Attached files

| file | filename |

|---|---|

| EX-99.2 - EXHIBIT 99.2 - PROASSURANCE CORP | ex99_2.htm |

| 8-K - PROASSURANCE CORP 8-K 9-8-2011 - PROASSURANCE CORP | form8k.htm |

Exhibit 99.1

This presentation contains Forward Looking Statements and other information designed to convey

our projections and expectations regarding future results. There are a number of factors which

could cause our actual results to vary materially from those projected in this presentation. The

principal risk factors that may cause these differences are described in various documents we file

with the Securities and Exchange Commission, such as our Current Reports on Form 8-K, and our

regular reports on Forms 10-Q and 10-K, particularly in “Item 1A, Risk Factors.” Please review

this presentation in conjunction with a thorough reading and understanding of these risk factors.

our projections and expectations regarding future results. There are a number of factors which

could cause our actual results to vary materially from those projected in this presentation. The

principal risk factors that may cause these differences are described in various documents we file

with the Securities and Exchange Commission, such as our Current Reports on Form 8-K, and our

regular reports on Forms 10-Q and 10-K, particularly in “Item 1A, Risk Factors.” Please review

this presentation in conjunction with a thorough reading and understanding of these risk factors.

We especially identify statements concerning our recently-completed acquisition of American

Physicians Service Group (NASDAQ: AMPH) as Forward Looking Statements and direct

your attention to recent filings on Forms 10K and 10Q for a discussion of risk factors

pertaining to this transaction and subsequent integration into ProAssurance.

Physicians Service Group (NASDAQ: AMPH) as Forward Looking Statements and direct

your attention to recent filings on Forms 10K and 10Q for a discussion of risk factors

pertaining to this transaction and subsequent integration into ProAssurance.

This presentation contains Non-GAAP measures, and we may reference Non-GAAP measures in

our remarks. A reconciliation of these measures to GAAP measures is available in our latest

quarterly news release, which is available in the Investor Relations section of our website,

www.ProAssurance.com, and in the related Current Reports on Form 8K disclosing that release.

our remarks. A reconciliation of these measures to GAAP measures is available in our latest

quarterly news release, which is available in the Investor Relations section of our website,

www.ProAssurance.com, and in the related Current Reports on Form 8K disclosing that release.

FORWARD LOOKING STATEMENTS

1

NON-GAAP MEASURES

Specialty writer of professional liability insurance, primarily Medical Professional Liability (MPL)

Market Cap : ~$2.1 billion

Total Assets: $4.9 billion

Shareholders’ Equity: $2.0 billion

Annualized dividend yield is 1.4%-first dividend to be paid October 13, 2011

Founded in 1975 / Demutualized to a public company in 1991

ProAssurance: Corporate Profile

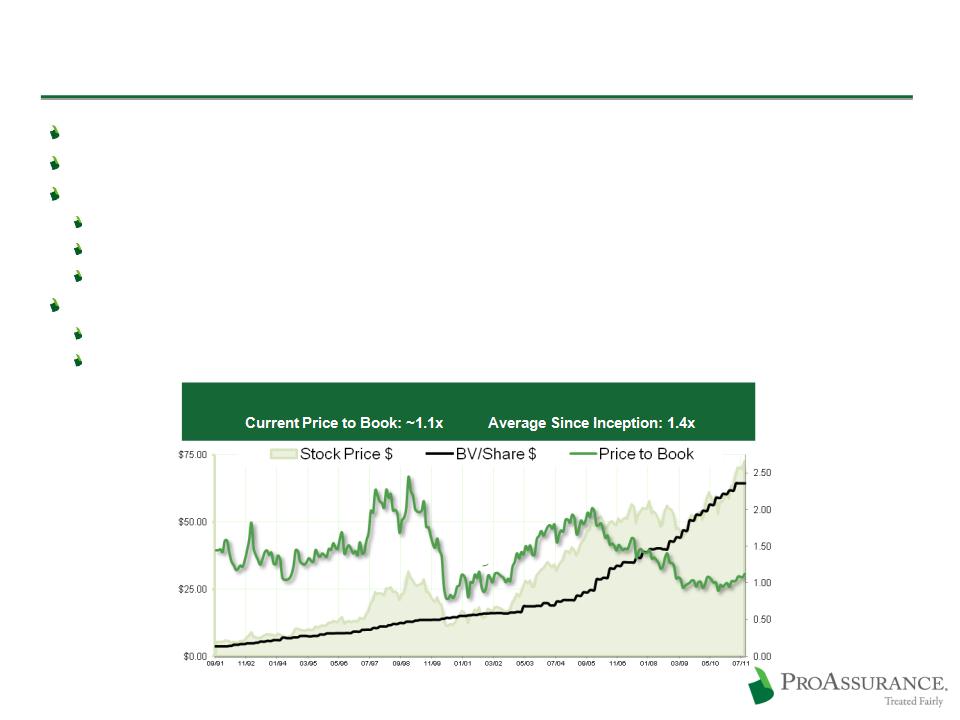

Historical Book Value Per Share

Inception to 6/30/11

CAGR: 16%

CAGR: 16%

Cumulative:1653%

10 Year Summary (2001 -2010)

CAGR: 15%

CAGR: 15%

Cumulative: 297%

Historical Stock Price (to 8/31/11)

Inception to 8/31/11

CAGR: 14%

CAGR: 14%

Cumulative:1287%

10 Year Summary (2001 -2010)

CAGR: 14%

CAGR: 14%

Cumulative: 263%

Consistently Successful Throughout the Insurance Cycle

ProAssurance: Business Profile

Largest independent publicly traded writer of MPL insurance

Fourth largest overall writer

Top 20 writers have just 65% of the market

More than 100 writers with some share of the market

Majority of companies are mutual or similar

Few operate in more than two or three states

3

DPW: SNL & Highline Data 2010

ProAssurance: Geographic Profile

Writing across the United States, ProAssurance has broad geographic diversification

Each state presents unique medical and legal challenges

Regional structure provides the local knowledge that differentiates ProAssurance

4

Corporate Headquarters

Corporate Headquarters

Claims / Underwriting Offices

Claims / Underwriting Offices

(Birmingham)

Market Share: Six-Ten1

Market Share: Six-Ten1

ProAssurance Footprint

June 30, 2011

1 DPW: SNL & Highline Data 2010

ProForma ProAssurance and American Physicians

ProAssurance: Risk and Distribution Profile

We insure a broad range of healthcare risks, from home health providers to large hospitals

Focus on individual physicians and physician groups

Rated “A” by A.M. Best and Fitch

5

Premium & Policyholder Data is YTD, June 30, 2010

Subject to Rounding

YTD 2011 Policyholders: ~71,000

2011 YTD Premium: $276 million

M & A Update: ProAssurance & American Physicians

Financial Highlights

Expected to be modestly accretive to earnings in 2011, after one-time charges and restructuring

costs

costs

Insurance Highlights

We are now the second leading writer in Texas

Adds high quality premium and

~6,700 well-underwritten policyholders

in a challenging market

~6,700 well-underwritten policyholders

in a challenging market

Texas Highlights

Stable, constitutional Tort Reform

Generally attractive legal environment

One of the fastest growing medical populations

Strong, resilient economy

APS headquarters becomes our Texas regional office

6

We are skilled at finding M & A opportunities, conducting in-depth due diligence and integrating

resulting acquisitions

resulting acquisitions

2009: Consolidation of:

Mid-Continent General Agency

Mid-Continent General Agency

2009: Consolidation of:

Mid-Continent General Agency

Mid-Continent General Agency

Georgia Lawyers Insurance Co.

Georgia Lawyers Insurance Co.

2004: Purchased Selected Renewal Rights from:

OHIC Insurance Company

OHIC Insurance Company

2004: Purchased Selected Renewal Rights from:

OHIC Insurance Company

OHIC Insurance Company

We Expect to Continue Growing Through M & A

7

1994: Consolidation of:

West Virginia Hosp. Ins Co.

West Virginia Hosp. Ins Co.

1994: Consolidation of:

West Virginia Hosp. Ins Co.

West Virginia Hosp. Ins Co.

1995: Consolidation of;

1995: Consolidation of;

Physicians Ins Co of Indiana

Physicians Ins Co of Indiana

Assumed business of:

Physicians Ins Co of Ohio

Physicians Ins Co of Ohio

Assumed business of:

Physicians Ins Co of Ohio

Physicians Ins Co of Ohio

1996: Consolidation of:

1996: Consolidation of:

Missouri Medical Ins Co

Missouri Medical Ins Co

1995: Assumed business of:

Associated Physicians Ins Co. (IL)

Associated Physicians Ins Co. (IL)

1995: Assumed business of:

Associated Physicians Ins Co. (IL)

Associated Physicians Ins Co. (IL)

1998: Consolidation of:

Physicians Protective Trust Fund (FL)

Physicians Protective Trust Fund (FL)

1998: Consolidation of:

Physicians Protective Trust Fund (FL)

Physicians Protective Trust Fund (FL)

1996: Assumed business of:

American Medical Ins Exchange (IN)

American Medical Ins Exchange (IN)

1996: Assumed business of:

American Medical Ins Exchange (IN)

American Medical Ins Exchange (IN)

Founding in the 1970s

Founding in the 1970s

1999: Assumed business of:

Medical Defense Associates (MO)

Medical Defense Associates (MO)

1999: Assumed business of:

Medical Defense Associates (MO)

Medical Defense Associates (MO)

Mutual Assurance

Physicians Ins. Co. of Michigan

Professionals Group

Creation of:

Creation of:

2005: Consolidation of:

NCRIC Group

NCRIC Group

2005: Consolidation of:

NCRIC Group

NCRIC Group

2006: Consolidation of:

PIC Wisconsin Group

PIC Wisconsin Group

2006: Consolidation of:

PIC Wisconsin Group

PIC Wisconsin Group

2007: PRI renewal rights deal

2002: SERTA renewal rights deal

2001: OUM renewal rights deal

2000: DPM Merger

1999: PACO Acquisition

Completed

11/30/10

11/30/10

The Case for Growing Through M & A

Legal and regulatory environment must be favorable

Not all M & A opportunities should be pursued

The key is understanding why companies are available

We don’t “bet the farm” and can acquire without “breaking the bank”

We prefer “healthcare centric” but look for closely related liability lines to leverage expertise

(attorneys E & O for example)

(attorneys E & O for example)

Our strategy adapts to the available opportunities for profitable growth

De Novo vs. Acquisition

Soft Market

Hard Market

M & A

de novo

Expansion

Expansion

Internal

Growth

Growth

All avenues

open

because of

pricing

power

open

because of

pricing

power

M & A is

preferable

because of

pricing

pressure

preferable

because of

pricing

pressure

M & A and the Insurance Cycle

Strategy & Operations: Differentiation is the Key

Medical Professional Liability Stands Apart

Long-tail vs short tail

Prolonged period of “benign profitability”

Premiums remain well above levels of year 2000

No large commercial competitors have entered

the market in a meaningful manner

the market in a meaningful manner

Significant barriers to entry in underwriting and

claims handling

claims handling

No “cat” exposure

Significant policyholder retention

10

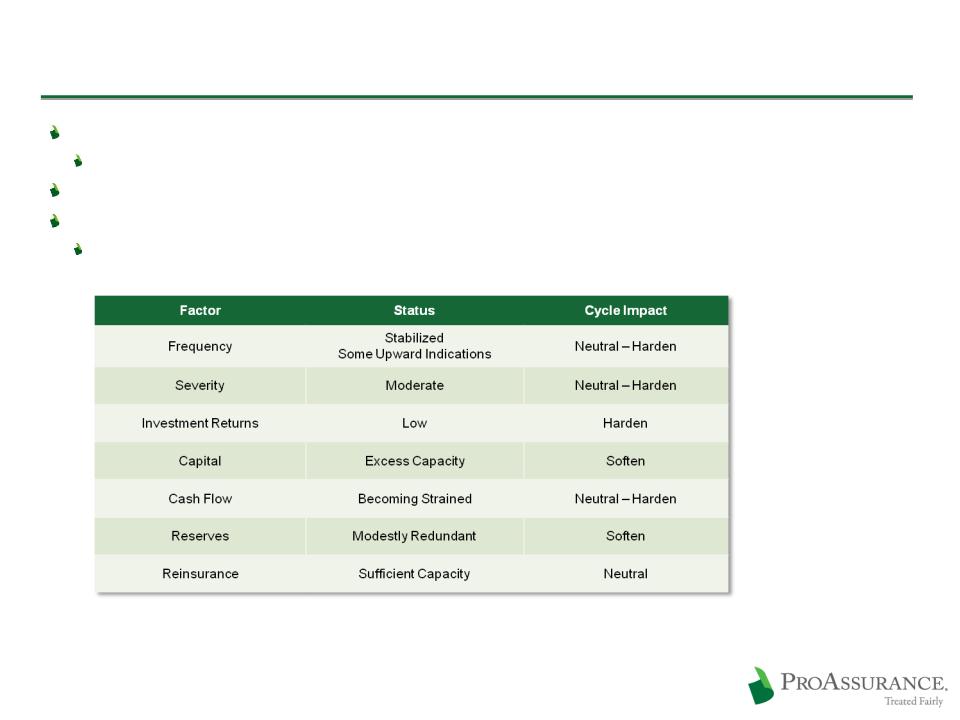

Current Industry Status

We are in a period of “benign profitability”

Prices have been falling yet profitability remains at attractive levels

We have seen no new large scale market entry from larger commercial competitors

Some consolidation among “mid-decade” start-ups

Start-up pricing advantage has vanished in current market conditions

11

Differentiate Through Claims Defense

Our deep expertise in claims defense has always set us apart

Our financial strength gives our insureds the opportunity for an uncompromising defense of their

claim

claim

Our successful approach to claims establishes a unique competitive advantage

Differentiates our product

Provides long-term financial and marketing advantages

A significant factor in our high retention rate

Helps deter future lawsuits

Our insureds increasingly value reputational defense as claims data becomes public

12

ProAssurance: 82% Favorable Outcomes

Industry: 73% Favorable Outcomes

Source: The PIAA

Five Year Average

2005-2009

2005-2009

The Ohio Example: 2005 - 2009 Data

Comprehensive, reliable data provided by the Ohio Department of Insurance

Broad range of competitors and business approaches

13

www.insurance.ohio.gov/Legal/Reports/Documents/2009ClosedClaimReport.pdf

Fewer Claims Closed With Indemnity

More Claims Defended in Court

2.5x Lower Average Indemnity Payment per Closed Claim

Malpractice Made Public

Malpractice judgments/settlements now

disclosed in 26 states

disclosed in 26 states

Disciplinary actions

now disclosed in

all states

now disclosed in

all states

Board / Discipline / Med-Mal

Med-Mal disclosure

legislation proposed

legislation proposed

P

Source: Federation of State Medical Boards National Clearinghouse and

ProAssurance research

ProAssurance research

ProAssurance Claims Tried to a Verdict

New Claims Opened Each Year

Claims Trends Remain Favorable

With frequency down compared to mid-decade the result is fewer cases to try

Severity trends steady and manageable

Trends are much the same in states with or without Tort Reform

15

Loss Trends and Rate Actions

Rates on renewing physician business down less than 14% from peak pricing in 2006

Improved frequency trends are reflected in recent rate declines

Improvement in frequency has outweighed a steady, manageable rise in severity of ~4% per year

Loss trends have improved in states with and without tort reforms

Rate changes (up or down) in 2011 will likely be low-to-mid single digits

Despite competitors’ concessions on pricing and terms, we are retaining existing business and

writing some new business that meets our long-term profitability goals

writing some new business that meets our long-term profitability goals

16

Physician Rate Change History1

Premium Retention History

1Excludes PICA for clarity of historical comparison

We enforce stringent underwriting standards to maintain rate structure and enhance profitability

Underwriting process driven by individual risk selection and assessment of loss history, areas of practice,

and location

and location

Rate filings consider the results of the past five to seven years to ensure a single year does not

unduly influence results

unduly influence results

Demonstrated Underwriting Performance

ProAssurance Average: 93.8% Industry Average: 107.4%

Source: A.M. Best Aggregates and Averages, Medical Malpractice Lines of Business

17

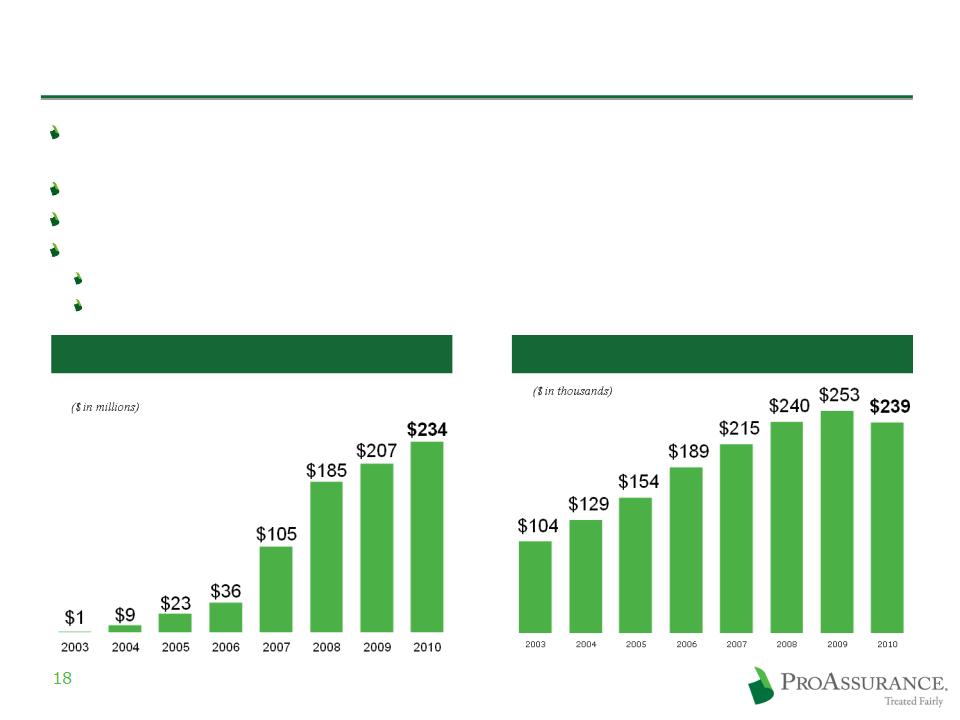

Conservative Approach to Reserves

No change in the historic reserving practices that have produced favorable net reserve

development in each of the last eight years

development in each of the last eight years

Conservative reserve strategy provides protection against a loss trend reversal

Reviewed at least quarterly by internal actuarial staff

Regular outside reviews

Independent consulting actuaries (Towers Watson) conduct full review twice per year

Actuaries associated with independent auditor (E&Y) review once per year

Net Favorable Reserve Development

Net Reserve per Open MPL Claim1

1 Statutory basis; Loss & LAE

Acquired company data included at end of acquiring year

Tort Reform Resurfaces

Federal Tort Reform has reappeared in Washington

Lots of smoke, so far no fire in Washington

Resurfaced during President Obama’s State of the Union Speech

Multiple bills being pushed by Republicans in the House, at least on bill introduced in the Senate

Democrats have offered to consider scaled-back reforms

Meaningful Tort Reform was not enacted when Republicans controlled Congress and the White

House

State Tort Reforms—where the real battles are fought

2011 legislative update

Reforms Passed in North Carolina, Oklahoma and Tennessee, rejected in New York

2011 courtroom update

State Supreme courts reviewing mid-2000’s reforms in Kansas, Mississippi, Nevada and WV

Long-standing reforms in California, Indiana and Louisiana also under review by State Supreme Courts

2010 courtroom results

Overturned in Georgia and Illinois

Upheld in Maryland

Split decision in Missouri

Whether federal or state, we never give advance credit for untested reforms unless required by

law or regulation

law or regulation

We are prepared, operationally and financially, if Tort Reforms are struck down in our states

Prices are set, and reserves established, as if there is no tort reform, until results reflect otherwise

19

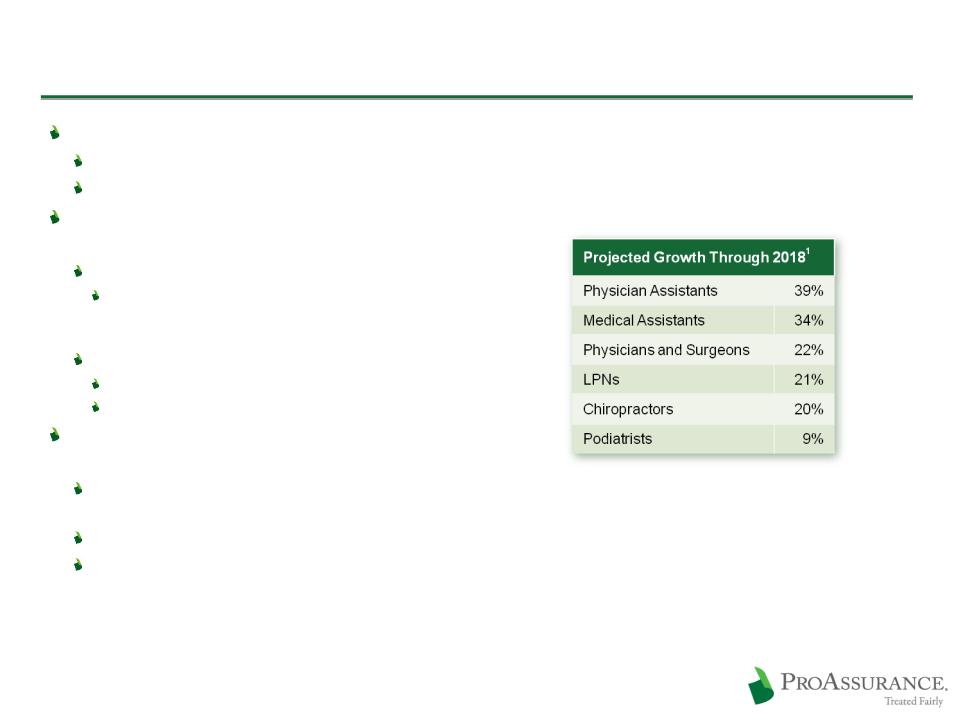

The Potential Effects of Healthcare Reform

No meaningful Tort Reform in the bill

No immediate effect on the medical/legal climate

Demonstration projects do not provide meaningful reform or immediate data

More patients will ultimately require more physicians and

ancillary providers

ancillary providers

Known: More customers for us

We have enhanced our ability to write new classes of business

through the acquisition of PICA and

ProAssurance Mid-Continent General Underwriters

through the acquisition of PICA and

ProAssurance Mid-Continent General Underwriters

Unknown: Effect on the medical/legal environment

Increased patient frustration with the system

Possibility of more unexpected outcomes

May accelerate the growing movement of insureds into

hospital-owned practices and larger groups

hospital-owned practices and larger groups

Provides an opportunity for us due to our geographic reach,

long-term experience in hospitals and our financial strength

long-term experience in hospitals and our financial strength

We are introducing new approaches and new products to take advantage

Likely to hasten M&A amongst smaller insurers that lack the capacity

or capability to insure hospitals or facilities

or capability to insure hospitals or facilities

20

1 Bureau of Labor Statistics 2008 to 2018 Projections

http://data.bls.gov/oep/nioem

http://data.bls.gov/oep/nioem

New Products for a Changing Market

Certitudetm program in conjunction with Ascension Health

Largest Catholic healthcare system in the US

38 ministry locations in 18 states

Initial offering to ~1,000 physicians insured by an Ascension affiliate

Now expanding to Ascension-affiliated physicians insured in the open market

Insurance operations performed by ProAssurance

PRA policies jointly marketed

Coordinated claims and risk management efforts

Financial involvement of both entities creates incentive to reduce risk

Program enjoying widespread acceptance among targeted physicians

Joint physician/hospital insurance product: ProControl

Addresses the unique risk tolerance and claims-handling expectation of each insured

Physicians largely seek claims defense to protect their reputation

Hospitals/facilities seek to protect their reputation in different ways

Broad interest in the market

Alternative risk and self-insurance mechanisms

Captive insurance and sophisticated risk sharing programs

Risk Retention Groups for specific specialties or regions

21

Financial Performance and Investments

Steady Return in an Unfavorable Environment

Meeting our long-term ROE target of 12% -14%

Components of Return on Equity (in millions)

Long-Term Financial Strength Sets Us Apart

Ensuring the strength of our balance sheet is our top financial priority

Financial strength differentiates us in the market

The claims defense philosophy that differentiates us in the market leverages our financial strength

24

Shareholders’ Equity

Up Over 70% Since 12/31/06

Total Assets

25

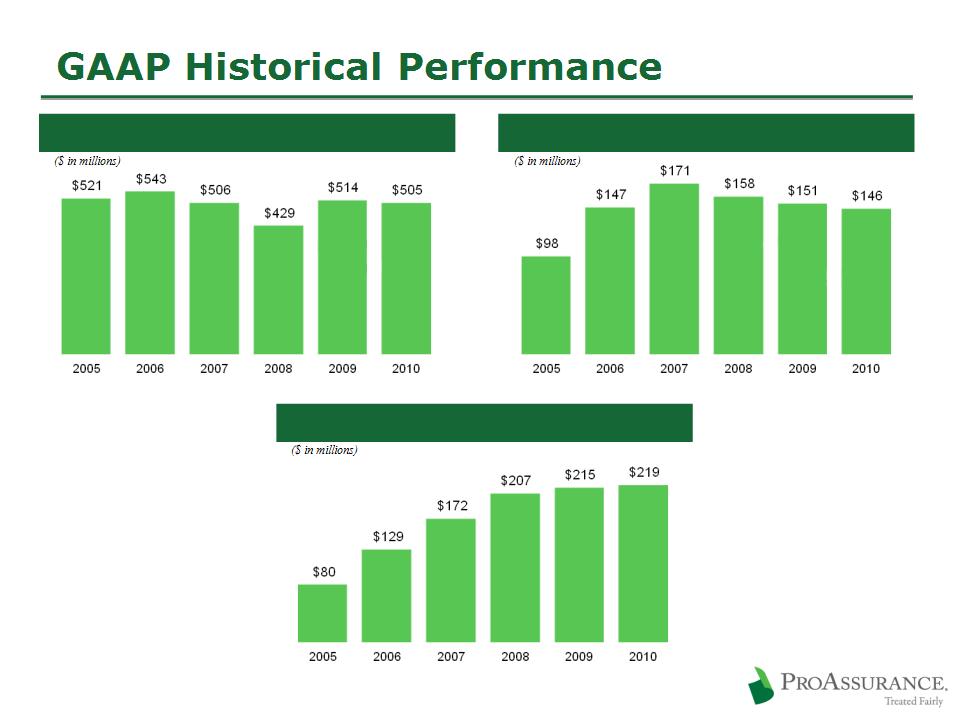

Consolidated Operating Net Income1

Net Investment Income

Net Premiums Written

1 Excludes the after-tax effects of net realized gains or losses and guaranty fund assessments or recoupments

Capital Growth: 2006-2010

in $000’s except total equity (000,000’s)

26

Capital Management

Initial Dividend Announced September 7, 2011

$0.25/share, annualized yield 1.4%

Record date: September 29, 2011

Payment date: October 13, 2011

27

Share Repurchase

$106 million spent in 2010 to buy

1.9 million shares

1.9 million shares

$315 million spent to repurchase 6.0 million shares

since 2005

since 2005

Proven discipline in prudently deploying

capital

capital

Building the company and enhancing return

through M&A

through M&A

Enhancing shareholder value by repurchasing

shares at prices that build Book Value

shares at prices that build Book Value

Share Repurchase History

Conceptual Model of Projected A. M. Best BCAR Scores if

Premiums Increase

Surplus is Reduced

Excess Capital vs. Excess Capacity

Conservative Use of Debt and Low Leverage

Low Debt to Cap Ratio

No strain on cash flow

28

Debt to Equity

No Debt Prior to 2001

Strong Capital Position

Prepared for an improving market

Investments Balance Risk vs. Return

29

$4 Billion Overall Portfolio

$3.6 Billion Fixed Income Portfolio

Average duration: 4.1 years

Average tax-equivalent yield: 4.7%

Investment grade: 97%

Weighted average: AA-

6/30/11

Key actions in Q2

Added short ABS

Added Governments to mitigate concerns

over spread widening

over spread widening

CUSIP-level portfolio disclosure on our website:

www.proassurance.com/investorrelations/supplemental.aspx

www.proassurance.com/investorrelations/supplemental.aspx

Pricing discipline becomes even more

critical in a low interest rate environment

critical in a low interest rate environment

Lack of investment yield may be a hard

market catalyst

market catalyst

Return on Equity and Investment Returns

30

Assumes a 1:1 premium to surplus ratio for physicians professional liability claims-made coverages

Combined Ratio Required to

Generate a 13% Return on Equity

Generate a 13% Return on Equity

Long-Term ROE Target is 13%

The choice: chase yield or extend duration

We are maintaining duration, looking for

opportunities

opportunities

The Yield Trap

Investing in ProAssurance

Effective, Experienced & Invested Management

32

All subject to share ownership requirements

Driven to Excel / Focused on Shareholder Value

Maintaining our profitability and book value growth

Outstanding performance in a challenging financial market and a demanding line of insurance

Producing sustainable shareholder value

Finding the right M & A opportunities

Growing Book Value per Share

Significant share ownership at all levels

Focusing on long-term

Preparing for a changing market while maintaining our leading position in the current market

Protecting the balance sheet and preparing for the market turn

33

Current Prices Present a Compelling Buying Opportunity

Supplemental Discussion Materials

Performance Recognition

Leading industry operating performance

in 2009, ranked by Moody’s top 100

property & casualty insurers

in 2009, ranked by Moody’s top 100

property & casualty insurers

ProAssurance ranks 79th by premium, but

outperforms in key financial measures

outperforms in key financial measures

Fifth straight year in the Ward’s 50

Recognition as one of the 50 top

performing Property & Casualty

insurance companies

performing Property & Casualty

insurance companies

35

Source: Moody’s - Statistical Handbook, Ward Group’s - 2010 Ward’s 50

Lower is better

Operating Ratio

PRA 2008 Rank: #1

Combined Ratio

PRA 2008 Rank: #2

Loss & LAE Ratio

PRA 2008 Rank: #5

Return on Surplus

PRA 2008 Rank: #1

PRA 2008 Rank: #5

2011 Year-to-Date Financial Highlights

36

|

|

Six Months Ended June 30,

|

|

|

|

2011

|

2010

|

|

Gross Premiums Written

|

$ 276,115

|

$ 255,699

|

|

Net Premiums Earned

|

269,140

|

248,825

|

|

Net Investment Income

|

72,457

|

74,709

|

|

Net Income (Includes Investment Losses)

|

102,790

|

78,493

|

|

Operating Income

|

98,642

|

81,844

|

|

Net Income per Diluted Share

|

$ 3.33

|

$ 2.40

|

|

Operating Income per Diluted Share

|

$ 3.20

|

$ 2.50

|

|

|

|

|

|

|

June 30, 2011

|

December 31, 2010

|

|

Total Assets

|

$ 4,926,607

|

$ 4,875,056

|

|

Shareholders’ Equity

|

1,966,364

|

1,855,863

|

2010 Financial Highlights

37

|

|

December 31

|

|

|

|

2010

|

2009

|

|

Gross Premiums Written

|

$ 533,205

|

$ 553,922

|

|

Net Premiums Earned

|

519,107

|

497,543

|

|

Net Investment Income

|

146,380

|

150,945

|

|

Net Income (Includes Investment Losses)

|

231,598

|

222,026

|

|

Operating Income

|

219,457

|

215,210

|

|

Net Income per Diluted Share

|

$ 7.20

|

$ 6.70

|

|

Operating Income per Diluted Share

|

$ 6.82

|

$ 6.49

|

|

|

December 31

|

|

|

|

2010

|

2009

|

|

Total Assets

|

$ 4,875,056

|

$ 4,647,414

|

|

Shareholders’ Equity

|

1,855,863

|

1,704,595

|

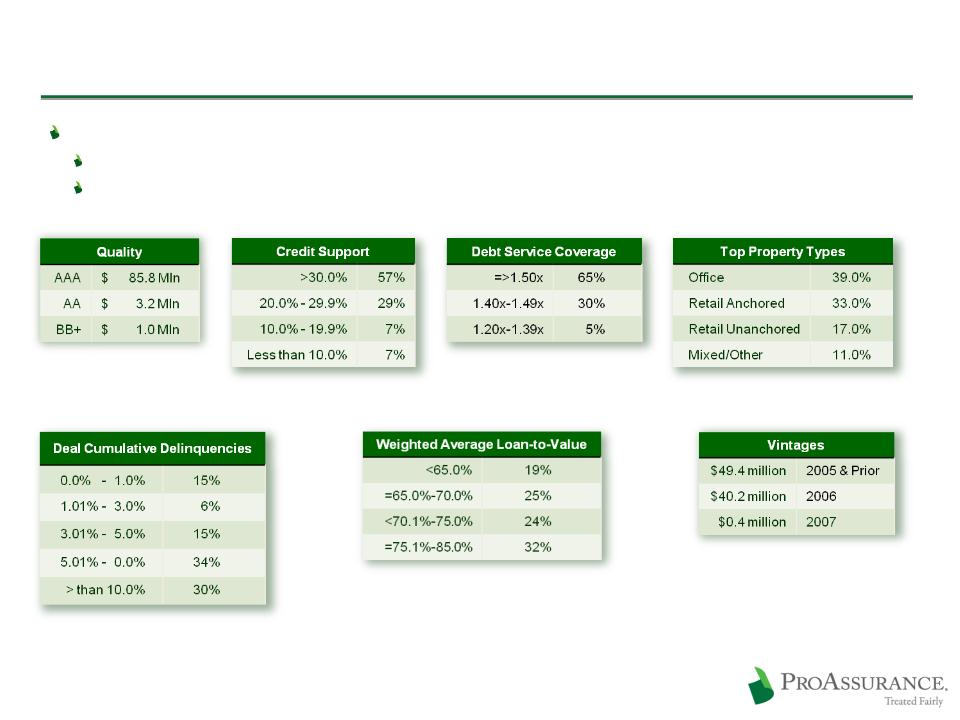

ProAssurance Portfolio Detail: Asset Backed

38

6/30/11

Asset Backed: $743 Million

Weighted Average Rating: “AA+”

Breakdown of Agency MBS Holdings

CMBS Details Provided on Page 36

Sub-Prime: $9.1 mln Market Value (AFS)

$1.0 mln net unrealized loss

$1.0 mln net unrealized loss

ProAssurance Portfolio Detail: CMBS

$90.0 million Fair Value in non-agency CMBS

Book Value: $86 million (2% of fixed income portfolio)

We have experienced no losses on our CMBS positions.

39

6/30/11

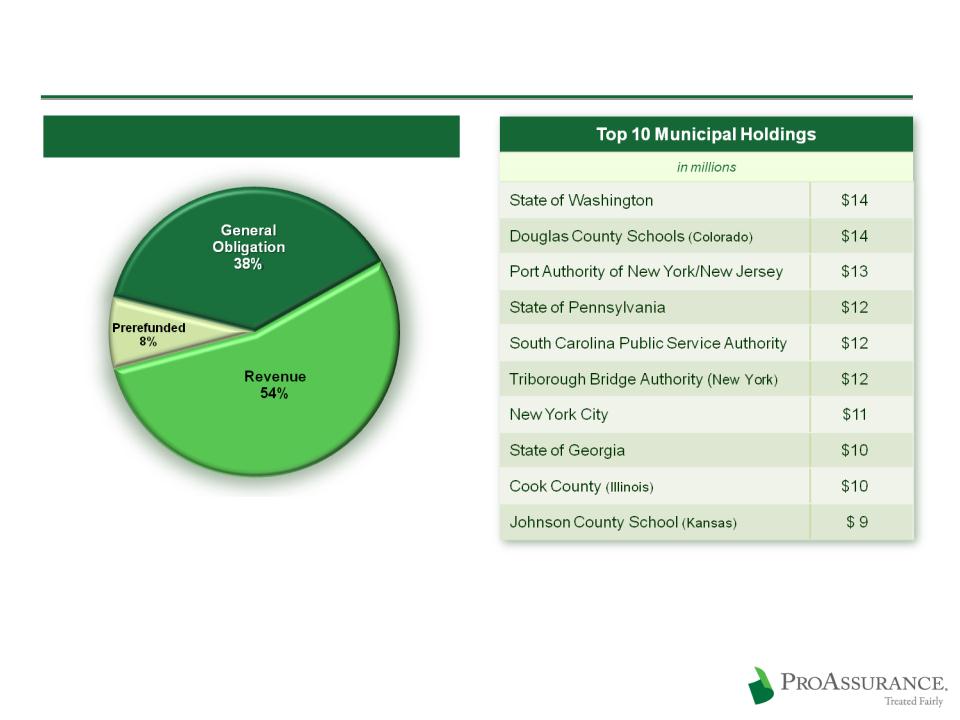

ProAssurance Portfolio Detail: Municipals

40

Municipals: $1.2 Billion / Average Rating is AA

Investment policy has always required

investment grade rating prior to applying the

effect of insurance

investment grade rating prior to applying the

effect of insurance

Weighted Average Rating: AA

6/30/11

ProAssurance Portfolio Detail: Equities & Other

41

Equities & Other: $189 Million

6/30/11

ProAssurance Portfolio Detail: Corporate

42

Corporates: $1.4 Billion

Weighted Average Rating: A

6/30/11

ProAssurance Portfolio Detail: Various

Rated A1/P1 or better

Money Markets:

Moody’s: Aaa

S&P: AAA

Weighted average rating

Moody’s: AA3

S&P: AA-

A. M. Best: A+

Treasury / GSE: $368 Million

Short Term: $129 Million

BOLI: $51 Million

6/30/11