Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - POTLATCHDELTIC CORP | d265328d8k.htm |

POTLATCH CORPORATION

Michael J. Covey

Chairman, President & Chief Executive Officer

Eric J. Cremers

Vice President, Finance and Chief Financial Officer

POTLATCH CORPORATION

DECEMBER 2011

Exhibit 99.1 |

POTLATCH CORPORATION

2

Forward-Looking Statements

This presentation contains certain forward-looking statements within the

meaning of the Private Litigation Reform Act of 1995 as amended, including

without limitation statements about future company performance, the company’s business model, strength

of

the

company’s

balance

sheet

and

credit

metrics,

dividend

levels

and

yields,

direction

of

markets

and

the

economy,

management of timberlands to optimize values, projected inland private timber

growth and harvest, future harvest levels and their

relation

to

market

trends,

cash

flow

and

dividend

leverage

to

sawlog

pricing,

impact

of

the

pine

beetle

on

North

American

lumber supply, forecasts of North American exports of lumber to China, softwood

stumpage price trends, forecast of U.S. housing starts, the company’s

capital structure, weighted average cost of debt, cash flow generation, Canadian/U.S. dollar

exchange rate, funds available for distribution, real estate business potential and

land development potential, real estate value opportunities, biomass

opportunities, forecasts of U.S. biomass consumed to produce electricity, management of the output of

our Wood Products facilities, leverage and interest coverage ratios, debt

repayment, net asset value, and dividend policy. These

forward-looking

statements

are

based

on

current

expectations,

estimates,

assumptions

and

projections

that

are

subject

to

change, and actual results may differ materially from the forward-looking

statements. Factors that could cause actual results to differ materially

include, but are not limited to, changes in timberland values; changes in timber harvest levels on the company’s

lands; changes in timber prices; changes in policy regarding governmental timber

sales; changes in the United States and international economies; changes in

the level of domestic construction activity; changes in international tariffs, quotas and trade

agreements involving wood products; changes in domestic and international demand

for wood products; changes in production and production capacity in the

forest products industry; competitive pricing pressures for the company’s products; unanticipated

manufacturing disruptions; changes in general and industry-specific

environmental laws and regulations; unforeseen environmental liabilities or

expenditures; weather conditions; changes in fuel and energy costs; changes in raw material and

other

costs;

the

ability

to

satisfy

complex

rules

in

order

to

remain

qualified

as

a

REIT;

changes

in

tax

laws

that

could

reduce

the

benefits associated with REIT status; and other risks and uncertainties described

from time to time in the company’s public filings with the Securities

and Exchange Commission. All forward-looking statements are made as of the date of this

presentation, and the company does not undertake to update any forward-looking

statements. |

POTLATCH CORPORATION

3

Converted to tax efficient REIT in 2006

Single level of taxation

Lower cost of capital

Fourth largest US Timber REIT

1.45 million acres of owned timberland

Growing real estate business

Five wood products manufacturing facilities

Enterprise value of $1.5 billion

(1)

Market cap of ~$1.2 billion

Net debt

(2)

of ~$0.3 billion

Strong balance sheet with solid credit metrics

Attractive dividend at $1.24

Company Overview

(1)

Based on November 28, 2011 closing stock price of $30.66 a share.

(2)

We define net debt as the total of short-term and long-term debt less cash

and short-term investments, see reconciliation on page 29.

Potlatch

Corporation

(REIT)

Resource

(Timberlands)

Taxable REIT

Subsidiaries

North

South

Real

Estate

Wood

Products |

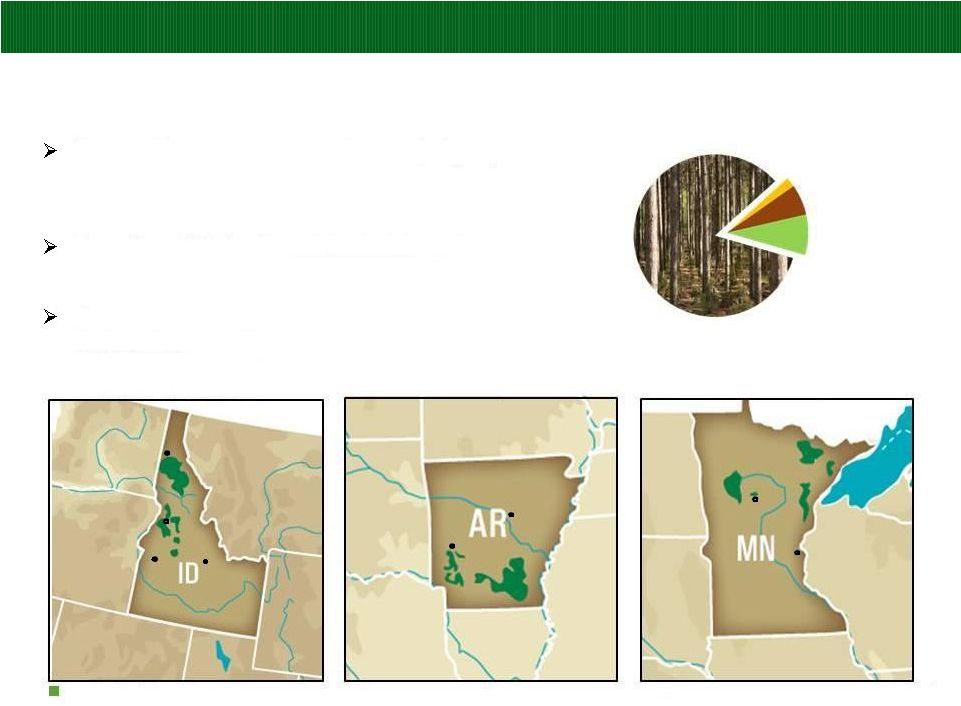

POTLATCH CORPORATION

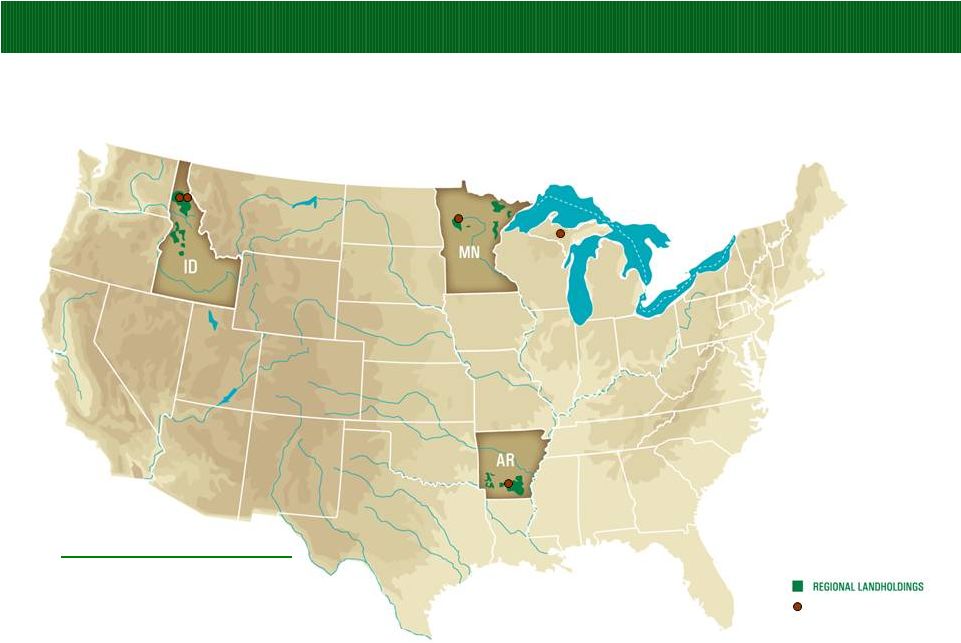

4

Wood Products

Manufacturing Facilities

Idaho:

813,000 acres

Arkansas:

407,000 acres

Minnesota:

225,000 acres

Total:

1,445,000 acres Timberlands

(1)

(1) As of September 30, 2011.

Potlatch owns approximately 1.45 million acres of FSC-certified timberland in

Arkansas, Idaho and Minnesota and five wood products manufacturing

facilities Potlatch Business Overview

[813,000 acres]

[813,000 acres]

[225,000 acres]

[225,000 acres]

[407,000

acres] [407,000 acres]

407,000 acres] |

POTLATCH CORPORATION

5

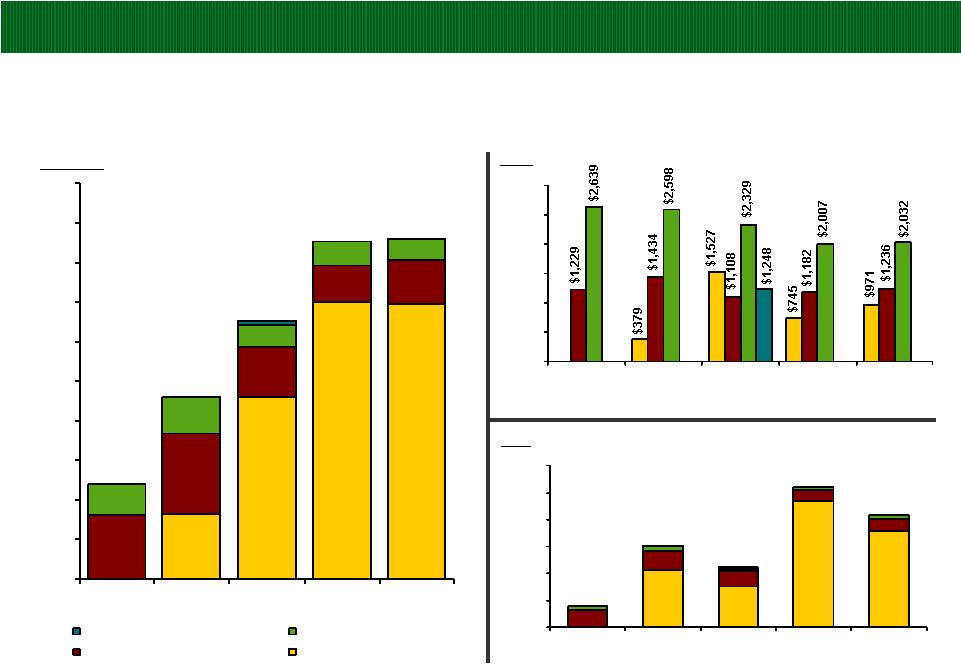

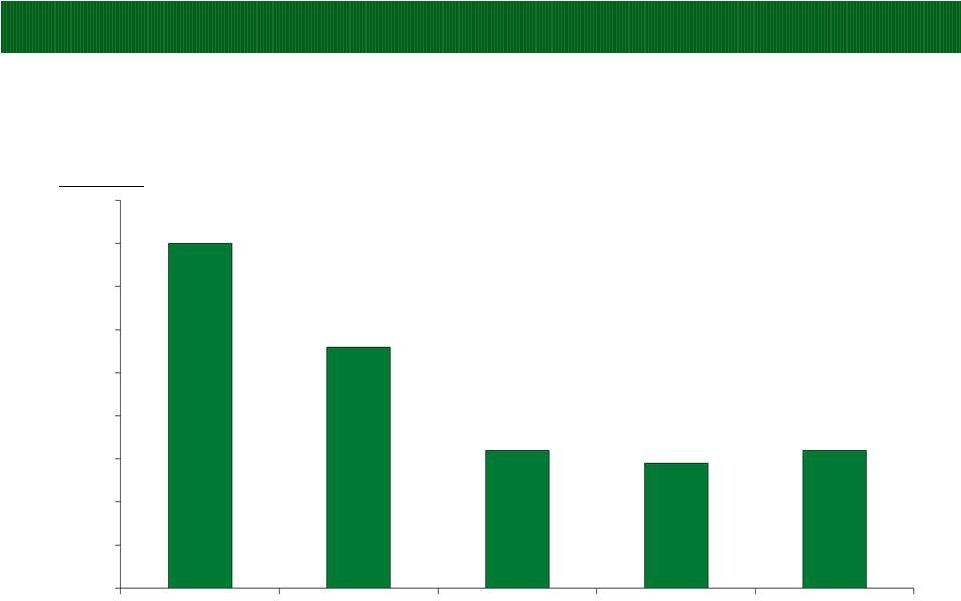

Potlatch Financial Overview

($ in millions)

2010 Segment Revenues

(1)

2010 Segment EBITDDA

(2)

Segment EBITDDA Margin

(3)

Resource

$226

$83

36.7%

Real Estate

$85

$79

92.9%

Wood

Products

$274

$15

5.5%

(1)

Segment revenues and EBITDDA presented prior to intersegment eliminations.

(2) See page 33 of this presentation for definitions of EBITDDA and segment

EBITDDA, and page 28 for reconciliations to most comparable GAAP measures.

(3) Segment

EBITDDA

Margin

is

defined

as

Segment

EBITDDA

divided

by

Segment

Revenues.

Historical

Consolidated

Revenue

and

EBITDDA

(2)

$423

$440

$476

$539

$102

$107

$131

$151

$0

$200

$400

$600

2007

2008

2009

2010

Revenue

EBITDDA |

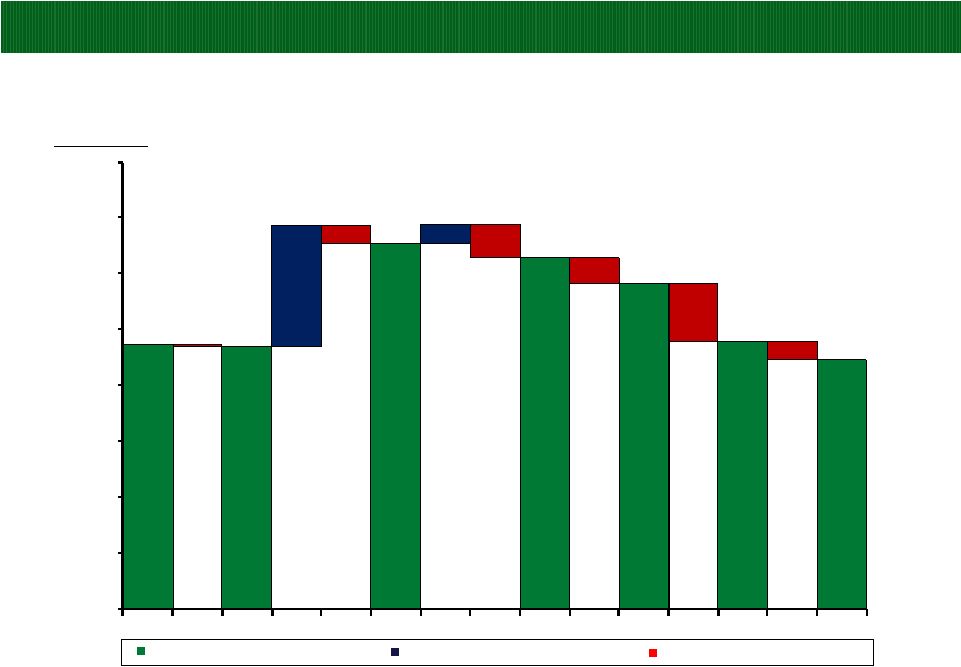

POTLATCH

CORPORATION 0.0

1.0

2.0

3.0

4.0

5.0

2004

2005

2006

2007

2008

2009

2010

2011F

2012F

~3

Years

Forward

Sawlogs

Pulpwood

$72

$80

$70

$53

$60

$64

$27

$34

$36

$33

$34

$32

$0

$25

$50

$75

$100

2006

2007

2008

2009

2010

Q3 2011

YTD

Sawlogs ($/ton)

Pulpwood ($/ton)

6

Attractive Timber Inventory & Harvest Profile

Allows active management of harvest

volumes to correspond with the

strength or weakness in timber prices

Attractive distribution of timber across

age-classes

Flexibility to monetize sawlog or pulpwood

harvests

Overall, harvest volume increasing

over time

Recently lowered harvest volume to 3.5

million tons for 2012 to preserve net asset

value

4.6 million tons expected in approximately

3 years

Potlatch’s cash flow (and dividend) is

highly leveraged to sawlog pricing

$7/ton price increase in 2010 produced

incremental EBITDDA of $21 million

Fee Harvest Log Volume

Timber Prices

3.0

3.3

3.3

3.9

4.4

3.8

~4.6

$/Ton

Tons in millions

4.2

4.1

3.5 |

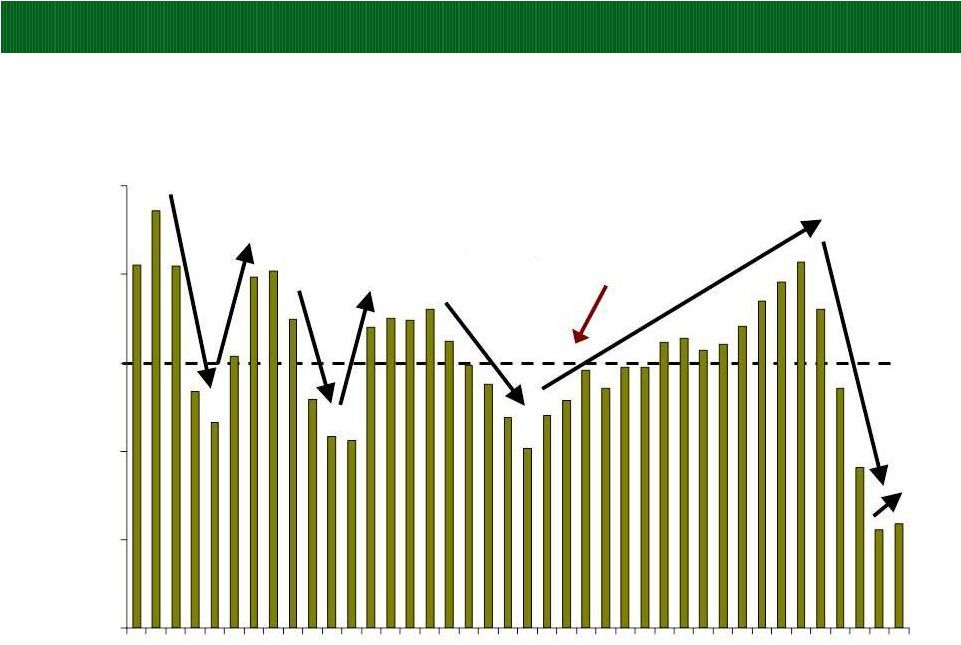

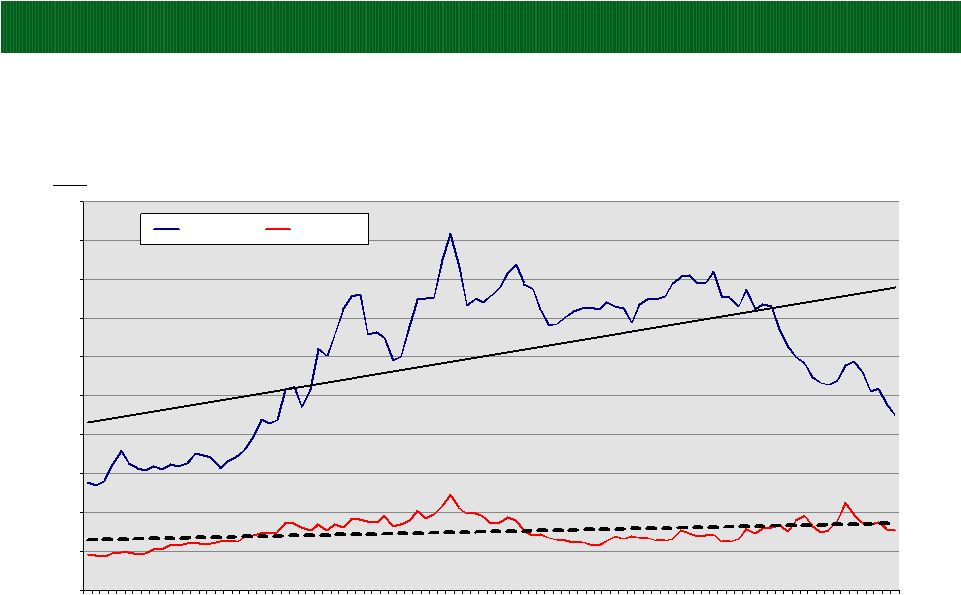

POTLATCH CORPORATION

7

Total Housing Starts

Housing starts are presently far below the long-term average

(in thousands)

Source: U.S. Census Bureau

0

500

1,000

1,500

2,000

2,500

71

73

75

77

79

81

83

85

87

89

91

93

95

97

99

01

03

05

07

09

Year

Average Starts Since 1971:

1.5 million |

POTLATCH CORPORATION

Million U.S. Starts

0.0

0.2

0.4

0.6

0.8

1.0

1.2

1.4

1.6

1.8

2.0

2.2

'03

'04

'05

'06

'07

'08

'09

'10

'11

'12

'13

U.S. Housing Starts Forecast

Single Family & Multifamily Only

Source: APA: Housing Starts: October 2011

(1)

RBC: Royal Bank of Canada

(2)

FEA: Forest Economic Advisors

(3)

NAR: National Association of Realtors

Actual

Forecast

8

Forecasts (000)

2011

2012

2013

RBC

(1)

-Nov 15

593

727

NA

NAHB-Oct 28

592

681

934

FEA

(2)

-Nov 11

595

668

878

Mesirow Financial-Nov 11

600

700

NA

NAR

(3)

-Nov 7

583

630

NA

RISI-Nov 1

590

630

NA

APA-Nov 16

595

630

730

Wells Fargo-Nov 9

580

610

740

Average

591

660

820 |

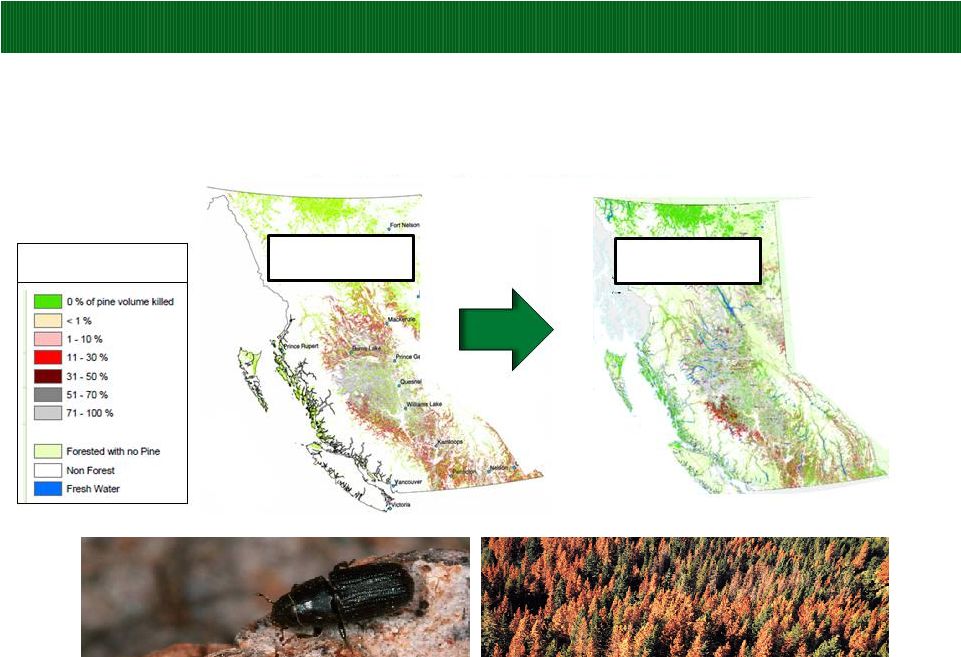

POTLATCH CORPORATION

Impact of the Pine Beetle on North American Lumber Supply

Source:

British Columbia Ministry of Forest and Range

9

Combined with Eastern Canadian harvest reductions of 20%, the pine beetle in British

Columbia is projected to lower North American lumber supply up to 15% over

the next few years, depending on lumber price levels.

Cumulative Percentage of

Killed

British Columbia

2009

British Columbia

2016 |

POTLATCH CORPORATION

10

North American Exports of Lumber to China as a % of North American Production

Source: RISI North American Lumber Forecast, June 2011 & Potlatch Internal

Forecast. 0.2%

0.5%

1.0%

2.6%

4.7%

7.6%

9.1%

8.8%

0%

1%

2%

3%

4%

5%

6%

7%

8%

9%

10%

2006

2007

2008

2009

2010

2011

2012

2013

Actual

Forecast |

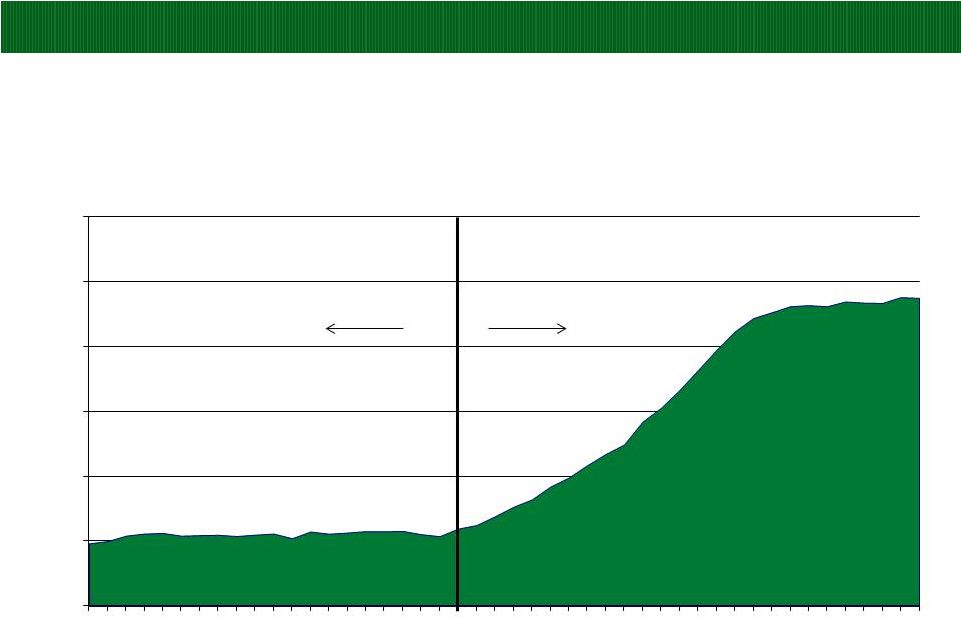

POTLATCH CORPORATION

U.S. Biomass Consumed to Produce Electricity

(1)

(Millions Green Tons)

11

Actual

Forecast

(1) EIA Annual Energy Outlook 2011 & Potlatch Estimates.

0

50

100

150

200

250

300

1990

1994

1998

2002

2006

2010

2014

2018

2022

2026

2030

2034 |

POTLATCH CORPORATION

Random Lengths Pricing for KD SYP (West) #2 2x6

($/MBF)

12

2007

2008

2009

2010

2006

2005

2011

(1)

(1) Pricing through October 2011. |

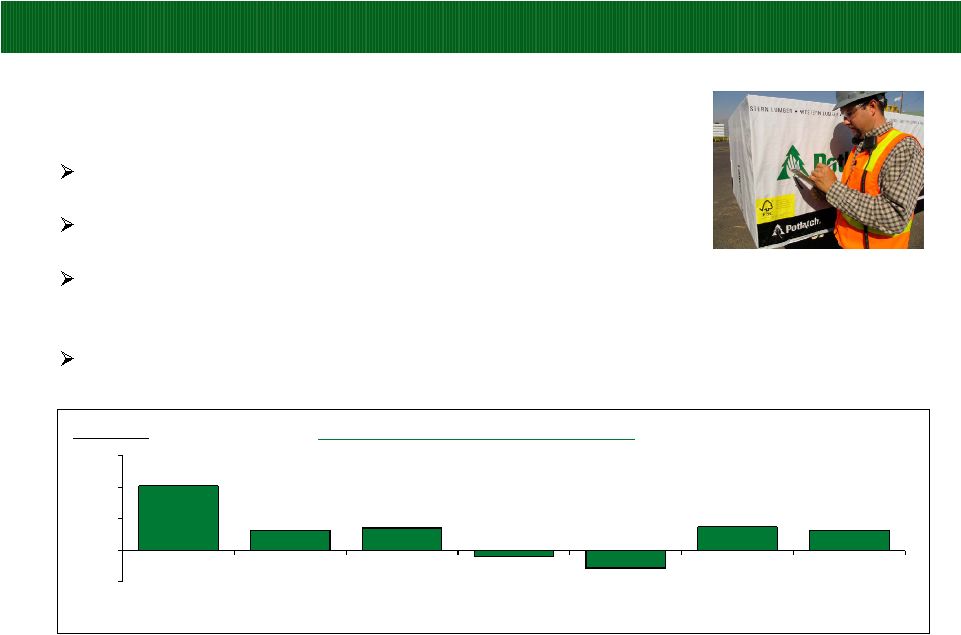

POTLATCH CORPORATION

Wood Products Segment

$41

$13

$14

($4)

($11)

$15

$13

-$20

$0

$20

$40

$60

2005

2006

2007

2008

2009

2010

LTM

Q3 2011

13

Five manufacturing facilities, lumber and plywood

Sell to wholesalers for use in homebuilding and construction

Potlatch operates four sawmills in Idaho, Arkansas, Minnesota and Michigan as

well as one industrial-grade plywood mill in Idaho

Actively manage output of facilities to match supply and demand

$ in millions

(1)

(2)

Note: See page 33 of this presentation for the definition of segment EBITDDA, and page 28

for reconciliation to most comparable GAAP measure.

(1)

Wood Products EBITDDA excludes $31 million for Canadian lumber settlement. (2)

Wood Products EBITDDA includes asset impairment charge of $3 million. Wood

Products

Segment

EBITDDA |

POTLATCH CORPORATION

14

Rural Real Estate

~95,000 acres

Frequently assess acreage to maximize

value through sale of non-core timberland

real estate

More than 3,000 miles of desirable water

frontage

More than 9 million people live within three

states of ownership

Potlatch Timberlands

(1)

Core Timberland

~1.2 million acres

Non-Strategic Timberland

~15,000 acres

HBU/Development

~125,000 acres

Land Portfolio

Idaho:

813,000 acres

Arkansas:

407,000 acres

Minnesota:

225,000 acres

(1)

As of September 30, 2011.

Real Estate Overview

Coeur d’Alene

Boise

Sun Valley

McCall

Little Rock

Hot Springs

Brainerd

Minneapolis

St. Paul |

POTLATCH CORPORATION

15

Value Opportunities Are Unique to Each Category

CONSERVATION

EASEMENT

NON-STRATEGIC

TIMBERLAND

RURAL REAL

ESTATE

HIGHER-BETTER-USE

DEVELOPMENT

$400 to $1,000 per acre

$500 to $1,500 per acre

$1,000 to $1,500 per acre

$2,000 to $7,000 per acre

120,000

Opportunity dependent

10,000 to 20,000 acres

90,000 to 100,000 acres

120,000 to 130,000 acres

Characteristics:

-

Habitat related

-

Appropriate payment for

opportunity sold

-

Selective core lands

Characteristics:

-

Fringe of ownership

-

Location disadvantage

-

Higher operation cost

-

Capital allocation focus

Characteristics:

-

Fringe of ownership

-

Opportunity varies by

geographic market

-

Recreation character

and amenities

-

Adjacent ownership

influence

Characteristics:

-

Property attribute focus

-

Investor interest

-

Explore proper land use

and entitlements

-

Emerging development

focus

LOWER VALUE

OPPORTUNITIES

HIGHER VALUE

OPPORTUNITIES |

POTLATCH CORPORATION

16

Significant Real Estate Portfolio

Realization of Non-Core Timberland Asset Value

16.3

46.1

70.1

69.5

16.2

20.5

12.5

9.2

11.1

7.9

9.3

5.6

5.9

5.3

1.2

$0

$10

$20

$30

$40

$50

$60

$70

$80

$90

$100

2007

2008

2009

2010

LTM

Q3 2011

Segment Revenue

Conservation Easement

HBU/Development

Rural Real Estate

Non-Strategic Timberland

$0

$500

$1,000

$1,500

$2,000

$2,500

$3,000

2007

2008

2009

2010

LTM

Q3 2011

$/Acre

Price Per Acre

42,841

30,168

93,974

71,561

13,166

14,266

11,234

7,796

8,991

3,009

3,562

2,430

2,967

2,583

954

0

20,000

40,000

60,000

80,000

100,000

120,000

2007

2008

2009

2010

LTM

Q3 2011

Acres

Acres Sold

(1)

$24.1

$46.1

$65.4

16,175

60,669

44,786

(1)

Segment Revenue in 2008 excludes sale of building.

(2)

Excludes the sale of the Boardman, Oregon tree farm of 17,000 acres.

$

in

millions

$85.2

104,737

(2)

$85.9

83,135 |

POTLATCH CORPORATION

Potlatch Timberland Holdings

17

1,000

1,100

1,200

1,300

1,400

1,500

1,600

1,700

1,800

2005

2006

2007

2008

2009

1,471

(3)

1,468

218

1,653

36

(61)

1,628

(45)

1,583

(105)

1,478

Acres (000’s)

PCH Owned Acreage at End of Period

PCH Acquired Acreage During the Year

PCH Sold Acreage During the Year

2010

(33)

(1)

(1)

Includes the sale of the Boardman, Oregon tree farm of 17,000 acres.

(2)

Acreage through September 30, 2011.

(33)

2011

1,445

(2) |

POTLATCH CORPORATION

18

Balance Sheet Review

ASSETS

Cash and short-term investments

81

$

Other current assets

78

Long-term assets

594

Total assets

753

$

LIABILITIES & EQUITY

Current liabilities

86

$

Long-term debt

345

Other liabilities

132

Total liabilities

563

Equity

190

Total liabilities & equity

753

$

September 30, 2011

($ in millions)

Strong credit metrics

$150

million

revolver

expiring

December

2013

(1)

$68 million of fixed rate debt swapped to

floating as of June 30, 2010

$63 million of floating rate debt outstanding

Maturities in 2012 -

2018

6.9% weighted average cost of debt (including

interest rate swaps)

8.6 weighted average years to maturity

7.1% weighted average cost of debt (all at fixed rate)

(1) Per an amendment to our credit agreement, the revolver decreased to

$150 million from $250 million, effective February 4, 2011. |

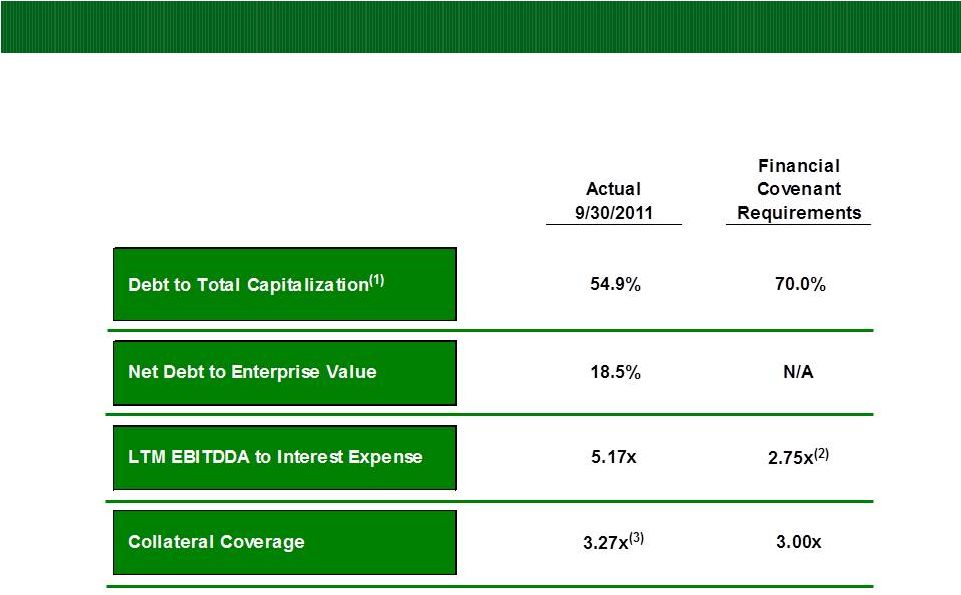

POTLATCH CORPORATION

19

Conservative Leverage and Interest Coverage Ratios

(1)

as of September 30, 2011

(1)

Calculated per our bank credit agreement, using an accumulated other comprehensive loss

“AOCL” exclusion. Per an amendment to the credit agreement, the Minimum Collateral

Coverage ratio increased to 3.00 and the Maximum Funded Indebtedness to Capitalization ratio increased

to 70.0% effective as of February 4, 2011. (2)

This requirement will increase to 3.00 on October 1, 2011.

(3)

Updated for new appraisal dated June 15, 2011.

Note: We define net debt as the total of short-term and long-term debt less cash and

short-term investments, see page 29 for reconciliation. See page 33 of this presentation for

the definition of EBITDDA and page 28 for reconciliation to most comparable GAAP measure.

|

POTLATCH CORPORATION

20

Strong Net Asset Value

Arkansas

Timberland

407,000 Acres

Secured Idaho

Timberland

352,000 Acres

Unsecured Idaho

Timberland

461,000 Acres

Wisconsin

Timberland 1,000 Acres

Minnesota

Timberland

225,000 Acres

Total = Approx. 1.45 Million Acres

Annually we obtain an appraisal on 352,000 acres of core Idaho timberland

The 2011 appraisal valued the secured core Idaho timberland at $707

million

(1)

,

or

$2,000

an

acre

Thus, while cash flows are currently depressed due to the weak housing

market, the Company’s net asset value remains intact

The

appraisal

is

done

by

an

independent

3

rd

party

appraiser

(1)

Updated for new appraisal dated June 15, 2011. The appraisal uses comparable transactions and

discounted cash flow analyses for purposes of the valuation. There is no assurance that sales

could be effected at the appraised values or as to the timing of sales. The calculation of discounted cash flows involves projection of future market conditions, harvest levels

and other factors, all of which could vary materially from those projected. There is no implication

that the company’s other timberlands would have a similar value per acre. |

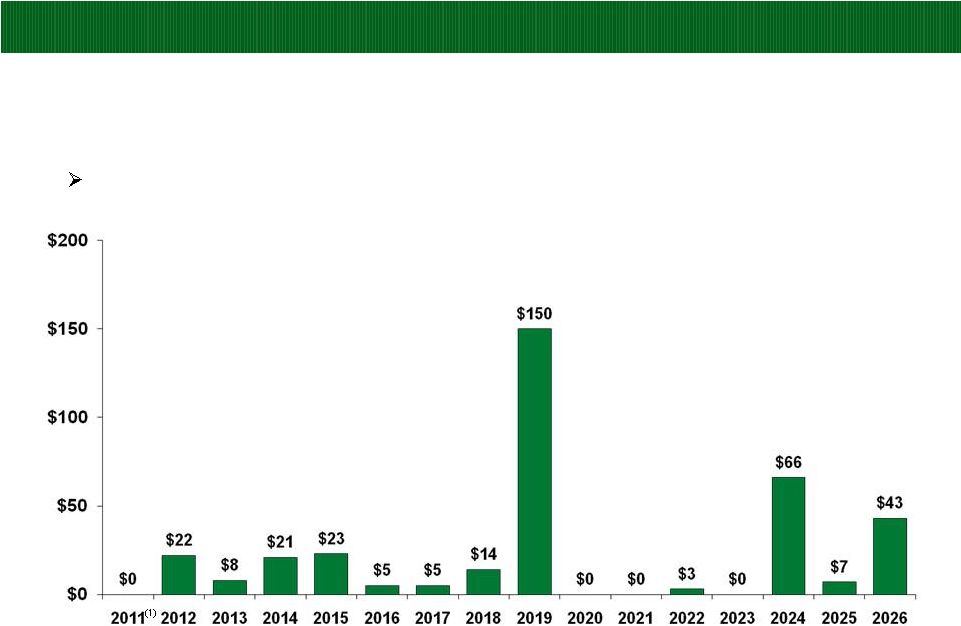

POTLATCH CORPORATION

Conservative Capital Structure –

Long Term Debt Maturity Profile

($ in millions)

21

Mandatory principal repayments of only $79 million through 2016

(1) $5 million maturity paid in January, 2011 with cash on hand.

|

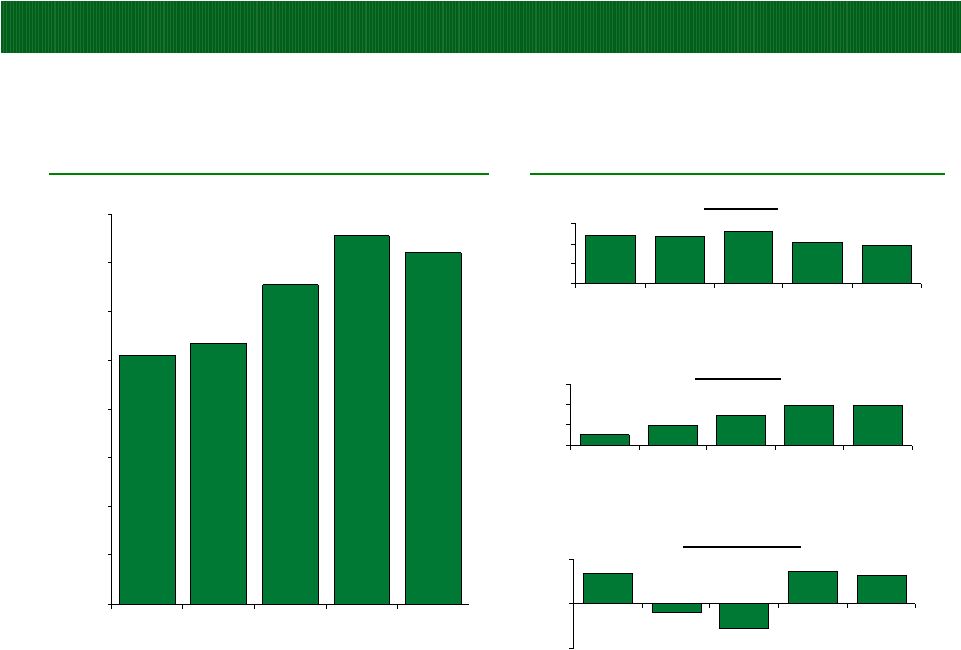

POTLATCH CORPORATION

Strong Cash Flow Generation

($ in millions)

$102

$107

$131

$151

$144

$0

$20

$40

$60

$80

$100

$120

$140

$160

2007

2008

2009

2010

LTM

Q3 2011

22

Total EBITDDA

(1)

$97

$95

$105

$83

$78

$0

$40

$80

$120

2007

2008

2009

2010

LTM

Q3 2011

Resource

$21

$41

$60

$79

$79

$0

$40

$80

$120

2007

2008

2009

2010

LTM

Q3 2011

Real Estate

$14

($4)

($11)

$15

$13

-$20

$0

$20

2007

2008

2009

2010

LTM

Q3 2011

Wood Products

Segment EBITDDA

(1)

(1)

See page 33 of this presentation for the definition of EBITDDA and Segment EBITDDA,

and page 28 for a reconciliation to most comparable GAAP measures. (2)

Consolidated and Wood Products EBITDDA includes a $3 million asset impairment

charge taken in 2009. (2)

(2) |

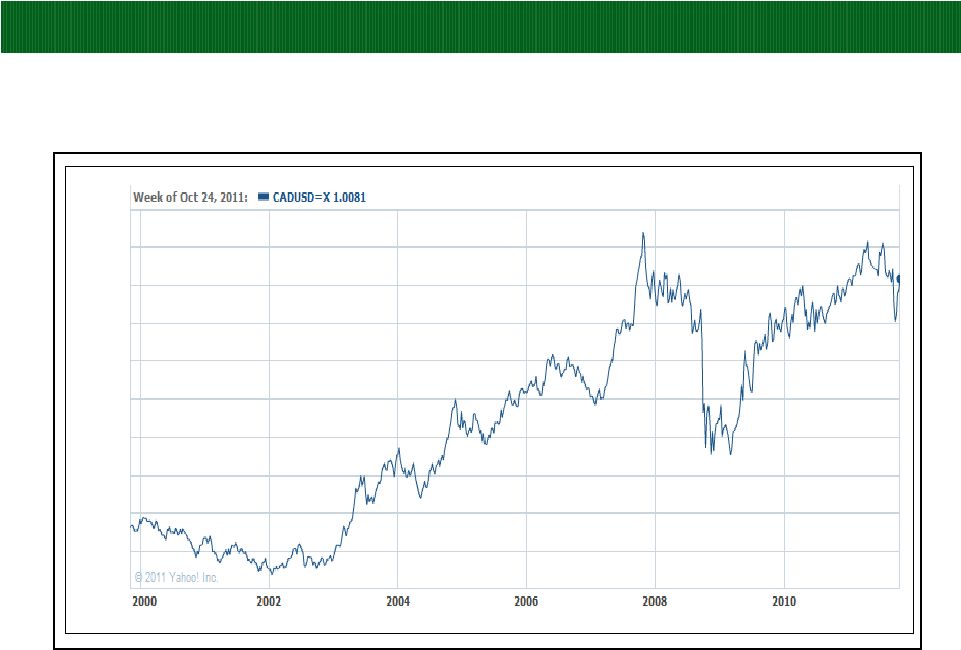

POTLATCH CORPORATION

Exchange Rate

Canadian Dollar to U.S. Dollar

23

$1.05

$1.00

$0.95

$0.90

$0.85

$0.80

$0.75

$0.70

$0.65 |

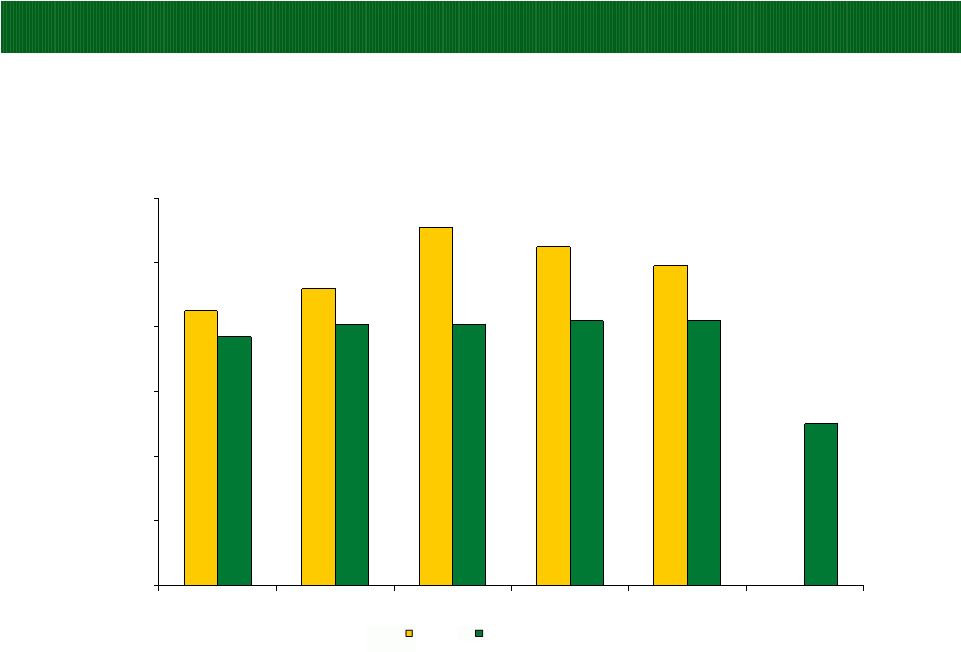

POTLATCH CORPORATION

Funds Available for Distribution (FAD)

($ in millions)

$85

$92

$111

$105

$99

$77

$81

$81

$82

$82

$50

$0

$20

$40

$60

$80

$100

$120

2007

2008

2009

2010

LTM

Q3 2011

2012F

FAD

Dividend Distribution

24

Note:

See page 33 of this presentation for the definition of FAD, and see page 29 for a

reconciliation to most comparable GAAP measure. Excludes dividend distribution of

Clearwater Paper stock in 2008. |

POTLATCH CORPORATION

25

Attractive Dividend

Potlatch's dividend policy has been driven primarily by the performance of its

timber and real estate businesses

Given the prolonged downturn of the U.S. housing market, we recently reduced our

dividend from $0.51/share to $0.31/share

Dividend

remains

very

attractive

relative

to

peers

as

well

as

to

S&P

500

We anticipate increasing harvest levels and dividend as the housing market

improves |

POTLATCH CORPORATION

26

Conclusion

Potlatch maintains a very attractive asset base of 1.45 million acres of

timberland We have the ability to meaningfully expand high margin sawlog

harvest levels Wood Products business stabilized and generating solid cash

flow Real Estate segment low risk, high margin

Attractive dividend

Strong balance sheet with attractive debt cost and maturity profile

Industry trends beginning to turn positive

Housing starts beginning to grow, albeit slowly

Exports to China from North America continue to expand

Pine beetle to impact supply from Canada

Biomass continues to hold promise |

Appendix

POTLATCH CORPORATION

DECEMBER 2011 |

POTLATCH

CORPORATION 28

EBITDDA and Segment EBITDDA Reconciliation

($ in millions)

2005

2006

(1)

2007

2008

2009

(2)

2010

LTM

Q3 2011

Consolidated

Earnings from continuing operations

74

$

73

$

81

$

40

$

51

$

Less:

Income tax benefit (provision)

17

25

16

(5)

(4)

Add:

Net cash interest expense

15

20

20

26

25

Depreciation, depletion, and amortization

26

30

35

31

30

Basis of real estate sold

4

9

11

49

36

Non-cash asset impairment and eliminations

(2)

Consolidated EBITDDA

102

$

107

$

131

$

151

$

144

$

Resource

Operating income

82

$

76

$

82

$

62

$

60

$

Depreciation, depletion, and amortization

15

19

23

21

18

Resource Segment EBITDDA

97

$

95

$

105

$

83

$

78

$

Real Estate

Operating income

17

$

32

$

49

$

30

$

43

$

Basis of real estate sold

4

9

11

49

36

Real Estate Segment EBITDDA

21

$

41

$

60

$

79

$

79

$

Wood Products

Operating income (loss)

29

$

2

$

4

$

(14)

$

(21)

$

7

$

5

$

Depreciation

12

11

10

10

10

8

8

Wood Products Segment EBITDDA

41

$

13

$

14

$

(4)

$

(11)

$

15

$

13

$

Fiscal Year

(1)

Wood Products EBITDDA excludes $31 million for Canadian lumber settlement.

(2)

Consolidated and Wood Products EBITDDA includes a $3 million asset impairment charge taken in

2009. |

POTLATCH CORPORATION

29

Potlatch Net Debt Reconciliation

($ in millions)

September 30

2007

2008

2009

2010

2011

Long-term debt

321

$

221

$

368

$

363

$

345

$

Current installments on long-term debt

-

101

-

5

22

Current notes payable

110

129

-

-

-

Cash

(9)

(1)

(2)

(6)

(6)

Short-term investments

(22)

(3)

(53)

(85)

(75)

Net Debt

400

$

447

$

313

$

277

$

286

$

At December 31

FAD Calculation

($ in millions)

(1) Excludes distribution of Clearwater Paper stock in 2008.

2007

2008

2009

2010

LTM

Q3 2011

Operating income (loss):

Resource

82

$

76

$

82

$

62

$

60

$

Real Estate

17

32

49

30

43

Wood Products

4

(14)

(21)

7

5

Eliminations and adjustments

1

(1)

8

2

4

104

93

118

101

112

Corporate administration

(32)

(25)

(33)

(30)

(33)

Net cash interest expense

(15)

(20)

(20)

(26)

(25)

Income tax benefit (provision)

17

25

16

(5)

(3)

Earnings from continuing operations

74

73

81

40

51

Depreciation, depletion and amortization

26

30

35

31

30

Basis of real estate sold

4

9

11

49

36

Capital expenditures

(19)

(20)

(16)

(15)

(16)

Non-cash asset impairment & eliminations

(2)

Funds Available for Distribution

85

$

92

$

111

$

105

$

99

$

Distributions to Common Stockholders

(1)

77

$

81

$

81

$

82

$

82

$

Fiscal Year |

POTLATCH CORPORATION

30

Softwood Stumpage Price Trends

Southwide Average Nominal Prices

Source: Timber Mart-South, updated through September 30, 2011.

$0

$5

$10

$15

$20

$25

$30

$35

$40

$45

$50

1987

1989

1991

1993

1995

1997

1999

2001

2003

2005

2007

2009

2011

$/Ton

Years

Pine Sawtimber

Pine Pulpwood |

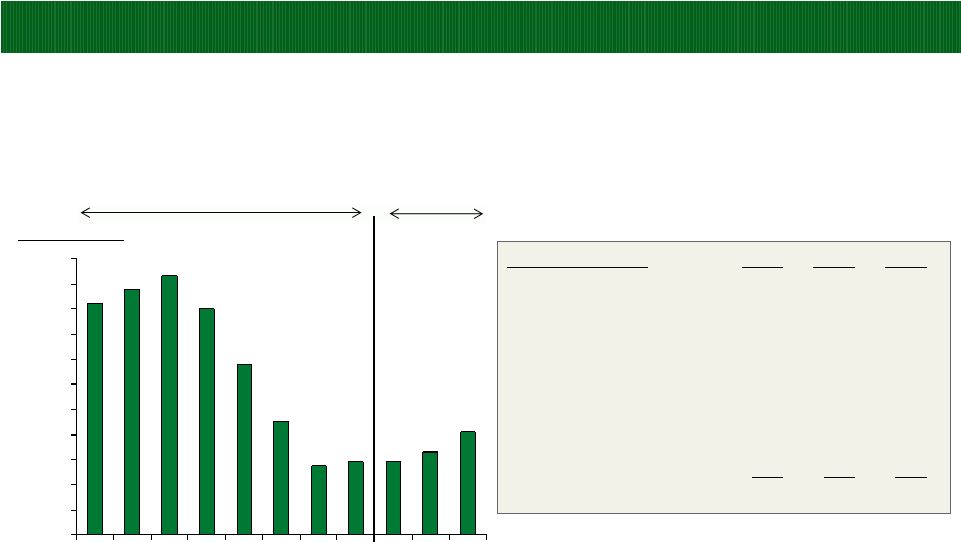

POTLATCH CORPORATION

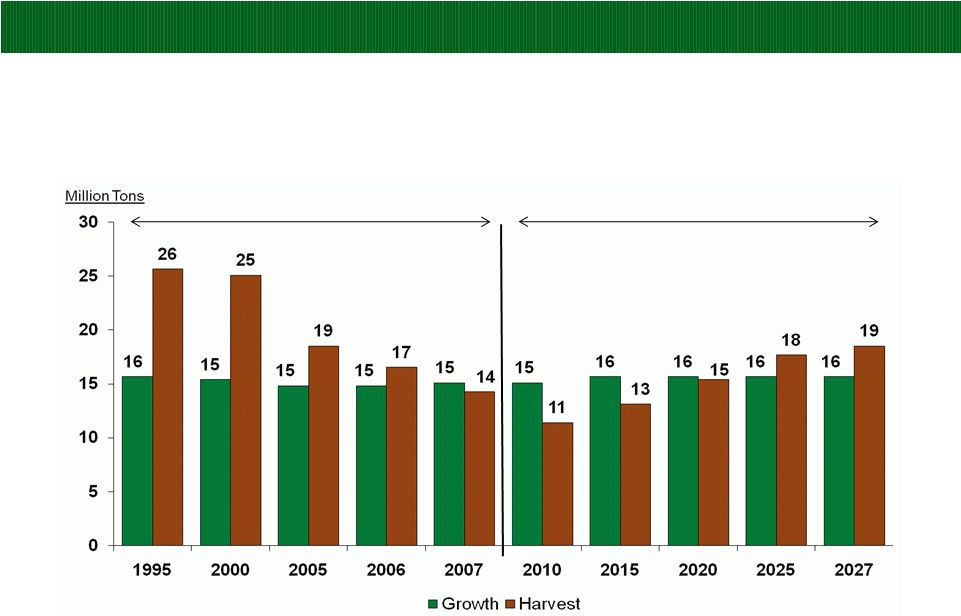

Projected Inland Private Timber Growth and Harvest (1995-2027)

31

Source: F2M and Potlatch Corporation

Actual

Forecast |

POTLATCH

CORPORATION Inland Private Sawtimber Inventory –

Private Lands (1995-2007)

Inland West (Idaho, Eastern Washington, and Western Montana)

32

Source: F2M and Potlatch Corporation

510

486

462

459

462

430

440

450

460

470

480

490

500

510

520

1995

2000

2005

2006

2007

Million Tons |

POTLATCH CORPORATION

33

Definitions of Non-GAAP Measures

EBITDDA

is a non-GAAP measure that management uses to evaluate the cash generating

capacity of the company. The most directly comparable GAAP measure is

net earnings. EBITDDA, as we define it, is net earnings from

continuing operations adjusted for net cash interest expense, provision/benefit for

income taxes, depreciation, depletion and amortization, basis of real estate

sold and non-cash asset impairment and eliminations. It should not be

considered as an alternative to net earnings computed under GAAP.

Funds

Available

for

Distribution

(FAD)

is

a

non-GAAP

measure.

FAD,

as

defined

in

the

indenture

governing

our

senior notes, is earnings from continuing operations, plus depreciation, depletion

and amortization, plus basis of real estate sold, minus capital expenditures

and non-cash asset impairment and eliminations. For purposes of this

definition, capital expenditures exclude all expenditures relating to direct or

indirect timberland purchases in excess of $5

million.

We

do

not

use

FAD

as,

nor

should

it

be

considered

to

be,

an

alternative

to

net

cash

provided

by

operating

activities computed under GAAP as an indicator of our operating performance, or as

an indicator of our ability to fund our cash needs. FAD, as defined in the

indenture governing our senior notes may not be comparable with measures of

similar titles reported by other companies.

Segment

EBITDDA

from

continuing

operations,

as

we

define

it,

is

segment

operating

income

(loss)

adjusted

for

depreciation, depletion, amortization and the basis of real estate sold.

|