Attached files

| file | filename |

|---|---|

| 8-K - 8-K - TOTAL SYSTEM SERVICES INC | d246540d8k.htm |

| EX-99.1 - EX-99.1 - TOTAL SYSTEM SERVICES INC | d246540dex991.htm |

2011

Third Quarter Results October 25, 2011

©

2011 Total System Services, Inc.®.

Proprietary. All rights reserved worldwide.

Exhibit 99.2 |

Forward-Looking Statements

This presentation and comments made by management contain

forward-looking statements including, among others, statements

regarding the expected future operating results of TSYS. These

statements are based on management’s current expectations and

assumptions and are subject to risks, uncertainties and changes in

circumstances. Forward-looking statements include all statements

that are not historical facts and can be identified by the use of

forward- looking

terminology

such

as

the

words

“believe,”

“expect,”

“anticipate,”

“intend,”

“plan,”

“estimate”

or similar expressions. Actual results may

differ materially from those set forth in the forward-looking statements

due to a variety of factors. More information about these risks,

uncertainties and factors may be found in TSYS’

2010 Annual Report

on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports

on Form 8-K. TSYS does not assume any obligation to update any

forward-looking statements as a result of new information, future

developments or otherwise.

2

©2011 Total System Services, Inc.®

. Proprietary. All rights reserved worldwide. |

Use of

Non-GAAP Financial Measures This slide presentation contains certain

non-GAAP financial measures determined by methods other than in

accordance with generally accepted accounting principles. Such non-GAAP

financial measures include the following: revenues before reimbursable

items; operating margin excluding reimbursable items; revenues

measured

on

a

constant

currency

basis;

the

impact

of

termination

fees

on

total

revenues, operating income, income from continuing operations, and earnings per

share from continuing operations; free cash flow; and EBITDA. The most

comparable GAAP measures to these measures are revenues; operating margin;

revenues; revenues, operating income, income from continuing operations and

earnings per share from continuing operations; cash flows from operating

activities; and net income, respectively. Management uses these non-GAAP

financial measures to assess the performance of TSYS’

core business. TSYS believes that

these non-GAAP financial measures provide meaningful additional information

about TSYS to assist investors in evaluating TSYS’

operating results. These non-

GAAP

financial

measures

should

not

be

considered

as

a

substitute

for

operating

results determined in accordance with GAAP and may not be comparable to other

similarly titled measures of other companies. The computations of the

non-GAAP financial

measures

used

in

this

slide

presentation

are

set

forth

in

the

Appendix

to

this slide presentation.

3

©2011 Total System Services, Inc.®.

Proprietary. All rights reserved worldwide. |

Phil

Tomlinson Chairman and Chief Executive Officer

©

2011 Total System Services, Inc.®.

Proprietary. All rights reserved worldwide. |

Jim

Lipham Chief Financial Officer

©

2011 Total System Services, Inc.®.

Proprietary. All rights reserved worldwide. |

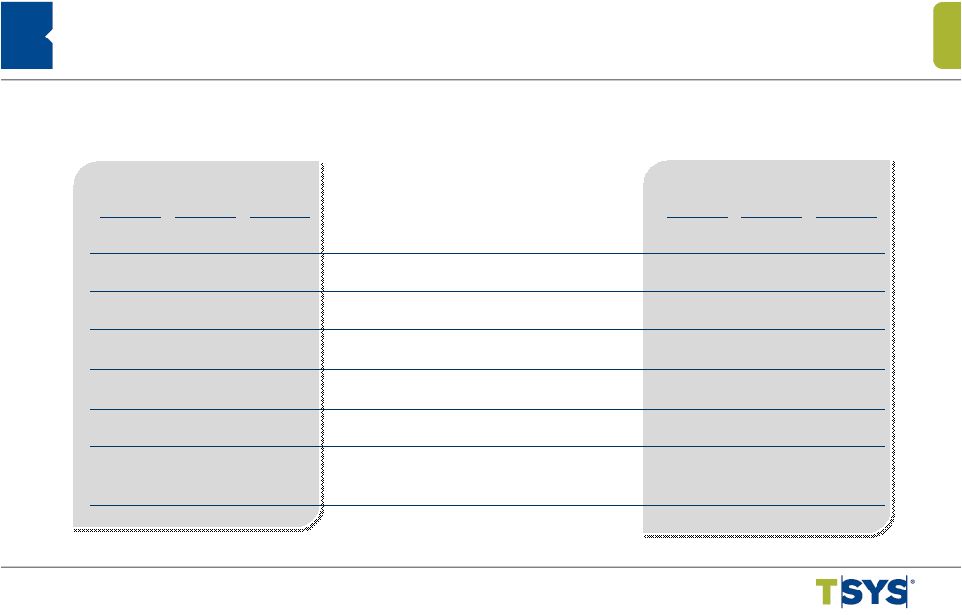

Consolidated Selected Financial Highlights

6

©2011 Total System Services, Inc.®

Proprietary. All rights reserved worldwide.

$ 459,747

$ 433,236

6.1%

Total Revenues

$ 1,336,732

$ 1,277,586

4.6%

390,161

363,192

7.4

Revenues Before Reimbursable Items

1,133,015

1,068,592

6.0

81,180

78,914

2.9

Operating Income

232,738

238,455

(2.4)

58,148

48,206

20.6

Income from Continuing Operations to

TSYS Common Shareholders

160,684

149,937

7.2

58,148

45,743

27.1

Net Income Attributable to TSYS Common

Shareholders

160,684

146,773

9.5

2,233.3

1,981.2

12.7

Total Cardholder Transactions (in millions)

6,321.8

5,582.2

13.3

$0.30

$0.25

23.9

Earnings Per Share from Continuing

Operations Attributable to TSYS Common

Shareholders

$0.83

$0.76

9.7

YTD

2011

YTD

2010

Percent

Change

(in thousands, except per share data)

3rd Qtr

2011

3rd Qtr

2010

Percent

Change |

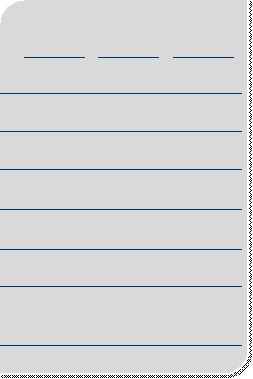

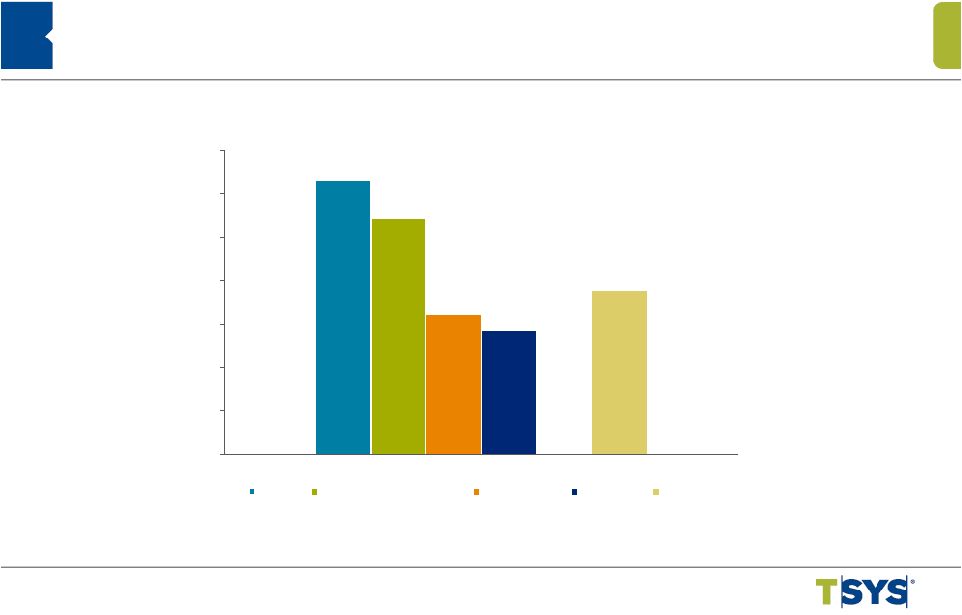

2011 YTD

Revenue Change Revenues Before Reimbursable Items

7

©2011 Total System Services, Inc.®

Proprietary. All rights reserved worldwide.

10%

25%

5%

0%

4.1%

Internal

Growth

New

Clients

2.6%

Acquisitions

3.6%

Lost

Business,

Non-recurring

Items and

Price

Compression

(5.8%)

Reported

6.0%

Currency

20%

15%

1.5% |

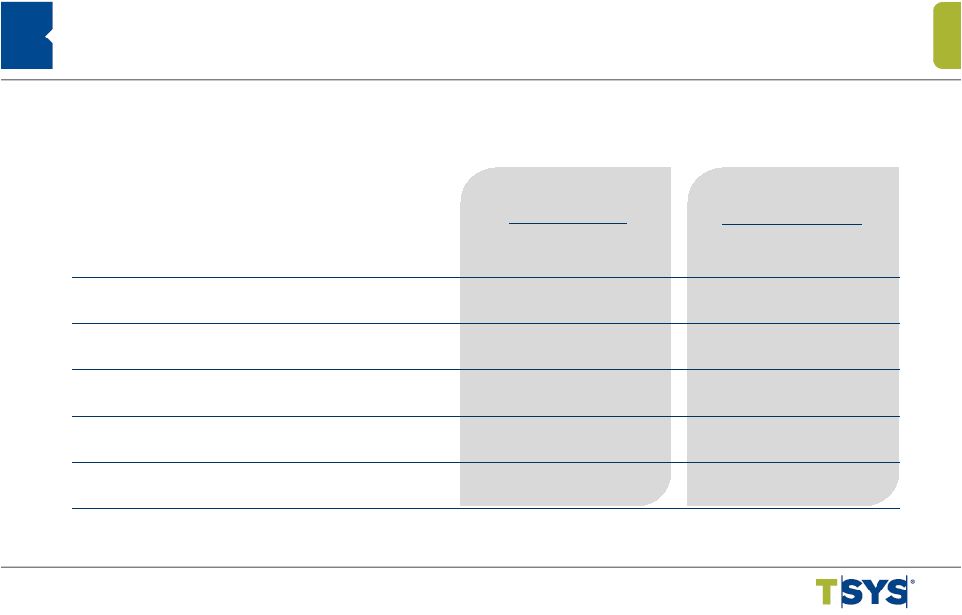

Consolidated Accounts on

File Portfolio Summary

Consumer Credit

194.2

180.2

7.7

194.2

187.6

3.5

Government

Services

32.6

26.9

21.4

32.6

30.0

8.7

Retail

23.2

23.1

0.2

23.2

23.7

(2.4)

Total Consumer

250.0

230.2

8.6

250.0

241.3

3.6

Commercial

59.6

51.9

14.7

59.6

55.2

7.9

Other

7.0

5.7

23.6

7.0

6.7

4.9

Subtotal

316.6

287.8

10.0

316.6

303.2

4.4

Prepaid /

Stored Value

75.8

51.4

47.7

75.8

72.8

4.1

Total AOF

392.4

339.2

15.7

392.4

376.0

4.3

(in millions)

Sep

2011

Sep

2011

Sep

2010

Sep

2010

%

Change

%

Change

Sep

2011

Sep

2011

Jun

2011

Jun

2011

%

Change

%

Change

8

©2011 Total System Services, Inc.®

Proprietary. All rights reserved worldwide. |

Key

Drivers 3Q 2011 Year Over Year

Segment Financial Highlights

•

Strong organic growth

•

Increased volumes

•

Volumes

–

Accounts on file were 341.9 million

–

Total cardholder transactions were 1,872.8 million,

an increase of 12.9%

Revenues

$243.9 million

Excluding Reimbursables

$206.1 million

Operating Income

$68.0 million

Operating Margin

27.9%

Excluding Reimbursables

33.0%

Same Client Transactions

1,867.6 million

Increase of 12.7%

North America

Services

9

©2011 Total System Services, Inc.®

Proprietary. All rights reserved worldwide. |

Key

Drivers 3Q 2011 Year Over Year

Segment Financial Highlights

•

Favorable currency impact on revenues of

$4.9 million

•

Conversion of new clients

•

Volumes

–

Accounts on file were 50.5 million

–

Total cardholder transactions were 360.5 million, an

increase of 11.7%

10

©2011 Total System Services, Inc.®

Proprietary. All rights reserved worldwide.

Revenues

$99.9 million

Constant currency basis

$95.0 million

Operating Income

$8.3 million

Operating Margin

8.3%

Excluding Reimbursables

8.6%

Same Client Transactions

347.5 million

Increase of 7.8%

International

Services |

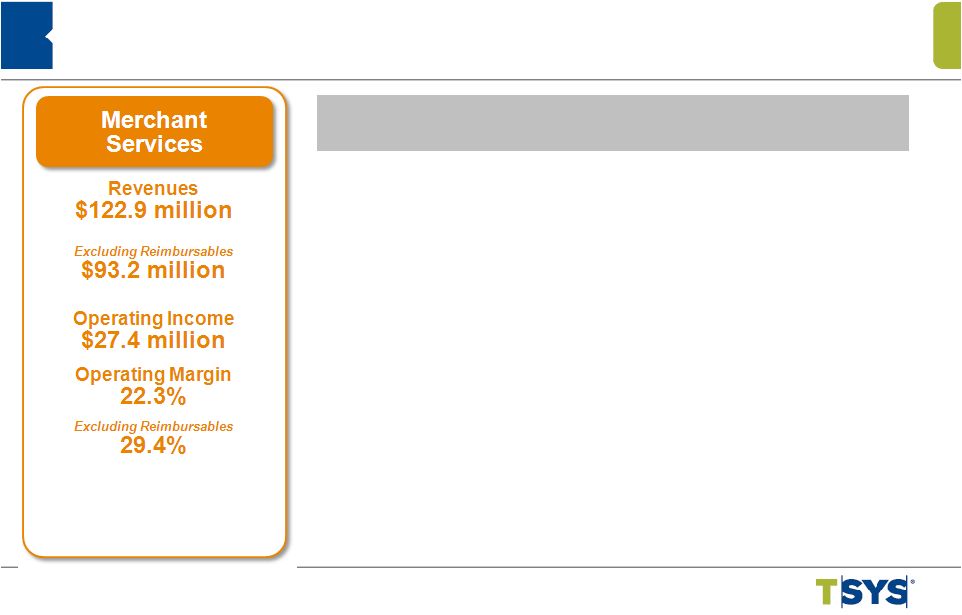

Key

Drivers 3Q 2011 Year Over Year

Segment Financial Highlights

•

Acquisition of TermNet

•

Decline in revenues associated with

deconverted clients

•

Volumes

–

Point-of-Sale Transactions were 1,263.3 million, a

decrease of 6.1%

–

Excluding deconverted clients, Point-of-Sale

Transactions increased 5.1%

11

©2011 Total System Services, Inc.®

Proprietary. All rights reserved worldwide. |

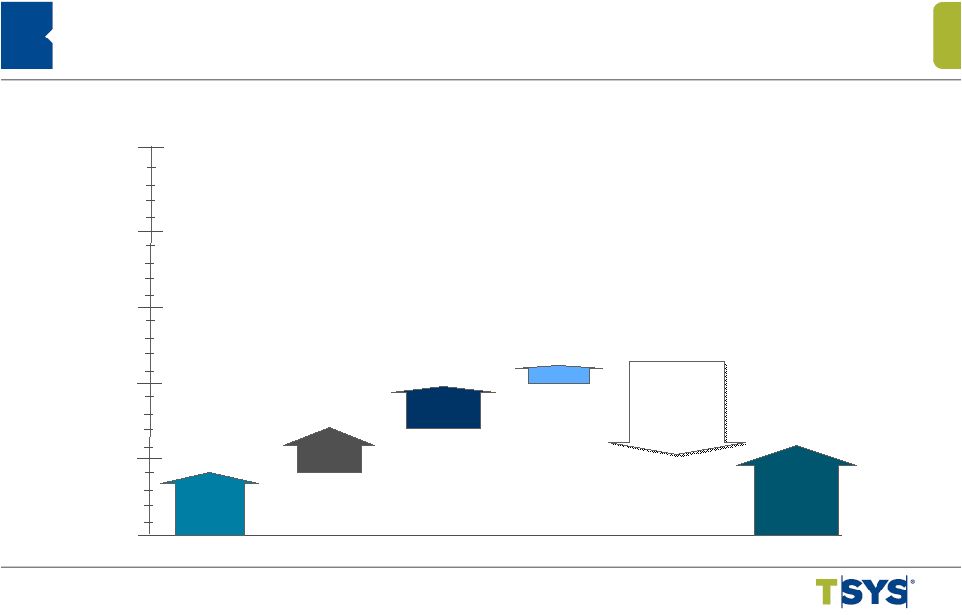

Cash

Flow Strength: 2011 TTM Consolidated Financial Highlights

$473

$407

$240

$213

$281

$0

$75

$150

$225

$300

$375

$450

$525

EBITDA

Cash flow from operations

Free cash flow

Net income

Ending cash

(in millions)

TTM = Trailing Twelve Months

12

©2011 Total System Services, Inc.®

Proprietary. All rights reserved worldwide. |

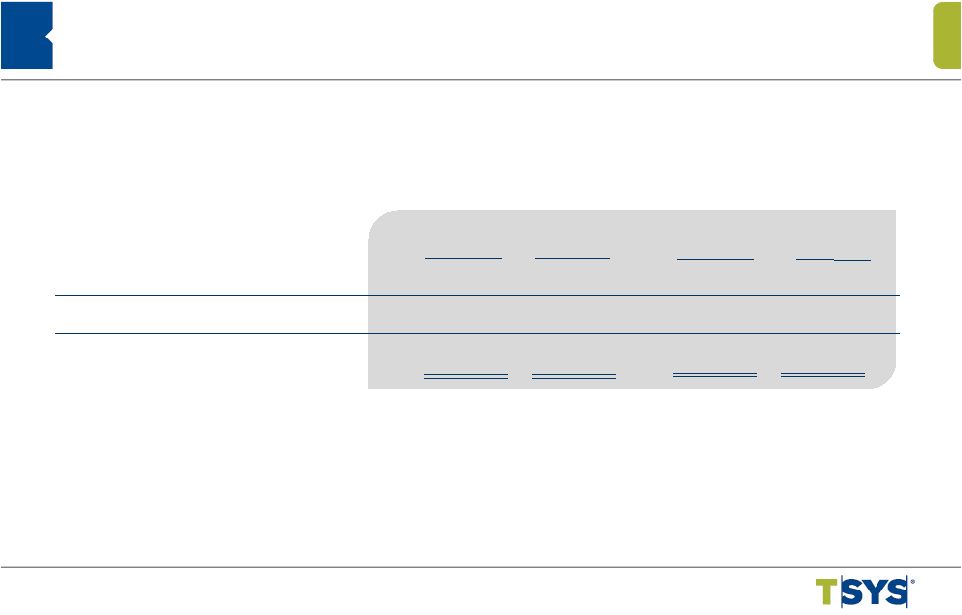

Revised 2011 Guidance

©2011 Total System Services, Inc.®

Proprietary. All rights reserved worldwide.

13

Range

Change

Range

Percent Change

Total Revenues

$1,786

to

$1,800

4 %

to

5%

Reimbursable Items

266

to

270

(3)

to

(2)

Revenues Before Reimbursable Items

1,520

to

1,530

5

to

6

Income from Continuing Operations Available

to TSYS Common Shareholders

219

to

221

11

to

12

Earnings per Share from Continuing

Operations

$1.14

to

$1.15

14

to

15

Average Shares

192.0

(in millions, except per share data)

|

Appendix

©

2011 Total System Services, Inc.®.

Proprietary. All rights reserved worldwide. |

Appendix Non-GAAP Reconciliation –

Revenues Before Reimbursable Items

Three Months Ended

Nine Months Ended

9/30/11

9/30/10

9/30/11

9/30/10

Total Revenues

$ 459,747 $ 433,236

$ 1,336,732 $

1,277,586 Reimbursable Items

69,586

70,044

203,717

208,994

Revenues Before Reimbursable Items

$ 390,161

$ 363,192

$ 1,133,015

$ 1,068,592

(in thousands)

15

©2011 Total System Services, Inc.®

Proprietary. All rights reserved worldwide. |

Three Months Ended

9/30/11 9/30/10

Three Months Ended

9/30/11 9/30/10

Three Months Ended

9/30/11 9/30/10

Operating Income (a)

$ 68,016

$ 52,645

$ 8,279

$ 12,305

$ 27,398

$ 31,439

Total Revenues (b)

243,899

231,547

99,891

85,327

122,933

125,178

Reimbursable Items

37,812

38,647

3,751

3,078

29,713

30,144

Revenues Before

Reimbursable Items(c)

206,087

192,900

96,140

82,249

93,220

95,034

Operating Margin (a)/(b)

27.89%

22.74%

8.29%

14.42%

22.29%

25.12%

Operating Margin Excluding Reimbursables (a)/(c)

33.00%

27.29%

8.61%

14.96%

29.39%

33.08%

Appendix Non-GAAP Reconciliation –

Segment

Operating Margin Excluding Reimbursable Items

North America

International

Merchant

(in thousands)

16

©2011 Total System Services, Inc.®

Proprietary. All rights reserved worldwide. |

Nine

Months Ended

9/30/11 9/30/10

Percentage

Change

Three

Months Ended

9/30/11 9/30/10

Percentage

Change

Appendix Non-GAAP Reconciliation –

Constant Currency

(1) Reflects current period results on a non-GAAP basis as if foreign currency

rates did not change from the comparable prior year period. (2) Reflects the

impact of calculated changes in foreign currency rates from the comparable period.

(in thousands)

Consolidated:

Constant Currency (1)

$ 454,852

$ 433,236

5.0%

$ 1,319,653

$ 1,277,586

3.3%

Foreign Currency (2)

4,895

---

17,079

---

Total Revenues

459,747

433,236

6.1%

1,336,732

1,277,586

4.6%

International Services:

Constant Currency (1)

$ 94,974

$ 85,327

11.3%

$ 271,137

$242,706

11.7%

Foreign Currency (2)

4,916

---

17,134

---

Total Revenues

$99,891

$85,327

17.1%

$288,271

$242,706

18.8%

17

©2011 Total System Services, Inc.®

Proprietary. All rights reserved worldwide. |

Appendix Non-GAAP Reconciliation –

EBITDA

Trailing Twelve

Months Ended

9/30/2011

Net Income

$ 213,385

Adjusted for:

Add: Discontinued Operations

81

Deduct: Equity in Income of Equity Investments

(10,254)

Add: Income Taxes

94,921

Add: Nonoperating expense

5,578

Add: Depreciation and Amortization

169,407

EBITDA

$ 473,118

(in thousands)

18

©2011 Total System Services, Inc.®

Proprietary. All rights reserved worldwide. |

Appendix Non-GAAP Reconciliation –

Free Cash Flow

Trailing Twelve

Months Ended

9/30/2011

Cash Flows from Operating Activities

$ 406,923

Less:

Purchase of Property and Equipment

(34,820)

Additions to Licensed Computer Software from Vendors

(52,635)

Additions to Internally Developed Computer Software

(23,577)

Additions to Contract Acquisition Costs

(55,401)

Free Cash Flow

$ 240,490

(in thousands)

19

©2011 Total System Services, Inc.®

Proprietary. All rights reserved worldwide. |