Attached files

| file | filename |

|---|---|

| 8-K - Black Tusk Minerals Inc. | blacktusk8k_121411.htm |

EXHIBIT 99.1

A copy of this amended and restated preliminary prospectus has been filed with the securities regulatory authority in the Province of Alberta but has not yet become final. Information contained in this amended and restated preliminary prospectus may not be complete and may have to be amended.

This prospectus does not constitute a public offering of any securities. No securities regulatory authority has expressed an opinion about these securities and it is an offence to claim otherwise.

“Amended and restated preliminary prospectus dated December 6, 2011, amending and

restating the preliminary prospectus dated November 30, 2011.”

Non-Offering Prospectus

BLACK TUSK MINERALS INC.

No securities are being offered pursuant to this prospectus.

This amended and restated preliminary prospectus (the “Prospectus”) is being filed with the securities regulatory authorities in the province of Alberta to enable Black Tusk Minerals Inc. (the “Company”) to become a reporting issuer pursuant to applicable securities legislation in the province of Alberta, notwithstanding that no sale of its securities is contemplated herein.

Since no securities are being offered pursuant to this Prospectus, no proceeds will be raised and all expenses in connection with the preparation and filing of this Prospectus will be paid by the Company from its general corporate funds.

The Company’s common stock is quoted in the United States on the Over The Counter Bulletin Board (“OTCBB”), which is sponsored by the Financial Industry Regulatory Authority “FINRA”. The OTCBB is not considered a “national exchange”. Our symbol is “BKTK”. As of December 6, 2011, the last sale on the OTCBB was US$0.11.

Our common stock began trading on the OTCBB on February 1, 2008. Accordingly, there is only a very limited trading history for our common stock. Further, the market for shares in our common stock is limited because only a small number of our outstanding shares are available for trading in the public market. Until a larger secondary market for our common stock develops, the price of our common stock may fluctuate substantially. Please see “Risk Factors”.

No underwriter has been involved in the preparation of the Prospectus or performed any review or independent due diligence of the contents of the Prospectus.

The Company is incorporated, continued or otherwise organized under the laws of a foreign jurisdiction or resides outside Canada. Although the Company has appointed The Corporation Trust Company of Nevada, 6100 Neil Road, Suite 500, Reno, Nevada, 89511, as its agent for service of process in the United States it may not be possible for investors to enforce judgements obtained in Canada against the Company.

|

TABLE OF CONTENTS

|

|

|

Cautionary Note Regarding Forward Looking Statements

|

3

|

|

Glossary of Terms

|

4

|

|

Glossary of Terms Relating to Mining and Mineral Properties

|

6

|

|

Conversions

|

7

|

|

Currency

|

7

|

|

SUMMARY OF PROSPECTUS

|

7

|

|

Principal Business

|

7

|

|

Use of Proceeds

|

7

|

|

Risk Factors

|

7

|

|

Selected Financial Information

|

9

|

|

CORPORATE STRUCTURE

|

10

|

|

Name, Address and Incorporation

|

10

|

|

Intercorporate Relationships

|

10

|

|

DESCRIPTION OF BUSINESS

|

11

|

|

Description of Business

|

11

|

|

Three Year History

|

11

|

|

Description of the Peru Properties

|

12

|

|

USE OF PROCEEDS

|

19

|

|

Business Objectives and Milestones

|

19

|

|

DIVIDENDS

|

19

|

|

MANAGEMENT’S DICSCUSSION AND ANALYSIS

|

19

|

|

MD&A For the Fiscal Year Ended May 31, 2011

|

19

|

|

MD&A For the Quarterly Period Ended August 31, 2011

|

24

|

|

MD&A For the Fiscal Year Ended May 31, 2010

|

33

|

|

DESCRIPTION OF SHARE CAPITAL

|

37

|

|

Common Shares

|

38

|

|

Debt Securities

|

38

|

|

CONSOLIDATED CAPITALIZATION

|

38

|

|

Consolidated Capitalization

|

38

|

|

OPTIONS TO PURCHASE SECURITIES

|

39

|

|

Options to Purchase Securities

|

39

|

|

PRIOR SALES

|

42

|

|

Prior Sales

|

42

|

|

Trading Price and Volume

|

43

|

|

ESCROWED SECURITIES AND SECURITIES SUBJECT TO CONTRACTUAL RESTRICTION ON TRANSFER

|

43

|

|

PRINCIPAL SECURITYHOLDERS

|

43

|

|

Principal Securityholders

|

43

|

|

DIRECTORS AND EXECUTIVE OFFICERS

|

44

|

|

Name, Occupation and Security Holding

|

44

|

|

Cease Trade Orders, Bankruptcies, Penalties or Sanctions

|

45

|

|

Conflicts of Interest

|

46

|

|

Management of Junior Issuers

|

46

|

|

EXECUTIVE COMPENSATION

|

47

|

|

Compensation Discussion and Analysis

|

47

|

|

Narrative Disclosure to Summary Compensation Table

|

48

|

|

Other Compensation Information

|

48

|

|

Outstanding Equity Awards at Fiscal Year-End

|

48

|

|

Retirement, Resignation or Termination Plans

|

49

|

|

Compensation of Directors

|

49

|

|

Employment Contracts and Termination of Employment and Change-In-Control Arrangements

|

50

|

|

Compensation Committee

|

50

|

|

Compensation Committee Report

|

50

|

|

INDEBTEDNESS OF DIRECTORS AND EXECUTIVE OFFICERS

|

50

|

|

Aggregate Indebtedness

|

50

|

|

AUDIT COMMITTEES AND CORPORATE GOVERNANCE

|

50

|

2

|

Audit Committees

|

50

|

|

Corporate Governance

|

54

|

|

PLAN OF DISTRIBUTION

|

56

|

|

Name of Underwriters

|

56

|

|

RISK FACTORS

|

56

|

|

Risk Factors

|

56

|

|

PROMOTERS

|

62

|

|

Promoters

|

62

|

|

LEGAL PROCEEDINGS AND REGULATORY ACTIONS

|

63

|

|

Legal Proceedings

|

63

|

|

Regulatory Actions

|

63

|

|

INTERESTS OF MANAGEMENT AND OTHERS IN MATERIAL TRANSACTIONS

|

63

|

|

Interests of Management and Others in Material Transactions

|

63

|

|

AUDITORS, TRANSFER AGENTS AND REGISTRARS

|

63

|

|

Auditors

|

63

|

|

Transfer Agent and Registrar

|

63

|

|

MATERIAL CONTRACTS

|

63

|

|

Documents Affecting the Rights of Security Holders

|

63

|

|

Material Contracts

|

63

|

|

EXPERTS

|

64

|

|

Names of Experts

|

64

|

|

Interest of Experts

|

64

|

|

OTHER MATERIAL FACTS

|

64

|

|

Other Material Facts

|

64

|

|

FINANCIAL STATEMENT DISCLOSURE

|

65

|

|

SIGNIFICANT ACQUISITIONS

|

65

|

|

CERTIFICATE OF THE COMPANY

|

65

|

|

AUDITORS’ CONSENT

|

66

|

|

Appendix “A”

|

67

|

Cautionary Note Regarding Forward Looking Statements

This Prospectus and the exhibits attached hereto contain "forward-looking statements". Such forward-looking statements concern the Company's anticipated results and developments in the Company's operations in future periods, planned exploration and development of its properties, plans related to its business and other matters that may occur in the future. These statements relate to analyses and other information that are based on forecasts of future results, estimates of amounts not yet determinable and assumptions of management.

Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance (often, but not always, using words or phrases such as “believes” or “does not believe”, "expects" or "does not expect", "is expected", "anticipates" or "does not anticipate", "plans", "estimates" or "intends", or stating that certain actions, events or results "may", "could", "would", "might" or "will" be taken, occur or be achieved) are not statements of historical fact and may be forward-looking statements. Forward-looking statements are subject to a variety of known and unknown risks, uncertainties and other factors which could cause actual events or results to differ from those expressed or implied by the forward-looking statements, including, without limitation, risks related to:

|

•

|

Our failure to obtain additional financing;

|

|

|

|

•

|

Our inability to continue as a going concern;

|

|

|

•

|

The unique difficulties and uncertainties inherent in the mineral exploration business;

|

|

|

•

|

The inherent dangers involved in mineral exploration;

|

|

|

•

|

Our officer’s inability or unwillingness to devote a sufficient amount of time to our business operations;

|

|

|

•

|

Environmental, health and safety laws in Peru;

|

| • | Governmental regulations and processing licenses in Peru; |

3

|

|

•

|

Uncertainty as to the termination and renewal of our Peruvian mining concessions;

|

|

|

•

|

Our drilling and exploration program and Banking Feasibility Study;

|

|

|

•

|

Our development projects in Peru;

|

|

|

•

|

Peruvian economic and political conditions;

|

|

|

•

|

The Peruvian legal system;

|

|

|

•

|

Native land claims in Peru;

|

|

|

•

|

Natural hazards in Peru; and

|

|

|

•

|

Our common stock.

|

This list is not exhaustive of the factors that may affect our forward-looking statements. Some of the important risks and uncertainties that could affect forward-looking statements are described further under the sections titled "Risk Factors", "Description of Business" and "Management's Discussion and Analysis" of this Prospectus. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those anticipated, believed, estimated or expected. We caution readers not to place undue reliance on any such forward-looking statements, which speak only as of the date made. Except as required by law, we disclaim any obligation subsequently to revise any forward-looking statements to reflect events or circumstances after the date of such statements or to reflect the occurrence of anticipated or unanticipated events.

We qualify all the forward-looking statements contained in this Prospectus by the foregoing cautionary statements.

Glossary of Terms

“2009 Technical Report” means the technical report dated August 28, 2009 entitled “Geological Evaluation of the Huanza Property”, prepared pursuant to the provisions of National Instrument 43-101 by Glen MacDonald P.Geo;

“2009 Plan” means the Company’s 2009 Nonqualified Stock Option Plan adopted the Company’s Board of Directors on August 24, 2009 and approved by the Company’s shareholders on November 16, 2009;

“2011 Plan” means the Company’s 2011 Nonqualified Stock Option Plan adopted the Company’s Board of Directors on March 17, 2011 and approved by the Company’s shareholders on April 29, 2011;

“Cedron’s” means Jorge Carlos Cedron Morales, Rafael Eduardo Cedron Morales and Mario Fernando Cedron Lassus;

“Cedron Units” means the Company’s issuance of 66,667 units to the Cedron’s at a price of $0.15 per unit on September 28, 2011, in partial consideration of services provided;

“Common Shares” means the shares of common stock in the capital of the Company;

“Company” means Black Tusk Minerals Inc., a company incorporated under the laws of the state of Nevada;

“Concession” means, under Peruvian law, a specific staked area that has been granted a title from the Peruvian mining authorities that allows its holder to carry out exploration and exploitation activities within the area;

“EDGAR” means the system for Electronic Data Gathering, Analysis and Retrieval accessible at www.sec.gov;

"Exchange Act" means the United States Securities Exchange Act of 1934, as amended;

“FINRA” means the Financial Industry Regulatory Authority in the United States;

“Huanza Technical Report” means the technical report dated February 2011 entitled “Geological Evaluation of the Huanza Property”, prepared pursuant to the provisions of National Instrument 43-101 by Glen MacDonald P.Geo;

“INGEMMET” means the Instituto Geológico Minero y Metalúrgico, a Peruvian mining authority;

4

“Magellan” means Magellan Management Company, a private British Columbia company owned by Gavin Roy;

“Magellan Debt” means expenses paid by Magellan on behalf of the Company and advances provided to the Company in the amount of $261,032;

“Magellan Placement” means the Company’s issuance of 5,559,713 units to Magellan at a price of $0.05 per unit on February 8, 2011, in consideration of the cancellation of the Magellan Debt;

“Master Purchase Agreement” means the mineral property purchase agreement dated December 5, 2007 between the Company, Subsidiary, Leonard Raymond De Melt, and Marlene Ore Lamilla, respecting the acquisition of the Peru Properties;

“MD&A” means management’s discussion and analysis;

“NSR Royalty” means the royalty on the net smelter returns upon commercial production;

“NI 43-101” means National Instrument 43-101 (Standards of Disclosure for Mineral Projects);

“OTCBB” means the Over The Counter Bulletin Board, which is sponsored by the Financial Industry Regulatory Authority in the United States;

“Pediment” means, under Peruvian law, a specific area staked for future development of mining activities that is yet to be granted a mining concession title with the Peruvian mining authorities;

“Peru Transfer Agreement” means the Mining Concessions and Claims Transfer Agreement dated December 5, 2007, between the Company, Subsidiary, Leonard Raymond De Melt, and Marlene Ore Lamilla governing the transfer and registration of the Peru Properties under Peruvian law;

“Peru Properties” means the Company’s 19 mining concessions located in the District of Huanza, Province of Huarochiri, Department of Lima, Peru;

“Qualified Person” A qualified person is defined in NI 43-101 as an individual who is an engineer or geoscientist with at least five years of experience in mineral exploration, mine development or operation or mineral project assessment, or any combination of these; has experience relevant to the subject matter of the mineral project and the technical report; and is a member in good standing of a professional association.

“Prospectus” means this preliminary prospectus and any appendices, schedules or attachments hereto;

“Rescission and Conditional Purchase Agreements” means the rescission and conditional purchase agreements between the Company and Magellan entered into on March 30, 2011 and April 14, 2011;

“Rescission Units” means a portion of the Magellan Placement rescinded and cancelled pursuant to the Rescission and Conditional Purchase Agreements;

"SEC" means the Securities and Exchange Commission of the United States of America;

"Securities Act" means the Securities Act of 1933 of the United States of America, as amended;

“SEDAR” means the System for Electronic Document Analysis and Retrieval accessible at www.sedar.com;

“Subsidiary” means Black Tusk Minerals Peru SAC, a company incorporated under the laws of the Republic of Peru;

“TSX.V” means the TSX Venture Exchange;

“U.S. Dollar” means the currency of the United States;

“U.S. GAAP” means accounting principles generally accepted in the United States;

“USGS” means the United States Geological Survey;

“Validity Fees” means annual payments under the General Mining Law of Peru which must be paid in order to maintain mining pediments or concessions in good standing.

5

“Warrants” means shares of common stock of the Company issued upon the proper exercise of the Warrants.

Glossary of Terms Relating to Mining and Mineral Properties

|

Alteration

|

Any change in the mineralogic composition of a rock brought about by physical or chemical means.

|

|

Andesitic

|

An extrusive igneous, volcanic rock.

|

|

Argillic

|

Pertaining to clay or clay minerals.

|

|

Basalt

|

A fine-grained igneous rock dominated by dark-colored minerals.

|

|

A mineral composed of calcium carbonate, CaCO3.

|

|

|

Chlorite

|

Family of tetrahedral sheet silicates of iron, magnesium, and aluminum, characteristic of low-grade metamorphism.

|

|

Cu

|

Chemical symbol for copper.

|

|

Dacite

|

A fine-grained extrusive rock with the same general composition as andesite, but having a less calcic plagioclase and more quartz.

|

|

Dyke

|

A long and relatively thin body of igneous rock that, while in the molten state, intruded a fissure in older rocks.

|

|

Epidote

|

A basic silicate of aluminum, calcium, and iron.

|

|

Epithermal veins

|

Hydrothermal mineral deposit formed within about 1 kilometre of the Earth's surface.

|

|

Fault

|

A fracture or a fracture zone in crustal rocks along which there has been displacement of the two sides relative to one another parallel to the fracture.

|

|

Folding

|

The formation of folds in rocks.

|

|

Fossiliferous Calcareous Sediments

|

Fossilized sediments that contain as much as 50% calcium carbonate.

|

|

Au

|

Chemical symbol for gold.

|

|

Granitic

|

Pertaining to or composed of granite.

|

|

Hydrothermal Alteration

|

Alteration of rocks or minerals by the reaction of hydrothermal water with preexisting solid phases.

|

|

Intrusive

|

A body of igneous rock formed by the consolidation of magma intruded into other rocks.

|

|

Pb

|

Chemical symbol for lead.

|

|

Lower Creataceous

|

The earlier or lower of the two major divisions of the Cretaceous period. It is usually considered to stretch from 146 to 100 million years ago.

|

|

Mafic Minerals

|

Pertaining to or composed dominantly of the ferromagnesian rock-forming silicates.

|

|

Mantos

|

A flat-lying, bedded deposit; either a sedimentary bed or a replacement strata-bound orebody.

|

|

Siliceous

|

containing or resembling silica or a silicate.

|

|

Polymetallic Sulphide

|

A sulfide deposit rich in copper, zinc, lead, silver, or gold, which forms as a result of hydrothermal activity.

|

|

Porphyritic

|

Containing relatively large isolated crystals in a mass of fine texture.

|

|

Precambrian

|

Rocks older than the Cambrian age. Refers to the great shield-shaped areas of ancient mineral-bearing rocks.

|

|

Propylitic

|

The result of low-pressure-temperature alteration around many orebodies.

|

|

Quartz

|

A mineral whose composition is silicon dioxide. A crystalline form of silica.

|

|

Quatenary Period

|

The geological time period roughly 2.588 million years ago.

|

|

Sedimentary

|

A type of rock that is formed by sedimentation of material at the earth’s surface.

|

|

Sericite

|

A white, fine-grained potassium mica occurring in small scales as an alteration product of various aluminosilicate minerals.

|

|

Shear

|

A deformation resulting from stresses that cause or tend to cause contiguous parts of a body to slide relatively to each other in a direction parallel to their plane of contact.

|

|

Ag

|

Chemical symbol for silver.

|

|

Skarn

|

Lime-bearing silicates, of any geologic age, derived from nearly pure limestone and dolomite.

|

|

Stratigraphically

|

Pertaining to the composition, sequence, and correlation of stratified rocks.

|

|

Structures

|

The disposition of the rock formations; i.e., the broad dips, folds, faults, and unconformities at depth.

|

|

Subduction

|

Act of one tectonic unit's descending under another.

|

|

Sulfide

|

A mineral compound characterized by the linkage of sulfur with a metal or semimetal.

|

|

Synistral Displacement

|

The sense of displacement in a strike-slip fault zone where one block is displaced to the left of the block from which the observation is made.

|

|

Tertiary

|

The geological period between 65 to 1.64 million years ago.

|

|

Tuffs

|

Rock composed of fine volcanic ash.

|

|

Upper Jurassic

|

The geological period between 161 to 145 million years ago.

|

6

|

Veins

|

An epigenetic mineral filling of a fault or other fracture in a host rock, in tabular or sheetlike form, often with associated replacement of the host rock.

|

|

Zn

|

Chemical symbol for zinc.

|

Conversions

In this Prospectus, both metric and imperial measures are used with respect to mineral properties. Conversion rates

from metric to imperial are provided below:

|

Metric Unit = Imperial Measure

|

Metric Unit = Imperial Measure

|

||

|

1 hectare

|

2.47 acres

|

0.4047 hectare

|

1 acre

|

|

1 metre

|

3.28 feet

|

0.3048 metre

|

1 foot

|

|

1 kilometre

|

0.62 mile

|

1.609 kilometres

|

1 mile

|

|

1 gram

|

0.032 ounce (troy)

|

31.103 grams

|

1 ounce (troy)

|

|

1 tonne

|

1.102 tons (short)

|

0.907 tonne

|

1 ton (short)

|

|

1 gram/tonne

|

0.029 ounce (troy)/ton

|

34.28 grams/tonne

|

1 ounce (troy/ton)

|

Currency

Currency: In this Prospectus all references to "$" or "dollars" mean the U.S. dollar, and unless otherwise indicated all currency amounts in this Prospectus are stated in U.S. dollars. All financial statements have been prepared in accordance with accounting principles generally accepted in the United States and are reported in U.S. dollars. Canadian dollar amounts have been converted herein at an exchange rate of US$1 = C$0.95

SUMMARY OF PROSPECTUS

The following is a summary only and should be read together with the more detailed information and financial data and statements contained elsewhere in this Prospectus.

Principal Business

We were incorporated on August 8, 2005 under the laws of the state of Nevada. Our principal offices are located in Vancouver, British Columbia, Canada. Our corporate address is 7425 Arbutus Street, Vancouver, British Columbia V6P 5T2, and our telephone number is (360) 930-3910.

Our principal business is the acquisition and exploration of mineral properties. To that end, in 2008, we acquired 19 mining concessions and pediments located in the District of Huanza, Province of Huarochiri, Department of Lima, Peru (“the Peru Properties”). Other than the Peru Properties, the Company has no other properties or rights to acquire properties. Our objective is to increase value of our shares through the acquisition, exploration and potential development of mineral properties, beginning with the Peru Properties. We have not presently determined whether our properties contain economic quantities of minerals. The Company currently has no significant employees other than its officers. The Company currently retains consultants to assist in its operations on an as-needed basis. Please see “Description of Business” for a full description.

Use of Proceeds

Since no securities are being offered pursuant to this Prospectus, no proceeds will be raised and all expenses in connection with the preparation and filing of this Prospectus will be paid by the Company from its general corporate funds. Please see “Use of Proceeds” for a full description.

Risk Factors

Readers should carefully consider the risks and uncertainties described below before deciding whether to invest in shares of our common stock.

Our failure to successfully address the risks and uncertainties described below would have a material adverse effect on our business, financial condition and/or results of operations, and the trading price of our common stock may decline and investors may lose all or part of their investment. We cannot assure you that we will successfully address these risks or other unknown risks that may affect our business. Please see “Risk Factors” for a full description.

Risks Related to the Company

7

|

|

•

|

We have no proven or probable reserves on our property and we may never identify any commercially exploitable mineralization.

|

|

|

•

|

We have no history of commercial production.

|

|

|

•

|

We will be required to raise additional capital to fund our exploration programs on our property.

|

|

•

|

Because of the unique difficulties and uncertainties inherent in the mineral exploration business, we face a high risk of business failure.

|

|

|

•

|

Because of the inherent dangers involved in mineral exploration, there is a risk that we may incur liability or damages as we conduct our business.

|

|

|

•

|

Increased costs could affect our financial condition.

|

|

|

•

|

A shortage of equipment and supplies could adversely affect our ability to operate our business.

|

|

|

•

|

Recent market events and conditions, including disruptions in the U.S. and international credit markets and other financial systems and the deterioration of the U.S. and global economic conditions, could, among other things, impede access to capital or increase the cost of capital, which would have an adverse effect on our ability to fund our working capital and other capital requirements.

|

|

|

•

|

General economic conditions.

|

|

|

•

|

Actual capital costs, operating costs, production and economic returns may differ significantly from those anticipated and there are no assurances that any future development activities will result in profitable mining operations.

|

|

|

•

|

Weather conditions could dictate the timing of exploration work on the Peru Properties.

|

|

|

•

|

We depend on a single property - the Peru Properties.

|

|

|

•

|

We do not insure against all risks.

|

|

|

|

•

|

We compete with larger, better capitalized competitors in the mining industry.

|

|

•

|

Because our officer’s have only agreed to provide their services on a part-time basis, they may not be able or willing to devote a sufficient amount of time to our business operations, causing our business to fail.

|

Risks Associated with Doing Business in Peru

|

•

|

Environmental, health and safety laws and other regulations may increase our costs of doing business, restrict our operations or result in operational delays.

|

|

|

•

|

Obtaining governmental approvals, licenses and permits is not guaranteed and is largely beyond our control.

|

|

|

•

|

There is uncertainty as to the termination and renewal of our mining concessions.

|

|

|

•

|

Drilling, exploration and completing a banking feasibility study (BFS).

|

|

|

•

|

Development projects.

|

|

•

|

Peruvian economic and political conditions may have an adverse impact on our business.

|

|

|

•

|

Legal system in Peru.

|

|

|

•

|

Native land claims might affect our title to the Peru Properties and our business plan may fail.

|

Risks Relating to Our Common Stock

8

|

|

•

|

Our common stock has a limited trading history and has experienced price volatility.

|

|

|

•

|

We anticipate that we will raise additional capital through equity financing, which may cause substantial dilution to our existing shareholders.

|

|

|

•

|

We have not paid cash dividends on our common stock and do not anticipate paying any dividends on our common stock in the foreseeable future.

|

|

|

•

|

A decline in the price of our common stock could affect our ability to raise further working capital and adversely impact our operations.

|

|

|

•

|

Our stock is a penny stock. Trading of our stock may be restricted by the SEC's penny stock regulations which may limit a stockholder's ability to buy and sell our stock.

|

|

|

•

|

The Financial Industry Regulatory Authority, or FINRA, has adopted sales practice requirements which may also limit a stockholder's ability to buy and sell our stock.

|

|

•

|

The trading volume for our common stock is illiquid and the price of our common stock may be subject to fluctuations in the future.

|

Selected Financial Information

The following selected financial information is subject to the detailed information contained in the financial statements of the Company and notes thereto appearing elsewhere in the Prospectus. The selected financial information is derived from the audited and unaudited financial statements of the Company for the periods indicated. Please see “Financial Statement Disclosure”.

|

INCOME STATEMENT

DATA

|

For the Three

Months Ended

August 31, 2011 |

Fiscal Year

Ended May 31, 2011 |

Fiscal Year

Ended May 31, 2010 |

Fiscal Year Ended

May 31, 2009 |

||||

|

unaudited

|

audited

|

audited

|

audited

|

|||||

|

Revenue

|

$

|

0

|

$

|

0

|

$

|

0

|

$

|

0

|

|

Operating Expenses

|

$

|

60,060

|

$

|

265,379

|

$

|

820,510

|

$

|

113,134

|

|

Net Income (Loss)

|

$

|

(63,886)

|

$

|

(278,079)

|

$

|

(841,814)

|

$

|

(140,776)

|

|

Net Income (Loss) per Common Share*

|

$ | (0.01) | $ | (0.15) | $ | (0.88) | $ | (0.15) |

* Basic and diluted

|

BALANCE SHEET

DATA

|

At August 31, 2011

|

At May 31, 2011

|

At May 31, 2010

|

At May 31, 2009

|

||||

|

unaudited

|

audited

|

audited

|

audited

|

|||||

|

Working Capital (Deficiency)

|

$

|

(189,136)

|

$

|

(319,337)

|

$

|

(270,436)

|

$

|

(51,162)

|

|

Total Assets

|

$

|

11,765

|

$

|

3,276

|

$

|

397

|

$

|

81

|

|

Accumulated Deficit

|

$

|

(3,067,270)

|

$

|

(3,003,384)

|

$

|

(2,725,305)

|

$

|

(1,883,491)

|

|

Shareholders’ Equity (Deficit)

|

$

|

(221,968)

|

$

|

(351,340)

|

$

|

(322,605)

|

$

|

(90,822)

|

Currency: In this Prospectus all references to "$" or "dollars" mean the U.S. dollar, and unless otherwise indicated all currency amounts in this Prospectus are stated in U.S. dollars. All financial statements have been prepared in accordance with accounting principles generally accepted in the United States “U.S. GAAP” and are reported in U.S. dollars. Canadian dollar amounts have been converted herein at an exchange rate of US$1 = C$0.95.

9

CORPORATE STRUCTURE

Name, Address and Incorporation

Black Tusk Minerals Inc. was incorporated on August 8, 2005 under the laws of the state of Nevada. Our principal offices are located in Vancouver, British Columbia, Canada. Our corporate address is 7425 Arbutus Street, Vancouver, British Columbia V6P 5T2.

On August 31, 2007, the Board of Directors of the Company authorized a 2-for-1 forward stock split of the Company’s common stock, par value $0.001. On September 6, 2007, the Company filed a Certificate of Change with the Nevada Secretary of State amending its Articles of Incorporation, effective as of September 12, 2007, to provide for (a) an increase in the authorized share capital of the Company from One Hundred Million Shares (100,000,000) to Two Hundred Million Shares (200,000,000) and (b) a 2-for-1 forward stock split of the Company’s issued and outstanding shares of common stock, par value $0.001 per share, payable upon surrender of certificates. The record date for the forward stock split was September 11, 2007 and the Company began trading on a post-split basis at the open of markets on September 12, 2007 under the trading symbol BKTK.

On September 20, 2010, the Board of Directors of the Company authorized a 1-for-50 reverse stock split of the Company’s common stock, par value $0.001. On September 22, 2010, the Company filed a Certificate of Change with the Nevada Secretary of State amending its Articles of Incorporation, effective as of October 11, 2010, to provide for (a) a decrease in the authorized share capital of the Company from Two Hundred Million Shares (200,000,000) to One Hundred Million Shares (100,000,000) and (b) a 1-for-50 reverse stock split of the Company’s issued and outstanding shares of common stock, par value $0.001 per share. The Company elected to treat the reverse stock split as a non-mandatory exchange. The record date for the forward stock split was October 11, 2010 and the Company began trading on a post-split basis at the open of markets on October 12, 2010 under the trading symbol BKTKD for a period of 20 business days. Thereafter, the “D” was removed from the Company's trading symbol, and it reverted to the previous symbol, "BKTK". The new CUSIP number of the Company's common stock is 092258300.

The Company determined that it may have improperly effected a share consolidation and that the Company may not have sufficient authorized capital to satisfy the Company’s business objectives and obligations. On March 30, 2011 and April 14, 2011, the Company entered into rescission and conditional purchase agreements (the “Rescission and Conditional Purchase Agreements”) with Magellan Management Company (“Magellan”), a company owned by Gavin Roy, President and a director of the Company, whereby Magellan and the Company agreed to rescind a portion of the Magellan Placement by rescinding and cancelling 2,703,509 and 266,667 (2,970,176 in the aggregate) shares of common stock and 2,703,509 and 266,667 (2,970,176 in the aggregate) share purchase warrants (collectively, the “Rescinded Units”) in consideration for the Company’s acknowledgement of the debt obligation in the amount of $135,176 owed to Magellan in connection with the rescission of a portion of the Magellan Placement. The Company and Magellan also agreed that the Company would use commercially reasonable efforts to amend the Articles of Incorporation to increase the authorized capital of the Company, including obtaining shareholder approval for the amendment by a majority of the shareholders of the Company and a majority of the disinterested shareholders of the Company (shareholders excluding Magellan and Gavin Roy), and upon the increase in the authorized shares of common stock of the Company, the Company would permit Magellan to purchase the Rescinded Units under the Rescission and Conditional Purchase Agreements under the same terms as the Magellan Placement.

On April 29, 2011 shareholders of the Company passed by written consent amendments to the Bylaws of the Company and an amendment to the Certificate of Incorporation of the Company to increase the authorized share capital of the Company from 4,000,000 to 100,000,000. The amendment to the Certificate of Incorporation was effective June 9, 2011. Additional information can be found in the definitive 14C filed on SEDAR on May 9, 2011 and on the Current Report on form 8-K filed on SEDAR on June 13, 2011.

Intercorporate relationships

On September 21, 2007, the Company incorporated a Peruvian subsidiary, Black Tusk Minerals Peru SAC (the “Subsidiary”). The Company directly controls 99 percent of all the voting securities and was incorporated and is existing pursuant to the laws of the Republic of Peru. The Subsidiary holds all the Company’s properties consisting of 19 mining concessions covering approximately 8,000 hectares located in the District of Huanza, Province of Huarochiri, Peru.

10

DESCRIPTION OF BUSINESS

Description of Business

Our principal business is the acquisition and exploration of mineral properties. To that end, in 2008, we acquired the Peru Properties. Other than the Peru Properties, the Company has no other properties or rights to acquire properties. Our objective is to increase value of our shares through the acquisition, exploration and potential development of mineral properties, beginning with the Peru Properties. We have not presently determined whether our properties contain economic quantities of minerals. The Company currently has no significant employees other than its officers. The Company currently retains consultants to assist in its operations on an as-needed basis.

Three Year History

On August 13, 2007, we entered into a term sheet with Leonard Raymond De Melt, an individual, and Marlene Ore Lamilla, an individual, detailing the principal terms of our proposed acquisition of certain mining concessions and pediments, the Peru Properties, located in the District of Huanza, Province of Huarochiri, Department of Lima, owned by Marlene Ore Lamilla.

On December 5, 2007, we entered into a property purchase agreement (the “Master Purchase Agreement”), between the Company, our newly-formed Subsidiary, Leonard Raymond De Melt, and Marlene Ore Lamilla pursuant to which we agreed to issue an aggregate of 400,000 Common Shares, par value $0.001 per share, of the Company to Ms. Lamilla and her designees in consideration for the transfer by Ms. Lamilla to Black Tusk Minerals Peru SAC of the Peru Properties. As additional consideration for the transfer of the Peru Properties, Black Tusk Minerals Peru SAC agreed to grant to Marlene Ore Lamilla (or her designee) a 1% royalty on the net smelter returns (“NSR Royalty”) upon commercial production on the Peru Properties.

Concurrently with the execution of the Master Purchase Agreement, Ms. Lamilla and Black Tusk Minerals Peru SAC entered into a mining concessions and claims transfer agreement, dated as of December 5, 2007 (the “Peru Transfer Agreement”), to govern the transfer and registration of the Peru Properties under Peruvian law.

On April 24, 2008, we consummated the transactions contemplated by the Master Purchase Agreement and the Peru Transfer Agreement. Our consummation of the Master Purchase Agreement and the Peru Transfer Agreement was contingent upon, among other things, the formalization of the Peru Transfer Agreement into a public deed before a Peruvian notary public, recordation of the Peru Transfer Agreement with the appropriate Peruvian governmental entity and registration of the Peru Properties in the name of “Black Tusk Minerals Peru SAC” with the appropriate Peruvian registries. All of the Peru Properties have been registered with the appropriate Peruvian registries.

On February 25, 2008, we consummated a ten-year term agreement with the Peasant Community of Huanza, which is the registered titleholder of the land in which our Peru Properties are located, for the use of their land to conduct mining exploration activities. This agreement has been recorded with the public registry in order to ensure enforceability against the State and third parties with regards to all of the Peru Properties.

On August 31, 2009, a Canadian National Instrument 43-101 (“NI 43-101”) compliant technical report relating to the Peru Properties entitled “Geological Evaluation of the Huanza Property” dated August 28, 2009 (the “2009 Technical Report”) was filed with the securities regulatory authorities in Canada, pursuant to Canadian securities laws. The report was prepared and authored by Glen MacDonald P.Geo., a “Qualified Person” as defined in NI 43-101, at the request of Robert Krause, a mineral geologist for the Company. The 2009 Technical Report is based on information collected by Mr. MacDonald during a site visit to the Peru Properties performed in August 2009, with additional information provided by the Company. Other information was obtained from sources within the public domain.

On December 7, 2010, the Peru Transfer Agreement was amended to eliminate the NSR Royalty whereby the NSR Royalty reverted to Black Tusk Minerals Peru SAC and was terminated. The amendment to the Peru Transfer Agreement was registered with the appropriate Peruvian authority.

On April 4, 2011, the Company filed the Huanza Technical Report dated February 2011 (the “Hunza Technical Report”) regarding the Peru Properties with the securities regulatory authorities in Canada, pursuant to Canadian securities laws. The Huanza Technical Report was prepared in accordance with NI 43-101 by Glen MacDonald, P.Geo., who is a Qualified Person as defined by NI 43-101. The Huanza Technical Report was prepared by Mr. MacDonald at the request of Robert Krause, a Company geologist. The Huanza Technical Report is based on information collected by Mr. MacDonald during a site visit to the Company’s properties in the Huanza District of Peru in August 2009, with additional information collected through publicly available sources and provided by the Company. The Huanza Technical Report forms the basis for much of the information in this Prospectus regarding the

11

Peru Properties. Readers are encouraged to review the technical report in its entirety for more information regarding the Peru Properties.

Description of the Peru Properties

On April 4, 2011, the Huanza Technical Report, a NI 43-101 compliant technical report, prepared by Glen MacDonald P.Geo, regarding the Peru Properties was published and filed on SEDAR at www.sedar.com. Readers are encouraged to review the Huanza Technical Report in its entirety for more information regarding the Peru Properties.

Property Description and Location

The Peru Properties cover an area of 8066.51 hectares in the Republic of Peru and consist of 19 registered claims. The corner coordinates for the claims boundaries are registered with the Instituto Geológico Minero y Metalúrgico (INGEMMET) Avenida Las Artes Sur 220, San Borja, Lima. The Peru Properties are located approximately 120 kilometers northeast of the capital, Lima, in the long hydrothermal alteration trend known as the Central Polymetallic Belt. This area is situated in the rugged Western Andean range at an average elevation of 4,200 meters, an area with a long history of successful production.

The Peru Properties consist of the following mining claims located in the District of Huanza, Province of Huarochiri, Department of Lima, Peru:

|

N°

|

CONCESSION

|

CODE

|

INGEMMET

|

PUBLIC REGISTRY

|

| 01 | ALTOCOCHA MINE | 0101292-07 |

Resolution N° 3423 INGEMMET/PCD/PM

|

12125438

|

|

02

|

ALTOCOCHA MINE 1

|

0101324-07

|

Resolution N°002242-2007-INACC/J

|

12089171

|

|

03

|

ALTOCOCHA MINE 2

|

0101325-07

|

Resolution N° 002666-2007-INGEMMET/PCD/PM

|

12134767

|

|

04

|

ALTOCOCHA MINE 3

|

0101326-07

|

Resolution N°000071-2007-INGEMMET/PCD/PM

|

12089882

|

|

05

|

ALTOCOCHA MINE 4

|

0101327-07

|

Resolution N° 002099-2007-INACC/J

|

12089359

|

|

06

|

ALTOCOCHA MINE 5

|

0101328-07

|

Resolution N° 000310-2007-INGEMMET/PCD/PM

|

12189875

|

|

07

|

ALTOCOCHA MINE 7

|

0101598-07

|

Resolution N° 002425-2007-INACC/J

|

12089522

|

|

08

|

ALTOCOCHA MINE 8

|

0101597-07

|

Resolution N° 002458-2007-INACC/J

|

12089420

|

|

09

|

ALTOCOCHA MINE 9

|

0101664-07

|

Resolution N° 002100-2007-INACC/J

|

12089424

|

|

10

|

ALTOCOCHA MINE 10

|

0101665-07

|

Resolution N° 002579-2007-INGEMMET/PCD/PM

|

12135392

|

|

11

|

ALTOCOCHA MINE 11

|

0101666-07

|

Resolution N° 000402-2007-INGEMMET/PCD/PM

|

12089535

|

|

12

|

ALTOCOCHA MINE 12

|

0101667-07

|

Resolution N° 001448-2007-INGEMMET/PCD/PM

|

12089549

|

|

13

|

ALTOCOCHA MINE 14

|

0104158-07

|

Resolution N° 004169-2008-INGEMMET/PCD/PM

|

12359543

|

|

14

|

ALTOCOCHA MINE 15

|

0106330-07

|

Resolution N° 001890-2008-INGEMMET/PCD/PM

|

12359721

|

|

15

|

ALTOCOCHA MINE 16

|

0106329-07

|

Resolution N° 001705-2008-INGEMMET/PCD/PM

|

12359751

|

|

16

|

BLACK TUSK 1

|

0102020-09

|

Resolution N°4919-2009- INGEMMET/PCD/PM

|

12477466

|

|

17

|

BLACK TUSK 2

|

0102019-09

|

Resolution N°0209-2010- INGEMMET/PCD/PM

|

12477470

|

| 18 | BLACK TUSK 3 |

0102018-09

|

Resolution N° 0367-2010-INGEMMET/PCD/PM

|

12477475

|

| 19 | BLACK TUSK 4 |

0102021-09

|

Resolution N° 0045-2010-INGEMMET/PCD/PM

|

12477483

|

Peruvian Mining Concessions

Under the laws of Peru, mineral resources belong to the state and government concessions are required to explore for or exploit mineral reserves. In Peru, our mineral rights derive from concessions from the Peruvian Ministry of Energy and

12

Mines for exploration, exploitation, extraction, transportation and/or production operations. Mining concessions in Peru may be terminated if the requirements of the concessionaire are not satisfied.

According to the General Mining Law of Peru, “Validity Fees” are payable annually at a cost of US$ 3.00 per hectare and must be paid by the 30th of June. Should payment of Validity Fees not be made for two consecutive years, mining pediments or concessions will be cancelled. After pediments or concessions are held by a party for 6 years annual fees change according to the following framework;

“Holders of mining concessions are obliged to achieve a minimum production equivalent to US$100.00 per hectare per year, within six years following the year in which the respective mining concession title is granted. If this minimum production is not reached, as of the first semester of the 7th year after the concession title has been granted, the holder of the concession should pay a US$6.00 penalty per hectare per year. If such minimum production is not obtained until the end of the 11th year after obtaining the concession title, the penalty to be paid as of the 12th year increases to US$ 20.00 per hectare per year.”

Following the same principle established in connection with the Validity Fee, evidence of compliance with the requested minimum production or investment or, in its defect, payment of the corresponding penalty can only be missed for one year. Non-compliance with any of these possibilities for two consecutive years, results in the cancellation of the mining concession.

Peruvian Licensing and Regulation

Governmental approvals, licenses and permits are, as a practical matter, subject to the discretion of the applicable governments or governmental offices in Peru. We must comply with known standards, existing laws and regulations that may entail greater or lesser costs and delays depending on the nature of the activity to be permitted and the interpretation of the laws and regulations implemented by the permitting authority.

New laws and regulations, amendments to existing laws and regulations, or more stringent enforcement of existing laws and regulations, could have a material adverse impact on our results of operations, financial condition and prospects. Exploration, mining and processing activities are dependent upon the grant of appropriate licenses, concessions, leases, permits, approvals, certificates and regulatory consents which may be withdrawn or made subject to limitations. There can also be no assurance that they will be granted or renewed or, if so, on what terms.

Certain licenses contain a range of past, current and future obligations, including minimum expenditure requirements. In some cases there could be adverse consequences of breach of these obligations, ranging from penalties to, in extreme cases, suspension or termination of the licenses or related contracts.

The level of any royalties or taxes payable to the Peruvian government or any other governmental authority in respect of the production of precious or base metals or minerals may be varied at any time as a result of changing legislation.

Peruvian Environmental, Health and Safety Laws

Our exploration and mining activities are subject to a number of Peruvian laws and regulations, including environmental laws and regulations, as well as certain industry technical standards, permits, licenses and authorizations. Additional matters subject to regulation include, but are not limited to, concession fees and penalties, transportation, production, water use and discharge, power use and generation, use and storage of explosives, controlled chemical supplies, surface rights, community and stakeholders’ participation and involvement, plant and facilities’ construction approval, housing and other facilities for workers, reclamation, taxation, labor standards, mine safety and occupational health.

Environmental regulations and sustainable development standards in Peru have become increasingly stringent over the last decade, which may require us to dedicate a substantial amount of time and money to compliance and remediation activities. We expect additional laws and regulations will be enacted over time with respect to environmental, social and sustainable development matters. Recently, Peruvian environmental laws have been enacted imposing closure and remediation obligations on the mining industry.

The development of more stringent environmental protection programs in Peru and in relevant trade agreements could impose constraints and additional costs on our operations and require us to make significant capital expenditures in the future. Future legislative, regulatory or trade developments may have an adverse effect on our business, properties, results of operations, financial condition or prospects.

13

The Company is without knowledge of any environmental issues specific to the Peru Properties. The Company intends to undertake an extensive environmental due diligence program on the entire site.

Peruvian Native Land Claims

We are unaware of any outstanding native land claims on the Peru Properties. However, it is possible that a native land claim could be made in the future. Should we encounter a situation where a native person or group claims an interest in our claims, we may be able to provide compensation to the affected party in order to continue with our exploration work, or if such an option is not available, we may have to relinquish our interest in these claims. In either case, the costs and/or losses could be greater than our financial capacity and our business would fail. Notwithstanding the foregoing, we currently have a ten year term agreement with the Peasant Community of Huanza, which is the registered titleholder of the land in which our Peru Properties are located, for the use of their land to conduct mining exploration activities. The ten year term agreement became effective February 25, 2008. This agreement has been recorded with the public registry in order to ensure enforceability against the State and third parties with regards to all of the Peru Properties.

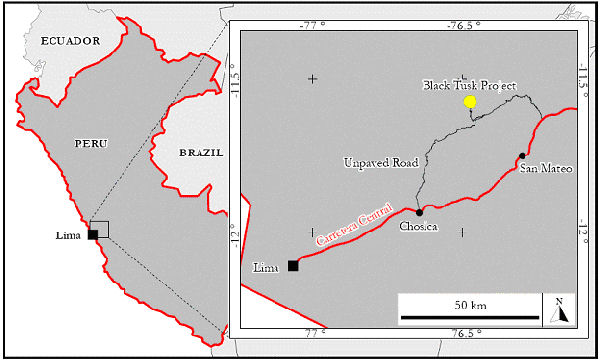

Access, Climate, Local Resources, Infrastructure, and Physiography

Access to the project area from Lima is via the Carretera Central Highway to the towns of Chosica 70 (kilometers) or San Mateo (100 kilometers) then continuing via unpaved road, a further 50 kilometers from Chosica or San Mateo, traversing mountainous terrain. Driving time from Lima is approximately 5 hours. The elevation of the mine gate is about 4,100 meters above sea level. The Company’s anticipates using diesel generators as the exclusive power source for the Peru Properties.

Figure 1. Map Location of Black Tusk Project

The climate in the project area is typical of the Peruvian Andes with both wet and dry seasons. The wet season is from December to March, during which limited periods of electrical storm activity can develop with hail, rain and occasionally snow above 5,000 meters. Individual rainfall events can be severe, with over an inch falling in an hour. Dense fog is common during the rainy season and temperatures rarely reach above 15°C. The dry season is from April to November, during which the coldest temperatures can fall below 0°C and highest temperatures may exceed 25°C. Rainfall is very rare in the dry season.

The Peru Properties are located in an area of high altitude between 4,000 and 4,800 meters above sea level. The mountain slopes are steep to occasionally vertical where local topography is defined by fault planes. Valley floors and gently dipping terrain below 4,500 meters is covered with short grasses and small bushes near drainages and the upper

14

terrain is covered with barren rock. Subsistence farming is variably developed in the valleys and alpacas, llamas and goats are herded at higher elevations.

The town of San Mateo, with approximately 4,500 inhabitants, is the only population center in the immediate vicinity of the Property and is located along the Carretera Central Highway approximately two hours from Lima.

The western cordillera has a long history of mining and exploration, experienced Peruvian labor can be found in many towns including Chosica and San Mateo, the more local mountain village of Huanza (10 kilometers) is also likely to have a ready work force. The Village of Hunaza is supplied with hydroelectricity and is the closest electrical supply to the project area. Electricity pylons, that once carried electricity to the Finlandia mine and mill, stand within the project concessions, power cables however have been removed. Water flows year-round in mountain streams.

The unpaved roads between the Carretera Central Highway and project area cross an operating freight railroad between Lima and La Oroya. The nearest airport to the Peru Properties is Jorge Chavez International Airport in Lima (120 kilometers). A few derelict buildings stand within the concession boundaries, ownership of these buildings is not known.

As an international mining centre Peru (and Lima in-particular) has a good supply of world-class mining and exploration related services including; drilling companies, Toronto Stock Exchange accredited assay laboratories, surveying companies, specialist tool and equipment suppliers.

History

Gold mining in the Lima region of Peru dates back to the early colonial days, when the Spaniards are reported to have mined the polymetallic veins located in the Huanza area.

More recent exploration and mining in the Huanza area started in the mid 1950s. Commercial production from the Nueva Condor mine, which the Peru Properties surround, commenced in 1956. Based on information published prior to the completion of the Company’s technical reports, it is reported that from 1956 to 1991, Compania Minera Huampar S.A., produced about 25,000 ounces of gold and about 15 million ounces of silver. 2.5 million tons averaging 1.6 g/t Au, 5.4 oz/ton Ag, 3.8% Pb and 5.0% Zn was reported to have been milled.

The mine, however, was shut down in 1991 due to a terrorist event which destroyed a major power plant, hence stopping part of the power supply to the city of Lima and also to the Nueva Condor Mine.

Geologic Setting

Regional Geology

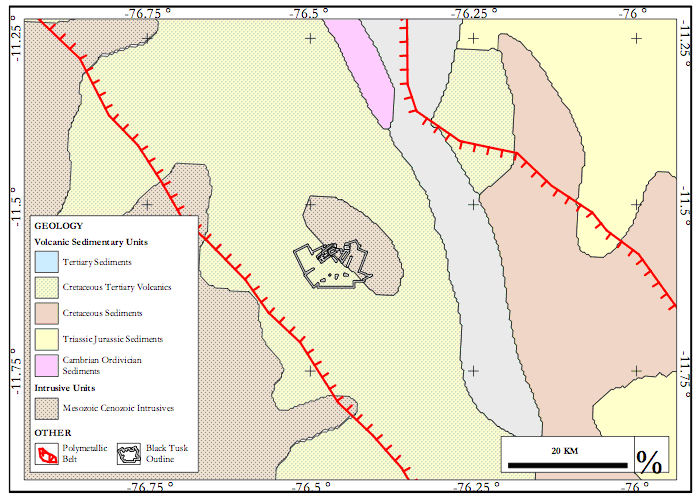

The Black Tusk Project is situated within the Central Polymetallic Belt, part of the Western Cordillera, central Peru, (figure 2). Precambrian basement of the Western Cordillera is overlain by lower to middle tertiary volcanics and sediments; and intruded by upper Jurassic to Lower Creataceous intrusions of varying compositions.

15

Figure 2. Regional geology (data sourced USGS website) with Central Polymetallic Belt and Project Location.

West to east subduction of the Nazca tectonic plate beneath South American has introduced pervasive folding and faulting throughout the Western Cordillera.

The geology of Huanza district in particular, is dominated by tertiary volcanic sequences; bedded andesitic lavas and tuffs, of varying colours and textures as well as basalts. Dykes and metal bearing veins are associated with intrusions and faulting.

Local Geology

Introduction

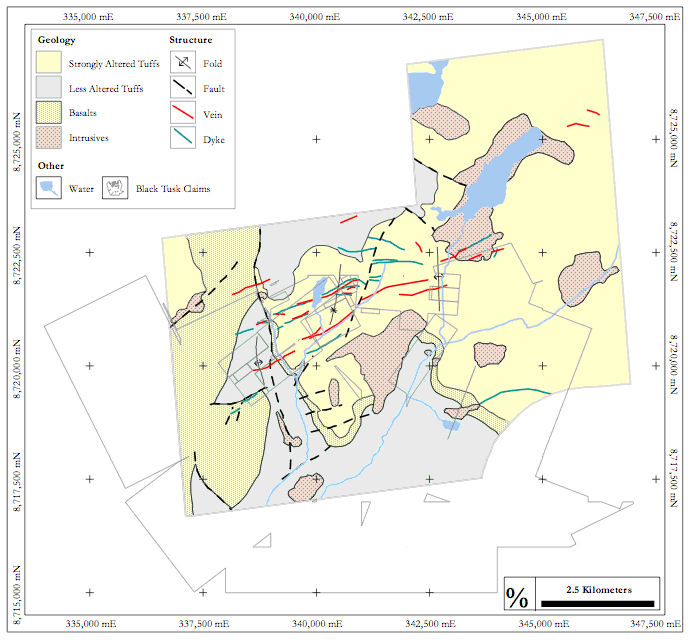

Map sheets 24K Matacuna and 24J Chosica cover the geology of the Black Tusk Project at 1:50,000 scale and show volcanics intruded by intrusives and areas of quaternary cover. Petersen and Diaz (1972) mapped part of the geology (Figure 3) of the Huanza district in greater detail as great variability of the volcanics hindered straight correlation with the volcanics of the surrounding areas. Their detailed mapping recorded subunits within the volcanic sequence as well as hydrothermal alteration and structures.

16

Figure 3. Local geology modified from Petersen and Diaz (1972). Coordinates: UTM-PSAD ’56-Zone 18S.

Geology

Andesitic units dominate the volcanic sequence and are interdigitated with lesser amounts of dacite. These units range from tuffs to massive lava flows and vary in colour, texture and thickness. Minor siliceous and fossiliferous calcareous sediments are recorded stratigraphically below these sequences.

Basaltic units are more abundant to the west of the north-south trending Yau-Yau fault, east of this fault a narrow band of basalts divide lesser from more altered andesitic units.

The units described above have been intruded by later intrusions of varying compositions.

Structure

North-south trending, north plunging folds are common and two principle fault systems dominate the Huanza district; one trending east-northeast, the other north south. The former comprising vertical faults and tensional fractures that are the exclusive loci of mineralisation (metal bearing veins) and dyke emplacement (Kamilli and Ohmotto, 1977).

The Lourdes Fault (Figure 3), is a major north-northeast near vertical structure with synistral displacement. Near vertical tensional fractures propagate from this structure at shallow angles (20-40), a number of dykes and metal bearing veins are hosted within these fractures.

17

Mineralisation

Polymetallic sulphide bearing veins are a typically found within east-northeast tensional openings, within strongly altered andesitic units. Vein development along this trend varies, pinching and swelling, introduces barren gaps and areas of thickening, individual veins range between zero and 2.5 meters in width. Veins may be copper or lead-zinc rich +/- silver and gold.

Kamilli and Ohmotto (1977) described a general zoning of metal content within the veins mapped by Petersen and Diaz; centered on the Cobre Vein (Figure 3) mineralisation is copper rich, moving away from this vein, in both directions, along the east northeast trend veins become more lead-zinc and eventual silver rich.

Alteration

Mafic minerals within volcanic units are variably altered; hydrothermal alteration is strongest in the east often resulting in mafic minerals being unidentifiable. Tuffs, being more permeable exhibit a greater degree of alteration than do flows, intrusives are less altered then the surrounding volcanics. In general, with greater proximity to mineralised veins alteration grades from propylitic (epidote, calcite, sericite, chlorite) to argillic (quartz, sericite), although immediately adjacent to veins, alteration may not be noticeably different to that of the country rock (Petersen and Diaz, 1972).

Project Geology

A large part of the project area is covered by the mapping of Petersen and Diaz (1972) (figure 3). Variably altered andesitic units are the dominant rock type in the project area. Lesser altered andesites to the west of the project area are separated from more altered andesites in the east by basalts. Intrusions are mapped within all units.

Folding is pervasive within the volcanic units and in general is hinged around a north south axis. Faulting is dominated by north to south and northeast to southwest fault sets, lesser developed fault sets are also mapped.

Recent Exploration Work

As of December 6, 2011, we have performed very limited exploration and sampling of the Peru Properties. The Company has made no improvements on the Peru Properties and they contain no physical plant, equipment, or other structures. The Company has neither improved the present condition of, nor undertaken any work on, the Peru Properties aside from road construction.

Conclusion of the Huanza Technical Report

The Peru Properties are located in an historical and current base and precious metal mining area of the Peruvian Andes. The claims cover a series of volcanic and sedimentary rocks intruded by granitic stocks of varying composition. Mineralization at adjoining and nearby properties is hosted in structurally-controlled veins and shears, mantos and skarns, and porphyritic intrusives. The volcanic rocks underlying the Peru Properties have undergone extensive structural deformation and contain numerous fracture and shear zones, some of which contain quartz veins. No assays are reported from the historic claim holders. Exploration work is warranted by the Company to evaluate the potential of the Peru Properties to host mineralization in styles now known to exist in the area in addition to structurally-controlled epithermal veins. No systematic modern exploration has taken place on the Peru Properties and a program is recommended to be undertaken.

Recommended Program

The Huanza Technical Report recommends the following program during the Company’s fiscal year ending May 31, 2012:

|

Satellite Imagery

|

$25,000

|

|

Airborne geophysical survey (500 km @ $200/km)

|

$100,000

|

|

Ground follow-up (geology, soil geochemistry, rock sampling)

|

$100,000

|

Drilling

A drilling decision will be made following a review of results of this initial exploration work.

18

USE OF PROCEEDS

Since no securities are being offered pursuant to this Prospectus, no proceeds will be raised and all expenses in connection with the preparation and filing of this Prospectus will be paid by the Company from its general corporate funds.

As of November 30, 2011 we had no cash and a working capital deficit in the amount of $210,000. We currently do not have any operations and we have no revenue from operations

Business objectives and milestones

The Company’s objective is to conduct exploration on its Peru Properties to determine if economic quantities of minerals exist on the properties. The Company also intends to devote a portion of its efforts to the assessment of additional mineral properties and will consider the acquisition of such properties if opportunity to acquire properties of value and interest to the Company arises. Our business plan calls for expenses in connection with the technical review and exploration of the Peru Properties as follows:

Recommended Program

On April 4, 2011, the Huanza Technical Report, a NI 43-101 compliant technical report, prepared by Glen MacDonald P.Geo, regarding the Peru Properties was published and filed on SEDAR at www.sedar.com. Readers are encouraged to review the Huanza Technical Report in its entirety for more information regarding the Peru Properties.

The Huanza Technical Report recommends the following program:

|

Satellite Imagery

|

$25,000

|

|

Airborne geophysical survey (500 km @ $200/km)

|

$100,000

|

|

Ground follow-up (geology, soil geochemistry, rock sampling)

|

$100,000

|

A drilling decision will be made following a review of results of this initial exploration work.

Our current operating funds will not be sufficient to carry out our planned exploration program on the Peru Properties of $225,000.

We will need to obtain additional financing to complete our planned programs and to sustain our business operations. If our exploration programs are successful in discovering ore of commercial tonnage and grade, we will require additional funds in order to place the Peru Properties into commercial production, if warranted. The Company’s plans for the next twelve months are to focus on the exploration of the Peru Properties. We estimate that cash requirements of approximately $1,150,000 will be required for exploration, administration, and working capital costs for the next twelve months. However, we do not have any commitments to fund these costs. Therefore, we need to raise an additional $1,150,000 in the next twelve months. We believe that such funds, if raised, will be sufficient to meet our liquidity requirements through the next twelve months.

DIVIDENDS

We have not paid any cash dividends on our common stock and we have no intention of paying any dividends on our shares of common stock in the near future. Our current policy is to retain earnings, if any, for use in our operations and in the development of our business. Our future dividend policy will be determined from time-to-time by our Board of Directors. We have no restrictions that could prevent us from paying dividends.

MANAGEMENT’S DICSCUSSION AND ANALYSIS

For the Fiscal Year Ended May 31, 2011

Management’s discussion and analysis is prepared in accordance with Item 303 of Regulation S-K under the 1934 Act. The Company has based the discussion in the MD&A on financial statements prepared in accordance with U.S. GAAP.

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

You should read the following discussion and analysis of our financial condition and results of operations together with our financial statements and related notes appearing elsewhere in this Prospectus. This discussion and analysis contains forward-looking statements that involve risks, uncertainties and assumptions. Our actual results may differ

19

materially from those anticipated in these forward-looking statements as a result of many factors, including, but not limited to, those set forth under “Risk Factors” and elsewhere in this Prospectus. Please see “Cautionary Note Regarding Forward-Looking Statements”.

Plan of Operation

Peru Properties

The Company’s plans for the next twelve months are to focus on the exploration of the Peru Properties and estimates that cash requirements of approximately $900,000 will be required for exploration and administration costs and to fund working capital. We do not have any commitments to fund these costs. Therefore, we need to raise an additional $900,000 in debt or equity financing in the next twelve months. We believe that such funds, if raised, will be sufficient to meet our liquidity requirements through May 31, 2012. However, we do not have any commitments to fund such costs during the next twelve months. Since May, 31, 2010, we obtained proceeds in the amount of: (1) $16,500 through a private placement of units consisting of shares of common stock and share purchase warrants, 330,000 units were issued at $0.05 per unit; (2) $43,500 through a private placement of 7% convertible debentures; and (3) proceeds in the amount of $20,000 through a private placement of our Common Shares by issuing 266,667 shares of common stock at $0.075 per share.

We anticipate that we will incur the following expenses over the next 12 months as of May 31, 2012:

|

(1)

|

$350,000 for operating expenses, including general, legal, accounting and administrative expenses associated with our reporting obligations under the Securities Exchange Act of 1934 (the “Exchange Act”), and general working capital expenditures;

|

|

(2)

|

$550,000 for expenses related to the technical review and exploration of the Peru Properties, including, but not limited to, satellite imagery, the airborne geophysical survey, and geology, soil geochemistry, and rock sampling.

|

Failure to raise needed financing could result in our having to discontinue our mining exploration and development business.

On April 4, 2011, the Company filed the NI 43-101 compliant Huanza Technical Report with the securities regulatory authorities in Canada, pursuant to Canadian securities laws. The Huanza Technical Report was prepared in accordance with Canadian National Instrument. Readers are encouraged to review the Huanza Technical Report in its entirety on SEDAR (www.sedar.com) or EDGAR (www.sec.gov) for more information regarding the Peru Properties.

Limited Operating History; Need for Additional Capital

In Note 1 to the Company’s audited consolidated financial statements as of May 31, 2011, included elsewhere in this Prospectus, the Company included an explanatory paragraph stating that, because the Company had a working capital deficiency of $319,337 as of May 31, 2011, and had incurred accumulated losses of $3,003,384 for the period from August 8, 2005 (inception) to May 31, 2011, there was substantial doubt about its ability to continue as a going concern.

There is limited historical financial information about the Company upon which to base an evaluation of its performance. The Company is a development stage enterprise and has not generated any revenues from operations. The Company cannot guarantee it will be successful in its business operations. The Company’s business is subject to risks inherent in the establishment of a new mineral exploration company, including limited capital resources, unanticipated problems relating to exploration and additional costs and expenses that may exceed current estimates. To become profitable and competitive, the Company will implement its plan of operation as detailed above.

The Company will be required to raise funds to complete the technical review of the Peru Properties, to conduct the recommended exploration program on the Peru Properties and for general working capital purposes. Such financing activities could include issuing debt or equity securities in the Company and could result in a dilution of the Company’s existing share capital. The Company can give no assurance that future financing will be available to it on acceptable terms or at all. If financing is not available on satisfactory terms, the Company may be unable to continue, develop or expand its operations.

20

Results of Operations

We did not earn any revenues from May 31, 2010 to May 31, 2011. We do not anticipate earning revenues until such time as we have entered into commercial production of our mineral properties. We are presently in the exploration stage of our business and we can provide no assurance that we will discover commercially exploitable levels of mineral resources on our properties, or if such resources are discovered, that we will enter into commercial production of our mineral properties.

We incurred operating expenses in the amount of $265,279 for the period from May 31, 2010 to May 31, 2011 compared to $820,510 for the period from May 31, 2009 to May 31, 2010. These operating expenses included: (a) professional fees in connection with our corporate organization of $86,982 (2010: $113,862); (b) donated office rent of $3,000 (2010: $3,000); (c) donated management services of $6,000 (2010: $6,000); (d) impairment of mineral property costs of $Nil (2010: $21,958); and (e) general and administrative costs of $145,662 (2010: $633,547).

We incurred a net loss in the amount of $278,079 for the period from May 31, 2010 to May 31, 2011 compared to $841,814 for the period from May 31, 2009 to May 31, 2010. The smaller loss was attributable to less general and administrative fees, professional fees and property impairment costs.

Liquidity and Capital Resources

There is limited financial information about the Company upon which to base an evaluation of our performance. We are an exploration stage company and have not generated any revenues from operations.

As at May 31, 2011, we had cash of $2 (2010: $257), a working capital deficit of $319,337 (2010: $270,436) and an accumulated deficit of $3,003,384 (2010: $2,725,305). The increase in working capital deficit was due to decrease in monies due to related parties from $224,734 as at May 31, 2010 to $151,673 as at May 31, 2011 which is offset by increase in accounts payable by $52,589 since May 31, 2010 and increase in current portion of convertible notes and interest from $Nil (May 31, 2010) to $60,168 at May 31, 2011.