Attached files

| file | filename |

|---|---|

| 8-K - 1st United Bancorp, Inc. | i00456_fubc-8k.htm |

| EX-2.1 - 1st United Bancorp, Inc. | i00456_ex2-1.htm |

| EX-2.2 - 1st United Bancorp, Inc. | i00456_ex2-2.htm |

| EX-99.2 - 1st United Bancorp, Inc. | i00456_ex99-2.htm |

| EX-99.1 - 1st United Bancorp, Inc. | i00456_ex99-1.htm |

ACQUISITION OF ANDEREN FINANCIAL

October 25, 2011

Forward Looking Statements Disclosure

Any non-historical statements in this press release are “forward-looking statements” within the meaning of the Private Securities

Litigation Reform Act of 1995. Such forward-looking

statements are based on current plans and expectations that are subject to

uncertainties and risks, which could cause 1st United’s future results to differ materially. The following factors, among others, could

cause our actual results

to differ: the satisfaction of closing conditions for the acquisition, including receipt of regulatory approvals

for the transaction; receipt of approval by the shareholders of Anderen for the transaction, and the possibility that the transaction will

not

be completed, or if completed, will not be completed on a timely basis; disruption to the parties’ businesses as a result of the

announcement and pendency of the transaction; our need and our ability to incur additional debt or equity financing; our

ability to

comply with the terms of the loss sharing agreements with the FDIC; the strength of the United States economy in general and the

strength of the local economies in which we conduct operations; the accuracy of our financial statement estimates

and assumptions,

including the estimate of our loan loss provision; the effects of harsh weather conditions, including hurricanes, and man-made

disasters; inflation, interest rate, market, and monetary fluctuations; the effects of our lack of a diversified

loan portfolio, including

the risks of geographic and industry concentrations; the frequency and magnitude of foreclosure of our loans; legislative and

regulatory changes, including the Dodd-Frank Act; our ability to comply with the extensive laws and

regulations to which we are

subject; the willingness of clients to accept third-party products and services rather than our products and services and vice versa;

changes in securities and real estate markets; increased competition and its effect on

pricing, including the impact on our noninterest

margin from the repeal of Regulation Q; negative publicity and the impact on our reputation; technological changes; changes in

monetary and fiscal policies of the U.S. Government; the effects of security

breaches and computer viruses that may affect our

computer systems; changes in consumer spending and saving habits; changes in accounting principles, policies, practices or

guidelines; anti-takeover provisions under federal and state law as well as

our Articles of Incorporation and our Bylaws; and our

ability to manage the risks involved in the foregoing. In addition, if and when the transaction is consummated, there will be risks and

uncertainties related to 1st United’s ability

to successfully integrate the business and employees of 1st United and Anderen, including

the failure to achieve expected gains, revenue growth, and/or expense savings. These factors, as well as additional factors, can be

found in our periodic

and other filings with the SEC, which are available at the SEC’s internet site (http://www.sec.gov) or on

request from 1st United or Anderen. Actual results may differ materially from projections and could be affected by a variety of

factors, including

factors beyond our control. Forward-looking statements in this press release speak only as of the date of the press

release, and neither 1st United nor Anderen assumes any obligation to update forward-looking statements or the reasons why actual

results

could differ.

2

Additional Information & Where to Find It

1st United intends to file with the SEC a registration statement on Form S-4, in which a proxy statement of Anderen will be included

and a prospectus of 1st United will be included, and other documents

in connection with the proposed acquisition of Anderen. The

proxy statement/prospectus will be sent to the shareholders of Anderen. Before making any decision with

respect to the proposed

transaction, shareholders of Anderen are urged to read the proxy statement/prospectus and other relevant materials because

these materials will contain important information

about the proposed transaction. The registration statement and proxy

statement/prospectus and other documents which will be filed by 1st United with the SEC will be available

free of charge at the

SEC’s website, www.sec.gov, or by directing a request to 1st United, One North Federal Highway, Boca Raton, FL 33432, Attention:

Investor Relations; or by directing a request to Anderen Financial, Inc., 3450 East Lake Road,

Palm Harbor, FL 34685, Attention:

Investor Relations. Certain executive officers and directors of Anderen have interests in the proposed transaction that may differ

from the interests of shareholders generally, including benefits conferred

under retention, severance and change in control

arrangements and continuation of director and officer insurance and indemnification. This communication shall not constitute an

offer to sell or the solicitation of an offer to buy, nor shall

there be any sale of such securities, in any jurisdiction in which such offer,

solicitation or sale would be unlawful prior to appropriate registration or qualification under the securities laws of such jurisdiction.

3

Summary of Transaction Terms

4

Purchase Price

$37.0 million ($2.0 million less than Anderen Financial’s tangible equity which was

$39.0 million at June 30, 2011)

Consideration

50% stock / 50% cash consideration mix

Exchange Ratio

For stock portion, the exchange ratio is determined as follows:

If FUBC stock price < $5.37 (TBVPS as of 6/30/11), then exchange ratio is fixed based on a $5.37 stock price

(however, if stock price falls below $4.50, Anderen may terminate the transaction)

If FUBC stock price is between $5.37 - $6.50, then exchange ratio floats

If FUBC stock price > $6.50, then exchange ratio is fixed based on a $6.50 share price

If FUBC stock price = $8.00, then FUBC may terminate the transaction

Deal Protection

$2 million termination fee, under certain circumstances

Pricing

Price / Tangible Book Value = 95%

Due Diligence

Completed comprehensive due diligence

Board

Representation

1 Director from Anderen to join both 1st United Bancorp

and 1st United Bank board; 1

additional Director to

serve on 1st United Bank board

Anticipated Closing

Second Quarter 2012

Compelling Strategic Rationale

5

Advances objective of profitable growth and capital deployment

Complements recently announced FDIC-assisted acquisition of Old Harbor (Clearwater, Florida)

Anderen’s 4 branches provide additional scale to Old Harbor’s 7 branch network in Central

Florida

Strategic market expansion into the Central Florida market

Legacy market for 1st United’s management team

as prior institution operated successfully

in both the Orlando and Tampa markets

Adds a measure of market diversity to 1st United’s

existing South Florida footprint which

offers different risk/reward elements

1st United’s current footprint, in addition to

the Central Florida market, positions the

franchise to benefit from a presence in the best banking markets in Florida

Will provide for enhanced growth opportunities in a market that at times operates differently

than Southeast Florida

1st United’s scalable platform facilitates a readily

achievable level of cost savings resulting from

increased operating leverage across a number of business units.

Additional management talent, which includes Anderen’s Chairman & President as well as its

CEO, with significant experience in Central Florida positions 1st United for growth and expansion

in these markets.

Strong pro forma capital levels and enhanced market presence opens up additional acquisition

opportunities which enable

1st United to continue to execute upon its franchise expansion goals

Overview of Anderen Financial, Inc.

6

Company Overview

Executive Management

Source: SNL Financial, FRY-9SP and Company data.

John Warren

Chairman & CEO of Anderen Bank

Chairman and President of Anderen Financial

Formerly President and CEO of Florida Choice Bank; President of Southern

Community Bank; SVP Barnett Bank and SunTrust Bank.

MBA, The University of West Florida

Charles Allcott

President of Anderen Bank

Chief Executive Officer of Anderen Financial

Formerly President of Gulf Community Bank; Market President for Compass

Bank; SVP Barnett Bank for a 20 office system in Pasco County and VP/Senior

Lender in Lake County; Founding President of Anderen.

BA, Rollins College

Company Name

Anderen Financial, Inc.

Headquarters

Palm Harbor, FL

Date Established

November 15, 2007

Depository Branches

4

June 30, 2011 Financial Information

Total Assets ($000)

$209,223

Total Equity ($000)

$39,043

TCE / TA (%)

18.7%

Texas Ratio (%)

17.7%

NPAs / Assets (%)

3.58%

YTD Earnings ($000)

$509

Expansion into Attractive Markets

7

1st United

Old

Harbor

Anderen

Source: SNL Financial. Deposit data in thousands and as of 6/30/2011.

Winter Park branch

Deposits = $49,607

Palm Harbor branch

Deposits = $53,132

Clearwater branch

Deposits = $24,841

Tampa branch

Deposits = $41,224

Countryside branch

Deposits = $43,372

Belleair Bluffs branch

Deposits = $23,687

Clearwater branch

Deposits = $14,233

Palm Harbor branch

Deposits = $34,590

New Port Richey branch

Deposits = $24,087

Trinity branch

Deposits = $29,346

Dunedin branch

Deposits = $48,458

Anderen management team continuing with the combined

organization provides significant in-market resources to

successfully grow the Central Florida franchise.

Density of newly acquired branches provides the potential for

branch consolidation.

Extensive Due Diligence Performed

8

Comprehensive on-site credit review

Eight person 1st United evaluation team

91% of the loan portfolio reviewed, including all loans > $100,000 that were rated

substandard or worse

Majority of special mention loans reviewed

Loan mark based on conservative estimates of credit losses for both performing and

non-performing loans

Gross loss estimate of $6 million - $10 million which is approximately 2 – 3x

the level of Anderen’s loan loss reserve

1st United has extensive credit quality review experience

Substantial on-site and off-site due diligence review of all other operations and business

lines performed

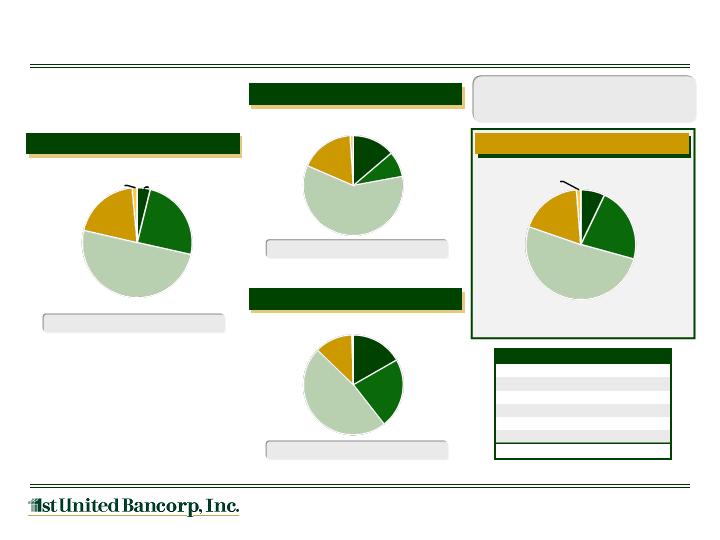

Pro Forma Loan Composition

9

1st United

Anderen Bank

Pro Forma Combined

Source: SNL Financial, Form 10-Q. FUBC loan composition as reported as of 9/30/11. Other loan data is regulatory data as of 6/30/11. The above assumes no acquisition-related fair value accounting adjustments.

Old Harbor Bank

Approximately 57% of the combined loan

portfolio will be subject to loss share or will have

been recently marked.

Construction

$30.3MM

Residential

$194.1MM

Comm. RE

$394.8MM

C&I

$156.6MM

Consumer

$11.8MM

Construction

$20.3MM

Residential

$12.3MM

Comm. RE

$87.4MM

C&I

$25.7MM

Consumer

$1.5MM

Construction

$27.2MM

Residential

$36.9MM

Comm. RE

$77.6MM

C&I

$20.1MM

Consumer

$0.7MM

Construction

$77.8MM

Residential

$243.3MM

Comm. RE

$559.8MM

C&I

$202.4MM

Consumer

$14.0MM

Pro Forma Loan Composition (%)

Construction

7.1%

Residential

22.2

Comm. RE

51.0

C&I

18.4

Consumer

1.3

Other

0.0

Total

100.0%

Total Loans & Leases ($MM)

$162.4

Total Loans & Leases ($MM)

$787.7

Total Loans & Leases ($MM)

$147.2

Total Loans & Leases ($MM)

$1,097.3

Pro Forma Combined

Pro Forma Deposit Composition

10

1st United

Anderen Bank

Old Harbor Bank

Source: SNL Financial, Company data. FUBC deposit composition as of 9/30/11. Other deposit data is regulatory data as of 6/30/11. The above assumes no acquisition-related accounting adjustments.

Demand

$316.4MM

NOW &

Other Trans.

$122.0MM

MMDA &

Savings

$323.5MM

Jumbo Time

$139.1MM

Retail Time

$104.4MM

Demand

$16.7MM

NOW &

Other Trans.

$3.5MM

MMDA &

Savings

$68.4MM

Jumbo Time

$64.2MM

Retail Time

$16.0MM

Total Deposits ($MM)

$1,005.4

Non-Interest Bearing Deposits (%)

31.47%

Total Deposits ($MM)

$168.8

Non-Interest Bearing Deposits (%)

9.91%

Demand

$10.4MM

NOW &

Other Trans.

$15.9MM

MMDA &

Savings

$67.1MM

Jumbo Time

$47.1MM

Retail Time

$77.3MM

Total Deposits ($MM)

$217.8

Non-Interest Bearing Deposits (%)

4.77%

Demand

$343.5MM

NOW &

Other Trans.

$141.4MM

MMDA &

Savings

$459.1MM

Jumbo Time

$250.4MM

Retail Time

$197.6MM

Total Deposits ($MM)

$1,392.0

Non-Interest Bearing Deposits (%)

24.68%

Pro Forma Deposit Composition (%)

Demand

24.7%

NOW & Other Trans.

10.2

MMDA & Savings

33.0

Jumbo Time

18.0

Retail Time

14.2

Total

100.0%

Pro Forma Financial Impact

11

Key Assumptions

Estimated cost saves of approximately 30% of Anderen’s non-interest

expense base, 75% phased in for 2012 and 100% thereafter

Gross loan mark expected to be between 4% - 7% of total loans

One-time deal-related charges of approximately $2 million

Core deposit intangible created of $600k

Anticipated to be immediately accretive to EPS (excluding one-time

charges)

Tangible book value earn-back estimated to be less than 3 years based on

the purchase price, expected loan mark along with the projected earnings

and synergies

Deploys excess capital in a value accretive manner

Strong pro forma capital (i.e. TCE/Assets ~11%) supports future growth

and franchise development

Opportunity for 1st United to leverage its excess liquidity

position to

reshape Anderen’s deposit mix and reduce the overall level of time

deposits

Financially

Attractive

Efficient Integration History

12

Transaction History

FUBC is an experienced acquiror and

integrator

Proven ability to extract cost savings

(1) Assets and deposits for Old Harbor based on 6/30/2011 reported information.

At Acquisition

Acquisition

Date

($ Millions)

Acquired Bank

Headquarters

Type

Announced

Integrated

Assets

Deposits

First Western Bank

Cooper City, FL

Whole Bank

4/04

7/04

$35.7

$26.7

Equitable Bank

Fort Lauderdale, FL

Whole Bank

2/08

5/08

222.2

136.0

Citrus Bank, N.A.

Vero Beach, FL

Divestiture

8/08

8/08

92.5

87.5

Republic Federal Bank, N.A.

Miami, FL

FDIC

12/09

5/10

296.7

350.0

The Bank of Miami, N.A.

Miami, FL

FDIC

12/10

4/11

378.3

254.5

Old Harbor Bank (1)

Clearwater, FL

FDIC

10/11

Pending

215.9

217.8

1st United Ranks 6th Among Public Florida-Based Institutions on Deposits

13

Top Public Institutions Headquartered in Florida Ranked by Total Deposits

(1)

Nonperforming assets are calculated as nonaccrual loans + OREO. Loans covered by FDIC loss share agreements are excluded. “Pro Forma Combined” NPAs/Assets are a preliminary

estimate. The actual level of pro forma

NPAs will be based on a fair value determination utilizing acquisition accounting principles and guidance.

Source: SNL Financial, Form 10-Q. Public institutions include those listed on the NYSE, NASDAQ, and OTCBB as well as pink-sheet companies. Florida deposit data as of 6/30/11. Market capitalization as of 10/18/11.

Total

FL Deposit

Market

Deposits

Market

Cap

NPAs/

Rank

Institution

(1)

($MM)

(1)

(1)

Share

(1)

(1)

($MM)

(1)

Assets

(1)

1

BankUnited Inc.

$7,380,426

1.72%

$1,974

1.59%

2

BankAtlantic Bancorp Inc.

3,442,825

0.85

32

8.55

3

Capital City Bank Group Inc.

2,114,450

0.44

178

4.73

4

CenterState Banks Inc.

1,992,994

0.49

167

4.05

5

Seacoast Banking Corp. of Florida

1,699,406

0.42

150

3.50

6

Pro Forma Combined

$1,457,496

0.35%

$171

2.16%

6

1st United Bancorp Inc.

$1,070,919

0.26%

$153

2.09%

7

Great Florida Bank

1,069,350

0.26

2

10.96

8

First Southern Bancorp Inc.

817,727

0.20

205

4.41

9

Stonegate Bank

654,676

0.17

113

2.60

10

Beach Community Bancshares Inc.

548,539

0.14

2

22.34

Old Harbor Bank

$217,773

0.05%

0

15.04%

Anderen Financial Inc.

$168,804

0.04%

NA

3.61%

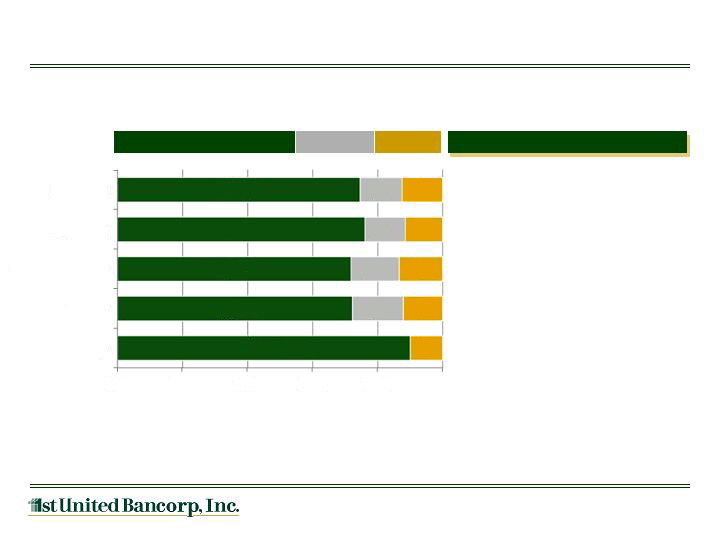

Pro Forma Balance Sheet

14

1st United

Anderen

Combined Company ($MM) (1)

Total Assets:

$1,672.9

Cash & Securities:

$414.6

Total Loans & Leases:

$1,097.3

Deposits:

$1,392.0

Tang Common Equity: (2)

$184.9

Source: SNL Financial and Company data (Company information as of 9/30/2011, remaining information as of 6/30/2011)

(1)

Combined company financial data excludes the impact of acquisition-related accounting adjustments.

(2)

Tangible common equity displayed for Anderen represents the stock portion of the transaction consideration (i.e. 50%).

Old

Harbor

Tang Common Equity

Deposits

Total Loans & Leases

Cash & Securities

Total Assets

0%

20%

40%

60%

80%

100%

$166

$1,005

$788

$315

$1,248

$218

$162

$52

$216

$19

$169

$147

$48

$209

15

Executing on Growth

10/1/07 – Announced the

merger with Equitable

Financial Group, which had

approximately $180 million

in

assets and 5 branches in

Broward and Miami-Dade

Counties. Filled out base

franchise in Broward and

provided an entry point into

Miami-Dade.

2/27/08 – Announced the

acquisition of the banking center

network (6 branches, 3 retained),

substantially

all the deposits ($88

million), and much of the loan

portfolio ($38 million) of Citrus

Bank, N.A. in a P&A transaction.

5/5/08 – Sold $6.6 million of

preferred stock in a private

offering. Also raised $10.4

million

through a Rights

Offering of common stock.

3/13/09 – Issued and sold $10

million of preferred stock to

Treasury as part of the TARP

program; redeemed

TARP

preferred on 11/18/09.

12/11/09 – Acquired

Republic Federal

Bank, N.A. through a

FDIC-assisted

transaction ($297

million

in assets, $350

million in deposits).

12/17/10 – Acquired

The Bank of Miami,

N.A. through a FDIC-

assisted transaction

($378 million in assets,

$255 million in

deposits).

9/23/09 – Raised

$80.5 million

through an initial

public offering of

common stock.

2007

2008

2009

2010

2011

3/22/11 – Raised

$37.4 million

through a follow-

on common stock

offering

10/24/11 – Announced

the acquisition of Palm

Harbor, Fla.-based

Anderen Financial, Inc.

($209 million

in

assets).

10/21/11 – Acquired Old

Harbor Bank through an

FDIC-assisted transaction

(approximately $210

million of

assets

purchased; $213 million of

deposits assumed).

December 31, 2006

$332 million in assets

6 branches

September 30, 2011

$1.7 Billion in assets

26 branches

(1)

(1)

Information pro forma for Anderen and Old Harbor.

Summary

16

Attractive transaction economics

Meaningfully accretive to EPS in the first full year

Earn-back of tangible book value dilution within 3 years

Substantial expense efficiencies identified

Although not modeled, significant revenue synergy opportunities exist

Opportunity to lower funding costs to 1st United levels

Effective capital deployment

Proven track record of seamless integrations and realization of efficiencies

Strong pro forma capital and liquidity levels retain 1st United’s strategic flexibility

Strengthens the Company’s growth prospects and franchise development momentum

Enhances recently acquired footprint in Tampa and marks entry into the attractive

Orlando market

Provides platform for increased market share in Central Florida

Transaction will add to the depth of talent in the combined company’s management team

and board of directors