Attached files

| file | filename |

|---|---|

| 8-K - 1st United Bancorp, Inc. | i00456_fubc-8k.htm |

| EX-2.1 - 1st United Bancorp, Inc. | i00456_ex2-1.htm |

| EX-2.2 - 1st United Bancorp, Inc. | i00456_ex2-2.htm |

| EX-99.3 - 1st United Bancorp, Inc. | i00456_ex99-3.htm |

| EX-99.1 - 1st United Bancorp, Inc. | i00456_ex99-1.htm |

Nasdaq: FUBC

Purchase and Assumption of Old Harbor

Bank of Florida from the FDIC

October 21, 2011

Forward-Looking Statements

2

This presentation includes forward-looking statements, including statements about future results. These statements

are subject to uncertainties and risks, including but not limited to legislative

or regulatory changes, including the Dodd-

Frank Act; the strength of the United States economy in general and the strength of the local economies in which we

conduct operations; the accuracy of our financial statement estimates and assumptions, including

the estimate for our

loan loss provision; the frequency and magnitude of foreclosure of our loans; our customers’ willingness to make timely

payments on their loans; our ability to comply with the terms of the loss sharing agreements with the FDIC;

our ability

to integrate the business and operations of companies and banks that we have acquired, and those we may acquire in

the future; the effects of the health and soundness of other financial institutions, including the FDIC’s need to increase

Deposit Insurance Fund assessments; the failure to achieve expected gains, revenue growth, and/or expense savings

from future acquisitions; our ability to declare and pay dividends; changes in the securities and real estate markets

changes in monetary

and fiscal policies of the U.S. Government; inflation, interest rate, market and monetary

fluctuations; the effects of our lack of a diversified loan portfolio, including the risks of geographic and industry

concentrations; our need and our ability

to incur additional debt or equity financing; the effects of harsh weather

conditions, including hurricanes, and man-made disasters; our ability to comply with the extensive laws and regulations

to which we are subject; the willingness of clients to

accept third-party products and services rather than our products

and services and vice versa; increased competition and its effect on pricing, including the impact on our non interest

margin from the repeal of Regulation Q; technological changes; negative

publicity and the impact on our reputation; the

effects of security breaches and computer viruses that may affect our computer systems; changes in consumer

spending and saving habits; growth and profitability of our noninterest income; changes in accounting

principles,

policies, practices or guidelines; the limited trading activity of our common stock; the concentration of ownership of our

common stock; anti-takeover provisions under federal and state law as well as our Articles of Incorporation and our

Bylaws; other risks described from time to time in our filings with the Securities and Exchange Commission; and our

ability to manage the risks involved in the foregoing. These factors, as well as additional factors, can be found in our

periodic

and other filings with the SEC, which are available at the SEC’s internet site (http://www.sec.gov). Actual

results may differ materially from projections and could be affected by a variety of factors, including factors beyond our

control. Forward-looking

statements in this presentation speak only as of the date of these materials, and we assume

no obligation to update forward-looking statements or the reasons why actual results could differ.

Transaction Overview

3

1st United has purchased and assumed substantially all

of the assets and liabilities from the

FDIC as receiver of Old Harbor Bank of Florida (“Old Harbor”) – Clearwater, Florida

Transaction includes substantially all of the assets

1st United will receive additional indemnifications from the FDIC

Depositors of Old Harbor have become depositors of 1st United and continue to have FDIC

insurance coverage on their deposits

FDIC whole bank acquisition with loss sharing

Purchased assets of approximately $210 million

Includes approximately $154.3 million of loans and $1.3 million of Other Real Estate covered by FDIC

loss share protection. Approximately $32 million of the acquired loans were classified

as non-

performing by Old Harbor

Remaining assets consist primarily of cash and securities, all transferred at fair market values

Assumption of approximately $213 million of total deposits (of which none are wholesale

deposits)

Loss share agreement covers all purchased loans

70% of losses covered by FDIC up to first $49 million

All regulatory approvals have been received and the transaction has closed

Stifel Nicolaus served as financial advisor and Smith MacKinnon, P.A. as legal counsel to

1st

United in connection with this transaction

Strategic Rationale

4

FDIC assisted whole bank acquisition with loss sharing

Accelerates strategic growth aspirations

1st United’s franchise is enhanced with our entrance into one of Florida’s largest banking market

Provides a platform for growth in a legacy market

Financially compelling for shareholders

Increased scale provides additional operating leverage that will further improve profitability

Transaction accomplished without significant dilution to existing shareholders by leveraging

approximately $20 million of existing equity capital

1st United’s significant liquidity prior to the deal used to redeem higher cost wholesale deposits

Expect transaction to provide a modest initial goodwill, and following integration, expect the

transaction to show on-going accretion

Cost savings are expected to be significant

Creation of a $1.4 billion balance sheet in a risk averse manner due to loss sharing support from

the FDIC

Loss sharing and asset purchase discount limit the downside risk of transaction

Leverages expertise in administering loss share agreements

Transaction Structure

5

$8.5 million discount on assets acquired

0% premium on assumed deposits

$154.3 million of covered loans ($128.3mm commercial / $26mm

residential loans)

FDIC assumes 70% of up to first $49 million of losses

Included in loan balance is approximately $32 million of non performing

loans

Approximately $1.3 million in ORE covered by loss share

Cash (at book value), securities (at fair market value) and other tangible

assets acquired at fair value

90-day option to purchase property & equipment and assume leases

Branches will be reviewed for long-term strategic fit

Discount /

Premium

Loss Share

Agreement

Other Assets

Asset Discount = ($8.5) million

Deposit Premium = $ 0.0 million

Net Bid = ($8.5) million

Loss Exposure Risk Mitigation

6

FDIC loss sharing agreement in conjunction with 1st

United’s bid

substantially reduces the adverse financial impact of the credit risk

associated with acquired assets

Approximately 49% of 1st United loan portfolio after

this acquisition is

covered under FDIC loss share agreements

Preliminary Estimate of Accounting Impact

7

Anticipate a potential goodwill amount under FASB ASC Topic 805

(formerly FAS 141R) as the acquisition date fair value of the assets acquired

is anticipated to be less than the liabilities

assumed. The goodwill amount is

estimated at $4 - $10 million and will result in a slight dilution to book value

per share.

Acquired approximately $122 million in higher cost time deposits and

anticipate using

1st United’s

existing liquidity to substantially reduce this

balance. Remaining deposits of approximately $102 million appear to be

core deposits

with a good mix.

Pro forma leverage ratio estimated at approximately 11.5%

Above amounts subject to change as precise amount of goodwill is

dependent on completion of final appraisals and mark-to-market valuations

of the assets and liabilities.

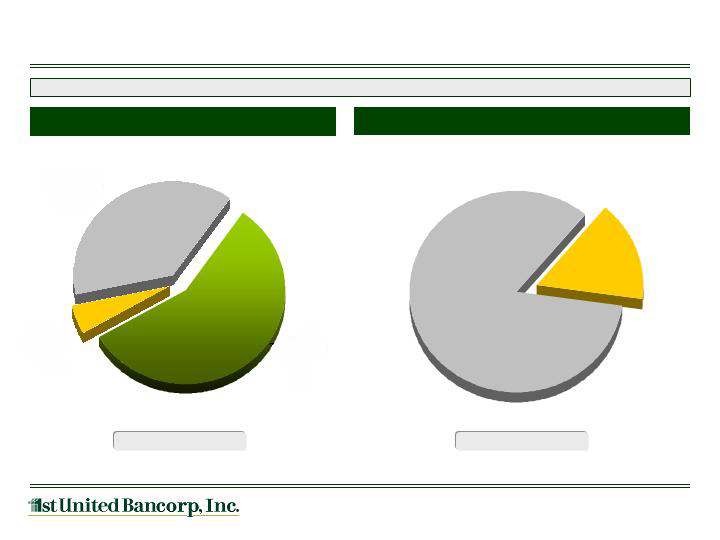

8

Deposits

Interest Bearing

Transaction

38%

Non Interest

Bearing

5%

Time Deposits

57%

Loan Portfolio

Composition of Acquired Loans & Assumed Deposits

Increases 1st United’s loans to deposits ratio from 79% to approximately 90%

Cost of Funds = 1.20%

Yield on Loans = 4.8%

Note: Information displayed above is estimated based on information received from the FDIC and 1st United estimates.

Commercial

84%

Consumer and

Residential

16%

9

Pro Forma Branch Map

1st United

Former Old

Harbor

1st United Branch Offices

Combined Branch Footprint

Former Old Harbor Branch Offices

Branch

Address

City, State, Zip

Belleair Bluffs

715 N Indian Rocks Rd.

Belleair Bluffs, FL 33770

Countryside

2605 Enterprise Rd. E

Clearwater, FL 33759

Clearwater

2201 Drew St.

Clearwater, FL 33765

Dunedin

1352 Main St.

Dunedin, FL 34698

New Port Richey

5138 Deer Park Dr.

New Port Richey, FL 34653

Palm Harbor

32700 US Hwy. 19 N

Palm Harbor, FL 34684

Trinity

9040 Tryfon Blvd.

Trinity, FL 34655

Branch

Address

City, State, Zip

Headquarters & Main Office

One N Federal Hwy.

Boca Raton, FL 33432

Barefoot Bay

1020 Buttonwood St.

Barefoot Bay, FL 32976

Brickell

1001 Brickell Bay Dr.

Miami, FL 33131

Cooper City

5854 S Flamingo Rd.

Cooper City, FL 33330

Coral Bridge

2800 E Oakland Park Blvd.

Fort Lauderdale, FL 33306

Coral Springs

2855 N University Dr.

Coral Springs, FL 33065

Coral Way

2159 Coral Way

Miami, FL 33145

Doral

8484 NW 36th St.

Doral, FL 33166

Fort Lauderdale Downtown

633 S Federal Hwy

Fort Lauderdale, FL 33301

North Miami Beach

15801 Biscayne Blvd.

North Miami Beach, FL 33160

North Palm Beach

741 US Hwy. 1

North Palm Beach, FL 33408

Palm Beach

335 S County Rd.

Palm Beach, FL 33480

Sebastian

1020 US Hwy. 1

Sebastian, FL 32958

Vero Beach

1717 Indian River Blvd.

Vero Beach, FL 32960

West Palm Beach

307 Evernia St.

West Palm Beach, FL 33401

Integration Plan

10

Management team has a history of successfully completing and integrating M&A

transactions having accomplished 35 bank M&A transactions on a combined basis

Depositors in all Old Harbor branches have access to their funds (no interruption of service)

Early 2012 conversion to 1st United’s IT platform

Branches will be integrated into 1st United’s existing banking network and reviewed for

long-term strategic fit (30 day option to decide)

Branches will be locally managed by 1st United and Old Harbor’s team of experienced

bankers with centralized support

A current Market Executive of 1st United will be relocated in market to aid in integration

1st United will leverage Old Harbor’s experienced banking professionals to first integrate the

customers and second to sell

1st United’s broad array of banking products and services to Old

Harbor’s customer base

Continuing to leverage our Loss Share Department experience to manage FDIC loss share

compliance

Integration will be seamless to Old Harbor customers and is already underway

Transaction Merits

11

Major growth catalyst

Pro forma balance sheet remains fortified with robust capital ratios well in excess

of “well-capitalized” thresholds

Expands franchise in legacy market with significant market share opportunity

Strong pro forma liquidity and capital builds customer confidence and enables

1st

United to pursue additional balance sheet growth

Approximately 49% of 1st United’s loan portfolio subject to loss share

Leverage 1st United’s strong liquidity position