Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT - IRELAND INC. | form8k.htm |

Forward Looking Statements

This Presentation may contain, in addition to historical information, forward-looking statements. Statements in this Presentation that are forward-looking statements are subject to various risks and uncertainties concerning the specific factors disclosed under the heading "Risk Factors” and elsewhere in the Company's periodic filings with the U.S. Securities and Exchange Commission. When used in this Presentation, the words such as "could," "plan," "estimate," "expect," "intend," "may," "potential,“ "should," and similar expressions, are forward-looking statements. The risk factors that could cause actual results to differ from these forward-looking statements include, but are not restricted to the Company‘s limited operating history, uncertainties about the availability of additional financing, geological or mechanical difficulties affecting the Company's planned geological work programs, uncertainty of estimates of mineralized material, operational risk, environmental risk, financial risk, currency risk, and other statements that are not historical facts as disclosed under the heading "Risk Factors" in the Company's Annual Report on Form 10-K filing with the SEC and elsewhere in the Company's periodic filings with securities regulators in the United States. Copies of the Company's periodic reports are available on the SEC's website at http://www.sec.gov.

2

Cautionary Note Regarding Estimates

This presentation uses the terms “inferred,” “indicated,” and “measured resources”. The United States Securities and Exchange Commission (the “SEC”) does not normally permit issuers to disclose resource estimates in their filings with the SEC. SEC guidelines normally permit only the disclosure of “reserve” estimates, which are those parts of a mineral deposit that could be economically and legally extracted or produced at the time the estimate is made. Inferred resource estimates generally may not be used as the basis for pre-feasibility or feasibility studies. There are no assurances that any inferred, indicated or measured resource estimates provided in this press release can be economically or legally extracted or produced or that any of these resource estimates will ever be converted to reserves. There are also no assurances that any inferred resource estimates will be converted into indicated or measured resources.

Investors are advised to carefully review the reports and documents that the Company files from time to time with the SEC, particularly our Annual and Quarterly Reports.

3

Company Vision

|

Create value for shareholders by the development

through to monetization of two precious metal

projects. | |

|

• |

Columbus Project – In active development (surface mining)

| |

| • | Red Mountain Project – Not

in active development Option to acquire 100% Gold / Tungsten / Silver mining rights |

|

4

Why Invest in Ireland?

| Columbus Project

|

| |

| 1.

2. 3. 4. |

Large Opportunity

Growing Opportunity Low Cost Process Near Term Production Potential |

|

5

Why Invest in Ireland?

|

Large Opportunity |

| ||

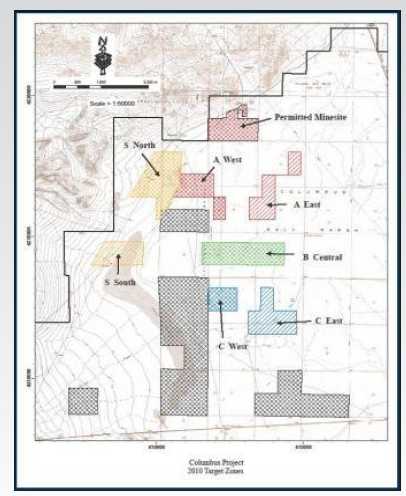

| -- | ‘08 and ‘09 drill programs outlined seven mineralized zones (2-Sand zones; 5- Clay zones) within 5,000 acre “area of interest” | ||

| -- | Current focus on Sand zones of 110+ million tons inferred with an average grade of 0.040 ounces per ton gold equivalent (AuE) | ||

| -- | Nine bulk leach tests extracted +85% of Au & Ag from Sand material | ||

|

| |||

6

Why Invest in Ireland?

|

Growing Opportunity |

|||

| -- |

Mineralized area is still open in all directions | ||

| -- |

Results from 2010 drill program are expected shortly | ||

| -- |

2010 drill program was designed to both expand and further delineate the Sand Resources by in-fill drilling | ||

|

Goal is to increase the tonnage and to upgrade the classification of the Sand Resources from Inferred to Indicated or Measured | |||

| -- |

Permits granted for next drill/bulk sampling program | ||

7

Why Invest in Ireland?

|

Lower Cost Process |

||

|

Process Cost Estimates ~ $12/ton of Sand Material | ||

|

Goal: 75% extraction of 0.040 opt AuE (current test results exceeding goal) | ||

|

If achieved: Operating Costs ~ $400/oz Au | ||

|

Hard Rock Mining Comparison ~$450 - $550/oz Au | ||

|

Expect to be Low Cost Operation: Strong positioning for production or acquisition | ||

8

Why Invest in Ireland?

| • | Near Term Production Potential |

| ||

| -- | Gold/Silver leach extraction circuit installed at onsite

pilot plant in Q3 2011 |

|||

| -- | Currently

optimizing precious metals extraction circuit for Sand

Material |

|||

| -- | Pilot Plant operations expected to determine feasibility

of Project in 2012 |

|||

9

Management Team

Douglas Birnie – Chief Executive

Officer, President and Director

Mr. Birnie

was a founder of Columbus Group Communications Inc., a privately-owned company

that was acquired by TELUS Corp., one of Canada’s leading telecommunications

companies.

Robert McDougal – Chief Financial

Officer and Director

Mr. McDougal, a

Certified Public Accountant, was a director and officer of GEXA Gold Corporation

and was one of the founders of Millennium Mining Corporation, which has been

merged into Gold Summit Corporation.

Mark Brennan –

Director

Mr. Brennan is the President of

his own consulting firm, the Brennan Consulting Group. In addition to his

ongoing management consulting practice, Mr. Brennan has also founded and

operated a number of private companies in a variety of

industries.

Nanominerals Corp. / Dr. Charles

Ager

Nanominerals is a private company

focused on the development and application of new technology in the exploration

of refractory gold deposits. Dr. Ager, the CEO of Nanominerals, is a geophysical

engineer with over 40 years of international experience in mine discovery,

production and finance.

10

Overview – Columbus Project

|

• | Gold and Silver Project |

| • | A “dry salt marsh” with drill indicated

zones of surface mineable material |

|

| • | Located between Las Vegas and Reno in the Columbus Basin, in Esmeralda County, Nevada – a region

with a proven history of major discoveries of gold

and silver |

|

| • | Mine site production permit has been granted |

|

| • | Short horizon to potential production |

|

11

Columbus Project Assets

|

19,738 acres

of mineral claims on federal land administered

by the BLM (Bureau of Land Management), with an option for an additional

23,440 acres |

||

378 acres

permitted to 40 feet for extraction

of gold and silver (Permitted Area) | |||

| -

- - |

320 acre mine site, 58

acre mill site 15,000 sq ft mill building Additional permits needed for sand | ||

| Water usage rights of aquifers in basin | |||

| 80 acres of private land | |||

| - | Future development flexibility | ||

12

Drill Program 2008 and 2009

|

Identified Seven Mineralized Zones with Inferred Resource of 343MM tons with 0.040 opt AuE, including 110+MM tons of Sand Material. All reported drill results are by Caustic Fusion Assay and analysis of extracted metal-in-hand for Gold and Silver. The Caustic Fusion protocol was selected because our research has shown it to be a more effective pyrometallurgical method than conventional fire assay to extract gold and silver from the organic carbon rich Sands/Clays at Columbus. Caustic Fusion assays values are being confirmed by both cyanide and thiosulphate leaches. |

13

Bulk Extraction Test Results

Need to prove extraction process is economically viable as next step of Project Feasibility. Goal: 75% Au recovery.

Sand Material

| Head Ore (HO)

Caustic Fusion |

Cyanide Leach

Extraction |

Thiosulphate

Leach Extraction | ||||

| Test | Au opt | Ag opt | Au % | Ag % | Au % | Ag % |

| 3747C | 0.082 | 1.772 | 85.8% | 67.0% | 87.3% | 68.7% |

| 3749C | 0.049 | 0.152 | 90.0% | 51.3% | 83.4% | 55.6% |

| 1 | 0.028 | 0.482 | 85.7% | 90.0% | 71.4% | 96.5% |

| 2 | 0.018 | 0.825 | 116.7%[1] | 91.5% | *[2] | * |

| 3 | 0.059 | 0.552 | 83.1% | 71.4% | 76.3% | 95.5% |

| 4 | 0.047 | 1.025 | 97.9% | 96.4% | 93.6% | 111.5% |

| 5 | 0.051 | 0.965 | 96.1% | 63.3% | 92.2% | 81.6% |

| 6 | 0.064 | 0.612 | 90.6% | 94.4% | 81.3% | 88.9% |

| 7 | 0.052 | 0.404 | 94.2% | 92.3% | 94.2% | 99.0% |

| Average | 0.050 | 0.754 | 90.4% | 79.7% | 85.0% | 87.2% |

| [1] |

- Result possibly due to nugget effect, and as such, removed from average | |

| [2] |

* - test not performed |

14

Independent Confirmation

All reported work to date has been

completed and performed by third

party engineers/geologists under Chain of

Custody (COC)

Technical Team – independent firms:

| Permitting | |

| Lumos & Associates – based in Reno, NV | |

| Project Resources | |

| McEwen Geological – Drilling Management / Resource Modeling | |

| Arrakis Inc. – Mine Planning/Process Development/Metallurgy | |

| AuRIC Metallurgical Labs – Sample Assaying/Bulk Sample Testing/Leach Circuit Design/Metallurgy | |

| Project Feasibility | |

| Arrakis – Pilot Plant Operations/Project Construction | |

| AuRIC – Leach Circuit Installation / Process Development | |

15

Project Goals 2011 - 2012

| 1. |

Confirm we have excess of 250 million tons of Sand Resources | |

|

Define by Drilling and Bulk Sampling (1.5 sq. miles by 200 foot depth) | ||

|

Report Drilling and Bulk Sample Results | ||

| 2. |

Confirm Commercial Process for Extracting Au/Ag | |

|

Process up to 2,000 tons at pilot plant | ||

|

Determine Extraction Rates and Operating Costs | ||

|

Target is to extract Au <$400/oz Operating Costs | ||

|

At $1,700/oz for gold our breakeven would be an extraction of 17.6% of our average head grade of 0.04 opt Au | ||

| 3. |

Complete Project Feasibility | |

|

Update geological report – Upgrade Resources to Reserves | ||

|

Finalize Mine Plan & Flow Sheet for Project | ||

|

Determine Operating/Capital Costs for Production | ||

16

Financial Information

17

Capitalization and Finances

| Capitalization (6/30/2011) | |

| Issued and Outstanding | 127,452,641 |

| Free Float | ~ 59,000,000 |

| Total Fully Diluted | 167,595,795 |

| Market Capitalization (6/30/2011) | ~ $65 MM |

| Finances | |

| Cash(06/30/11) | ~ $2,714,000 |

| Budget (July 1 ‘11 to Jun 31 ‘12) | ~ $5,830,000 |

| Expected Cash Position (06/30/12) | ~ ($3,257,000) |

18

Expenses

| Cash Expenses | |

| Budget (07/01/11 – 06/30/12) | |

| Columbus Project | |

| Property Payments | $ 280,000 |

| Drilling Program and Resource Estimates | 1,836,000 |

| Pilot Plant / Project Feasibility | 1,799,000 |

| Columbus Project Sub-Total | 3,915,000 |

| Red Mountain Project | 90,000 |

| General and Admin. | 1,825,000 |

| Cash Expenditure | $5,830,000 |

19

Investment Summary

-

Pilot Plant Operating – Optimizing Leach Circuit

-

Inferred Sand Resource of 110+MM tons grading 0.040 opt AuE identified by 2008/2009 Drilling –

Potential to increase resources by 2010/2011 Drilling and Bulk Sampling -

Environmentally neutral Leach Process. Goal: Produce Au for <$400/oz

-

Target is to complete Project Feasibility in 2012

-

Talented technical team assembled

-

Operations funded through Jan 2012

20

Ireland Inc.

| Corporate Office: | |

| 2441 West Horizon Ridge Parkway, Suite 100 | |

| Henderson, NV, 89052 | |

| (702) 932-0353 | |

| info@irelandminerals.com | |

| http://www.irelandminerals.com | |

| Investor Relations: | |

| Terri MacInnis | R. Jerry Falkner, CFA |

| Bibicoff + MacInnis, Inc. | RJ Falkner & Company, Inc. |

| Tel: 818-379-8500 | Tel: 800-377-9893 |

| Email: terri@bibimac.com | Email: info@rjfalkner.com |

21