Attached files

| file | filename |

|---|---|

| 8-K - HANCOCK HOLDING CO 8-K 11-9-2011 - HANCOCK WHITNEY CORP | form8k.htm |

EXHIBIT 99.1

Sandler O’Neill

Sandler O’Neill

East Coast Financial Services

Conference

Conference

East Coast Financial Services

Conference

Conference

November 10, 2011

November 10, 2011

Carl J. Chaney

President & CEO

President & CEO

Carl J. Chaney

President & CEO

President & CEO

Forward-Looking Statements

Forward-Looking Statements

During this presentation we may make forward-looking statements.

During this presentation we may make forward-looking statements.

Forward-looking statements provide projections of results of operations or of financial

condition or state other forward-looking information, such as expectations about

future conditions and descriptions of plans and strategies for the future. Hancock’s

ability to accurately project results or predict the effects of future plans or strategies is

inherently limited.

condition or state other forward-looking information, such as expectations about

future conditions and descriptions of plans and strategies for the future. Hancock’s

ability to accurately project results or predict the effects of future plans or strategies is

inherently limited.

Forward-looking statements provide projections of results of operations or of financial

condition or state other forward-looking information, such as expectations about

future conditions and descriptions of plans and strategies for the future. Hancock’s

ability to accurately project results or predict the effects of future plans or strategies is

inherently limited.

condition or state other forward-looking information, such as expectations about

future conditions and descriptions of plans and strategies for the future. Hancock’s

ability to accurately project results or predict the effects of future plans or strategies is

inherently limited.

We believe that the expectations reflected in the forward-looking statements are based

on reasonable assumptions, but actual results and performance could differ materially

from those set forth in the forward-looking statements. Factors that could cause

actual results to differ from those expressed in the Company's forward-looking

statements include, but are not limited to, those outlined in Hancock's SEC filings,

including the “Risk Factors” section of the Company’s form 10-K and 10-Q.

on reasonable assumptions, but actual results and performance could differ materially

from those set forth in the forward-looking statements. Factors that could cause

actual results to differ from those expressed in the Company's forward-looking

statements include, but are not limited to, those outlined in Hancock's SEC filings,

including the “Risk Factors” section of the Company’s form 10-K and 10-Q.

We believe that the expectations reflected in the forward-looking statements are based

on reasonable assumptions, but actual results and performance could differ materially

from those set forth in the forward-looking statements. Factors that could cause

actual results to differ from those expressed in the Company's forward-looking

statements include, but are not limited to, those outlined in Hancock's SEC filings,

including the “Risk Factors” section of the Company’s form 10-K and 10-Q.

on reasonable assumptions, but actual results and performance could differ materially

from those set forth in the forward-looking statements. Factors that could cause

actual results to differ from those expressed in the Company's forward-looking

statements include, but are not limited to, those outlined in Hancock's SEC filings,

including the “Risk Factors” section of the Company’s form 10-K and 10-Q.

Hancock does not intend, and undertakes no obligation, to update or revise any

forward-looking statements, and you are cautioned not to place undue reliance on

such forward-looking statements.

forward-looking statements, and you are cautioned not to place undue reliance on

such forward-looking statements.

Hancock does not intend, and undertakes no obligation, to update or revise any

forward-looking statements, and you are cautioned not to place undue reliance on

such forward-looking statements.

forward-looking statements, and you are cautioned not to place undue reliance on

such forward-looking statements.

Hancock Holding

Hancock Holding

The Premier Gulf South Financial Services Franchise

üLeadership position in the Gulf South

üDiversified revenue stream with strong earnings momentum

üLoyal customer base and attractive deposit funding

üCommanding presence in attractive markets that we know

üHighly accretive upon realization of identified cost savings

üPotentially significant revenue synergies from Insurance, Cash

Management, Trust, etc.

Management, Trust, etc.

üMaintaining a very strong balance sheet - capital / liquidity

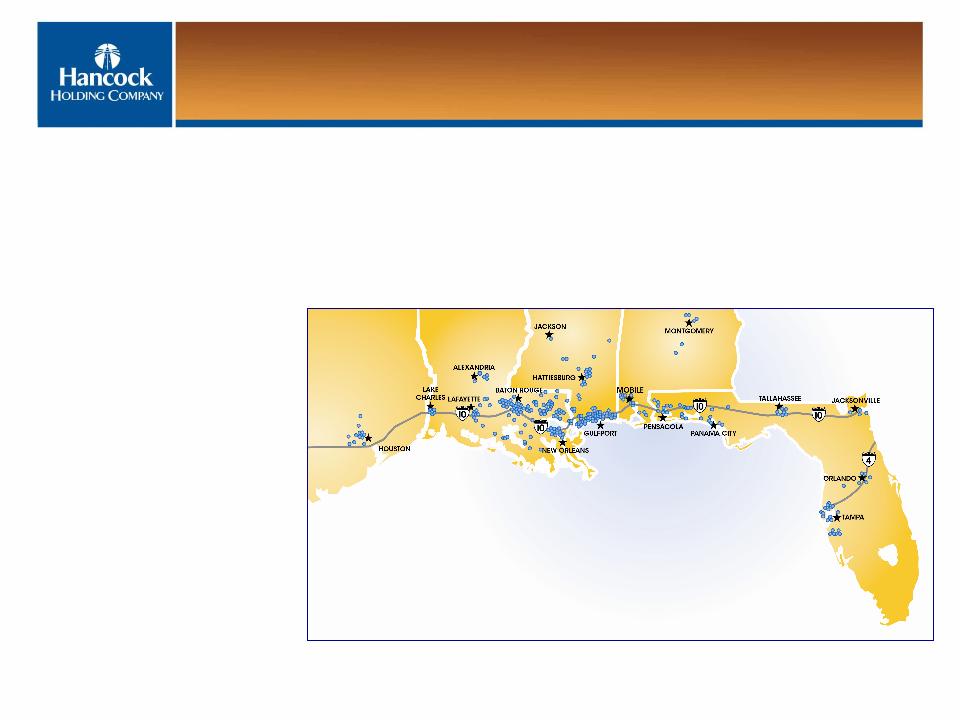

Diversified Footprint Across The Gulf South

As of September 30, 2011

Leading Position In Key Markets;

Building A Presence In Other Attractive Markets

Building A Presence In Other Attractive Markets

• 2-bank Holding Company

– Hancock Bank

– Whitney Bank

• 5-state footprint

• $19B in assets

• $11B in loans

• $15B in deposits

• ~300 branches

• ~400 ATMs

• ~4,800 employees

Whitney Acquisition

Whitney Acquisition

• Closed June 4, 2011

• Purchase price $1.6B

• Added $11.7B in assets, $6.5B in loans and

$9.2B in deposits

$9.2B in deposits

• Integration continues to progress as scheduled

• Main systems conversion scheduled for 1Q12

• Total pre-tax restructuring charge approximately $125 million

• Customer and employee retention remains a priority

• Outlook is very positive and exciting

Branch Divestiture Complete

Branch Divestiture Complete

• Required by the Department of Justice to resolve branch concentration

concerns

concerns

• Completed on September 16, 2011

• Sold eight Whitney branches

– 7 on the Mississippi Gulf Coast

– 1 in Bogalusa, Louisiana

• Sale included approximately $47 million in loans and approximately

$180 million in deposits

$180 million in deposits

• Premium received on the branch sale effectively reduced goodwill at

acquisition

acquisition

– No gain was recorded since branches divested were recorded at fair market value

at acquisition date

at acquisition date

As of September 30, 2011

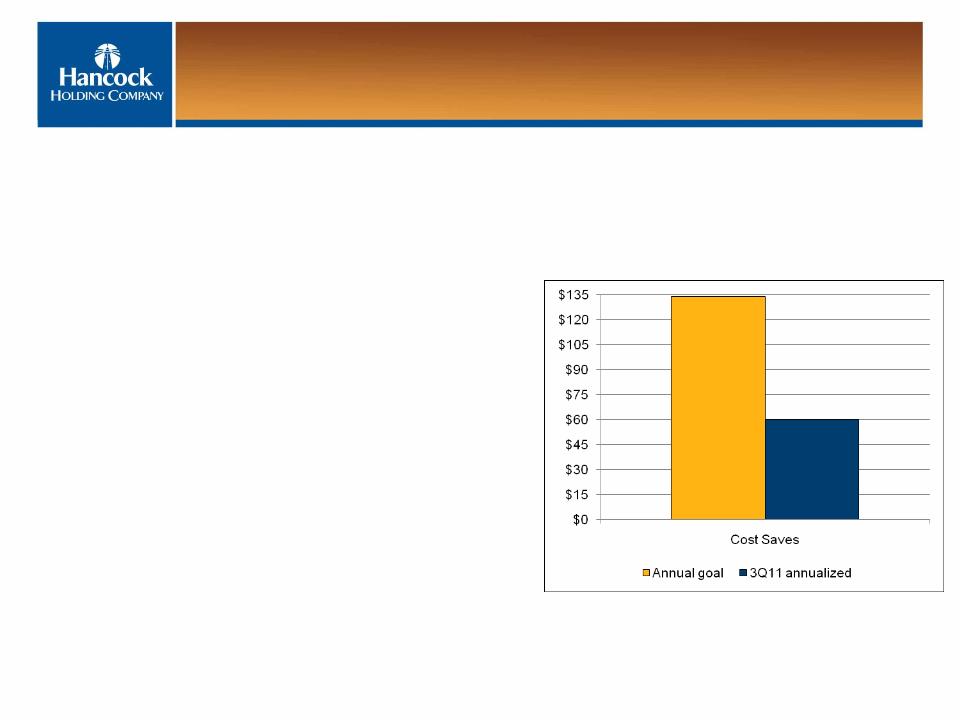

Harvesting Cost Synergies

ü Realized approximately $15 million in

cost synergies in 3Q11 compared to

proforma 3Q10

cost synergies in 3Q11 compared to

proforma 3Q10

– 45% of target (annualized)

ü Synergies will level out over the next

couple of quarters until systems

conversion is completed

couple of quarters until systems

conversion is completed

ü Remain confident we will meet total

projected annual cost saves of $134

million for 2013

projected annual cost saves of $134

million for 2013

As of September 30, 2011

Cultivating Revenue Prospects

Cultivating Revenue Prospects

• Opportunities for cross-selling legacy Hancock and Whitney products

are being cultivated

are being cultivated

• Key lines of business are:

– Treasury Management

– International Banking

– Insurance and Private Banking

• Successfully added new business across the footprint since merger

completed

completed

• Systems conversion in 1Q12 will enhance revenue sales opportunities

Michael M. Achary

CFO

CFO

Michael M. Achary

CFO

CFO

3Q11 Earnings Summary

3Q11 Earnings Summary

* A reconciliation of net income to operating income and pre-tax, pre-provision income is included in the appendix.

** Noninterest expense as a percent of total revenue (TE) before amortization of purchased intangibles, securities transactions and merger expenses.

|

($s in millions; except per share data)

|

3Q11

|

2Q11

|

|

Operating Income*

|

$45.2

|

$26.6

|

|

Operating E.P.S. (diluted)*

|

$.53

|

$.48

|

|

Return on Assets (operating)*

|

0.92%

|

0.92%

|

|

Merger Costs

|

$22.8

|

$22.2

|

|

Net Income

|

$30.4

|

$12.1

|

|

Earnings Per Share (diluted)

|

$.36

|

$.22

|

|

Pre-Tax, Pre-Provision Income*

|

$73.9

|

$49.5

|

|

Net Interest Margin

|

4.32%

|

4.11%

|

|

Net Charge-offs

|

0.28%

|

0.49%

|

|

Tangible Common Equity

|

8.56%

|

8.11%

|

|

Efficiency Ratio**

|

66.98%

|

65.62%

|

As of September 30, 2011

Customer Retention Remains A Priority

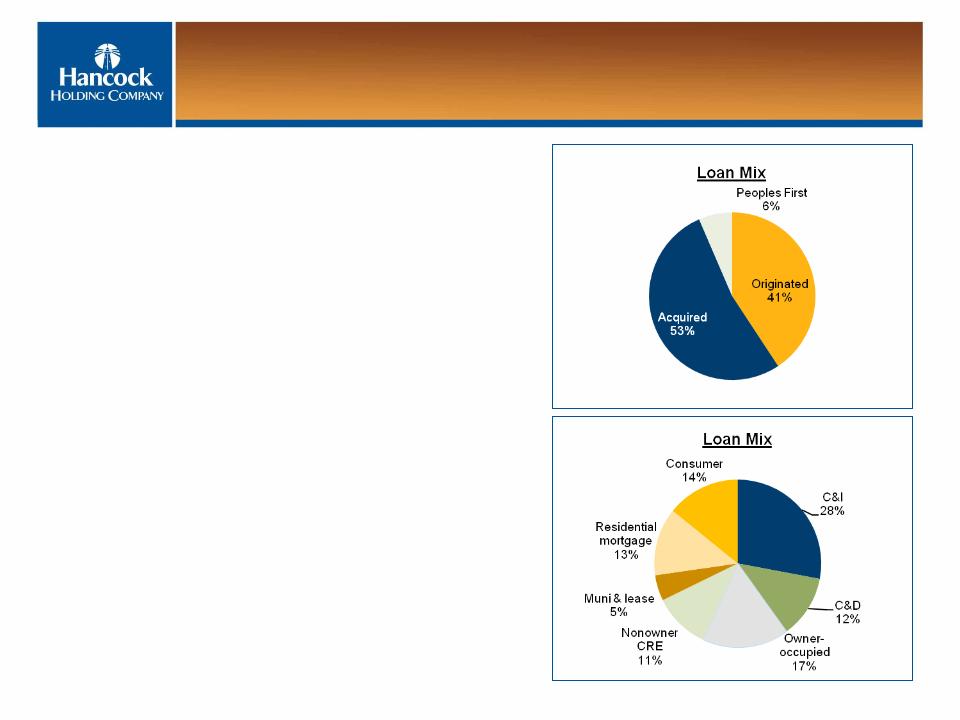

• Total loans $11.1B

• Balanced portfolio

– C&I Exposure 45%

– CRE Exposure 28%

– Mortgage & Consumer Exposure 27%

• Decline of $147 million, or 1%,

linked-quarter

linked-quarter

– Approximately $47 million related to branch divestiture

– Approximately $60 million related to the

resolution of problem credits

resolution of problem credits

– Approximately $26 million related to the covered Peoples

First loss share portfolio

First loss share portfolio

• Positioned for rising rates

As of September 30, 2011

Strong Core Deposit Funding

• Total deposits $15.3B

• Decline of $296 million linked-quarter

– Approximately $180 million related to branch divestiture

– Approximately $73 million related to runoff in the

Peoples First CD portfolio

Peoples First CD portfolio

– Approximately $160 million decline in seasonal

public fund deposits

public fund deposits

• Funding mix remained strong

– Low cost of funds (50bps)

– Noninterest bearing demand deposits (DDA) comprised 33% of

total period-end deposits compared to 31% at June 30, 2011

total period-end deposits compared to 31% at June 30, 2011

• Approximately $2.1B in CDs maturing

over the next 3 quarters at average rate of

1.45%

over the next 3 quarters at average rate of

1.45%

As of September 30, 2011

4Q11

1.41%

1.41%

1Q12

1.49%

1.49%

2Q12

1.45%

1.45%

Improved Net Interest Margin

• 3Q11 net interest margin 4.32% up 21bps

linked-quarter

linked-quarter

– Approximately 24bps of the NIM was related to net

accretion of purchase accounting adjustments (8bps in

2Q11)

accretion of purchase accounting adjustments (8bps in

2Q11)

– Accretion of the loan discount and amortization of the

fair value adjustments on the securities and CD

portfolios will continue to impact the NIM and net

interest income in future quarters and will decline

over time

fair value adjustments on the securities and CD

portfolios will continue to impact the NIM and net

interest income in future quarters and will decline

over time

• Reflects a favorable shift in funding

sources and a decline in funding costs,

partly offset by a less favorable shift in

earning asset mix

sources and a decline in funding costs,

partly offset by a less favorable shift in

earning asset mix

• Deployment of excess liquidity and CD

repricing will further benefit the NIM

repricing will further benefit the NIM

As of September 30, 2011

* Excludes impact of purchase accounting adjustments

** Impact of purchase accounting adjustments.

Credit Quality Metrics Remain Solid

• Allowance for loan losses was $118 million,

up from $112 million at June 30, 2011

up from $112 million at June 30, 2011

• Provision for loan losses was $9.3 million

– $9.1 million for non-covered loans

– $0.2 million for FDIC covered loans

• Net charge-offs totaled $7.8 million

• ALLL/loans was 1.86%

(excluding the impact of the Whitney acquired loans and FDIC covered loans)

(excluding the impact of the Whitney acquired loans and FDIC covered loans)

• Nonperforming assets declined $27 million linked-quarter

– NPLs declined $20 million

– ORE declined $7 million

• Whitney’s legacy classified portfolio declined 15% linked-quarter

As of September 30, 2011

Declining NPAs

Cross-Sell Opportunities

• Noninterest income totaled $65 million in 3Q11

– No significant changes to recurring sources of income

• Impact from new interchange rates related to the Durbin amendment

could lower noninterest income by:

could lower noninterest income by:

– Approximately $2 - $3 million for the remainder of 2011

– Approximately $15 - $18 million in 2012

– Do not anticipate charging customers a per item or monthly debit card

service fee

service fee

– Reviewing opportunities to offset loss of income

• Cross-sell opportunities expected to generate additional fee income

As of September 30, 2011

Focused On Efficiency Targets

• Noninterest expense totaled $194 million in 3Q11

– Merger-related expenses totaled $22.8 million

– Amortization of intangibles totaled $7.1 million

• Realized approximately $15 million in cost synergies in 3Q11

compared to proforma 3Q10

compared to proforma 3Q10

– 45% of target (annualized)

• Efficiency ratio 66.98% in 3Q11*

– Short term target: 62-63% (impact from 100% of cost saves)

– Longer term target: less than 60%

As of September 30, 2011

* Noninterest expense as a percent of total revenue (TE) before amortization of purchased

intangibles and securities transactions and merger expenses

intangibles and securities transactions and merger expenses

Working Towards ROA Target

Ø ROA target in 2013 of 1.20%+ included:

– 3% annual asset growth

– $134 million annual cost saves

Ø Proforma 3Q11 assuming 100%

quarterly cost saves = 1.17% ROA

quarterly cost saves = 1.17% ROA

Ø ROA target did not include:

– Investment of excess liquidity

– Increase in interest rates

– Additional CDs repricing

– Increased loan/deposit ratio

– Revenue synergies

– Additional strategic investments

As of September 30, 2011

|

$s in millions

|

3Q11

GAAP |

3Q11

Operating |

Proforma

3Q11 Operating plus additional quarterly cost savings |

|

Net interest income

|

177.0

|

177.0

|

177.0

|

|

Provision for loan losses

|

9.3

|

9.3

|

9.3

|

|

Noninterest income

|

65.0

|

65.0

|

65.0

|

|

Noninterest expense

|

194.0

|

194.0

|

194.0

|

|

Merger costs

|

--

|

(22.8)

|

(22.8)

|

|

Additional quarterly cost

saves |

--

|

--

|

(18.5)

|

|

Net income before tax

|

38.7

|

61.5

|

80.0

|

|

Taxes

|

8.3

|

16.3

|

22.8

|

|

Net income

|

30.4

|

45.2

|

57.2

|

|

|

|

|

|

|

Average Assets

|

19,555.7

|

19,555.7

|

19,555.7

|

|

ROAA

|

.62%

|

.92%

|

1.17%

|

Carl J. Chaney

President & CEO

President & CEO

Carl J. Chaney

President & CEO

President & CEO

n Conservative approach to banking since 1899

― 50 years of continuous profitability

― Never missed or lowered our dividend

n Our culture defines how we run our bank

― Commitment to strong capital

― Superior asset quality

― Superior liquidity / low loan to deposit ratio

― No exotic securities

― Did not take TARP

n Experienced and stable management team

n A safe harbor in times of distress

Honor & Integrity

Strength & Stability

Commitment

to Service

Teamwork

Personal

Responsibility

Proud History of Conservative Banking

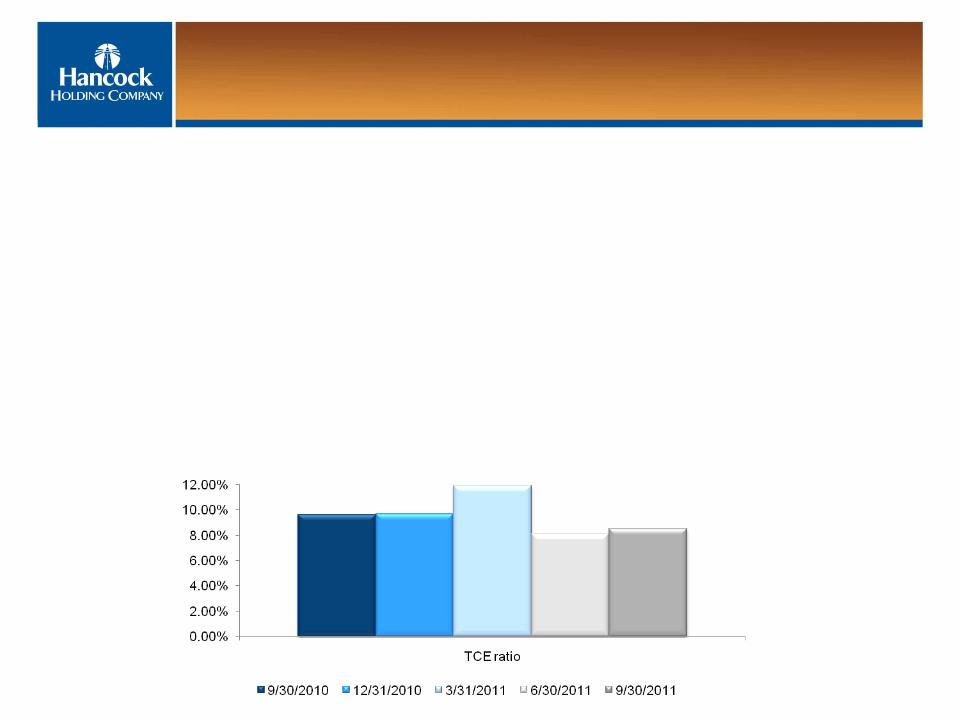

Ø Total equity $2.4 billion at September 30

Ø TCE ratio improved 45bps to 8.56% linked-quarter

Ø Expect to build capital in the near term

– Current focus is on completing Whitney integration

Ø TCE ratio target: 8% minimum

Ø Will review opportunities to deploy excess capital post integration

Ample Capital

As of September 30, 2011

Capital

raise

raise

Whitney

acquisition

acquisition

Well Positioned For The Future

Ø Creates dominant Gulf South leader

Ø History of effective capital management

Ø Superior liquidity

Ø Excellent asset quality and conservative culture

Ø Management and leadership in place

Ø Focused on integration

Ø Enhanced earnings potential

Ø Well positioned for future growth

Ø Focused on shareholder value creation

Notes:

1. As of 9/30/2011

2. KRX index of 50 regional U.S. banks

3. BKX index of 24 large-cap U.S. banks

10-Year Total Return (1)

10-Year Total Return (1)

Large Cap

Peers (3)

Peers (3)

Regional

Peers (2)

Peers (2)

S&P 500

Index

Index

149%

32%

10%

(17%)

(50)

0

50

100

150

200

Sandler O’Neill

Sandler O’Neill

East Coast Financial Services

Conference

Conference

East Coast Financial Services

Conference

Conference

November 10, 2011

November 10, 2011

Appendix

Appendix

Purchase Accounting Items

• Impact of the acquisition is reflected in 2Q11 financial

information from the acquisition date, or only 26 days

information from the acquisition date, or only 26 days

• Whitney’s balance sheet was “marked” to fair value at acquisition

• Whitney’s allowance for loan losses at acquisition date of $208

million was not carried forward and the loan portfolio was

reduced, or “marked” $463 million

million was not carried forward and the loan portfolio was

reduced, or “marked” $463 million

• Total nonaccrual loans and past due accruing loans do not include

purchased credit impaired loans which were written down to fair

value

purchased credit impaired loans which were written down to fair

value

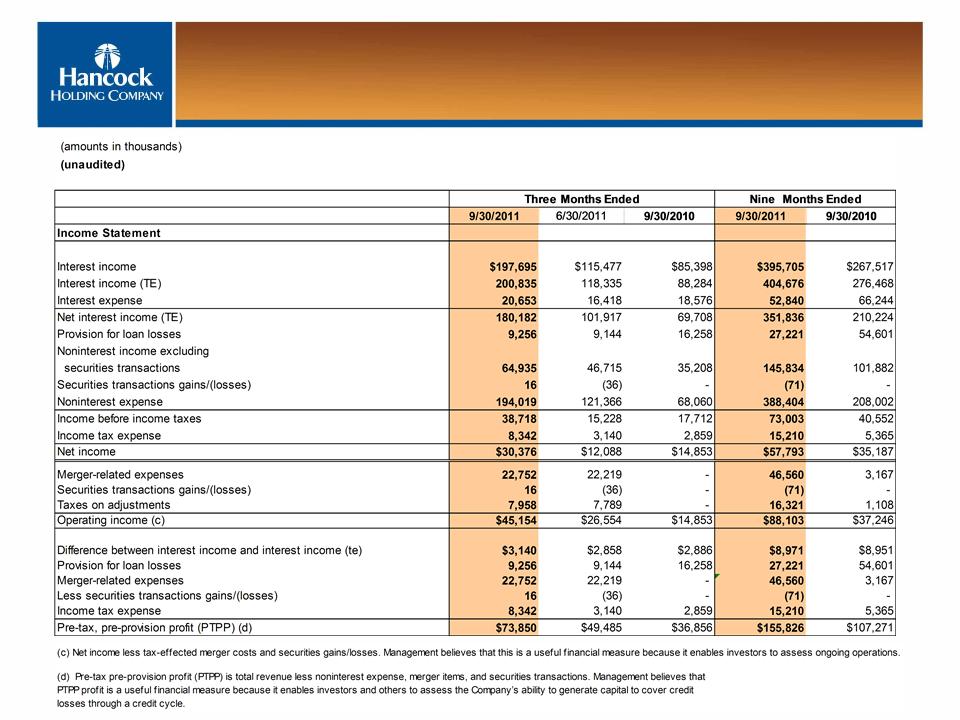

Non-GAAP Reconciliation

Non-GAAP Reconciliation

Investor Contacts

Investor Contacts

Carl J. Chaney - President & CEO

carl_chaney@hancockbank.com

Michael M. Achary - EVP & CFO

michael_achary@hancockbank.com

Trisha Voltz Carlson - SVP, Investor Relations

trisha_carlson@hancockbank.com

Hancock Holding Company

P.O. Box 4019, Gulfport, MS 39502

Phone: 228.868.4000 or 1.800.522.6542

HancockBank.com