Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT ON FORM 8-K - WEYERHAEUSER CO | wy8k91511.htm |

WEYERHAEUSER COMPANY

UBS GLOBAL PAPER AND FOREST PRODUCTS CONFERENCE

New York, NY

September 15, 2011

FORWARD LOOKING STATEMENT

This presentation contains statements concerning the Company’s future results and performance that are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements are based on various assumptions and may not be accurate because of risks and uncertainties surrounding the assumptions. Factors listed below, as well as other factors, may cause actual results to differ significantly from these forward-looking statements. There is no guarantee that any of the events anticipated by these forward-looking statements will occur. If any of the events occur, there is no guarantee what effect they will have on Company operations or financial condition. The Company will not update these forward-looking statements after the date of the presentation.

Some forward-looking statements discuss the Company’s plans, strategies and intentions. They use words such as “expects,” “may,” “will,” “believes,” “should,” approximately,” “anticipates,” “estimates,” and “plans.” In addition, these words may use the positive or negative or a variation of those terms.

This presentation contains forward-looking statements regarding the Company’s expectations regarding third quarter 2011, including housing market conditions; market challenges for our Timberlands, Wood Products and Real Estate segments; soft domestic log markets due to weak lumber markets, some improvement in log export demand, particularly in Japan and China, despite continued high inventories in China, and reduced earnings from non-strategic land sales in the third compared to the second quarter; the lack of any recovery in wood products markets, with engineered wood volumes and prices especially weak, and a review of closed capacity that could result in additional non-cash impairments; prices weakening in the third quarter in the Cellulose Fibers segment due to global economic uncertainty and the strengthening U.S. dollar, despite some pickup in export demand; and continued weak markets in our single-family homebuilding operations, with markets softening during the quarter due to weak employment data, political uncertainties and the impact of severe weather in the East and South. Major risks, uncertainties and assumptions that affect the Company’s businesses and may cause actual results to differ from these forward-looking statements include, but are not limited to:

• general economic conditions, including employment rates, housing starts, interest rate levels, availability of financing for home mortgages, strength of the U.S. dollar;

• market demand for the Company’s products, which is related to the strength of the various business segments and economic conditions;

• performance of the Company’s manufacturing operations, including maintenance requirements;

• raw material prices;

• energy and transportation costs;

• successful execution of internal performance plans including restructurings and cost reduction initiatives;

• level of competition from domestic and foreign producers;

• the effect of the Japanese disaster on demand for company products;

• the effect of weather and the risk of loss from fires, floods, windstorms, hurricanes, pest infestation and other natural disasters;

• federal tax policies;

• the effect of forestry, land use, environmental and other governmental regulations;

• legal proceedings;

• the effect of timing of retirements and changes in the market price of our common stock on charges for share-based compensation;

• changes in accounting principles;

• performance of pension fund investments and derivatives; and

• the other factors described under “Risk Factors” in the Company’s annual report on Form 10-K.

The Company also is a large exporter and is affected by changes in economic activity in Europe and Asia, particularly Japan and China. It also is affected by changes in currency exchange rates, particularly the relative value of the U.S. dollar to the Canadian dollar, Euro and Yen. Restrictions on international trade or tariffs

imposed on imports also may affect the Company.

2

INTRODUCTION

Dan Fulton

President and Chief Executive Officer

3

WEYERHAEUSER OVERVIEW

Weyerhaeuser Company

Timberlands (REIT)

Over 6 million acres of timberlands

Taxable REIT Subsidiary

Non-REIT Timber Business

Minerals and other

non-qualifying activities

Wood Products

Lumber, OSB,

Engineered Wood Products

Weyerhaeuser Real

Estate Company (WRECO)

Single Family Homebuilding

Land Development

Cellulose Fibers

Specialty Absorbent Pulp

4

TIMBERLANDS STRATEGY

Grow and manage financially attractive,

sustainable forests

Apply market knowledge

and scale to create

additional value

Explore opportunities for

future growth

Increase cash flow and asset value

5

COMPETITIVE ADVANTAGE OF WEYERHAEUSER TIMBERLANDS

World class timberland holdings

Managed for optimum value by reducing costs and increasing yield

Innovative silviculture - precision landscape forestry

Focus on high value sawlogs

Cost-advantaged infrastructure and logistics capabilities

Broad access to domestic and international markets

Strong, long-standing customer relationships

6

U.S. TIMBERLANDS IN MOST PRODUCTIVE REGIONS

Approximately 2 million acres west of the Cascade Mountains, primarily high value Douglas fir

Over 4 million acres in 7 states across the U.S. South, primarily loblolly pine

US West

US South

7

INNOVATIVE FORESTRY MAXIMIZES RETURNS

Silviculture practices enable us to grow high-quality sawtimber faster at lower cost

8

SCALE INFRASTRUCTURE AND LOGISTICS PROVIDE COST ADVANTAGES

Harvesting

Merchandising

Hauling / dispatch trucking

Strategically located, Weyerhaeuser-owned port facilities

Efficiently reach broad mix of domestic and international markets

9

UNIQUELY ADVANTAGED TO SERVE ASIAN EXPORT MARKETS

One port to one port loading

19% of timberlands revenue from export log sales

Japan is a premium market for Weyerhaeuser logs

China represents an increasingly large and attractive opportunity

Long-standing customer relationships

2010 Export Log

Revenue by Country

Japan 81%

China 13%

Korea 6%

10

ADDITIONAL SOURCES OF VALUE FROM TIMBERLANDS

7.1 million net mineral acres

Oil and gas

$30-50 million annual business

Revenue interest in >1,000 producing wells

Haynesville Shale (LA)

~12,000 acres under lease in core

Aggregates and minerals

$10+ million annual business

Economic downturn affected

2009-2010 revenues

New operations adding to revenues

11

SUSTAINABILITY CREATES VALUE

12

BUSINESS CONDITIONS AND FINANCIAL UPDATE

Patty Bedient

Executive Vice President,

and Chief Financial Officer

13

BUSINESS CONDITIONS

Timberlands

Export log markets still strong

Domestic log markets remain soft

Wood Products

Markets remain challenged

Weyerhaeuser Real Estate Company (WRECO)

Profitable despite weak housing markets

Cellulose Fibers

Uncertainty in global markets

U.S. dollar strengthening

14

DIVIDEND PAYOUT POLICY

Targeting a dividend payout ratio of 75% of

Funds Available for Distribution (FAD) over cycle

FAD defined as cash flow before debt repayment and dividends

Will consider repurchasing shares

Current quarterly dividend of 15 cents per share,

or 60 cents per share on annualized basis

2011 dividend payout ratio could exceed 75% of FAD, given current outlook

A sustainable dividend that

we expect to grow over time

15

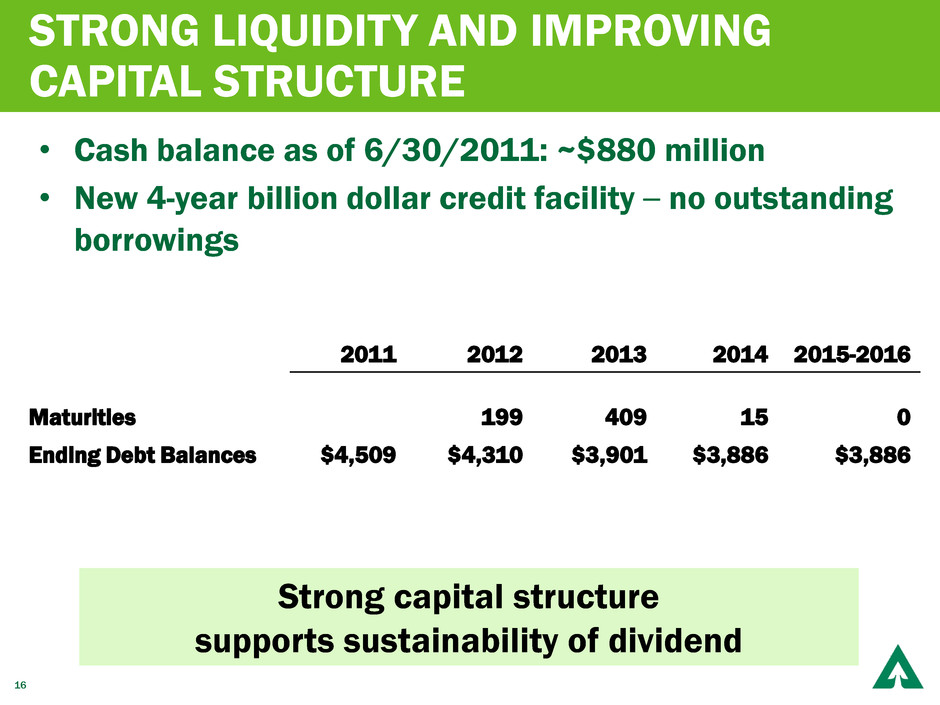

STRONG LIQUIDITY AND IMPROVING CAPITAL STRUCTURE

Cash balance as of 6/30/2011: ~$880 million

New 4-year billion dollar credit facility – no outstanding borrowings

2011 2012 2013 2014 2015-2016

Maturities 199 409 15 0

Ending Debt Balances $4,509 $4,310 $3,901 $3,886 $3,886

Strong capital structure

supports sustainability of dividend

16

REASONS TO OWN WEYERHAEUSER

World class timberland holdings

Leader in extracting value from timberlands

Cash and earnings expected to significantly improve throughout housing recovery

Committed to a sustainable dividend that

we expect to grow over time

Opportunistic growth in timberland holdings

Committed to creating value for our shareholders

17