA approval of any application may include many delays or never be granted. If a product is approved, the approval will impose limitations on the indicated uses for which the product may be marketed, may require that warning statements be included in the product labeling, may require that additional studies be conducted following approval as a condition of the approval, and may impose restrictions and conditions on product distribution, prescribing, or dispensing in the form of a risk management plan, or otherwise limit the scope of any approval. Marketing a product for other indicated uses or making certain manufacturing or other changes requires FDA review and approval of a BLA supplement or new BLA. Further post-marketing testing and surveillance to monitor the safety or efficacy of a product is required. Also, product approvals may be withdrawn if compliance with regulatory standards is not maintained or if safety or manufacturing problems occur following initial marketing. In addition, new government requirements may be established that could delay or prevent regulatory approval of Synageva’s product candidates under development.

As part of the newly enacted Patient Protection and Affordable Care Act of 2010, Public Law No. 111-148, under the subtitle of Biologics Price Competition and Innovation Act of 2009 (“BPCI”), a statutory pathway has been created for licensure, or approval, of biological products that are biosimilar to, and possibly interchangeable with, earlier biological products licensed under the Public Health Service Act. Also under the BPCI, innovator manufacturers of original reference biological products are granted 12 years of exclusive use before biosimilars can be approved for marketing in the U.S. The objectives of the BPCI are conceptually similar to those of the Drug Price Competition and Patent Term Restoration Act of 1984, commonly referred to as the “Hatch-Waxman Act,” which established abbreviated pathways for the approval of drug products. The implementation of an abbreviated approval pathway for biological products is under the direction of the FDA and is currently being developed. In late 2010, the FDA held a hearing to receive comments from a broad group of stakeholders regarding the implementation of the BCPI. The approval of a biologic product biosimilar to one of Synageva’s products could have a material adverse impact on its business as it may be significantly less costly to bring to market and may be priced significantly lower than Synageva’s products.

Both before and after the FDA approves a product, the manufacturer and the holder or holders of the BLA for the product are subject to comprehensive regulatory oversight. For example, quality control and manufacturing procedures must conform, on an ongoing basis, to cGMP requirements, and the FDA periodically inspects manufacturing facilities to assess compliance with cGMP. Accordingly, manufacturers must continue to spend time, money and effort to maintain cGMP compliance.

Orphan Drug Act

The Orphan Drug Act provides incentives to manufacturers to develop and market drugs for rare diseases and conditions affecting fewer than 200,000 persons in the U.S. at the time of application for Orphan Drug Designation. The first developer to receive FDA marketing approval for an orphan drug is entitled to a seven year exclusive marketing period in the U.S. for that product. However, a drug that the FDA considers to be clinically superior to, or different from, another approved orphan drug, even though for the same indication, may also obtain approval in the U.S. during the seven year exclusive marketing period. In addition, holders of exclusivity for orphan drugs are expected to assure the availability of sufficient quantities of their orphan drugs to meet the needs of patients. Failure to do so could result in the withdrawal of marketing exclusivity for the drug.

Legislation similar to the Orphan Drug Act has been enacted in other countries outside the U.S., including the EU. The orphan legislation in the EU is available for therapies addressing chronic debilitating or life-threatening conditions that affect five or fewer out of 10,000 persons or are financially not viable to develop. The market exclusivity period is for 10 years, although that period can be reduced to six years if, at the end of the fifth year, available evidence establishes that the product is sufficiently profitable not to justify maintenance of market exclusivity. The market exclusivity may be extended to 12 years if sponsors complete a pediatric investigation plan agreed upon with the relevant committee of the EMA.

Foreign Regulation

In addition to regulations in the U.S., Synageva is subject to a variety of foreign regulatory requirements governing human clinical trials and marketing approval for drugs. The foreign regulatory approval process includes all of the risks associated with FDA approval set forth above, as well as additional country-specific regulations. Whether or not Synageva obtains FDA approval for a product, it must obtain approval of a product by the comparable regulatory authorities of foreign countries before it can commence clinical trials or marketing of the product in those countries. The approval process varies from country to country, and the time may be longer or shorter than that required for FDA approval. The requirements governing the conduct of clinical trials, product licensing, pricing, and reimbursement vary greatly from country to country.

Corporate Information

Synageva was incorporated in Delaware in 1996. Prior to August 2008, Synageva was named AviGenics, inc. Synageva’s address is 128 Spring Street, Suite 520, Lexington, Massachusetts 02421. Synageva’s telephone number is (781) 357-9900. Synageva’s website address is www.synageva.com. Information contained in, and that can be accessed through, Synageva’s website is not incorporated into and does not form a part of this joint proxy statement/prospectus.

Employees

As of June 30, 2011, Synageva had 72 full-time employees. Approximately 51 were primarily engaged in research and development activities and 21 were primarily engaged in general, administrative, and pre-commercial activities. None of Synageva’s employees are subject to a collective bargaining agreement, and Synageva believes its employee relations to be good.

Property and Facilities

Synageva’s corporate headquarters and research laboratories are located in Lexington, Massachusetts, where Synageva leases and occupies approximately 11,000 rentable square feet of office and laboratory space. The lease expires on August 31, 2013 with an option to extend the lease by an additional two years. Synageva’s technical and manufacturing operations are located in and around Athens, Georgia, where Synageva leases and occupies approximately 53,000 rentable square feet of office and laboratory space in three different buildings. The first facility lease expires June 30, 2012, the second facility lease expires April 10, 2013, and the third facility lease expires June 30, 2013. Synageva believes that its facilities are suitable and adequate for its needs.

Legal Proceedings

Synageva is not currently engaged in any material legal proceedings.

SYNAGEVA’S MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

This discussion of Synageva’s financial condition and results of operations should be read together with the consolidated financial statements and notes contained elsewhere in this joint proxy statement/prospectus. Certain statements in this section and other sections are forward-looking. While Synageva believes these statements are accurate, its business is dependent on many factors, some of which are discussed in the sections entitled “Risk Factors” and “Synageva’s Business”. Many of these factors are beyond Synageva’s control and any of these and other factors could cause actual results to differ materially from the forward-looking statements made in this joint proxy statement/prospectus. See the section entitled “Risk Factors” for further information regarding these factors. Synageva undertakes no obligation to release publicly the results of any revisions to the statements contained in this report to reflect events or circumstances that occur subsequent to the date of this joint proxy statement/prospectus.

Overview

Synageva is a clinical stage biopharmaceutical company focused on the discovery, development, and commercialization of therapeutic products for patients with life-threatening rare diseases and unmet medical needs. Synageva’s management team is experienced in the development and commercialization of drugs for diseases with small patient populations, including clinical and translational research, working with payors to establish reimbursement, and designing and building commercial organizations to reach highly specialized physicians to facilitate patient identification. Synageva has several protein therapeutics in development, including two enzyme replacement therapies for lysosomal storage disorders and two programs for life-threatening genetic conditions for which there are currently no approved treatments. Its lead program, SBC-102, is a recombinant human LAL currently under clinical investigation in the U.S. and EU for the treatment of patients with LAL Deficiency, which is a rare, devastating disease that causes significant morbidity and mortality. SBC-102 has been granted Orphan Drug Designations by FDA and the EMA and a Fast Track Designation by the FDA. Synageva has not yet received approval to market this product and is not currently commercializing any other products.

Financial Operations Overview

General

Synageva’s future operating results will depend on the progress of drug candidates currently in its research and development pipeline. The results of Synageva’s operations will vary significantly from year to year and quarter to quarter and will depend largely on, among other factors, the cost and outcome of any preclinical development or clinical trials then being conducted.

Synageva, on a stand-alone basis, anticipates that its existing cash and cash equivalents as of June 30, 2011 should enable it to maintain current and planned operations into the first half of 2012. Synageva’s ability to continue funding its planned operations through and beyond the first half of 2012 is dependent on its ability to manage its expenses and its ability to raise additional funds through additional equity or debt financings, other sources of financing or corporate collaborations.

A discussion of certain risks and uncertainties that could affect Synageva’s liquidity, capital requirements and ability to raise additional funds is set forth under the section entitled “Risk Factors” in this joint proxy statement/prospectus.

Revenue

Synageva does not expect to generate any revenue from the direct sale of products for several years, if ever. Substantially all of its revenues to date have been derived from grant revenue and license and collaboration fees.

Synageva’s only source of significant revenues and/or cash flows from operations for the foreseeable future will be up-front license payments and funded research and development that it may receive under new collaboration agreements, if any. Synageva’s ability to enter into new collaborations and its receipt of additional payments under its existing collaborations cannot be assured, nor can it predict the timing of any such arrangements or payments, as the case may be.

Research and Development

Synageva expenses research and development costs as incurred. Research and development expense consists of costs incurred to discover, research and develop drug candidates, including personnel and facility-related expenses, outside contracted services including clinical trial costs, manufacturing and process development costs, research costs, outside consulting services and other external costs.

General and Administrative

General and administrative expense consists primarily of salaries, stock-based compensation expense and other related costs for personnel in executive, finance, accounting, business development, legal, information technology, corporate communications and human resource functions. Synageva also expenses patent costs and expenses associated with maintaining its intellectual property as incurred. Other costs include facility costs not otherwise included in research and development expense, insurance, and professional fees for legal and accounting services.

Results of Operations

Six Months Ended June 30, 2011 and June 30, 2010

Revenues

Total revenues increased approximately $26,000, or 9%, to $301,000 for the six months ended June 30, 2011 as compared to $275,000 for the comparable period in 2010. In May 2010, Synageva was awarded a two-year National Institute of Health grant (the “NIH Grant”) totaling $747,000. Grant revenues for the six months ended June 30, 2011 and June 30, 2010 were $196,000 and $132,000, respectively. Grant revenues are recognized in the period in which Synageva has incurred the expenditures in compliance with the specific restrictions of the NIH Grant. At June 30, 2011, Synageva had one ongoing collaboration. In accordance with the proportional performance method of revenue recognition, due to the timing of milestone payments, revenue is limited to amounts billed or cash paid. Collaboration revenues for the six months ended June 30, 2011 and June 30, 2010 were $105,000 and $143,000, respectively.