Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - PROASSURANCE CORP | ex99_1.htm |

| 8-K - PROASSURANCE CORP 8-K 9-8-2011 - PROASSURANCE CORP | form8k.htm |

Exhibit 99.2

This presentation contains Forward Looking Statements and other information designed to convey

our projections and expectations regarding future results. There are a number of factors which

could cause our actual results to vary materially from those projected in this presentation. The

principal risk factors that may cause these differences are described in various documents we file

with the Securities and Exchange Commission, such as our Current Reports on Form 8-K, and our

regular reports on Forms 10-Q and 10-K, particularly in “Item 1A, Risk Factors.” Please review

this presentation in conjunction with a thorough reading and understanding of these risk factors.

our projections and expectations regarding future results. There are a number of factors which

could cause our actual results to vary materially from those projected in this presentation. The

principal risk factors that may cause these differences are described in various documents we file

with the Securities and Exchange Commission, such as our Current Reports on Form 8-K, and our

regular reports on Forms 10-Q and 10-K, particularly in “Item 1A, Risk Factors.” Please review

this presentation in conjunction with a thorough reading and understanding of these risk factors.

We especially identify statements concerning our recently-completed acquisition of American

Physicians Service Group (NASDAQ: AMPH) as Forward Looking Statements and direct

your attention to recent filings on Forms 10K and 10Q for a discussion of risk factors

pertaining to this transaction and subsequent integration into ProAssurance.

Physicians Service Group (NASDAQ: AMPH) as Forward Looking Statements and direct

your attention to recent filings on Forms 10K and 10Q for a discussion of risk factors

pertaining to this transaction and subsequent integration into ProAssurance.

This presentation contains Non-GAAP measures, and we may reference Non-GAAP measures in

our remarks. A reconciliation of these measures to GAAP measures is available in our latest

quarterly news release, which is available in the Investor Relations section of our website,

www.ProAssurance.com, and in the related Current Reports on Form 8K disclosing that release.

our remarks. A reconciliation of these measures to GAAP measures is available in our latest

quarterly news release, which is available in the Investor Relations section of our website,

www.ProAssurance.com, and in the related Current Reports on Form 8K disclosing that release.

FORWARD LOOKING STATEMENTS

1

NON-GAAP MEASURES

Corporate Overview

ProAssurance Corporate Profile

Specialty writer of professional liability insurance

Primarily Medical Professional Liability (MPL)

Only “pure play” public company MPL writer

Market Cap : ~$2.1 billion

Total Assets: $4.9 billion

Shareholders’ Equity: $2.0 billion

Annualized dividend yield is 1.4%

Initial dividend to be paid on October 13, 2011

Rated “A” by A.M. Best and Fitch

3

Medical Professional Liability Stands Apart

Long-tail vs short tail

Prolonged period of “benign profitability”

Premiums remain well above levels of year 2000

No large commercial competitors have entered

the market in a meaningful manner

the market in a meaningful manner

Significant barriers to entry in underwriting and

claims handling

claims handling

No “cat” exposure

Significant policyholder retention

4

Consistent Success in All Financial Climates

5

Historical Book Value Per Share

Inception to 6/30/11

CAGR: 16%

CAGR: 16%

Cumulative:1653%

10 Year Summary (2001 -2010)

CAGR: 15%

CAGR: 15%

Cumulative: 297%

Up

15%

Y-O-Y

15%

Y-O-Y

Founded in 1978, Demutualized to a

Public Company in September, 1991

Public Company in September, 1991

Consistent Success in All Financial Climates

6

Up

13%

Y-O-Y

13%

Y-O-Y

Historical Stock Price (to 8/31/11)

Inception to 8/31/11

CAGR: 14%

CAGR: 14%

Cumulative:1287%

10 Year Summary (2001-2010)

CAGR: 14%

CAGR: 14%

Cumulative: 263%

Founded in 1978, Demutualized to a

Public Company in September, 1991

Public Company in September, 1991

ProAssurance Business Profile

Fourth largest writer in a fragmented market

Top 20 writers have just 65% of the market

More than 100 writers with some share of the market

Majority of companies are mutual or similar

Few operate in more than two or three states

7

ProAssurance Geographic Profile

Writing across the United States, ProAssurance

has broad geographic diversification

has broad geographic diversification

Regional structure

provides the local

knowledge that

differentiates us

provides the local

knowledge that

differentiates us

8

Corporate Headquarters

Corporate Headquarters

Claims / Underwriting Offices

Claims / Underwriting Offices

(Birmingham)

Market Share: Six-Ten1

Market Share: Six-Ten1

1 DPW: SNL & Highline Data 2010

ProForma ProAssurance and American Physicians

ProAssurance Risk Profile

We insure a broad range of healthcare risks,

from home health providers to large hospitals

from home health providers to large hospitals

Dual Distribution

Agents: 67%

Direct: 33%

Direct in Alabama, Florida and in all states for

Podiatric business

Podiatric business

Dual distribution in DC, Texas and parts of

Missouri

Missouri

9

Policyholder Data is YTD, June 30, 2010

Subject to Rounding

YTD 2011 Policyholders: ~71,000

Operational Highlights

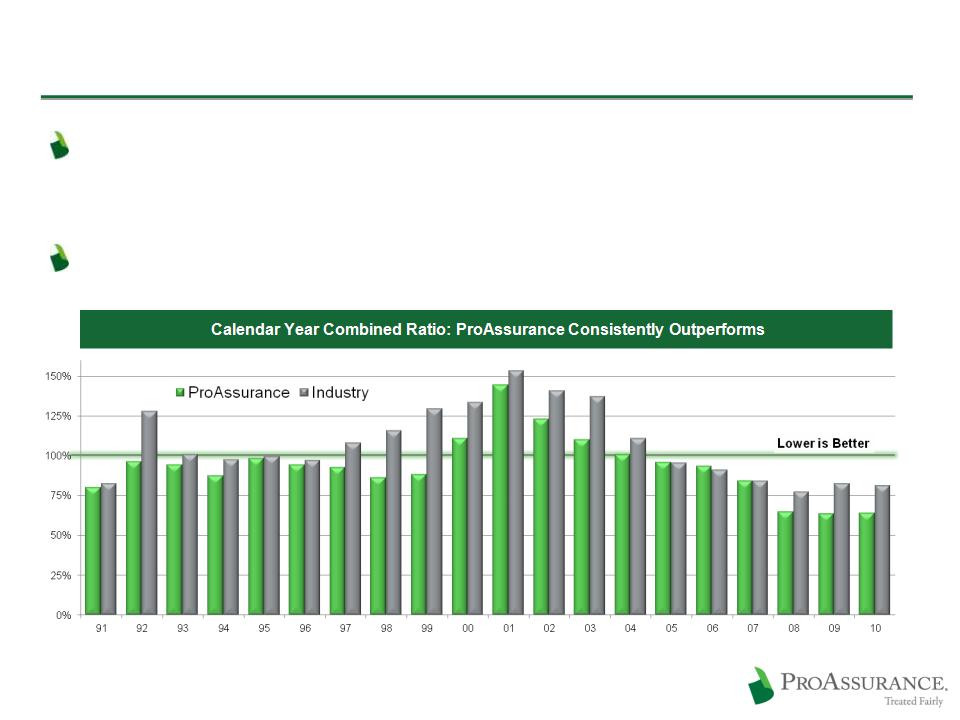

ProAssurance Outperforms

Stringent underwriting based on individual risk

selection

selection

Frequent rate/loss review ensures adequate price

11

ProAssurance Average: 93.8% Industry Average: 107.4%

Source: A.M. Best Aggregates and Averages, Medical Malpractice Lines of Business

ProAssurance Rate History & Trends

Frequency stable after several years of decline

Yearly severity increase

is manageable at ~4%

is manageable at ~4%

Retention remains

at ~90%

at ~90%

12

Physician Rate Change History1

1Excludes PICA for clarity of historical comparison

Conservative Approach to Reserves

No change in the historic reserving practices

which help provide protection against a loss

trend reversal

which help provide protection against a loss

trend reversal

Net Favorable Reserve Development

Net Reserve per Open MPL Claim1

1 Statutory basis; Loss & LAE

Acquired company data included at end of acquiring year

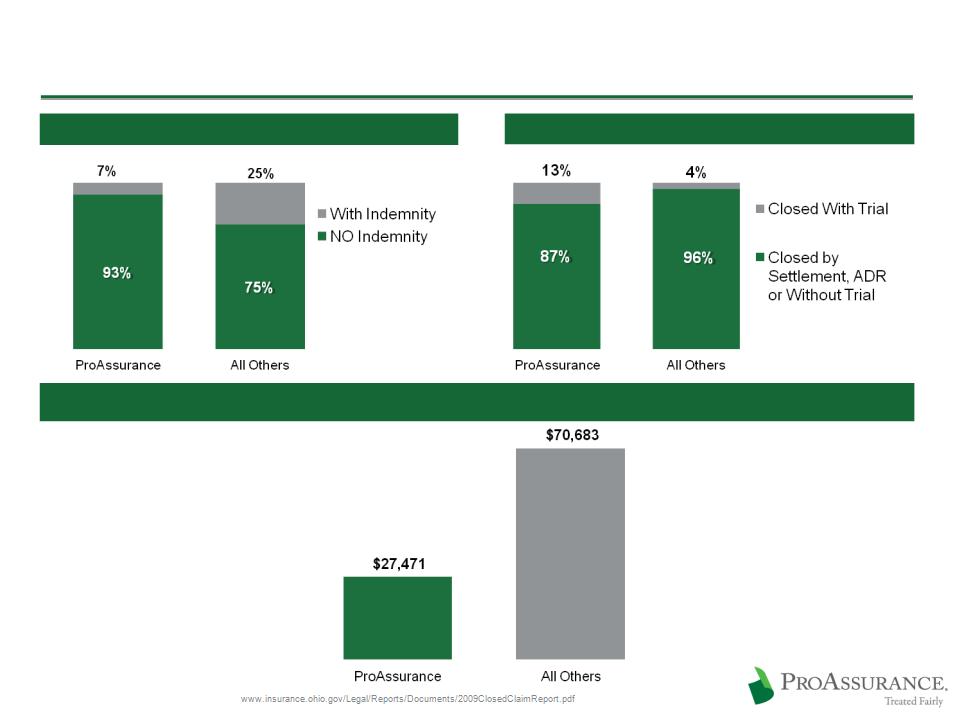

Successful Claims Defense Sets Us Apart

We leverage financial strength to give our insureds the opportunity

for an uncompromising defense of their claim

for an uncompromising defense of their claim

Differentiates our product

Provides long-term financial and marketing advantages

Helps retain business and deter future lawsuits

Increasingly important as claims data becomes public

14

ProAssurance: 82% Favorable Outcomes

Industry: 73% Favorable Outcomes

Source: The PIAA

Five Year Average

2005-2009

2005-2009

The Bottom Line: The Ohio Example

15

Fewer Claims Closed With Indemnity

More Claims Defended in Court

The Payoff: 2.5x Lower Average Indemnity Payment per Closed Claim

Malpractice Made Public

Malpractice judgments/settlements now

disclosed in 26 states

disclosed in 26 states

Disciplinary actions

now disclosed in

all states

now disclosed in

all states

Board / Discipline / Med-Mal

Med-Mal disclosure

legislation proposed

legislation proposed

P

Source: Federation of State Medical Boards National Clearinghouse and

ProAssurance research

ProAssurance research

Regulatory Changes = Opportunity

Healthcare Reform will require more providers across

all levels of care

all levels of care

More customers for certain, maybe more litigation

Likely to accelerate the trend of physicians joining

into hospital-owned practices and larger groups

into hospital-owned practices and larger groups

We are uniquely positioned due to geographic reach, long-

term experience in hospitals and financial strength

term experience in hospitals and financial strength

May hasten M&A amongst smaller insurers that lack the

capacity or capability to insure hospitals or facilities

capacity or capability to insure hospitals or facilities

Tort Reform remains a state-level issue

17

Financial Performance and Investments

Investments Balance Risk vs. Return

19

$4 Billion Overall Portfolio

$3.6 Billion Fixed Income Portfolio

Average duration: 4.1 years

Average tax-equivalent yield:

4.7%

4.7%

Investment grade: 97%

Weighted average: AA-

6/30/11

Key actions in Q2

Added short ABS

Added Governments to mitigate

concerns over spread widening

concerns over spread widening

CUSIP-level portfolio disclosure on

our website:

www.proassurance.com/investorrelations/supplemental.aspx

our website:

www.proassurance.com/investorrelations/supplemental.aspx

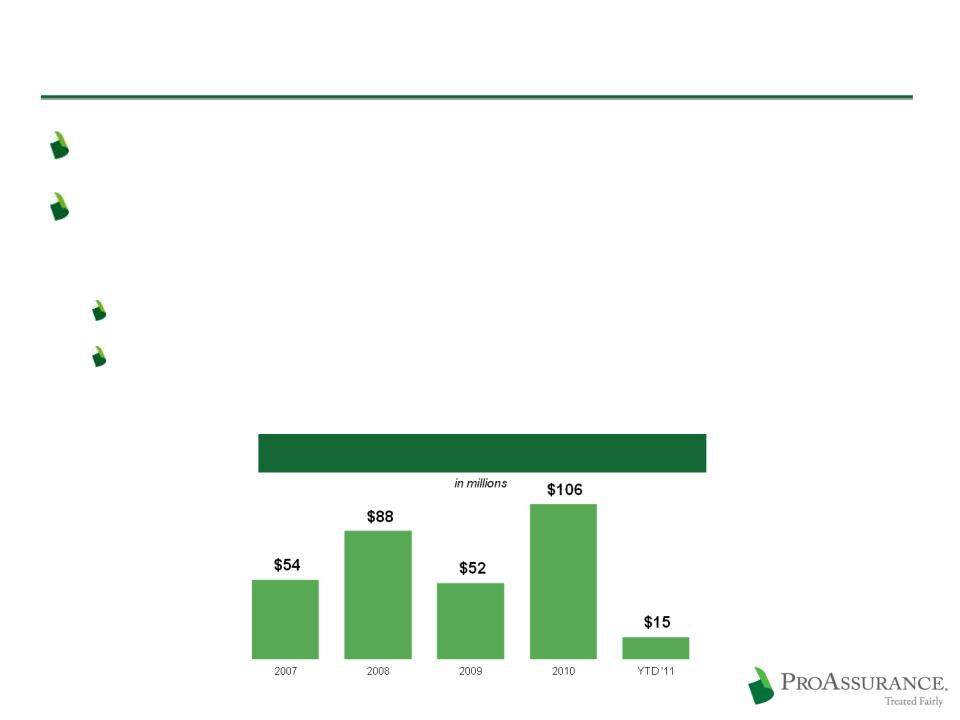

Committed to Capital Management

Newly announced dividend of $1.00/share/year

Complements our prudent share repurchase

program

program

$315 million spent to repurchase 6.0 million shares since 2005

Enhancing shareholder value by repurchasing

shares at prices that build Book Value

shares at prices that build Book Value

20

Share Repurchase History

Steady Return in an Unfavorable Environment

Meeting our long-term ROE target of 12% -14%

Components of Return on Equity (in millions)

Driven to Excel / Focused on Shareholder Value

Maintaining profitability

Sustaining book value growth

Producing sustainable shareholder value

Focusing on long-term—ready for the turn

22

Current Prices Present a Compelling Buying Opportunity