Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - WESBANCO INC | d231205d8k.htm |

Exhibit 99.1 |

Forward-looking

statements

in

this

presentation

relating

to

WesBanco’s

plans,

strategies,

objectives,

expectations,

intentions

and

adequacy

of

resources,

are

made

pursuant

to

the

safe

harbor

provisions

of

the

Private

Securities

Litigation

Reform

Act

of

1995.

The

information

contained

herein

should

be

read

in

conjunction

with

WesBanco’s

2010

Annual

Report

on

Form

10-K

filed

with

the

Securities

and

Exchange

Commission

(“SEC”),

including

WesBanco’s

Form

10-Q

as

of

March

31,

2011

and

June

30,

2011,

which

are

available

on

the

SEC’s

website

www.sec.gov

or

at

WesBanco’s

website

www.wesbanco.com.

Investors

are

cautioned

that

forward-looking

statements,

which

are

not

historical

fact,

involve

risks

and

uncertainties,

including

those

detailed

in

WesBanco’s

2010

Annual

Report

on

Form

10-K

filed

with

the

SEC

under

the

section,

“Risk

Factors”

in

Part

1,

Item

1A.

Such

statements

are

subject

to

important

factors

that

could

cause

actual

results

to

differ

materially

from

those

contemplated

by

such

statements.

WesBanco

does

not

assume

any

duty

to

update

any

forward-looking

statements. |

Headquarters in Wheeling, West Virginia

Assets: $5.4 billion

Founded in 1870

32 banks/23 companies acquired in 25 years

Banking operations in West Virginia, Ohio and

Western Pennsylvania

112 banking offices + Pittsburgh Business Loan Office

124 ATM’s

Non-bank

activities

include:

Wealth management, securities brokerage, insurance and

proprietary family of mutual funds |

Columbus

Springfield

Dayton

Huntington

Wheeling

* SNL 12/31/10 Deposit Market Share Data

Ranked #1-3 in

deposit market

share in 15

counties out of 37*

Expanding along

major highways to

population centers

(Columbus,

Dayton,

Cincinnati)

Organized into

seven markets |

($ in

thousands, except diluted earnings per share)00’s except per

share data)

Jun 2011

Mar 2011

Dec 2010

Sep 2010

Jun 2010

Net Income

$11,918

$10,240

$10,310

$9,153

$8,238

Diluted Earnings Per Share

$ 0.45

$ 0.39

$ 0.39

$ 0.34

$ 0.31

Provision for Credit Losses

$6,802

$8,041

$9,625

$11,778

$11,675

Return on Average Assets

0.88%

0.77%

0.76%

0.67%

0.61%

Return on Average Tangible

Equity

14.73%

13.29%

13.09%

11.80%

10.98%

Net Interest Margin (FTE)

3.73%

3.67%

3.66%

3.61%

3.56%

Efficiency Ratio

59.79%

61.63%

60.36%

61.05%

60.36% |

|

•

Net Operating Revenue = Net Interest Income plus Non-interest Income,

excluding net securities gains and gains/losses on REO. See non-GAAP

measures for additional information relating to the calculation of this item.

|

Summary

– Capital Ratios %

*See non-GAAP measures for additional

information relating to the calculation of this item.

|

Recent

Accomplishments Increased dividends to shareholders in 1Q’11 and in

3Q’11 by 14.3% in total.

Growth in tangible capital and regulatory capital ratios

through growth in retained earnings.

Remained profitable each quarter throughout recession.

Continued growth in earnings per share in each of the past

7 quarters.

Purchased five branches with $600 million in deposits

using existing capital resources.

Paid back $75 million in TARP without common raise.

Maintained strong capital position, considered “well

capitalized”. |

(MM)

Growth by Acquisition:

A WSBC Core Competency

Focused on higher growth

metro markets and

enhancing market share.

Five acquisitions in nine

years –

assets more than

doubled since the

beginning of 2002.

A history of successful

consolidations.

Acquired 5 branches in

Columbus, Ohio market in

2009, resulting in #9

market share.

Acquired Assets: 2002 to 2011 = $3.6B

($ in billions)

$0.0

$1.0

$2.0

$3.0

$4.0

$5.0

$6.0

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

YTD |

WesBanco is focused on targeted M & A opportunities in its

market areas.

Limited FDIC-assisted transactions expected, but plenty of

moderately distressed banks and “tired”

management

teams.

Management, technology/back office and capital/liquidity

strength to compete for deals of interest.

Current stock valuation provides for upside potential for

acquired bank’s shareholders. |

$3.0B of assets under management/custody.

Over 5,000 trust relationships.

4 locations in WV & OH

Improving performance as

asset values have grown.

Product capabilities:

Trust

Investment management

WesMark Funds

Estate planning

Financial planning

Brokerage sales

Retirement planning |

Economic Benefits of WV

WV reported a surplus of revenue over expense

for the latest fiscal year.

State of WV has implemented legislation to

reduce Business Franchise and Corporate Net

Income Taxes.

WV generated 8% higher revenues in 2011 and

GDP rose by 4% vs. the 2.6% national average.

WV reports stable home prices over the past

five years.

WV reports lower than national average

unemployment. |

Map Source: Oil & Gas Financial Journal through Sterne Agee; data from

Pennsylvania State University College of Earth and Mineral Sciences

Research Study of 5/24/10.

Area five time as large as

Barnett Shale –

primarily in

WV & PA, parts of NY & OH.

WVU study suggests 43k-

83k

jobs created by Marcellus

drilling activity by 2015.

Total estimated economic

activity by 2020 -

$3B.

WSBC in 10 out of 32 counties

in WV with activity.

Top 5 in deposit share in five

of those counties.

Over 1,000 Marcellus wells

drilled to date in WV.

4,145 drilling permits applied

for between 1/1/09 –

7/31/11 in

WV. |

2011 Business Initiatives

Actively remix the balance sheet –

loans & deposits -

to

improve revenue, interest rate sensitivity, regulatory capital

and profitability.

Continuing efforts to address credit quality and impaired

loan levels as economy improves.

Focus on organic loan growth, with an emphasis on

business banking and C&I lending.

Pursue opportunities for activities related to Marcellus

Shale.

Continue to focus on wealth management and other fee-

related opportunities.

Monitor opportunities for selective acquisitions in footprint.

|

Price

/

2012

Estimated

Earnings

(x)

(1)

Price

/

2012

Estimated

Earnings

(x)

(1)

Source: FactSet Research Systems and SNL Financial; Market data as of

8/26/2011 (1) 2012E earnings estimates per First Call; SRCE earnings estimate

not available (2)

Includes

nationwide

banks

and

thrifts

between

$2

billion

and

$10

billion

in

total

assets |

Market Performance –

Cycle-to-Date

Market Performance –

Cycle-to-Date

6/30/07

7/11/08

7/28/09

8/11/10

8/26/11

0.00%

25.00%

50.00%

75.00%

100.00%

125.00%

WesBanco, Inc. (-38.41%)

KBW Regional Banking Index (-54.92%)

KBW Bank Index (-66.65%)

S&P 500 Index (-21.72%) |

Market Performance –

Since January 1, 2010

Market Performance –

Since January 1, 2010

1/1/10

5/31/10

10/29/10

3/28/11

8/26/11

60.00%

80.00%

100.00%

120.00%

140.00%

160.00%

180.00%

WesBanco, Inc. (47.24%)

KBW Regional Banking Index (-7.62%)

KBW Bank Index (-11.85%)

S&P 500 Index (5.53%) |

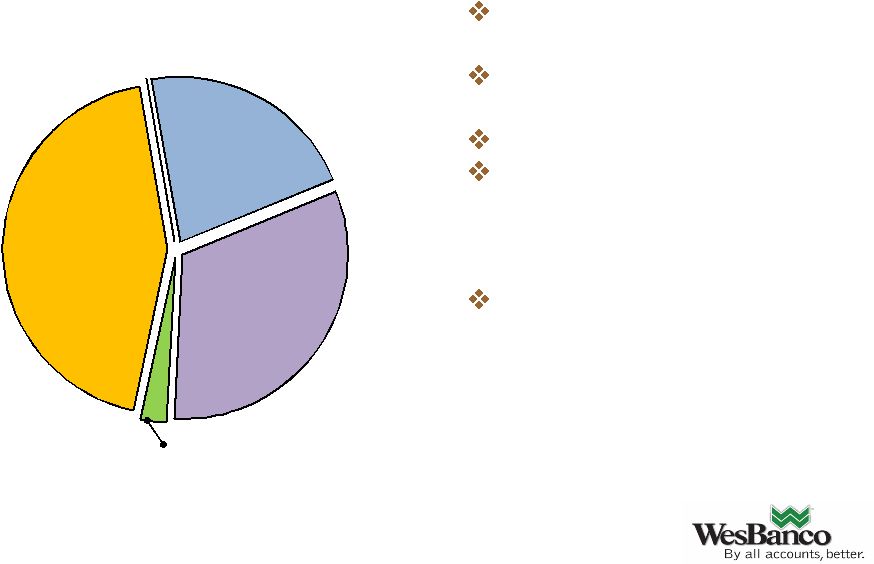

Securities Portfolio –

Quality & Liquidity

Agency

Agency

Mortgage-

Mortgage-

Backed &

Backed &

CMOs, 43.9%

CMOs, 43.9%

US Govt.

US Govt.

Agencies

Agencies

21.6%

21.6%

Securities = $1.52 B

~28.1% of total assets

Municipals,

32.0%

Equities &

Others, 2.5%

Average portfolio yield

of 3.72% at 6/30/11.

WAL approx. 4.8 years,

modified duration 3.6%.

Over 55% unpledged.

No significant private

label RMBS, equities

and corporate/ABS

securities.

Net unrealized AFS

securities gains of $11.0

million at 6/30/11: total

portfolio gain of $20.3

million. |

Portfolio comprised of $494 million of tax exempts and

taxable Build America Bonds.

Approximately 90% are local issuers.

G.O.’s are 74% of total; 26% revenue bonds.

96% rated, with 78% rated AA (or its equivalent) or higher.

Only 6.0% below A –

all are investment grade.

About 59% in held to maturity –

longer dated maturities.

Average tax-equivalent yield –

5.8%; average life 6.8 years.

Average size of each issue is $644 thousand. Average

holdings per issuer are $914 thousand. |

Diversified

Loan Portfolio Diversified Loan Portfolio

Comm. Real Estate =

$1.73 B

Const & Dev.

10%

Total Portfolio Loans = $3.26 B

Investor-

owned

57%

Owner-

occupied

33%

Comm.

Real

Estate,

53%

Comm. &

Ind., 13%

Consumer,

8%

HELOC, 8%

Res. Real

Estate, 18% |

Non-Accrual

& Restructured Loans Non-Accrual & Restructured Loans

|

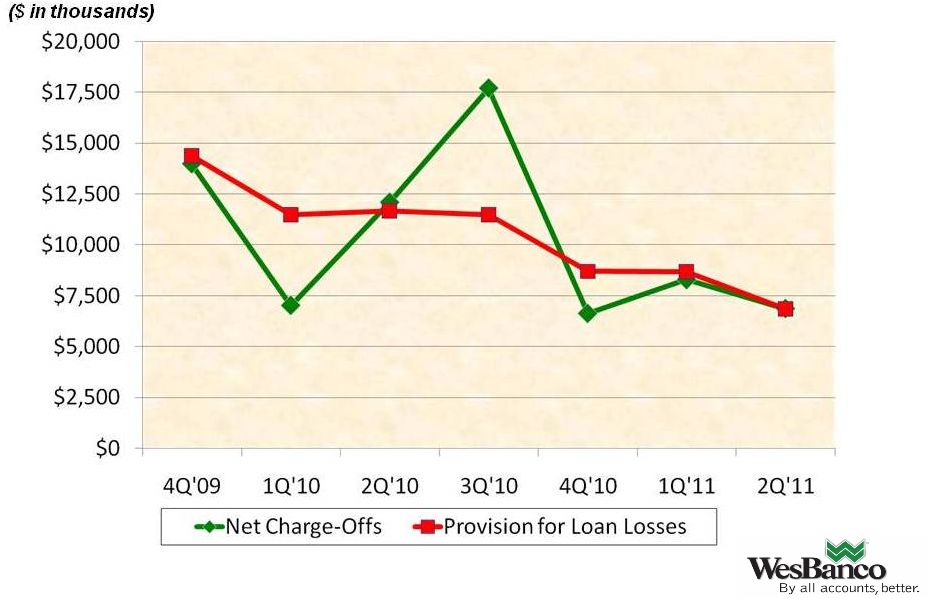

Net

Charge-Offs vs. Provision for Loan Losses Net Charge-Offs vs. Provision for Loan

Losses |

•

National

Peer

Group

=

Average

of

94

banks

nationwide

with

assets

between

$2-$10

B.

•

Source:

SNL

Financial

Annualized Net Loan Charge-offs /

Average Loans |

•

National

Peer

Group

=

Average

of

94

banks

nationwide

with

assets

between

$2-$10

B.

•

Source:

SNL

Financial

NPA +

90 PD Loans /

Total Loans + OREO |

Conservative

Exposure to Potential Problem Loan Areas

Conservative Exposure to Potential Problem

Loan Areas

Exposure¹

($ Millions)

% of RBC²

Regulatory

Guideline

Land, Construction & Development

$257

53%

100%

Investor-Owned Commercial

$668

137%

N/A

Investor-Owned Multi-Family

$214

43%

N/A

Total Land, C&D, and Investor-Owned

$ 1,139

233%

300%

1

Total Loans Outstanding and Unfunded Commitments.

2

Total Risk-Based Capital = $488.3 million at 6/30/11

WSBC is Below Regulatory CRE Guidelines |

Net Interest

Margin & Efficiency Ratio Net Interest Margin & Efficiency Ratio

|

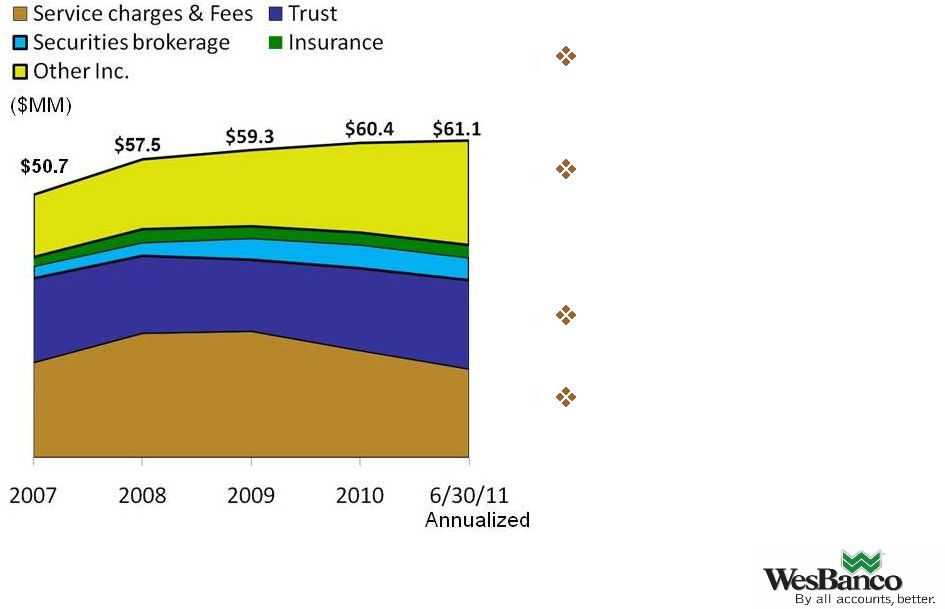

Diversified

Operating Non-interest Income* Diversified Operating Non-interest Income*

Noninterest income

contributed 26% of 2011

YTD revenue.

Non-bank offerings (trust,

insurance, securities)

contributed $12.4 million in

YTD 2011 revenue.

Trust fees are up 17.4%

year over year.

Approximate 17% decline in

service fee income for YTD

2011, as a result of mid-

2010 implemented

regulatory requirements.

* Operating non-interest income excludes G/L on securities and G/L on

sale of OREO property, see non-GAAP measures for additional

information relating to the calculation of this. |

Interest Rate

Sensitivity Interest Rate Sensitivity

Immediate Change in

Interest Rates

% Change in Net Interest Income from

Base Over One Year

June 30, 2011

Dec. 31, 2010

Up 1% Rate Shock

+1.2%

+2.4%

Up 2% Rate Shock

Up 2% Rate Shock

+0.6%

+0.6%

+1.7%

+1.7%

Up 2% Rate Ramp

+1.5%

+2.3%

Down 1% Rate Shock

-3.7%

-2.9% |

Investor

Remarks Investor Remarks

•

Solid

2Q:11

results

on

strengthening

PTPP

and

lower

credit

costs:

WesBanco

reported

2Q:11

GAAP

EPS

of

$0.45,

a

45%

increase

from

the

$0.31

reported

for

2Q:10

…which

was

$0.10

above

our

estimate

and

$0.07

ahead

of

the

Street.

Douglas

Rainwater,

Rodman

&

Renshaw,

July

28,

2011.

•

"Solid

upside

surprise

in

2Q11;

raising

estimates;

shares

likely

have

moderate

near-term

upside.

2Q11

earnings

entailed

the

third

consecutive

upside

surprise

and

likely

a

round

of

upward

estimate

revisions."

Kenneth

James,

Sterne

Agee,

July

27,

2011.

•

"Reported

Better-Than-Expected

2Q11

Results;

Raising

Rating

to

Outperform

and

Initiating

$23.00

Target

Price.

Matthew

Schultheis,

Boenning

&

Scattergood,

July

27,

2011.

•

"WSBC

reported

another

quarter

of

earnings

improvement,

beating

both

the

Street

and

our

estimate.

Catherine

Mealor,

Keefe,

Bruyette

&

Woods,

July

26,

2011. |

Stability, Diversity and Capital Strength

Financial performance indicates well managed

bank.

Strong regulatory capital.

Proven acquisition-oriented growth strategy.

Excellent liquidity.

Asset quality compares favorably with peers.

Diverse earnings stream.

Potential for improved stock price. |

Commercial

Retail

Total Loans

Upper Ohio Valley

$ 465

$ 381

$ 846

North Central WV

236

175

411

Parkersburg

204

84

288

Kanawha Valley

59

35

94

Western PA

199

14

213

Total East Markets

$ 1,163

$ 689

$ 1,852

Central Ohio

520

138

658

Southwest Ohio

329

148

477

Southeast Ohio

154

123

277

Total West Markets

$ 1,003

$ 409

$ 1,412

Total Bank

$ 2,166

$ 1,098

$ 3,264

($ in thousands) |

90

Day PD & Accruing

Non-

Accrual

TDR

Other RE

Owned

Upper Ohio Valley

$ 1,494

$ 7,691

$ 4,200

$ 472

North Central WV

702

519

859

147

Parkersburg

956

6,099

235

188

Kanawha Valley

88

2,722

N/A

295

Western PA

105

2,538

249

275

Total East Markets

$ 3,345

$ 19,569

$ 5,543

$ 1,377

Central Ohio

1,678

17,899

18,737

2,003

Southwest Ohio

1,176

21,059

11,923

1,239

Southeast Ohio

536

3,517

232

162

Total West Markets

$ 3,390

$ 42,475

$ 30,892

$ 3,404

Total Bank

$ 6,735

$ 62,044

$ 36,435

$ 4,781

* -

Includes $0.9 Million for bank-owned hospitality property.

($ in thousands)

Appendix: Credit Quality By Market ($ thousands) |

2Q’10

3Q’10

4Q’10

1Q’11

2Q’11

Total shareholder’s equity

$ 604,714

$ 608,287

$ 606,863

$ 611,978

$ 623,037

Less: goodwill & other

intangible assets

(286,908)

(286,228)

(285,559)

(284,941)

(284,336)

Tangible equity

317,806

322,059

321,304

327,037

338,701

Total assets

5,356,261

5,362,623

5,361,458

5,368,852

5,425,907

Less: goodwill & other

intangible assets

(286,908)

(286,228)

(285,559)

(284,941)

(284,336)

Tangible assets

$5,069,353

$5,076,395

$5,075,899

$5,083,911

$5,141,571

Tangible equity to tangible

assets

6.27%

6.34%

6.33%

6.43%

6.59%

Non-GAAP Financial Measures

Tangible equity to tangible assets

($ in thousands) |

2Q’10

3Q’10

4Q’10

1Q’11

2Q’11

Net Interest income

$ 41,148

$ 41,986

$ 42,326

$ 41,476

$ 43,053

Plus: Non-interest income

14,585

14,976

14,997

14,504

15,019

Less: Net securities gains and

net gains/losses on other real

estate owned and other assets

(417)

327

(551)

(528)

(257)

Net revenue

$ 56,150

$ 56,635

$ 57,874

$ 56,508

$ 58,329

Non-GAAP Financial Measures

Net Revenue

($ in thousands) |

2007

2008

2009

2010

2011

(annualized)

Non-interest Income

$ 52,939

$ 57,346

$ 64,589

$ 59,599

$ 59,531

Less: Net Securities gains

943

1,556

6,046

3,362

60

Less: losses on other real estate

owned and other assets

1,306

(1,715)

(747)

(4,128)

(1,646)

Net operating non-interest

income

$ 50,690

$ 57,505

$ 59,290

$ 60,365

$ 61,117

Non-GAAP Financial Measures

Operating non-interest income

($ in thousands) |

2Q’10

3Q’10

4Q’10

1Q’11

2Q’11

Net income (annualized)

$ 33,043

$ 36,313

$ 40,903

$ 41,531

$ 47,805

Plus: amortization of

intangibles (annualized)

1,787

1,743

1,724

1,629

1,577

Net income before

amortization of intangibles

(annualized)

34,830

38,056

42,627

43,159

49,382

Average total shareholders’

equity

$ 604,334

$ 608,932

$ 611,497

$ 610,077

$ 619,954

Less: average goodwill & other

intangibles

(287,221)

(286,537)

(285,860)

(285,219)

(284,611)

Average tangible equity

$ 317,113

$ 322,395

$ 325,637

$ 324,858

$ 335,343

Return on average tangible

equity

10.98%

11.80%

13.09%

13.29%

14.73%

Non-GAAP Financial Measures

Return on Average Tangible Equity

($ in thousands) |

1Q’10

2Q’10

3Q’10

4Q’10

1Q’11

2Q’11

Income before provision

for income taxes

$ 8,780

$ 9,491

$ 9,503

$12,187

$12,448

$15,564

Provision for credit losses

11,500

11,675

11,778

9,625

8,041

6,802

Taxable equivalent

adjustment

1,612

1,535

1,488

1,507

1,608

1,640

21,892

22,701

22,769

23,319

22,097

24,006

Annualized

$ 88,784

$ 91,053

$ 90,334

$ 92,516

$ 89,616

$ 96,288

Average assets

$ 5,414,341

$ 5,437,010

$ 5,422,181

$ 5,394,837

$ 5,363,365

$ 5,428,747

ROAA

1.64%

1.67%

1.67%

1.71%

1.67%

1.77%

Non-GAAP Financial Measures

ROAA: Pre-tax, Pre-provision

($ in thousands) |

*

*

*

*

*

*

*********

*

*

*

**

*

*

* |