Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - PROVIDENT FINANCIAL SERVICES INC | d253629d8k.htm |

Sandler O’Neill & Partners

East Coast Financial Services Conference

November 10, 2011

Exhibit 99.1 |

Certain statements contained herein are "forward-looking statements"

within the meaning of Section 27A of the Securities Act of 1933 and Section

21E of the Securities Exchange Act of 1934. Such forward-looking

statements may be identified by reference to a future period or periods, or by the use

of forward-looking terminology, such as "may," "will,"

"believe," "expect," "estimate,"

"anticipate," "continue," or similar terms or variations on

those terms, or the negative of those terms. Forward- looking statements

are subject to numerous risks and uncertainties, including, but not limited to, those

related to the economic environment, particularly in the market areas in which

Provident Financial Services, Inc. (the “Company”) operates,

competitive products and pricing, fiscal and monetary policies of the U.S.

Government, changes in government regulations affecting financial institutions,

including regulatory fees and capital requirements, changes in prevailing interest

rates, acquisitions and the integration of acquired businesses, credit risk

management, asset-liability management, the financial and securities

markets and the availability of and costs associated with sources of liquidity.

The Company cautions readers not to place undue reliance on any such

forward-looking statements which speak only as of the date made. The

Company also advises readers that the factors listed above

could

affect

the

Company's

financial

performance

and

could

cause

the

Company's

actual

results for future periods to differ materially from any opinions or statements

expressed with respect to future periods in any current statements. The

Company does not undertake and specifically declines any obligation to

publicly release the result of any revisions which may be made to any

forward-looking statements to reflect events or circumstances after the date of

such statements or to reflect the occurrence of anticipated or unanticipated

events. Forward Looking Statements |

Christopher Martin

Christopher Martin

Chairman, President &

Chief Executive Officer |

NYSE

Symbol

-

PFS

$7.0 billion in assets

Headquartered in Jersey City, NJ

Holding company for The Provident Bank, the oldest NJ bank

(chartered in 1839)

Converted to stock form in 2003

82 branch locations throughout northern and central NJ

Two Loan Production Offices in NJ

Consolidated administrative operations to Metro Park (Iselin) in

March 2011 –

Sale of two buildings to close Q4

Did not participate in TARP, No TRUPS

CORPORATE PROFILE |

Market Capitalization: $806 million

60.0 million Shares Outstanding

11.04% Insider Ownership (includes 7.67% held by ESOP)

including 22,060 shares purchased by CEO/CFO & Directors

in 2011

64.71% Institutional Ownership

3.60% Dividend Yield

137% Price/TBV

84.9% Price/BV

13.5x P/E

13.0x Price/2012 Est. Earnings

Market Data –

10/28/11 |

Senior management team has, on average, over 25 years of

relationship banking experience with large commercial banks

& thrifts in our primary markets

Extremely knowledgeable and results-oriented

Conservative business practices

Culture of accountability, efficiency and integrity

Majority of officers have been with publicly-traded

organizations

Ongoing leadership development throughout organization to

ensure management succession and performance

Executive Leadership Team |

New

Strategic

Plan

in

place

September

2011

Challenge: Increase revenue in difficult environment

Focus on Relationships by defined target customer segments

Community Bank with commercial emphasis

Ongoing SBA Initiative

Reduce marginally accretive asset classes

Expand non-interest income with concentration on Wealth

Management

Aggressively manage credit quality

Continue Branch rationalization/relocations

Continue to evaluate acquisition opportunities

Seeking Out Strategic Organic Growth & Opportunities

|

Current Retail Franchise

82 Branches in 11 New Jersey Counties |

Market

Demographics (as of 6/30/11) Source: FDIC-Summary of Deposit &

SNL Provident Financial Services, Inc. (NYSE: PFS)

New Jersey (NJ)

Middlesex

5

25

1,595,709

7.16

794,605

78,561

Hudson

4

14

933,095

3.48

607,650

52,525

Morris

9

10

777,042

3.83

496,157

104,165

Essex

12

7

479,377

2.21

783,531

55,914

Monmouth

10

11

462,256

2.60

649,429

82,974

Bergen

28

3

197,111

0.51

910,386

84,344

Somerset

9

4

193,594

2.26

333,075

101,044

Ocean

13

4

159,815

1.22

578,728

60,936

Union

20

2

131,607

0.76

531,112

73,602

Mercer

20

1

59,980

0.53

371,697

75,009

Passaic

21

1

25,979

0.26

500,140

62,332

NJ Totals

82

5,015,565

6,556,510

Weighted Average: New Jersey Franchise

76,203

Aggregate: Entire State of New Jersey

8,822,373

72,519

Aggregate: National

311,212,863

54,442

County

Market

Rank

Number

of

Branches

Company

Deposits

in Market

($000)

Deposit

Market

Share

(%)

Total

Population

2010

(Actual)

Median

HH

Income

2010

($) |

Asset

Composition – At 9/30/11

Total cash & cash

equivalents

1.8%

Total investments

24.2%

Net loans

64.2%

Foreclosed assets

0.1%

Premises &

equipment

1.1%

Accrued interest

receivable

0.3%

Intangible assets

5.2%

Bank

-owned life

insurance

2.0%

Other assets

1.1% |

Loan

Portfolio – At 9/30/11

($ in thousands)

Owner Occupied loans totaled $453,738M at 9/30/11 and are included under the Commercial loan portfolio

total of $814,112M. Net total of $3,819M representing premiums,

discounts & deferred fees, has not been included in the outstanding loan

totals. |

CRE

Portfolio by Industry – At 9/30/11

Total CRE Loans = $1,733 MM |

C

& I Loan Portfolio – At 9/30/11

C&I Loans= $814 MM

Primary Property Type

($ in thousands) |

Construction Loan Portfolio –

At 9/30/11

Total Construction Loans = $117 MM

Construction loan balance does not reflect unfunded commitments of $60MM. No

loans are located outside of NJ/NY/PA.

Primary Property Type

($ in thousands) |

Loan

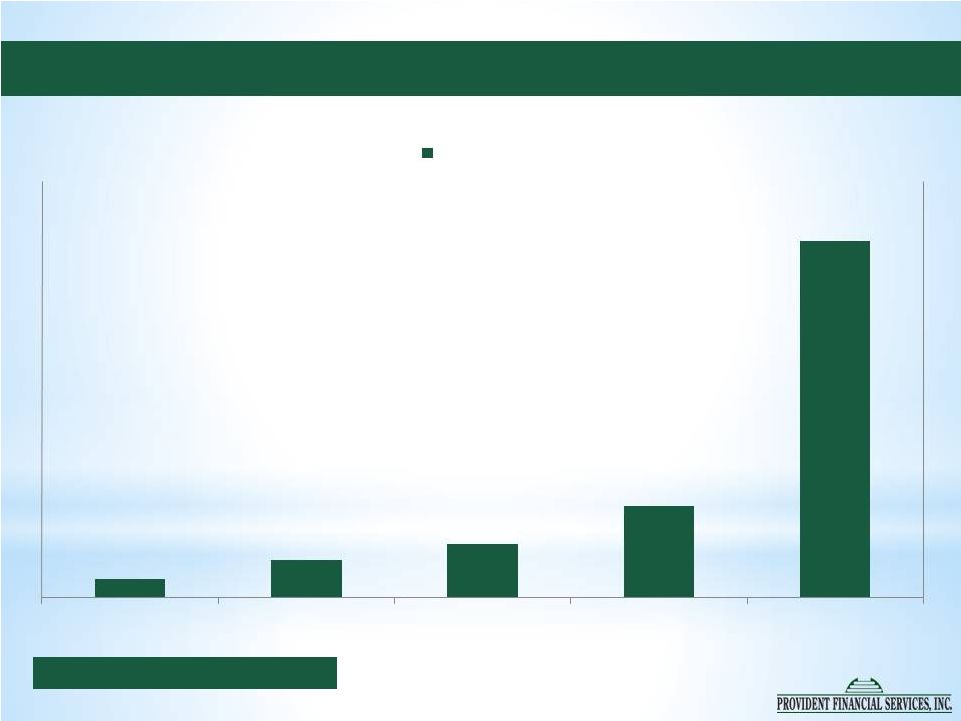

Originations Note: Does not include loan purchases or renewals.

|

Loan

Quality by Portfolio As of 9/30/11

Net

total

of

$3.8

MM

representing

premiums,

discounts

&

deferred

fees,

has

not

been

included

in

the

outstanding

loan totals.

($ in thousands)

TOTAL

LOAN PORTFOLIO BALANCE

1,848,645

$

814,112

$

553,670

$

1,347,973

$

4,564,400

$

NON-PERFORMING LOANS

47,115

$

29,732

$

8,438

$

40,048

$

125,333

$

% OF PORTFOLIO

2.55%

3.65%

1.52%

2.97%

2.75%

% OF TOTAL LOANS

1.03%

0.65%

0.18%

0.88%

2.75%

NET CHARGE-OFFS (YTD)

1,678

$

6,429

$

5,935

$

3,925

$

17,967

$

0.13%

1.09%

1.41%

0.38%

0.53%

CRE/CONST

C & I

CONSUMER

1-4 FAMILY

ANNUALIZED

NET

CHARGE-

OFFS

AS % OF AVG. O/S |

NPAs

& 90+ day Delinquencies / Loans & REO Peer Group : BNCL, CBU,

FNB, FCF, FFIC, INDB, ISBC, NPBC, NBTB, NWBI, STBA, SASR, SUSQ, UBSI, VLY,

WSBC, WSFS

Source: SNL

2.83%

2.78%

2.99%

2.94%

3.35%

2010Q3

2010Q4

2011Q1

2011Q2

2011Q3

Other Assets Owned

Consumer

Commercial Loans

Construction Loans

Commercial Real Estate

1-4 Family 1st Mortgages

Peer Mean |

Investment Securities –

At 9/30/11

Note:

78% are Available for Sale.

Weighted

Avg. Life

AFS

2.6 yrs.

HTM

3.8 yrs.

Total

2.9 yrs. |

Deposit Composition –

At 9/30/11

Total Deposits= $5,074 MM

77% Core

Total Cost of Deposits: 0.81%

Savings

18%

MMA

21%

NOW

15%

NIB

13%

CDs

23%

Muni

10% |

($

in thousands) $218,023

$614,181

$130,628

$98,157

$117,835

0.84%

1.01%

2.76%

3.05%

2.39%

Time Deposit Maturities

Time Deposit Maturities –

At 9/30/11

Note: % = Weighted Avg. Cost |

Borrowings –

At 9/30/11

Note: % = Weighted Avg. Cost

($ in thousands)

$27,400

$54,100

$77,587

$132,793

$514,338

2011

2012

2013

2014

Thereafter

Borrowings

4.05%

3.76%

2.72%

2.37%

2.51% |

Thomas M. Lyons

Thomas M. Lyons

Executive Vice President &

Chief Financial Officer |

Financial

Highlights ($ in thousands)

BALANCE SHEET:

9/30/11

12/31/10

Total assets

$6,997,359

$6,824,528

Total loans

4,568,220

4,409,813

Total deposits

5,074,293

4,877,734

Total investments

1,695,372

1,763,232

Total borrowed funds

912,567

969,683

Total stockholders' equity

949,397

921,687 |

Financial Highlights

($ in thousands except

Earnings per Share)

INCOME STATEMENT:

9/30/11

9/30/10

Net Income

$42,474

$37,590

Diluted Earnings per Share

$0.75

$0.66

ROATE

9.76%

9.16%

ROAA

0.83%

0.74%

Net Interest Margin

3.51%

3.45%

Efficiency Ratio

57.13%

57.18%

Nine Months Ended |

Return on Average Assets (%)

Peer Group : BNCL, CBU, FNB, FCF, FFIC, INDB, ISBC,

NPBC, NBTB, NWBI, STBA, SASR, SUSQ, UBSI, VLY,

WSBC, WSFS

Source: SNL

0.80

0.71

0.76

0.82

0.90

0.71

0.76

0.73

0.84

0.91 |

Pre-Provision Net Interest Income |

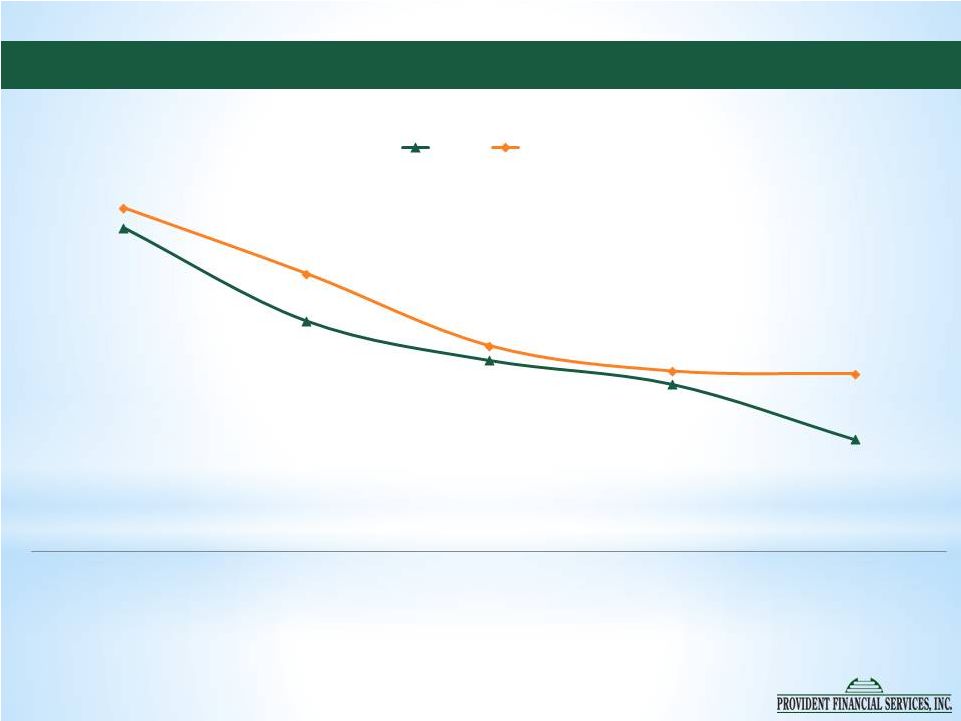

Net

Interest Margin (%) Peer Group : BNCL, CBU, FNB, FCF, FFIC, INDB, ISBC,

NPBC, NBTB, NWBI, STBA, SASR, SUSQ, UBSI, VLY,

WSBC, WSFS

Source: SNL |

Cost

of Deposits (%) Peer Group : BNCL, CBU, FNB, FCF, FFIC, INDB, ISBC,

NPBC, NBTB, NWBI, STBA, SASR, SUSQ, UBSI, VLY,

WSBC, WSFS

Source: SNL

2010Q3

2010Q4

2011Q1

2011Q2

2011Q3

PFS

Peer

0.95

0.85

0.81

0.78

0.72

0.97

0.90

0.82

0.79

0.79 |

Cost

of Funds (%) Peer Group : BNCL, CBU, FNB, FCF, FFIC, INDB, ISBC,

NPBC, NBTB, NWBI, STBA, SASR, SUSQ, UBSI, VLY,

WSBC, WSFS

Source: SNL

2010Q3

2010Q4

2011Q1

2011Q2

2011Q3

1.30

1.17

1.10

1.07

1.00

1.36

1.25

1.17

1.13

1.08

PFS

Peer |

Interest Rate Sensitivity

Net Interest Income

Change in Interest

Rates in Basis

Points (Rate

Ramp)

Dollar Amount

(in thousands)

Dollar Change

Percent Change %

-100

206,213

(5,845)

(2.8)

Static

212,058

—

—

+100

212,468

410

0.2

+200

208,989

(3,069)

(1.4)

+300

206,284

(5,774)

(2.7) |

Asset

Quality (%) Peer Group : BNCL, CBU, FNB, FCF, FFIC, INDB, ISBC,

NPBC, NBTB, NWBI, STBA, SASR, SUSQ, UBSI, VLY,

WSBC, WSFS

Source: SNL

1.58

1.56

1.63

1.62

1.61

1.76

1.71

1.73

1.71

1.65

2010Q3

2010Q4

2011Q1

2011Q2

2011Q3

Loan Loss Reserve / Loans |

Asset

Quality (%) Peer Group : BNCL, CBU, FNB, FCF, FFIC, INDB, ISBC,

NPBC, NBTB, NWBI, STBA, SASR, SUSQ, UBSI, VLY,

WSBC, WSFS

Source: SNL

2.45

2.38

2.83

3.06

2.74

2.37

2.34

2.55

2.54

2.38

2010Q3

2010Q4

2011Q1

2011Q2

2011Q3

Non Performing Loans/Loans

PFS

Peer |

Asset

Quality (%) Peer Group : BNCL, CBU, FNB, FCF, FFIC, INDB, ISBC,

NPBC, NBTB, NWBI, STBA, SASR, SUSQ, UBSI, VLY,

WSBC, WSFS

Source: SNL

Cumulative for the

period

PFS

0.51

Peer

0.84

Net Charge-offs/Avg. Loans |

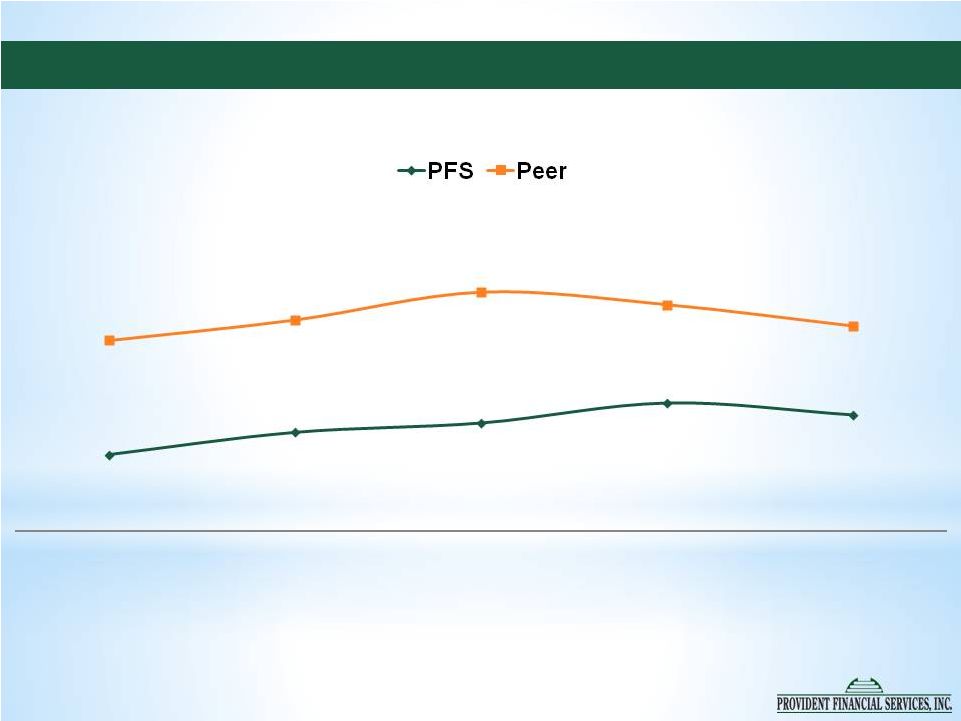

Net

Operating Exp / Avg Assets (%) Peer Group : BNCL, CBU, FNB, FCF, FFIC,

INDB, ISBC, NPBC, NBTB, NWBI, STBA, SASR, SUSQ, UBSI, VLY,

WSBC, WSFS

Source: SNL

1.51

1.52

1.57

1.57

1.56

1.56

1.56

1.61

1.61

1.59

2010Q3

2010Q4

2011Q1

2011Q2

2011Q3 |

Efficiency Ratio (%)

Peer Group : BNCL, CBU, FNB, FCF, FFIC, INDB, ISBC,

NPBC, NBTB, NWBI, STBA, SASR, SUSQ, UBSI, VLY,

WSBC, WSFS

Source: SNL

54.77

55.44

55.73

56.33

55.97

58.23

58.85

59.69

59.31

58.67

2010Q3

2010Q4

2011Q1

2011Q2

2011Q3 |

Diluted EPS / Annualized ROATE

$0.24

$0.21

$0.23

$0.25

$0.27

9.48%

8.41%

9.13%

9.63%

10.48%

0.00%

2.00%

4.00%

6.00%

8.00%

10.00%

12.00%

$0.00

$0.05

$0.10

$0.15

$0.20

$0.25

$0.30

2010Q3

2010Q4

2011Q1

2011Q2

2011Q3

Diluted EPS

Annl. ROATE |

Capital –

At 9/30/11

Amount

Ratio

Amount

Ratio

Regulatory Tier 1 leverage capital

261,461

$

4.00%

571,567

$

8.74%

Tier 1 risk-based capital

177,900

$

4.00%

571,567

$

12.85%

Total risk-based capital

355,800

$

8.00%

627,384

$

14.11%

REQUIRED

ACTUAL

(Dollars in thousands)

The Company continues to exceed all current

regulatory requirements and is “well capitalized.”

|

Capital Flexibility

Tangible Common Equity/ Tangible Assets = 8.86%

Never a reduction in the quarterly dividend rate

Increased dividend 9% in 2011, to $0.12 per quarter

Targeted payout ratio 45-55%

1.9 million shares eligible for repurchase under current authorization

Ability to grow through acquisition |

Looking Forward

Expand relationships while money center banks remain dislocated

Cultivate and reward existing relationships to defend from competition

Assess acquisition opportunities in our contiguous markets where accretive

Implement process improvements to achieve efficiency target and achieve Line of

Business profitability targets

Challenge our strategic assumptions, stress test our business lines and

accurately assess risks

Continue to enhance branch franchise

Adapt to new regulations from Dodd-Frank and SEC

Improve net interest income while managing risk

Provide tax-efficient return to stockholders

Clear Strategy and Effective Execution with an Economic

Backdrop of Uncertainty |