Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - ITC Holdings Corp. | d265519d8k.htm |

| EX-99.2 - PRESS RELEASE - ITC Holdings Corp. | d265519dex992.htm |

| EX-99.3 - JOINT PRESS RELEASE - ITC Holdings Corp. | d265519dex993.htm |

ITC

Holdings Corp. Transaction Overview

Entergy to Divest and Merge Electric

Transmission Business Into ITC

December 5, 2011

Exhibit 99.1 |

Safe

Harbor Language & Legal Disclosure This

presentation

contain

certain

statements

that

describe

ITC

Holdings

Corp.

(“ITC”)

management’s beliefs concerning future business conditions and

prospects, growth opportunities and the outlook for ITC’s

business, including ITC’s business and the electric transmission industry based upon information

currently

available.

Such

statements

are

“forward-looking”

statements within the meaning of the Private Securities Litigation

Reform Act of 1995. Wherever possible,

ITC

has

identified

these

forward-looking

statements

by

words

such

as

“anticipates”,

“believes”,

“intends”,

“estimates”,

“expects”,

“projects”

and

similar phrases. These forward-looking statements are based upon

assumptions ITC management believes are reasonable. Such forward-looking statements

are subject to risks and uncertainties which could cause ITC’s

actual results, performance and achievements to differ materially from those expressed in, or

implied

by,

these

statements,

including,

among

other

things,

(a)

the risks and uncertainties disclosed in ITC’s annual report on

Form 10-K and ITC’s quarterly

reports

on

Form

10-Q

filed

with

the

Securities

and

Exchange

Commission

(the

“SEC”)

from time to time and (b) the following transactional factors

(in addition to others described elsewhere in this document and in

subsequent filings with the SEC): (i) risks inherent in the contemplated transaction,

including: (A) failure to obtain approval by the Company’s

shareholders; (B) failure to obtain regulatory approvals necessary to consummate the transaction

or to obtain regulatory approvals on favorable terms; (C) the ability

to obtain the required financings; (D) delays in consummating the transaction or the

failure to consummate the transactions; and (E) exceeding the expected

costs of the transactions; (ii) legislative and regulatory actions, and (iii) conditions of

the capital markets during the periods covered by the

forward-looking statements. Because ITC’s

forward-looking statements are based on estimates and assumptions that are subject to significant business, economic and competitive

uncertainties, many of which are beyond ITC’s control or are

subject to change, actual results could be materially different and any or all of ITC’s forward-

looking statements may turn out to be wrong. They speak only as of the

date made and can be affected by assumptions ITC might make or by known or

unknown risks and uncertainties. Many factors mentioned in this

document and the exhibits hereto and in ITC’s annual and quarterly reports will be

important in determining future results. Consequently, ITC cannot

assure you that ITC’s expectations or forecasts expressed in such forward-looking

statements will be achieved. Actual future results may vary materially.

Except as required by law, ITC undertakes no obligation to publicly update any of

ITC’s forward-looking or other statements, whether as a result

of new information, future events, or otherwise. The transaction

is subject to certain conditions precedent, including regulatory approvals, approval of ITC’s shareholders and the availability of financing.

ITC

cannot

provide

any

assurance

that

the

proposed

transactions

related

thereto

will

be

completed,

nor

can

it

give

assurances

as

to the terms on which such

transactions will be consummated.

2 |

Safe

Harbor Language & Legal Disclosure ITC

and

Mid

South

TransCo

LLC

(“TransCo”)

will

file

registration

statements

with

the

SEC

registering

shares

of

ITC common stock and TransCo common

units

to

be

issued

to

Entergy

Corporation

(“Entergy”)

shareholders

in

connection

with

the

proposed

transactions.

ITC

will also file a proxy statement with the

SEC that will be sent to the shareholders of ITC. Entergy shareholders

are urged to read the prospectus and/or information statement that will be included in the

registration

statements

and

any

other

relevant

documents,

because

they

contain

important

information

about

ITC,

TransCo

and

the

proposed

transactions.

ITC’s

shareholders

are

urged

to

read

the

proxy

statement

and

any

other

relevant

documents

because

they

contain

important

information

about ITC, TransCo and the

proposed

transactions.

The proxy statement, prospectus and/or information statement, and

other documents relating to the proposed transactions (when they are

available)

can

be

obtained

free

of

charge

from

the

SEC’s

website

at

www.sec.gov.

The documents, when available, can also be obtained free of charge

from Entergy

upon

written

request

to

Entergy

Corporation,

Investor

Relations,

P.O.

Box

61000

New

Orleans,

LA

70161

or by calling Entergy’s Investor Relations

information line at 1-888-ENTERGY (368-3749), or from ITC

upon written request to ITC Holdings Corp., Investor Relations, 27175 Energy Way, Novi, MI

48377 or by calling 248-946-3000

This presentation is not a solicitation of a proxy from any security

holder of ITC. However, Entergy, ITC and certain of their respective directors and executive

officers

and

certain

other

members

of

management

and

employees

may

be

deemed

to

be

participants

in

the

solicitation

of

proxies

from

shareholders

of

ITC in

connection with the proposed transaction under the rules of the SEC.

Information about the directors and executive officers of Entergy may be found in its 2010

Annual

Report

on

Form

10-K

filed

with

the

SEC

on

February

28,

2011,

and

its

definitive

proxy

statement

relating

to

its

2011

Annual

Meeting

of

Shareholders

filed with the SEC on March 24, 2011. Information about the directors

and executive officers of ITC may be found in its 2010 Annual Report on Form 10-K filed

with

the

SEC

on

February

23,

2011,

and

its

definitive

proxy

statement

relating

to

its

2011

Annual

Meeting

of

Shareholders filed with the SEC on April 21, 2011.

3 |

Transaction Overview

Joseph Welch, Chairman, President & CEO |

Transaction Overview

5

Transaction Structure

•

Reverse Morris Trust -

Entergy’s transmission business merges into ITC

•

Prior to merger, Entergy to pursue tax free spin-off of transmission business

and ITC to effectuate a recapitalization, anticipated to be special

dividend of $700 million

•

100% stock consideration

•

Entergy to issue approximately $1.775 billion of debt, to be assumed by ITC

•

ITC to issue approximately $700 million of unsecured debt at holdings level

ITC Shareholders

Post-Merge

•

50.1% Entergy shareholders

•

49.9% ITC shareholders

ITC Senior

Mgmt & Board

•

Two new independent directors who have transmission industry knowledge and

familiarity with Entergy’s region

•

ITC’s management team will remain intact for combined business, supplemented

with key Entergy leadership personnel from Entergy’s transmission

business Headquarters

•

Regional headquarters in Jackson, MS

•

Corporate headquarters in Novi, MI

Expected Closing

•

In 2013, subject to timing of approvals

Approval Process

•

Entergy retail regulatory approvals

•

Federal Energy Regulatory Commission approvals

•

ITC shareholder approval

•

Certain other regulatory approvals |

Transaction Rationale

•

Attractive and natural strategic fit

–

Validates independent transmission model and resulting benefits

•

Strengthens ITC’s leading transmission platform in the U.S.; combined business

enhanced by increased scale and reach

–

Largest electric transmission company in U.S. based on net PP&E and peak load

served –

Adds sizable new markets to operating and development business

–

Expands geographic reach

–

Enhances and diversifies meaningful growth prospects

•

Provides tangible customer and stakeholder benefits

–

Furthers objectives of independent transmission model: system reliability,

reduced congestion, and greater access to competitive markets

–

Solid track record of capital investment and O&M programs to support system

reliability –

Commitment to the communities and stakeholders served through corporate

citizenship and community support

•

Financially compelling

–

Immediately and sustainably value accretive to ITC shareholders

–

Natural extension of existing ITC business model

–

Diversification of ITC capital investment profile and resulting growth

portfolio –

Enhances overall credit quality, while credit metric neutral to ITC

6 |

7

Attractive & Natural Strategic Fit

7

•

Highlights and supports the benefits and the

value of the independent model for all

constituents

•

Transformational to ITC size, scale, scope

and financial

strength

–

Expands

the

ITC

network

across

entire

middle of the country from Great Lakes to

Gulf Coast

–

Effectively doubles ITC’s asset base

•

Adds sizeable new markets to ITC’s operating

and development portfolio; diversifies and

enhances growth prospects through

expanded footprint

–

Provides additional avenue of sustainable

long-term growth through needed

upgrades of existing Entergy system

–

Accelerates growth and solidifies leading

transmission platform

–

Shifts growth drivers towards predictable

base capital investment

–

Diversifies growth portfolio and provides for

incremental development opportunities |

8

Independent Model

8

Benefits of ITC independent

transmission model

Transparency

Improved

Reliability

Aligned with

Public Policy

Operational

Excellence

Improved Credit

Quality

Competitive

Markets

Reduced System

Congestion

Enhanced Generator

Interconnections |

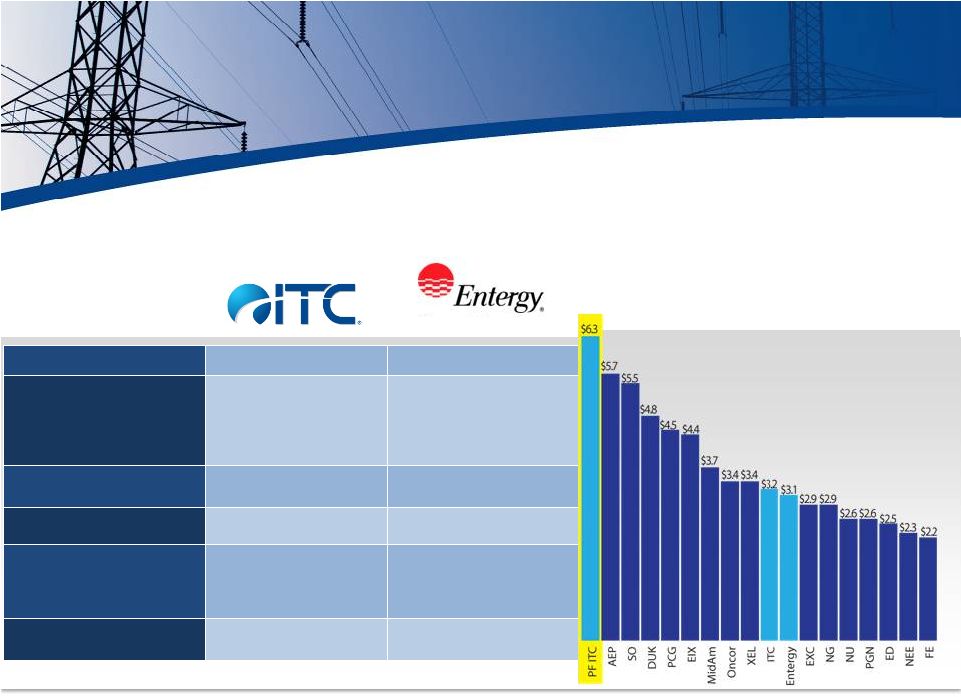

Leading Transmission Platform

9

•

Further establishes ITC as the leading transmission platform in the U.S.

Transmission Business

Network System Peak Load

26,100 MW

28,000 MW

Service Area

Seven states –

including

footprint in Michigan, Iowa,

Minnesota, Illinois,

Missouri, Kansas &

Oklahoma

Four states –

including

footprint in Arkansas, Texas,

Louisiana and Mississippi

Total Transmission Miles

Approximately 15,100

miles

Approximately 15,700 miles

9/30/2011 Net PP&E

$3.2 billion

$3.1 billion

RTO Membership

MISO & SPP

Currently Independent

Coordinator of Transmission

with anticipated full transition

to MISO by December 2013

Full Time Equivalent

Employees

Approximately 450*

Approximately 750*

* Excludes contract work force

** ITC, ETR & Pro forma ITC net PP&E as of 9/30/2011 based on GAAP, all

other amounts per June 30, 2011 FERC Form 1 –

Largest electric utility based on total transmission net PP&E & peak load

served Net transmission PP&E ($bn)** |

Customer & Stakeholder Benefits

10

Furthers objectives of independent transmission model

•

Including the commitment to maintain strong reliability, reduce congestion,

enhance opportunities Facilitator of competitive markets

•

Building robust interconnections and related system upgrades to bring all

generation to market Culture of safety and proven safety performance

•

Top safety performance of all EEI companies

Investments

in

the

system

–

both

capital

and

O&M

•

Invested $2.3 billion in CAPEX and $640 million in O&M since inception to

support system Commitment

to

regions

and

communities

we

serve

through

corporate

citizenship

•

Ingrain company in communities and regions including supporting economic

development and for interconnecting generators and foster greater access to

competitive markets reliability and expansion

resulting jobs, community involvement and supporting charities

|

Approvals & Timeline

Entergy Retail Regulators

(APSC, LPSC, MPSC,

PUCT, CCNO)

•

Change of control of transmission assets

•

Authorization to incur debt in some jurisdictions

FERC

•

Change of control of transmission assets

•

Establish new regulatory construct for new ITC subsidiaries

•

Authorization for operating company financings

Hart-Scott-Rodino Act

(DOJ / FTC)

•

Pre-merger notification to review potential antitrust and competition issues

IRS Private Letter Ruling

•

Ruling regarding tax-free treatment of the distribution of Transco Holdco

ITC Shareholders

•

Merger

•

Amendment to ITC Articles of Incorporation to increase the number of authorized

shares

•

Authorization for issuance of greater than 20% of outstanding shares

* Approvals may be required in Missouri and Tennessee due to limited assets in

those territories. Approval may be required in Oklahoma for ITC. 11

•

The transaction is targeted to close in 2013, subject to receipt of the following approvals and

closing conditions

•

Anticipated Approval Requirements* |

Proven ITC Transaction Experience

12

ITC

Transmission

Acquired in 2003

FERC approval required;

foundation for company

METC

Acquired in 2006

FERC approval required; signaled

ongoing support of independent model

and resulting benefits

IP&L

Acquired in 2007

FERC approval and four state

jurisdictional approvals required;

achieved all approvals in support of

independent business model and

much needed transmission investment

for acquired system |

Transaction

Structure & Financial Overview

Cameron Bready, Executive Vice President & CFO |

$1.775b of newly-issued debt will

be raised at Entergy’s

transmission business, the

proceeds from which will be

distributed to Entergy

Entergy

shareholders

Entergy

Transmission

business

Entergy will create and

distribute new Transco (“Mid

South TransCo LLC “) to

Entergy shareholders

Entergy

Mid South

TransCo

LLC

ITC

shareholders

ITC

Prior to the merger, ITC will recapitalize,

currently anticipated to be a one-time

$700mm special dividend to existing

shareholders, funded by newly-issued senior

unsecured notes at ITC Holdings

Entergy

shareholders

Entergy

Mid South

TransCo

LLC

Entergy

shareholders

ITC

shareholders

ITC

ITC Merger

Sub

Mid South TransCo LLC will subsequently merge

with ITC Merger Sub; Entergy shareholders will

receive 50.1% ownership in the combined company

Entergy

shareholders

ITC

shareholders

Entergy

ITC

Holdings

Mid South

TransCo LLC

49.9%

100%

ITC

OpCos

6 OpCos

6 OpCos

6 OpCos

14

Transaction Key Steps

ITC Pro Forma Structure |

Pro

Forma Ownership Structure 15

50.1% Entergy

Shareholders

49.9% ITC

Shareholders

6 OpCos

Mid South

TransCo

LLC |

Financial Highlights

•

Final transaction value determined by ITC

share price at time of closing

–

Combination of ITC market capitalization,

post-recapitalization, and assumed debt

•

Natural expansion of current business

model

–

Enhanced due to diversified growth

prospects from the Entergy transmission

business and footprint

–

Expect to seek regulatory construct for the

Entergy operating companies similar to that

of ITC’s current regulated operating

subsidiaries

•

Combination of ITC’s strengthened earnings

power is expected to result in value

accretion for ITC shareholders

–

Including impacts of recapitalization

16

Projected Year-End Rate Base

($ amounts in billions)

$ 6.2

$ 7.1

•

Strengthened and improved earnings power

due to increase and diversification of rate

base |

Development

35%

Generator

Interconnections

26%

Base Capital

Plan

39%

Development

< 25%

Generator

Interconnections

< 20%

Base Capital

Plan

> 55%

ITC Pre-Merge

ITC Post-Merge

Growth Profile

17

•

Diversification of ITC capital

investment profile and growth

portfolio

–

Diversifies overall growth portfolio

–

Long-term, sustainable growth

resulting from base capital

investments

–

Enhanced development portfolio

and opportunities

•

Combined platform better positions

company to achieve sustainable

growth

–

15 to 17% five-year EPS CAGR

remains intact

–

Incremental development

opportunities expected to provide

enhanced growth potential

•

2012 EPS guidance and long-term

EPS growth rate emphasize strong

focus on achieving growth

–

2012 EPS guidance of $3.90 to

$4.05 per diluted share

*

1

*Excludes transaction-related expenses |

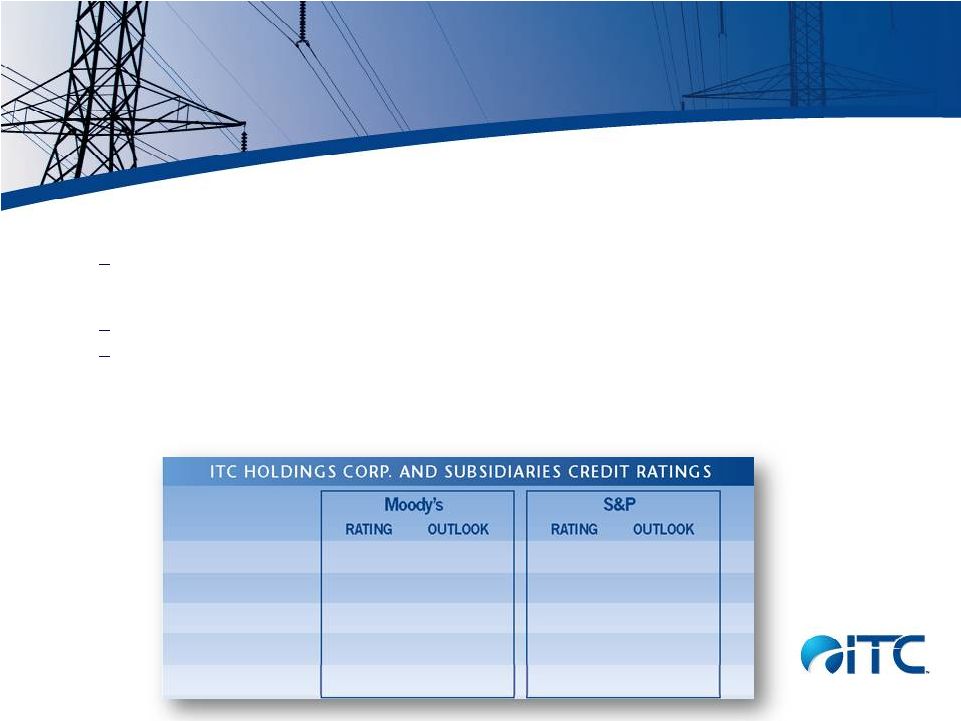

•

ITC expects to maintain its current solid investment grade credit ratings and

achieve similar investment grade credit ratings for the merged entities

Prior to close, ITC to put in place a conservative and prudent financing plan

•

Transaction expected to be credit metric neutral for ITC

Reaffirms strong investment grade credit metrics

Enhanced credit quality due to diversified growth platform and improved balance

sheet size / increased scale

•

Improved credit ratings will also strengthen credit quality for the Entergy

transmission business

ITC Holdings

Baa2

Stable

BBB-

Positive

ITCTransmission

A1

Stable

A-

Positive

METC

A1

Stable

A-

Positive

ITC Midwest

A1

Stable

A-

Positive

ITC Great Plains

Baa1

Stable

BBB

Positive

Credit Ratings & Quality

18 |

•

Capitalization of pro forma business expected to enhance the overall credit quality

for pro forma ITC due to its increased size, scale and financial

resources –

Structured to preserve ITC’s existing strong credit metrics to remain

consistent with current levels •

Consistent with previous plan, total near-term cash requirements to execute on

capital investments for pro forma business will be supported through internal

operating cash flows and new debt issuances

–

New equity issuances are not anticipated to fund capital investments in the

near-term –

Overall capitalization and funding plans positions company well to maintain

current investment grade ratings

•

ITC to maintain current dividend policy, near-term and longer-term, for pro

forma business –

Continue to balance shareholder return with long-term funding requirements for

growth and maintain appropriate payout ratio given capital investment

requirements Current annualized dividend of $1.41 per share, annual yield of

approximately 2% and payout ratio just over 40%

Historical annual dividend increases average approximately 5%

Capitalization & Dividend Policy

19 |

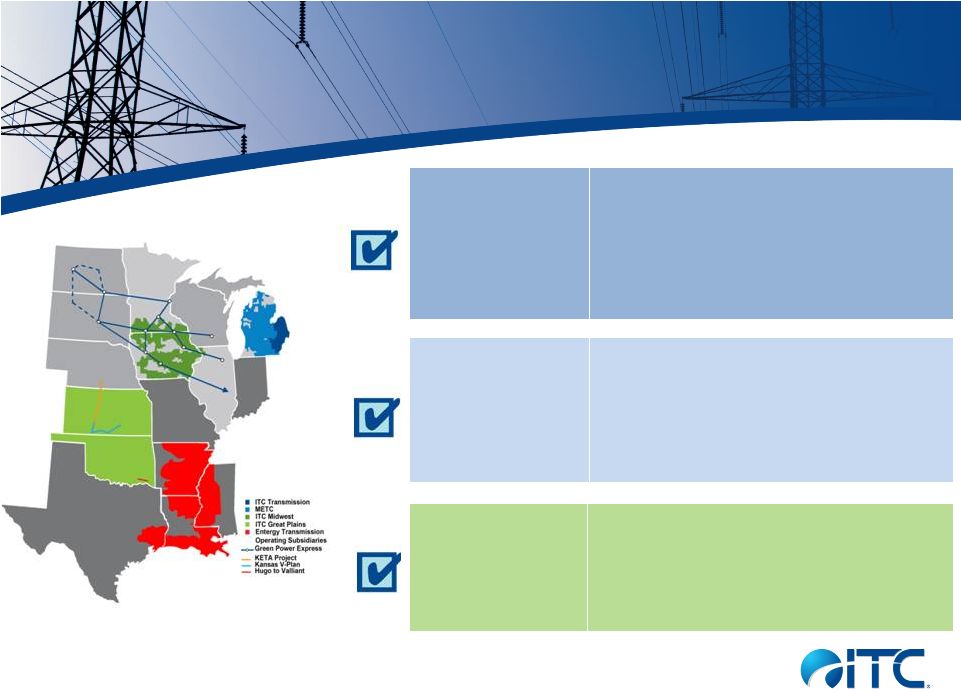

Value enhancing

to stand-alone

plan

•

Immediately and sustainably value

accretive to ITC shareholders

•

Increased flexibility in capital

deployment and enhanced growth

portfolio

Strategically

compelling

•

New system with identified need

for base capital investments

•

Large footprint supports

incremental development

opportunities

•

Transformational to size and scale

Maintains credit

quality

•

Credit quality enhancing through

diversified rate base and increased

scale

•

Credit metric neutral to stand alone

ITC

Stated M&A Philosophy

20 |

•

Transaction ultimately benefits all

constituencies, through independent model and

overall best practices

–

Improved reliability, reduced congestion and

greater access to competitive energy

marketplace

–

Strong credit and ability to attract capital for

needed transmission investments

–

Highest objectivity for transmission planning

and operations; aligns with public policy

objectives

–

Maintains jobs and provides opportunities for

job creation and local economic development

–

Commitment to communities and customers

that ITC serves through corporate citizenship,

and community involvement

–

Value accretive to ITC shareholders, taking

into account recapitalization, and improves

position to execute on current growth plans

Transaction Closing

BENEFITS ALL STAKEHOLDERS

21

Transaction

Benefits |