Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - SRC Energy Inc. | syrg_8k.htm |

| EX-99.1 - EXHIBIT 99.1 - SRC Energy Inc. | syrg_ex991.htm |

Exhibit 99.2

Corporate Management Presentation

December 2011

NYSE Amex: SYRG

October

Disclaimer: Forward Looking

Statements

Statements

• This presentation includes forward-looking statements within the meaning of Section 27-A

of the Securities Act of 1933, and Section 21-E of the Securities Exchange Act of 1934.

of the Securities Act of 1933, and Section 21-E of the Securities Exchange Act of 1934.

• Such statements include declarations regarding the intent, belief, or current expectations

of the company and its management.

of the company and its management.

• Prospective investors are cautioned that any such forward-looking statements are not

guarantees of future performance, and involve a number of risks and uncertainties that can

materially affect actual results as identified from time to time in the Company’s reports.

guarantees of future performance, and involve a number of risks and uncertainties that can

materially affect actual results as identified from time to time in the Company’s reports.

• Forward looking statements provided herein as of a specified date are not hereby

reaffirmed or updated.

reaffirmed or updated.

www.synergyresourcescorporation.com

2

NYSE Amex: SYRG

Introductions - Key Senior

Executives

Executives

Company’s Management has Owned/Operated 300+ D-J Basin Wells in the Last 30+ years.

Key Corporate Executives

§ Edward Holloway, President, Chief Executive Officer, Director

– 25+ Years of Oil and Gas Executive Leadership

– Director of Synergy since June 2008

– Former Co-Founder, Cache Exploration Inc.

– Co-Founder, Petroleum Management, LLC and Petroleum Exploration & Management, LLC

– Board Member of Denver-Julesburg Petroleum Association

– Past president of Colorado Oil and Gas Association - 1990

§ William Scaff Jr., Vice President, Secretary, Treasurer, Director

– 20+ Years of Oil and Gas Executive Leadership

– Director of Synergy since June 2008

– Former Dresser Industries Area Manager and Total Petroleum Regional Manager

– Co-Founder, Petroleum Management, LLC and Petroleum Exploration & Management, LLC

– Board of Trustee of Colorado/Wyoming Petroleum Marketers Association

§ Frank Jennings, Principal Financial Officer

– 20+ years of accounting and finance experience; MBA from Indiana University

– Joined Synergy full time in March 2011, after serving on a part time basis since 2008

– Five years as Chief Financial Officer of Gold Resource Corporation (NYSE Amex: GORO)

– Ten years as CPA with PriceWaterhouseCoopers in Houston

– Four years as Audit Manager with The Walt Disney Companies

– Experience in oil and gas drilling, services, exploration and production industry

3

www.synergyresourcescorporation.com

NYSE Amex: SYRG

Introductions - Board of Directors

§ George Seward was appointed as a Director in July 2010. Mr. Seward co-founded

Prima Energy in 1980 and served as its Secretary until 2004 when Prima was sold to

Petro-Canada for $534 million.

Prima Energy in 1980 and served as its Secretary until 2004 when Prima was sold to

Petro-Canada for $534 million.

§ The management team has significant oil and natural gas experience combined with

financial management expertise.

financial management expertise.

(*) Denotes independent director.

www.synergyresourcescorporation.com

4

NYSE Amex: SYRG

Company Overview

§ Independent operator in the exploration and production of crude oil and natural gas

focusing on the Denver-Julesburg Basin

focusing on the Denver-Julesburg Basin

§ Expand acreage position in the thriving Denver-Julesburg

Basin and develop low cost and low risk vertical wells with

nearly a 100% success rate

§ Favorable oil and gas contracts in place

www.synergyresourcescorporation.com

5

NYSE Amex: SYRG

Strengths of the Wattenberg

Field

Field

Low Drilling and

Completion Costs

Completion Costs

Rapid Return on

Investment

Investment

High Success Rate

(99% of Wells in Wattenberg Field

Are Completed)

Are Completed)

Low Lifting Costs

($2.13 per BOE)

Liquid-Rich

Natural Gas

Natural Gas

(High BTU Content)

Long Life Production

and Reserves

and Reserves

(30+ Years)

Takeaway Capacity

(Enhanced in Rocky

Mountain Region)

Horizontal Drilling

in Niobrara & Codell

§ Efficient use of capital

§ Build reserves and cash flow to fund future drilling program

§ Significant upside potential from multiple pay zones and horizontal wells targeting the

Niobrara & Codell

Niobrara & Codell

www.synergyresourcescorporation.com

7

F & D Costs

($16.62 per BOE)

NYSE Amex: SYRG

Largest Producers in the Wattenberg and D

-J Basin

-J Basin

Source: Bloomberg, Company Presentations

Market values as of market close on November 30, 2011

NYSE Amex: SYRG

www.synergyresourcescorporation.com

9

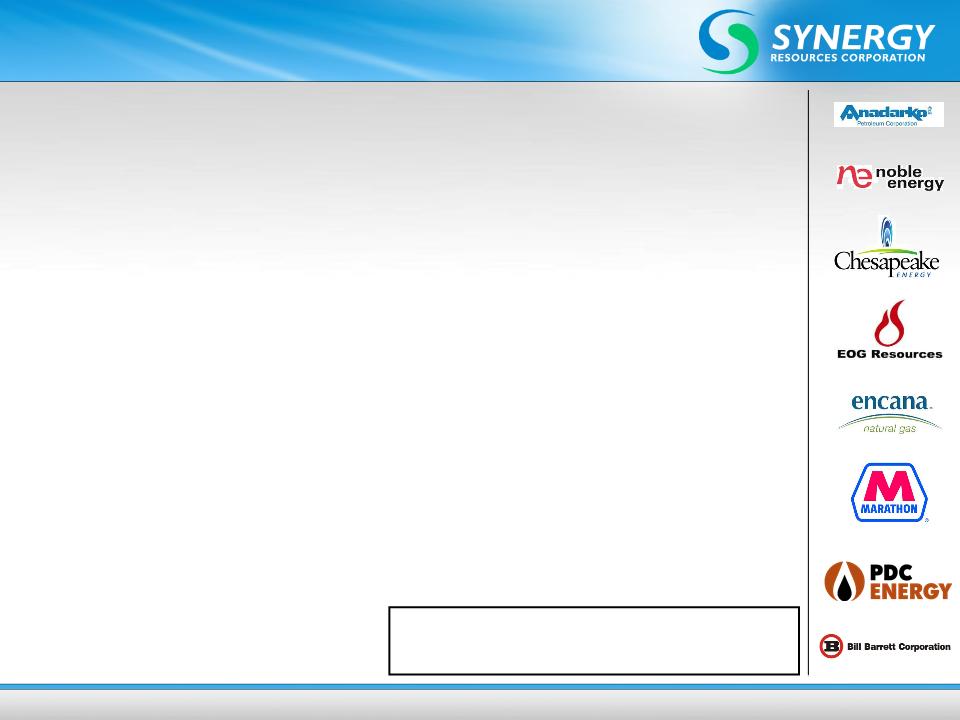

§ Anadarko Petroleum (NYSE:APC) - Market Cap $40.31B

– Believes the play has net resources potential of 500 million to 1.5 billion BOE; believes it has 1,200 -

2,700 future drilling locations with EURs of 300,000-600,000 per well and expects to drill 160

horizontal wells in 2012 (up from 40 in 2011) utilizing 7 rigs in the Basin

2,700 future drilling locations with EURs of 300,000-600,000 per well and expects to drill 160

horizontal wells in 2012 (up from 40 in 2011) utilizing 7 rigs in the Basin

§ Noble Energy (NYSE:NBL) - Market Cap $17.16B

– Holds 400,000 net acres in the Wattenberg, plans to operate 5-6 rigs in 2012 and is targeting 8-10

wells to be completed per month in 2012

wells to be completed per month in 2012

§ Chesapeake Energy Corporation (NYSE:CHK) - Market Cap $15.87B

– Recently sold part of their interest in the Niobrara for over $4,800 per acre total consideration

§ EOG Resources (NYSE:EOG) - Market Cap $28.01B

– Has 3 rig drilling program in the region and plans on 40 new wells in 2011

§ EnCana (NYSE:ECA) - Market Cap $14.82B

– Among the largest independent producers in the United States with a significant presence

in the Wattenberg and Rocky Mountain Region

§ Marathon Oil (NYSE:MRO) - Market Cap $19.74B

– Entered into a joint venture with Marubeni Corp, in which a subsidiary of Mauribeni

will pay $270 million for a 30% working interest in MRO’s 180,000 net acres in the Niobrara

formation, equating to roughly $5,000 per acre

will pay $270 million for a 30% working interest in MRO’s 180,000 net acres in the Niobrara

formation, equating to roughly $5,000 per acre

§ PDC Energy (Nasdaq:PETD) - Market Cap $774.92mm

– The Niobrara continues to outperform the company's expectations; EURs in core Wattenberg Field

acreage likely to rise substantially above 300 MBOE; plans to drill 14 wells in 2011

acreage likely to rise substantially above 300 MBOE; plans to drill 14 wells in 2011

§ Bill Barrett Corporation (NYSE:BBG) - Market Cap $1.86B

– Paid $150 million for 28,000 net acres and 650 BOE per day of production in the D-J Basin

In a recent APC research report, Bank of America

Merrill Lynch estimates individual horizontal well NPVs

of ~$7mm and IRR of ~70% in the Wattenberg Field

Merrill Lynch estimates individual horizontal well NPVs

of ~$7mm and IRR of ~70% in the Wattenberg Field

Leased Acreage

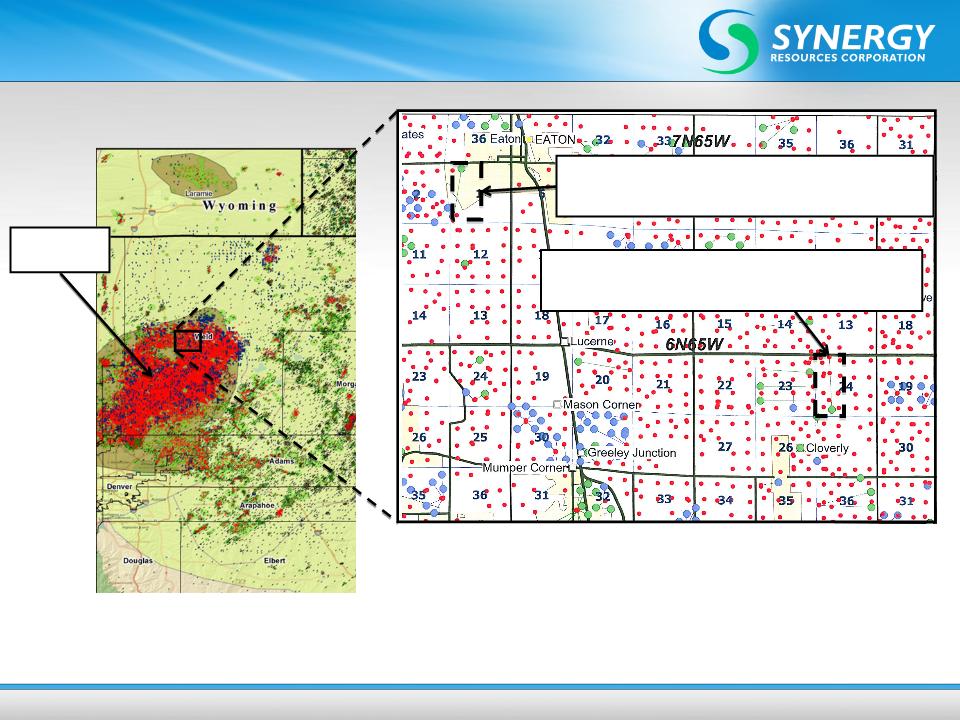

§ Significant number of vertical wells in the oil and high-liquids portion of the Wattenberg Field in the D

-J Basin (Codell/Niobrara/J-Sands formations)

-J Basin (Codell/Niobrara/J-Sands formations)

§ Highly prospective for the horizontal Niobrara

§ Advancements in horizontal drilling, coupled with the relatively untapped potential of the Niobrara

creates a significant opportunity for growth in SYRG’s core geographic area

creates a significant opportunity for growth in SYRG’s core geographic area

www.synergyresourcescorporation.com

10

Northern Weld and Morgan Counties, CO

2,072 net (high liquids)

Wattenberg Field, CO

9,717 net (high liquids)

Chase County, NE

48,321 net (oily)

Dundy County, NE

31,551 net (oily)

Hayes County, NE

34,315 net (oily)

Hitchcock County, NE

2,492 net (oily)

2,492 net (oily)

Yuma & Washington Counties, CO

31,740 net (dry gas)

31,740 net (dry gas)

NYSE Amex: SYRG

Niobrara Horizontal Well

Participation

Participation

www.synergyresourcescorporation.com

NYSE Amex: SYRG

11

Recent AFE’s:

•Synergy has elected to participate in two horizontal Niobrara wells

with notable operators. The two wells have been permitted and are

expected to be drilled in the first quarter of 2012.

with notable operators. The two wells have been permitted and are

expected to be drilled in the first quarter of 2012.

•Synergy expects to receive six to ten more AFE’s on horizontal wells

within the near future.

within the near future.

Wattenberg

Field

Field

25% Working Interest: PDC Energy Operated

Leffler 14-1H

W/2 Sec 1, T6N-R66W

25% Working Interest: Noble Energy Operated

Wake E24-77HN

W/2 Sec 24, T6N-R65W

Leveraging New Technology

New technology leads to improved drilling

efficiencies, reduced costs and increased

production; including:

efficiencies, reduced costs and increased

production; including:

The use of directional drilling:

§ Reduces drilling costs, increases drilling success

rates and reduces environmental impact - Pad

drilling

rates and reduces environmental impact - Pad

drilling

§ Can drill multiple wells from one pad targeting the J-

Sand/Codell/Niobrara formations

Sand/Codell/Niobrara formations

New well completion and stimulation techniques:

§ Can triple the extraction of reserves over the life of

the well - Refrac potential

the well - Refrac potential

§ Increases cash flow and investment returns

Advanced horizontal drilling techniques:

§ Unlock Niobrara potential

NYSE Amex: SYRG

www.synergyresourcescorporation.com

12

Industry Leaders Projected

Vertical Well Strategy

www.synergyresourcescorporation.com

13

NYSE Amex: SYRG

Maximizing the Barrels of Oil Equivalent per Vertical Well:

By drilling to the J-Sand first, then plugging and moving up-pipe to

the Codell and Niobrara zones, Synergy believes it can maximize

the BOE’s per well with an estimated ultimate recovery of 120,000

BOEs per well (with refrac)

the Codell and Niobrara zones, Synergy believes it can maximize

the BOE’s per well with an estimated ultimate recovery of 120,000

BOEs per well (with refrac)

Analyst Marty Beskow, CFA, of Northland Capital Markets has

estimated a $1.1mm NPV per vertical well by exploiting this strategy

estimated a $1.1mm NPV per vertical well by exploiting this strategy

Financial Profile and Recent

Developments

Developments

FINANCIAL PROFILE: NYSE Amex: SYRG

(metrics in millions except per share statistics; as of 11/30/11)

§ 52 Week Stock Price Range: $2.20 - $4.90

§ Share Price As Of Nov 30, 2011 - $3.25

§ Market Capitalization: $117.32

§ Shares Outstanding: 36.10

§ Warrants Outstanding: 14.93

(1mm @ $10 / 13.1mm @ $6 / 0.8mm @$1.62)

§ Options Outstanding: 4.6

(2mm @ $10 / 2mm @ $1 / 0.6mm @ $3.40)

§ Current Float: 67.3%

§ Avg. Vol - 3 Months: 23,428

§ Insiders Ownership: 32.7%

OPERATING PROFILE

(metrics in millions and represent FYE 8/31/11)

§ Revenue: $10.0

§ EBITDA: $5.7

§ Cash And Short-term Investments: $9.5

§ Debt Outstanding: $5.2

§ Total Assets: $63.7

www.synergyresourcescorporation.com

14

NYSE Amex: SYRG

Nov 30, 2011

Increased Revolving Line of

Credit to $15mm

Credit to $15mm

Revenue Mix for MRQ:

Revenue Growth Per Quarter

Oil = 71%

Gas = 29%

www.synergyresourcescorporation.com

15

NYSE Amex: SYRG

|

Average Sales Price per Quarter:

|

||||||||

|

|

1Q Nov 2009

|

2Q Feb 2010

|

3Q May 2010

|

4Q Aug 2010

|

1Q Nov 2010

|

2Q Feb 2011

|

3Q May 2011

|

4Q Aug 2011

|

|

Oil (Bbls)

|

$ 58.12

|

$ 69.44

|

$ 73.22

|

$ 85.37

|

$ 72.39

|

$ 83.64

|

$ 95.15

|

$ 89.91

|

|

Gas (Mcf)

|

$ 3.67

|

$ 7.05

|

$ 4.90

|

$ 7.57

|

$ 3.48

|

$ 4.40

|

$ 5.34

|

$ 6.22

|

1P Reserve Growth by Year (PV-

10)*

10)*

www.synergyresourcescorporation.com

NYSE Amex: SYRG

17

Total 1P PV-10 = $232,957

Total 1P PV-10 = $16,557,726

* Reserve estimates prepared by Ryder Scott Company

Summary

The management team has a well-defined and clear plan for creating shareholder value which

includes:

includes:

§ Continuing to expand our acreage footprint through leases and acquisitions

§ Utilize an aggressive drilling program in proven low-risk areas with predicable rates-

of-return

of-return

§ Leverage management’s significant experience and expertise in the basin

www.synergyresourcescorporation.com

18

NYSE Amex: SYRG