Attached files

| file | filename |

|---|---|

| 8-K - 8-K - rue21, inc. | d8k.htm |

Exhibit

99.1 |

Safe

Harbor Statement Safe Harbor Statement

Certain statements in this presentation and responses to various

questions may be “forward-looking statements” which reflect the

company’s current expectations or beliefs concerning future events.

Actual results of operations may differ materially from historical results

or current expectations. Any such forward-looking statements are

subject to various risks and uncertainties, including the strength of the

economy, changes in the overall level of consumer spending or

preferences in apparel, our ability to compete with other retailers, the

performance of the company’s products within the prevailing retail

environment, our strategy and expansion plans, reliance on key

personnel, trade restrictions, political or financial instability in countries

where the company’s goods are manufactured, availability of suitable

store locations at appropriate terms and other factors which are set

forth in the company’s SEC filings, which are available on our website. 2

|

3

Predictable Growth From Multi-Pronged Strategy

Predictable Growth From Multi-Pronged Strategy |

4

Represents

26%

of business and growing

4

Accessories Diversification

Accessories Diversification |

5

Growing

Growing etc! Accessories % of Business |

6

Quickly identify and respond to newest

fashion trends

Item-based merchandising strategy (vs.

collections)

Work closely with a network of US-based

importers

We do not own or operate any manufacturing facilities

Benefits of our sourcing strategy include:

Short lead times (7 days to 90 days)

Competitive product pricing

Vendor accountability for merchandise performance

No overseas sourcing expenses

Flexible Fast Fashion Business Model

Flexible Fast Fashion Business Model |

Withstanding 2011 Inflation Drivers

Withstanding 2011 Inflation Drivers

No impact in first half and expect to see minimal impact

through

Not obligated to any one vendor for any overseas factories

Vendor matrix has anticipated the effects of the increase in

cotton and cotton based yarns

We have a series of strategies that include creative sourcing, new

fabric development and closer timing of commitments.

Accessories

etc!

category

is

26%

of

sales

and

not

cotton

dependent

Good, better, best merchandise strategy that maintains

value proposition

Upside margin opportunities to be captured with improved

allocation and planning business processes and systems.

7

the

second

half

of

2011 |

Leading

Retailer in Underserved Markets Leading Retailer in Underserved Markets

8

Small markets (populations typically less than 50,000)

rue21 tends to be the only girls and guys specialty

apparel retailer in our shopping centers

Positioned typically in strip centers with other value

retailers (e.g. Walmart) and regional malls

Middle markets (populations typically 50,000-200,000)

rue21 is positioned for dominance within the community

typically separating itself from the other retail competition

Competition includes Walmart, Target, Kohl’s and other

big-box and small-box value retailers and regional malls

723 Stores

Regional

Malls

33.0%

Strip

Centers

51.6%

Outlet

Centers

15.4% |

Future

Store Mix Future Store Mix

Attractive Real Estate Opportunities

Attractive Real Estate Opportunities

9

Current Store Mix

Current Store Mix

Strip Centers

Regional Malls

Outlet

51.6%

33.0%

15.4%

0%

20%

40%

60%

80%

100%

35%

0%

20%

40%

60%

80%

100%

10%

55%

Growth Potential by Real Estate

rue21 Current Store Count

rue21 Current Store Count

Identified Location

Identified Location

Share

Share

Strip Centers

Strip Centers

Regional Mall

Regional Mall

Outlet Center

Outlet Center

373

239

111

2,500

1100

175

15%

22%

63%

Total

Total

723

3,775

19% |

In-House

Expertise

Discipline

Speed to

Market

Entire real estate team based at

headquarters

Six weeks from lease signing to store

opening

Track record of opening stores on or

ahead of plan

Opportunities filtered from 400+

potential sites to 115 best

opportunities

CEO reviews and approves all real

estate deals

Results:

Results:

10

Increasing New

Store

Productivity

Decreasing

Rents per New

Store

INCREASING STORE

LEVEL RETURNS

Proven Real Estate Execution

Proven Real Estate Execution |

4,400

2,270

1,762

1,101

1,097

723

0

500

1,000

1,500

2,000

2,500

3,000

3,500

4,000

4,500

5,000

Walmart

Sears

Target

JCP

Kohl's

rue21

Walmart

Sears

Target

JCP

Kohl's

rue21

11

*Store count reflects U.S stores only

1500+ Store Opportunity

1500+ Store Opportunity

rue21 Store Growth Opportunity

rue21 Store Growth Opportunity |

(millions)

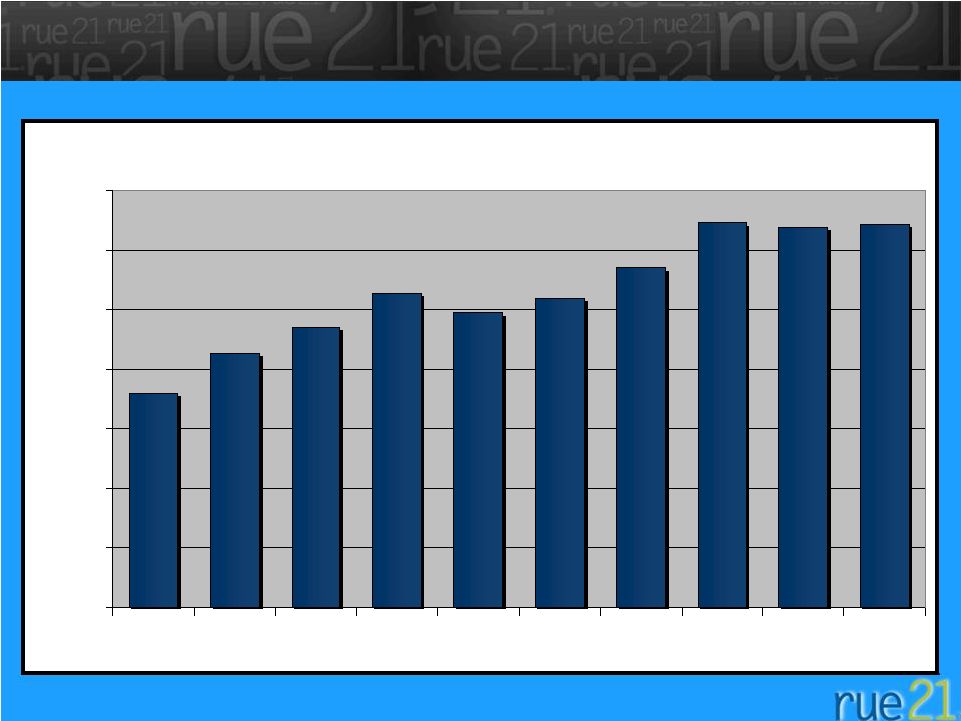

Consistent Sales Growth Performance

Consistent Sales Growth Performance

Millions

Compound Sales Growth of 28% over 7 yrs.

12

$120.6

$146.9

$192.8

$225.6

$296.9

$391.4

$634.7

$525.6

$0.0

$100.0

$200.0

$300.0

$400.0

$500.0

$600.0

$700.0

2003

2004

2005

2006

2007

2008

2009

2010 |

Compound EBITDA Growth of 49% over 7 yrs.

13

Predictable Earnings Growth and Margin Expansion

Predictable Earnings Growth and Margin Expansion

$33.6

$25.8

$17.8

$14.9

$8.6

$4.4

$71.8

$53.8

$0.0

$10.0

$20.0

$30.0

$40.0

$50.0

$60.0

$70.0

$80.0

2003

2004

2005

2006

2007

2008

2009

2010 |

Compelling and Continuing New Store Economics

Compelling and Continuing New Store Economics

14

High-Return Stores That Payback Investment in Less Than a Year

High-Return Stores That Payback Investment in Less Than a Year

Note: Dollars in thousands.

Contribution

Contribution

Contribution

Investment

Investment

Investment

~5,300

19%

$900 -

$1,100

$130

40

$170

Pre-tax ROIC

> 100%

Payback Period

Less Than 1 Year

•

Total Investment

•

Net Inventory

•

Net Build-out

•

Average store size (sq ft)

•

Annual sale (year 1)

•

4-wall contribution (year 1) |

Performance in

all Economic Environments 15

rue21 Comp Store Sales and Change in United States GDP

-15.0%

-10.0%

-5.0%

0.0%

5.0%

10.0%

15.0%

US GDP

rue21 comps |

Real Long Term

Comp Sales Gains $100 Valued by Successive Comp Store % Performances

$99.47

$96.94

$99.78

$103.70

$111.79

$114.14

$100.00

$100.00

$85.00

$90.00

$95.00

$100.00

$105.00

$110.00

$115.00

$120.00

2007

2008

2009

2010

Peers

rue21

16 |

rue 21 Gross Margin

32.0%

33.0%

34.0%

35.0%

36.0%

37.0%

38.0%

FY08

FY09

FY10

Q2 FY11

TTM

Consistent Long Term Gross Margin Growth

17 |

18

Year over Year Margin Change Compared to Peers

-1.0%

-0.5%

0.0%

0.5%

1.0%

1.5%

2.0%

FY08

FY09

FY10

FY11

1st Half

rue21

Peers

Real Gross Margin Long Term Gains |

19

Gross Margin Dollar Per Square Foot

$0.00

$5.00

$10.00

$15.00

$20.00

$25.00

$30.00

$35.00

Q1 09

Q2 09

Q3 09

Q4 09

Q1 10

Q2 10

Q3 10

Q4 10

Q1 11

Q2 11

Leveraging Square Footage through Gross Margin Growth

Leveraging Square Footage through Gross Margin Growth |

20

Ability to Expand Net Income by Double Digits in Low Comp Growth

Quarters

First

Second

Third

Fourth

First

Second

Third

Fourth

Quarter

Quarter

Quarter

Quarter

Quarter

Quarter

Quarter

Quarter

Net Sales Growth

40.1%

42.0%

27.9%

20.9%

20.4%

26.9%

33.6%

43.6%

Net Income Growth

249.7%

59.0%

50.9%

22.5%

56.3%

31.2%

55.8%

33.1%

Comp Store Sales

12.7%

8.9%

9.8%

1.8%

-5.2%

0.7%

6.6%

11.2%

First

Second

Third

Fourth

First

Second

Third

Fourth

Quarter

Quarter

Quarter

Quarter

Quarter

Quarter

Quarter

Quarter

Net Sales Growth

40.7%

27.6%

40.7%

30.5%

27.6%

14.3%

19.5%

22.3%

Net Income Growth

257.5%

23.5%

106.9%

67.9%

94.7%

20.0%

19.5%

41.0%

Comp Store Sales

8.3%

0.6%

13.5%

8.6%

7.7%

-1.6%

1.8%

1.5%

First

Second

Quarter

Quarter

Net Sales Growth

25.5%

21.0%

Net Income Growth

65.2%

20.0%

Comp Store Sales

5.2%

-0.3%

Fiscal 2011

Fiscal 2007

Fiscal 2009

Fiscal 2010

Fiscal 2008

Expansion of Net Income

Expansion of Net Income |

2010

2010

2011

2011

%

%

$

$

% increase

% increase

Total Net Sales

Total Net Sales

$280.7 M

$345.6 M

23.1%

% Comp Growth

% Comp Growth

2.8%

2.4%

Comp Store Growth

Comp Store Growth

Non Comp Store Growth

Non Comp Store Growth

Gross Margin

Gross Margin

38.0%

39.0%

+100bps

Operating Margin

Operating Margin

7.3%

8.1%

+80bps

Net Income

Net Income

$12.2M

$17.3M

41.6%

$5.1M

Total Growth Opportunity Drives Predictable Profit Growth

Total Growth Opportunity Drives Predictable Profit Growth

21

Growth

Growth

100%

100%

97.6%

97.6%

2.4%

2.4%

$6.5M

First Half

$ 64.9M

$ 58.4M |

22

Years Ended

TTM

Jan -10

Jan -11

Jul-11

GOAL

Gross Margin

35.8%

37.0%

37.6%

38.5

-

39.0%

Selling, General and

Administrative

25.5%

25.7%

26.0%

25.0

-

25.5%

Depreciation and Amortization

3.2%

3.4%

3.5%

3.0%

Operating income Margin

7.0%

7.9%

8.2%

10.5%

Pre-Tax Income Margin

6.9%

7.8%

8.2%

10.5

-

11.0%

Net Income

4.2%

4.8%

5.0%

6.0

-

7.0%

Margin Expansion Opportunity

Margin Expansion Opportunity |

23

2010

2011

2010

2011

% Growth

Sales

$280.0M $345.6M

$634.7M

$762M

-

$785M

20% -

24%

Net Income

$12.2M

$17.3M

$30.2M

24% -

28%

EPS

$0.49

$0.69

$1.21

$1.50 -

$1.54

24% -

27%

Diluted Shares

25.0M

25.1M

25.0M

25.2M

First Half

Total Year

Reaffirming Q3 & Y/E Guidance

Reaffirming Q3 & Y/E Guidance

$37.5M -

$38.8M |

METRIC

METRIC

LONG-TERM TARGET

LONG-TERM TARGET

SQUARE FOOTAGE CAGR

MID TO HIGH TEENS

COMPARABLE STORE SALES

GROWTH

LOW SINGLE DIGITS

GROSS MARGIN

150 BPS IMPROVEMENT

NET INCOME CAGR

20-25%

Financial Targets

Financial Targets

24 |

Consistent Sales Growth Performance and Opportunity

Predictable Long Term Earnings Growth

Strength and Flexibility in Real Estate Strategy

Attractive New Store Economics

Experienced Management Team with Significant Ownership

Distinct Company Culture

Why Invest in rue21

Why Invest in rue21

25 |

|