Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Maiden Holdings, Ltd. | v234245_8k.htm |

Maiden Holdings KBW 2011 Insurance Conference September 7, 2011

Forward Looking Statements This presentation contains “forward ‐ looking statements” which are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. The forward ‐ looking statements are based on the Company’s current expectations and beliefs concerning future developments and their potential effects on the Company . There can be no assurance that actual developments will be those anticipated by the Company . Actual results may differ materially from those projected as a result of significant risks and uncertainties, including non‐ receipt of expected payments, changes in interest rates, effect of the performance of financial markets on investment income and fair values of investments, developments of claims and the effect on loss reserves, decreases in existing and new client projected premiums, accuracy in projecting loss reserves, the impact of competition and pricing environments, changes in the demand for the Company’s products, the effect of general economic conditions, adverse state and federal legislation, regulations and regulatory investigations into industry practices, developments relating to existing agreements, heightened competition, changes in pricing environments and changes in asset valuations . The Company undertakes no obligation to publicly update any forward ‐looking statements, except as may be required by law. Additional information about these risks and uncertainties, as well as others that many cause actual results to differ materially from those projected is contained in Item 1A. Risk Factors in the Company’s Annual Report on Form 10‐ K for the year ended December 31, 2010. 2

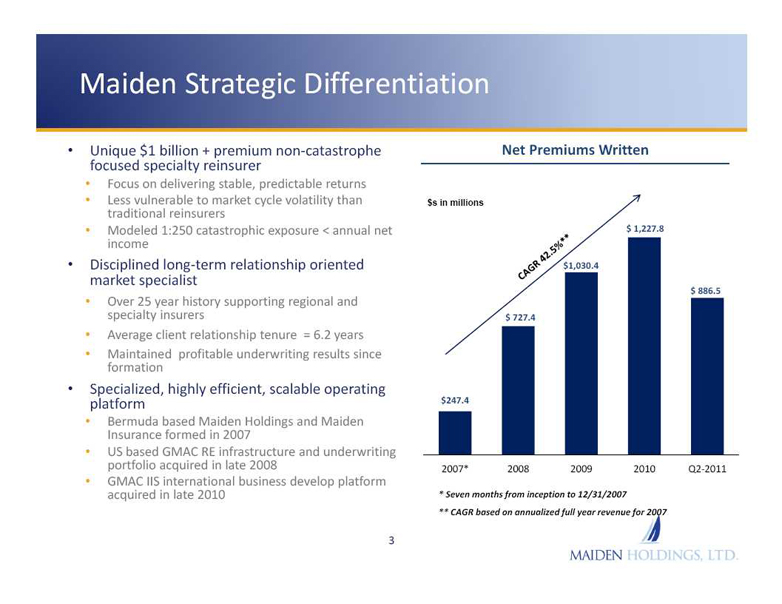

Maiden Strategic Differentiation • Unique $1 billion + premium non‐ catastrophe Net Premiums Written focused specialty reinsurer • Focus on delivering stable, predictable returns • Less vulnerable to market cycle volatility than $s in millions traditional reinsurers • Modeled 1:250 catastrophic exposure < annual net $ 1,227.8 income • Disciplined long‐ term relationship oriented $1,030.4 market specialist $ 886.5 • Over 25 year history supporting regional and specialty insurers $ 727.4 • Average client relationship tenure = 6.2 years • Maintained profitable underwriting results since formation • Specialized, highly efficient, scalable operating platform $247.4 • Bermuda based Maiden Holdings and Maiden Insurance formed in 2007 • US based GMAC RE infrastructure and underwriting portfolio acquired in late 2008 2007* 2008 2009 2010 Q2‐ 2011 • GMAC IIS international business develop platform acquired in late 2010 * Seven months from inception to 12/31/2007 ** CAGR based on annualized full year revenue for 2007 3

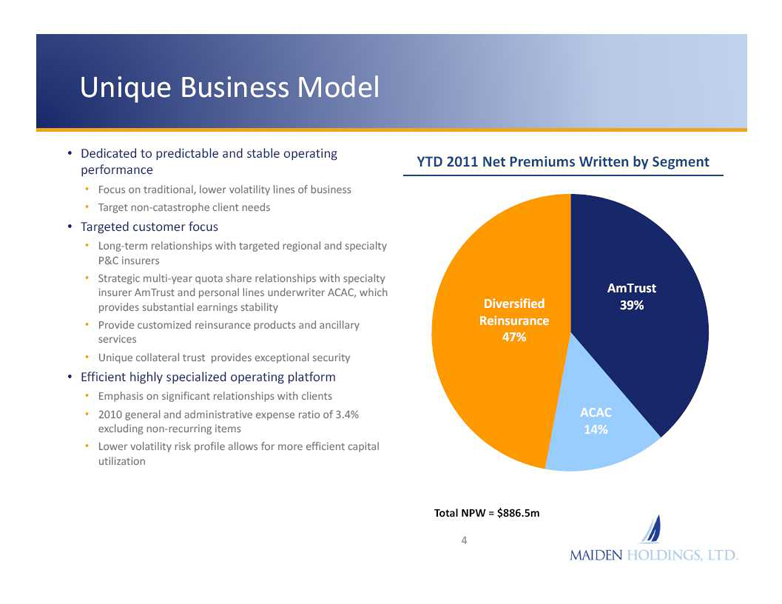

Unique Business Model • Dedicated to predictable and stable operating YTD 2011 Net Premiums Written by Segment performance • Focus on traditional, lower volatility lines of business • Target non‐ catastrophe client needs • Targeted customer focus • Long‐ term relationships with targeted regional and specialty P&C insurers • Strategic multi‐ year quota share relationships with specialty insurer AmTrust and personal lines underwriter ACAC, which AmTrust provides substantial earnings stability Diversified 39% • Provide customized reinsurance products and ancillary Reinsurance services 47% • Unique collateral trust provides exceptional security • Efficient highly specialized operating platform • Emphasis on significant relationships with clients • 2010 general and administrative expense ratio of 3.4% ACAC excluding non‐ recurring items 14% • Lower volatility risk profile allows for more efficient capital utilization Diversified AmTrust Total NPW = $886.5m ACAC 4

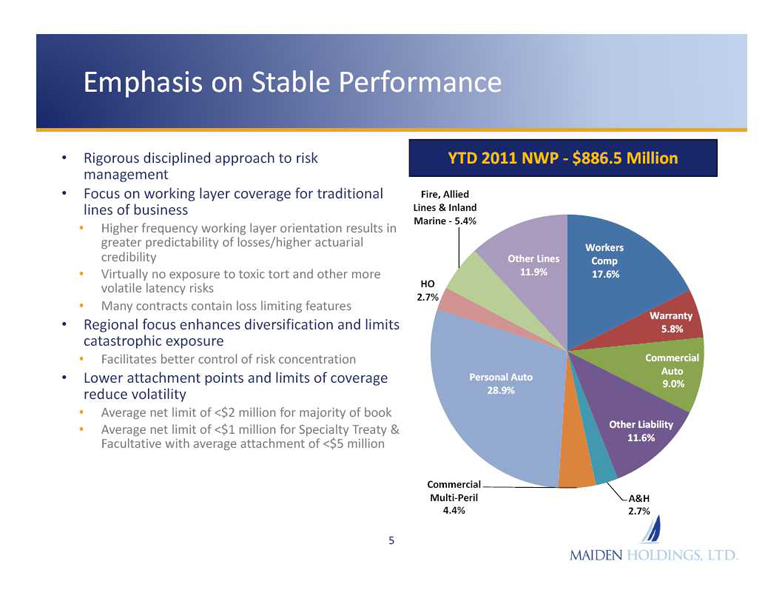

Emphasis on Stable Performance • Rigorous disciplined approach to risk YTD 2011 NWP ‐ $886.5 Million management • Focus on working layer coverage for traditional Fire, Allied lines of business Lines & Inland Marine ‐ 5.4% • Higher frequency working layer orientation results in greater predictability of losses/higher actuarial Workers credibility Other Lines Comp • Virtually no exposure to toxic tort and other more 11.9% 17.6% volatile latency risks HO 2.7% • Many contracts contain loss limiting features Warranty • Regional focus enhances diversification and limits 5.8% catastrophic exposure • Facilitates better control of risk concentration Commercial Auto • Lower attachment points and limits of coverage Personal Auto 9.0% reduce volatility 28.9% • Average net limit of <$2 million for majority of book Other Liability • Average net limit of <$1 million for Specialty Treaty & 11.6% Facultative with average attachment of <$5 million Commercial Multi‐ Peril A&H 4.4% 2.7% 5

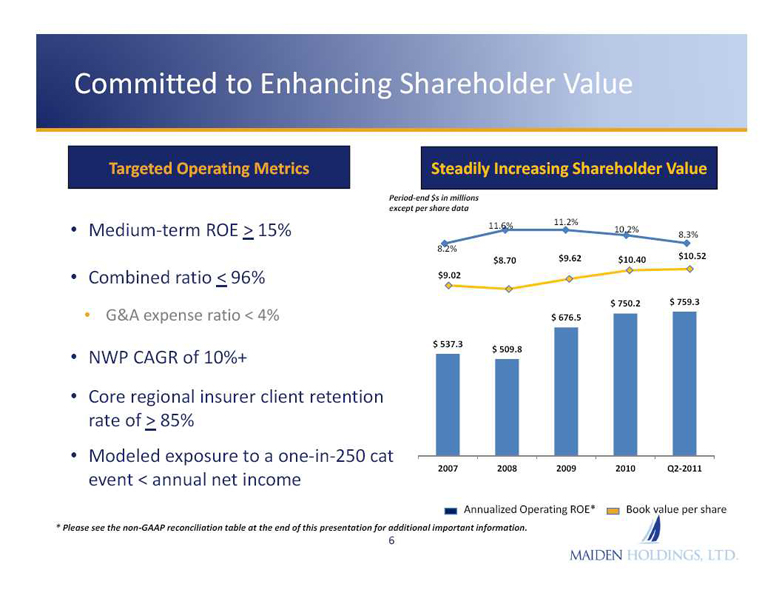

Committed to Enhancing Shareholder Value Targeted Operating Metrics Steadily Increasing Shareholder Value Period‐ end $s in millions except per share data 11.6% 11.2% • Medium ‐ term ROE > 15% 10.2% 8.3% 8.2% $9.62 $10.52 $8.70 $10.40 • Combined ratio < 96% $9.02 $ 750.2 $ 759.3 • G&A expense ratio < 4% $ 676.5 $ 537.3 $ 509.8 • NWP CAGR of 10%+ • Core regional insurer client retention rate of > 85% • Modeled exposure to a one ‐ in‐ 250 cat 2007 2008 2009 2010 Q2‐ 2011 event < annual net income Annualized Operating ROE* Book value per share * Please see the non‐ GAAP reconciliation table at the end of this presentation for additional important information . 6

Maiden Continued to Deliver Solid Underwriting Results During an Eventful Second Quarter • Despite impact from unusually high frequency of U.S. thunderstorm and tornado activity, Maiden continued to produce profitable underwriting results through the first 6 months of 2011 • No impact from Q1 global catastrophes • Maiden losses driven by impact of extraordinary frequency of US storm activity on non catastrophe reinsurance contracts • $9.5 million in losses, net of the Company’s quarterly provisions for normalized catastrophe activity added 2.6 and 1.3 points to combined ratio for Q2 and YTD results • Expanded and enhanced AmTrust relationship • Negotiated 1% ceding commission reduction for the balance of 2011 in recognition of business mix changes; added adjustable feature in 2012 and beyond to reflect future changes in business mix • Extended multi year quota share an additional year to 2014 while maintaining three‐ year contract • Effective April 1, entered into 40% Quota Share of AmTrust’s European Hospital Liability business • Strong revenue trend reflecting year on year growth in US Maiden Re business, Q4 2010 international acquisition, full year of ACAC writings, and the addition of the AmTrust European Hospital Liability program 7

Partial Debt Refinancing Lowers Cost of Capital • Maiden NA completed a $107.5 million offering of 8.25% Senior Notes due June 15, 2041 with an optional call feature at par available after June 15, 2016 • The Senior Notes trade on the New York Stock Exchange under the symbol “MHNA” • Maiden used the proceeds to repurchase a like amount of 14% junior subordinated debt associated with 2009 Trust Preferred Offering • Q2 results reflect $35.4 million in charges associated with the repurchase • Transaction terms reflect a balance of size against the need to maintain a lower coupon • Represents Maiden’s first public debt transaction and positions the company for enhanced future access to debt markets • Transaction will increase earnings by $.08 per share on an annualized basis and will have a long term favorable impact on ROE and capital growth as well, despite Q2 book value and net income impact • Maiden will continue to explore additional refinancing options for the remaining $152.5 balance of the higher coupon TRUPs 8

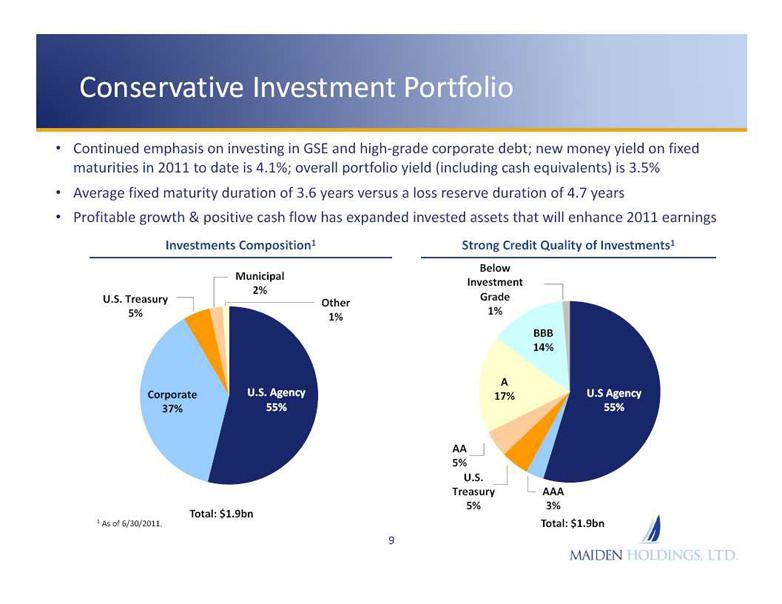

Conservative Investment Portfolio • Continued emphasis on investing in GSE and high‐ grade corporate debt; new money yield on fixed maturities in 2011 to date is 4.1%; overall portfolio yield (including cash equivalents) is 3.5% • Average fixed maturity duration of 3.6 years versus a loss reserve duration of 4.7 years • Profitable growth & positive cash flow has expanded invested assets that will enhance 2011 earnings Investments Composition 1 Strong Credit Quality of Investments 1 Below Municipal Investment 2% U.S. Treasury Grade Other 5% 1% 1% BBB 14% A Corporate U.S. Agency 17% U.S Agency 37% 55% 55% AA 5% U.S. Treasury AAA 5% 3% Total: $1.9bn 1 As of 6/30/2011. Total: $1.9bn 9

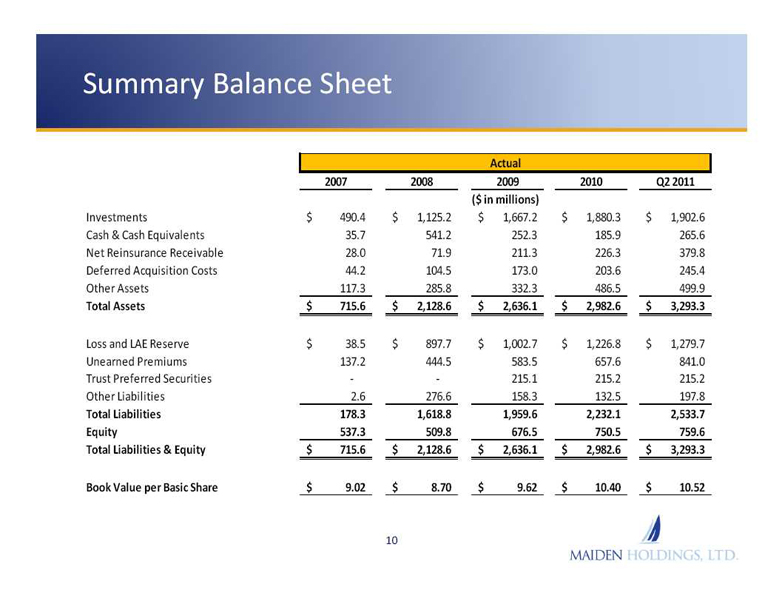

Summary Balance Sheet Actual 2007 2008 2009 2010 Q2 2011 ($ in millions) Investments $ 490.4 $ 1,125.2 $ 1,667.2 $ 1,880.3 $ 1,902.6 Cash & Cash Equivalents 35.7 541.2 252.3 185.9 265.6 Net Reinsurance Receivable 28.0 71.9 211.3 226.3 379.8 Deferred Acquisition Costs 44.2 104.5 173.0 203.6 245.4 Other Assets 117.3 285.8 332.3 486.5 499.9 Total Assets $ 715.6 $ 2,128.6 $ 2,636.1 $ 2,982.6 $ 3,293.3 Loss and LAE Reserve $ 38.5 $ 897.7 $ 1,002.7 $ 1,226.8 $ 1,279.7 Unearned Premiums 137.2 444.5 583.5 657.6 841.0 Trust Preferred Securities ‐‐ 215.1 215.2 215.2 Other Liabilities 2.6 276.6 158.3 132.5 197.8 Total Liabilities 178.3 1,618.8 1,959.6 2,232.1 2,533.7 Equity 537.3 509.8 676.5 750.5 759.6 Total Liabilities & Equity $ 715.6 $ 2,128.6 $ 2,636.1 $ 2,982.6 $ 3,293.3 Book Value per Basic Share $ 9.02 $ 8.70 $ 9.62 $ 10.40 $ 10.52 10

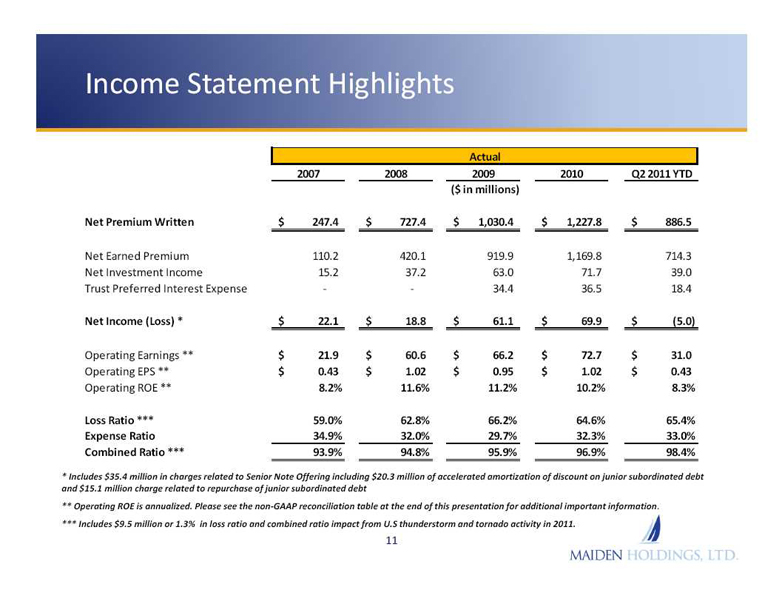

Income Statement Highlights Actual 2007 2008 2009 2010 Q2 2011 YTD ($ in millions) Net Premium Written $ 247.4 $ 727.4 $ 1,030.4 $ 1,227.8 $ 886.5 Net Earned Premium 110.2 420.1 919.9 1,169.8 714.3 Net Investment Income 15.2 37.2 63.0 71.7 39.0 Trust Preferred Interest Expense ‐ 34.4 36.5 ‐ 18.4 Net Income (Loss) * $ 22.1 $ 18.8 $ 61.1 $ 69.9 $ (5.0) Operating Earnings ** $ 21.9 $ 60.6 $ 66.2 $ 72.7 $ 31.0 Operating EPS ** $ 0.43 $ 1.02 $ 0.95 $ 1.02 $ 0.43 Operating ROE ** 8.2% 11.6% 11.2% 10.2% 8.3% Loss Ratio *** 59.0% 62.8% 66.2% 64.6% 65.4% Expense Ratio 34.9% 32.0% 29.7% 32.3% 33.0% Combined Ratio *** 93.9% 94.8% 95.9% 96.9% 98.4% * Includes $35.4 million in charges related to Senior Note Offering including $20.3 million of accelerated amortization of discount on junior subordinated debt and $15.1 million charge related to repurchase of junior subordinated debt ** Operating ROE is annualized . Please see the non‐ GAAP reconciliation table at the end of this presentation for additional important information . *** Includes $9.5 million or 1.3% in loss ratio and combined ratio impact from U.S thunderstorm and tornado activity in 2011. 11

Well ‐ positioned Specialty Reinsurer Competitive phase of reinsurance cycle continues Impact of significant global catastrophes in 2011 remains uncertain Maiden Differentiation • Competitive advantages position Maiden • Revenue/profit prospects are favorable across well despite market uncertainty all business segments • Customer ‐ centric differentiated model • ACAC and International revenue in 2011 will • Strong client longevity tied to value added reflect a full year’s writings relationships • Positioning activity to provide capital solutions • Multi‐ year strategic quota‐ share to European regional insurers relationships enhance revenue/profit • Maiden Re US experienced strong 01/01 stability renewal season/continued strong deal flow • Low G&A expense levels • Addition of AmTrust European Hospital Liability • Maiden collateral trust quota share provides further profitable diversification • Disciplined approach to underwriting and pricing • Growth in invested assets driving increased earnings • Debt refinancing improves return profile 12

Non ‐ GAAP Financial Measures • In presenting the Company’s results, management has included and discussed in this presentation certain non generally accepted accounting principles (“non‐ GAAP”) financial measures within the meaning of Regulation G as promulgated by the U.S. Securities and Exchange Commission . Management believes that these non‐ GAAP measures, which may be defined differently by other companies, better explain the company’s results of operations in a manner that allows for a more complete understanding of the underlying trends in the Company’s business . However, these measures should not be viewed as a substitute for those determined in accordance with generally accepted accounting principles (“U.S. GAAP”) . • Operating Earnings and Operating Earnings per Share: In addition to presenting net income determined in accordance with GAAP, we believe that showing operating earnings enables investors, analysts, rating agencies and other users of our financial information to more easily analyze our results of operations in a manner similar to how management analyzes our underlying business performance . Operating earnings should not be viewed as a substitute for U.S. GAAP net income. Operating earnings are an internal performance measure used in the management of our operations and represents operating results excluding, as applicable, realized investment gains or losses, foreign exchange gain or loss, the amortization of intangible assets and non‐ cash deferred tax expenses . We also exclude certain non‐ recurring expenditures that are material to understanding our results of operations . For 2011 and 2010, we exclude transaction expenses related to the IIS Acquisition as these are non‐ recurring . In 2011, as a result of the Senior Notes Offering, we exclude the junior subordinated debt repurchase expense and the accelerated amortization of junior subordinated debt discount and issuance costs, as both are non‐recurring . We exclude net realized investment gains or losses and foreign exchange gain or loss as we believe that both are heavily influenced in part by market opportunities and other factors. We do not believe amortization of intangible assets are representative of our ongoing business . We believe all of these amounts are largely independent of our business and underwriting process and including them distorts the analysis of trends in our operations . • Operating Return on Equity ("Operating ROE"): Management uses operating return on average shareholders' equity as a measure of profitability that focuses on the return to common shareholders . It is calculated using operating earnings available to common shareholders (realized gains or losses on investments, foreign exchange gains and losses, amortization of intangibles, and amortization of intangible assets) divided by average common shareholders' equity. In calculating and presenting Operating ROE, amounts for 2011 are annualized as follows: the operating earnings for the period as defined above is multiplied by the number of such periods in a calendar year in order to arrive at annualized operating earnings . Management has set as a target a long‐ term average of 15% Operating ROE, which management believes provides an attractive return to shareholders for the risk assumed . • See slide 14 for a reconciliation of non‐ GAAP measures used in this presentation to their most directly comparable GAAP measures . 13

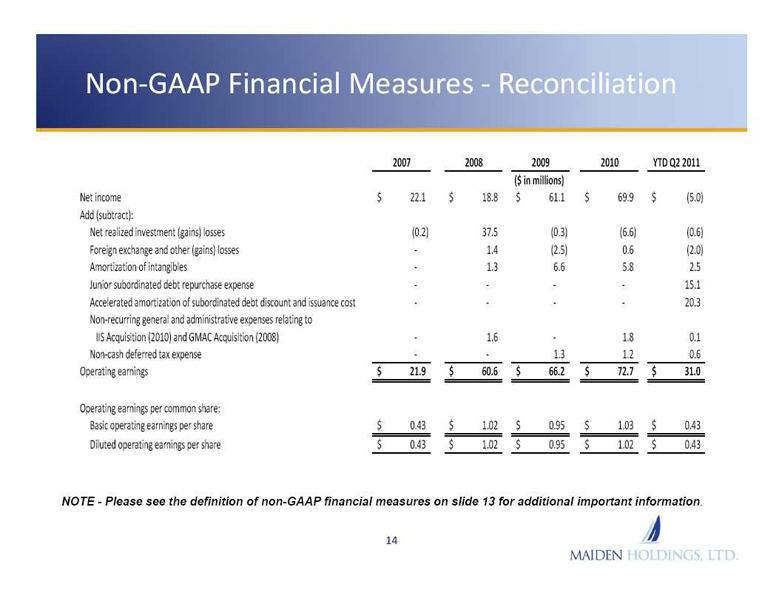

Non ‐GAAP Financial Measures Reconciliation‐ 2007 2008 2009 2010 YTD Q2 2011 ($ in millions) Net income $ 22.1 $ 18.8 $ 61.1 $ 69.9 $ (5.0) Add (subtract): Net realized investment (gains) losses (0.2) 37.5 (0.3) (6.6) (0.6) Foreign exchange and other (gains) losses ‐ 1.4 (2.5) 0.6 (2.0) Amortization of intangibles ‐ 1.3 6.6 5.8 2.5 Junior subordinated debt repurchase expense ‐‐‐15.1 ‐Accelerated amortization of subordinated debt discount and issuance cost ‐‐‐20.3 ‐Non‐ recurring general and administrative expenses relating to IIS Acquisition (2010) and GMAC Acquisition (2008) ‐ 1.6 1.8 ‐ 0.1 Non‐ cash deferred tax expense ‐ 1.3 ‐ 1.2 0.6 Operating earnings $ 21.9 $ 60.6 $ 66.2 $ 72.7 $ 31.0 Operating earnings per common share: Basic operating earnings per share $ 0.43 $ 1.02 $ 0.95 $ 1.03 $ 0.43 Diluted operating earnings per share $ 0.43 $ 1.02 $ 0.95 $ 1.02 $ 0.43 NOTE - Please see the definition of non-GAAP financial measures on slide 13 for additional important information . 14