Attached files

| file | filename |

|---|---|

| 8-K - ROSE UPDATED COMPANY PRESENTATION - NBL Texas, LLC | roseupdatedpres.htm |

Exhibit 99.1

Rosetta Resources Inc.

Investor Presentation

December 2011

www.rosettaresources.com / NASDAQ: ROSE

High Asset Quality - Executing Business Plan - Future Growth Catalysts - Financial Strength

2

This presentation includes forward-looking statements, which give the Company's current expectations or forecasts

of future events based on currently available information. Forward-looking statements are statements that are not

historical facts, such as expectations regarding drilling plans, including the acceleration thereof, production rates and

guidance, resource potential, incremental transportation capacity, exit rate guidance, net present value, development

plans, progress on infrastructure projects, exposures to weak natural gas prices, changes in the Company's liquidity,

changes in acreage positions, expected expenses, expected capital expenditures, and projected debt balances. The

assumptions of management and the future performance of the Company are subject to a wide range of business

risks and uncertainties and there is no assurance that these statements and projections will be met. Factors that

could affect the Company's business include, but are not limited to: the risks associated with drilling of oil and natural

gas wells; the Company's ability to find, acquire, market, develop, and produce new reserves; the risk of drilling dry

holes; oil and natural gas price volatility; derivative transactions (including the costs associated therewith and the

abilities of counterparties to perform thereunder); uncertainties in the estimation of proved, probable, and possible

reserves and in the projection of future rates of production and reserve growth; inaccuracies in the Company's

assumptions regarding items of income and expense and the level of capital expenditures; uncertainties in the timing

of exploitation expenditures; operating hazards attendant to the oil and natural gas business; drilling and completion

losses that are generally not recoverable from third parties or insurance; potential mechanical failure or

underperformance of significant wells; availability and limitations of capacity in midstream marketing facilities,

including processing plant and pipeline construction difficulties and operational upsets; climatic conditions; availability

and cost of material, supplies, equipment and services; the risks associated with operating in a limited number of

geographic areas; actions or inactions of third-party operators of the Company's properties; the Company's ability to

retain skilled personnel; diversion of management's attention from existing operations while pursuing acquisitions or

dispositions; availability of capital; the strength and financial resources of the Company's competitors; regulatory

developments; environmental risks; uncertainties in the capital markets; general economic and business conditions

(including the effects of the worldwide economic recession); industry trends; and other factors detailed in the

Company's most recent Form 10-K, Form 10-Q and other filings with the Securities and Exchange Commission. If

one or more of these risks or uncertainties materialize (or the consequences of such a development changes), or

should underlying assumptions prove incorrect, actual outcomes may vary materially from those forecasted or

expected. The Company undertakes no obligation to publicly update or revise any forward-looking statements except

as required by law.

of future events based on currently available information. Forward-looking statements are statements that are not

historical facts, such as expectations regarding drilling plans, including the acceleration thereof, production rates and

guidance, resource potential, incremental transportation capacity, exit rate guidance, net present value, development

plans, progress on infrastructure projects, exposures to weak natural gas prices, changes in the Company's liquidity,

changes in acreage positions, expected expenses, expected capital expenditures, and projected debt balances. The

assumptions of management and the future performance of the Company are subject to a wide range of business

risks and uncertainties and there is no assurance that these statements and projections will be met. Factors that

could affect the Company's business include, but are not limited to: the risks associated with drilling of oil and natural

gas wells; the Company's ability to find, acquire, market, develop, and produce new reserves; the risk of drilling dry

holes; oil and natural gas price volatility; derivative transactions (including the costs associated therewith and the

abilities of counterparties to perform thereunder); uncertainties in the estimation of proved, probable, and possible

reserves and in the projection of future rates of production and reserve growth; inaccuracies in the Company's

assumptions regarding items of income and expense and the level of capital expenditures; uncertainties in the timing

of exploitation expenditures; operating hazards attendant to the oil and natural gas business; drilling and completion

losses that are generally not recoverable from third parties or insurance; potential mechanical failure or

underperformance of significant wells; availability and limitations of capacity in midstream marketing facilities,

including processing plant and pipeline construction difficulties and operational upsets; climatic conditions; availability

and cost of material, supplies, equipment and services; the risks associated with operating in a limited number of

geographic areas; actions or inactions of third-party operators of the Company's properties; the Company's ability to

retain skilled personnel; diversion of management's attention from existing operations while pursuing acquisitions or

dispositions; availability of capital; the strength and financial resources of the Company's competitors; regulatory

developments; environmental risks; uncertainties in the capital markets; general economic and business conditions

(including the effects of the worldwide economic recession); industry trends; and other factors detailed in the

Company's most recent Form 10-K, Form 10-Q and other filings with the Securities and Exchange Commission. If

one or more of these risks or uncertainties materialize (or the consequences of such a development changes), or

should underlying assumptions prove incorrect, actual outcomes may vary materially from those forecasted or

expected. The Company undertakes no obligation to publicly update or revise any forward-looking statements except

as required by law.

Forward-Looking Statements and Terminology Used

3

For filings reporting year-end 2010 reserves, the SEC permits the optional disclosure of probable and possible

reserves. The Company has elected not to report probable and possible reserves in its filings with the SEC. We use

the term “net risked resources” to describe the Company’s internal estimates of volumes of natural gas and oil that are

not classified as proved reserves but are potentially recoverable through exploratory drilling or additional drilling or

recovery techniques. Estimates of unproved resources are by their nature more speculative than estimates of proved

reserves and accordingly are subject to substantially greater risk of actually being realized by the

Company. Estimates of unproved resources may change significantly as development provides additional data, and

actual quantities that are ultimately recovered may differ substantially from prior estimates. We use the term “BFIT

NPV10” to describe the Company’s estimate of before income tax net present value discounted at 10 percent

resulting from project economic evaluation. The net present value of a project is calculated by summing future cash

flows generated by a project, both inflows and outflows, and discounting those cash flows to arrive at a present value.

Inflows primarily include revenues generated from estimated production and commodity prices at the time of the

analysis. Outflows include drilling and completion capital and operating expenses. Net present value is used to

analyze the profitability of a project. Estimates of net present value may change significantly as additional data

becomes available, and with adjustments in prior estimates of actual quantities of production and recoverable

reserves, commodity prices, capital expenditures, and/or operating expenses.

reserves. The Company has elected not to report probable and possible reserves in its filings with the SEC. We use

the term “net risked resources” to describe the Company’s internal estimates of volumes of natural gas and oil that are

not classified as proved reserves but are potentially recoverable through exploratory drilling or additional drilling or

recovery techniques. Estimates of unproved resources are by their nature more speculative than estimates of proved

reserves and accordingly are subject to substantially greater risk of actually being realized by the

Company. Estimates of unproved resources may change significantly as development provides additional data, and

actual quantities that are ultimately recovered may differ substantially from prior estimates. We use the term “BFIT

NPV10” to describe the Company’s estimate of before income tax net present value discounted at 10 percent

resulting from project economic evaluation. The net present value of a project is calculated by summing future cash

flows generated by a project, both inflows and outflows, and discounting those cash flows to arrive at a present value.

Inflows primarily include revenues generated from estimated production and commodity prices at the time of the

analysis. Outflows include drilling and completion capital and operating expenses. Net present value is used to

analyze the profitability of a project. Estimates of net present value may change significantly as additional data

becomes available, and with adjustments in prior estimates of actual quantities of production and recoverable

reserves, commodity prices, capital expenditures, and/or operating expenses.

Forward-Looking Statements and Terminology Used (cont.)

4

– Doubled proved reserves to 970 Bcfe at mid-year 2011

– Set record levels of liquids production

– Increased project inventory to 2.8 Tcfe

– Increased gross estimated ultimate recovery to 10 Bcfe per Gates Ranch Eagle

Ford well*

Ford well*

– Increased Gates Ranch planned well density to 65 acres per well

– Announced three new Eagle Ford field discoveries

– Firm transportation and processing capacity from Eagle Ford in place to execute

business plan

business plan

– Advanced Southern Alberta Basin horizontal drilling program

2011 Highlights

* EUR based on 850’ well spacing

5

– $640 million of capital; more than 90 percent allocated to Eagle Ford

– Four-rig program in Eagle Ford Area; 60 completions per year

– Continued Gates Ranch development

– Step out into other areas

– Completion of seven-well horizontal drilling program in Southern Alberta Basin

– Maintain acreage position

– Base capital program funded from internally-generated cash flow supplemented

by borrowings under current credit facility

by borrowings under current credit facility

– Eagle Ford program self-funding by year-end

– Divestitures remain an option

– Debt-to-Capitalization ratio approximately 30% at strip pricing

– Approximately 40% production growth over 2011

2012 Plans

6

Includes capitalized interest and other corporate costs.

Excludes New Ventures and A&D.

2012E

2012E

2011E

2011E

Capital Expenditures

Total: $640MM

Total: $475MM

7

– Asset Base High-Graded

– Executing Business Plan

– Testing Growth Catalysts

– Financial Strength

Agenda

8

Asset Base High-Graded

9

Alberta Basin

300,000 net acres

6 BBOE hydrocarbon resource in place

1500 potential locations

Exploration underway

11 delineation wells completed

4 horizontal wells drilled

Horizontal completions underway

Eagle Ford Liquids

50,000 net acres

20 TCFE hydrocarbon resource in place

600 potential remaining locations

52 horizontal wells completed*

125 MMcfe/d net*

10 years of potential remaining inventory

Eagle Ford Dry Gas

15,000 net acres

5 TCFE hydrocarbon resource in place

170 potential locations

4 horizontal wells completed*

5 MMcfe/d net*

3-4 years of remaining inventory

South Texas

(Non-Eagle Ford)

100,000 net acres

Numerous stacked reservoirs

20 MMcfe/d net*

* End of 3Q 2011

Asset Base High-Graded

10

Executing Business Plan

11

Proved Reserves - Doubled Since YE 2010

■ Eagle Ford

■ Other Core

■ Non-Core

351 Bcfe

479 Bcfe

970 Bcfe

12

Year-end 2011: 56 wells*

* Completed wells

9 miles

More than 12 TCFE of “hydrocarbons in place” have been delineated and are now being

exploited…

exploited…

Gates Ranch

13

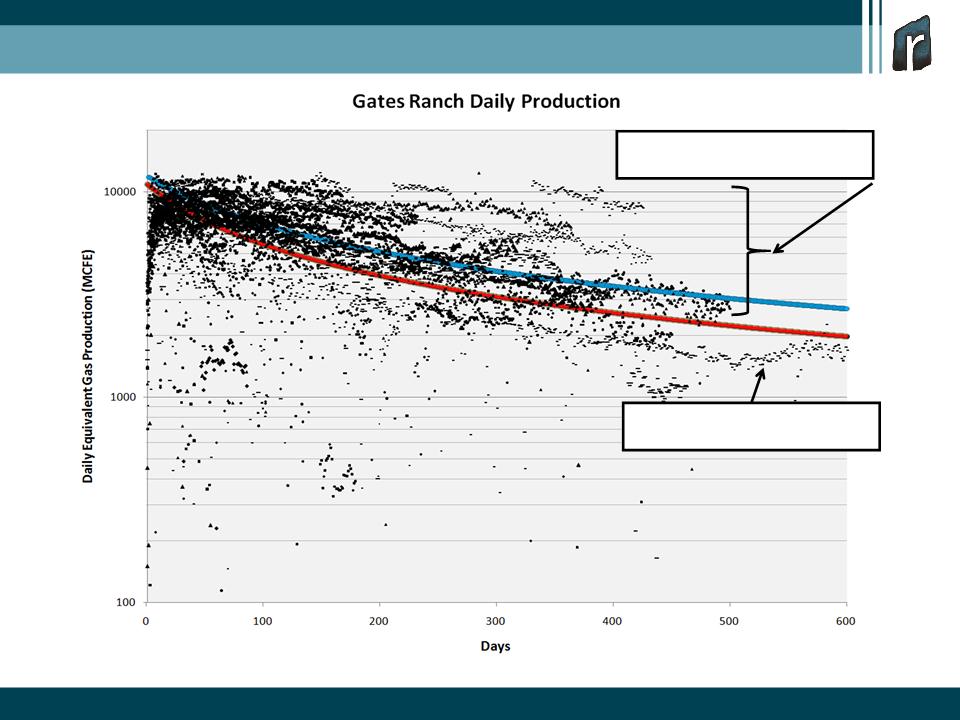

7.3 BCFE Composite Type Curve (PUD bookings)

10 BCFE Composite Type Curve

DISCOVERY WELL

3500 ft lateral & 10 frac stages

DEVELOPMENT WELLS

5000 ft lateral & 15 frac stages

Gates Ranch Well Performance

14

Increased Firm Take-Away Capacity

¹ Net equivalent gas production (MMcfe/d) equals 1.35 times gross wet wellhead gas (MMcf/d).

15

Quarterly Production Performance

Production

(MMcfe/d)

250-280

220-240

16

Testing Growth Catalysts

17

|

Area

|

Window

|

Net

Acreage |

|

Gates Ranch

|

Liquids

|

26,500

|

|

Non-Gates Ranch

|

Liquids

|

23,500

|

|

Encinal Area

|

Dry Gas

|

15,000

|

|

TOTAL

|

|

65,000

|

Other Eagle Ford Areas

18

• Increased Well Density

• 280 locations remaining to be drilled

Gates Ranch

Field-wide development plans on 65-acre well spacing

Field-wide development plans on 65-acre well spacing

19

Discovery Well Test

• Southern Dimmit County Area

• 3,545 net acres

• 47 well locations remaining

• Initial Rate

• 850 bpd Oil

• 490 bpd NGL’s

• 3,900 mcfpd

• 1,990 BOEPD

Eagle Ford Discovery

Briscoe Ranch

Briscoe Ranch

20

Discovery Well Test

• Central Dimmit County Area

• 8,143 net acres

• 125 well locations remaining

• 7 day average rate

• 506 bpd Oil

• 102 bpd NGL’s

• 436 mcfpd

• 680 BOEPD

Eagle Ford Discovery

Central Dimmit County

Central Dimmit County

21

Discovery Well Test

• Southern Gonzales County Area

• 1,900 net acres

• 21 well locations remaining

• Initial Rate

• 2,450 bpd Oil

• 250 bpd NGL’s

• 2,000 mcfpd

• 3,033 BOEPD

Eagle Ford Discovery

Karnes Trough Area

Karnes Trough Area

22

* Includes only “well tested” inventory and excludes inventory on our 10,000 net acres that has offset data and will be tested in the upcoming quarters.

Eagle Ford

Well Tested Inventory

Well Tested Inventory

23

Delineation wells

Remaining Horizontal Wells

Southern Alberta Basin

2 of 7 Horizontal Wells Tested

2 of 7 Horizontal Wells Tested

Tribal Riverbend 07-04H

q Drilled +/- 3,500’ lateral length

q Middle Bakken interval

q Tested 154 BOEPD

Fee Simonson 34-01H

q Drilled +/- 3,700’ lateral length

q Middle Bakken interval

q Tested 104 BOEPD

24

– Confirmed significant resource in place, 6 billion BOE

– Advanced the well science work needed to “crack code” of complex play

– Identified fracture azimuth and orientation

– Achieved good vertical growth in initial stimulations

– Identified fracture stimulation design improvements to utilize in next four horizontal

well completions

well completions

– Improve isolation for more effective stimulations (cement liner and perf & plug)

– Targeted assumptions for well commerciality

– IP 250 Boe/d, EUR 185 MBOE, 160-acre spacing, $4 million well costs

– 21% ROR at $85 per barrel WTI

Next Steps

– Complete seven-well horizontal drilling program

– Maintain acreage position

– Engage industry service providers to identify opportunities to expand infrastructure

and reduce costs in the basin

and reduce costs in the basin

– Monitor long-term production performance to confirm model

Southern Alberta Basin Key Learnings

25

Financial Strength

26

Lower Cost Structure

|

|

|

2011 Full Year

|

|

2012 Full Year

|

||||

|

|

|

(Guidance Range)

|

|

(Guidance Range)

|

||||

|

Direct Lease Operating Expense

|

|

$ 0.44

|

-

|

$ 0.46

|

|

$ 0.25

|

-

|

$ 0.28

|

|

Workover Expenses

|

|

0.01

|

-

|

0.01

|

|

0.01

|

-

|

0.01

|

|

Insurance

|

|

0.02

|

-

|

0.02

|

|

0.03

|

-

|

0.03

|

|

Ad valorem Tax

|

|

0.12

|

-

|

0.13

|

|

0.13

|

-

|

0.14

|

|

Production Taxes

|

|

0.17

|

-

|

0.18

|

|

0.24

|

-

|

0.26

|

|

Treating, Transportation and Marketing

|

|

0.41

|

-

|

0.43

|

|

0.63

|

-

|

0.69

|

|

G&A, excluding stock-based compensation

|

0.74

|

-

|

0.78

|

|

0.50

|

-

|

0.55

|

|

|

Interest Expense

|

|

0.36

|

-

|

0.38

|

|

0.25

|

-

|

0.28

|

|

DD&A

|

|

2.03

|

-

|

2.13

|

|

1.85

|

-

|

1.95

|

27

Eagle Ford - Oil Marketing

Gates Ranch

– Velocity Midstream

– Long term condensate pipeline gathering and truck loading terminal transfer

– Current: Gathering capacity of 15,000 Bbls/d to Catarina with 15,000 Bbls

storage

storage

– January 2012: Gathering capacity of 25,000 Bbls/d to Gardendale with up to

60,000 Bbls storage

60,000 Bbls storage

– Long Term Crude Purchase Agreements

– 5,000 Bbls/d @ Catarina, Truck/Pipe; @ Gardendale, Pipeline Mid-2012

– Pricing based on Louisiana Light Sweet price less transportation

– Crude Oil Pricing Mix expected for 2012

– Gates Ranch, Briscoe Ranch and Central Dimmit County Properties

– 5,000 Bbls/d priced based on Louisiana Light Sweet (LLS) price less gravity and

transportation adjustments starting in mid-2012

transportation adjustments starting in mid-2012

– All other Condensate prices based on West Texas Intermediate (WTI) less gravity

and transportation adjustments

and transportation adjustments

– Karnes Trough Properties

– WTI-based price (currently with premium), no gravity or transportation adjustment

28

50

20

10,300

5,400

3,750

* NGL hedges exclude the Ethane component

29

Debt and Liquidity

350

250

402

237

30

– Adequate liquidity available to fund 2012 $640 million capital

program

program

– Strong cash flow in 2012

– $295 million of $325 million borrowing base available

– Potential to raise borrowing base based on performance

– Option for additional property divestitures

– In low price environment, $250 million capital spend will maintain

2012 production level flat versus 2011 exit rate

2012 production level flat versus 2011 exit rate

Liquidity

31

|

(MM)

|

3Q 2011

|

4Q 2010

|

|

Long-Term Debt

|

$250

|

$350

|

|

Total Stockholder’s Equity

|

608

|

529

|

|

TOTAL

|

$858

|

$879

|

|

|

|

|

|

Capitalization

|

|

|

|

- Debt

|

29%

|

40%

|

|

- Capital

|

71%

|

60%

|

|

TOTAL

|

100%

|

100%

|

Capital Structure

32

– Asset Base High-Graded

– Divestiture program complete

– South Texas focus

– Alberta Basin option

– Strong Eagle Ford project inventory

– Executing Business Plan

– Proved reserves doubled since 12/31/10

– Gates Ranch recoveries increased

– Increased firm take-away capacity

– Strong exit rates and 2012 growth projected

– Testing Growth Catalysts

– Increased Gates Ranch well density

– Other Eagle Ford areas

– Complete and evaluate Alberta Basin horizontal program

– Financial Strength

– Lower cost structure

– $402MM in liquidity

Summary

33

Appendix

34

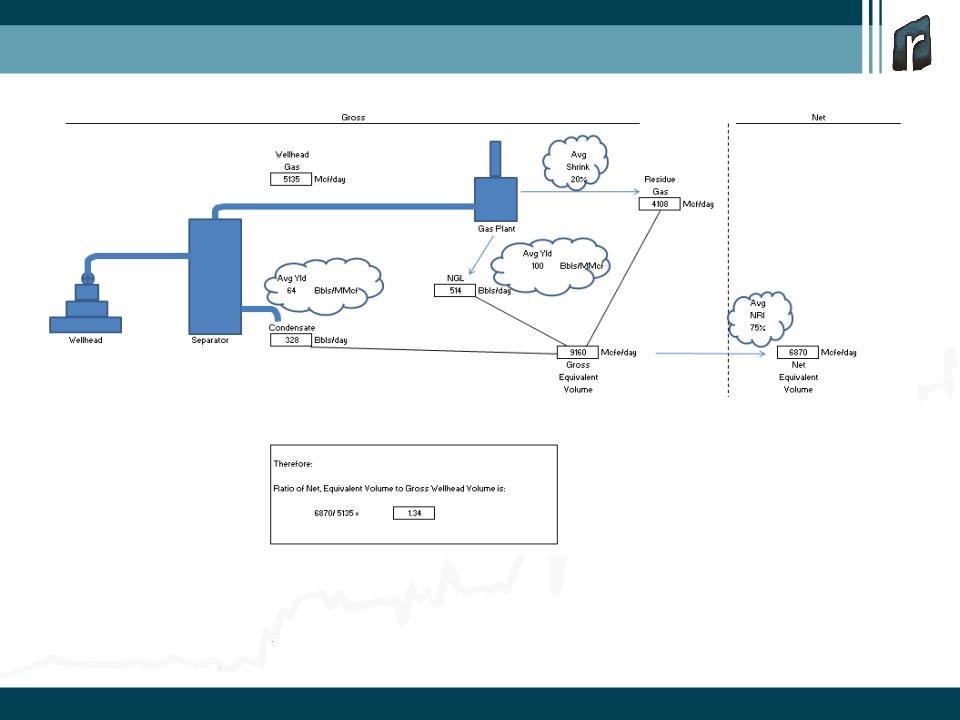

Note: This example describes the 3-streams of production from the average 2010 Gates Ranch horizontal

wells (based on completions as of January, 2011) and also provides a “rule of thumb” factor to convert

“net Rosetta sales volumes” (measured in Mcfe/d) to “gross wellhead gas” (measured in Mcf/d). This is

important for understanding Rosetta’s takeway capacity situation. As described, gross wellhead gas, and

therefore takeaway capacity, is multiplied by ~1.3 to determine net sales to Rosetta.

wells (based on completions as of January, 2011) and also provides a “rule of thumb” factor to convert

“net Rosetta sales volumes” (measured in Mcfe/d) to “gross wellhead gas” (measured in Mcf/d). This is

important for understanding Rosetta’s takeway capacity situation. As described, gross wellhead gas, and

therefore takeaway capacity, is multiplied by ~1.3 to determine net sales to Rosetta.

3-Stream Process Flow - Gates Ranch

35