Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - BANC OF CALIFORNIA, INC. | d254861d8k.htm |

Q3

Earnings Results November 10, 2011

Exhibit 99.1 |

1

Executing on Growth

Important Disclosures

Executing on Growth

Forward-Looking Statements

Additional Information About the FPTB / Beach Business Bank Transaction

This presentation includes forward-looking statements within the meaning of the

"Safe-Harbor" provisions of the Private Securities Litigation Reform Act of 1995. These

statements are necessarily subject to risk and uncertainty, and actual results could differ

materially from those anticipated due to various factors, including those set forth from

time to time in filings by First PacTrust Bancorp, Inc. (“FPTB,” “First

PacTrust,” “we,” “us” or “our”) with the Securities and Exchange Commission (the “SEC”). Such risks and

uncertainties include, but are not limited to, (1) the occurrence of any event, change or

other circumstances that could give rise to the termination of the stock purchase

agreement for First PacTrust’s pending acquisition of Gateway Bancorp

(“Gateway”) or the merger agreement for First PacTrust’s pending acquisition of Beach Business Bank

(“Beach”); (2) the outcome of any legal proceedings that may be instituted against

First PacTrust, Gateway or Beach; (3) the inability to complete the Gateway or Beach

transaction due to the failure to satisfy each transaction's respective conditions to

completion, including the receipt of regulatory approvals and, in the case of the Beach

transaction, the receipt of the approval of Beach's stockholders; (4) risks that the Gateway

or Beach transaction disrupts current plans and operations and the potential

difficulties in customer and employee retention as a result of the proposed transactions; (5)

the amount of the costs, fees, expenses and charges related to the proposed

transactions; (6) deterioration in the financial condition of borrowers resulting in

significant increases in loan losses and provisions for those losses; (7) continuation of the

historically low short-term interest rate environment; (8) changes in loan underwriting,

credit review or loss reserve policies associated with economic conditions, examination

conclusions or regulatory developments; (9) increased levels of non-performing and

repossessed assets that may result in future losses; (10) greater than anticipated

deterioration or lack of sustained growth in the national or local economies; (11) changes in

state and federal legislation, regulations or policies applicable to banks or other

financial service providers, including regulatory or legislative developments, like the

Dodd-Frank Wall Street Reform and Consumer Protection Act; (12) the results of regulatory

examinations; and (13) increased competition with other financial institutions. You should not

place undue reliance on forward-looking statements, and First PacTrust undertakes

no obligation to update any such statements to reflect circumstances or events that occur after the date on which the forward-looking statement is made.

First PacTrust will be filing a proxy statement/prospectus and other relevant documents

concerning the Beach merger with the SEC. This communication does not constitute an

offer to sell or the solicitation of an offer to buy any securities or a solicitation of any

vote or approval. WE URGE INVESTORS TO READ THE PROXY STATEMENT/PROSPECTUS AND ANY

OTHER DOCUMENTS TO BE FILED WITH THE SEC IN CONNECTION WITH THE BEACH MERGER OR INCORPORATED BY REFERENCE IN THE PROXY

STATEMENT/PROSPECTUS BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. Investors will be able

to obtain these documents free of charge at the SEC's Web site (www.sec.gov). In

addition, documents filed with the SEC by First PacTrust will be available free of charge from First PacTrust by contacting Richard Herrin, Corporate Secretary

of First PacTrust, at (619) 691-1519. The directors, executive officers and certain other

members of management and employees of First PacTrust may be deemed to be participants

in the solicitation of proxies in favor of the Beach merger from the stockholders of Beach. Information about the directors and executive officers of First PacTrust is

included in the proxy statement for its 2011 annual meeting of stockholders, which was filed

with the SEC on April 25, 2011. The directors, executive officers and certain other

members of management and employees of Beach may also be deemed to be participants in the

solicitation of proxies in favor of the Beach merger from the stockholders of Beach.

Information about the directors and executive officers of Beach is included in the proxy statement for its 2010 annual meeting of stockholders, which is available on

Beach's website at www.beachbusinessbank.com by clicking on "Investor Relations" and

then "SEC Filings." Additional information regarding the interests of such participants

will be included in the proxy statement/prospectus and the other relevant documents filed with

the SEC when they become available. |

2

Executing on Growth

Review of Q3 Results

•

First PacTrust Bancorp earned net income of $0.6 million and net income available to

common shareholders of $0.5 million

•

Earned

$1.1

million

in

core

earnings

for

the

quarter

or

$0.10

per

share

of

common

stock,

excluding

$0.5 million of non-core transaction related expenses (change of control payments and

professional fees), on an after tax basis.

•

PacTrust experienced a reduction in the level of non-performing loans by $5.9 million or

41.4%, to $8.3 million (1.19% of gross loans) as of September 30, 2011.

•

PacTrust experienced a reduction in the level of Classified loans, which fell 16.2% to $29.8

million. •

Pre-tax

pre-provision

income,

adjusted

for

OREO

charges

,

increased

to

$3.3

million

from

$2.8

million, linked quarters, driven primarily by a $24 million increase in PacTrust Bank’s

loan portfolio, a $26 million increase in PacTrust Bank’s total deposits and a 5

basis point expansion in the Bank’s net interest margin.

•

Bancorp increased its quarterly dividend to $0.115 per share, its fourth consecutive

quarterly dividend increase.

1

Please see appendices regarding non-GAAP Financial Information

1

1 |

3

Executing on Growth

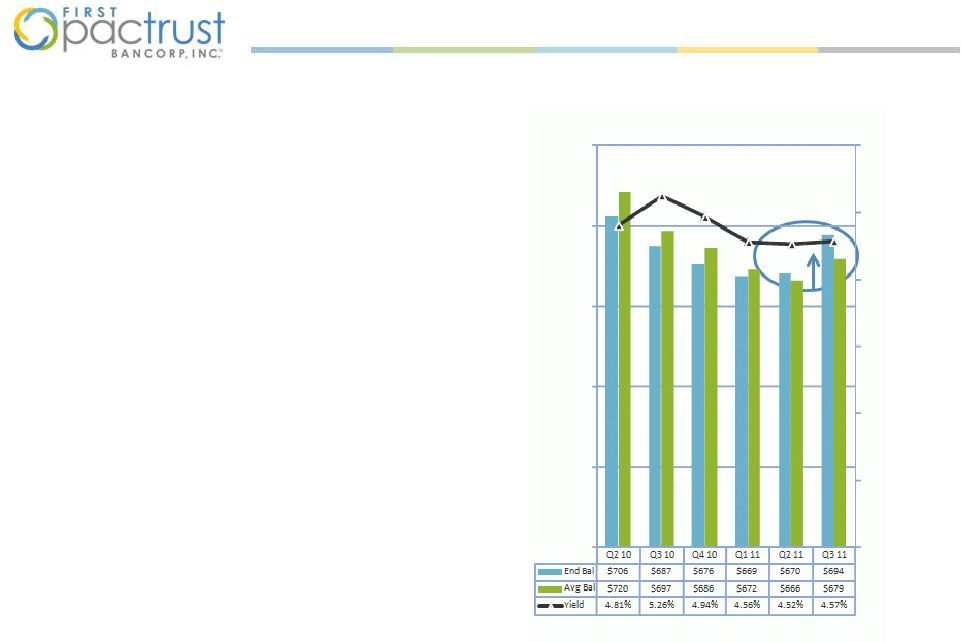

Loans and yield

•

Q3 2011 quarter end balance increased

after consecutive quarters of decline

•

Loan production grew 115% linked quarters

to $68.7 million

•

Loan yields during Q2 2011 experienced a 5

basis point growth linked quarters

–

5.14% average rate on new loan

production

–

Improved credit metrics reduced NPA

interest income drag

–

Offset slightly by ARM resets to lower

coupons

0.00%

1.00%

2.00%

3.00%

4.00%

5.00%

6.00%

$500

$550

$600

$650

$700

$750

Outstanding Loan Balances

(amounts in $ millions / % annualized) |

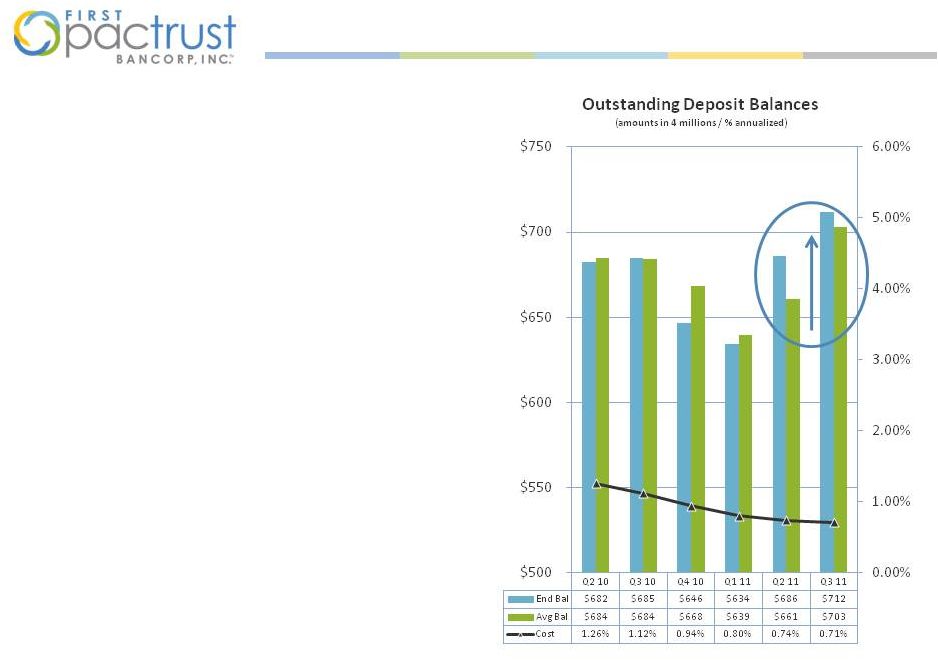

•

Q3 2011 ending deposit balance grew by

$25 million from Q2 2011’s $686 million to

$712 million

–

San Marcos (de novo) branch added

$10 million; opened in June 2011

–

Growth from La Jolla (de novo) branch

accounted for $5 million of Q3 2011

increase ($29 million YTD)

•

Q2 2011 cost of deposits saw a favorable

decline to 71 basis points

–

Re-pricing of higher rate CDs

–

Low cost state deposits

–

Impact of checking and savings

account sales focus

Deposits and cost of deposits

4

Executing on Growth |

5

Executing on Growth

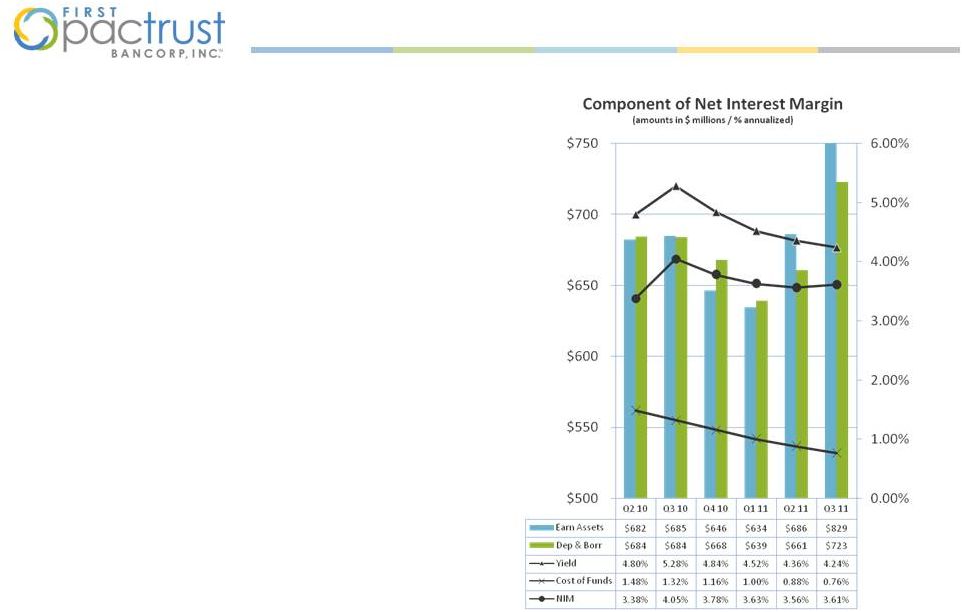

Net interest margin

•

Net interest margin for Q2 2011 rose by 5

basis point linked quarters

•

Resulted in $476 thousand or 6.8% increase

in net interest income, before provision

•

Average Earning Assets for Q3 2011 grew

$42 million or 5.3% versus prior linked

quarter, outpacing growth in liabilities

–

Yield on earning assets declined 12

basis point s compared to Q1 2011

–

Decline was largely driven by lower

yield on investments due to sale of

higher yielding impaired investments

•

Interest bearing liabilities for Q2 2011 grew

$13 million or 1.8% versus prior linked

quarter

–

Costs of funds declined 12 basis points

compared to Q2 2011

–

Decline was driven by 3 basis point

drop in cost of deposits and the

repayment of high rate FHLB

borrowings |

6

Executing on Growth

Non-interest income

•

Q3 2011 non-interest income was $2.012

million; compares favorably against Q2 2011

non-interest income of $1.635 million

•

Excluding gain on sale of securities, linked

quarter non-interest income increased $45

thousand or 8.7% from $517 thousand in Q2

2011 to $562 thousand in Q3 2011

–

A $23 thousand increase in customer

service fees accounted for 51% of the

increase in non-interest income; the

increase benefited from disciplined

sales activity

–

Prepayment penalties assessed on

customer loans that paid off during Q3

2011 added $28 thousand of income

$250

$275

$300

$325

$350

$375

$400

Customer Service

Fees

(amounts in $ thousands)

Q2 10

Q3 10

Q4 10

Q1 11

Q2 11

Q3 11

Customer Service Fees

$345

$336

$341

$338

$373

$396 |

7

Executing on Growth

Non-interest expense

•

Non-interest expense increased by $1.7

million from $6.0 million during Q2 2011 to

current quarter’s $7.7 million

–

difference is due to $1.3 million in

additional OREO charges, change in

control expenses booked during Q3 2011

of $0.2 million and $0.3 million

incremental expenses associated with

strategic initiatives, including

acquisitions

•

Selected expenses

–

Q4 2010 and Q1 & Q3 2011 salaries &

employee benefits were impacted by

change of control payments; 2011 also

reflects additions in branch & loan

production personnel to drive organic

growth

–

Prior quarter professional services

expense was impacted by private

placement; today reflects acquisition

activity

–

OREO and related expenses fluctuate

driven by completion of current asset

resolution activities

Q2 10

Q3 10

Q4 10

Q1 11

Q2 11

Q3 11

Non-interest Expense

$4,925

$3,846

$9,187

$6,816

$5,999

$7,661

$-

$2,000

$4,000

$6,000

$8,000

$10,000

Non-interest Expense

(amounts in $ thousands)

Q2 10

Q3 10

Q4 10

Q1 11

Q2 11

Q3 11

REO/FrclsurExp

$1,546

$277

$1,738

$1,131

$720

$1,994

Prof Srvcs

$141

$238

$400

$335

$414

$667

Salaries

$1,536

$1,614

$5,088

$3,381

$2,856

$3,251

$-

$2,000

$4,000

$6,000

$8,000

$10,000

Selected Expenses

(amounts in $ thousands) |

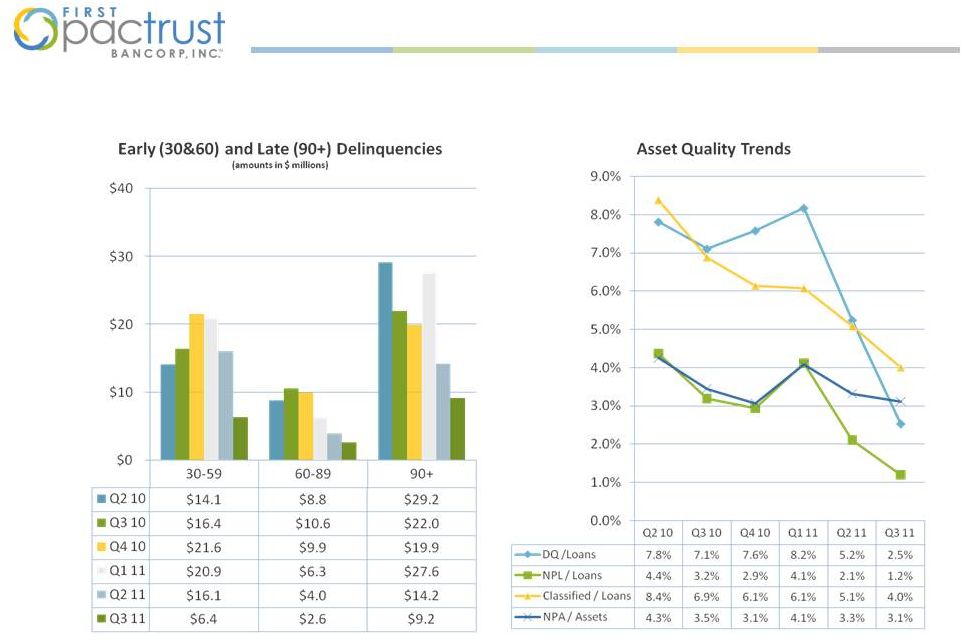

8

Executing on Growth

Credit quality and provision

•

Early delinquencies at lowest level during

past 6 quarters

•

NPLs at lowest level during past 6 quarters

•

OREO increased as resolution activity

matures

•

ALLL coverage as a % of non-accrual loans is

largest in 6 quarter

Early DQ

NPL

OREO

Q2 10

$29.2

$8.3

Q3 10

$27.0

$22.0

$7.8

Q4 10

$31.5

$19.9

$6.6

Q1 11

$27.2

$27.6

$6.4

Q2 11

$20.1

$14.2

$15.0

Q3 11

$9.0

$9.2

$20.6

$0

$10

$20

$30

$40

Early Delinquencies & NPA Components

(amounts in $ millions)

ALLL

$17.7

$17.6

$14.6

$11.9

$8.4

$9.0

as a % of Non

Accrual Loans

40.2%

46.0%

41.3%

38.8%

38.2%

82.4%

0.0%

10.0%

20.0%

30.0%

40.0%

50.0%

60.0%

70.0%

80.0%

90.0%

$-

$2.0

$4.0

$6.0

$8.0

$10.0

$12.0

$14.0

$16.0

$18.0

$20.0

Allowance for Loan & Lease Losses

(amounts in $ millions / %)

Q2

10

Q3

10

Q4

10

Q1

11

Q2

11

Q3

11

$22.9 |

9

Executing on Growth

Credit metrics

Credit metrics

Improved asset quality |

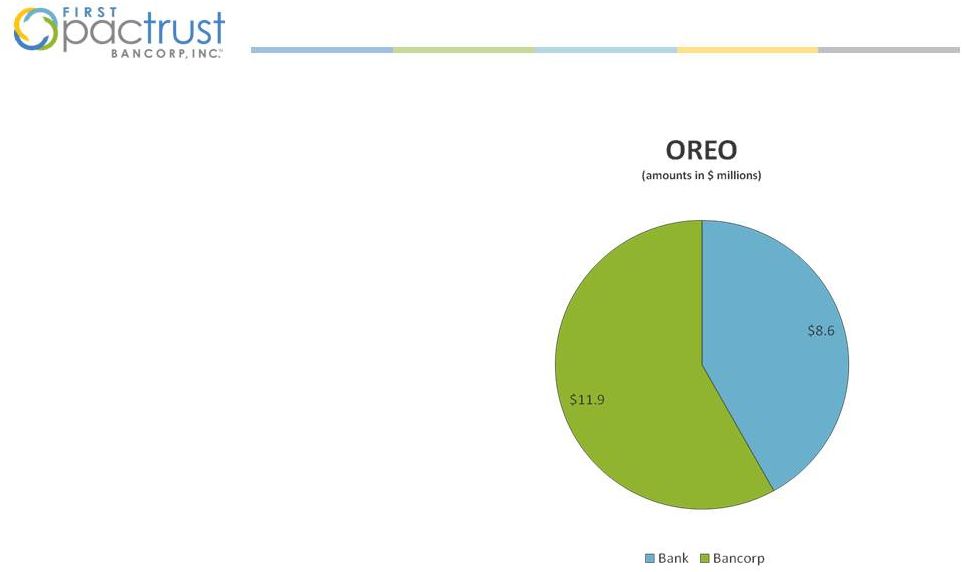

10

Executing on Growth

OREO

•

OREO rose to $20.6 million as of

September 30, 2011 versus $15.0 million at

June 30, 2011; the Company saw $2.4

million reductions to OREO properties and

added 9 properties totaling $8.0 million

•

Growth in OREO was expected as Company

cleared out NPAs

•

OREO balances are concentrated at the

holding company or in a special purpose

subsidiary of the holding company, which

combined, total $11.9 million or 58% of

total OREO; includes 3 construction/land

loans that have been written down to less

than 20% of original loan amounts

•

Expect reductions in OREO during the next

few quarters with completion of property

sales and fewer migration of remaining

NPLs into OREO |

11

Executing on Growth

Capital

•

Strong capital position made stronger

through $32 million SBLF preferred equity

raise

•

FPTB’s tangible common equity to asset

ratio remains at 18.2%

–

FPTB maintains sufficient equity to

support M&A commitments and

organic growth

•

Strong capital position at Pacific Trust Bank

–

Q3 2011 total core capital to adjusted

tangible assets stands at 14.3% and

total risk-based capital ratio stands at

20.8%

Ratio

Q2

10

Q3

10

Q4

10

Q1

11

Q2

11

Q3

11

Total Core

Capital

9.2%

9.8%

11.1%

12.1%

11.6%

14.3%

Tier 1 Risk-

based Capital

12.1%

12.9%

14.9%

16.0%

16.0%

19.7%

Total Risk-

based Capital

13.4%

14.2%

16.2%

17.3%

17.2%

20.8%

Pacific Trust Bank Regulatory Capital Ratios

Q2 10

Q3 10

Q4 10

Q1 11

Q2 11

Q3 11

TCE to Assets

8.8%

9.2%

15.8%

16.3%

18.2%

18.2%

0.0%

5.0%

10.0%

15.0%

20.0%

TCE to Assets |

12

Executing on Growth

Other items

Gateway merger

•

Merger and integration activities are

underway

•

Awaiting OCC approval

•

Expect to file waiver with FRB

•

On track for Q4 2011 close

Beach merger

•

S-4 filing

•

FRB notified of BANC’s intention to become

a multi-bank holding company

•

On track for Q1 2012 close

Liquidity

•

FPTB and Pacific Trust Bank have sufficient

on-balance sheet liquidity to fund daily

activities

•

Cash and equivalents total $75 million or

8.1% of assets

•

Securities total $65 million or 7.0% of

assets; generates approximately $4 million

in cash flow a month

Regulatory Update

•

OCC conducting initial safety and soundness

exam |

13

Executing on Growth

Summary

Delivering earnings while building for growth

$1.0 million in core earnings to common in the Q3 2011 (excluding non-core transaction

expenses);

Pre-tax pre-provision of $3.1 million, adjusted for OREO charges

Improved credit quality

Improved quality of earnings

Lending platforms produced $69 million of production and strong pricing

New branches delivering organic funding growth

Opportunity for further NIM expansion as higher-cost CDs mature in 2011

Strong capital position

Strong liquidity position |

Appendices |

15

Executing on Growth

Non-GAAP Financial Information

6/30/2010

9/30/2010

12/31/2010

3/31/2011

6/30/2011

9/30/2011

Stockholders’equity

$

96,413

$

98,867 $

136,009 $

135,650 $

160,475 $

191,488

Less: Intangible assets

0

0

0

0

0

0

Less: Preferred stock

0

0

0

0

0

31,940

Tangible common equity

$

96,413

$

98,867 $ 136,009

$ 135,650

$ 160,475

$

159,548

This presentation contains certain financial information determined by methods other than in

accordance with accounting principles generally accepted in the United States

(“GAAP”). These non-GAAP financial measures include tangible common equity, tangible

common equity per share pre-tax pre-provision income, non-interest income excluding

gain-on-sale of securities and core earnings. Tangible common equity and tangible common equity per share are calculated by excluding preferred

equity from stockholders’ equity and excluding any intangible assets (of which we

currently have none) from assets. We believe that this is consistent with the treatment

by our regulatory agency, which excludes any intangible assets from the calculation of risk-based capital ratios.

Accordingly, management believes that these non-GAAP financial measures provide information to

investors that is useful in understanding the basis of our risk-based capital ratios.

Management also believes that core earnings is a useful measure of assessing our operating

performance. Pre-tax pre-provision profit is total revenue less non-interest expense and pre-tax

pre-provision profit , adjusted for OREO charges, is total revenue less non-interest

expense plus OREO-valuation allowance plus loss on sale of OREO. Management believes that

these two additional non-GAAP financial measures are useful because it enables investors and

other to assess the Company’s ability to generate capital to cover losses through a credit

cycle. Reconciliations of the non-GAAP measures to the comparable GAAP measures are provided below.

The following table presents a reconciliation of tangible common equity to stockholders’ equity

(dollars in thousands):

|

16

Executing on Growth

Non-GAAP Financial Information

(Continued)

6/30/2011

9/30/2011

Net income

$

1,549

$

644

Add: Income tax expense (benefit)

644

368

Add: Provision for loan losses

451

823

Pre-tax pre-provision income

$

2,644

$

1,835

Add: OREO-valuation allowance

137

1,329

Add: Loss on sale of OREO

51

105

Pre-tax pre-provision income, adjusted for OREO charges

$

2,832

$

3,269

The

following

table

presents

a

reconciliation

of

pre-tax

pre-provision

income

to

net

income

(dollars

in

thousands):

6/30/2011

9/30/2011

Non-interest income

$

1,635

$

2,012

Less: Gain-on-sale of securities

1,118

1,450

Non-interest income, excluding gain-on-sale of securities

517

562

The following table presents a reconciliation of non-interest income to

non-interest income, excluding gain-on-sale of securities

(dollars in thousands): |

17

Executing on Growth

Non-GAAP Financial Information

(Continued)

9/30/11

Net income

$

644

Add: Non-core change of control payment (net of tax)

155

Add: Non-core professional service & other expense (net of tax)

302

Core earnings

$

1,101

Less: Preferred dividend

138

Core earnings to common

$

963

The following table presents a reconciliation of core earnings to net income

(dollars in thousands): |