Attached files

| file | filename |

|---|---|

| EX-32.1 - EXHIBIT 32.1 - BEFUT International Co., Ltd. | v235159_ex32-1.htm |

| EX-31.1 - EXHIBIT 31.1 - BEFUT International Co., Ltd. | v235159_ex31-1.htm |

| EX-31.2 - EXHIBIT 31.2 - BEFUT International Co., Ltd. | v235159_ex31-2.htm |

| EX-32.2 - EXHIBIT 32.2 - BEFUT International Co., Ltd. | v235159_ex32-2.htm |

| EX-14.1 - EXHIBIT 14.1 - BEFUT International Co., Ltd. | v235159_ex14-1.htm |

| EX-21.1 - EXHIBIT 21.1 - BEFUT International Co., Ltd. | v235159_ex21-1.htm |

| EX-10.12 - EXHIBIT 10.12 - BEFUT International Co., Ltd. | v235159_ex10-12.htm |

| EX-10.13 - EXHIBIT 10.13 - BEFUT International Co., Ltd. | v235159_ex10-13.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 10-K

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended June 30, 2011

or

¨ TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _________ to _____________

Commission file number: 000-51336

BEFUT International Co., Ltd.

(Exact name of registrant as specified in its charter)

|

Nevada

|

20-2777600

|

|

|

(State or other jurisdiction of

incorporation or organization)

|

(IRS Employer Identification No.)

|

|

27th Floor, Liangjiu International Tower

5 Heyi Street

Dalian City, 116011

P. R. China

|

(Address of Principal Executive Offices) (Zip Code)

Registrant’s telephone number: (011)-86-411-83678755

Securities registered pursuant to Section 12(b) of the Act: None.

Securities registered pursuant to Section 12(g) of the Act: Common Stock, Par Value $0.001 Per Share

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such report(s)), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ¨ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer ¨

|

Accelerated filer ¨

|

|

Non-accelerated filer ¨

Do not check if a smaller reporting company

|

Smaller reporting company x

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

The aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter: $1,875,205.46 as of December 31, 2010, based on the average bid and asked price $1.05 of the Company’s common stock on such date as reported by the Over-the-Counter Bulletin Board. Shares of voting stock held by each executive officer and director of the registrant and each person who beneficially owns 10% or more of the registrant’s outstanding voting stock has been excluded from the calculation. This determination of affiliated status may not be conclusive for other purposes.

The number of outstanding shares of the registrant’s common stock on September 19, 2011 was 29,715,640.

Documents Incorporated by Reference: None.

FORM 10-K ANNUAL REPORT

FISCAL YEAR ENDED JUNE 30, 2011

TABLE OF CONTENTS

|

PAGE

|

||||

|

PART I

|

|

|||

|

Item 1.

|

Business.

|

2

|

||

|

Item 1A.

|

Risk Factors.

|

21

|

||

|

Item 1B.

|

Unresolved Staff Comments.

|

37

|

||

|

Item 2.

|

Properties.

|

37

|

||

|

Item 3.

|

Legal Proceedings.

|

41

|

||

|

Item 4.

|

(Removed and Reserved).

|

41

|

||

|

PART II

|

||||

|

Item 5.

|

Market for the Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

|

41

|

||

|

Item 6.

|

Selected Financial Data.

|

43

|

||

|

Item 7.

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations.

|

44

|

||

|

Item 7A.

|

Quantitative and Qualitative Disclosures About Market Risk.

|

54

|

||

|

Item 8.

|

Financial Statements and Supplementary Data.

|

54

|

||

|

Item 9.

|

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure.

|

54

|

||

|

Item 9A.

|

Controls and Procedures.

|

55

|

||

|

Item 9B.

|

Other Information.

|

57 | ||

|

PART III

|

||||

|

Item 10.

|

Directors, Executive Officers and Corporate Governance.

|

57

|

||

|

Item 11.

|

Executive Compensation.

|

59

|

||

|

Item 12.

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholders Matters.

|

60

|

||

|

Item 13.

|

Certain Relationships and Related Transactions, and Director Independence.

|

62

|

||

|

Item 14.

|

Principal Accountant Fees and Services.

|

62

|

||

|

PART IV

|

||||

|

Item 15.

|

Exhibits, Financial Statement Schedules.

|

63

|

||

|

SIGNATURES

|

64 | |||

|

EXHIBIT INDEX

|

65 | |||

|

FINANCIAL STATEMENTS

|

F-1

|

|||

FORWARD-LOOKING STATEMENTS

Certain statements in this report, and the documents incorporated by reference herein, constitute “forward-looking statements.” Such forward-looking statements include statements, which involve risks and uncertainties, regarding, among other things, (a) our projected sales, profitability, and cash flows, (b) our growth strategies, (c) anticipated trends in our industries, (d) our future financing plans, and (e) our anticipated needs for, and use of, working capital. They are generally identifiable by use of the words “may,” “will,” “should,” “anticipate,” “estimate,” “plan,” “potential,” “project,” “continuing,” “ongoing,” “expects,” “management believes,” “we believe,” “we intend,” or the negative of these words or other variations on these words or comparable terminology. These statements may be found under “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Business,” as well as in this report generally. Actual events or results may differ materially from those discussed in forward-looking statements as a result of various factors and matters described in this report generally. In light of these risks and uncertainties, there can be no assurance that the forward-looking statements contained in this filing will in fact occur. You should not place undue reliance on these forward-looking statements.

The forward-looking statements speak only as of the date on which they are made, and, except to the extent required by federal securities laws, we undertake no obligation to update any forward-looking statement to reflect events or circumstances after the date on which the statement is made or to reflect the occurrence of unanticipated events except to the extent as required by applicable law.

Unless otherwise noted, all currency figures in this filing are in U.S. dollars. References to "yuan" or "RMB" are to the Chinese yuan (also known as the renminbi). According to www.safe.gov.cn, the official website of the PRC State Administration of Foreign Exchange, as of June 30, 2011, US $1.00 = RMB 6.4716.

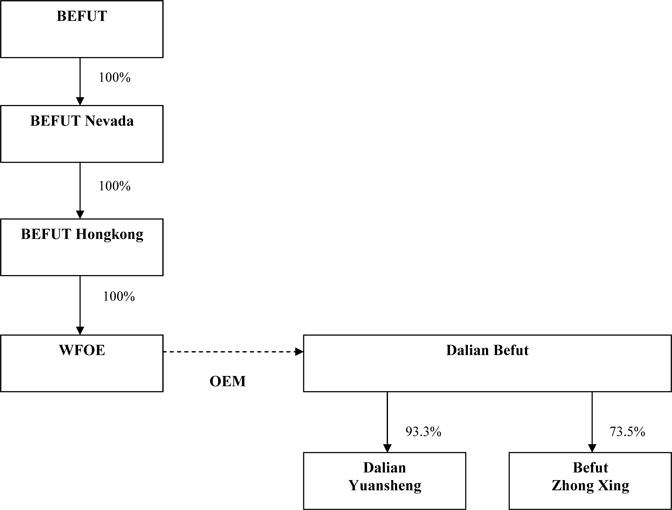

The "Company", "we," "us," "our," and the "Registrant" refer to (i) BEFUT International Co., Ltd., the public company incorporated in the state of Nevada (“BEFUT”), (ii) BEFUT Corporation, the direct subsidiary of BEFUT, a corporation incorporated in the State of Nevada (“Befut Nevada”); (iii) Hongkong BEFUT Co., Ltd. (“Befut Hongkong”), a wholly-owned subsidiary of Befut Nevada incorporated under the laws of Hong Kong; (iv) Befut Electric (Dalian), Co., Ltd. (“WFOE”), a corporation organized under the laws of the People’s Republic of China (the “PRC”) that is wholly owned by Befut Hongkong; (v) Dalian Befut Wire & Cable Manufacturing Co., Ltd. (“Dalian Befut”), a corporation organized under the laws of the PRC which is the captive manufacturing company to WFOE; (vi) Dalian Marine Cable Co., Ltd., a corporation organized under the laws of the PRC which was 86.6% owned by Dalian Befut as of February 25, 2011 (“Befut Marine”); (vii) Dalian Befut Zhong Xing Switch Co., Ltd (“Befut Zhong Xing”), a corporation organized under the laws of the PRC which is 73.5% owned by Dalian Befut, and (viii) Dalian Yuansheng Technology Co., Ltd. (“Dalian Yuansheng”), a corporation organized under the laws of the PRC which is 93.3% owned by Dalian Befut.

1

PART I

ITEM 1. BUSINESS

Overview

We believe that we are one of the most competitive manufacturers of specialty cable products in northeastern China. Our cable products consist of (i) traditional electric power system cable and (ii) an assortment of specialty cable, including marine cable, mining specialty cable and, petrochemical cable. We also have developed the capability to produce other types of specialty cable such as carbon fiber composite cable, submarine cable and certain “new energy” cable, including cable for wind and solar energy. Our traditional cable products are primarily focused on serving end-user applications in the construction, electrical utility, and transportation (including automotive) markets. Our specialty cable products are used primarily in ship building, nuclear power plants, mining and petrochemical operations. We also have the technical capability for large-scale production of marine cable for use in electronic conveyance, controls and lighting on a variety of ships, a segment of the market with significantly higher profit margin potential that we intend to further pursue. Additionally, we recently began developing and producing switch appliances, including high and low voltage distribution cabinet switches and crane electronic control switches, which products compliment our cable product offerings.

We are headquartered in the city of Dalian, a large trading and financial center in northeastern China located at the tip of China’s Liaodong Peninsula. Our sales and marketing activities are conducted through our 14 branch offices located throughout China. Currently, our products are sold through our sales force to over 500 Chinese customers.

We are in the process of constructing a new manufacturing facility located in Dalian’s Changxing Island Harbor Industrial Zone. In December 2009, we completed Phase I of this project (the “Phase I Changxing Facility”) which consists of 45,477 square meters of floor space with a maximum production capacity of approximately 4,000 km of cable per year. This facility commenced production in April 2010 and currently has a production capacity of 2,400 km of cable per year. We estimate that Phase II of this project (the “Phase II Changxing Facility”) will add 89,684 square meters of additional floor space with a maximum production capacity of approximately 6,667 km of cable per year.

We also have a high-quality customer base of companies, including Shougang Group, China Huaneng Group, China National Petroleum Corporation, China Shipbuilding Industry Corporation, and China Ocean Shipping (Group) Company, which enables us to maintain and strengthen our competitive position in the wire and cable industry.

Corporate History and Structure

We are a holding company and conduct substantially all of our production, marketing, finance, research and development, and administrative activities through our indirect subsidiaries and captive manufacturing entity located in the PRC. On May 2, 2005, we were incorporated in the State of Nevada under the name “Frezer, Inc.” which was a former public shell company as defined in Rule 12b-2 of the Securities Exchange Act of 1934, as amended.

On March 13, 2009, we entered into a Share Exchange Agreement with Befut Nevada and Befut International Co. Limited, a British Virgin Islands company (“Befut BVI”) pursuant to which Befut BVI transferred to us all of the outstanding shares of common stock of Befut Nevada in exchange for (i) the issuance to Befut BVI of an aggregate of 117,768,300 or 98.3% of our then outstanding shares of common stock, and (ii) the cancellation of an aggregate of 2,176,170 shares of our common stock then owned by Befut Nevada (the “Share Exchange”). Befut Nevada had acquired such shares from three individuals for an aggregate purchase price of $370,000 pursuant to the terms of a Stock Purchase Agreement dated as of March 2, 2009.

Simultaneously with the Share Exchange, the Company consummated a private placement of 15% convertible promissory notes and warrants to purchase an aggregate of 720,076 shares of our common stock for gross proceeds of $500,000. As of the date of this report, such convertible notes are no longer outstanding.

2

On June 18, 2009, we changed our name to “BEFUT International Co., Ltd.” and effectuated a 1-for-4.07 reverse stock split of our outstanding shares of common stock. As a result, our ticker symbol was changed to BFTI.OB. Befut BVI is our largest shareholder and currently owns approximately 46.9% of the issued and outstanding common stock of the Company.

Befut Hongkong was incorporated on September 10, 2008 under the laws of Hong Kong and is a wholly-owned subsidiary of Befut Nevada. On February 13, 2009, Befut Hongkong invested 100% of the registered capital to form WFOE, a Chinese company incorporated in the city of Dalian, the People’s Republic of China (the “PRC” or “China”).

We conduct our operations through WFOE and Dalian Befut, a captive manufacturing entity of WFOE. Dalian Befut was incorporated on June 13, 2002 under the laws of the PRC, and is currently owned by eight individual residents of the PRC. Mr. Hongbo Cao, our chairman, president and chief executive officer, and Mr. Tingmin Li are the largest shareholders of Dalian Befut, owning an aggregate of 94.6% of its equity interests. For a discussion of our contractual manufacturing relationship with Dalian Befut, see the section entitled “Business – Manufacturing Process – OEM Agreements.”

Befut Marine, incorporated on April 14, 2006, was previously a direct subsidiary of Dalian Befut. On February 25, 2011, Dalian Befut sold its entire 86.6% equity interest in Befut Marine, to Mr. Fansheng Li, a noncontrolling shareholder of Befut Marine, for RMB 17,320,000 (approximately $2.67 million) in cash. Befut Marine previously conducted all of our production and sales of marine cable. Dalian Befut, as the captive manufacturer for WFOE, will manufacture marine cable for the Company in accordance with the OEM Agreements (defined below).

On July 1, 2009, Dalian Befut formed Befut Zhong Xing, a joint venture under the laws of the PRC, by investing approximately $100,000 (RMB700,000) for its 70% equity interest in Befut Zhong Xing. In July 2010 , Dalian Befut increased its equity interests in Befut Zhong Xing from 70% to 73.5% by contributing RMB 14 million ($2.06 million) to the registered capital of Befut Zhong Xing. The other shareholder is Mr. Chengnian Yan who owns 26.5% of equity interest in Befut Zhong Xing. Befut Zhong Xing manufactures switch appliances, including high-low-voltage distribution cabinet switches and crane electronic control switches.

On July 23, 2010, Dalian Befut acquired 60% of equity interests of Dalian Yuansheng for $88,235 (the registered capital value of such equity interests) from Mr. Chengnian Yan. Dalian Befut also increased the Dalian Yuansheng’s registered capital by RMB 5 million ($735,294), thereby increasing Dalian Befut’s total equity interest to 93.3%. The other shareholder is Mr. Xianjun Cheng who owns 6.7% of equity interest in Dalian Yuansheng. Dalian Yuansheng is engaged in the research and development of carbon fiber composite cable and other specialty cable. One of the principal shareholders of Dalian Yuansheng holds a patent for carbon fiber composite cable which will be transferred to Dalian Yuansheng.

3

Our corporate organizational chart is set forth below:

* WFOE does not have equity ownership in Dalian Befut. Dalian Befut is a captive manufacturer of WFOE pursuant to the OEM Agreements described below.

Recent Developments

On February 25, 2011, Dalian Befut sold its entire 86.6% equity interest in Befut Marine, a company engaged in the marketing and production of marine cables to Mr. Fansheng Li, a noncontrolling shareholder of Befut Marine, for RMB 17,320,000 (approximately $2.67 million) in cash. As part of the transaction, the applicable certifications required for producing marine cables that were held by Befut Marine were transferred to WFOE. Dalian Befut, as the captive manufacturer for WFOE, will manufacture marine cable for the Company in accordance with the Manufacturing Agreement. As a result, the Company has determined that Dalian Befut’s sale of its entire equity interest in Befut Marine does not have any material adverse effect on the Company’s operation, business and financial position.

4

In April, 2011, we began construction on the Phase II Changxing Facility. We estimate that the Phase II Changxing Facility will add 89,684 square meters of additional floor space with a maximum production capacity of approximately 6,667 km of cable per year. We believe we have the customer base, technological, manufacturing and research and development capabilities to take advantage of the growing cable and wire market to produce high levels of sales and profits over the next few years.

Our Products

Our products are categorized into three types: traditional cable, specialty cable and switch appliances. The following table provides information about our principal products:

|

Products

|

Features

|

Applications

|

||

|

Traditional Cable

|

||||

|

Electric Cable

|

Thermo-mechanical, electrical and anti-corrosion

|

Used in the telecommunications industry, auto industry, metal refining industry, electrical and petrochemical industry, transportation industry (including electrified railway and urban rail transportation) and construction industry.

|

||

|

Specialty Cable

|

||||

|

Marine Cable

|

Anti-erosion, anti-stretch and long-life

|

Used in various capacities in the shipping industry, including the construction of ships, on-water oil platforms and coastal marine projects. It is also capable of meeting other needs on a ship, including power transmission, signal transmission of lighting and information processing equipment, and control systems.

|

||

|

Mine Specialty Cable

|

Temperature resistant, corrosion protection, soft, low-temperature resistant

|

Used by mining companies.

|

||

|

Petrochemical Cable

|

Corrosion protection, long-life, high stretch resistance feature

|

Used in the petrochemical industry and in offshore construction.

|

||

|

Other Specialty Cable

|

High-temperature resistant, low-temperature resistant, hard-wear, acid-bases resistant, age-resistant, long-life

|

Used in steelwork and at iron ore yards.

|

||

|

Switch Appliances

|

||||

|

High-low-voltage distribution cabinet switch

|

Power grids under 20KV

|

Used between transformer room and production workshop.

|

||

|

Crane electronic control switch

|

Easy to operate, convenient to maintain, and reliable

|

Used on various cranes.

|

5

We believe that the specialty cable sector is one of the most profitable sectors in the wire and cable industry with significantly higher gross margins of up to 60%. Specialty cable is typically produced for specific uses in harsh conditions that are unsuitable for other traditional cable.

With the completion of the Phase I Changxing Facility, we plan to enhance the development of marine cable (one of our specialty cable products), including submerged cable used to transfer data and telecommunications and marine cable used in shipbuilding. We have recently begun to develop carbon fiber composite cable, which is a new type of cable composed of carbon fiber and a metallic conductor. Carbon fiber is one of the most advanced cable products in China and has the potential for higher gross margins than other types of specialty cable. Carbon fiber composite cable is lighter than pure metal cable and has better electrical conductivity. We believe it can be useful in upgrading China’s power grid. We also believe the use of carbon fiber composite cable could alleviate the pressure on cables caused by natural disasters, including heavy snowfall. We are one of the few manufacturers in China producing carbon fiber composite cable. With this new technology, we expect that carbon fiber composite cable will be one of our primary areas of our focus for growth in the next few years. Additionally, we are developing cable for “new energy” sources such as wind and solar energy, which we believe will also be cable products with high-margin potential.

Dalian Befut, together with its two subsidiaries, Dalian Yuansheng and Befut Zhong Xing, currently hold 17 patents and have 47 pending patent applications with respect to our cable products, and we are the only company in the PRC cable and wire industry holding a patent for watertight cable. The patent for carbon fiber composite cable is owned by Dalian Yuansheng, Dalian Befut’s recently acquired subsidiary.

The following table shows the sales of our products in our three main categories (traditional cable, specialty cable and switch appliances) as a percentage of total sales for the fiscal years ended June 30, 2011, 2010 and 2009:

|

Percentage of Total Sales for Fiscal Years Ended June 30,

|

||||||||||||||||||||||||

|

Products

|

2011

|

2010

|

2009

|

|||||||||||||||||||||

|

USD

|

Percentage

|

USD

|

Percentage

|

USD

|

Percentage

|

|||||||||||||||||||

|

Traditional Cable

|

23,998,683 | 43.16 | % | 12,938,647 | 41.39 | % | 10,581,298.57 | 54.8 | % | |||||||||||||||

|

Specialty Cable

|

||||||||||||||||||||||||

|

Marine Cable

|

9,091,051 | 16.35 | % | 6,589,038 | 21.08 | % | 1,274,389.97 | 6.6 | % | |||||||||||||||

|

Petrochemical Cable

|

11,160,457 | 20.07 | % | 5,133,764 | 16.42 | % | 1,409,552.55 | 7.3 | % | |||||||||||||||

|

Mine Specialty Cable

|

9,188,496 | 16.53 | % | 5,862,434 | 18.75 | % | 3,784,552.04 | 19.6 | % | |||||||||||||||

|

Total Specialty Cable

|

29,440,004 | 52.95 | % | 17,585,236 | 56.25 | % | 6,468,494.56 | 33.5 | % | |||||||||||||||

|

Other Cable

|

N/A | N/A | N/A | N/A | % | 2,259,145.87 | 11.7 | % | ||||||||||||||||

|

Switch Appliances

|

2,159,225 | 3.89 | % | 734,778 | 2.35 | N/A | N/A | |||||||||||||||||

|

Total

|

55,597,912.00 | 100 | % | 31,258,662.00 | 100 | % | 19,308,939.00 | 100 | % | |||||||||||||||

6

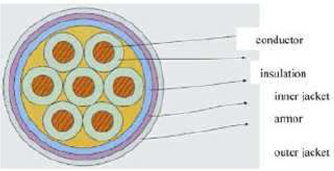

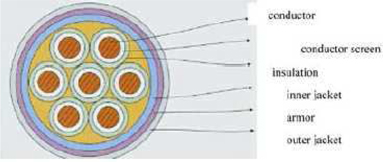

The following pictures illustrate the physical structure of our traditional cable and marine cable:

Traditional Cable

Marine Cable

Manufacturing

OEM Agreements

We conduct substantially all of our operations through, and generate substantially all of our revenues from Dalian Befut, pursuant to an Original Equipment Manufacturer Agreement, dated February 16, 2009 (the "Manufacturing Agreement") with Dalian Befut, pursuant to which (i) Dalian Befut is the exclusive manufacturer of cable and wire products for WFOE, and may not manufacture products for any other third party without the written consent of WFOE; (ii) WFOE provides all the raw materials and advance related costs to Dalian Befut, as well as provides the design requirements of the products to be manufactured; and (iii) in no event may Dalian Befut use the arrangements under the Manufacturing Agreement for commercial or noncommercial marketing or promotional activities in any form. In addition, on February 16, 2009, WFOE and Dalian Befut entered into (i) an Intellectual Property License Agreement, pursuant to which WFOE shall be permitted to use the intellectual property rights such as trademark, patents and knowhow for the marketing and sale of the products (the “IP Agreement”); and (ii) a Non-competition Agreement, pursuant to which Dalian Befut shall not compete against WFOE (the “Non compete Agreement”, together with the IP Agreement and Manufacturing Agreement, collectively, the “OEM Agreements”). We have no direct ownership interest in Dalian Befut nor do we have voting control of any shares of Dalian Befut. As a result, these OEM Agreements may not be as effective in providing us with control over Dalian Befut as direct ownership of Dalian Befut would be. For example, Dalian Befut may breach the OEM Agreements by deciding not to manufacture products for WFOE, and consequently the Company. In the event of any such breach, we would have to rely on legal remedies under PRC law, which may not always be available or effective to enforce our rights, particularly in light of uncertainties in the PRC legal system. To mitigate such a risk, WFOE has the exclusive right under the OEM Agreements, exercisable in its sole discretion, to purchase all or part of the assets and/or equity of Dalian Befut.

7

All cash flows generated under the OEM Agreements are maintained in the custody of Dalian Befut instead of in the custody of the Company. There are no prohibitions under applicable PRC law on the transfer of cash from Dalian Befut to WFOE. Accordingly, except for the relevant PRC laws, regulations and government policies on capital outflow, no risks exist as to the movement of cash balances from the Company’s PRC operating subsidiaries or Dalian Befut up to the Company. Transfer of cash may be made from Dalian Befut to WFOE and up to the Company, when necessary to meet the Company’s cash requirements, including, for example, to satisfy any debt obligations or make cash dividends. Such transfers must be made in compliance with applicable PRC laws regarding, among other things, currency controls, tax and payment of dividends.

Changxing Island Manufacturing Facilities

We are in the process of constructing a new manufacturing facility located in Dalian’s Changxing Island Harbor Industrial Zone, which is located approximately 120 kilometers from Dalian. Construction of the Phase I Changxing Facility began in 2006 and was completed in December 2009. We relocated all of our cable manufacturing operations to the Phase I Changxing Facility and commenced operations and product manufacturing at this facility in April 2010. The Phase I Changxing Facility boasts 45,477 square meters of floor space, consisting of 24,964 square meters of production space, 5,326 square meters of warehouse space, 8,264 square meters of office space, and 6,923 square meters of supporting facilities space. The Phase I Changxing Facility has over 70 sets of advanced wiring equipment, 20 of which are newly purchased sets. The Phase I Changxing Facility currently has a production capacity of 2,400 km of cable per year, which is three times the amount we were able to produce at our old manufacturing facility. The Phase I Changxing Facility is estimated to reach its full production capacity of approximately 4,000 km of cable per year by June 30, 2013.

Construction of the Phase II Changxing Facility commenced in April 2011 and is expected to be completed by the end of 2012. The Phase II Changxing Facility will cover 89,684 square meters of floor space, and will be used primarily for the development and production of specialty cable in accordance with our plan to focus our business on specialty cable over the next five years. After completion of the Phase II Changxing Facility, our total production capacity is expected to reach approximately 10,667 km of cable per year.

Previously, our cable manufacturing was conducted at a manufacturing facility located in the city of Dalian with a production capacity of approximately 800 km of cable per year. We now use our old manufacturing facility for the production of switch appliances.

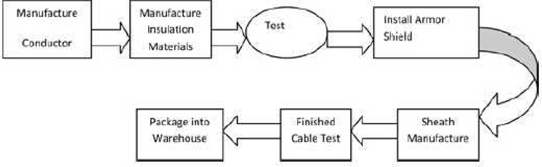

Manufacturing Process

We, through Dalian Befut, utilize sophisticated manufacturing processes and know-how, which enable us to produce a wide array of traditional and specialty cable. Due to our research and development efforts, we believe we are a leader in the material configuration and manufacturing processes for specialty cable.

The following illustration shows the basic steps in the manufacturing process of our cable products:

8

Raw Materials and Suppliers

Our primary raw materials are copper wire, insulation materials and protective materials. Our main suppliers for copper wire for the fiscal year ended June 30, 2011 are Dalian Lian Zhong Hai Fu Tong Co., Ltd, Tianjin Huabei Cable Factory and Shenyang Tailida Copper Co., Ltd. Our main suppliers for insulation and protective materials for the same period are Zhejiang Wanma Polymer Material Co., Ltd. and Tianjin Wuqing District Houxiang County Jianwei Metal Hardware Factory.

Our principal raw materials are generally available in the market and we have not experienced any raw material shortages in the past. Because of the general availability of these raw materials, we do not believe that we will experience any raw material shortages in the foreseeable future; however, changes in the price of copper, which has a history of volatility, directly affect the prices of our products and may influence the demand for our products. Nonetheless, because we seek to pass the cost of our raw materials (mainly copper wire) on to our customers, we believe our actual margin rate will not be significantly affected even if the price of raw materials increases.

The following is a list of our top suppliers expressed as a percentage of the U.S. dollar amount of total raw materials purchased in the fiscal year ended June 30, 2011:

|

Ranking

|

Suppliers

|

Total Amount (USD)

|

Percentage

of Total

Purchases

|

|||||||

|

1

|

Dalian Lian Zhong Hai Fu Tong Co., Ltd

|

11,253,596 | 24.69 | % | ||||||

|

2

|

Tianjin Huabei Cable Factory

|

9,343,502 | 20.50 | % | ||||||

|

3

|

Shenyang Tailida Copper Co., Ltd.

|

4,165,992 | 9.14 | % | ||||||

|

4

|

Shenyang Jiuxing Cable Limited Company

|

3,000,823 | 6.58 | % | ||||||

|

5

|

Kaiyuan city dragon metal trade limited company

|

2,114,577 | 4.64 | % | ||||||

9

Distribution, Sales Network and Customers

We sell our products through a team of 24 full-time sales personnel located in Dalian and another 20 full-time sales personnel located at 14 sales branch offices in major cities throughout China, including in Beijing, Shenyang, Tianjin, Jilin, Harbin and Benxi. In addition, we have contracted with five distributors to sell our products. Normally, the contracts we have with the distributors are for one year and are non-exclusive. In the year ended June 30, 2011, most of our sales were generated by our full-time sales personnel, who are responsible for maintaining business relationships with our customers.

As of June 30, 2011, we had a total of approximately 500 customers located throughout China.

In the year ended June 30, 2011, our five largest customers accounted for approximately 18.90% of our total sales, among which COSCO Dalian Shipyard Co., Ltd. was the largest, accounting for 4.77% of our total revenue. These key customers and their respective percentages of our total sales are listed below:

Top 5 Customers for the Fiscal Year Ended June 30, 2011

|

Customer Name

|

Product

|

Sales (USD)

|

% of Total Sales

|

|||||||

|

COSCO Dalian Shipyard Co., Ltd.

|

Marine Cable

|

2,687,407 | 4.77 | % | ||||||

|

Liaohe Oilfield

|

Special Cable

|

2,170,809 | 3.86 | % | ||||||

|

Huaneng Beijing Thermal Power Co., Ltd.

|

Electric Cable

|

2,035,805 | 3.62 | % | ||||||

|

Tianjin Xingang Shipbuilding Heavy Industry Co., Ltd.

|

Marine Cable

|

1,991,690 | 3.54 | % | ||||||

|

Marine Equipment Co., Ltd.

|

Marine Cable

|

1,751,297 | 3.11 | % | ||||||

Top 5 Customers for the Fiscal Year Ended June 30, 2010

|

Customer Name

|

Product

|

Sales (USD)

|

% of Total Sales

|

|||||||

|

Dalian Huasheng Electrical Installation Co., Ltd.

|

Electric Cable

|

2,894,472 | 10.03 | % | ||||||

|

COSCO Dalian Shipyard Co., Ltd.

|

Marine Cable

|

2,755,916 | 9.55 | % | ||||||

|

Tianjin Xingang Shipbuilding Heavy Industry Co., Ltd.

|

Marine Cable

|

2,607,949 | 9.03 | % | ||||||

|

Angang Steel Co., Ltd. Bayuquan Steel Branch

|

Electric Cable

|

2,593,340 | 8.98 | % | ||||||

|

China Nuclear Power Engineering Co., Ltd. North Branch

|

Mining Cable

|

2,406,732 | 8.34 | % | ||||||

Since the Phase I Changxing Facility became operational in April 2010, our increased production capacity has enabled us to adjust our sales strategy to increase our focus on larger customers that desire higher volumes of our products. As a result, in fiscal 2011 we experienced increased total revenue, much of which was derived from sales to these larger customers.

Growth Strategy

Our objective is to become the leading manufacturer of specialty cable products in China. We intend to achieve this objective by pursuing a growth strategy that includes:

Increase focus on high-margin specialty products. To meet the growing demand for specialty cable products, we plan to increase the production of high-margin specialty cable from approximately 52.55% to approximately 60% of our total production volume over the next three to five years. In addition, we plan to produce submarine cable, carbon fiber composite cable and other high-end cable products with high profit margins, increasing our sales and financial performance.

10

Our sales generated from specialty cable in our fourth fiscal quarter ended June 30, 2011 accounted for 52.55% of our total sales revenue in that quarter. Additionally, current economic policy in China encourages marine construction, mining, petrochemical and new energy industries. Based on these factors, in our fiscal year ending June 30, 2012 we plan to continue devoting more resources to developing, marketing and selling petrochemical and marine cable and investing in our new high-margin product, carbon fiber composite cable.

We currently possess the technology and know-how to produce these new cable products. With regard to submarine cable, however, we likely will be required to make significant additional expenditures to execute this element of our strategy. Such expenditures may include acquisition of land rights close to the coast, construction of a separate production facility on such site and hiring of additional personnel. Such expenditures will require us to obtain additional financing, the success of which cannot be assured.

Expand production capacity. In order to accommodate the increasing demand for our products, we intend to expand our current production capacity of 2,400 km of cable per year to 4,000 km of cable per year by maximizing the production capacity from our Phase I Changxing Facility. Upon its completion, the Phase II Changxing Facility will further increase our production capacity. An increase in production capacity will allow us to produce and sell a higher quantity of products while lowering our manufacturing costs due to economies of scale. The Phase II Changxing Facility will expand our production capacity for specialty cable.

Expand into new markets. We plan to enter into new markets, such as the submarine cable market and the “new energy” cable market, which includes the production of wind and solar energy cable. We entered into the switch appliance market in fiscal 2010. Because switch appliances are not our primary business, the sales of switch appliances only accounts for 4% of our total revenue for the fiscal year ended June 30, 2011.

Increase sales and broaden customer base. We plan to continue to provide high quality cable products to our existing customer base and use our existing customer contacts, industry reputation and experienced sales team to increase our sales of traditional and specialty cable products. In the short-term, we will continue our sales and marketing efforts to increase our sales of our traditional cable products, while our long-term strategy is to concentrate on developing and expanding our sales and customer base for our specialty cable products.

Pursue strategic acquisitions. We will continue to actively consider possible investments in or acquisitions of companies that complement our business strategies and expand our product offerings. As a result of the fragmented nature of the cable and wire industry in China, we believe attractive potential acquisition targets may present themselves. We plan to consider strategic acquisitions as a means to accelerate our growth, increase our sales and expand our market share.

Seasonality

Demand for our traditional cable is generally lower from January to March than from April to December primarily due to the Chinese new year and spring festival which occurs from January to March. Sales of our specialty cable products have not experienced seasonal trends. We believe that our expanding focus on specialty cable products will significantly reduce the impact of seasonality on our overall business.

11

Research and Development

For the fiscal years ended June 30, 2011 and 2010, we spent $1,118,288 and $880,944 on research and development, respectively. We significantly increased our budget for research and development in fiscal 2011 compared to fiscal 2010, all of which was spent on the research and development of new technologies which are the subject of 47 pending patent applications (including fees associated with the application process). We maintain an internal research and development department staffed with 40 senior technical employees consisting of 31 full-time employees and 9 part-time employees.

Our research and development team is led by Mr. Guoxiang Liu, who was formerly employed by the Shenyang Electric Cable Factory, a state owned enterprise and formerly one of Asia’s largest cable companies. Due to our research and development efforts, we believe we are a leader in the material configuration and manufacturing process of specialty cable. As an ancillary method of our research and development, we also have a research cooperation relationship with Dalian University of Technology to share their technology and research achievements. The general framework for our cooperative partnership with the Dalian University of Technology is set forth in an agreement dated July 10, 2009 (the “Cooperation Agreement”). Pursuant to the Cooperation Agreement, which has a three year term and may be terminated by either party at any time, we agree to collaborate with the Dalian University of Technology on a project basis. We have no financial obligations under the Cooperation Agreement but may fund projects at our discretion.

We plan to continue differentiating ourselves from our competitors by focusing our activities on developing the most advanced products in the cable and wire industry.

Intellectual Property

Trademarks. Dalian Befut is the registered holder of the following trademark, which is registered with the Trademark Office of the State Administration for Industry and Commerce in China.

M∙Q∙E

The registered scope of use of this trademark includes wire products such as wire cable, electric wire, power materials (electric wire and wire cable), and electric resisters for copper wire. The current registered term of the trademark expires on September 6, 2021. Under the PRC Trademark Law, registered trademarks are granted for a term of ten years and are renewable for additional terms. Each renewal is limited to a ten-year term and the registrant must continue to use the trademark and apply for a renewal within six months prior to the expiration of the current term.

12

In 2008, the trademark above was recognized as a “Famous Trademark” in China through a judicial procedure pursuant to Rules on Famous Trademark Recognition and Protection promulgated by the PRC National Industrial and Commercial Bureau. A Famous Trademark in China entitles the owner of the mark to stronger protection as compared to a general trademark. For example, a holder of a Famous Trademark may prohibit others from using the same or similar mark not only on the same or similar products but also on products in other industries if the use of such mark would cause confusion or be misleading to a reasonable consumer. In addition, in a trademark dispute adjudication, a Famous Trademark itself provides evidence of influence on consumers. In Dalian, there are only ten Famous Trademarks, one of which is our mark.

Patents. Dalian Befut, together with its two subsidiaries, Dalian Yuansheng and Befut Zhong Xing, have seventeen registered patents in China. The following table provides information regarding each patent.

|

Name of Patent

|

|

Type

of

Patent

|

|

Patent No.

|

|

Inventor’s

Name

|

Date of

Application

|

Date of

Publication

and Term

|

||

|

Intelligent reactive power

compensation for automatic

screen

|

Utility model

|

ZL200720184912.4

|

Dalian Befut Wire & Cable Manufacturing Co., Ltd

|

12/14/2007

|

10/15/2008; Term: 10 years from 10/15/2008 to 10/14/2018

|

|||||

|

Automatic Protection Ni-mh Battery Screen

|

Utility model

|

ZL200720184913.9

|

12/14/2007

|

01/07/2009

Term: 10 years from 01/07/2009 to 01/06/2019

|

||||||

|

New tide-proof power cable

|

Utility model

|

ZL200820015254.0

|

Guoxiang Liu,

Hongming Wu,

Ying Zhao and Hongbo Cao

|

08/29/2008

|

06/10/2009

Term: 10 years from 06/10/2009 to 06/09/2019

|

|||||

|

Sonar watertight cable

|

Utility model

|

ZL200820015255.5

|

08/29/2008

|

06/10/2009

Term: 10 years from 06/10/2009 to 06/09/2019

|

||||||

|

Environmentally friendly wire & cable of low-smoke, halogen-free, fire-retardant insulation

|

Utility model

|

ZL200820015256.X

|

08/29/2008

|

06/10/2009

Term: 10 years from 06/10/2009 to 06/09/2019

|

||||||

|

Mine fire-retardant rubber branch of the pre-cable

|

|

Utility model

|

|

ZL200820015332.7

|

|

09/01/2008

|

06/10/2009

Term: 10 years from 06/10/2009 to 06/09/2019

|

13

|

High-temperature plastic extrusion die-tool

|

Utility model

|

ZL200820015331.2

|

Guoxiang Liu,

Hongming Wu,

Ying Zhao and Hongbo Cao

|

08/29/2008

|

08/12/2009

Term: 10 years from 08/12/2009 to 08/12/2019

|

|||||

|

High-strength silicone rubber motor lead wire

|

Utility model

|

ZL201020271860.6

|

Hongming Wu, Yuanfeng Liu, Lan Luan, Zhou yong Han, Ying Zhang, Hongbo Cao

|

07/27/2010

|

04/20/2011

Term:10 years

from

04/20/2011 to 04/20/2021

|

|||||

|

Aviation fluoroplastic F46 insulated shielded wire

|

Utility model

|

ZL201020271862.5

|

07/27/2010

|

04/20/2011

Term:10 years

from

04/20/2011 to 04/20/2021

|

||||||

|

PVC insulated nylon shielded wire

|

Utility model

|

ZL201020271858.9

|

07/27/2010

|

02/09/2011

Term:10 years

from

02/09/2011 to 02/09/2021

|

||||||

|

A carbon fiber hotline

|

Utility model

|

ZL201020271844.7

|

07/27/2010

|

02/09/2011

Term:10 years

from

02/09/2011 to 02/09/2021

|

||||||

|

Glass fiber and carbon fiber composite core for power cable

|

Utility model

|

ZL200920012806.7

|

Dalian Yuansheng Technology Development Co., Ltd.

|

04/10/2009

|

04/28/2010

Term:10 years from 04/28/2010 to

04/28/2020

|

14

|

A modular carbon fiber cable for embedded in heating floor

|

Utility model

|

ZL201020283590.X

|

08/06/2010

|

03/23/2011

Term:10 years from 03/23/2011 to 03/23/2021

|

||||||

|

New dual-core convoluted carbon fiber composite cable

|

Utility model

|

ZL201020283661.7

|

08/06/2010

|

03/23/2011

Term:10 years from 03/23/2011 to 03/23/2021

|

||||||

|

A single conductor carbon fiber geothermal cable

|

Utility model

|

ZL201020283662.1

|

08/06/2010

|

03/23/2011

Term:10 years from 03/23/2011 to 03/23/2021

|

||||||

|

A new type of carbon fiber electric boiler

|

Utility model

|

ZL201020283664.0

|

08/06/2010

|

03/23/2011

Term:10 years from 03/23/2011 to 03/23/2021

|

||||||

|

A new type of carbon fiber electric kettle

|

Utility model

|

ZL201020283665.5

|

08/06/2010

|

03/23/2011

Term:10 years from 03/23/2011 to 03/23/2021

|

In addition to the registered patents, Dalian Befut, together with its two subsidiaries, Dalian Yuansheng and Befut Zhong Xing, have pending applications for 47 additional patents as set forth in the table below.

|

Name of Patent

|

|

Type of

Patent

|

|

Patent No.

|

|

Inventor’s

Name

|

Date of

Application

|

Date of

Acceptance

of the

Application

by the PRC

IP Office

|

Status of

Application

|

|||

|

Pre-fabricated

branched cable

|

Utility model

|

200920247890.0

|

Hongbo Cao

|

11/06/2009

|

11/06/2009

|

Patent Pending

|

||||||

|

Thermocouple compensation cable with flame retardant

|

Utility model

|

200920247891.5

|

11/06/2009

|

11/06/2009

|

Patent Pending

|

15

|

BXVW outdoor weather-proof sheathed cable

|

Utility model

|

200920247892.X

|

11/06/2009

|

11/06/2009

|

Patent Pending

|

|||||||

|

Measurement and computer input cable

|

Utility model

|

200920247894.9

|

11/06/2009

|

11/06/2009

|

Patent Pending

|

|||||||

|

Fluoroplastic -46 insulated shielded wire

|

Utility model

|

200920247889.8

|

11/06/2009

|

11/06/2009

|

Patent Pending

|

|||||||

|

Halogen-free flame-retardant thermocouple compensation cable

|

Utility model

|

200910219723.X

|

Hongbo Cao

|

11/10/2009

|

11/10/2009

|

Patent Pending

|

||||||

|

Flame-retardant BXVW outdoor weather-proof sheathed cable

|

Utility model

|

200910219732.9

|

11/10/2009

|

11/10/2009

|

Patent Pending

|

|||||||

|

Flame-retardant silicon rubber insulated and sheathed measurement and computer input cable

|

Utility model

|

200910219731.4

|

11/10/2009

|

11/10/2009

|

Patent Pending

|

|||||||

|

High-strength silicone rubber motor lead wire

|

Invention model

|

200910219726.3

|

11/10/2009

|

11/10/2009

|

Patent Pending

|

|||||||

|

High-strength silicone rubber motor lead wire

|

Utility model

|

200910219726.4

|

11/10/2009

|

11/10/2009

|

Patent Pending

|

|||||||

|

Aviation fluoroplastic -46 insulated, shielded wire

|

Utility model

|

200910219727.8

|

11/10/2009

|

11/10/2009

|

Patent Pending

|

|||||||

|

Flame-retardant, fire-resistant, halogen-free pre-fabricated branched cable

|

Utility model

|

200910219719.3

|

11/10/2009

|

11/10/2009

|

Patent Pending

|

|||||||

|

Shielded instrumentation cable for communication equipment

|

Utility model

|

200910219842.5

|

Hongbo Cao

|

11/13/2009

|

11/13/2009

|

Patent Pending

|

||||||

|

Shielded signal cable for metro communication

|

Utility model

|

200910219843.X

|

11/13/2009

|

11/13/2009

|

Patent Pending

|

|||||||

|

A new type of wind cable

|

Utility model

|

200910219840.6

|

11/13/2009

|

11/13/2009

|

Patent Pending

|

|||||||

|

Safety explosion-proof type computer input cables

|

Utility model

|

200910219841.0

|

11/13/2009

|

11/13/2009

|

Patent Pending

|

16

|

A new type of control cable for nuclear power station

|

Utility model

|

200910219914.6

|

Hongbo Cao

|

11/17/2009

|

11/17/2009

|

Patent Pending

|

||||||

|

New type wind cable

|

Utility model

|

200920248142.4

|

11/17/2009

|

11/17/2009

|

Patent Pending

|

|||||||

|

Computer input cables

|

Utility model

|

200920248147.7

|

11/17/2009

|

11/17/2009

|

Patent Pending

|

|||||||

|

Flexible shielded control cable for marine engine

|

Invention model

|

200910219917.X

|

11/17/2009

|

11/17/2009

|

Patent Pending

|

|||||||

|

Flexible shielded control cable for marine engine

|

Utility model

|

200910219917.5

|

11/17/2009

|

11/17/2009

|

Patent Pending

|

|||||||

|

Shielded signal cable for metro communication

|

Utility model

|

200920248141.X

|

11/17/2009

|

11/17/2009

|

Patent Pending

|

|||||||

|

A type of high-temperature fire-resistant shielded cable

|

Invention patent

|

201010228208.0

|

Hongbo Cao

|

07/16/2010

|

07/16/2010

|

Patent Pending

|

||||||

|

Aluminum-plastic composite shielded halogen-free fire-retardant cable

|

Utility model

|

201020502130.2

|

Dalian Befut Wire & Cable Manufacturing Co., Ltd

|

08/24/2010

|

08/24/2010

|

Patent

Pending

|

||||||

|

Halogen-free low-smoke fire-retardant extension type of cable with steel armor

|

Utility model

|

201020502119.6

|

08/24/2010

|

08/24/2010

|

Patent Pending

|

|||||||

|

Intrinsically safe explosion-proof type computer input cable

|

Utility model

|

201020502128.5

|

08/24/2010

|

08/24/2010

|

Patent Pending

|

|||||||

|

Fire-retardant fire-resistant halogen-free pre-fabricated branched cable

|

Utility model

|

201020502111.X

|

Hongbo Cao

|

08/24/2010

|

08/24/2010

|

Patent Pending

|

||||||

|

Fire-resistant control cable

|

Utility model

|

201020502103.5

|

08/24/2010

|

08/24/2010

|

Patent Pending

|

|||||||

|

Crane control cable

|

Utility model

|

201020293825.4

|

Dalian Befut Wire & Cable Manufacturing Co., Ltd

|

08/17/2010

|

08/17/2010

|

Patent Pending

|

||||||

|

Waterproof power cable

|

Utility model

|

201020293822.0

|

08/17/2010

|

08/17/2010

|

Patent Pending

|

|||||||

|

Wind energy cable

|

Utility model

|

201020293823.5

|

08/17/2010

|

08/17/2010

|

Patent Pending

|

|||||||

|

Polyolefin shielded halogen-free low-smoke fire-retardant thermocouple cable

|

Utility model

|

201020293814.6

|

Hongbo Cao

|

08/17/2010

|

08/17/2010

|

Patent Pending

|

|

High-temperature fire-resistant control cable

|

Utility model

|

201020293815.0

|

Dalian Befut Wire & Cable Manufacturing Co., Ltd

|

08/17/2010

|

08/17/2010

|

Patent Pending

|

17

|

A carbon fiber composite core electric heating cable and processing technology

|

Invention patent

|

201010246591.2

|

Dalian Yuansheng Technology Development Co., Ltd.

|

08/16/2010

|

12/15/2010

|

Patent Pending

|

||||||

|

A self-extinguishing carbon fiber cable

|

Invention patent

|

201010246585.7

|

08/16/2010

|

12/15/2010

|

Patent Pending

|

|||||||

|

New type of carbon fiber composite wire for heat energy transmission

|

Invention patent

|

201010246584.2

|

08/16/2010

|

02/16/2011

|

Patent Pending

|

|||||||

|

Method to repair surface layer of carbon fiber cable

|

Invention patent

|

201010246583.8

|

08/16/2010

|

12/08/2010

|

Patent Pending

|

|||||||

|

A Carbon Fiber Cable for Human Health

|

Utility Model

|

201020283674.4

|

08/06/2010

|

08/06/2010

|

Patent Pending

|

|||||||

|

New Type Cable Made of Carbon Fiber Reinforced Material

|

Utility Model

|

201020283671.0

|

08/06/2010

|

08/06/2010

|

Patent Pending

|

|||||||

|

A Carbon Fiber Composite Material Pultrusion Technology Products

|

Utility Model

|

201020283673.X

|

08/06/2010

|

08/06/2010

|

Patent Pending

|

|||||||

|

A New Type Carbon Fiber Cable for Mining

|

Utility Model

|

201020283663.6

|

08/06/2010

|

08/06/2010

|

Patent Pending

|

|||||||

|

Pultrusion Process Positioning Dipping Device

|

Utility Model

|

201020283672.5

|

08/06/2010

|

08/06/2010

|

Patent Pending

|

|||||||

|

Carbon Fiber Far Infrared Electric Heating Blanket

|

Utility Model

|

201020283569.0

|

08/06/2010

|

08/06/2010

|

Patent Pending

|

|||||||

|

A New Type of Mining Cable Hook

|

Utility Model

|

201020283566.7

|

08/06/2010

|

08/06/2010

|

Patent Pending

|

|||||||

|

A New Type of Carbon Fiber Composite Board

|

Utility Model

|

201020283563.3

|

08/06/2010

|

08/06/2010

|

Patent Pending

|

|||||||

|

New Type Carbon Fiber Composite Cable Body for Electric Power Transmission

|

Utility Model

|

201020283578.X

|

08/06/2010

|

08/06/2010

|

Patent Pending

|

|||||||

|

A Carbon Fiber Composite Cable

|

Utility Model

|

201020283588.3

|

08/06/2010

|

08/06/2010

|

Patent Pending

|

Under the PRC Patent Law, a patent is valid for a term of twenty years in the case of an invention and a term of ten years in the case of utility models and designs. Our pending patents are for both utility models and inventions. Any use of a patent without consent or a proper license from the patent owner constitutes an infringement of patent rights. We cannot assure you that any patent applications filed by us will be approved in the future.

18

With respect to intellectual property rights such as trademarks and patents as described above and know-how for the marketing and sale of the products manufactured by Dalian Befut, WFOE and Dalian Befut have entered into an Intellectual Property License Agreement, pursuant to which, WFOE is permitted to use Dalian Befut’s trademarks, patents (except newly issued patents not existing as of the date of the agreement) and know-how for nominal consideration. After any of the above patent applications are granted, WFOE intends to either enter into a similar Intellectual Property License Agreement with Dalian Befut or we will arrange for the transfer of such patents from Dalian Befut to WFOE in the future.

Competition

Currently, there are approximately 7,000 manufacturers in China producing a variety of types of cable and wire. Among these manufacturers, we estimate that approximately 2,000 manufacturers have the capability to produce specialty cable, approximately 40 of such manufacturers have the capability to produce nuclear cable and approximately 20 have the capability to produce marine cable. Unlike most other competitors, we are capable of producing both nuclear cable and marine cable. In addition, we are one of the few manufacturers in China producing carbon fiber composite cable.

Our competitors include manufacturers that have the ability to conduct comprehensive cable and wire production, such as Far East Cable Co., Limited (“Far East”), Shangshang Cable Co., Ltd., as well as manufacturers that can produce specialty cable, such as Yangzhou Marine Cable Manufacturing Factory (“Yangzhou Marine”). Far East is our largest competitor in the sector of traditional electrical cable and wire and is a leader in terms of market share. We believe our competitive advantage over Far East is in specialty cable production, a segment in which we have more qualification certificates and market share. In terms of specialty cable, Yangzhou Marine is our major competitor. It entered into this market earlier than we did and currently has a strong competitive advantage on qualification certificates and market share. However, Yangzhou Marine's primary market is mostly in the adjacent provinces, such as Jiangsu and Zhejiang, areas in which we have not focused our sales and marketing efforts.

Competitive Advantages

We believe we have the following competitive advantages:

|

|

·

|

We have a strong research and development team. We believe we have an exceptional research and development team with highly skilled personnel, many of whom are former employees of the Shenyang Electric Cable Factory, a state owned enterprise and formerly one of Asia’s largest cable companies. Our team also includes experts from Dalian Science and Technology University.

|

|

|

·

|

We have the unique ability to produce certain types of specialty cable. We are one of a few manufacturers in China producing carbon fiber composite cable, an advanced cable product that can be utilized for upgrading China’s power grid. The patent for carbon fiber composite cable is held by Dalian Yuansheng, Dalian Befut’s recently acquired subsidiary. Additionally, we are the only company in the PRC cable and wire industry holding a patent for watertight cable. These specialty cable products are high-margin products with great market potential in the cable and wire industry.

|

19

|

|

·

|

We have modern production facilities. Our Phase I Changxing Facility has greatly increased our production capacity. We believe that such expansion provides us with a significant advantage in terms of production scale and capacity in northeastern China. The addition of the Phase II Changxing Facility will make our production capabilities even more competitive. The construction of the Phase II Changxing Facility commenced in April 2011 and is expected to be complete by December 31, 2012.

|

|

|

·

|

We have a strong internal sales force. We primarily sell our products to our customers through our internal sales force of 44 people with minimal reliance on distributors or outside sales personnel. We believe this approach enables us to enjoy lower sales costs and higher profit margins than many of our competitors.

|

|

|

·

|

Our geographic location allows us to better serve our regional customer base. There are currently more than 100 companies located in northern China that, on average, purchase at least $7 million of specialty cable per year. As most of our competitors are located in southern China, our geographic location provides us with a significant advantage over them with respect to attracting large customers in northern China due to lower transportation costs, regional relationships and similar cultural backgrounds.

|

Certifications

We have obtained qualifications in specialty cable production and we are a nationally-designated enterprise for coal mining and mechanical products. Additionally, we have obtained classification society certifications from the China Classification Society, RINA Italy Classification Society, American Bureau of Shipping, Germanischer Lloyd, Nippon Kaiji Kyokai and Korean Register of Shipping for our marine cable. We have also received a MIL-Spec Quality Management System certification. As of June 30, 2011, we are one of 29 designated suppliers of China National Petroleum Corporation, one of the largest companies in the world with very strict standards of selecting cable and wire suppliers, further evidencing the quality of our cable products.

Environmental Compliance

We are subject to environmental regulations that are generally applicable to manufacturing companies in the PRC. For example, we obtained necessary approvals for our new manufacturing facilities. We are also subject to periodic inspection by environmental regulators and must follow specific procedures in some of our processes. As of the date of this report, we are in material compliance with the environmental regulations and approved practices applicable to us.

Employees

We currently have 300 employees in total, of whom 291 are full-time and 9 are part-time.

Government Regulation

We are subject to the recent PRC State Administration of Foreign Exchange (“SAFE”) regulations regarding offshore financing activities by PRC residents. SAFE issued a public notice in October 2005 requiring PRC domestic residents to register with the local SAFE branch before establishing or controlling any company outside of China for the purpose of capital financing with assets or equities of PRC companies, referred to in the notice as an “offshore special purpose company.” For details, please see the risk factor – “Recent PRC regulations relating to the establishment of offshore special purpose companies by PRC domestic residents may subject our PRC resident beneficial owners to personal liability, limit our ability to inject capital into our PRC subsidiaries, limit our subsidiaries’ ability to increase their registered capital or distribute profits to us, or may otherwise adversely affect us.” under “ITEM 1A. RISK FACTORS - Risks Related to Doing Business in the PRC.” The PRC domestic residents that were former shareholders of the WFOE fully complied with the SAFE regulations and have duly registered with the SAFE in accordance with the public notice.

20

Dalian Befut’s production facilities maintain an ISO 9001 Quality Management System.

According to The Rule Regarding the Administration on Compulsory Products Certification promulgated by the General Administration of Quality Supervision, Inspection and Quarantine of the PRC on December 3, 2001 and effective May 1, 2002, products that impact health and safety of human beings, life and health of animals and plants and environmental protection and public safety that are listed in the Index of the PRC Compulsory Production Certification (the “Index”) are subject to the universally applicable national standards, technical rules and implementation procedures. China Compulsory Certification (“CCC”) is a mandatory requirement for the production, distribution and exportation of any of the products that are listed in the Index. Certain of our cable and wire products are subject to such certification and we have maintained effective CCC status on those products accordingly.

In 2006, we obtained a license from the Dalian customs bureau for importing and exporting cable, wire and power equipment. We renewed this license in July 2009 and extended the expiration date to July 20, 2012.

ITEM 1A. RISK FACTORS

An investment in our common stock involves a high degree of risk. You should carefully consider the following information about these risks, together with the other information contained in this report before investing in our common stock. If any of the events anticipated by the risks described below occur, our results of operations and financial condition could be adversely affected which could result in a decline in the market price of our common stock, causing you to lose all or part of your investment.

Risks Related to our Business

Adverse capital and credit market conditions may significantly affect our ability to meet liquidity needs, access to capital and cost of capital.

The capital and credit markets may experience extreme volatility and disruption from time to time, including, among other things, extreme volatility in securities prices, severely diminished liquidity and credit availability, ratings downgrades of certain investments and declining valuations of others. Adverse market conditions may limit our ability to replace, in a timely manner, maturing liabilities and access the capital necessary to operate and grow our business. As such, we may be forced to delay raising capital or bear an unattractive cost of capital which could decrease our profitability and significantly reduce our financial flexibility. Demand for our products is vulnerable to economic downturns. The worsening of economic conditions could result in a decrease in or cancellation of orders for our products. We are unable to predict the duration and severity of any disruption in financial markets and global adverse economic conditions and the effect such events might have on our business. Our results of operations, financial condition, cash flows and capital position could be materially adversely affected by disruptions in the financial markets. Further, any decreased collectability of accounts receivable or early termination of sales contracts due to the current deterioration in economic conditions could negatively impact our results of operations.

21

Quarterly operating results may fluctuate due to factors beyond our control, including customer demand and raw materials pricing.

Our quarterly results of operations may fluctuate as a result of a number of factors, including fluctuation in the demand for our products and changes in the price of copper, which directly affect the prices of our products and may influence demand. Quarter-to-quarter comparisons of results of operations have been and will be impacted by the volume of such orders and shipments. In addition, our operating results each quarter could be adversely affected by the following factors, among others, such as variations in the mix of product sales, price changes in response to competitive factors, increases in raw material costs and increases in utility costs (particularly electricity). Demand for our traditional cable products are subject to seasonality factors which can affect our quarter to quarter results as well.

Fluctuating copper prices impact our business and operating results.

Copper is the principal raw material used in the manufacture of our products. The copper industry is highly volatile and cyclical in nature. Copper prices, which have increased over the past several years followed by more recent sharp declines, have varied significantly and may vary significantly in the future. This affects our business both positively and negatively, as higher copper prices generate higher sales for us since we pass the incremental costs onto our customers, while lower copper prices will reduce the sales price of our products. The price of copper is influenced by factors including general economic conditions, industry capacity utilization, import duties and other trade restrictions. We cannot predict copper prices in the future or the effect of fluctuations in the costs of copper on our future operating results. In accordance with customary practice in our industry, we seek to mitigate the impact of changing raw material prices by passing price increases and decreases onto our customers by adjusting our prices to reflect changes in raw material prices. We may not be able to adjust our product prices rapidly enough in the short-term to recover the costs of increases in raw materials. Our future profitability may be adversely affected to the extent we are unable to pass on higher raw material costs to our customers.

We face substantial competition in our business and our failure to compete effectively may adversely affect our ability to generate revenue.

The wire and cable industry in China is competitive and highly fragmented with more than 7,000 companies. The principal elements of competition in the market are, in our opinion, pricing, payment terms, product availability and quality. While we believe that we have attained a competitive position with respect to all of these factors, our major competitors such as Far East Cable Co., Limited and Yangzhou Marine Cable Factory may have substantially greater resources than us and may be better able to successfully endure downturns in our industry or primary market segments. In periods of reduced demand for our products, we reduce our selling prices to maintain or increase market share or maintain selling prices, which may result in loss of market share. Under either situation, we would experience a reduction in our sales and overall profitability. In addition, we cannot assure you that additional competitors will not enter our markets, or that we will be able to compete successfully against existing or new competition.

We may not be able to effectively control and manage our growth.

If our business and primary markets, including shipbuilding, nuclear power and mining, continue to grow and develop as we expect, it will be necessary for us to finance and manage expansion in an orderly fashion. We may face challenges in managing the production and sale of expanding product offerings and in integrating acquired businesses with our own. Such events will increase demands on our existing management and facilities. Failure to manage this growth and expansion could interrupt or adversely affect our operations, cause production backlogs, longer product development time frames and administrative inefficiencies.

22

In the past several years we have derived a significant portion of our revenues from a small group of customers. If we were to become dependent again upon a few customers, such dependency could negatively impact our business, operating results and financial condition.

Previously, our customer base has been highly concentrated. For the year ended June 30, 2011 and 2010, our five largest customers accounted for 18.9% and 46% of our total sales, respectively, and the largest customer accounted for approximately 4.77% and 10.0% of our total sales in such periods, respectively. As our customer base may change from year-to-year, during such years that the customer base is highly concentrated, the loss of, or reduction of our sales to, any of such major customers could have a material adverse effect on our business, operating results and financial condition. Moreover, our success will depend in part upon our ability to obtain orders from new customers, as well as the financial condition and success of our customers and general economic conditions.

Shortages or disruptions in the availability of raw materials, especially copper, could have a material adverse effect on our business.

Copper, protective materials and insulation materials are our principal raw materials used in the manufacture of our cable products. Copper, our principal raw material, accounted for approximately 85.13% of our raw material purchases during the fiscal year ended June 30, 2011. We expect that copper will continue to account for a significant portion of our raw material purchases in the future. The price of raw materials fluctuate because of general economic conditions, global supply and demand and other factors causing monthly variations in the costs of our raw materials purchases. These macro-economic factors, together with labor and other business interruptions experienced by certain raw material suppliers, have contributed to periodic shortages in the supply of raw materials to other industry participants. Likewise, we could suffer shortages in the future, although we do not expect shortages of any material nature in the foreseeable future. If we are unable to procure adequate supplies of raw material to meet our future production needs and customer demand, shortages could result in a material loss of customers and revenues and adversely impact our results of operations. In addition, supply shortages or disruptions or the loss of key suppliers may cause us to procure our raw materials from less cost effective sources and may have a material adverse affect on our business, revenues and results of operations.