Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - CNO Financial Group, Inc. | form8-k11282011fbrpresenta.htm |

FBR Fall Investor Conference November 29, 2011 Exhibit 99.1

CNO Financial Group 2

CNO Financial Group 3 Non-GAAP Measures This presentation contains the following financial measures that differ from the comparable measures under Generally Accepted Accounting Principles (GAAP): operating earnings measures; earnings before net realized investment gains (losses) and corporate interest and taxes; and debt to capital ratios, excluding accumulated other comprehensive income (loss). Reconciliations between those non-GAAP measures and the comparable GAAP measures are included in the Appendix, or on the page such measure is presented. While management believes these measures are useful to enhance understanding and comparability of our financial results, these non-GAAP measures should not be considered substitutes for the most directly comparable GAAP measures. Additional information concerning non-GAAP measures is included in our periodic filings with the Securities and Exchange Commission that are available in the “Investors – SEC Filings” section of CNO’s website, www.CNOinc.com.

CNO Financial Group 4 The Company: CNO Financial Group Focused on serving the protection needs of the fast-growing but underserved middle income and senior markets Products include supplemental health, Medicare supplement, life, annuity and long-term care Products sold through efficient, growing distribution channels: – Bankers Life: strong career agent franchise – Washington National: wholly-owned distributor (PMA) and independent agents –Colonial Penn: direct distribution platform Centralized services operation to add value to all units Over 3.9 million policies in force

CNO Financial Group 5 Value Through Growth and Execution The Opportunity: Rapidly Growing, Underserved Market Our focus is meeting the needs of fast-growing senior market Attractive demographics: Baby Boomers reaching retirement age – The first of Boomer population becoming Medicare-eligible this year – In twenty years, percentage of population 65 years old and older is projected to increase by 50% – On average, over 10,000 Americans will turn 65 each day through 2030 – Financial downturn underscored importance of risk management and guaranteed products The senior middle income market is attractive; we know it well, pursue it full time, and we represent a pure play in this market

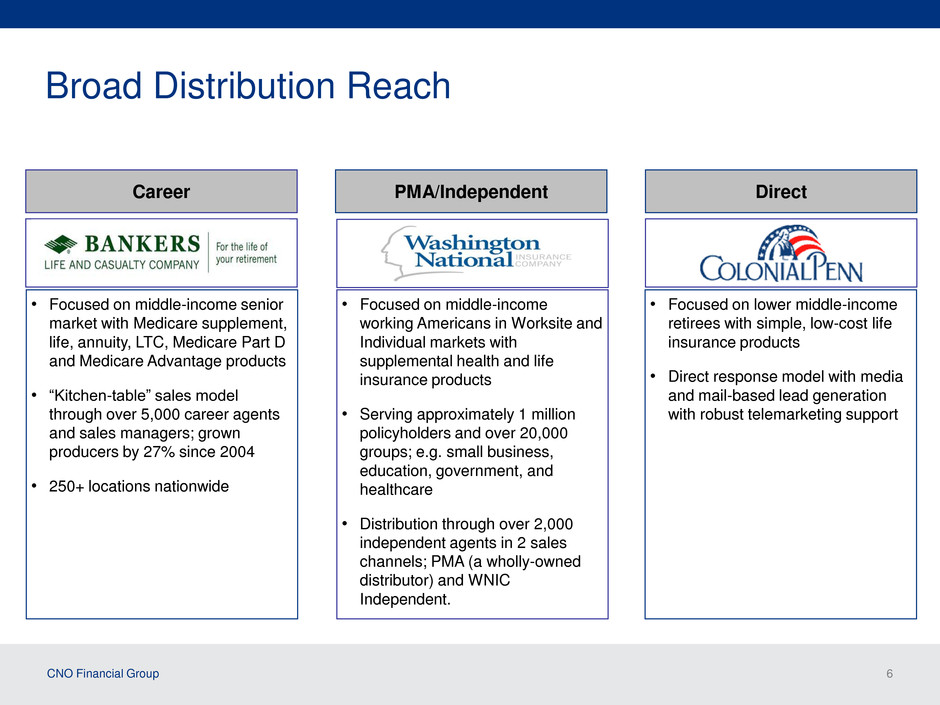

CNO Financial Group 6 Broad Distribution Reach • Focused on middle-income working Americans in Worksite and Individual markets with supplemental health and life insurance products • Serving approximately 1 million policyholders and over 20,000 groups; e.g. small business, education, government, and healthcare • Distribution through over 2,000 independent agents in 2 sales channels; PMA (a wholly-owned distributor) and WNIC Independent. • Focused on lower middle-income retirees with simple, low-cost life insurance products • Direct response model with media and mail-based lead generation with robust telemarketing support Career Direct PMA/Independent • Focused on middle-income senior market with Medicare supplement, life, annuity, LTC, Medicare Part D and Medicare Advantage products • “Kitchen-table” sales model through over 5,000 career agents and sales managers; grown producers by 27% since 2004 • 250+ locations nationwide

CNO Financial Group 7 • Fixed and Fixed-Index Life and Annuity Products • Long-Term Care • Medicare Supplement • Whole and Universal life products • Final expense • Supplemental Health CNO can access consumers across multiple channels • With an Agent (Retail) • Bankers • Washington National • PMA (CNO-owned) • Independents • Without an Agent (Direct) • Colonial Penn • At Work (Worksite Marketing) • PMA Worksite Division • Washington National - Independents • Rising medical costs • Decline of societal safety nets (government and employer) • Increased longevity • Greater awareness of need for retirement planning CNO: The right products and the right channels for today’s middle-market consumer CNO has expertise across important middle-market products Strong trends are driving middle-market consumers

CNO Financial Group 8 Bankers Long Term Care Insurance Sold through exclusive distribution – Aides in acceptance of rate increases – Decreases risk of anti-selection No group business which has limited to no underwriting Extended asset durations at the beginning of 2010 – Minimizes risk of reinvesting at sustained low interest rates Liability durations, while long, can be matched with investments due to target market (~65) Solid underwriting guidelines and underwriting tools (e.g. cognitive testing) – Benefited by target market (underwriting at ~65 vs. the “at work” population) Rigorous claims management New products have little exposure to some higher risk policy benefits (e.g. “0” day elimination, lifetime benefits, high compound inflation protection, etc…) Almost 50% of new sales are short term care policies with different risk profile than LTC New business priced for double digit returns Successful in obtaining approval for rate increases where actuarially justified and necessary Over the last several quarters, the interest-adjusted benefit ratio has been 66% - 75%

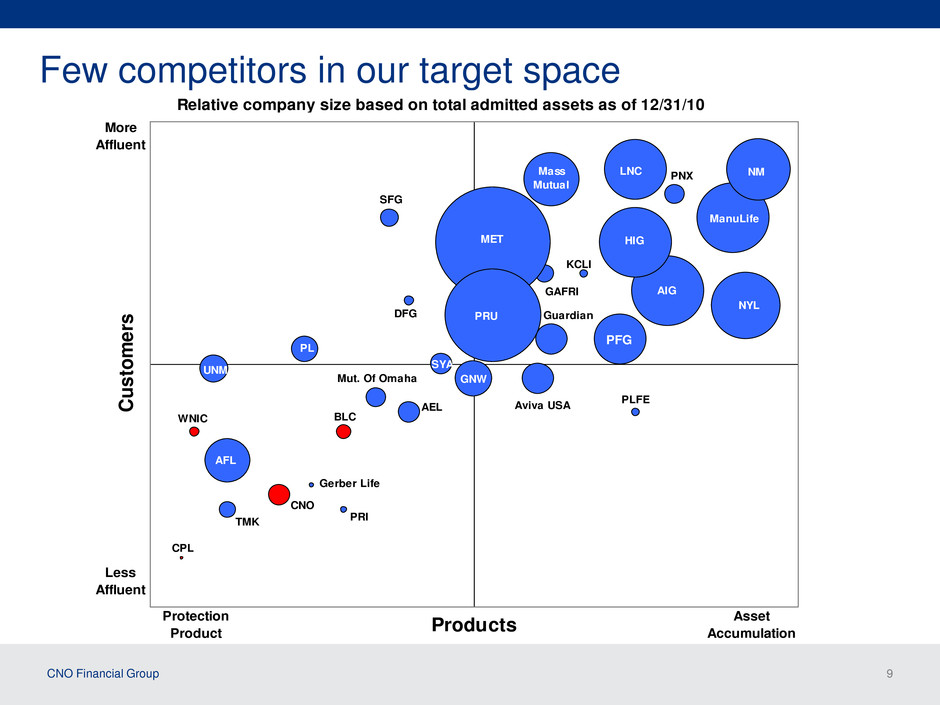

CNO Financial Group 9 Few competitors in our target space AEL AFL AIG Aviva USA DFG Gerber Life GAFRI GNW Guardian HIG ManuLife KCLI LNCMass Mutual MET Mut. Of Omaha NM NYL PFG PL PNX PLFE PRU WNIC SFG TMK UNM BLC CPL CNO PRI SYA Products C us to m er s More Affluent Less Affluent Protection Product Asset Accumulation Relative company size based on total admitted assets as of 12/31/10

CNO Financial Group 10 CNO’s Stock Value Proposition Growth – Above average growth potential – Expected sales growth of 8-12% annually – On average, over 10,000 Americans will turn 65 each day through 2030 Capital – Strong capital position • 359% RBC and $169mm at holding company at 9/30/11 – Excess capital generation of $75-$200mm annually Competitive Advantage – Exclusive, growing distribution – Target market focus, with growth as Baby Boomers turn 65 – Sustainable with barriers to entry

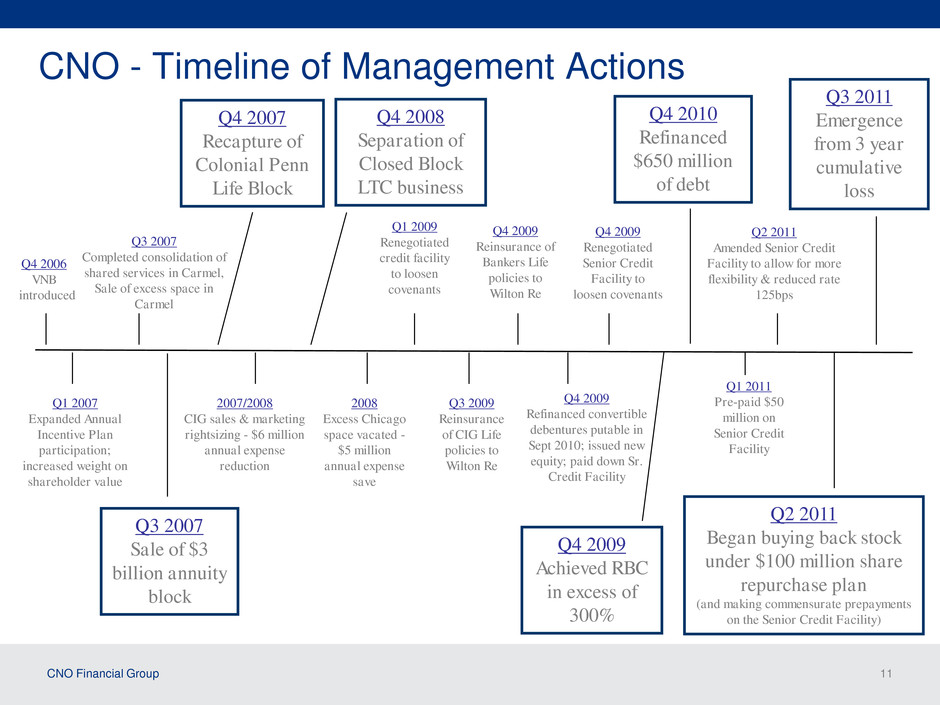

CNO Financial Group 11 CNO - Timeline of Management Actions Q4 2008 Separation of Closed Block LTC business Q4 2006 VNB introduced 2007/2008 CIG sales & marketing rightsizing - $6 million annual expense reduction 2008 Excess Chicago space vacated - $5 million annual expense save Q4 2007 Recapture of Colonial Penn Life Block Q3 2007 Sale of $3 billion annuity block Q3 2007 Completed consolidation of shared services in Carmel, Sale of excess space in Carmel Q1 2009 Renegotiated credit facility to loosen covenants Q1 2007 Expanded Annual Incentive Plan participation; increased weight on shareholder value Q3 2009 Reinsurance of CIG Life policies to Wilton Re Q4 2010 Refinanced $650 million of debt Q4 2009 Reinsurance of Bankers Life policies to Wilton Re Q4 2009 Refinanced convertible debentures putable in Sept 2010; issued new equity; paid down Sr. Credit Facility Q4 2009 Renegotiated Senior Credit Facility to loosen covenants Q4 2009 Achieved RBC in excess of 300% Q1 2011 Pre-paid $50 million on Senior Credit Facility Q2 2011 Amended Senior Credit Facility to allow for more flexibility & reduced rate 125bps Q2 2011 Began buying back stock under $100 million share repurchase plan (and making commensurate prepayments on the Senior Credit Facility) Q3 2011 Emergence from 3 year cumulative loss

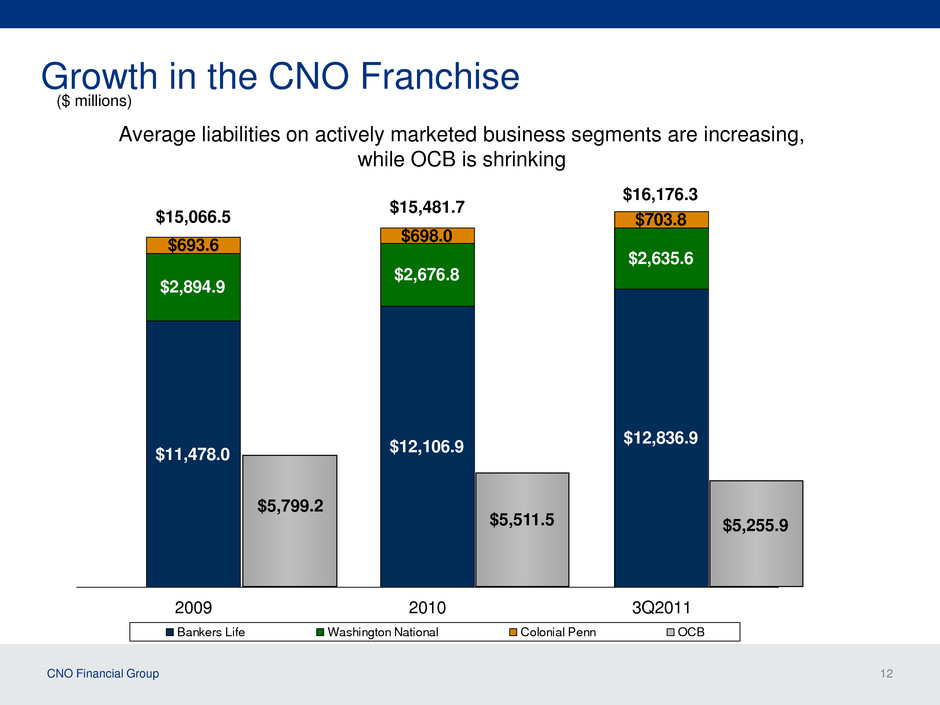

CNO Financial Group 12 $11,478.0 $12,106.9 $12,836.9 $2,894.9 $2,676.8 $2,635.6 $698.0 $703.8 $693.6 2009 2010 3Q2011 Bankers Life Washington National Colonial Penn OCB Growth in the CNO Franchise ($ millions) $16,176.3 Average liabilities on actively marketed business segments are increasing, while OCB is shrinking $5,799.2 $5,511.5 $5,255.9 $15,066.5 $15,481.7

CNO Financial Group 13 Results Demonstrate CNO’s potential (1) Risk-Based Capital (“RBC”) requirements provide a tool for insurance regulators to determine the levels of statutory capital and surplus an insurer must maintain in relation to its insurance and investment risks. The RBC ratio is the ratio of the statutory consolidated adjusted capital of our insurance subsidiaries to RBC. (2) As defined in our Senior Secured Credit Agreement. See appendix for reconciliation to GAAP measure. (3) Refer to appendix for more information regarding this non-GAAP measure 3Q2011 marks the eleventh consecutive quarter of GAAP net income Statutory Operating Earnings (net of tax): – $245.6 million for the first nine months of 2011 – Up 45% over first nine months of 2010 Financial strength as of 9/30/2011: – Consolidated RBC(1) at 359% – Liquidity at the holding company of $168.9 million – Debt to total capitalization(2) at 18.0% Continued focus on profitable growth – 2010 EBIT(3) up 7% over 2009 – First nine months 2011 EBIT up 16% over first nine months 2010 Results recognized with credit rating upgrades from four rating agencies

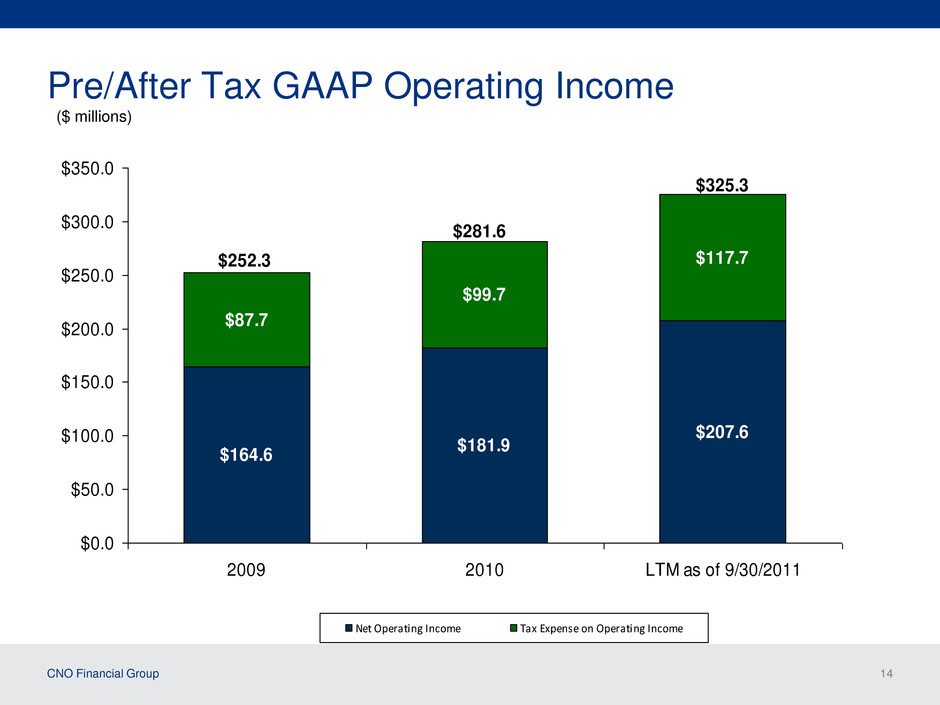

CNO Financial Group 14 Pre/After Tax GAAP Operating Income ($ millions) $164.6 $181.9 $207.6 $87.7 $99.7 $117.7 $0.0 $50.0 $100.0 $150.0 $200.0 $250.0 $300.0 $350.0 2009 2010 LTM as of 9/30/2011 Net Operating Income Tax Expense on Operating Income $252.3 $325.3 $281.6

CNO Financial Group 15 Statutory Earnings Power ($ millions) $269.5 $279.2 $348.5 $137.1 $132.4 $147.4 -$50.0 $50.0 $150.0 $250.0 $350.0 $450.0 $550.0 2009 2010 LTM as of 9/30/2011 Pre-Tax Operating Income Fees and Interest to Holding Company $406.6 $411.6 $495.9

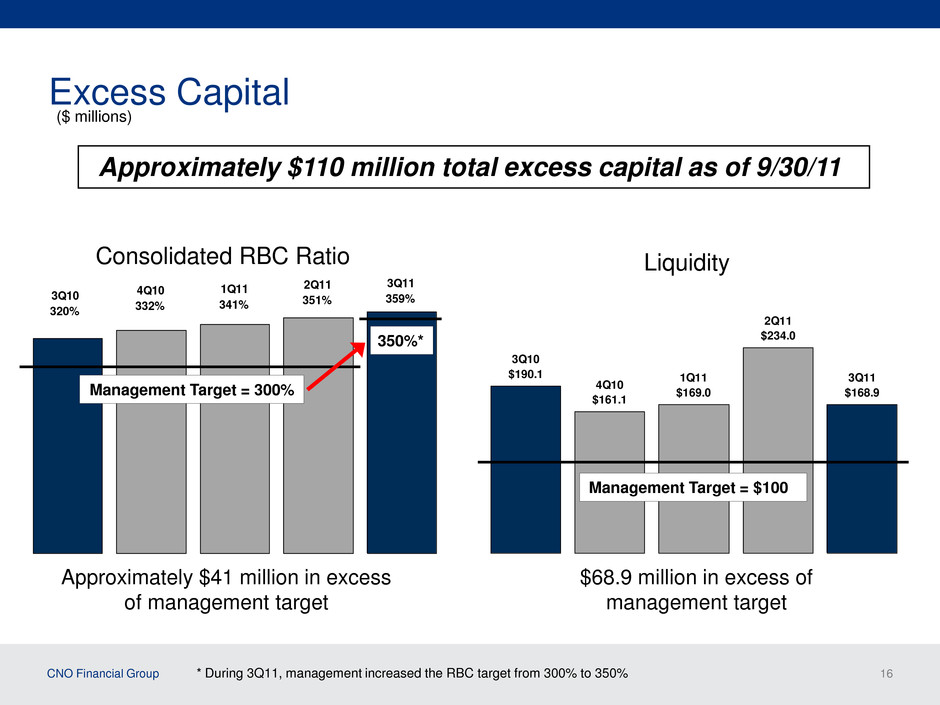

CNO Financial Group 16 3Q11 359% 2Q11 351% 1Q11 341% 4Q10 332% 3Q10 320% 3Q10 $190.1 4Q10 $161.1 1Q11 $169.0 2Q11 $234.0 3Q11 $168.9 Excess Capital Consolidated RBC Ratio Liquidity ($ millions) Approximately $41 million in excess of management target $68.9 million in excess of management target 350%* Management Target = $100 Approximately $110 million total excess capital as of 9/30/11 Management Target = 300% * During 3Q11, management increased the RBC target from 300% to 350%

CNO Financial Group 17 Excess Capital Utilization Opportunities Debt Prepayment Share Buybacks Investing in Business for Additional Growth – Growth and expansion of distribution channels – Recapture reinsurance blocks Holding Company Investment Portfolio – Utilize non-life operating loss carryforward

CNO Financial Group 18 Share Repurchase & Debt Payments $100mm share repurchase authorization effective in May 2011 Through September 30, 2011, purchased 8.8 million shares for $55.7 million – Average cost per share of $6.35 – 3.5% of outstanding shares at December 31, 2010 – Mandatory principal prepayments of $55.7 million made on Senior Secured Credit Facility Voluntary prepayment of $50 million on Senior Secured Credit Facility Early payment of $25 million on Senior Health Note The debt to total capital ratio as defined in our Senior Secured Credit Agreement improved by 1.8% as a result of these transactions Principal payments of $45 million due in 2012 include: - $10mm due on 9/30/12 and 12/31/12 on the Senior Secured Credit Agreement - $25mm due on 11/12/12 on Senior Health Note

CNO Financial Group 19 Holding Company Investments at 9/30/11 ($ millions) Alternatives & Equities (Balance) Fixed Income (net) $75 Cash & Money Market $25 Cash and Money Market $54.9 Fixed Income (net) 66.0 Equities 16.1 Alternatives 31.9 TOTAL $168.9 Long Term Target Allocation Current Investments

CNO Financial Group 20 Valuation Allowance $558.0 Valuation Allowance $353.1 Net $614.8 Net $311.5 $0.0 $200.0 $400.0 $600.0 $800.0 $1,000.0 Life Non- Life Capital Valuation Allow ance for Loss Carryforw ards Net Loss Carryforw ards in Deferred Tax Asset Gross $614.8 Gross $353.1 Gross $869.5 GAAP Balances for Deferred Tax Asset as of 9/30/11: Loss Carryforwards – Gross1 vs. Net2 ($ millions) 1. Gross loss carryforward equals the total life, non-life, and capital loss carryforwards multiplied by a 35% tax rate plus state operating loss carryforwards 2. Net loss carryforward equals the gross loss carryforward net of the allowance 3. Totals also include amounts related to state carryforwards and other items not reflected in the bar chart Totals Gross Loss Carryforwards3 Net Loss Carryforwards Valuation Allowance3 Valuation Allowance Analysis: Released $143.0 of the valuation allowance due largely to emergence from 3 year cumulative loss. $1,855.1 (938.4) $916.7 $143 decrease in Allowance in 3Q

CNO Financial Group 21 GAAP Valuation Allowance Reduction ($ millions) $143 million valuation allowance reduction in 3Q11; $95 million reduction in 4Q10 No longer in a 3-year cumulative loss position as of 9/30/2011 Achieved normalized taxable income in each of the last 12 quarters Ability to model future increases in taxable income supports the 3Q11 release of the valuation allowance (5% annual growth in the next five years) Future benefits of NOLs recognized on the balance sheet continue to be determined by accounting rules that require us to maintain a valuation allowance based on verifiable evidence

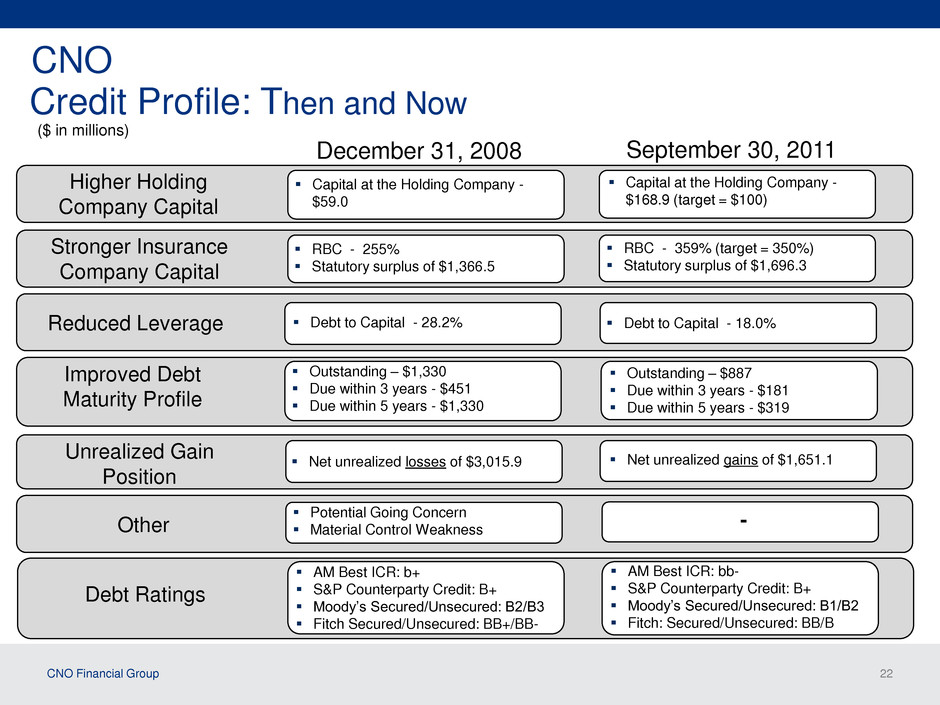

CNO Financial Group 22 CNO December 31, 2008 September 30, 2011 Higher Holding Company Capital Stronger Insurance Company Capital Improved Debt Maturity Profile Capital at the Holding Company - $59.0 RBC - 255% Statutory surplus of $1,366.5 Capital at the Holding Company - $168.9 (target = $100) RBC - 359% (target = 350%) Statutory surplus of $1,696.3 Outstanding – $1,330 Due within 3 years - $451 Due within 5 years - $1,330 Outstanding – $887 Due within 3 years - $181 Due within 5 years - $319 Other Potential Going Concern Material Control Weakness Debt to Capital - 18.0% Reduced Leverage Debt to Capital - 28.2% Unrealized Gain Position Net unrealized losses of $3,015.9 ($ in millions) Net unrealized gains of $1,651.1 - Debt Ratings AM Best ICR: b+ S&P Counterparty Credit: B+ Moody’s Secured/Unsecured: B2/B3 Fitch Secured/Unsecured: BB+/BB- AM Best ICR: bb- S&P Counterparty Credit: B+ Moody’s Secured/Unsecured: B1/B2 Fitch: Secured/Unsecured: BB/B Credit Profile: Then and Now

CNO Financial Group 23 CNO’s Stock Value Proposition Growth – Above average growth potential – Expected sales growth of 8-12% annually – On average, over 10,000 Americans will turn 65 each day through 2030 Capital – Strong capital position • 359% RBC and $169mm at holding company at 9/30/11 – Excess capital generation of $75-$200mm annually Competitive Advantage – Exclusive, growing distribution – Target market focus, with growth as Baby Boomers turn 65 – Sustainable with barriers to entry

Questions and Answers

Appendix Certain Non-GAAP Financial Measures

CNO Financial Group 26 The following provides additional information regarding certain non-GAAP measures used in this presentation. A non-GAAP measure is a numerical measure of a company’s performance, financial position, or cash flows that excludes or includes amounts that are normally excluded or included in the most directly comparable measure calculated and presented in accordance with GAAP. While management believes these measures are useful to enhance understanding and comparability of our financial results, these non-GAAP measures should not be considered as substitutes for the most directly comparable GAAP measures. Additional information concerning non-GAAP measures is included in our periodic filings with the Securities and Exchange Commission that are available in the “Investor – SEC Filings” section of our website, www.CNOinc.com. Operating earnings measures Management believes that an analysis of net income applicable to common stock before loss on extinguishment or modification of debt, net realized gains or losses, fair value changes due to fluctuations in the interest rates used to discount embedded derivative liabilities related to our fixed index annuities and increases or decreases to our valuation allowance for deferred tax assets (“net operating income,” a non-GAAP financial measure) is important to evaluate the performance of the Company and is a key measure commonly used in the life insurance industry. Management uses this measure to evaluate performance because these items are unrelated to the Company’s continuing operations. Information Related to Certain Non-GAAP Financial Measures

CNO Financial Group 27 Information Related to Certain Non-GAAP Financial Measures A reconciliation of earnings before net realized investment gains (losses), fair value changes in embedded derivatives, corporate interest, loss on extinguishment or modification of debt and taxes (“EBIT”) to net income is as follows (dollars in millions): Nine Months Ended Sept 30, 2011 Nine Months Ended Sept 30, 2010 Year Ended December 31, 2010 Year Ended December 31, 2009 Bankers Life 240.0$ 212.7$ 284.1$ 278.0$ Washington National 70.0 75.9 104.6 110.9 Colonial Penn 21.1 20.7 26.5 29.4 Other CNO Business 13.9 (17.5) (11.5) (43.6) EBIT from business segments 345.0 291.8 403.7 374.7 Corporate operations, excluding interest expense (39.3) (29.1) (42.8) (37.7) Total EBIT 305.7 262.7 360.9 337.0 Corporate interest expense (58.6) (59.3) (79.3) (84.7) 247.1 203.4 281.6 252.3 Tax expense on period income 91.2 73.2 99.7 87.7 Net perating income 155.9 130.2 181.9 164.6 Net realized investment gains (losses) 21.9 (12.0) 12.1 (41.5) Fair value changes in embedded derivative liabilities (9.4) - - - Loss on extinguishment or modification of debt, net of income taxes (2.0) (1.8) (4.4) (14.4) Net income before valuation allowance for deferred tax assets 166.4 116.4 189.6 108.7 (Increase) decrease in valuation allowance for deferred tax assets 143.0 - 95.0 (23.0) Net income 309.4$ 116.4$ 284.6$ 85.7$ Income before net realized investment gains (losses), fair value changes in embedded derivative liabilities and taxes

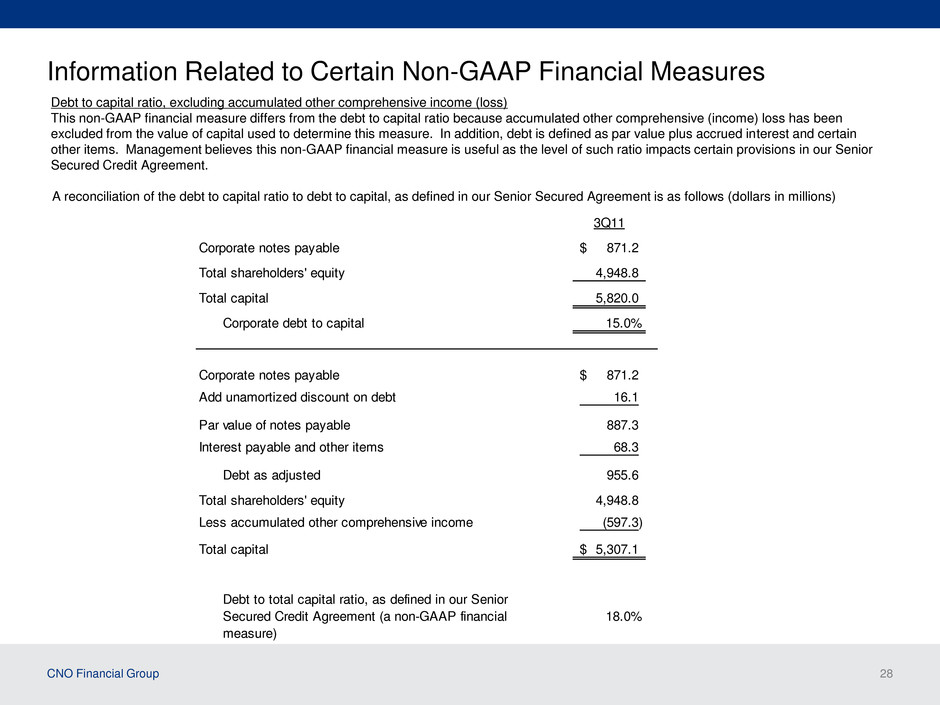

CNO Financial Group 28 Information Related to Certain Non-GAAP Financial Measures A reconciliation of the debt to capital ratio to debt to capital, as defined in our Senior Secured Agreement is as follows (dollars in millions) 3Q11 Corporate notes payable 871.2$ Total shareholders' equity 4,948.8 Total capital 5,820.0 Corporate debt to capital 15.0% Corporate notes payable 871.2$ Add unamortized discount on debt 16.1 Par value of notes payable 887.3 Interest payable and other items 68.3 Debt as adjusted 955.6 Total shareholders' equity 4,948.8 Less accumulated other comprehensive income (597.3) Total capital 5,307.1$ Debt to total capital ratio, as defined in our Senior Secured Credit Agreement (a non-GAAP financial 18.0% measure) Debt to capital ratio, excluding accumulated other comprehensive income (loss) This non-GAAP financial measure differs from the debt to capital ratio because accumulated other comprehensive (income) loss has been excluded from the value of capital used to determine this measure. In addition, debt is defined as par value plus accrued interest and certain other items. Management believes this non-GAAP financial measure is useful as the level of such ratio impacts certain provisions in our Senior Secured Credit Agreement.