Attached files

UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C. 20549

FORM

10-K

(Mark One)

[X]

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE

ACT OF 1934

For the fiscal year ended December 31,

2010

[__] TRANSITION REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For

the transition period from _____to _____

COMMISSION FILE NUMBER

000-50033

IRELAND

INC.

(Exact name of registrant as specified in its

charter)

| NEVADA | 91-2147049 |

| State or other jurisdiction of incorporation or organization | (I.R.S. Employer Identification No.) |

| 2441 West Horizon Ridge Parkway, Suite 100 | |

| Henderson, Nevada | 89052 |

| (Address of principal executive offices) | (Zip Code) |

(702) 932-0353

Registrant's telephone number,

including area code

Securities registered pursuant to Section 12(b) of

the Act: NONE.

Securities

registered pursuant to Section 12(g) of the Act:

Common Stock, $0.001 Par Value Per Share.

Indicate by check

mark if the registrant is a well-known seasoned issuer, as defined by Rule 405

of the Securities Act.

[__] Yes

[X] No

Indicate by check mark if

the registrant is not required to file reports pursuant to Section 13 or Section

15(d) of the Act.

[__]

Yes

[X] No

Indicate by check mark whether the registrant (1) has filed all

reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the

registrant was required to file such reports), and (2) has been subject to such

filing requirements for the past 90 days.

[X]

Yes [__] No

Indicate by check mark whether the registrant has submitted

electronically and posted on its corporate Web site, if any, every Interactive

Data File required to be submitted and posted pursuant to Rule 405 of Regulation

S-T (s. 232.405 of this chapter) during the preceding 12 months (or for such

shorter period that the registrant was required to submit and post such

files).

[X] Yes

[__] No

Indicate by check mark if disclosure of delinquent filers

pursuant to Item 405 of Regulation S-K (s229.405 of this chapter) is not

contained herein, and will not be contained, to the best of registrant’s

knowledge, in definitive proxy or information statements incorporated by

reference in Part III of this Form 10-K or any amendment to this Form 10-K.

[__]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer [__] | Accelerated filer [__] |

| Non-accelerated filer [__] (Do not check if a smaller reporting company) | Smaller reporting company [X] |

Indicate by check mark whether the registrant is a shell company

(as defined in Rule 12b-2 of the Act).

[__]

Yes

[X] No

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter: $31,960,899 as of June 30, 2010, based on an average of the closing bid of $0.36 and the closing ask of $0.53 as quoted by the OTC Bulletin Board on that date.

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date. As of March 29, 2011, the Registrant had 122,434,442 shares of common stock outstanding.

IRELAND INC.

ANNUAL REPORT ON FORM

10-K

FOR THE YEAR ENDED DECEMBER 31, 2010

TABLE OF

CONTENTS

2

PART I

The information in this discussion contains forward-looking statements. These forward-looking statements involve risks and uncertainties, including statements regarding the Company's capital needs, business strategy and expectations. Any statements contained herein that are not statements of historical facts may be deemed to be forward-looking statements. In some cases, you can identify forward-looking statements by terminology such as "may," "will," "should," "expect," "plan," "intend," "anticipate," "believe," "estimate,” "predict," "potential" or "continue," the negative of such terms or other comparable terminology. Actual events or results may differ materially. In evaluating these statements, you should consider various factors, including the risks described below, and, from time to time, in other reports the Company files with the United States Securities and Exchange Commission (the “SEC”). These factors may cause the Company's actual results to differ materially from any forward-looking statement. The Company disclaims any obligation to publicly update these statements, or disclose any difference between its actual results and those reflected in these statements.

As used in this Annual Report, the terms “we,” “us,” “our,” “Ireland,” and the “Company” mean Ireland Inc. and its subsidiaries, unless otherwise indicated. All dollar amounts in this Annual Report are expressed in U.S. dollars, unless otherwise indicated.

ITEM 1. BUSINESS.

General

We were incorporated on February 20, 2001 under the laws of the State of Nevada. We are a minerals exploration and development company focused on the discovery and extraction of precious metals from mineral deposits in the Southwestern United States.

In February 2008, we acquired our lead project, a prospective gold, silver and calcium carbonate property located in Esmeralda County, Nevada, that we call the “Columbus Project.” The Columbus Project consists of 19,738 acres of placer mineral claims, including a 378 acre Permitted Mine Area (58-acre mill site and mill facility and 320-acre mine site). Our current permits allow us to mine up to 792,000 tons per year to 40 feet in depth for the purpose of extracting precious metals and calcium carbonate from the Permitted Mine Area. We also have a mineral lease covering, and the option to acquire, an additional 23,440 acres of placer mineral claims adjoining the current project area (the “DDB Claims”).

Current geologic modeling for the Columbus Project has outlined seven mineralized zones containing a total of 343.9 million tons of material in place with an average grade of 0.040 ounces per ton (“opt”) gold equivalent (“AuE”) (AuE opt = Au opt + 0.013 Ag opt) (based on $900/oz Au and $12/oz Ag). Current geologic modeling is based upon a full analysis of the technical data generated from our 2008 and 2009 drill programs and presents a refinement of the parameters previously used to delineate mineralized zones at the Columbus Project.

In addition to the Columbus Project, we own the right to acquire a prospective gold, silver and tungsten property located in San Bernardino County, California, that we call the “Red Mountain Project.”

Recent Corporate Developments

The following significant corporate developments occurred after the completion of our fiscal quarter ended September 30, 2010:

Exercise of Options by Director

On October 27, 2010, we issued an aggregate of 500,000 shares of our common stock to Mr. Steele upon the exercise of options with an exercise price of $0.05 per share granted to Mr. Steele under our 2007 Stock Incentive Plan. The shares were issued to Mr. Steele pursuant to the exemptions from registration provided by Section 4(2) of the Securities Act of 1933, as amended.

3

Resignation of Director

On December 7, 2010, we received notice of Michael A. Steele’s intention to resign from our Board of Directors and Audit Committee effective December 31, 2010. Mr. Steele stated that his current business endeavours and demanding travel schedule did not allow him to give the time and attention necessary to be an effective participant as a member of our Board of Directors and Audit Committee. To the knowledge of our executive officers and remaining directors, there were no disagreements between Mr. Steele and us relating to our operations, policies, practices or otherwise.

Competition

We are a mineral resource exploration and development company. We compete with other mineral resource exploration and development companies for the acquisition of new mineral properties, the services of contractors, equipment and financing. Many of the mineral resource exploration and development companies with whom we compete may have greater access to a limited supply of qualified technical personnel and contractors and to specialized equipment needed in the exploration, development and operation of mineral properties. This could have an adverse effect on our ability to explore and develop our properties in a timely manner. In addition, because many of our competitors are more established and have a longer operating history than us, they may have greater access to promising mineral properties.

In addition, many of our competitors have greater financial resources than us. Accordingly, these competitors may be able to spend greater amounts on acquisitions of mineral properties of merit, on exploration of their mineral properties and on development of their mineral properties. In addition, they may be able to afford greater geological expertise in the targeting and exploration of mineral properties. This may make our competitors more attractive to potential investors and could adversely impact our ability to obtain additional financing if and when needed.

Government Regulations

The mining industry in the United States is highly regulated. We intend to secure all necessary permits for the exploration of the Columbus Project and the Red Mountain Project and, if development is warranted on the properties, will file final plans of operation prior to starting any mining operations. The consulting geologists that we hire are experienced in conducting mineral exploration activities and are familiar with the necessary governmental regulations and permits required to conduct such activities. As such, we expect that our consulting geologists will inform us of any government permits that we will be required to obtain prior to conducting any planned activities on the Columbus Project and the Red Mountain Project. We are not able to estimate the full costs of complying with environmental laws at this time since the full nature and extent of our proposed mining activities cannot be determined until we complete our exploration program.

If we enter into the development or production stages of any mineral deposits found on our mineral properties, of which there are no assurances, the cost of complying with environment laws, regulations and permitting requirements will be substantially greater than in the exploration phases because the impact on the project area is greater. Permits and regulations will control all aspects of any mineral deposit development or production program if the project continues to those stages because of the potential impact on the environment. Examples of regulatory requirements include:

| - | Water discharge will have to meet water standards; | |

| - | Dust generation will have to be minimal or otherwise remediated; | |

| - | Dumping of material on the surface will have to be recontoured and revegetated; | |

| - | An assessment that all material to be left on the surface will need to be environmentally benign; | |

| - | Ground water will have to be monitored for any potential contaminants; | |

| - | The socio-economic impact of the project will have to be evaluated and if deemed negative, will have to be remediated; and, | |

| - | There will have to be a report of the potential impact of the work on the local fauna and flora. |

Employees

As of the date of this Annual Report, other than our officers and directors, we have 12 full-time employees and 1 part-time employee.

4

Research and Development Expenditures

We have not incurred any research or development expenditures since our incorporation.

ITEM 1A. RISK FACTORS.

The following are some of the important factors that could affect our financial performance or could cause actual results to differ materially from estimates contained in our forward-looking statements. We may encounter risks in addition to those described below. Additional risks and uncertainties not currently known to us, or that we currently deem to be immaterial, may also impair or adversely affect our business, financial condition or results of operation.

Although we have installed the leach circuit of the onsite pilot production module for the Columbus Project, there is no assurance that this project is commercially feasible.

We have begun testing and optimizing the onsite pilot production module at the Columbus Project. This pilot production module is part of our pre-feasibility study for the Columbus Project and is designed to evaluate the commercial viability of the Columbus Project. There is no assurance that the results of our pre-feasibility program will result in a decision to enter into commercial production.

Additional exploration work is required before proved or probable reserves can be established.

We intend to report the results of our exploration activities promptly after those results have been received and analyzed. However, there is no assurance that the test results reported by us will be indicative of extraction rates throughout our mineral properties. We have not yet established proved or probable reserves on the Columbus Project or on our other mineral properties and additional exploration work will be required before proved or probable reserves can be established.

We will likely require additional financing to complete our exploration and development programs for our mineral projects.

We expect to spend approximately $4,320,000 on the exploration and development of our Columbus and Red Mountain Projects and the general costs of operating and maintaining our business and mineral properties for the twelve months ending December 31, 2011. We do not currently have sufficient financial resources to pay for our anticipated expenditures for that period. We anticipate that our existing financial resources are sufficient only to pay for the anticipated costs of our exploration and development programs until June 30, 2011. Thereafter, we anticipate that we will require additional financing to complete our planned exploration and development plans. In addition, actual costs of completing our exploration and development plans could be greater than anticipated and we may need additional financing sooner than anticipated. If we are unable to obtain sufficient financing to complete our planned exploration and development plans, we will scale back our plans depending upon our existing financial resources. We do not currently have any financing arrangements in place.

Our ability to obtain future financing will be subject to a number of factors, including the variability of market prices for gold and silver, investor interest in our mineral projects, and the performance of equity markets in general. These factors may make the timing, amount, terms or conditions of additional financing unavailable to us. If we are not able to obtain financing when needed or in an amount sufficient to enable us to complete our programs, we may be required to scale back our exploration and development programs

If we complete additional financings through the sale of our common stock, our existing stockholders will experience dilution.

The most likely source of future financing presently available to us is through the sale of shares of our common stock. The only other anticipated alternative for the financing of further exploration would be the offering by us of an interest in our mineral properties to be earned by another party or parties carrying out further exploration thereof, which is not presently contemplated. In addition, if our management decides to exercise the right to acquire a 100% interest in the Red Mountain Project, we will be required to issue significantly more shares of our common stock. Issuing shares of our common stock, for financing purposes or otherwise, will dilute the interests of our existing stockholders.

5

In order to maintain the rights to our mineral properties, we will be required to make annual filings with federal and state regulatory agencies and/or be required to complete assessment work or pay fees in respect of those properties.

In order to maintain the rights to our mineral projects, we will be required to make annual filings and pay fees with federal and state regulatory authorities. On March 1, 2010, Nevada’s State Assembly and Senate passed Assembly Bill No. 6 (“AB6”). AB6 has installed an additional tiered fee that is payable in conjunction with the annual filing of an affidavit of the work performed on or improvements made to a mining claim, or an affidavit of the intent to hold a mining claim applied to holders of 11 or more claims. The fee ranges from $70 per claim for holders of 11 to 199 claims up to $195 per mining claim for holders of 1,300 or more claims as of the date of filing. AB6 was approved by the Governor of Nevada on March 12, 2010.

In addition to these fees, we may be required by federal and/or state legislation or regulations to complete minimum annual amounts of mineral exploration work on our mineral properties. A failure by us to meet the annual maintenance requirements under federal and state laws could cause our mineral rights to lapse.

Because we are an exploration stage company, we face a high risk of business failure.

To date, our primary business activities have involved the acquisition of mineral claims and the exploration and development on these claims. We have not earned any revenues as of the date of this report. Potential investors should be aware of the difficulties normally encountered by exploration stage companies and the high rate of failure of such enterprises. The likelihood of success must be considered in light of the problems, expenses, difficulties, complications and delays encountered in connection with the exploration of the mineral properties that we plan to undertake. These potential problems include, but are not limited to, unanticipated problems relating to exploration, and additional costs and expenses that may exceed current estimates.

Because we anticipate that our operating expenses will increase prior to earning revenues, we may never achieve profitability.

Prior to exiting the exploration stage, we anticipate that we will incur increased operating expenses without realizing any revenues. We therefore expect to incur significant losses into the foreseeable future. We recognize that if we are unable to generate significant revenues from the exploration of our mineral claims and the production of minerals thereon, if any, we will not be able to earn profits or continue operations. There is no history upon which to base any assumption as to the likelihood that we will prove successful, and we may not be able to ever generate any operating revenues or achieve profitable operations. If we are unsuccessful in addressing these risks, our business will most likely fail.

Because of the speculative nature of exploration of mining properties, there is substantial risk that no commercially exploitable minerals will be found.

The search for valuable minerals as a business is extremely risky. Although we have been encouraged by the results of the exploration work conducted by us to date, further exploration work is required before proven or probable reserves can be established, and there are no assurances that we will be able to establish any proven or probable reserves. Exploration for minerals is a speculative venture, necessarily involving substantial risk. The expenditures to be made by us may not result in the discovery of commercial quantities of ore. Problems such as unusual or unexpected formations and other conditions are involved in mineral exploration and often result in unsuccessful exploration efforts.

Because of the inherent dangers involved in mineral exploration, there is a risk that we may incur liability or damages if and when conducting mineral exploration activities.

The search for valuable minerals involves numerous hazards. As a result, when conducting exploration activities we may become subject to liability for such hazards, including pollution, cave-ins and other hazards against which we cannot insure or against which we may elect not to insure. The payment of such liabilities may have a material adverse effect on our financial position.

6

Even if we establish proven or probable reserves on our mineral claims, we may not be able to successfully reach commercial production.

We anticipate using a low cost, high volume surface dredge operation to mine the Columbus Project. Our pre-feasibility program for the Columbus Project is designed to test and optimize our planned mining process for the Columbus Project. There is no assurance that this pre-feasibility program will result in a decision to enter into commercial production. In addition, expanding our production facilities to accommodate commercial operations is expected to require substantially more financial resources than what we currently have available to us.

There is a risk that we will not be able to obtain such financing if and when needed.

Even if we can successfully reach commercial production, any change to mining laws or regulations or levy of additional taxes in the future may make our planned production process nonviable economically.

Several bills have been introduced by the US federal government that would levy resource taxes on mineral exploration companies. Any levy of additional taxes would have an adverse effect on our business. In addition, laws and regulations governing the exploration of mineral properties and the mining process are subject to change. Changes to mining laws and regulations that would have the effect of increasing the cost of mineral exploration and mining activities would adversely impact our business.

We are subject to compliance with government regulations. The costs of complying with these regulations may change without notice, and may increase the anticipated cost of our exploration and development programs.

There are several government regulations that materially restrict the exploration of minerals. We will be required to obtain work permits, post bonds and perform remediation work for any physical disturbance to the land in order to comply with these laws. While our planned exploration program budgets for regulatory compliance, there is a risk that new regulations could increase our costs of doing business and prevent us from carrying out our exploration program.

In addition, if our applications for permits from the relevant regulatory bodies are denied, we may not be able to proceed with our exploration and development programs.

If we decide to pursue commercial production, we may be subject to an environmental review process that may delay or prohibit commercial production.

Our planned method for mining the Columbus Project is not expected to generate any significant long term environmental impact. However, we have not yet had a comprehensive environmental review conducted on our planned mining operations for the Columbus Project.

Compliance with an environmental review process may be costly and may delay commercial production. Furthermore, there is the possibility that we would not be able to proceed with commercial production upon completion of the environmental review process if government authorities do not approve our mine or if the costs of compliance with government regulation adversely affected the commercial viability of the proposed mine.

The market for our common stock is limited and investors may have difficulty selling their stock.

Our shares are currently traded on the over the counter market, with quotations entered for our common stock on the OTC Bulletin Board under the symbol “IRLD.” However, the volume of trading in our common stock is currently limited. As a result, holders of our common stock may have difficulty selling their shares.

Because our common stock is a penny stock, stockholders may be further limited in their ability to sell their shares.

Our shares constitute a penny stock under the Securities Exchange Act of 1934, as amended (the “Exchange Act”) and are expected to remain classified as a penny stock for the foreseeable future. Classification as a penny stock makes it more difficult for a broker-dealer to sell the stock into a secondary market, which makes it more difficult for a purchaser to liquidate his or her investment. Any broker-dealer engaged by the purchaser for the purpose of selling his or her shares will be subject to Rules 15g-2 through 15g-9 of the Exchange Act. Rather than having to comply with these rules, some broker-dealers will refuse to attempt to sell a penny stock.

7

No assurance that forward looking assessments will be realized.

Our ability to accomplish our objectives and whether or not we are financially successful is dependent upon numerous factors, each of which could have a material effect on the results obtained. Some of these factors are in the discretion and control of management and others are beyond management’s control. The assumptions and hypothesis used in preparing any forward-looking assessments contained herein are considered reasonable by management. There can be no assurance, however, that any projections or assessments contained herein or otherwise made by management will be realized or achieved at any level.

If we are, or were, a U.S. real property holding corporation, non-U.S. holders of our common stock or other security convertible into our common stock could be subject to U.S. federal income tax on the gain from the sale, exchange, or other disposition of such security.

If we are or ever have been a U.S. real property holding corporation (a “USRPHC”) under the Foreign Investment Real Property Tax Act of 1980, as amended (“FIRPTA”) and applicable United States Treasury regulations (collectively, the “FIRPTA Rules”), unless an exception described below applies, certain non-U.S. investors in our common stock (or options or warrants for our common stock) would be subject to U.S. federal income tax on the gain from the sale, exchange or other disposition of shares of our common stock (or such options or warrants), and such non-U.S. investor would be required to file a United States federal income tax return. In addition, the purchaser of such common stock, option or warrant would be required to withhold from the purchase price an amount equal to 10% of the purchase price and remit such amount to the U.S. Internal Revenue Service.

In general, under the FIRPTA Rules, a company is a USRPHC if its interests in U.S. real property comprise at least 50% of the fair market value of its assets. If we are or were a USRPHC, so long as our common stock is “regularly traded on an established securities market” (as defined under the FIRPTA Rules), a non-U.S. holder who, actually or constructively, holds or held no more than 5% of our common stock is not subject to U.S. federal income tax on the gain from the sale, exchange, or other disposition of our common stock under FIRPTA. In addition, other interests in equity of a USRPHC may qualify for this exception if, on the date such interest was acquired, such interests had a fair market value no greater than the fair market value on that date of 5% of our common stock. Any of our common stockholders (or owners of options or warrants for our common stock) that are non-U.S. persons and own or anticipate owning more than 5% of our common stock (or, in the case of options or warrants, of a value greater than the fair market value of 5% of our common stock) should consult their tax advisors to determine the consequences of investing in our common stock (or options or warrants). We have not conducted a formal analysis of whether we are or have ever been a USRPHC. We do not believe that we are or have ever been a USRPHC. However, if we later determine that we were a USRPHC, then we believe that we would have ceased to be a USRPHC as of June 1, 2005 and that non-U.S. holders would not be subject to FIRPTA with respect to a sale, exchange, or other disposition of shares of our common stock (or options or warrants) after June 1, 2010.

FOR ALL OF THE AFORESAID REASONS AND OTHERS SET-FORTH AND NOT SET-FORTH HEREIN, AN INVESTMENT IN OUR SECURITIES INVOLVES A CERTAIN DEGREE OF RISK. ANY PERSON CONSIDERING TO INVEST IN OUR SECURITIES SHOULD BE AWARE OF THESE AND OTHER FACTORS SET-FORTH IN THIS REPORT AND IN THE OTHER REPORTS AND DOCUMENTS THAT WE FILE FROM TIME TO TIME WITH THE SEC AND SHOULD CONSULT WITH HIS/HER LEGAL, TAX AND FINANCIAL ADVISORS PRIOR TO MAKING AN INVESTMENT IN OUR SECURITIES. AN INVESTMENT IN OUR SECURITIES SHOULD ONLY BE ACQUIRED BY PERSONS WHO CAN AFFORD TO LOSE THEIR TOTAL INVESTMENT.

8

ITEM 2. PROPERTIES.

We currently lease office space located at Suite 100, 2441 W. Horizon Ridge Parkway, Henderson, NV 89052 at a rate of $5,975 per month. The lease terms expired on August 31, 2008, and we continue to rent the existing space on a month-to-month basis.

We currently own an interest in, or rights to, two mineral projects that we refer to as the Columbus Project and the Red Mountain Project.

THE COLUMBUS PROJECT

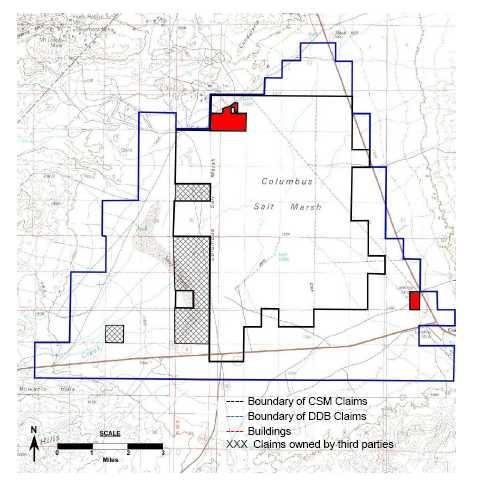

The Columbus Project is a sediment hosted gold and silver exploration project located in western Nevada. It is comprised of 296 mining and millsite claims which cover 43,178 acres and an additional 80 acres of private land, for a total of 43,258 acres. We currently own a 100% stake in 149 of the claims (which we refer to as the “CSM Claims”), with rights to an additional 147 peripheral claims (which we refer to as the “DDB Claims”).

LOCATION

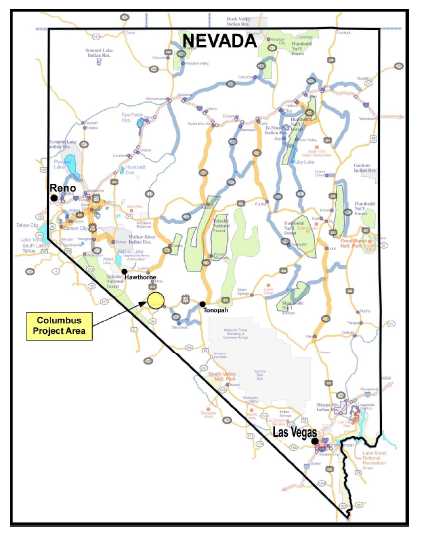

The mineral claims that make up the Columbus Project are located in the Columbus Salt Marsh, Esmeralda County, Nevada, northwest of Coaldale Junction, approximately 50 miles west of Tonopah (Fig. 1) halfway between Las Vegas and Reno. Access is from the junction of US6 and Nevada Highway 95, approximately 10 miles north of Coaldale Junction, to a gravel road westerly to the mill site and to the remains of the town of Columbus.

The Columbus Salt Marsh is an enclosed basin and is a dry lake bed for the majority of the year. All surface drainage from a surrounding 360 square mile area flows into the Columbus Salt Marsh.

9

Figure 1: Location of Columbus Project

TITLE AND OWNERSHIP RIGHTS TO THE CSM CLAIMS AND THE DDB CLAIMS

The CSM Claims are wholly owned by Columbus S.M., LLC (“CSM”). CSM is a wholly owned subsidiary of Columbus Minerals Inc., which is a wholly owned subsidiary of Ireland Inc. The DDB Claims are wholly owned by a mining syndicate known as the DDB Syndicate. Lawrence E. Chizmar, Jr., a former member of our Board of Directors (and a former director of Columbus Brine Inc. (“CBI”), the former owner of CSM and the CSM claims) and a limited liability company controlled by Douglas D.G. Birnie, our President and Chief Executive Officer, and a member of our Board of Directors, are each the owners of a 1/8 interest in the DDB Syndicate. The remaining members of the DDB Syndicate are made up of the former officers and directors of CBI, the brother of a former officer and director of CBI, and certain affiliates of Nanominerals Corp. (“Nanominerals”). Nanominerals is a significant shareholder in our Company. Mr. Birnie also owns a 3.5% interest in Nanominerals. The DDB Claims were located by the DDB Syndicate in February 2007, prior to Mr. Birnie’s, Nanominerals’ or Mr. Chizmar’s involvement with our Company. Mr. Birnie also acquired his interest in Nanominerals prior to his involvement with our Company.

10

Figure 2: Location of the CSM Claims and the DDB Claims

We acquired our interest in the CSM Claims and the DDB Claims from Nanominerals pursuant to an assignment by Nanominerals of its rights to both the Columbus Project and the Red Mountain Project under the terms of two letter agreements (the “Columbus Letter Agreement” and the “Red Mountain Letter Agreement,” respectively). By December 2007, under the terms of the Columbus Letter Agreement, we had earned a 15% operating interest in the Columbus Project.

In February 2008, we increased our ownership of the Columbus Project to 100% by merging CBI with and into our wholly owned subsidiary incorporated for the sole purpose of acquiring CBI, CBI Acquisition, Inc. Subsequent to the completion of the merger, CBI Acquisition, Inc.’s name was changed to Columbus Minerals Inc. To complete the merger, we issued to the former stockholders of CBI an aggregate of 10,440,087 shares of our common stock and share purchase warrants to acquire an additional 5,220,059 shares of our common stock. The warrants issued are exercisable at a price of $2.39 per share and expire on February 19, 2013. After August 19, 2010, if our common stock trades at an average price of 150% of the exercise price of the warrants over a period of 20 consecutive trading days, then we may accelerate the expiration date to a date that is 30 days after the date that we send notice of our intention to exercise the acceleration right. The warrants issued to the former stockholders of CBI provide the holder with a cashless exercise right. In addition, we agreed to honor the terms of an option previously granted by CBI to one of its former stockholders, and to extend that option to June 29, 2010. As a result, this person had an option to purchase 79,719 shares of our common stock at a price of $1.36 per share on or before June 29, 2010. None of these options were exercised before they expired.

After completing the acquisition of CBI, we acquired CBI’s rights under the terms of a mining lease that CBI entered into with the DDB Syndicate in November 2007 (the “DDB Agreement”). The DDB Agreement provides us with a five year lease on the DDB Claims, ending on November 29, 2012, with an option to purchase the DDB Claims at anytime during the lease period. To date, we have paid the DDB Syndicate $190,000 under the terms of the DDB Agreement, and we must pay the DDB Syndicate a rental payment of $30,000, payable on June 30, 2011 in order to maintain our lease rights. Under the option rights provided under the DDB Agreement, we may purchase the DDB Claims at any time by either:

| (a) |

paying the DDB Syndicate the purchase price of $400,000 (with all previously made rental payments credited against such purchase price); or | |

| (b) |

paying the DDB Syndicate $10, plus granting the DDB Syndicate a royalty of 2% of net smelter returns on the DDB Claims. |

11

ACCESS AND INFRASTRUCTURE

The Columbus Project contains an existing mill site with power generator sets and an onsite fresh water well. Water used for processing is available from existing wells located on the surrounding basin (the “Columbus Basin”). There is also a high voltage grid located at the Candelaria Mines, approximately three miles from the Columbus Project.

Permits have been obtained for the extraction of precious metals and the production of calcium carbonate from an area of interest consisting of approximately 378 acres, including millsite, roads and mineable acreage.

HISTORY

The Columbus area has had mining activity for over 100 years. Silver was discovered in 1863 in the area of the Candelaria Mine, to the northwest of the Columbus Basin. These deposits were mined intermittently by different companies through 1999, producing large quantities of silver and minor gold. Salt was first mined in the Columbus Salt Marsh in 1864, followed by borax in 1871. Precious metals were thought to exist in the basin sediments as early as the late 19th century but no production is documented. Mining ceased in the Columbus Marsh around the beginning of the 20th century.

The Columbus Project is located in an area that has historically been known as a well mineralized region. A silver and gold mining operation known as the Candelaria Mine is located approximately five miles northwest of the Columbus Project. The Round Mountain project is a gold operation located approximately 60 miles northeast of the Columbus Project. The Clayton Valley Brine Project, a lithium extraction project, is located approximately 25 miles southeast of the Columbus Project.

GEOLOGY

The Columbus Project covers a flat enclosed basin with a surface composed of salt deposits and is primarily devoid of vegetation. Older sediments, which host the silver deposits of Candelaria, underlie several sequences of volcanic rocks, with the youngest being the 15Ma Gilbert Andesite. The region has undergone older thrust faulting, which hosts the Candelaria deposits, and later extensional faulting as a result of movement along the Walker Lane. The Columbus Basin is one of several structural basins in the region caused by right lateral movement along the Walker Lane and the subsequent clockwise rotation and oblique extensional down dropping of the blocks within this structural domain.

EXPLORATION AND DEVELOPMENT ACTIVITIES CONDUCTED ON THE COLUMBUS PROJECT TO DATE

Surface Sampling Program and Initial Metallurgical Work

Near surface basin sediment samples were taken in late 2006 and early 2007 and analyzed by Arrakis Inc. (“Arrakis”), an independent engineering lab based in Denver, Colorado. 64 surface samples, four shallow boring samples, and a bulk sample were taken and analyzed using a four acid total digestion and atomic absorption analysis. Samples were analyzed for Au, Ag, Cu, and Fe. This work led to the discovery of a 5,000 acre surface gold anomaly in the northwestern part of the basin. This gold anomaly is the primary focus of current exploration and development work. The Permitted Mine Area (320 acres) is situated in the north end of this zone.

12

Drilling Program

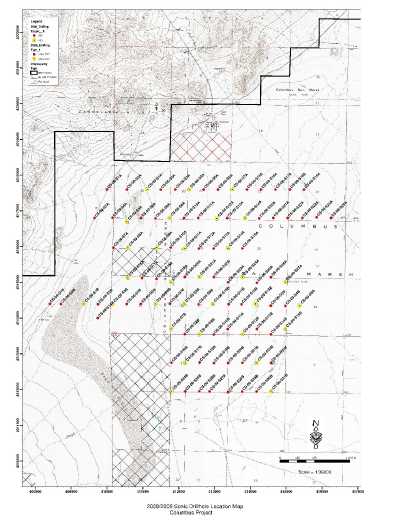

Figure 3: Map of 2008 and 2009 Drill Hole Locations

An 18-hole hollow stem auger drill program was undertaken in Q3 2007 in the Permitted Mine Area to establish mineral potential at depth. Samples were 18” in length, taken every 10’ with a split spoon sampler. Material was analyzed by Arrakis using a 3-acid modified version of aqua regia. A split was analyzed by CBI staff at the onsite facility using a standard fire assay and it was found that standard fire assay was ineffective. Repeated firing of the slag showed that various amounts of the metals remained in the slag after each firing.

Encouraging results warranted a second drill program, managed by independent consultants McEwen Geological LLC (“McEwen”), which took place in Q2-Q3 2008, consisting of 39 widely spaced holes and a total of just less than 10,000 feet using sonic drilling technology. 25 holes were drilled in the ‘A’ program, 14 holes in the ‘B’ program. For this program, holes were drilled to a maximum depth of 400’. The sonic drilling resulted in continuous sample material, therefore providing an improved representation of each drill interval. Samples were sent to Arrakis and AuRic Metallurgical Laboratories (“AuRic”) for analysis under chain of custody protocols.

A follow up drilling program was initiated in Q2 of 2009 to delineate mineralized zones and further define the extent of gold and silver mineralization potential in the project area. 58 holes, for a total of 15,270 feet, were drilled as a follow up to the ~10,000 feet drilled in 2008. Sample intervals were changed from 10’ to 20’ because of the homogeneity of the sample material. Again, the drill material was stored in polyethylene bags in the onsite core facility. Samples were submitted to AuRic for caustic fusion analysis under chain of custody protocols. In addition, 211 clay samples were taken at various depths for density determinations.

13

Our most recent drilling program commenced in Q3 of 2010. The activity was focused in 2 areas: (a) the existing production permitted area; and (b) a five acre area in the northwest area of the Columbus Basin in the area previously identified as Zone S North. The Zone S North area is primarily comprised of sand material. The drilling in the production permitted area consisted of 147 holes drilled to a depth of 40 feet with 10 foot sample composites. The drilling in Zone S North consisted of 28 holes drilled to a depth of 200 feet with 20 foot composite samples.

The drilling was completed in Q3 of 2010, under budget and ahead of schedule. The samples are currently being analyzed by independent laboratories under strict chain of custody standards. We will report results when they are delivered to the company.

The purpose of our drill programs is to determine the grade and tonnage consistency in the area we identified as our area of interest.

MODELING RESULTS

The following discussion is based upon geologic and mineralization modeling prepared for us by McEwen.

Geologic Model

The lakebed clay varies in color, moisture content, texture, and organic content. Because of the wide drill hole spacing, it is not possible to correlate between individual clay units. At present, the clay will not be sub-classified and will be referred to as a single unit. Average dry bulk density of the clay, taken from the 200+ samples, is 1.423 tonnes/m3.

Along the western edge of the project area, alluvial material occurs as ‘fans’ which descend beneath the clay toward the center of the basin. The depth to this sand was gridded and contoured. This information is very useful for determining where this sand unit might be encountered during future drilling. In general, changes in sand depth parallel the basin.

Mineralization Model

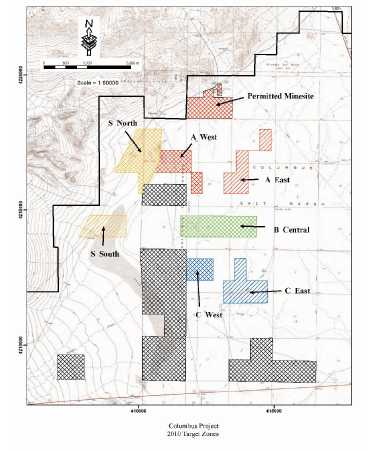

Results from the computer generated mineralization model developed by McEwen were used to determine zones of potentially economic metal concentration. Seven distinct zones were identified for further evaluation. These zones will be prioritized by us for further exploration and development based on their spatial distribution, overall estimated metal content, and proximity to the existing facilities. All results are reported in total Au equivalent (AuE), calculated using the formula Au(opt)+0.013Ag(opt)=AuE(opt) (based on $900/oz Au and $12/oz Ag). A head grade cutoff value of 0.03opt was chosen based on recent metallurgical results from AuRic.

| Zone | Million tons (short) | Sample Grade (AuE opt) |

| S North | 83.5 | 0.038 |

| S South | 29.5 | 0.035 |

| A West | 44.5 | 0.042 |

| A East | 42.0 | 0.037 |

| B Central | 63.4 | 0.045 |

| C West | 24.5 | 0.037 |

| C East | 56.5 | 0.042 |

| TOTAL | 343.9 | 0.040 |

Of all seven zones identified to date, four are laterally continuous and three are two dimensional. Zones S South, B Central, and C West are two dimensional and the confidence for mineralization estimation is less than for the other zones. The most favorable zone is the S North zone. This zone is a mixed sand/clay zone. The assay results for the sand are for the most part >0.02opt, with a high value of 0.055opt AuE. Zone S South is also in the sand unit, with consistently high assay. Even though zone S South is two dimensional, it is highly likely that these zones are contemporaneous and this southern zone is of exploration significance.

14

Zone A West could be thought of as an eastern extension of the S North zone. It is comprised of clay and is two dimensional with lateral extension to the south side. It appears that the trend of the blocks >0.03opt dips to the east, with the anomalous values becoming deeper. This is, however, a function of the vertical exaggeration and just an expression of the natural topography. It is presently thought that this zone is along the trend of an inferred northwesterly subsurface structure. This zone is distinguished from the S North zone by the absence of sand above 100’ depth.

Zone A East is laterally continuous, with a void between the southern and northern blocks. It is of lower concentrations and shows moderate potential. Zones B Central and C West are both two dimensional, with no lateral extension. At this time, not enough information exists to determine if these zones are of potentially sufficient concentration, thus placing them of lowest priority.

Zone C East is, like A West, laterally continuous in a single block to the north. It contains a similar average concentration, larger tonnage potential, and is open to the east and south. This makes it of interest for continued exploration. However, because of its location and distance from the existing infrastructure, it is lower in priority than the A West zone.

Figure 4: Identified Mineralized Zones

______________________________________________________

Analytical Methodology

All reported drill results were determined by caustic fusion assay and analysis of the extracted metal for gold and silver. Sampling and analyses were conducted by qualified independent professionals, under chain of custody procedures, and included blind labeling of samples, the insertion of blanks, standard reference material and repeats to ensure the quality of results.

Independent metallurgists engaged in extensive research and testing before they determined the best pyrometallurgical and hydrometallurgical methodologies for extracting gold and silver from the organic carbon rich clays at the Columbus Project.

15

Caustic fusion is a standard pyrometallurgical method used for rock dissolution and subsequent analysis. A caustic fusion protocol was selected as the preferred method for head grade assays, because it has proven to be very effective in liberating and collecting gold and silver, as metal-in-hand, from the Columbus organic carbon rich clays. Independent work has shown that conventional fire assaying, another standard pyrometallurgical method, extracts extremely low gold and silver values from the Columbus Project material.

Thiosulphate leaching is a relatively new, environmentally friendly, hydrometallurgical method for extracting gold and silver from ores. Again, independent work has shown that thiosulphate leaching, followed by resin or carbon extraction, has been very effective in bench and pilot scale tests for the extraction of gold and silver, as “metalin-hand”, at the Columbus Project. Aqua regia and cyanide leaching tests proved ineffective and resulted in extremely low gold and silver extraction. It is the thiosulphate leach system that is currently being tested onsite to determine the feasibility of leaching both the clay and sand deposits.

As mentioned previously, the entombment of the precious metals in the organic carbon and clays at the Columbus Project can cause problems of detection by many methods of analysis. In January 2010, the Nevada Bureau of Mines and Geology (NBMG) reported they found no economically significant amounts of gold and silver in five surface samples from the Columbus Salt Marsh using a variety of assay methods. These results are consistent with the values initially found by our independent consultants using similar methods. However, further research and testing led to the development of a caustic fusion protocol, a thiosulphate leach process and, more recently, a standard fire assay method on gravity concentrates that has extracted economically significant values of gold and silver as “metal-in-hand,” from samples where conventional fire assay, aqua regia leach and cyanide leach of head ore extracted very low values.

The best assay of any geological sample is by quantifying the extracted metal. That is why we and our consultants rely only on extracted gold and silver as “metal-in-hand” for reporting assay results. Both the caustic fusion and the thiosulphate leach provide “metal-in-hand” and, together with the quality assurances and quality controls of the drill program, we and our consultants are confident of the results that we have reported from head ore samples.

Pilot and Bench Scale Leach Test Results

In the first quarter of 2009, AuRic conducted a pilot scale leach test on 1,738 pounds of clay material extracted from our Permitted Mine Area by Arrakis under chain of custody protocols. No mineral processing operations, such as screening, crushing, grinding, concentrating or drying were performed on the sample prior to leaching. The material was analyzed using a caustic fusion technique and reported head grades of 0.055 ounces per ton (opt) gold (Au) and 0.520 opt silver (Ag). The material was then leached, resulting in the extraction of 0.047 opt Au and 0.464 opt Ag into solution. The precious metals were subsequently collected on resins and processed to produce Au and Ag bullion, for a net extraction of 0.038 opt Au and 0.385 opt Ag. This represents leach extraction of 86.2% of Au into solution and 69.1% of Au recovered as metal. This also represents leach extraction of 89.2% of Ag into solution and 74% of Ag recovered as metal. The overall extraction was 0.043 opt AuE. Upon completion of the test, the precious metal beads were delivered to us.

In the second quarter of 2009, AuRic conducted bench scale leach tests on composite drill samples (of clay material) taken from Zone B Central by McEwen. The tested materials were composited from previously submitted and analyzed drill samples taken during our 2008 drilling program. The results of these bench scale leach tests were consistent with the results obtained from the bulk leach test conducted on the clay material extracted from the Permitted Mine Area in the first quarter of 2009.

In the third quarter of 2009, AuRic conducted additional bench scale leach tests and a pilot scale leach test on clay samples taken from Zone B Central by McEwen. The bulk materials for the pilot scale test assayed 0.070 opt Au and 0.302 opt Ag, or 0.074 opt AuE. The pilot scale leach test on this clay material extracted 0.066 opt Au and 0.181 opt Ag, or 0.068 opt AuE. The extracted precious metals were then collected on activated carbon and processed to produce Au and Ag bullion for a net extraction of 0.060 opt Au and 0.168 opt Ag, or 0.062 opt AuE. This represents leach extraction of 92.4% of AuE into solution and 84.1% of AuE as metal in hand.

All bench scale leach tests were conducted on composite samples taken from the Permitted Mine Area or the 2008 and 2009 drill programs. AuRic created 5.5 pound composites for each of the mineralized intervals tested. The composites were then assayed using a caustic fusion technique, and then leached. The leach results indicate that the mineralogy of the clays from the Permitted Mine Area and Zone B Central are similar to each other.

16

Parameter / Zone |

Test Size (lbs) |

Head Grade (opt AuE) |

AuE Recovered into Solution (opt) |

% Recovered into Solution |

AuE Recovered as Metal (opt)1 |

% Recovered as Metal |

| Permitted Mine Area | 1,738 | 0.062 | 0.053 | 85.9% | 0.043 | 69.6% |

| S South – S1B Composite | 5.5 | 0.041 | 0.037 | 89.9% | n/a | n/a |

| B Central – S9B Composite | 5.5 | 0.074 | 0.066 | 89.8% | n/a | n/a |

| B Central – S12B Composite | 5.5 | 0.057 | 0.046 | 81.3% | n/a | n/a |

| B Central – S12B Composite | 5.5 | 0.057 | 0.054 | 94.0% | n/a | n/a |

| B Central – S9B | 5.5 | 0.074 | 0.055 | 74.7% | n/a | n/a |

| B Central – S9B | 1.8 | 0.074 | 0.058 | 78.7% | n/a | n/a |

| B Central – S9B | 2,000 | 0.074 | 0.068 | 92.4% | 0.062 | 84.1% |

Pilot Plant Installation and Surface Dredge Operations

Our pilot production plant was installed in the Permitted Mine Area by Arrakis in October 2008. The precious metals leach extraction circuit was added during the first quarter of 2010 to the onsite pilot plant and has undergone several months of leach testing on clay material mined by dredge from the permitted mine site. The pilot production process consists of a pilot scale production and processing circuit that we are using to test the commercial viability of mining and extracting precious metals from the Columbus Project. We currently have a production permit from Nevada Division of Environmental Protection that allows us to produce calcium carbonate and extract precious metals at the Permitted Mine Area at a rate of up to 792,000 tons per year.

__________________________

1 Bench Scale Tests

are too small to be recovered as metal with resins or activated carbon.

17

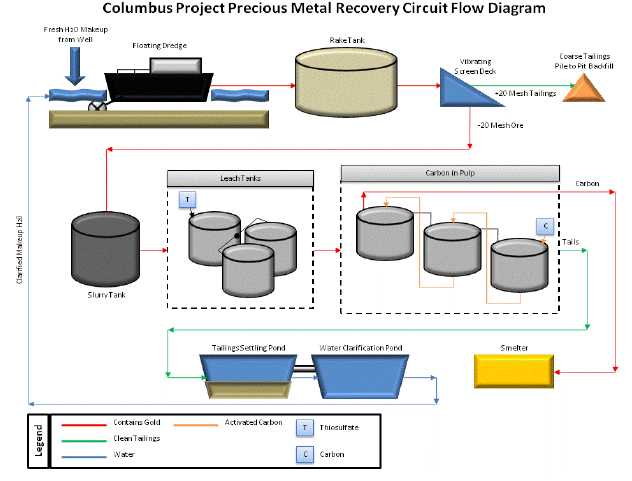

Figure 5:

We are currently using a low cost surface dredge mining method at the Permitted Mine Area. The clays are mined by dredge and handled as a slurry throughout the production process. Once the clays have been slurried, we use thiosulfate leaching and carbon-in-pulp for extraction of the precious metals. This mining process has, to date, proven to be very successful and is our preferred method of mining the clays as the cost per ton is low. The leach extraction method uses thiosulphate to recover the precious metals from the mined clay material. In March 2010, we completed the installation of the leach circuit. The metallurgical data generated from operating the leach plant will be used to determine the feasibility of this process on both the clay and sand material.

We announced in May 2010 that the pilot plant was operational as a thiosulphate leach carbon-in-pulp circuit. We also reported that the primary goal of the initial test runs was to demonstrate that the pilot plant facility could extract gold and silver from continuous runs of large tonnages of mineralized clays. This was achieved with the extraction of 0.011 opt gold and 0.037 opt silver from an estimated 58.58 tons of low grade (0.02 opt Au, 0.39 opt Ag) head ore. This represents a weighted average recovery rate of 51% for gold and 9.5% for silver.

To date we have completed 50 onsite bench and bulk sample tests. As of yet we have not been able to exceed the above mentioned 0.011 opt gold and 0.037 opt silver recovery from the clay material, even on higher grade head material. We have discovered that the clays from the dredge pit contain large quantities of organics which severely interfere with both leaching and extraction of the precious metals. We have tested a variety of different methods designed to either reduce or eliminate the organic problems, but have been unsuccessful to date. Although testing of the clay continues, we have recently decided to focus our efforts on the sand materials, located on the west side of the basin, where organics are minimal and previous testing has yielded positive results. Work is currently underway in this regard.

The 2010 drilling program was managed by McEwen, under chain-of-custody, and focused on testing both the clays in the permitted mine area and the sands in the north western part of the basin. The drill samples are being assayed by AuRic using the standard caustic fusion method developed for the Columbus clays and sands. As well, metal extraction tests are being conducted on sand samples, both from drill hole composites and surface samples, in order to further validate the potential commercial viability of the sands. Results will be reported when available.

18

Readers are cautioned that, although we believe that the results of our exploration activities to date have been sufficiently positive to proceed with the installation and operation of a pilot processing facility at the Columbus Project millsite, we have not yet established any probable or proven reserves. Additional exploration work will be required before probable or proven reserves can be established. There are no assurances that the results of our pre-feasibility and technical programs will result in a decision to enter into commercial production.

THE RED MOUNTAIN PROJECT

The Red Mountain Project is a potential gold, silver and tungsten project that consists of 60 mineral claims covering approximately 7,500 acres, all located in San Bernardino County and Kern County, California. Title to these mineral claims is currently recorded in the names of a number of individuals who, together, make up a mining syndicate known as Red Mountain Mining (“RMM”). We have been notified that some of the claims making up the Red Mountain Project may conflict with other existing mineral claims and other property rights covering the location of the project. We intend to work with RMM in order to resolve these issues.

RIGHTS TO THE RED MOUNTAIN PROJECT

We acquired our rights to the Red Mountain Project on August 14, 2007, pursuant to an assignment to us by Nanominerals of its rights and interests under the Red Mountain Letter Agreement between it and RMM.

The Red Mountain Letter Agreement provides that we are to:

| (a) |

pay $5,000 per month to RMM until December 31, 2011; | |

| (b) |

spend a total of $200,000 by December 31, 2008 on examining, testing, exploring or developing the Red Mountain Project (the “RMP Phase 1 Expenditures”); and | |

| (c) |

spend a total of $1,000,000 by December 31, 2011 on examining, testing, exploring or developing the Red Mountain Project (the “RMP Phase 2 Expenditures”). |

For each $100,000 spent by us on the RMP Phase 1 or RMP Phase 2 Expenditures, we will earn a 5% interest in the Red Mountain Project (or a proportionate fractional interest for expenditures in denominations of less than $100,000). We will earn a maximum 60% interest in the Red Mountain Project if we spend the full $1,200,000 of the RMP Phase 1 and RMP Phase 2 Expenditures by the deadlines set out above.

In addition, at any time, we may acquire a 100% interest in the Red Mountain Project (the “RM Acquisition Rights”) by:

| (a) |

paying and issuing to RMM the following consideration: | ||

| (i) |

$100,000 in cash; | ||

| (ii) |

between 280,000 and 5,600,000 shares of our common stock, with the actual number of shares to be issued to be determined by dividing $1,400,000 by the Acquisition Price (defined below); | ||

| (iii) |

for every four shares issued under (a)(ii), we will be required to issue one share purchase warrant to acquire one additional share of our common stock at a price per share equal to 125% of the Acquisition Price, for a period of two years; and | ||

| (b) |

if the Red Mountain Project achieves commercial production, paying and issuing to RMM the following additional consideration: | ||

19

| (i) |

an additional $100,000 in cash; | |

| (ii) |

between 480,000 and 9,600,000 additional shares of our common stock, with the actual number of additional shares to be issued to be determined by dividing $2,400,000 by the Acquisition Price; and | |

| (iii) |

for every four additional shares issued under (b)(ii), we will be required to issue one additional share purchase warrant to acquire one additional share of our common stock at a price per share equal to 125% of the Acquisition Price, for a period of two years. |

The Acquisition Price to be used to calculate the aggregate number of shares and share purchase warrants to be issued to RMM under the terms of the Red Mountain Letter Agreement will be the average closing price of our common stock during the 60 days prior to the acquisition date, provided, however, that the Acquisition Price shall not be lower than $0.25 and shall not be greater than $5.00.

As of December 31, 2010, the date of our most recently available financial statements, we had spent $819,499 on the Red Mountain Project, meaning that, as of December 31, 2010, we owned a 41% interest in the project. We are currently negotiating to extend our option rights on the Red Mountain Project for an additional five years to December 31, 2016.

LOCATION AND ACCESS

The Red Mountain Project is located at the base of Red Mountain, which is 27 miles south of Ridgecrest in San Bernardino County and Kern County, California, approximately 75 miles northeast of Los Angeles. The Red Mountain Project can be accessed by using a gravel road that bisects the project from northwest to southeast.

The Red Mountain Project does not contain any useable infrastructure other than a water well.

Figure 6: Location of the Red Mountain Project

20

HISTORY

The Red Mountain Project is east of and adjacent to the Rand Mining District, initially discovered in 1894. The Rand Mining District was mined off and on until just recently for gold, silver and tungsten. The majority of the mines in the area consisted of small independent operations. There is currently no commercial mining occurring on the Red Mountain Project site.

GEOLOGY

The area surrounding the Red Mountain Project is highly mineralized with recorded production of gold, silver and tungsten.

Nanominerals had Arrakis review the Red Mountain Project, including the existing reports on work previously done by RMM. RMM has excavated over 100 test pits at the project site and has gravity concentrated the bulk samples taken from these pits. The results of RMM’s tests show values ranging from less than 0.01 troy ounces of gold per ton to over 1.00 troy ounces of gold per ton. Those test results reportedly show an average of 0.06 opt. Arrakis reported that the grades were similar to other grades that have been reported in the area on similar mine sites.

Based on their review of the existing reports and a field visit to the Red Mountain Project site, Arrakis has recommended that we proceed with an exploration program to verify the reported gold grades in RMM’s studies and to test the recoverability in order to assess the economic viability of the Red Mountain Project.

CURRENT EXPLORATION

Our exploration and development program for the Red Mountain Project currently consists of a drilling and sampling program. Currently the Red Mountain Project is not in active development. We have set a budget of $75,000 for the Red Mountain Project for the 12 months ended December 31, 2011. We have reallocated funds originally budgeted towards the Red Mountain Project in order to provide us with maximum flexibility in achieving our technical milestones at our lead project.

ITEM 3. LEGAL PROCEEDINGS.

We are not a party to any other legal proceedings and, to our knowledge, no other legal proceedings are pending, threatened or contemplated.

21

PART II

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES.

MARKET INFORMATION

Quotations of our common stock are entered on the OTC Bulletin Board under the symbol “IRLD.” The following is the high and low bid information for our common stock during each fiscal quarter of our last two fiscal years.

| 2010 | 2009 | |||||||||||

| High | Low | High | Low | |||||||||

| First quarter ended March 31 | $ | 1.15 | $ | 0.45 | $ | 0.71 | $ | 0.21 | ||||

| Second quarter ended June 30 | $ | 0.955 | $ | 0.25 | $ | 0.69 | $ | 0.41 | ||||

| Third quarter ended September 30 | $ | 0.55 | $ | 0.32 | $ | 0.55 | $ | 0.30 | ||||

| Fourth quarter ended December 31 | $ | 0.55 | $ | 0.25 | $ | 0.51 | $ | 0.32 | ||||

Quotations entered on the OTC Bulletin Board reflect inter-dealer prices, without retail mark-up, markdown or commission and may not represent actual transactions.

PENNY STOCK RULES

The SEC has adopted rules that regulate broker-dealer practices in connection with transactions in penny stocks. Penny stocks are generally equity securities with a price of less than $5.00, other than securities registered on certain national securities exchanges or quoted on the NASDAQ system, provided that current price and volume information with respect to transactions in such securities is provided by the exchange or system. The penny stock rules require a broker-dealer, prior to a transaction in a penny stock not otherwise exempt from those rules, to deliver a standardized risk disclosure document prepared by the SEC, which:

| (a) |

contains a description of the nature and level of risk in the market for penny stocks in both public offerings and secondary trading; | |

| (b) |

contains a description of the broker's or dealer's duties to the customer and of the rights and remedies available to the customer with respect to a violation of such duties or other requirements of securities laws; | |

| (c) |

contains a brief, clear, narrative description of a dealer market, including bid and ask prices for penny stocks and the significance of the spread between the bid and ask price; | |

| (d) |

contains a toll-free telephone number for inquiries on disciplinary actions; | |

| (e) |

defines significant terms in the disclosure document or in the conduct of trading in penny stocks; and | |

| (f) |

contains such other information and in such form as the SEC shall require by rule or regulation. |

The broker-dealer also must, prior to effecting any transaction in a penny stock, provide the customer with:

| (a) |

bid and offer quotations for the penny stock; | |

| (b) |

the compensation of the broker-dealer and its salesperson in the transaction; | |

| (c) |

the number of shares to which such bid and ask prices apply, or other comparable information relating to the depth and liquidity of the market for such stock; and | |

| (d) |

monthly account statements showing the market value of each penny stock held in the customer's account. |

In addition, the penny stock rules require that, prior to a transaction in a penny stock that is not otherwise exempt from those rules, the broker-dealer must:

| (a) |

make a special written determination that the penny stock is a suitable investment for the purchaser; and | |

| (b) |

receive from the purchaser his or her written acknowledgement of receipt of the determination and a written agreement to the transaction. |

22

These disclosure requirements may have the effect of reducing the trading activity in the secondary market for our common stock and therefore stockholders may have difficulty selling those securities.

REGISTERED HOLDERS OF OUR COMMON STOCK

As of March 29, 2011, there were 168 registered holders of record of our common stock. We believe that a large number of stockholders hold stock on deposit with their brokers or investment bankers registered in the name of stock depositories.

DIVIDENDS

We have not declared any dividends on our common stock since our inception and we do not expect to declare any dividends in the foreseeable future. We expect to spend any funds legally available for the payment of dividends on the development of our mineral properties. There are no dividend restrictions that limit our ability to pay dividends on our common stock in our Articles of Incorporation or bylaws. Chapter 78 of the Nevada Revised Statutes (the “NRS”), does provide certain limitations on our ability to declare dividends. Section 78.288 of Chapter 78 of the NRS prohibits us from declaring dividends where, after giving effect to the distribution of the dividend:

| (a) |

we would not be able to pay our debts as they become due in the usual course of business; or | |

| (b) |

except as may be allowed by our Articles of Incorporation, our total assets would be less than the sum of our total liabilities plus the amount that would be needed, if we were to be dissolved at the time of the distribution, to satisfy the preferential rights upon dissolution of stockholders who may have preferential rights and whose preferential rights are superior to those receiving the distribution. |

RECENT SALES OF UNREGISTERED SECURITIES

Other than as previously disclosed in our Quarterly Reports on Form 10-Q or our Current Reports on Form 8-K, we have not completed any unregistered sales of equity securities during the fiscal year ended December 31, 2010.

ITEM 7. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS.

PLAN OF OPERATION

During the next 12 months, we intend to proceed with our exploration and development programs for the Columbus Project and the Red Mountain Project.

The Columbus Project

The technical program for the Columbus Project has two primary objectives: (a) to identify the mineral resources/reserves, and (b) to determine the feasibility of mining and extracting precious metals from the project.

| (a) |

Mineral Resources/Reserves: Exploration and development work to date has identified three different host materials (clay, sand, brine) each of which could potentially contain commercial quantities of silver and gold mineralization within the project area. The sand zones outcrop on the western side of the Columbus basin and dip gently eastward. The clay zones also outcrop and overlay the sand zones. The brine zone occurs as an aquifer at some 400 feet depth underlying the sand/clay zones. Minimal work has been done by the Company on the brine zone, however previous work has shown some potential for both silver and gold in the brine. The Company’s exploration efforts have focused on drilling both the sand and clay zones within the approximately 5,000 acre Columbus Project Area of Interest outlined by previous geochemical exploration work. |

23

The 2008 and 2009 drilling program identified some 343 million tons of mineralized sand and/or clay material, grading 0.040 opt gold equivalent from the surface to 100 feet depth. (AuE opt = Au opt + 0.013 Ag opt)(based on $900/oz Au and $12/oz Ag). The boundaries of these mineralized zones were identified at a wide drill hole spacing (about ¼ mile X ½ mile). The 2010 drill program was designed to both infill drill and to extend these previously drilled mineralized zones. All drill programs have been conducted by independent and qualified third parties under strict Chain-of-Custody, Quality Assurance and Quality Control standards. Samples will continue to be assayed using caustic fusion and metal extraction methods.

The first phase of the 2010 drill program consisted of 147 holes drilled to a depth of 40 feet (permitted production mining depth) within the permitted 320-acre mine site area. The goal of this drilling is to further define the mineralogy and grades within these mineralized clays. The second phase of the 2010 drill program consisted of 28 holes to a depth of 200 feet within the clay and sand zones located in the northwest sector of the property. These holes are designed to both infill and extend the mineral resources in this area. The 2010 drill program was completed in October 2010, ahead of schedule and under budget. Results will be reported as received.

| (b) |

Feasibility Study: The Company currently has a production permit for the Columbus Project. The production permit allows for the extraction of precious metals and the production of calcium carbonate on the 378 acre site (320 acre mine site and 58 acre mill site) at a mine rate of up to 792,000 tons per year. During the period 2008-2010 the Company has developed a dredge mine, constructed a Pilot Plant and began operations to develop and prove the extractive metallurgy for the Columbus project. | |

|

To date we have completed 50 onsite bench and bulk sample tests. As of yet we have not been able to exceed the above mentioned 0.011 opt gold and 0.037 opt silver recovery from the clay material, even on higher grade head material. We have discovered that the clays from the dredge pit contain large quantities of organics which severely interfere with both leaching and extraction of the precious metals. We have tested a variety of different methods designed to either reduce or eliminate the organic problems, but have been unsuccessful to date. Although testing of the clay continues, we have recently decided to focus our efforts on the sand materials, located on the west side of the basin, where organics are minimal and previous testing has yielded positive results. Work is currently underway in this regard. | ||

|

If the operation of the pilot plant proves, to our satisfaction, that the Columbus Project is economically viable, we may seek to expand the production permitted area, production process and/or construct additional production circuits within the mill site to increase production capacity. The production model for the Columbus Project is anticipated to be a low cost, high volume mining operation. |

Readers are cautioned that, although we believe that the results of our exploration activities to date are sufficiently positive to proceed with the installation and operation of a pilot production circuit for the Columbus Project, we have not yet established any probable or proven reserves. There is no assurance that we will be able to establish that any commercially extractable ore reserves exist on the Columbus Project or that we will enter into commercial production.

We anticipate spending approximately $1,950,000 on our exploration and development program and $500,000 on our capital expenditures for the Columbus Project from January 1, 2011 until December 31, 2011.

The Red Mountain Project

Sampling and Drilling Program: Our exploration and development program for the Red Mountain Project currently consists of a Drilling and Sampling program. Currently the Red Mountain Project is not in active development. We have set a budget of $75,000 for property payments and maintenance costs for the Red Mountain Project for the year ending December 31, 2011. We have reallocated funds originally budgeted towards the Red Mountain Project in order to provide us with maximum flexibility in achieving our technical milestones at our lead project.

24

Cash Requirements

We have budgeted for the following cash expenditures for the period from January 1, 2011 until December 31, 2011:

| Columbus Project | |||||

| • | Property Payments | $ | 100,000 | ||

| • | Drilling Program and Mineralization Estimates | 425,000 | |||

| • | Pilot Plant / Project Feasibility | 1,425,000 | |||

| Total for Columbus Project | $ | 1,950,000 | |||

| Red Mountain Project | |||||

| • | Property Acquisition and Maintenance Costs | $ | 75,000 | ||

| • | Sampling Exploration Program | 0 | |||

| Total for Red Mountain Project | $ | 75,000 | |||

| General and Administration | |||||

| Total for General and Administration | $ | 1,795,000 | |||

| Total Expected Expenses | $ | 3,820,000 | |||

| Total Expected Capital Expenditures | $ | 500,000 | |||

| Total Expected Cash Expenditures | $ | 4,320,000 | |||

As of December 31, 2010, we had cash in the amount of $1,602,179 and a working capital surplus of $2,541,774. We do not currently have sufficient financial resources to pay for our anticipated cash expenditures for the period from January 1, 2011 until December 31, 2011. We anticipate that our existing financial resources are sufficient only to pay for the anticipated costs of our exploration and development programs until June 30, 2011. Thereafter, we anticipate that we will require additional financing to complete our planned exploration and development plans. If we are unable to obtain sufficient financing to complete our planned exploration and development plans, we will scale back our plans depending upon our existing financial resources. We do not currently have any financing arrangements in place.

RESULTS OF OPERATIONS

Summary of Year End Results

| Year Ended December 31, | |||||||||

| Percentage | |||||||||

| Increase / | |||||||||

| 2010 | 2009 | (Decrease) | |||||||

| Revenue | $ | - | $ | - | n/a | ||||

| Operating expenses | (6,689,101 | ) | (4,962,226 | ) | 34.8% | ||||

| Interest income | 35,830 | 17,763 | 101.7% | ||||||

| Interest expense | (3,728 | ) | (2,255 | ) | 65.3% | ||||

| Income tax benefit | 1,965,945 | 1,698,066 | 15.8% | ||||||

| Net loss | $ | (4,691,054 | ) | $ | (3,248,652 | ) | 44.4% | ||

Revenue

We have not earned any operational revenues since our inception and we do not anticipate earning revenues until our mineral properties enter into commercial production, of which there are no assurances. Our pilot production plant at the Columbus Project is currently being operated for pre-feasibility testing purposes only. We are currently in the exploration stage of our business and we can provide no assurances that we will be able to establish the existence of probable or proved mineral reserves on our properties, or if such reserves are established, that we will be able to enter into commercial production.

25

Expenses

The major components of our expenses for the years ended December 31, 2010 and 2009 are outlined in the table below:

| Year Ended December 31, | |||||||||

| Percentage | |||||||||

| 2010 | 2009 | Increase / (Decrease) | |||||||

| Mineral exploration and evaluation expenses | $ | 2,592,912 | $ | 3,158,132 | (17.9)% | ||||

| Mineral exploration and evaluation expenses – related party | 535,974 | 520,831 | 2.9% | ||||||

| General and administrative | 2,925,358 | 1,177,632 | 148.4% | ||||||

| General and administrative – related party | 21,066 | - | 100.0% | ||||||

| Depreciation | 553,791 | 45,631 | 1113.6% | ||||||

| Mineral and property holding costs | 60,000 | 60,000 | 0.0% | ||||||

| Total operating expenses | $ | 6,689,101 | $ | 4,962,226 | 34.8% | ||||

Our operating expenses for the year ended December 31, 2010 increased as compared with our December 31, 2009 fiscal year. The increase in operating expenses was due to increases in general and administrative expenses and depreciation. This increase was offset by a decrease in mineral exploration and evaluation activities.

The item “Mineral exploration and evaluation expenses – related party” represents (a) amounts paid or reimbursed to Nanominerals for exploration work conducted on the Columbus and Red Mountain Projects; and (b) amounts paid in respect of the DDB Claims to the DDB Syndicate, an entity owned by related parties.