Attached files

| file | filename |

|---|---|

| EX-31.1 - EXHIBIT 31.1 - BEFUT International Co., Ltd. | v235619_ex31-1.htm |

| EX-31.2 - EXHIBIT 31.2 - BEFUT International Co., Ltd. | v235619_ex31-2.htm |

| EX-32.1 - EXHIBIT 32.1 - BEFUT International Co., Ltd. | v235619_ex32-1.htm |

| EX-32.2 - EXHIBIT 32.2 - BEFUT International Co., Ltd. | v235619_ex32-2.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 10-K/A

(Amendment No. 2)

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended June 30, 2010

or

¨ TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _________ to _____________

Commission file number: 000-51336

BEFUT International Co., Ltd.

(Exact name of registrant as specified in its charter)

|

Nevada

|

20-2777600

|

|

(State or other jurisdiction of

incorporation or organization)

|

(IRS Employer Identification No.)

|

27th Floor, Liangjiu International Tower

5 Heyi Street

Dalian City, 116011

P. R. China

(Address of Principal Executive Offices) (Zip Code)

Registrant’s telephone number: (011)-86-411-83678755

Securities registered pursuant to Section 12(b) of the Act: None.

Securities registered pursuant to Section 12(g) of the Act: Common Stock, Par Value $0.001 Per Share

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such report(s)), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ¨ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer o

|

Accelerated filer o

|

|

Non-accelerated filer o

Do not check if a smaller reporting company

|

Smaller reporting company x

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

The aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter: $585,556.04 as of December 31, 2009, based on the average bid and asked price $0.5075 of the Company’s common stock on such date as reported by the Over-the-Counter Bulletin Board. Shares of voting stock held by each executive officer and director of the registrant and each person who beneficially owns 10% or more of the registrant’s outstanding voting stock has been excluded from the calculation. This determination of affiliated status may not be conclusive for other purposes.

The number of outstanding shares of the registrant’s common stock on September 24, 2010 was 29,715,640.

Documents Incorporated by Reference: None.

EXPLANATORY NOTE

This Amendment No. 2 to the Annual Report on Form 10-K (“Amendment No. 2”) of BEFUT International Co., Ltd. (the “Company”) amends the Company’s Annual Report on Form 10-K for the fiscal year ended June 30, 2010, filed with the Securities and Exchange Commission (the “SEC”) on September 28, 2010 (the “Original 10-K”), as amended by Amendment No. 1 on Form 10-K/A, filed with the SEC on September 19, 2011 (“Amendment No. 1”). We refer to the Original 10-K, as amended by Amendment No. 1, as the “2010 Form 10-K”. This Amendment No. 2 is being filed to amend the 2010 Form 10-K by:

|

|

·

|

Revising the audit report of Patrizio & Zhao, LLC, the Company’s independent registered public accounting firm, to indicate that the financial statements of the Company for the years ended June 30, 2009 and 2010 have been restated to correct certain misstatements;

|

|

|

·

|

Revising the Parent Only Financials to include a Statement of Cash Flows for the fiscal year ended June 30, 2009; and

|

|

|

·

|

Removing the Parent Only Financials as an exhibit and including them as a footnote to the Restated Consolidated Financials.

|

Except as set forth above, this Amendment No. 2 is identical to the 2010 Form 10-K. This Amendment No. 2 does not reflect events occurring after the filing of the Original 10-K and no attempt has been made in this Amendment No. 2 to modify or update other disclosures as presented in the Original 10-K. Accordingly, this Amendment No. 2 should be read in conjunction with the Company’s filings with the SEC subsequent to the filing of the Original 10-K. Additionally, the Company has attached to this Amendment No. 2 updated certifications executed as of the date of this Amendment No. 2 by the Company’s chief executive officer and chief financial officer as required by Sections 302 and 906 of the Sarbanes Oxley Act of 2002. These updated certifications are attached as Exhibits 31.1, 31.2, 32.1 and 32.2 to this Amendment No. 2.

FORM 10-K/A ANNUAL REPORT

FISCAL YEAR ENDED JUNE 30, 2010

TABLE OF CONTENTS

|

PAGE

|

||||

|

PART I

|

2

|

|||

|

Item 1.

|

Business.

|

2

|

||

|

Item 1A.

|

Risk Factors.

|

14

|

||

|

Item 1B.

|

Unresolved Staff Comments. | 25 | ||

|

Item 2.

|

Properties.

|

25

|

||

|

Item 3.

|

Legal Proceedings.

|

27

|

||

|

PART II

|

28

|

|||

|

Item 5.

|

Market for the Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

|

28

|

||

| Item 6. | Selected Financial Data. | 29 | ||

|

Item 7.

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations.

|

30

|

||

|

Item 8.

|

Financial Statements and Supplementary Data.

|

38

|

||

|

Item 9.

|

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure.

|

38

|

||

|

Item 9A.

|

Controls and Procedures.

|

38

|

||

|

Item 9B.

|

Other Information.

|

39

|

||

|

PART III

|

40

|

|||

|

Item 10.

|

Directors, Executive Officers and Corporate Governance.

|

40

|

||

|

Item 11.

|

Executive Compensation.

|

41

|

||

|

Item 12.

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholders Matters.

|

42

|

||

|

Item 13.

|

Certain Relationships and Related Transactions, and Director Independence.

|

43

|

||

|

Item 14.

|

Principal Accountant Fees and Services.

|

44

|

||

|

PART IV

|

44 | |||

|

Item 15.

|

Exhibits, Financial Statement Schedules.

|

44

|

||

|

|

||||

|

SIGNATURES

|

46

|

|||

|

EXHIBIT INDEX

|

47

|

|||

|

FINANCIAL STATEMENTS

|

F-1

|

|||

FORWARD-LOOKING STATEMENTS

Certain statements in this Report, and the documents incorporated by reference herein, constitute "forward-looking statements". Such forward-looking statements include statements, which involve risks and uncertainties, regarding, among other things, (a) our projected sales, profitability, and cash flows, (b) our growth strategies, (c) anticipated trends in our industries, (d) our future financing plans, and (e) our anticipated needs for, and use of, working capital. They are generally identifiable by use of the words “may,” “will,” “should,” “anticipate,” “estimate,” “plan,” “potential,” “project,” “continuing,” “ongoing,” “expects,” “management believes,” “we believe,” “we intend,” or the negative of these words or other variations on these words or comparable terminology. These statements may be found under “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Business,” as well as in this Report generally. Actual events or results may differ materially from those discussed in forward-looking statements as a result of various factors and matters described in this report generally. In light of these risks and uncertainties, there can be no assurance that the forward-looking statements contained in this filing will in fact occur. You should not place undue reliance on these forward-looking statements.

The forward-looking statements speak only as of the date on which they are made, and, except to the extent required by federal securities laws, we undertake no obligation to update any forward-looking statement to reflect events or circumstances after the date on which the statement is made or to reflect the occurrence of unanticipated events except to the extent as required by applicable law.

Unless otherwise noted, all currency figures in this filing are in U.S. dollars. References to "yuan" or "RMB" are to the Chinese yuan (also known as the renminbi). According to www.safe.gov.cn , the official website of the PRC State Administration of Foreign Exchange, as of June 30, 2010, US $1.00 = RMB 6.7909 yuan.

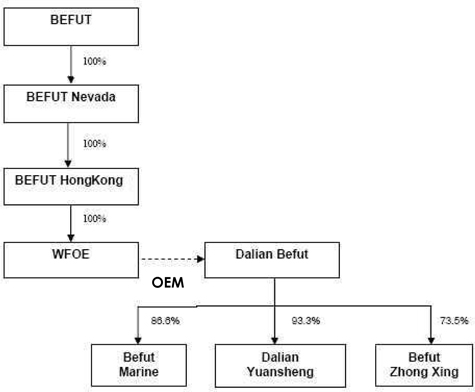

The "Company", "we," "us," "our," and the "Registrant" refer to (i) BEFUT International Co., Ltd., the public company incorporated in the state of Nevada (“BEFUT”), (ii) BEFUT Corporation, the direct subsidiary of BEFUT, a corporation incorporated in the State of Nevada (“Befut Nevada”); (ii) Hongkong BEFUT Co., Ltd. (“Befut Hongkong”), a wholly-owned subsidiary of Befut Nevada incorporated under the laws of Hong Kong; (iii)Befut Electric (Dalian), Co., Ltd. (“WFOE”), a corporation organized under the laws of the People’s Republic of China (the “PRC”) that is wholly owned by Befut Hongkong; (vi) Dalian Befut Wire & Cable Manufacturing Co., Ltd. (“Dalian Befut”), a corporation organized under the laws of the PRC which is the captive manufacturing company to WFOE; (vii) Dalian Marine Cable Co., Ltd., a corporation organized under the laws of the PRC which is 86.6% owned by Dalian Befut (“Befut Marine”); (viii) Dalian Befut Zhong Xing Switch Co., Ltd (“Befut Zhong Xing”), a corporation organized under the laws of the PRC which is 73.5% owned by Dalian Befut, and (ix) Dalian Yuansheng Technology Co., Ltd. (“Dalian Yuansheng”), a corporation organized under the laws of the PRC which is 93.3% owned by Dalian Befut.

PART I

ITEM 1. BUSINESS

Overview

We believe that we are one of the most competitive manufacturers of specialty cable products in northeastern China. Our cable products consist of (i) traditional electric power system cable and (ii) an assortment of specialty cable, including marine cable, mining specialty cable and, petrochemical cable. We also have developed the capability to produce other types of specialty cable such as carbon fiber composite cable, submarine cable and certain “new energy” cable, including cable for wind and solar energy. Our traditional cable products are primarily focused on serving end-user applications in the construction, electrical utility, and transportation (including automotive) markets. Our specialty cable products are used primarily in ship building, nuclear power plants, mining and petrochemical operations. We also have the technical capability for large-scale production of marine cable for use in electronic conveyance, controls and lighting on a variety of ships, a segment of the market with significantly higher profit margin potential that we intend to further pursue. Additionally, we recently began developing and producing switch appliances, including high and low voltage distribution cabinet switches and crane electronic control switches, which products compliment our cable product offerings.

We are headquartered in the city of Dalian, a large trading and financial center in northeastern China located at the tip of China’s Liaodong Peninsula. Our sales and marketing activities are conducted through our 14 branch offices located throughout China. Currently, our products are sold through our sales force to over 500 Chinese customers.

We are in the process of constructing a new manufacturing facility located in Dalian’s Changxing Island Harbor Industrial Zone. In December 2009, we completed Phase I of this project (the “Phase I Changxing Facility”) which consists of 45,477 square meters of floor space with a maximum production capacity of approximately 4,000 km of cable per year. This facility commenced production in April 2010 and currently has a production capacity of 2,400 km of cable per year. We estimate that Phase II of this project (the “Phase II Changxing Facility”) will add 89,684 square meters of additional floor space with a maximum production capacity of approximately 6,667 km of cable per year.

We also have a high-quality customer base, including Shougang Group, China Huaneng Group, China National Petroleum Corporation, China Shipbuilding Industry Corporation, China Ocean Shipping (Group) Company, which enables us to maintain and strengthen our competitive position in the wire and cable industry.

Recent Developments

In July 2010 , Dalian Befut increased its equity interests in Befut Zhong Xing from 70% to 73.5% by contributing RMB 14 million ($2.06 million) to the registered capital of Befut Zhong Xing. Befut Zhong Xing develops and manufactures switch appliances, including high-low-voltage distribution cabinet switches and crane electronic control switches.

On July 23, 2010, Dalian Befut acquired 60% of equity interests of Dalian Yuansheng for $88,235 (the registered capital value of such equity interests) from Mr. Chengnian Yan. Dalian Befut also increased the Dalian Yuansheng’s registered capital by RMB 5 million ($735,294), thereby increasing Dalian Befut’s total equity interest to 93.3%. Dalian Yuansheng is engaged in the research and development of carbon fiber composite cable and other specialty cable. One of the principal shareholders of Dalian Yuansheng holds a patent for carbon fiber composite cable which will be transferred to Dalian Yuansheng.

Our Products

Our products are categorized into three types: traditional cable, specialty cable and switch appliances. The following table provides information about our principal products:

2

|

Products

|

Features

|

Applications

|

||

|

Traditional Cable

|

||||

|

Electric Cable

|

Thermo-mechanical, electrical and anti-corrosion

|

Used in the telecommunications industry, auto industry, metal refining industry, electrical and petrochemical industry, transportation industry (including electrified railway and urban rail transportation) and construction industry.

|

|

Specialty Cable

|

||||

|

Marine Cable

|

Anti-erosion, anti-stretch and long-life

|

Used in various capacities in the shipping industry, including the construction of ships, on-water oil platforms and coastal marine projects. It is also capable of meeting other needs on a ship, including power transmission, signal transmission of lighting and information processing equipment, and control systems.

|

||

|

Mine Specialty Cable

|

Temperature resistant, corrosion protection, soft, low-temperature resistant

|

Used by mining companies.

|

||

|

Petrochemical Cable

|

Corrosion protection, long-life, high stretch resistance feature

|

Used in the petrochemical industry and in offshore construction.

|

||

|

Other Specialty Cable

|

High-temperature resistant, low-temperature resistant, hard-wear, acid-bases resistant, age-resistant, long-life

|

Used in steelwork and at iron ore yards.

|

||

|

Switch Appliances

|

||||

|

High-low-voltage distribution cabinet switch

|

Power grids under 20KV

|

Used between transformer room and production workshop.

|

||

|

Crane electronic control switch

|

Easy to operate, convenient to maintain, and reliable

|

Used on various cranes.

|

We believe that the specialty cable sector is one of the most profitable sectors in the wire and cable industry with significantly higher gross margins of up to 60%. Specialty cable is typically produced for specific uses in harsh conditions that are unsuitable for other traditional cable.

With the completion of the Phase I Changxing Facility, we plan to enhance the development of marine cable (one of our specialty cable products), including submerged cable used to transfer data and telecommunications and marine cable used in shipbuilding. We are also in the process of developing carbon fiber composite cable, which is a new type of cable composed of carbon fiber and a metallic conductor. Carbon fiber is one of the most advanced cable products in China and has the potential for higher gross margins than other types of specialty cable. Carbon fiber composite cable is lighter than pure metal cable and has better electrical conductivity. We believe it can be useful in upgrading China’s power grid. We also believe the use of carbon fiber composite cable could alleviate the pressure on cables caused by natural disasters, including heavy snowfall. By January 2011, we expect to be one of the few manufacturers in China producing carbon fiber composite cable. With this new technology, we expect that carbon fiber composite cable will be one of our primary areas of our focus for growth in the next few years. Additionally, we are developing cable for “new energy” sources such as wind and solar energy, which we believe will also be cable products with high-margin potential.

We, through Dalian Befut, currently hold 7 patents and have 22 pending patent applications with respect to our cable products, and we are the only company in the PRC cable and wire industry holding a patent for watertight cable. The patent for carbon fiber composite cable is currently owned by one of the principal shareholders of Dalian Yuansheng, Dalian Befut’s recently acquired subsidiary, and will be transferred to Dalian Yuansheng.

3

The following table shows the sales of our products in our three main categories (traditional cable, specialty cable and switch appliances) as a percentage of total sales for the fiscal years ended June 30, 2010, 2009 and 2008:

|

Percentage of Total Sales for Fiscal Years Ended June 30,

|

||||||||||||||||||||||||

|

Products

|

2010

|

2009

|

2008

|

|||||||||||||||||||||

|

USD

|

Percentage

|

USD

|

Percentage

|

USD

|

Percentage

|

|||||||||||||||||||

|

Traditional Cable

|

12,938,647

|

41.39

|

%

|

10,581,298.57

|

54.8

|

%

|

10,006,487.50

|

50.0

|

%

|

|||||||||||||||

|

Specialty Cable

|

||||||||||||||||||||||||

|

Marine Cable

|

6,589,038

|

21.08

|

%

|

1,274,389.97

|

6.6

|

%

|

1,280,830.40

|

6.4

|

%

|

|||||||||||||||

|

Petrochemical Cable

|

5,133,764

|

16.42

|

%

|

1,409,552.55

|

7.3

|

%

|

900,583.88

|

4.5

|

%

|

|||||||||||||||

|

Mine Specialty Cable

|

5,862,434

|

18.75

|

%

|

3,784,552.04

|

19.6

|

%

|

6,904,476.38

|

34.5

|

%

|

|||||||||||||||

|

Total Specialty Cable

|

17,585,236

|

56.25

|

%

|

6,468,494.56

|

33.50

|

%

|

9,085,890.66

|

45.40

|

%

|

|||||||||||||||

|

Other Cable

|

N/A

|

N/A

|

2,259,145.87

|

11.7

|

%

|

920,596.84

|

4.6

|

%

|

||||||||||||||||

|

Switch Appliances

|

734,778

|

2.35

|

%

|

N/A

|

N/A

|

N/A

|

N/A

|

|||||||||||||||||

|

Total

|

31,258,662.00

|

100

|

%

|

19,308,939.00

|

100

|

%

|

20,012,975.00

|

100

|

%

|

|||||||||||||||

The following pictures illustrate the physical structure of our traditional cable and marine cable:

Traditional Cable

Marine Cable

Manufacturing

OEM Agreements

All of our products are manufactured in the PRC by Dalian Befut, our captive manufacturer, pursuant to agreements between WFOE, our wholly-owned subsidiary in the PRC, and Dalian Befut executed on February 16, 2009. These agreements include an Original Equipment Manufacturer Agreement, an Intellectual Property License Agreement and a Non-competition Agreement (collectively, the “OEM Agreements”).

Pursuant to the Original Equipment Manufacturer Agreement, (i) Dalian Befut is required to manufacture products according to WFOE’s specifications and may not manufacture products for any person or entity other than WFOE; (ii) WFOE is responsible for supplying all raw materials to Dalian Befut and the design specifications for products to be manufactured; (iii) WFOE purchases the manufactured products from Dalian Befut at a price not greater than the cost of such manufactured products; and (iv) WFOE has an exclusive right to purchase some or all of the assets and/or equity of Dalian Befut at a mutually agreed price to the extent permitted by PRC law. The Original Manufacturing Agreement has an indefinite term and may only be terminated in the event of certain breaches of the agreement.

4

Pursuant to the Intellectual Property License Agreement, WFOE is permitted to use certain of Dalian Befut’s intellectual property rights, including trademarks, patents and know-how, for the marketing and sale of the products manufactured by Dalian Befut. Additionally, Dalian Befut agreed not to compete with WFOE pursuant to the Non-competition Agreement.

As a result of the OEM Agreements, Dalian Befut ceased to be an independent operating company and became contractually bound to manufacture products solely for our benefit and sell such products to us at cost. Throughout the remainder of this report, we use the term “captive manufacturer” to describe our relationship with Dalian Befut.

Changxing Island Manufacturing Facilities

We are in the process of constructing a new manufacturing facility located in Dalian’s Changxing Island Harbor Industrial Zone, which is approximately 120 kilometers from Dalian. Construction of the Phase I Changxing Facility began in 2006 and was completed in December 2009. We relocated all of our cable manufacturing operations to the Phase I Changxing Facility and commenced operations and product manufacturing at this facility in April 2010. The Phase I Changxing Facility boasts 45,477 square meters of floor space, consisting of 24,964 square meters of production space, 5,326 square meters of warehouse space, 8,264 square meters of office space, and 6,923 square meters of supporting facilities space. The Phase I Changxing Facility has over 70 sets of advanced wiring equipment, 20 of which are newly purchased sets. The Phase I Changxing Facility currently has a production capacity of 2,400 km of cable per year, which is three times the amount we were able to produce at our old manufacturing facility. The Phase I Changxing Facility is estimated to reach its full production capacity of approximately 4,000 km of cable per year by June 30, 2013.

We have completed the design plan for the Phase II Changxing Facility. Construction of the Phase II Changxing Facility is planned to commence after the Phase I Changxing Facility reaches its maximum production capacity. The Phase II Changxing Facility will be used primarily for the development and production of specialty cable which corresponds to our plan to focus our business on specialty cable over the next five years. After completion of the Phase II Changxing Facility, our total production capacity is expected to reach approximately 10,667 km of cable per year.

Previously, our cable manufacturing was conducted at a manufacturing facility located in the city of Dalian with a production capacity of approximately 800 km of cable per year. We now use our old manufacturing facility located in Dalian for the production of switch appliances.

Manufacturing Process

We, through Dalian Befut, utilize sophisticated manufacturing processes and know-how, which enable us to produce a wide array of traditional and specialty cable. Due to our research and development efforts, we believe we are a leader in the material configuration and manufacturing processes for specialty cable.

The following illustration shows the basic steps in the manufacturing process of our cable products:

Raw Materials and Suppliers

Our primary raw materials are copper wire, insulation materials and protective materials. Our main suppliers for copper wire for the fiscal year ended June 30, 2010 were Tianjin Huabei Wire & Cable Manufacturing, Shenyang Tailida Copper Co., Ltd. and Shanyang Metal Co., Ltd. Our main suppliers for insulation and protective materials in the same period were Yingkou Genorio Industrial Co., Ltd., Jiangsu Right Plastic Co., Ltd., Huayi Plastic Co., Ltd. and Tianjin Commercial Import & Export Co., Ltd.

5

Our principal raw materials are generally available in the market and we have not experienced any raw material shortages in the past. Because of the general availability of these raw materials, we do not believe that we will experience any raw material shortages in the foreseeable future; however, changes in the price of copper, which has a history of volatility, directly affect the prices of our products and may influence the demand for our products. Nonetheless, because we seek to pass the cost of our raw materials (mainly copper wire) on to our customers, we believe our actual margin rate will not be significantly affected even if the price of raw materials increases.

The following is a list of our top suppliers expressed as a percentage of the U.S. dollar amount of total raw materials purchased in the fiscal year ended June 30, 2010:

|

Percentage

|

||||||||||

|

of Total

|

||||||||||

|

Suppliers

|

Total Amount (USD)

|

Purchases

|

||||||||

| 1 |

Tianjin Huabei Cable Factory

|

10,235,535.32 | 43.0 | % | ||||||

| 2 |

Yingkou Genorio Industrial Co., Ltd.

|

2,923,471.82 | 12.29 | % | ||||||

| 3 |

Shenyang Tailida Copper Co., Ltd.

|

2,799,529.91 | 11.77 | % | ||||||

| 4 |

Shanyang Metal Co., Ltd.

|

1,212,324.14 | 5.1 | % | ||||||

| 5 |

Dalian Lian Zhong Fu Hai Tong Co., Ltd.

|

1,160,963.75 | 4.88 | % | ||||||

Distribution, Sales Network and Customers

We sell our products through a team of 24 full-time sales personnel located in Dalian and another 20 full-time sales personnel located at 14 sales branch offices in major cities throughout China, including in Beijing, Shenyang, Tianjin, Jilin, Harbin and Benxi. In addition, we have contracted with five distributors to sell our products. Normally, the contracts we have with the distributors are for one year and are non-exclusive. In the year ended June 30, 2010, most of our sales were generated by our full-time sales personnel, who are responsible for maintaining business relationships with our customers.

As of June 30, 2010, we had a total of approximately 500 customers located throughout China.

In the year ended June 30, 2010, our five largest customers accounted for approximately 45.93% of our total sales, among which Dalian Huasheng Electric Installation Corporation was the largest, accounting for 10.03% of our total revenue. These key customers and their respective percentages of our total sales are listed below:

Top 5 Customers for the Fiscal Year Ended June 30, 2010

|

Customer Name

|

Product

|

Sales (USD)

|

% of Total Sales

|

|||||||

|

Dalian Huasheng Electrical Installation Co., Ltd.

|

Electric Cable

|

2,894,472 | 10.03 | % | ||||||

|

COSCO Dalian Shipyard Co., Ltd.

|

Marine Cable

|

2,755,916 | 9.55 | % | ||||||

|

Tianjin Xingang Shipbuilding Heavy Industry Co., Ltd.

|

Marine Cable

|

2,607,949 | 9.03 | % | ||||||

|

Angang Steel Co., Ltd. Bayuquan Steel Branch

|

Electric Cable

|

2,593,340 | 8.98 | % | ||||||

|

China Nuclear Power Engineering Co., Ltd. North Branch

|

Mining Cable

|

2,406,732 | 8.34 | % | ||||||

|

Custom Name

|

Product

|

Sales (USD)

|

% of Total Sales

|

|||||||

|

Dalian Huasheng Electrical Installation Co., Ltd.

|

Electric Cable

|

4,108,709 | 19.49 | % | ||||||

|

Ningxia meili Paper Industry Co., Ltd.

|

Electric Cable

|

1,513,689 | 7.18 | % | ||||||

|

Dalian Binshan Group Air Condition Installation Co., Ltd.

|

Electric Cable

|

1,317,818 | 6.25 | % | ||||||

|

CCEED Industrial Equipment Installation Co. Ltd.

|

Electric Cable

|

1,156,218 | 5.48 | % | ||||||

|

Dalian Binshan Group Co., Ltd.

|

Specialty Cable

|

752,702 | 3.57 | % | ||||||

6

In light of our increased production capacity due to the completion of the Phase I Changxing Facility, in April 2010, we adjusted our sales strategy to increase our focus on larger customers that desire higher volumes of our products. As a result, in fiscal 2010 we experienced increased total revenue, much of which was derived from sales to these larger customers. This shift in sales strategy resulted in a change in our top five customers in fiscal 2010 as compared to fiscal 2009.

Growth Strategy

Our objective is to become the leading manufacturer of specialty cable products in China. We intend to achieve this objective by pursuing a growth strategy that includes:

Increase focus on high-margin specialty products. To meet the growing demand for specialty cable products, we plan to increase the production of high-margin specialty cable from approximately 58% to approximately 67% of our total production volume over the next three to five years. In addition, we plan to produce submarine cable, carbon fiber composite cable and other high-end cable products with high profit margins, increasing our sales and financial performance.

Our sales generated from specialty cable in our fourth fiscal quarter ended June 30, 2010 accounted for 58.6% of our total sales revenue in that quarter. Additionally, current economic policy in China encourages marine construction, mining, petrochemical and new energy industries. Based on these factors, in our fiscal year ending June 30, 2011 we plan to continue devoting more resources to developing, marketing and selling petrochemical and marine cable and investing in our new high-margin product, carbon fiber composite cable.

We currently possess the technology and know-how to produce these new cable products. With regard to submarine cable, however, we likely will be required to make significant additional expenditures to execute this element of our strategy. Such expenditures may include acquisition of land rights close to the coast, construction of a separate production facility on such site and hiring of additional personnel. Such expenditures will require us to obtain additional financing, the success of which cannot be assured.

Expand production capacity . In order to accommodate the increasing demand for our products, we intend to expand our current production capacity of 2,400 km of cable per year to 4,000 km of cable per year by maximizing the production capacity from our recently completed Phase I Changxing Facility. The construction of the Phase II Changxing Facility will further increase our production capacity. An increase in production capacity will allow us to produce and sell a higher quantity of products while lowering our manufacturing costs due to economies of scale. The Phase II Changxing Facility will expand our production capacity for specialty cable.

Expand into new markets. We plan to enter into new markets, such as the submarine cable market and the “new energy” cable market, which includes the production of wind and solar energy cable. We also recently entered the switch appliance market in the fiscal year ended June 30, 2010. Because switch appliances are not our primary business, this product only accounts for 2%-3% of our total revenue. However, we anticipate that the sales of switch appliances will to increase to 5% of our total revenue in the year ending June 30, 2011.

Increase sales and broaden customer base . We plan to continue to provide high quality cable products to our existing customer base and use our existing customer contacts, industry reputation and experienced sales team to increase our sales of traditional and specialty cable products. In the short-term, we will continue our sales and marketing efforts to increase our sales of our traditional cable products, while our long-term strategy is to concentrate on developing and expanding our sales and customer base for our specialty cable products.

Pursue strategic acquisitions. We will continue to actively consider possible investments in or acquisitions of companies that complement our business strategies and expand our product offerings. As a result of the fragmented nature of the cable and wire industry in China, we believe attractive potential acquisition targets may present themselves. We plan to consider strategic acquisitions as a means to accelerate our growth, increase our sales and expand our market share.

Seasonality

Demand for our traditional cable is generally lower from December to March than from April to November primarily due to the Chinese new year and spring festival which occurs from January to March. Sales of our specialty cable products have not experienced seasonal trends. We believe that our expanding focus on specialty cable products will significantly reduce the impact of seasonality on our overall business.

7

Research and Development

For the fiscal years ended June 30, 2010 and 2009, we spent $880,944 and $89,179 on research and development, respectively. We significantly increased our budget for research and development in fiscal 2010 compared to fiscal 2009, all of which was spent on the research and development of new technologies which are the subject of 22 pending patent applications (including fees associated with the application process). We maintain an internal research and development department staffed with 40 senior technical employees consisting of 31 full-time employees and 9 part-time employees.

Our research and development team is led by Mr. Guoxiang Liu, who was formerly employed by the Shenyang Electric Cable Factory, a state owned enterprise and formerly one of Asia’s largest cable companies. Due to our research and development efforts, we believe we are a leader in the material configuration and manufacturing process of specialty cable. As an ancillary method of our research and development, we also have a research cooperation relationship with Dalian University of Technology to share their technology and research achievements. The general framework for our cooperative partnership with the Dalian University of Technology is set forth in an agreement dated July 10, 2009 (the “Cooperation Agreement”). Pursuant to the Cooperation Agreement, which has a three year term and may be terminated by either party at any time, we agree to collaborate with the Dalian University of Technology on a project basis. We have no financial obligations under the Cooperation Agreement but may fund projects at our discretion.

We plan to continue differentiating ourselves from our competition by focusing our activities on developing the most advanced products in the cable and wire industry.

Intellectual Property

Trademarks. Dalian Befut is the registered holder of the following trademark, which is registered with the Trademark Office of the State Administration for Industry and Commerce in China.

M∙Q∙E

The registered scope of use of this trademark includes wire products such as wire cable, electric wire, power materials (electric wire and wire cable), and electric resisters for copper wire. The registered term of the trademark expires on September 6, 2011. Under the PRC Trademark Law, registered trademarks are granted for a term of ten years and are renewable for additional terms. Each renewal is limited to a ten-year term and the registrant must continue to use the trademark and apply for a renewal within six months prior to the expiration of the current term.

In 2008, the trademark above was recognized as a “Famous Trademark” in China through a judicial procedure pursuant to Rules on Famous Trademark Recognition and Protection promulgated by the PRC National Industrial and Commercial Bureau. A Famous Trademark in China entitles the owner of the mark to stronger protection as compared to a general trademark. For example, a holder of a Famous Trademark may prohibit others from using the same or similar mark not only on the same or similar products but also on products in other industries if the use of such mark would cause confusion or be misleading to a reasonable consumer. In addition, in a trademark dispute adjudication, a Famous Trademark itself provides evidence of influence on consumers. In Dalian, there are only ten Famous Trademarks, one of which is our mark.

Patents . Dalian Befut has seven registered patents in China. The following table provides information regarding each patent.

8

|

Type

of

Patent

|

Patent No.

|

Inventor’s

Name

|

Date of

Application

|

Date of

Publication

and Term

|

||||||

|

Intelligent reactive power compensation for automatic screen

|

Utility model

|

ZL200720184912.4

|

Dalian Befut Wire & Cable Manufacturing Co., Ltd

|

12/14/2007

|

10/15/2008; Term: 10 years from 10/15/2008 to 10/14/2018

|

|||||

|

Automatic Protection Ni-mh Battery Screen

|

Utility model

|

ZL200720184913.9

|

12/14/2007

|

01/07/2009

Term: 10 years from 01/07/2009 to 01/06/2019

|

||||||

|

New tide-proof power cable

|

Utility model

|

ZL200820015254.0

|

Guoxiang Liu,

Hongming Wu,

Ying Zhao and Hongbo Cao

|

08/29/2008

|

06/10/2009

Term: 10 years from 06/10/2009 to 06/09/2019

|

|||||

|

Sonar watertight cable

|

Utility model

|

ZL200820015255.5

|

08/29/2008

|

06/10/2009

Term: 10 years from 06/10/2009 to 06/09/2019

|

||||||

|

Environmentally friendly wire & cable of low-smoke, halogen-free, fire-retardant insulation

|

Utility model

|

ZL200820015256.X

|

08/29/2008

|

06/10/2009

Term: 10 years from 06/10/2009 to 06/09/2019

|

||||||

|

Mine fire-retardant rubber branch of the pre-cable

|

|

Utility model

|

|

ZL200820015332.7

|

|

09/01/2008

|

06/10/2009

Term: 10 years from 06/10/2009 to 06/09/2019

|

|||

|

High-temperature plastic extrusion die-tool

|

Utility model

|

ZL200820015331.2

|

Guoxiang Liu,

Hongming Wu,

Ying Zhao and Hongbo Cao

|

08/29/2008

|

08/12/2009

Term: 10 years from 08/12/2009 to 08/12/2019

|

|||||

9

In addition to the registered patents, Dalian Befut has pending applications for 22 additional patents as set forth in the table below.

|

Name of Patent

|

Type of

Patent

|

Patent No.

|

Inventor’s

Name

|

Date of

Application

|

Date of

Acceptance

of the

Application

by the PRC

IP Office

|

Status of

Application

|

||||||

|

Pre-fabricated branched cable

|

Utility model

|

200920247890.0

|

Hongbo Cao

|

11/06/2009

|

11/06/2009

|

Patent Pending

|

||||||

|

Thermocouple compensation cable with flame retardant

|

Utility model

|

200920247891.5

|

11/06/2009

|

11/06/2009

|

Patent Pending

|

|||||||

|

BXVW outdoor weather-proof sheathed cable

|

Utility model

|

200920247892.X

|

11/06/2009

|

11/06/2009

|

Patent Pending

|

|||||||

|

Measurement and computer input cable

|

Utility model

|

200920247894.9

|

11/06/2009

|

11/06/2009

|

Patent Pending

|

|||||||

|

Fluoroplastic -46 insulated shielded wire

|

Utility model

|

200920247889.8

|

11/06/2009

|

11/06/2009

|

Patent Pending

|

|||||||

|

Halogen-free flame-retardant thermocouple compensation cable

|

Utility model

|

200910219723.X

|

Hongbo Cao

|

11/10/2009

|

11/10/2009

|

Patent Pending

|

||||||

|

Flame-retardant BXVW outdoor weather-proof sheathed cable

|

Utility model

|

200910219732.9

|

11/10/2009

|

11/10/2009

|

Patent Pending

|

|||||||

|

Flame-retardant silicon rubber insulated and sheathed measurement and computer input cable

|

Utility model

|

200910219731.4

|

11/10/2009

|

11/10/2009

|

Patent Pending

|

|||||||

|

High-strength silicone rubber motor lead wire

|

Invention model

|

200910219726.3

|

11/10/2009

|

11/10/2009

|

Patent Pending

|

|||||||

|

High-strength silicone rubber motor lead wire

|

Utility model

|

200910219726.4

|

11/10/2009

|

11/10/2009

|

Patent Pending

|

|||||||

|

Aviation fluoroplastic -46 insulated, shielded wire

|

Utility model

|

200910219727.8

|

11/10/2009

|

11/10/2009

|

Patent Pending

|

|||||||

|

Flame-retardant, fire-resistant, halogen-free pre-fabricated branched cable

|

Utility model

|

200910219719.3

|

11/10/2009

|

11/10/2009

|

Patent Pending

|

|||||||

|

Shielded instrumentation cable for communication equipment

|

Utility model

|

200910219842.5

|

Hongbo Cao

|

11/13/2009

|

11/13/2009

|

Patent Pending

|

||||||

|

Shielded signal cable for metro communication

|

Utility model

|

200910219843.X

|

11/13/2009

|

11/13/2009

|

Patent Pending

|

|||||||

|

A new type of wind cable

|

Utility model

|

200910219840.6

|

11/13/2009

|

11/13/2009

|

Patent Pending

|

|||||||

|

Safety explosion-proof type computer input cables

|

Utility model

|

200910219841.0

|

11/13/2009

|

11/13/2009

|

Patent Pending

|

|||||||

|

A new type of control cable for nuclear power station

|

Utility model

|

200910219914.6

|

Hongbo Cao

|

11/17/2009

|

11/17/2009

|

Patent Pending

|

||||||

|

New type wind cable

|

Utility model

|

200920248142.4

|

11/17/2009

|

11/17/2009

|

Patent Pending

|

|||||||

|

Computer input cables

|

Utility model

|

200920248147.7

|

11/17/2009

|

11/17/2009

|

Patent Pending

|

|||||||

|

Flexible shielded control cable for marine engine

|

Invention model

|

200910219917.X

|

11/17/2009

|

11/17/2009

|

Patent Pending

|

|||||||

|

Flexible shielded control cable for marine engine

|

Utility model

|

200910219917.5

|

11/17/2009

|

11/17/2009

|

Patent Pending

|

|||||||

|

Shielded signal cable for metro communication

|

Utility model

|

200920248141.X

|

11/17/2009

|

11/17/2009

|

Patent Pending

|

10

Under the PRC Patent Law, a patent is valid for a term of twenty years in the case of an invention and a term of ten years in the case of utility models and designs. Our pending patents are all utility models and will be entitled to ten years of protection. Any use of a patent without consent or a proper license from the patent owner constitutes an infringement of patent rights. We cannot assure you that any patent applications filed by us will be approved in the future.

With respect to intellectual property rights such as trademarks and patents as described above and know-how for the marketing and sale of the products manufactured by Dalian Befut, WFOE and Dalian Befut have entered into an Intellectual Property License Agreement, pursuant to which, WFOE is permitted to use Dalian Befut’s trademarks, patents (except newly issued patents not existing as of the date of the agreement) and know-how for nominal consideration. If and when any of the above patent applications are granted, we intend to either enter into a similar Intellectual Property License Agreement between WFOE and Dalian Befut or arrange for the transfer such patents from Dalian Befut to WFOE.

Competition

Currently, there are approximately 7,000 manufacturers in China producing a variety of types of cable and wire. Among these manufacturers, we estimate that approximately 2,000 manufacturers have the capability to produce specialty cable, approximately 40 of such manufacturers have the capability to produce nuclear cable and approximately 20 have the capability to produce marine cable. Unlike most other competitors, we are capable of producing both nuclear cable and marine cable. In addition, by January 2011, we expect to become one of the few manufacturers in China producing carbon fiber composite cable.

Our competitors include manufacturers that have the ability to conduct comprehensive cable and wire production, such as Far East Cable Co., Limited (“Far East”), Shangshang Cable Co., Ltd., as well as manufacturers that can produce specialty cable, such as Yangzhou Marine Cable Manufacturing Factory (“Yangzhou Marine”). Far East is our largest competitor in the sector of traditional electrical cable and wire and is a leader in terms of market share. We believe our competitive advantage over Far East is in specialty cable production, a segment in which we have more qualification certificates and market share. In terms of specialty cable, Yangzhou Marine is our major competitor. It entered into this market earlier than we did and currently has a strong competitive advantage on qualification certificates and market share. However, Yangzhou Marine's primary market is mostly in the adjacent provinces, such as Jiangsu and Zhejiang, areas in which we have not focused our sales and marketing efforts.

Competitive Advantages

We believe we have the following competitive advantages:

|

|

·

|

We have a strong research and development team. We believe we have an exceptional research and development team with highly skilled personnel, many of whom are former employees of the Shenyang Electric Cable Factory, a state owned enterprise that was formerly one of Asia’s largest cable companies. Our team also includes experts from Dalian Science and Technology University.

|

|

|

|

|

·

|

We have the unique ability to produce certain types of specialty cable . By January 2011, we expect to be one of a few manufacturers in China producing carbon fiber composite cable. The patent for carbon fiber composite cable is currently owned by one of the principal shareholders of Dalian Yuansheng, Dalian Befut’s recently acquired subsidiary, and will be transferred to Dalian Yuansheng. Additionally, we are the only company in the PRC cable and wire industry holding a patent for watertight cable. These specialty cable products are both high-margin products with great market potential in the cable and wire industry.

|

|

|

·

|

We have modern production facilities. As of the date of this report, our Phase I Changxing Facility is now in operation has greatly increased our production capacity. We believe that such expansion may provide a significant advantage in terms of production scale and capacity in northeastern China. The addition of the Phase II Changxing Facility will make our production capabilities even more competitive.

|

|

|

·

|

We have a strong internal sales force. We primarily sell our products to our customers through our internal sales force of 44 people with minimal reliance on distributors or outside sales personnel. We believe this approach enables us to enjoy lower sales costs and higher profit margins than many of our competitors.

|

11

|

|

·

|

Our geographic location allows us to better serve our regional customer base. There are currently more than 100 companies located in northern China that, on average, purchase at least $7 million worth of specialty cable per year. As most of our competitors are located in southern China, our geographic location provides us with a significant advantage over them with respect to attracting large customers in northern China due to lower transportation costs, regional relationships and similar cultural backgrounds.

|

Certifications

We have obtained qualifications in specialty cable production and we are a nationally-designated enterprise for coal mining and mechanical products. Additionally, we have obtained classification society certifications from the China Classification Society, American Bureau of Shipping, Germanischer Lloyd, Nippon Kaiji Kyokai and Korean Register of Shipping for our marine cable. We have also received a MIL-Spec Quality Management System certification. In the year ended June 30, 2010, we became one of 29 designated suppliers of China National Petroleum Corporation, one of the largest companies in the world with very strict standards of selecting cable and wire suppliers, further evidencing the quality of our cable products.

Environmental Compliance

We are subject to environmental regulations that are generally applicable to manufacturing companies in the PRC. For example, we obtained necessary approvals for our new manufacturing facilities. We are also subject to periodic inspection by environmental regulators and must follow specific procedures in some of our processes. We have not violated environmental regulations or approved practices.

Employees

We currently have 208 employees in total, of whom 162 are full-time and 46 are part-time.

Government Regulation

We are subject to the recent PRC State Administration of Foreign Exchange (“SAFE”) regulations regarding offshore financing activities by PRC residents. SAFE issued a public notice in October 2005 requiring PRC domestic residents to register with the local SAFE branch before establishing or controlling any company outside of China for the purpose of capital financing with assets or equities of PRC companies, referred to in the notice as an “offshore special purpose company.” The PRC domestic residents that were former shareholders of the WFOE fully complied with the SAFE regulations and have duly registered with the SAFE in accordance with the public notice.

Dalian Befut’s production facilities maintain an ISO 9001 Quality Management System.

According to The Rule Regarding the Administration on Compulsory Products Certification promulgated by the General Administration of Quality Supervision, Inspection and Quarantine of the PRC on December 3, 2001 and effective May 1, 2002, products that impact health and safety of human beings, life and health of animals and plants and environmental protection and public safety that are listed in the Index of the PRC Compulsory Production Certification (the “Index”) are subject to the universally applicable national standards, technical rules and implementation procedures. China Compulsory Certification (“CCC”) is a mandatory requirement for the production, distribution and exportation of any of the products that are listed in the Index. Certain of our cable and wire products are subject to such certification and we have maintained effective CCC status on those products accordingly.

In 2006, we obtained a license from the Dalian customs bureau for importing and exporting cable, wire and power equipment. We renewed this license in July 2009 and the extended expiration date is July 20, 2012.

Corporate History and Structure

We are a holding company and conduct substantially all of our production, marketing, finance, research and development, and administrative activities through our indirect subsidiaries and captive manufacturing entity located in the PRC. We were incorporated in the State of Nevada under the name “Frezer, Inc.” on May 2, 2005. On June 18, 2009, we changed our name to “BEFUT International Co., Ltd.” and effectuated a 1-for-4.07 reverse stock split of our outstanding shares of common stock. As a result, our ticker symbol was changed to BFTI.OB. BEFUT International Co. Limited, a British Virgin Islands company (“Befut BVI”), is our majority shareholder and owns approximately 94% of the issued and outstanding common stock of the Company.

12

On March 13, 2009, we entered into a Share Exchange Agreement with Befut Nevada and Befut BVI pursuant to which Befut BVI transferred to us all of the outstanding shares of common stock of Befut Nevada in exchange for (i) the issuance to Befut BVI of an aggregate of 117,768,300 or 98.3% of our then outstanding shares of common stock, and (ii) the cancellation of an aggregate of 2,176,170 shares of our common stock then owned by Befut Nevada (the “Share Exchange”). Befut Nevada had acquired such shares from three individuals for an aggregate purchase price of $370,000 pursuant to the terms of a Stock Purchase Agreement dated as of March 2, 2009.

Simultaneously with the Share Exchange, the Company consummated a private placement of 15% convertible promissory notes and warrants to purchase common stock for gross proceeds of $500,000. As of the date of this report, such convertible notes are no longer outstanding.

As a result of the Share Exchange, Befut Nevada became our wholly-owned subsidiary. Befut Hongkong is a wholly-owned subsidiary of Befut Nevada, and WFOE is a wholly owned subsidiary of Befut Hongkong. Befut BVI remains our largest shareholder, owning 94.0% of our outstanding shares.

We conduct our operations through WFOE and Dalian Befut, a captive manufacturing entity of WFOE. Dalian Befut was incorporated on June 13, 2002 under the laws of the PRC, and is currently owned by eight individuals residents of the PRC. Mr. Hongbo Cao, our chairman, president and chief executive officer, and Mr. Tingmin Li are the largest shareholders of Dalian Befut, owning an aggregate of 94.6% of its equity interests. For a discussion of our contractual manufacturing relationship with Dalian Befut, see the section entitled “Business – Manufacturing Process – OEM Agreements.”

Befut Marine is a subsidiary of Dalian Befut incorporated on April 14, 2006. Befut Marine’s current shareholders are Dalian Befut, Ms. Lin Li , Mr. Hongbo Cao and Mr. Fansheng Li, each of whom own 86.6%, 5.0%, 5.0% and 3.4% of its equity interests, respectively. Befut Marine conducts all of our production and sales of marine cable.

Befut Zhong Xing is a subsidiary of Dalian Befut incorporated on July 1, 2009. Befut Zhong Xing’s current shareholders are Dalian Befut and Mr. Chengnian Yan, each of whom own 73.5% and 26.5% of its equity interests, respectively. Befut Zhong Xing manufactures switch appliances, including high-low-voltage distribution cabinet switches and crane electronic control switches.

Dalian Yuansheng is a recently acquired subsidiary of Dalian Befut incorporated on June 3, 2009. Dalian Yuansheng’s current shareholders are Dalian Befut and Mr. Xianjun Cheng, each of whom own 93.3% and 6.7% of its equity interests, respectively. Dalian Yuansheng is engaged in the research and development of carbon fiber composite and other specialty cable.

Our corporate organizational chart is set forth below.

13

* WFOE does not have equity ownership in Dalian Befut. Dalian Befut is a captive manufacturer of WFOE pursuant to the OEM Agreements described in Item 1 – Business.

ITEM 1A. RISK FACTORS

An investment in our common stock involves a high degree of risk. You should carefully consider the following information about these risks, together with the other information contained in this Report before investing in our common stock. If any of the events anticipated by the risks described below occur, our results of operations and financial condition could be adversely affected which could result in a decline in the market price of our common stock, causing you to lose all or part of your investment.

Risks Related to our Business

Adverse capital and credit market conditions may significantly affect our ability to meet liquidity needs, access to capital and cost of capital.

The capital and credit markets may experience extreme volatility and disruption from time to time, including, among other things, extreme volatility in securities prices, severely diminished liquidity and credit availability, ratings downgrades of certain investments and declining valuations of others. Adverse market conditions may limit our ability to replace, in a timely manner, maturing liabilities and access the capital necessary to operate and grow our business. As such, we may be forced to delay raising capital or bear an unattractive cost of capital which could decrease our profitability and significantly reduce our financial flexibility. Demand for our products is vulnerable to economic downturns. The worsening of economic conditions could result in a decrease in or cancellation of orders for our products. We are unable to predict the duration and severity of any disruption in financial markets and global adverse economic conditions and the effect such events might have on our business. Our results of operations, financial condition, cash flows and capital position could be materially adversely affected by disruptions in the financial markets. Further, any decreased collectability of accounts receivable or early termination of sales contracts due to the current deterioration in economic conditions could negatively impact our results of operations.

Quarterly operating results may fluctuate due to factors beyond our control, including customer demand and raw materials pricing.

Our quarterly results of operations may fluctuate as a result of a number of factors, including fluctuation in the demand for our products and changes in the price of copper, which directly affect the prices of our products and may influence demand. Quarter-to-quarter comparisons of results of operations have been and will be impacted by the volume of such orders and shipments. In addition, our operating results each quarter could be adversely affected by the following factors, among others, such as variations in the mix of product sales, price changes in response to competitive factors, increases in raw material costs and increases in utility costs (particularly electricity). Demand for our traditional cable products are subject to seasonality factors which can affect our quarter to quarter results as well.

14

Fluctuating copper prices impact our business and operating results.

Copper is the principal raw material used in the manufacture of our products. The copper industry is highly volatile and cyclical in nature. Copper prices, which have increased over the past several years followed by more recent sharp declines, have varied significantly and may vary significantly in the future. This affects our business both positively and negatively, as higher copper prices generate higher sales for us since we pass the incremental costs onto our customers, while lower copper prices will reduce the sales price of our products. The price of copper is influenced by factors including general economic conditions, industry capacity utilization, import duties and other trade restrictions. We cannot predict copper prices in the future or the effect of fluctuations in the costs of copper on our future operating results. In accordance with customary practice in our industry, we seek to mitigate the impact of changing raw material prices by passing price increases and decreases onto our customers by adjusting our prices to reflect changes in raw material prices. We may not be able to adjust our product prices rapidly enough in the short-term to recover the costs of increases in raw materials. Our future profitability may be adversely affected to the extent we are unable to pass on higher raw material costs to our customers.

We face substantial competition in our business and our failure to compete effectively may adversely affect our ability to generate revenue.

The wire and cable industry in China is competitive and highly fragmented with more than 7,000 companies. The principal elements of competition in the market are, in our opinion, pricing, payment terms, product availability and quality. While we believe that we have attained a competitive position with respect to all of these factors, our major competitors such as Far East Cable Co., Limited and Yangzhou Marine Cable Factory may have substantially greater resources than us and may be better able to successfully endure downturns in our industry or primary market segments. In periods of reduced demand for our products, we reduce our selling prices to maintain or increase market share or maintain selling prices, which may result in loss of market share. Under either situation, we would experience a reduction in our sales and overall profitability. In addition, we cannot assure you that additional competitors will not enter our markets, or that we will be able to compete successfully against existing or new competition.

We may not be able to effectively control and manage our growth.

If our business and primary markets, including shipbuilding, nuclear power and mining, continue to grow and develop as we expect, it will be necessary for us to finance and manage expansion in an orderly fashion. We may face challenges in managing the production and sale of expanding product offerings and in integrating acquired businesses with our own. Such events will increase demands on our existing management and facilities. Failure to manage this growth and expansion could interrupt or adversely affect our operations, cause production backlogs, longer product development time frames and administrative inefficiencies.

In the past several years we have derived a significant portion of our revenues from a small group of customers. If we were to become dependent again upon a few customers, such dependency could negatively impact our business, operating results and financial condition.

Previously, our customer base has been highly concentrated. For the year ended June 30, 2010 and 2009, our five largest customers accounted for 46% and 45% of our total sales, respectively, and the largest customer accounted for approximately 10.0% and 19.5% of our total sales in such periods, respectively. As our customer base may change from year-to-year, during such years that the customer base is highly concentrated, the loss of, or reduction of our sales to, any of such major customers could have a material adverse effect on our business, operating results and financial condition. Moreover, our success will depend in part upon our ability to obtain orders from new customers, as well as the financial condition and success of our customers and general economic conditions.

Shortages or disruptions in the availability of raw materials, especially copper, could have a material adverse effect on our business.

Copper, protective materials and insulation materials are our principal raw materials used in the manufacture of our cable products. Copper, our principal raw material, accounted for approximately 76.2% of our raw material purchases during the fiscal year ended June 30, 2010. We expect that copper will continue to account for a significant portion of our raw material purchases in the future. The price of raw materials fluctuate because of general economic conditions, global supply and demand and other factors causing monthly variations in the costs of our raw materials purchases. These macro-economic factors, together with labor and other business interruptions experienced by certain raw material suppliers, have contributed to periodic shortages in the supply of raw materials to other industry participants. Likewise, we could suffer shortages in the future, although we have do not expect shortages of any material nature in the foreseeable future. If we are unable to procure adequate supplies of raw material to meet our future production needs and customer demand, shortages could result in a material loss of customers and revenues and adversely impact our results of operations. In addition, supply shortages or disruptions or the loss of key suppliers may cause us to procure our raw materials from less cost effective sources and may have a material adverse affect on our business, revenues and results of operations.

15

We depend on a few suppliers for a significant portion of our principal raw materials and we do not have any long-term supply contracts with our raw materials suppliers. Interruptions of production at our key suppliers may affect our results of operations and financial performance.

We rely on a limited number of suppliers for most of the raw materials we use. During the fiscal year ended June 30, 2010, our purchases from our five largest suppliers of raw materials represented approximately 77% of our total raw material purchases. Purchases from our five largest suppliers of raw materials were approximately 62% and 69% in 2009 and 2008, respectively. Interruptions or shortages of supplies from our key suppliers of raw materials could disrupt production or impact our ability to increase production and sales. We do not have long-term or volume purchase agreements with our suppliers. Although there is a large pool of suppliers available to provide our raw materials, including copper, our principal raw material, we may have limited options in the short-term for alternative supply if our existing suppliers fail for any reason, including their business failure or financial difficulties, to continue the supply of materials or components. Moreover, identifying and accessing alternative sources may increase our costs. Interruptions at our key suppliers could negatively impact our results of operations, financial performance and the price of our common stock.

Due to increased volatility of raw material prices, the timing lag between the raw material purchase and product pricing can negatively impact our profitability.

Volatility in the prices of raw materials, among other factors, may adversely impact our ability to accurately forecast demand and may have a material adverse impact on our results of operations. For example, our manufacturing activities are determined, and raw materials purchases are scheduled, upon forecasted demand while sales prices are determined at the time of order placement, subject to adjustment at fulfillment. The lag between the point when raw materials are acquired in advance and the point when products are actually priced may impact us both positively and negatively, resulting in increased or decreased profitability. In addition, we routinely maintain a certain level of finished goods inventories to meet near term expected demand. Pricing for the sale of these inventories is generally based on current raw material prices. Rapid declines in the price of raw materials may result in our inventories being carried at costs in excess of net realizable value and may have an adverse effect on our results of operations and the price of our common stock.

If we fail to accurately project market demand for our products, our business expansion plans could be jeopardized and our business, financial condition and results of operations will be adversely affected.

To increase our production capacity, especially for specialty cable products, we are constructing a new manufacturing facility in the industrial zone of Changxing Island (the “Project”), located approximately 120 kilometers from Dalian. We recently completed Phase I of the Project comprising approximately 25,000 square meters of production facilities, which increased our annual production capacity from 800 km to 2,400 km. We plan to increase our production capacity of specialty cable products in Phase II of the Project, the construction of which will commence upon the full capacity utilization of Phase I expected by 2013. Our decision to increase our manufacturing capacity was based primarily on our goal to focus on specialty cables as our main business in the next five years. If actual customer orders are less than our projected market demand of specialty cables, we may suffer overcapacity problems and may have to leave capacity idle, which can reduce our overall profitability and hurt our financial condition and results of operations.

The cost of complying with new environmental laws in China may have a material adverse effect on our operations and financial condition.

As a manufacturer, we are subject to various Chinese environmental laws and regulations on air emission, waste water discharge, solid wastes and noise. Although we believe that our operations are in substantial compliance with current environmental laws and regulations, we may not be able to comply with these regulations at all times as the Chinese environmental legal regime is evolving and becoming more stringent. If the Chinese government imposes more stringent regulations in the future, we will have to incur additional and potentially substantial costs and expenses in order to comply with new regulations, which may negatively affect our results of operations. If we fail to comply with any of the present or future environmental regulations in any material aspects, we may suffer from negative publicity and may be required to pay substantial fines or suspend or even cease operations until compliance is achieved.

16

We do not maintain a reserve fund for warranty or defective products claims. Our costs could substantially increase if we experience a significant number of warranty claims.

We provide customers with warranties against technical defects in our products. The warranties require us to replace or repair defective components or refund the purchase price to the customer. We have not established any reserve funds for potential warranty claims since we have strict quality control procedures and, historically, have experienced few warranty claims for our products. If we experience an increase in warranty claims or if our repair and replacement costs associated with warranty claims increase significantly, it would have a material adverse effect on our financial condition and results of operations.

If we fail to adequately protect or enforce our intellectual property rights, we may be exposed to intellectual property infringement and the value of our intellectual property rights could diminish.

Our success, competitive position and future revenues will depend in part on our ability to obtain and maintain patent protection for our products, methods, processes and other technologies, to preserve our trade secrets, to prevent third parties from infringing on our proprietary rights and to operate without infringing the proprietary rights of third parties. Dalian Befut, our captive manufacturer, holds seven registered patents in the PRC and has 22 patents applications that are pending approval, which may take up to two years. However, we cannot assure you such patents will be issued, or that existing or future issued patents will be sufficient to provide us with meaningful protection or commercial advantage.

If we need to initiate litigation or administrative proceedings, such actions may be costly and may divert management attention as well as expend other resources which could otherwise have been devoted to our business. An adverse determination in any such litigation will impair our intellectual property rights and may harm our business, prospects and reputation. In addition, historically, implementation of PRC intellectual property-related laws has been lacking, primarily because of ambiguities in the PRC laws and difficulties in enforcement. Accordingly, intellectual property rights and confidentiality protections in China may not be as effective as in the United States or other countries, which increases the risk that we may not be able to adequately protect our intellectual property. Moreover, litigation may be necessary in the future to enforce our intellectual property rights. Future litigation could result in substantial costs and diversion of our management’s attention and resources, and could disrupt our business, as well as have a material adverse effect on our financial condition and results of operations. Given the relative unpredictability of China’s legal system and potential difficulties enforcing a court judgment in China, there is no guarantee that we would be able to halt any unauthorized use of our intellectual property through litigation.

The occurrence of any acts of God, war, terrorist attacks and other emergencies which are beyond our control may have a material adverse effect on our business operations and financial condition .

Acts of God, war, terrorist attacks and other emergencies which are beyond our control may have a material adverse effect on the economy and infrastructure in the PRC and on the livelihood of the Chinese population. While we have property damage insurance, we do not carry business disruption insurance, which is not readily available in China. Any disruption of the operations in our factories would have a significant negative impact on our ability to manufacture and deliver products, which would cause a potential diminution in sales, the cancellation of orders, damage to our reputation and potential lawsuits.