Attached files

| file | filename |

|---|---|

| EX-32.1 - EXHIBIT 32.1 - PARAMOUNT GOLD & SILVER CORP. | ex32_1.htm |

| EX-31.2 - EXHIBIT 31.2 - PARAMOUNT GOLD & SILVER CORP. | ex31_2.htm |

| EX-31.1 - EXHIBIT 31.1 - PARAMOUNT GOLD & SILVER CORP. | ex31_1.htm |

| EX-32.2 - EXHIBIT 32.2 - PARAMOUNT GOLD & SILVER CORP. | ex32_2.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

|

x

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the fiscal year ended: June 30, 2011

Or

|

o

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the transition period from: _____________ to _____________

Commission file number 001-33630

PARAMOUNT GOLD AND SILVER CORP.

(Exact name of registrant as specified in its charter)

|

Delaware

|

20-3690109

|

|

|

(State or other jurisdiction

of incorporation or organization)

|

(I.R.S. Employer

Identification No.)

|

|

665 Anderson Street Winnemucca, Nevada 89445

|

|

(Address of principal executive offices) (Zip Code)

|

|

(775)625-3600

|

|

(Registrant’s telephone number, including area code)

|

(Former name or former address, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Name of each exchange on which registered

|

|

|

common stock, $0.001 par value

|

NYSE Amex

|

Securities registered pursuant to Sectio 12(g) of the Act:

None

(Title of Class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

o Yes x No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

o Yes x No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

x Yes o No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

o Yes o No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendments to this Form 10-K.

x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer o

|

Accelerated filer x

|

|

Non-accelerated filer o

|

Smaller reporting company o

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).

o Yes x No

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant computed by reference to the price at which the common equity was last sold, or the average bid and asked price for such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter as reported by the NYSE Amex Equities on December 31, 2010 was approximately $442 million.

APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY

PROCEEDINGS DURING THE PRECEDING FIVE YEARS:

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Section 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court.

o Yes o No

APPLICABLE ONLY TO CORPORATE ISSUERS:

Indicate the number of shares outstanding of each of the issuer’s classes of common stock as of the latest practicable date: 136,268,262 shares of common stock, $.001 par value as of August 30, 2011.

DOCUMENTS INCORPORATED BY REFERENCE

List hereunder the following documents if incorporated by reference and the Part of the Form 10-K (e.g., Part I, Part II, etc.) into which the document is incorporated: (1)Any annual report to security holders; (2) Any proxy or information statement; and (3) Any prospectus filed pursuant to Rule 424(b) or (c) under the Securities Act of 1933.

None.

This Form 10-K contains “forward-looking statements” within the meaning of applicable securities laws relating to Paramount Gold and Silver Corp. (“Paramount” “we”, “our”, or the “Company”) which represent our current expectations or beliefs including, but not limited to, statements concerning our operations, performance, and financial condition. These statements by their nature involve substantial risks and uncertainties, credit losses, dependence on management and key personnel, variability of quarterly results, and our ability to continue growth. Statements in this annual report regarding planned drilling activities and any other statements about

Paramount’s future expectations, beliefs, goals, plans or prospects constitute forward-looking statements. You should also see our risk factors beginning on page 12. For this purpose, any statements contained in this Form 10-K that are not statements of historical fact are forward-looking statements. Without limiting the generality of the foregoing, words such as “may”, “anticipate”, “intend”, “could”, “estimate”, or “continue” or the negative or other comparable terminology are intended to identify forward- looking statements. Other matters such as our growth strategy and competition are beyond our control. Should one or more of these risks or uncertainties materialize or should the underlying assumptions prove incorrect, actual outcomes and results could differ materially from those indicated in the

forward-looking statements.

Any forward-looking statement speaks only as of the date on which such statement is made, and we undertake no obligation to update any forward-looking statement or statements to reflect events or circumstances after the date on which such statement is made or to reflect the occurrence of unanticipated events. New factors emerge from time to time and it is not possible for us to predict all of such factors, nor can we assess the impact of each such factor on the business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements.

We are under no duty to update such forward-looking statements.

EXCHANGE RATES:

THE COMPANY’S FUNCTIONAL CURRENCY IS THE U.S DOLLAR. EXCHANGE RATES BETWEEN CANADA AND THE UNITED STATES HAVE FLUCTUATED THROUGHOUT THE FISCAL YEAR RANGING FROM A HIGH OF $1.07 CAD FOR EVERY $1.00 USD TO A LOW OF $0.95 CAD FOR EVERY $1.00 USD. REPORTED TRANSACTIONS ARE CONVERTED TO U.S. DOLLARS AS OF THE DATE OF THE TRANSACTION.

METRIC CONVERSION TABLE AND ABBREVIATIONS

For ease of reference, the following conversion factors are provided:

|

1 acre

|

= 0.4047 hectare

|

1 mile

|

= 1.6093 kilometers

|

|||

|

1 foot

|

= 0.3048 meter

|

1 troy ounce

|

= 31.1035 grams

|

|||

|

1 gram per metric ton

|

= 0.0292 troy ounce/

short ton

|

1 square mile

|

= 2.59 square kilometers

|

|||

|

1 short ton (2000 pounds)

|

= 0.9072 tonne

|

1 square kilometer

|

= 100 hectares

|

|||

|

1 tonne

|

= 1,000 kg or 2,204.6 lbs

|

1 kilogram

|

= 2.204 pounds or 32.151 troy oz

|

|||

|

1 hectare

|

= 10,000 square meters

|

|

1 hectare

|

|

= 2.471 acres

|

The following abbreviations may be used herein:

|

Au

|

|

= gold

|

m2

|

= square meter

|

|

|

Ag

|

= silver

|

||||

|

g

|

|

= gram

|

m3

|

= cubic meter

|

|

|

g/t

|

|

= grams per tonne

|

mg

|

= milligram

|

|

|

Ha

|

|

= hectare

|

mg/m3

|

= milligrams per cubic meter

|

|

|

Km

|

|

= kilometer

|

T or t

|

= tonne

|

|

|

Km2

|

|

= square kilometers

|

oz

|

= troy ounce

|

|

|

Kg

|

|

= kilogram

|

ppm

|

= parts per million

|

|

|

m

|

|

= meter

|

Ma

|

= million years

|

Note: All units in this report are stated in metric measurements unless otherwise noted.

GLOSSARY OF MINING TERMS

An “exploration stage” prospect is one which is not in either the development or production stage.

A “development stage” project is one which is undergoing preparation of an established commercially mineable deposit for its extraction but which is not yet in production. This stage occurs after completion of a feasibility study.

The term “mineralized material” refers to material that is not included in the reserve as it does not meet all of the criteria for adequate demonstration for economic or legal extraction.

The term “probable reserve” refers to reserves for which quantity and grade and/or quality are computed from information similar to that used for proven (measured) reserves, but the sites for inspection, sampling, and measurement are farther apart or are otherwise less adequately spaced. The degree of assurance, although lower than that for proven reserves, is high enough to assume continuity between points of observation.

A “production stage” project is actively engaged in the process of extraction and beneficiation of mineral reserves to produce a marketable metal or mineral product.

The term “proven reserve” refers to reserves for which (a) quantity is computed from dimensions revealed in outcrops, trenches, workings or drill holes; grade and/or quality are computed from the results of detailed sampling and (b) the sites for inspection, sampling and measurement are spaced so closely and the geologic character is so well defined that size, shape, depth and mineral content of reserves are well-established.

The term “reserve” refers to that part of a mineral deposit which could be economically and legally extracted or produced at the time of the reserve determination. Reserves must be supported by a feasibility study done to bankable standards that demonstrates the economic extraction. (“Bankable standards” implies that the confidence attached to the costs and achievements developed in the study is sufficient for the project to be eligible for external debt financing.) A reserve includes adjustments to the in-situ tons and grade to include diluting materials and allowances for losses that might occur when the material is mined.

Additional Definitions

alteration – any change in the mineral composition of a rock brought about by physical or chemical means

assay – a measure of the valuable mineral content

diamond drilling – rotary drilling using diamond-set or diamond-impregnated bits, to produce a solid continuous core of rock sample

dip – the angle that a structural surface, a bedding or fault plane, makes with the horizontal, measured perpendicular to the strike of the structure

disseminated – where minerals occur as scattered particles in the rock

fault – a surface or zone of rock fracture along which there has been displacement

feasibility study – a comprehensive study of a mineral deposit in which all geological, engineering, legal, operating, economic, social, environmental and other relevant factors are considered in sufficient detail that it could reasonably serve as the basis for a final decision by a financial institution to finance the development of the deposit for mineral production

formation – a distinct layer of sedimentary rock of similar composition

geochemistry – the study of the distribution and amounts of the chemical elements in minerals, ores, rocks, solids, water, and the atmosphere

geophysics – the study of the mechanical, electrical and magnetic properties of the earth’s crust

geophysical surveys – a survey method used primarily in the mining industry as an exploration tool, applying the methods of physics and engineering to the earth’s surface

geotechnical – the study of ground stability

grade – quantity of metal per unit weight of host rock

heap leach – a mineral processing method involving the crushing and stacking of an ore on an impermeable liner upon which solutions are sprayed to dissolve metals i.e. gold, copper etc.; the solutions containing the metals are then collected and treated to recover the metals

host rock – the rock in which a mineral or an ore body may be contained

in-situ – in its natural position

lithology – the character of the rock described in terms of its structure, color, mineral composition, grain size and arrangement of tits component parts, all those visible features that in the aggregate impart individuality to the rock

mapped or geological mapping – the recording of geologic information including rock units and the occurrence of structural features, attitude of bedrock, and mineral deposits on maps

mineral – a naturally occurring inorganic crystalline material having a definite chemical composition

mineralization – a natural accumulation or concentration in rocks or soil of one or more potentially economic minerals, also the process by which minerals are introduced or concentrated in a rock

outcrop – that part of a geologic formation or structure that appears at the surface of the earth

open pit or open cut – surface mining in which the ore is extracted from a pit or quarry, the geometry of the pit may vary with the characteristics of the ore body

ore – mineral bearing rock that can be mined and treated profitably under current or immediately foreseeable economic conditions

ore body – a mostly solid and fairly continuous mass of mineralization estimated to be economically mineable

ore grade – the average weight of the valuable metal or mineral contained in a specific weight of ore i.e. grams per ton of ore

oxide – gold bearing ore which results from the oxidation of near surface sulfide ore

preliminary assessment – a study that includes an economic analysis of the potential viability of Mineral Resources taken at an early stage of the project prior to the completion of a preliminary feasibility study

QA/QC – Quality Assurance/Quality Control is the process of controlling and assuring data quality for assays and other exploration and mining data

quartz – a mineral composed of silicon dioxide, SiO2 (silica)

RC (reverse circulation) drilling – a drilling method using a tri-cone bit, during which rock cuttings are pushed from the bottom of the drill hole to the surface through an inner tube, by liquid and/or air pressure moving through an outer tube

rock – indurated naturally occurring mineral matter of various compositions

sampling and analytical variance/precision – an estimate of the total error induced by sampling, sample preparation and analysis

sediment – particles transported by water, wind, gravity or ice

sedimentary rock – rock formed at the earth’s surface from solid particles, whether mineral or organic, which have been moved from their position of origin and re-deposited

strike – the direction or trend that a structural surface, e.g. a bedding or fault plane, takes as it intersects the horizontal

strip – to remove barren rock or overburden in order to expose ore

sulfide – a mineral including sulfur (S) and iron (Fe) as well as other elements; metallic sulfur-bearing mineral often associated with gold mineralization

Table of Contents

PART 1

Item 1. Business.

Overview and History:

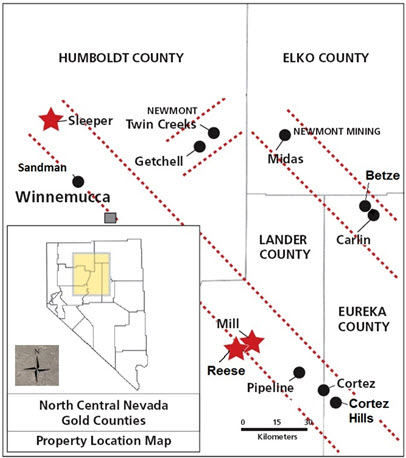

Paramount Gold and Silver Corp. is a U.S. based precious metals exploration stage mining company with projects in northern Nevada and Chihuahua, Mexico. We are a Delaware corporation and we were incorporated on March 29, 2005. Our head office is located at 665 Anderson Street, Winnemucca, Nevada. We also have a field office in Temoris, Chihuahua Mexico.

Through our wholly owned Mexican subsidiary, Paramount Gold de Mexico S.A. de C.V., we own a 100% interest in the San Miguel property which we acquired from Tara Gold Resources Corp. (“Tara Gold”).

In March 2009, we acquired all of the issued and outstanding shares of common stock of Magnetic Resources Ltd. (“Magnetic”). Magnetic is the sole beneficial shareholder of Minera Gama, S.A. de C.V. which holds interests in various mineral concessions in Mexico known as the Temoris project and the Morelos project. The Temoris project forms part of the greater San Miguel project. Magnetic also holds a 2.0% NSR royalty from production arising from the Iris mineral concessions located in the Municipality of Ocampo in Chihuahua, Mexico. The Morelos Project and the Iris Project are ancillary to our primary business plan.

Also in 2009, we closed on an agreement with Garibaldi Resource Corp (“Garibaldi”) in which we acquired the outstanding option on the Temoris project. With the acquisition of both Magnetic and our agreement with Garibaldi, we increased our mining claims in the San Miguel project area by approximately 54,000 hectares.

In May 2008, we signed an agreement with Mexoro Minerals Ltd. (“Mexoro”) and its Mexican subsidiary, Sunburst Mining de Mexico S.A. de C.V., to acquire, for a purchase price of US$3.7 million, Mexoro’s rights to a number of mining concessions known as the Guazapares concessions, comprising approximately 1,980 hectares and located in Chihuahua, Mexico. The Guazapares project comprises 12 claims surrounding Paramount’s San Miguel Project and also forms part of the greater San Miguel project An additional payment of US$1.6 million was due to Mexoro if, within 36 months, the project was put into commercial production or if Paramount or substantially all of its assets are

sold. The project has not been placed into commercial production and we are under no contractual obligations to make further payments to Mexoro.

On August 23, 2010, we acquired all of the issued and outstanding shares of common stock of X-Cal Resources Ltd. (“X-Cal”). We issued 22,001,453 shares of our common stock in exchange for all of the issued and outstanding shares of common stock of X-Cal. The principal asset of X-Cal is the Sleeper Gold Mine located in Humboldt County, Nevada. We successfully integrated X-Cal’s operations within the Company. We completed our first exploration at the Sleeper Gold Mine in January 2011 and commenced a new exploration program in May 2011.

Our work at both the San Miguel Project and Sleeper Gold Project is consistent with Paramount’s strategy of expanding and upgrading known, large-scale precious metal occurrences in established mining camps, defining their economic potential and then partnering them with nearby producers.

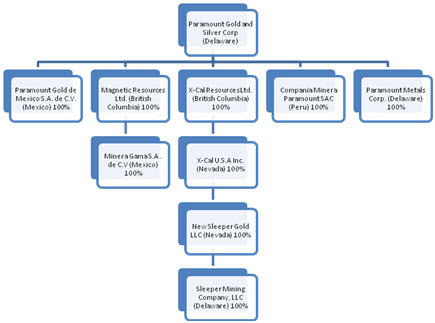

Inter-corporate Relationships:

The Company’s corporate structure is as follows:

Neither Compania Minera nor Paramount Metals is currently active.

Financings and Related Agreements:

We have been dependent upon equity financings to operate our business. On March 30, 2007 we closed on an equity financing that came from a private placement of our securities in the amount of $21,836,841. The financing consisted of the sale of 10,398,496 units at a price of $2.10 per unit. From April 2007 through February 2009, we completed several small private placements ranging from $100,000 to approximately $1.8 million. These funds were used to expand our drilling operations in Mexico as well as for general working capital purposes.

On March 20, 2009 we sold a total of 12 million units of our securities at a price of $0.75 CAD per unit for a total of $9,000,000 CAD (the “Financing”). (Based on an exchange rate of CAD$1 = US$0.80 we raised gross proceeds of US$7.2 million). Each unit consisted of one share of common stock and one common stock purchase warrant. Each warrant entitles the holder thereof to purchase one share of our common stock at an exercise price of $1.05 CAD per share for a period of four years from the date of issuance.

In October 2009 we sold a total of 16 million shares of our common stock at $1.25 by way of public offering lead by a U.S broker-dealer. In addition, our underwriter exercised all of its overallotment of 2.4 million shares generating approximately $23 million in gross proceeds and $21.7 net proceeds.

In January 2010, we issued to MineralFields Group, 3,636,362 shares of our common stock at a per share of $1.25 for gross proceeds of $4,454,525 CAD pursuant to the exercise of common share purchase warrants.

In June 2010 we issued 3 million shares of our common stock pursuant to the exercise of 3 million common stock warrants resulting in proceeds of $3,150,000 CAD.

From December 2010 through March 2011, the Company issued 2,140,100 shares of its common stock pursuant to the exercise of outstanding stock purchase warrants for proceeds of $2,247,000.

In June 2011, we issued 19,395 shares of our common stock for gross proceeds of $70,037 pursuant to an “at-the-market” offering .

Depending on the results of our drilling program, we may require additional financing. There can be no assurance that this financing will be available or if available, on terms acceptable to the Company.

MARKET DESCRIPTION

Gold and Silver:

We are a precious metals exploration company with gold and silver exploration properties located in Mexico and the United States. The gold and silver markets have been strong since 2001, where gold has increased from $268 per ounce to a high of approximately $1,900 per ounce to its current price of approximately $1,700 per ounce. Silver has increased from $4.58 per ounce to a high of $50 per ounce to its current price of approximately $40 per ounce. (Current prices are as of September 5, 2011). Management believes that both the gold and silver markets will remain strong for the foreseeable future.

Mineral exploration in Mexico and the United States.

Mexico is one of the world’s largest mineral producers. It provides an ideal business site for mining companies to operate given its stable government and inclusion in the North American Free Trade Agreement. U.S. mineral production has remained strong through the past decade. The state of Nevada is one of the most significant gold districts in the world.

Employees

As of July 30, 2011, we had approximately 40 employees and consultants located in Mexico and the United States.

Facilities

Our head office is located in Winnemucca, Nevada. Our administrative office is located in Ottawa, Ontario Canada. We also have an office in Temoris, Mexico. The premise leases for all facilities are in good standing.

Item 1A. Risk Factors.

(1) The risks and uncertainties described below are not the only ones facing the Company. Additional risks and uncertainties not presently known to us or that we currently deem immaterial may also impair our business operations. If any of the following risks actually occur, our business could be materially adversely affected. In such case, the Company may not be able to proceed with its planned operations and your investment may be lost entirely.

Risks Related to our Business Operations

It is possible investors may lose their entire investment in Paramount.

Prospective investors should be aware that if we are not successful in our endeavors, your entire investment in the Company could become worthless. Even if we are successful, in identifying mineral reserves that can be commercially developed, there can be no assurances that we will generate any revenues and our losses will continue.

We have not generated any revenues from operations. We have a history of losses and losses are likely to continue in the future.

We have not generated any revenues from operations. Our Net loss for the fiscal year ended June 30, 2011 totaled $27,989,076. Cumulative losses since inception totaled $89,619,848. We have incurred significant losses in the past and we will likely continue to incur losses in the future unless our drilling program proves successful. Even if our drilling program identifies gold, silver or other mineral reserves, there can be no assurance that we will be able to commercially exploit these resources, generate any revenues or generate sufficient revenues to operate profitably.

We may require additional financing to continue drilling operations.

We may require significant working capital to continue our current drilling program. There can be no assurance that we will be able to secure additional funding to meet our objectives or if we are able to identify funding sources, that the funding will be available on terms acceptable to the Company. Should this occur, we will have to significantly reduce our drilling programs which will limit our ability to secure additional equity participation in various joint ventures.

There are no confirmed mineral deposits on any properties from which we may derive any financial benefit.

Neither the Company nor any independent geologist has confirmed commercially mineable ore deposits. In order to carry out additional exploration programs of any potential ore body and to place it into commercial production, we will require substantial additional funding.

We have no history as a mining company.

We have no history of earnings or cash flow from mining operations. If we are able to proceed to production, commercial viability will be affected by factors that are beyond our control such as the particular attributes of the deposit, the fluctuation in metal prices, the cost of construction and operating a mine, prices and refining facilities, the availability of economic sources for energy, government regulations including regulations relating to prices, royalties, restrictions on production, quotas on exploration of minerals, as well as the costs of protection of the environment.

If our exploration costs are higher than anticipated, then our profitability will be adversely affected.

We are currently proceeding with exploration of our mineral properties on the basis of estimated exploration costs. This exploration program includes drilling programs at various locations within Mexico and the United States. If our exploration costs are greater than anticipated, then we will have less funds for other expenses or projects. If higher exploration costs reduce the amount of funds available for the extraction of gold or silver through mining and development activities, then our ability to generate revenues will be adversely affected. Factors that could cause exploration costs to increase are: adverse weather conditions, difficult terrain, increased government regulation and

shortages of qualified personnel.

During the next twelve months, and assuming no adverse developments outside of the ordinary course of business we have budgeted approximately $12.25 million for exploratory activities of which $9.25 million will be allocated to our Mexican operations and $3 million will be allocated to our drilling operations in Nevada. Exploration will be funded by our available cash reserves. Our drilling program may vary significantly from what we have budgeted depending upon drilling results. Even if we identify mineral reserves which have the potential to be commercially developed, we will not generate revenues until such time as we undertake mining operations. Mining operations will involve a significant

capital infusion. Mining costs are speculative and dependent on a number of factors including mining depth, terrain and necessary equipment. We do not believe that we will have sufficient funds to implement mining operations without a joint venture partner, of which there can be no assurance.

We have no ongoing mining operations.

We are not a mining company and have no ongoing mining operations of any kind. We have interests in mining concessions which may or may not lead to production.

We face many operating hazards.

The development and operation of a mine or mineral property involves many risks, which even a combination of experience, knowledge and careful evaluation may not be able to overcome. These risks include, among other things, ground fall, flooding, environmental hazards and the discharge of toxic chemicals, explosions and other accidents. Such occurrences may result in work stoppages, delays in production, increased production costs, damage to or destruction of mines and other producing facilities, injury or loss of life, damage to property, environmental damage and possible legal liability for such damages as well. Although the Company maintains liability

coverage in an amount which it considers adequate for its operations, such occurrences, against which the Company may not be able, or may elect not to insure, may result in a material adverse change in the Company’s financial position. The nature of these risks is such that liabilities may exceed policy limits, in which event the Company would incur substantial uninsured losses.

There may be insufficient mineral reserves to develop any of our properties and our estimates may be inaccurate.

There is no certainty that any expenditures made in the exploration of any properties will result in discoveries of commercially recoverable quantities of ore. Most exploration projects do not result in the discovery of commercially mineable deposits of ore and no assurance can be given that any particular level of recovery of gold from discovered mineralization will in fact be realized or that any identified mineral deposit will ever qualify as a commercially mineable ore body which can be legally and economically exploited. Estimates of reserves, mineral deposits and production costs can also be affected by such factors as environmental regulations and requirements, weather, environmental factors, unforeseen

technical difficulties, unusual or unexpected geological formations and work interruptions. In addition, the grade of ore ultimately mined may differ from that indicated by drilling results.

Short term factors relating to reserves, such as the need for orderly development of ore bodies or the processing of new or different grades, may also have an adverse effect on mining operations and on the results of operations. There can be no assurance that gold recovered in small scale laboratory tests will be duplicated in large scale tests under on-site production conditions. Material changes in estimated reserves, grades, stripping ratios or recovery rates may affect the economic viability of any project.

We have no proven reserves.

All of our properties are in the exploration stages only and are without known bodies of commercial ore. Development of these properties will follow only upon obtaining satisfactory exploration results. The long-term profitability of the Company’s operations will be in part directly related to the cost and success of its exploration and development programs. Mineral exploration and development are highly speculative businesses, involving a high degree of risk. Few properties which are explored are ultimately developed into producing mines. There is no assurance that our mineral exploration and development activities will result in any discoveries of

commercial quantities of ore. There is also no assurance that, even if commercial quantities of ore are discovered, a mineral property will be brought into commercial production. Discovery of mineral deposits is dependent upon a number of factors, not the least of which is the technical skill of the exploration personnel involved. The commercial viability of a mineral deposit once discovered is also dependent upon a number of factors, many of which are beyond the Company’s control, such as the particular attributes of the deposit (such as size, grade and proximity to infrastructure), metal prices and government regulations, including regulations relating to royalties, allowable production, importing and exporting of minerals, and environmental protection.

In the course of exploration, development, and mining of mineral properties, certain unanticipated conditions may arise or unexpected or unusual events may occur, including rock bursts, cave-ins, fires, floods, or earthquakes. It is not always possible to fully insure against such risks and we may decide not to take out insurance against such risks as a result of high premiums or for other reasons. Should such liabilities arise, they may reduce or eliminate any future profitability and may result in a decline in the value of the securities of the Company.

We face fluctuating gold and mineral prices and currency volatility.

The price of gold and silver as well as other precious base metals has experienced volatile and significant price movements over short periods of time and is affected by numerous factors beyond our control, including international economic and political trends, expectations of inflation, currency exchange fluctuations (including, the U.S. dollar relative to other currencies) interest rates, global or regional consumption patterns, speculative activities and increases in production due to improved mining and production methods. The supply of and demand for gold, other precious and base metals are affected by various factors, including political events, economic conditions and production costs in major mineral

producing regions.

Mining operations are hazardous, raise environmental concerns and raise insurance risks.

Mining operations are by their nature subject to a variety of risks, such as cave-ins and other accidents, flooding, environmental hazards, the discharge of toxic chemicals and other hazards. Such occurrences may delay development or production, increase production costs or result in a liability. We may not be able to insure fully or at all against such risks, due to political or other reasons, or we may decide not to take out insurance against such risks as a result of high premiums or other reasons. We intend to conduct our business in a way that safeguards public health and the environment and in compliance with applicable laws and regulations. Environmental hazards may exist on properties in which we hold an

interest which are unknown to us and may have been caused by prior owners. Changes to mining laws and regulations could require additional capital expenditures and increase operating and/or reclamation costs. Although we are unable to predict what additional legislation, if any, might be proposed or enacted, additional regulatory requirements could render certain mining operations uneconomic.

Our estimates of resources are subject to uncertainty.

Estimates of resources are subject to considerable uncertainty. Such estimates are arrived at using standard acceptable geological techniques, and are based on the interpretations of geological data obtained from drill holes and other sampling techniques. Engineers use feasibility studies to derive estimates of cash operating costs based on anticipated tonnage and grades of ore to be mined and processed, the predicted configuration of the ore bodies, expected recovery rates of metal from ore, comparable facility and operating costs and other factors. Actual cash operating costs and economic returns on projects may differ significantly from the original estimates, primarily due to fluctuations in the current prices

of metal commodities extracted from the deposits, changes in fuel costs, labor rates, changes in permit requirements, and unforeseen variations in the characteristics of the ore body. Due to the presence of these factors, there is no assurance that any geological reports will accurately reflect actual quantities of gold, silver or other metals that can be economically processed and mined by us.

If we are unable to obtain all of our required governmental permits, our operations could be negatively impacted.

Our future operations, including exploration and development activities, required permits from various governmental authorities. Such operations are and will be governed by laws and regulations governing prospecting, development, mining, production, exports, taxes, labor standards, occupational health, waste disposal, toxic substances, land use, environmental protection, mine safety and other matters. There can be no assurance that we will be able to acquire all required licenses or permits or to maintain continued operations at our properties.

We are subject to numerous environmental and other regulatory requirements.

All phases of mining and exploration operations are subject to governmental regulation including environmental regulation. Environmental legislation is becoming stricter, with increased fines and penalties for non-compliance, more stringent environmental assessments of proposed projects and heightened responsibility for companies and their officers, directors and employees. There can be no assurance that possible future changes in environmental regulation will not adversely affect our operations. As well, environmental hazards may exist on a property in which we hold an interest that was caused by previous or existing owners or operators of the

properties and of which the Company is not aware at present.

Government approvals and permits are required to be maintained in connection with our mining and exploration activities. Although we currently have all required permits for our operations as currently conducted, there is no assurance that delays will not occur in connection with obtaining all necessary renewals of such permits for the existing operations or additional permits for any possible future changes to the Company’s operations, including any proposed capital improvement programs. Failure to comply with applicable laws, regulations and permitting requirements may result in enforcement actions there under, including orders issued by

regulatory or judicial authorities causing operations to cease or be curtailed, and may include corrective measures requiring capital expenditures, installation of additional equipment, or remedial actions. Parties engaged in mining operations may be required to compensate those suffering loss or damage by reason of the mining activities and may be liable for civil or criminal fines or penalties imposed for violations of applicable laws or regulations. Amendments to current laws, regulations and permitting requirements, or more stringent application of existing laws, may have a material adverse impact on the Company resulting in increased capital expenditures or production costs, reduced levels of production at producing properties or abandonment or delays in development of properties.

There is no assurance that there will not be title or boundary disputes.

Although we have investigated the right to explore and exploit our properties and obtained records from government offices with respect to all of the mineral claims comprising our properties, this should not be construed as a guarantee of title. Other parties may dispute the title to any of our properties or that any property may be subject to prior unregistered agreements and transfers or land claims by aboriginal, native, or indigenous peoples. The title may be affected by undetected encumbrances or defects or governmental actions.

Local infrastructure may impact our exploration activities and results of operations.

Mining, processing, development and exploration activities depend, to one degree or another, on adequate infrastructure. Reliable roads, bridges and power and water supplies are important determinants that affect capital and operating costs. Unusual or infrequent weather phenomena, sabotage or government or other interference in the maintenance or provision of such infrastructure could adversely affect the activities and profitability of the Company.

Our financial position and results are subject to fluctuations in foreign currency values.

Any mining operations we undertake outside of the United States will be subject to currency fluctuations. Fluctuations in the exchange rate between the U.S. dollar and any foreign currency may adversely impact our operations. We do not anticipate that we will enter into any type of hedging transactions to offset this risk. In addition, with respect to commercial operations in Mexico or other countries, it is possible that material transactions incurred in local currency, such as engagement of local contractors for major projects, will be settled at a U.S. dollar value that is different from the U.S. dollar value of the transaction at the time it was incurred. This could have the effect of undermining

revenues from operations in that country.

Our property interests in Mexico are subject to risks from instability in that country.

We have property interests in Mexico which may be affected by risks associated with political or economic instability in that country. The risks with respect to Mexico or other developing countries include, but are not limited to: fluctuations in currency exchange rates, criminal activity, lack of personal safety or ability to safeguard property, labor instability or militancy, mineral title irregularities and high rates of inflation. In addition, changes in mining or investment policies or shifts in political attitude in Mexico or the United States may adversely affect our business. We may be affected in varying degrees by government regulation with respect to restrictions on production, price controls, export

controls, income taxes, expropriation of property, maintenance of claims, environmental legislation, land use, land claims of local people, water use and mine safety. The effect of these factors cannot be accurately predicted but may adversely impact our proposed operations in any foreign jurisdiction.

Increasing violence between the Mexican government and drug cartels may result in additional costs of doing business in Mexico.

To date, we have not incurred additional costs as a result of increasing violence between the Mexican government and drug cartels. The state of Chihuahua where the San Miguel property is located has experienced over 2,500 deaths attributable to the drug wars. To date, this violence has had no impact on our business operations. Management remains cognizant that the drug cartels may expand their operations or violence in areas in close proximity to our operations. Should this occur, we will be required to hire additional security personnel. We have not budgeted for increased security. However, if drug violence becomes a problem or, any other violence impacts our operations, the costs to protect our personnel and

property will adversely impact our operations.

There may be challenges to our title in our mining properties.

While we intend to conduct our own due diligence prior to committing significant funds to any project, mining properties may be subject to prior unregistered agreements, transfers or claims and title may be affected by undetected defects. Should this occur, we face significant delays, costs and the possible loss of any investments or commitment of capital.

Because of the speculative nature of exploration for gold and silver properties, there is substantial risk that our business will fail.

The search for precious metals as a business is extremely risky. We cannot provide any assurances that the gold or silver mining interests that we acquired will contain commercially exploitable reserves of gold or silver. Exploration for minerals is a speculative venture necessarily involving substantial risk. Any expenditure that we make may not result in the discovery of commercially exploitable reserves of gold.

The precious metals markets are volatile markets. This will have a direct impact on the Company’s revenues (if any) and profits (if any) and will probably have an adverse affect on our ongoing operations.

The price of both gold and silver has increased over the past few years. This has contributed to the renewed interest in gold and silver mining and companies engaged in that business, including the exploration for both gold and silver. However, in the event that the price of these metals fall, the interest in the gold and silver mining industry may decline and the value of the Company’s business could be adversely affected. Further, although it is anticipated that mining costs outside of the United States and Canada will be appreciably lower, no assurances can be given that the situation will remain, or that gold or silver will remain at a price that will enable us to generate revenues from our mining

operations. Even if we are able to generate revenues, there can be no assurance that any of our operations will prove to be profitable. Finally, in recent decades, there have been periods of both overproduction and underproduction of both gold and silver resources. Such conditions have resulted in periods of excess supply of and reduced demand on a worldwide basis and on a domestic basis. These periods have been followed by periods of short supply of and increased demand for both gold and silver. The excess or short supply of gold has placed pressure on prices and has resulted in dramatic price fluctuations even during relatively short periods of seasonal market demand. We cannot predict what the market for gold or silver will be in the future.

Government regulation or changes in such regulation may adversely affect the Company’s business.

The Company has and will, in the future, engage experts to assist it with respect to its operations. The Company deals with various regulatory and governmental agencies and the rules and regulations of such agencies. No assurances can be given that it will be successful in its efforts or dealings with these agencies. Further, in order for the Company to operate and grow its business, it needs to continually conform to the laws, rules and regulations of such jurisdiction. It is possible that the legal and regulatory environment pertaining to the exploration and development of gold mining properties will change. Uncertainty and new regulations and rules could increase the Company’s cost of doing business or

prevent it from conducting its business.

We are in competition with companies that are larger, more established and better capitalized than we are.

Many of our potential competitors have:

|

|

·

|

greater financial and technical resources;

|

|

|

·

|

longer operating histories and greater experience in mining;

|

|

|

·

|

greater awareness of the political, economic and governmental risks in operating in Mexico.

|

We may not be able to generate revenues.

To date, we have not generated any revenues from operations. We have incurred significant losses since inception and there can be no assurance that we will be able to reverse this trend. Even if we are able to successfully identify commercially exploitable mining reserves, there can be no assurance that we will have sufficient financing to exploit these reserves, generate revenues or find a willing buyer for the properties.

We have no proven reserves, no mining operations, and no operating income.

We currently have no revenues from operations, no mining operations, and no proven reserves. Reserves, by definition, contain mineral deposits in a quantity and in a form from which the target minerals may be economically and legally extracted or produced. We have not established that precious minerals exist in any quantity in the property which is the focus of our exploration efforts, and unless or until we do so we will not have any income from operations.

Exploration for economic deposits of minerals is speculative.

The business of mineral exploration is very speculative, since there is generally no way to recover any of the funds expended on exploration unless the existence of mineable reserves can be established and the Company can exploit those reserves by either commencing mining operations, selling or leasing its interest in the property, or entering into a joint venture with a larger resource company that can further develop the property to the production stage. Unless we can establish and exploit reserves before our funds are exhausted, we will have to discontinue operations, which could make our stock valueless.

Exploratory and mining operations are subject to environmental risks.

Both exploratory and mining activities are subject to strict environmental rules and regulations. While we believe that we have complied with all applicable rules and regulations to date, there can be no assurance that we will be able to comply with these rules in the future. Moreover, if it is determined that any prior activity on or about our mining reserves created environmental risks, we would be liable for this clean-up even though we did no perpetrate the violation. Environmental legislation is evolving in some countries or jurisdictions in a manner which will require stricter standards and enforcement, increased fines and penalties for non-compliance, more stringent environmental assessments of proposed

projects and a heightened degree of responsibility for companies and their officers, directors and employees. There is no assurance that future changes in environmental regulation, if any, will not adversely affect our projects. We are currently subject to U.S. federal and state government environmental regulations with respect to our properties in the United States and subject to environmental regulations in Mexico.

The mining industry is highly competitive and the success and future growth of our business depend upon our ability to remain competitive in identifying and developing mining properties with sufficient reserves for economic exploitation.

The mining industry is highly competitive and fragmented with limited barriers to entry, especially at the exploratory stages. We compete in national, regional and local markets with large multi-national corporations and against start-up operators hoping to identify a mining reserve. Some of our competitors have significantly greater financial resources than we do. This puts us at a competitive disadvantage if we choose to further exploit mining opportunities. As we expand into new geographic markets, our success will depend in part on our ability to locate and exploit mineral reserves.

The loss of key members of our senior management team could adversely affect the execution of our business strategy and our financial results.

We believe that the successful execution of our business strategy and our ability to move beyond the exploratory stages depends on the continued employment of key members of our senior management team. If any members of our senior management team become unable or unwilling to continue in their present positions, our financial results and our business could be materially adversely affected.

We operate in a regulated industry and changes in regulations or violations of regulations may result in increased costs or sanctions that could reduce our revenues.

Our organization is subject to extensive and complex foreign, federal and state laws and regulations. If we fail to comply with the laws and regulations that are directly applicable to our business, we could suffer civil and/or criminal penalties or be subject to injunctions or cease and desist orders. While we believe that we are currently compliant with applicable rules and regulations, if there are changes in the future, there can be no assurance that we will be able to comply in the future, or that future compliance will not significantly adversely impact our operations.

We rely on independent analysis to analyze our drilling results and planned exploration activities.

We rely on independent geologists to analyze our drilling results and to prepare resource reports on several of our mining concessions. While these geologists rely on standards established by the Canadian Institute of Mining, Metallurgy and Petroleum, Standards on Mineral Resources and Mineral Reserves and other standards established by various licensing bodies, there can be no assurance that their estimates or results will be accurate. Analyzing drilling results and estimating reserves or targeted drilling sites is not a certainty. Miscalculations and unanticipated drilling results may cause the geologists to alter their estimates. If this should happen, we would have devoted resources to areas where resources

could have been better allocated.

Risks Related to Our Common Stock

The following risks are currently applicable to Paramount and will remain applicable to the combined company upon completion of the Transaction.

Our stock price may be volatile.

The market price of our common stock has been volatile. We believe investors should expect continued volatility in our stock price. Such volatility may make it difficult or impossible for you to obtain a favorable selling price for our shares.

We have a large number of authorized but unissued shares of our common stock.

We have a large number of authorized but unissued shares of common stock, which our management may issue without further stockholder approval, thereby causing dilution of your holdings of our common stock. Our management will continue to have broad discretion to issue shares of our common stock in a range of transactions, including capital-raising transactions, mergers, acquisitions and in other transactions, without obtaining stockholder approval, unless stockholder approval is required. If our management determines to issue shares of our common stock from the large pool of authorized but unissued shares for any purpose in the future, your ownership position would be diluted without your further ability

to vote on that transaction.

During our last fiscal year, we issued a total of 26,179,931 shares of common stock as a result of acquisitions, financings and for the exercise or options and warrants. While the issuance of the additional shares of our common stock has resulted in dilution to our existing shareholders, management believes that the issuance of these shares of common stock has provided enhanced value to our company and preserved working capital for our drilling program and general working capital.

The exercise of our outstanding options and warrants and vesting of restricted stock awards may depress our stock price.

The exercise of outstanding options and warrants, and the subsequent sale of the underlying common stock in the public market, or the perception that future sales of these shares could occur, could have the effect of lowering the market price of our common stock below current levels and make it more difficult for us and our stockholders to sell our equity securities in the future.

Sales or the availability for sale of shares of common stock by stockholders could cause the market price of our common stock to decline and could impair our ability to raise capital through an offering of additional equity securities.

Item 1B. Unresolved Staff Comments.

None

Item 2. Properties

SAN MIGUEL PROJECT, MEXICO

Our exploratory activities are concentrated within the San Miguel Groupings which comprise the San Miguel Project.

Property Description and Location

Location

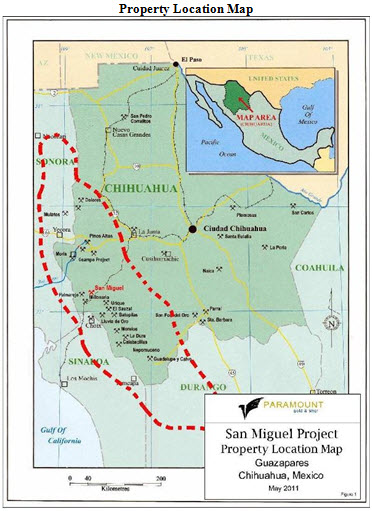

The San Miguel Project is located in southwestern Chihuahua in Northern Mexico, approximately 400 km by road from the state capital of Chihuahua City. The project is about 20 km north of the town of Temoris, adjacent to the village of Guazapares. It is in the Guazapares mining district, which is part of the Sierra Madre Occidental gold-silver belt. The location of the San Miguel Project is shown in Figure 1.

Mineral Claim Area

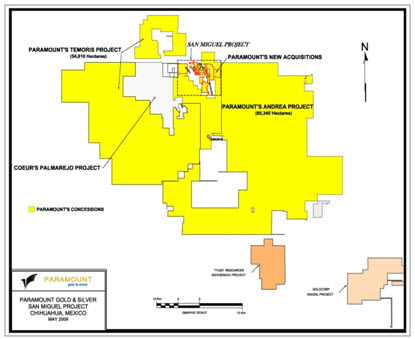

The San Miguel project originally consisted of 17 smaller concessions clustered near Guazapares, Chihuahua with a total area of 427 hectares, plus the much larger Andrea, Gissel and Isabel concessions which were staked in 2008, the Elyca concession which was acquired in 2008, and a joint venture agreement that had been signed with Garibaldi Resources Corporation as part of a district wide exploration program.

Since November 2008, there have been significant additions to the San Miguel project concessions. In March 2009 we acquired from Garibaldi all of their interest in several mining concession totalling approximately 54,000 hectares Pursuant to the agreement Paramount paid Garibaldi a total of $400,000 in cash and issued 6 million shares of Paramount’s common stock. A map of the new Temoris project is set forth below.

Also in March 2009, Paramount acquired all of the issued and outstanding shares of stock of Magnetic Resources Ltd. Magnetic was the sole beneficial shareholder of Minera Gama which was the underlying concession holder of Garibaldi’s Temoris Project, as well as two other groups of concessions which are not in the San Miguel area – the Morelos grassroots exploration and Iris royalty projects. In addition, Paramount purchased from Mexoro Minerals Ltd., and its Mexican subsidiary, Sunburst Mining de Mexico, S.A. de C.V., to acquire its interest to the Guazapares concession group adjacent to Paramount’s San Miguel group subject to certain net smelter return royalties for a purchase price of

$3.7 million. The property is comprised of approximately 2000 hectares.

San Miguel Concessions Including the Temoris Project

The following table outlines our concessions within the San Miguel Project:

San Miguel Project Concession Data

|

Concession

|

Owner

|

Title No.

|

Date Staked

|

Hectares

|

|

San Miguel Group

|

||||

|

SAN MIGUEL

|

Paramount

|

166401

|

4-Jun-80

|

13

|

|

SAN LUIS

|

Paramount

|

166422

|

4-Jun-80

|

4

|

|

EMPALME

|

Paramount

|

166423

|

4-Jun-80

|

6

|

|

SANGRE DE CRISTO

|

Paramount

|

166424

|

4-Jun-80

|

41

|

|

SANTA CLARA

|

Paramount

|

166425

|

4-Jun-80

|

15

|

|

EL CARMEN

|

Paramount

|

166426

|

4-Jun-80

|

59

|

|

LAS TRES B.B.B.

|

Paramount

|

166427

|

4-Jun-80

|

23

|

|

SWANWICK

|

Paramount

|

166428

|

4-Jun-80

|

70

|

|

LAS TRES S.S.S.

|

Paramount

|

166429

|

4-Jun-80

|

19

|

|

SAN JUAN

|

Paramount

|

166402

|

4-Jun-80

|

3

|

|

EL ROSARIO

|

Paramount

|

166430

|

4-Jun-80

|

14

|

|

GUADALUPE DE LOS REYES

|

Paramount

|

172225

|

4-Jun-80

|

8

|

|

CONSTITUYENTES 1917

|

Paramount

|

199402

|

19-Apr-94

|

66

|

|

MONTECRISTO

|

Paramount

|

213579

|

18-May-01

|

38

|

|

MONTECRISTO FRACCION

|

Paramount

|

213580

|

18-May-01

|

0.28

|

|

MONTECRISTO II

|

Paramount

|

226590

|

2-Feb-06

|

27

|

|

SANTA CRUZ

|

Amermin

|

186960

|

17-May-90

|

10

|

|

ANDREA

|

Paramount

|

231075

|

16-Jan-08

|

84,112

|

|

GISSEL

|

Paramount

|

228244

|

17-Oct-06

|

880

|

|

ISABEL

|

Paramount

|

228724

|

17-Jan-07

|

348

|

|

ELYCA

|

Paramount

|

179842

|

17-Dec-86

|

10

|

|

T o t a l

|

85,766

|

|||

|

Temoris Project

|

||||

|

Guazapares

|

Minera Gama

|

232082

|

18-May-07

|

6,265

|

|

Roble

|

Minera Gama

|

232084

|

18-May-07

|

797

|

|

Temoris Centro

|

Minera Gama

|

232081

|

18-May-07

|

40,386

|

|

Temoris Fracción 2

|

Minera Gama

|

229551

|

18-May-07

|

7,328

|

|

Temoris Fracción 3

|

Minera Gama

|

229552

|

18-May-07

|

14

|

|

Temoris Fracción 4

|

Minera Gama

|

229553

|

18-May-07

|

18

|

|

T o t a l

|

54,808

|

|||

|

Guazapares Claims

|

||||

|

San Francisco

|

Paramount

|

191486

|

19-Dec-91

|

38

|

|

Ampliación San Antonio

|

Paramount

|

196127

|

23-Sep-92

|

21

|

|

San Antonio

|

Paramount

|

204385

|

13-Feb-97

|

15

|

|

Guazaparez

|

Paramount

|

209497

|

3-Aug-99

|

30

|

|

Guazaparez 3

|

Paramount

|

211040

|

24-Mar-00

|

250

|

|

Guazaparez 1

|

Paramount

|

212890

|

13-Feb-01

|

452

|

|

Guazaparez 5

|

Paramount

|

213572

|

18-May-01

|

88

|

|

Cantilito

|

Paramount

|

220788

|

7-Oct-03

|

37

|

|

San Antonio

|

Paramount

|

222869

|

14-Sep-04

|

105

|

|

Guazaparez 4

|

Paramount

|

223664

|

2-Feb-05

|

64

|

|

Guazaparez 2

|

Paramount

|

226217

|

2-Dec-05

|

404

|

|

Vinorama

|

Paramount

|

226884

|

17-Mar-06

|

474

|

|

San Antonio

|

CA T-204385*

|

181963

|

17-Mar-88

|

15

|

|

T o t a l

|

1,993

|

|||

|

Grand Total

|

142,567

|

|||

(*) Under option

Current Agreements with respect to mining concessions:

Guazapares

Paramount’s Mexican subsidiary acquired the Guazapares claims from the Mexican subsidiary of Mexoro Minerals subject to future option payments and a retained NSR.

Temoris

On January 30, 2009, we closed on our agreement with Garibaldi whereby Garibaldi assigned its option in the Temoris Concession to Paramount. In consideration for the assignment of the Temoris option, Paramount paid Garibaldi a total of $400,000 in cash and issued to Garibaldi 6 million shares of our common stock. Subsequent to the purchase of Magnetic Resources as noted above, Paramount terminated the option agreement.

Ejido Agreements

We have signed agreements with two ejidos, or surface-owner councils, allowing for surface disturbance during exploration activities on Paramount’s concessions. Agreements with the Guazapares and Batosegachi ejidos were re-signed in April 2011, and are effective for a period of five years. The Guazapares and Batosegachi ejido agreements are registered with the National Agrarian Registry. The agreements permit Paramount to carry out exploration on the ejidos’ areas in exchange for compensation of a fixed sum per hectare of physical disturbance associated with exploration such as the cutting of trees and construction of drill access roads and drill pads, etc. In April 2010, we signed an

agreement with an additional Ejido covering the newly purchased concessions.

Community Involvement

Several rural communities are located within our work area, the most important of which are Temoris, Guazapares, Batosegachi, San José and Tahonitas. In keeping with our policy of community integration, Paramount has carried out a program of economic and other assistance, including: donations of materials and wages for construction projects at schools in Guazapares, San Jose and Temoris; a donation for the acquisition of computers for the regional junior high school; donation to DIF, the organization for integral family development in Temoris; construction materials for DIF, for the construction of houses for disadvantaged families; donation for purchase of fertilizer for the farmers of Batosegachi; financial

assistance for the upgrading and maintenance of local roads utilized by Paramount to access the San Miguel Project in Guazapares and Batosegachi ejidos; and the creation of up to 40 jobs.

Environmental Reports and Liabilities:

With the assistance of a Mexican environmental permitting consultant, Vugalit S.C., Paramount has satisfied the requirements regarding permitting for the ongoing exploration program with the office of the Mexican governmental environmental agency, SEMARNAT, in Chihuahua City. Disturbance associated with exploration work completed by Paramount to date is limited to construction of drill access roads, drill pads and trenches. No direct mining related activities have been carried out.

On Paramount’s behalf, Vugalit S.C submitted a NOM-120-SEMARNAT-1997 application to SEMARNAT on March 15, 2007 to permit exploration activities at the San Miguel Project. The application was accepted and became effective on July 19, 2007. The permit allows a total disturbance of 7.6224 hectares valid to December 31, 2011. The permit provides for reclamation of the concession areas by the Fondo Forestal Mexicano following the cessation of exploration activities in the permit area. The permit set the cost of reclamation at a total of 198,205 Mexican pesos, which was paid by Paramount to Fondo Forestal Mexicano.

Through our wholly owned Mexican subsidiary, we have been granted mineral claims which grant us exclusive exploration and exploitation rights. Mexican mining claims are valid for an initial 25 year term with one renewable term for 25 years. Exploration claims grant the automatic right to disturb the surface to conduct exploratory work such as drilling. Permits are automatically granted once rights have been issued together with the payment of nominal fees. Exploitation, mine development and construction requires the approval of various levels of local government in Mexico. However, this is not under consideration by Paramount at this time. Access to the properties are by agreement by the owner or local community and

are typically granted for a nominal fee.

Vugalit S.C also filed an Environmental Impact Study with SEMARNAT on behalf of Paramount.

With these exceptions, there has been no mining activity on the San Miguel concessions since the early 1900’s. Between 1958 and 1968, Alaska-Juneau operated the San Luis mine and mill, producing waste rock and tailings. In the late 1970’s, a few thousand tons of vein material were shipped from the San Miguel vein to El Paso as smelter flux. In the 1990’s a very small and unsuccessful attempt was made to heap leach oxidized silver ores near the north end of the La Union area. It is uncertain whether Paramount would be held responsible for the cleanup of these areas should it put a mine into production nearby.

Excepting the work that was carried out as part of the Environmental Impact Study, we have as not yet conducted any baseline environmental studies, such as surface or groundwater sampling, of the San Miguel Project area. We believe such studies should be conducted to document any residual effects that the historic mining activities may still be having on the soils and streams of the Guazapares area.

The village of Guazapares is immediately adjacent to the historic San Luis mine area and is also adjacent other Paramount exploration targets. The village of Batosegachi is less than a kilometer from the San Miguel exploration area. While the local people appear to be supportive of our current exploration efforts, it is not known what financial or time-related impacts to the permitting of a mining operation, if any, the close proximity to these villages might create.

Accessibility, Climate, Local Resources, Infrastructure and Physiography

Access:

Direct access to San Miguel is by the paved highway 127 to the town of Creel, then by reasonably good gravel roads to Temoris and then Guazapares. The simplest way for a visitor to reach Temoris is via the Chihuahua-Pacific rail service between Chihuahua City and Temoris, a nine hour trip. Two passenger trains in each direction and several freight trains serve Temoris and Los Mochis on the pacific coast daily. From the Temoris train station to the village of Guazapares the drive is about 15 minutes by a winding gravel road. In August we received approval from SEMARNAT to expand our drilling activities to new project areas.

Climate:

The Temoris area has a temperate climate. Undisturbed slopes are covered by juniper-pine-oak forests. Rainfall is largely in the summer months, with an annual average of about 8 cm. Maximum temperatures rarely exceed 35°C, and minimum temperatures are rarely less than 5o C. The average elevation in the vicinity of Guazapares is 1,600 meters. While there can occasionally be snow or heavy rains, it is anticipated that exploration work or mining can continue throughout the year.

Local Resources, Infrastructure:

The Temoris area has reasonably good local infrastructure and a workforce generally receptive to mining. Temoris and Chinipas have populations of approximately 1,500 people , 200 of which live in the village of Guazapares, and there are several smaller villages in the general area. The total available workforce of the area may approach 5,000 people.

A new electric power line is now reaching Guazapares for the first time. While it is adequate for home use, it will not be adequate for mineral processing. Management believes that future feasibility studies of potential mineral production and processing must consider either upgrading the power line or generating power on site.

It would appear that local streams and groundwater should suffice. They were adequate for underground mining by the Alaska-Juneau Company in 1960, and water abundance was a problem in the deeper workings.

As noted above the Chihuahua-Pacific railway connects Temoris to Los Mochis on the Pacific side and to Chihuahua on the east. This would provide convenient access for shipping of supplies and personnel. The gravel road from Temoris to Guazapares will require some improvement for mine access. There is an airstrip suitable for light aircraft at Temoris. While much of the region is deeply incised by stream drainages, the immediate area of Guazapares has relatively gentle topography, with several areas sufficiently level for construction of processing sites.

As an exploration company with no active mines under development or operating, we have relied on a series of public and temporary roads to access our properties.

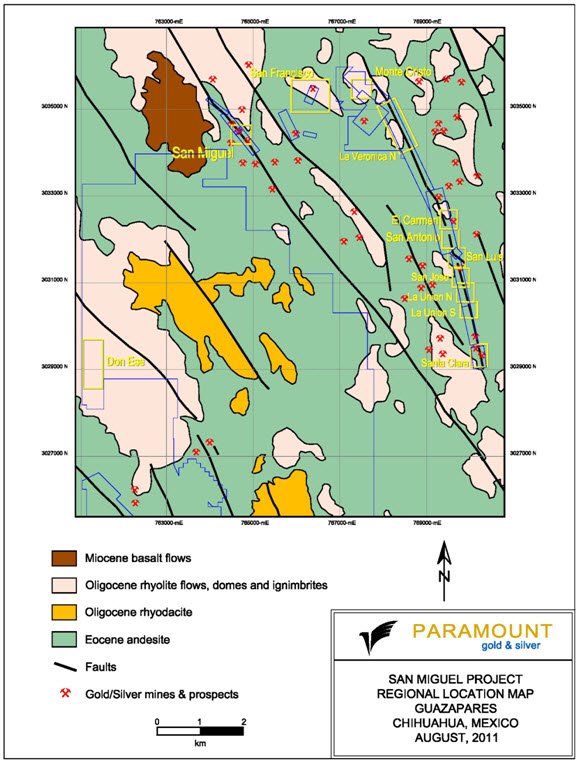

Physiography:

Paramount’s San Miguel project is near the center of the Sierra Madre Occidental range. This range is actually a relatively structurally undisturbed plateau composed of nearly flat-lying Tertiary volcanic rocks. This plateau is generally deeply incised, with many steeply walled canyons and small, relatively level, plateau remnants between them. The San Miguel project area explored to date occupies one of these more level areas. To the west the volcanic plateau is bounded by an extensional terrane, which represents the southern continuation of the basin and range province of the western USA.

The terrain is often hilly to steeply mountainous. It is generally covered with pinyon-juniper-oak forests where not cleared for agriculture. More gently sloping areas are used for small vegetable and corn plots and the grazing of cattle.

History

Pre-Paramount Mining and Exploration History:

The center of the San Miguel Project is in the Guazapares mining district. The town of Guazapares was founded in 1620 along with a Jesuit mission. The first recorded mining activity was in 1677. Small-scale mining apparently continued throughout the Spanish colonial period. The Guazapares quartz breccia-veins were being developed by 1830, but the major period of older production took place between 1870 and 1900. During this period four pan amalgamation mills were in production to treat oxidized ores. Very little gold was recovered due to the limitations of the process. A note in a recent report by Minera Rio Tinto says that 400,000 tons grading 300 g/t Ag was the total production (source unknown). Workings would

have been directed toward production of these oxide ores at depths less than 70 meters.

After 1905, a U.S. company (name unknown) consolidated most of the properties and reopened some of the workings, but went bankrupt during the market panic of 1907. Shortly thereafter Ramon Valenzuela acquired the main properties and ran a 5-stamp mill until 1912. At that point, Pancho Villa’s troops took the bullion and operated the mines briefly for the benefit of the revolution. Any mining in the subsequent 45 years was done on a very small scale by local prospectors.

In 1957 a company called Hilos de Plata rebuilt Valenzuela’s mill and began operating the San Luis mine, but rather ineffectively. Engineer C.W. Yetter of the Alaska-Juneau Mining Company evaluated the property in 1958. This led to its acquisition by Alaska-Juneau, who operated the mine from 1958 to 1968. During this period the San Luis ore was exploited by a 270 meter inclined shaft and processed in a 150 tons per day floatation mill. Production records are being sought, but are not available at this time. At 1960’s metal prices, the mined grades must have been quite high by today’s standards. The author had access to one longitudinal section of the principal San Luis vein, drawn by Alaska-Juneau,

showing 71 face samples in several stopes. A weighted average of these samples was 155.6 g/t Ag and 144 g/t Au. There were no lead and zinc assays noted, although both are apparent in the workings.

ASARCO LLC is reported to have drilled 15 core holes in the 1950’s in the San Luis and San Jose mine areas, but data are fragmentary and hole locations are uncertain. In a 1976 joint venture, Earth Resources and Penoles investigated the property. They sampled most accessible workings, did grid-based geochemical sampling and drilled 3,098 feet in 39 short air-trac holes with poor sample recovery. Preliminary metallurgical testing by Hazen Research at that time stated that the mineralization would be amenable to cyanidation, floatation or probably to heap leaching. Simons Associates did much of the fieldwork for the JV, and later continued to control the property. Copies of some of their reports are available in

Paramount’s files.

The Consejo de Recursos Minerales sampled parts of the underground workings in 1985 and 1988, the vestiges of which are still visible in the workings. Kennecott acquired a portion of the property in 1994, carried out surface and underground sampling, and drilled 12 RC holes for a total of 2,268 meters. Paramount has in its files sections including geology and assays for only 4 or these holes, but little other data from this work.

Minera Rio Tinto reviewed the available data and acquired large concessions to the east of the main Guazapares mineralization in 2002.

Paramount Exploration History in Mexico

As of August 31, 2008, Paramount had completed 69 trenches for a total of 3,743 meters, in the Santa Clara, La Union, San Jose, and San Antonio, El Carmen and La Veronica areas. Trenches approximately 30 inches wide were cut perpendicular to the strike of the veins with an excavator. They were cut as deep as the hardness of the rock would allow. All trenches were mapped for lithology, alteration, structural controls of mineralization and oxidation and were sampled in detail. Trench sampling was used to assist in the geological interpretation and modeling.

Also as of August 31, 2008, a total of 47,559 meters of HQ size (2.5 in) core drilling had been completed in 213 holes. All of the core has been photographed and logged in detail. Drilling was focused on the La Union, San Jose, San Luis, San Antonio, El Carmen, San Miguel and Montecristo areas.