Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - 180 DEGREE CAPITAL CORP. /NY/ | v231494_8k.htm |

| EX-99.2 - EXHIBIT 99.2 - 180 DEGREE CAPITAL CORP. /NY/ | v231494_ex99-2.htm |

SECOND QUARTER REPORT 2011

FELLOW SHAREHOLDERS:

These are certainly interesting times and unchartered territories. The world and the public markets appear to have finally turned their attention to the future prospects of America and Europe. It is a future that appears both troubling and uncertain.

We believe the public markets have become dominated by short-term trading strategies. Although we believe this trend has been playing itself out for the past few years, we believe the events of the past few weeks are pushing a market of traders even further into a mind set of short-term macroeconomic trends and a focus on short-term returns on investment. The market will remain volatile as it deals with this uncertainty. Unfortunately, this market is not a market that rewards long-term company building and prudent positioning. Thus, currently, market conditions are adversely impacting not only our shares, but also the shares of two of our portfolio companies, NeoPhotonics Corporation (NYSE: NPTN) and Solazyme, Inc. (Nasdaq: SZYM).

We are a venture capital company. We build companies, often as the first institutional investor. We build companies that intend to develop disruptive technologies that will transform their market. This company building can take five to ten years, but it has the potential to result in outsized returns. Despite the market’s current volatility and flight from risk, we remain convinced that the best strategy for long-term growth and for future success -- not only for ourselves and our investors, but also for an American economy struggling to compete in today’s global economy -- is to continue investing in transformative companies that commercialize disruptive technologies.

Our strategy is starting to be realized. Our net asset value per share (NAV) increased to $5.43 as of June 30, 2011, from $4.73 as of March 31, 2011, before the broader market sell-off that reduced the share price of both Solazyme and NeoPhotonics. While we continue to invest capital, and while we have operating expenses, we have also increased our cash position through the sale of BioVex Group, Inc. to Amgen, Inc. and through the sale of Innovalight, Inc. to E.I. du Pont de Nemours and Company (DuPont). The combination of both sales brought $12,249,859 in cash to our balance sheet as of August 5, 2011. Although the sale of Innovalight resulted in a realized loss, the terms of the sale did have a positive impact on NAV for the quarter ending June 30, 2011 because the amount of proceeds realized was greater than our value of Innovalight as of the quarter ended March 31, 2011.

We ended June 30, 2011, with $86,802,604 in primary and secondary liquidity, with $37,500,182 of that amount in cash and U.S. Treasuries. Our secondary liquidity consists of our publicly traded securities. As of June 30, 2011, these are Solazyme, NeoPhotonics and Champions Oncology, Inc. (OTC: CSBR). This secondary liquidity will fluctuate, potentially dramatically, with the price of these publicly traded securities, and this fluctuation will impact our NAV.

1

As of Friday, August 5, 2011, we had received $4,547,389 in cash from the sale of Innovalight. In the future, we expect to receive additional cash if milestone payments from BioVex and escrow payments from BioVex and Innovalight are realized. We could receive up to an additional $10,479,604 if all the BioVex milestones are met and the escrow payment received. As of June 30, 2011, we value these potential escrow and milestone payments at $3,792,759. Additionally, we have the potential for an additional $948,894 of proceeds from the sale of Innovalight that are being held in escrow until January 2013.

We have been opportunistic. In late 2009 and 2010, we realized that an initial public offering (“IPO”) window was opening, and we helped to prepare some of our mature companies to seek this route to liquidity. In 2011 year to date, we had two companies complete IPOs, NeoPhotonics and Solazyme. Although both companies have experienced volatility in the current market environment, their IPOs raised sufficient capital to allow these companies to execute on their long-term business plans. Both companies are led by management teams that have proven their ability to execute on their business even through the deep recession of 2008-2009. We believe they are positioned for long-term success. A market that is reacting to short-term volatility may not value these companies properly in the short term. However, we are in no hurry to sell our positions in these companies. We will wait until we believe they have successfully demonstrated their competitive advantages and value proposition, and that these attributes have been recognized by the public markets in the stock prices of these companies.

Because we were opportunistic, we believe we can execute through the uncertainty ahead. We have cash on our balance sheet. We have early investments in ABSMaterials, Inc., Enumeral Biomedical Corp., Champions Oncology, Produced Water Absorbents, Inc. and Ultora, Inc. that are maturing and attracting capital. We have been active filling our investment pipeline while valuations are low and capital is available. We currently see the potential to make additional new equity investments in 2011.

Additionally, our more mature private portfolio companies such as Bridgelux, Inc., Cambrios Technologies Corp., Contour Energy Systems, Inc., D-Wave Systems, Inc., Kovio, Inc., Metabolon, Inc., and Xradia, Inc., have recently announced financings, partnerships or revenue growth that we believe position them to execute in the uncertainty ahead and may bring them closer to potential liquidity events. Please see the Exhibit at the end of this letter for some of the announcements made by portfolio companies during the second quarter of 2011.

We are unable to predict the vagaries of the public markets, but we believe the threat of a second recession is real. If the events of the past few weeks cause the economy to sputter further and return us to a recessionary period, we believe many of our portfolio companies are prepared. Some of our portfolio companies will struggle, particularly if they require additional capital. We believe these risks are reflected through our inclusion of a discount for non-performance risk in the values of our portfolio companies as of the end of each quarter. That said, we believe many of our most mature companies will do what they did during the past recession -- continue to grow and execute.

We believe we have adequate resources in our primary and secondary liquidity to fund our current and new investments and our operating expenses. However, as we said in our letter to shareholders for the first quarter of 2011, “we remain capital constrained in our investment in individual companies.” Therefore, we are exploring options to expand our capital available for investment in a manner that does not dilute shareholders by selling additional shares in the public markets.

2

As we look forward over the next decade, we believe our nanotechnology investment thesis has greater credibility now than it did in 2002. The first decade of nanotechnology commercialization is giving way to a second decade of rapid commercial advancement of nanotechnology. Many of our companies are growing rapidly, even in an anemic macro-environment. We think it is worth revisiting our nanotechnology thesis especially in light of the recent pessimism in the economy and in the market.

In 2002, we focused on companies enabled by nanotechnology because we believed we would profit from the breakthroughs that can become the disruptive products of tomorrow. Historically, advances in energy, healthcare and electronics occur through understanding science and technology at smaller and smaller scales. Currently, the disruptive breakthroughs are occurring at the nanoscale and below.

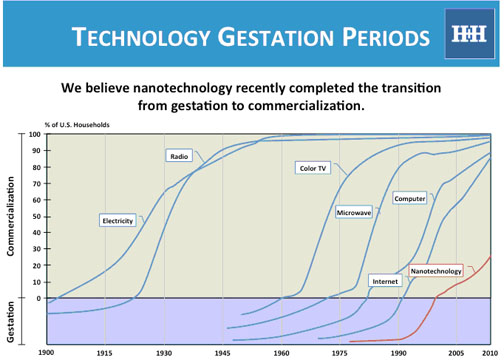

We believe nanotechnology can be classified as a foundational technology. An innovation qualifies as a foundational technology if it has the potential for pervasive use in a wide range of sectors in ways that change the competitive dynamics in those sectors. As the diagram below depicts, there have been many foundational technologies historically, and their development paths show some similarities.

First, foundational technologies go through a gestation phase. This gestation phase can last 20 years or more. During the gestation phase, the tools, materials and systems that will enable future growth are discovered and perfected. For nanotechnology, the enabling tools for imaging and manipulating at the nanoscale were invented in the late 1970s and 1980s. Many of the interesting material systems were discovered in the 1990s. Much of the first generation of products resulting from advancements in nanotechnology began to come to market after 2000, what we call the first decade in nanotechnology commercialization. Only towards the end of this first commercial decade, did product introductions begin to accelerate.

Second, after the gestation phase it often takes decades for foundational technologies to fully diffuse through their respective sectors. It took the internet close to two decades from its commercial

3

launch to reach over 80 percent of U.S. households. Nanotechnology is just beginning to become impactful, and the decades of its substantial diffusion and growth lie ahead of it. We believe this diffusion and growth in the coming decades will lead to great wealth creation from nanotechnology.

As we have published previously, the data continue to support the growing importance of nanotechnology. Most metrics in the field are increasing on average of 25 to 35 percent per year. From 2007 through 2009, through the depths of the recession, our aggregate portfolio company revenue increased. In 2010, the aggregate revenue of our own portfolio companies grew over 40 percent from $268 million to $380 million.

Over the past few years, we have seen growth in nanotechnology-enabled products being introduced into the market. The semiconductor industry continues to push its manufacturing capabilities below 100 nanometers. The introduction of sporting equipment such as rackets, golf clubs and specialty fabrics has been followed by the introduction of touch screen displays, LED lighting, new battery chemistries and newly approved therapeutics and diagnostics in the healthcare arena. Nanotechnology-enabled products are pervasive, and these products are capturing market share from those products not enabled by nanotechnology.

Many of our portfolio companies have products enabled by nanotechnology that are on the market and available for purchase. Algenist skin-care products developed by Solazyme are available from QVC and Sephora. Light fixtures that include LEDs from Bridgelux are available at Home Depot. Coin-cell batteries developed by Contour Energy are available from online stores such as Amazon.com. Smartphones with touch screens enabled by materials from Cambrios are available from MetroPCS and Huawei. Other of our companies including ABSMaterials, D-Wave Systems, Metabolon, Molecular Imprints, NeoPhotonics and Xradia, are selling their products and services directly to commercial purchasers.

Beginning around 2004, the world’s leading companies began to develop well-articulated strategies for nanotechnology. These companies realized nanotechnology would impact their competitive advantage over the coming decades. We believe this realization was among the reasons Amgen purchased BioVex and DuPont purchased Innovalight. Additionally, over two thirds of the companies in our portfolio have paid commercial partnerships or equity investments from leading worldwide companies. Many of these corporate partners are household names: Chevron, Unilever, Dow, BP, Pfizer, Bristol Myers Squibb, Novartis, Bosch, Intel, Panasonic, Samsung, Tyco and Lockheed Martin.

4

In conclusion, heading into the second half of 2011 and beyond, we believe nanotechnology has completed its gestation phase and the first decade of commercialization. The science has matured and products are becoming pervasive. If past technology cycles provide any guide, we believe the next decade of nanotechnology commercialization will be a decade of increasing commercialization and investment returns. Harris & Harris Group has demonstrated that it is a leader investing in nanotechnology-enabled companies, and we believe we are well positioned to profit as nanotechnology continues to develop.

We believe the current market conditions are incapable of differentiating quality companies. Many successful, small, entrepreneurial companies with disruptive technology are discarded. Often, these companies are the ones creating jobs. Often, these companies have transformative growth potential. In many cases, these companies are capitalized for success. In the long term, many of these companies go on to generate substantial returns for intelligent investors.

We believe the current public markets are short sighted in the value they are ascribing to TINY, to SZYM and to NPTN. We believe nanotechnology will continue to be disruptive for businesses in energy, healthcare and electronics. We believe our nanotechnology investment thesis will continue to provide us with attractive investment opportunities. We realize it is difficult for our shareholders to witness the short-term value being ascribed to the company. However, management is looking forward to building value for shareholders over the long term, and we believe this period of uncertainty creates attractive opportunities to build this value.

It was an opportunistic and good first half of the year for Harris & Harris Group. We intend to use our recent success as a further springboard to future success. As always, if you have any questions, please reach out to us.

|

|

|

Douglas W. Jamison

|

Daniel B. Wolfe

|

|

Chairman, Chief Executive Officer

|

President, Chief Operating Officer,

|

|

and Managing Director

|

Chief Financial Officer and Managing Director

|

|

|

|

Alexei A. Andreev

|

Misti Ushio

|

|

Executive Vice President and Managing Director

|

Executive Vice President and Managing Director

|

August 10, 2011

|

This letter may contain statements of a forward-looking nature relating to future events. These forward-looking statements are subject to the inherent uncertainties in predicting future results and conditions. These statements reflect the Company's current beliefs, and a number of important factors could cause actual results to differ materially from those expressed in this letter. Please see the Company's Annual Report on Form 10-K for the fiscal year ended December 31, 2010, as well as subsequent filings, filed with the Securities and Exchange Commission for a more detailed discussion of the risks and uncertainties associated with the Company's business, including but not limited to the risks and uncertainties associated with venture capital investing and other significant factors that could affect the Company's actual results. Except as otherwise required by Federal securities laws, the Company undertakes no obligation to update or revise these forward-looking statements to reflect new events or uncertainties. The reference to the website www.HHVC.com has been provided as a convenience, and the information contained on such website is not incorporated by reference into this letter.

|

5

Recent Portfolio Company News and Developments

|

ABSMaterials

|

In April 2011, field testing by DOE’s National Energy Technology Laboratory confirmed that ABSMaterials’ Osorb material could remove more than 99 percent of oil and grease from water, as well as more than 90 percent of toxic substances such as benzene, toluene, ethylbenzene and xylenes.

|

|

In June 2011, ABSMaterials noted the spinout and financing of its subsidiary, Produced Water Absorbents, Inc.

|

|

|

Adesto

|

In July 2011, Adesto announced the formation of a development and manufacturing partnership that will lead to the delivery of the first Conductive Bridging RAM-based devices in 2011.

|

|

Cambrios

|

In April 2011, Synaptics and Cambrios signed a reference design partnership agreement to bring Cambrios’ ClearOhm-based touch technology to the market.

|

|

In July 2011, Hitachi Chemical and Cambrios signed a collaboration agreement to produce photosensitive transparent conductive films that can be patterned using simple light exposure rather than expensive patterning techniques.

|

|

|

Champions Oncology

|

In April 2011, Champions Oncology announced a round of financing through private placement led by Battery Ventures.

|

|

Cobalt

|

In May 2011, Cobalt announced the close of a Series D round of financing led by the Whittemore Collection Ltd., the investment vehicle of Parsons & Whittemore.

|

|

Contour Energy

|

In June 2011, Contour Energy announced the close of a Series C round of financing led by EDBi, the investment arm of the government of Singapore.

|

|

In August 2011, Contour Energy announced a distribution agreement with INEC Medico Informatico LDA to expand distribution of its products in Spain and Portugal.

|

|

|

D-Wave Systems

|

In May 2011, D-Wave Systems announced Lockheed Martin Corporation entered into an agreement to purchase a quantum computing system from the company.

|

|

Enumeral

|

In June 2011, Enumeral completed its Series A round of financing led by us with participation from high-net-worth individual investors, a corporate investor and a venture capital firm.

|

|

Innovalight

|

In July 2011, Innovalight announced it had been acquired by DuPont.

|

1

|

Kovio

|

In June 2011, Kovio announced a round of financing led by Tyco Retail Solutions, a unit of Tyco International.

|

|

Metabolon

|

In June 2011, Metabolon announced the publication of "Identification of Metabolites in the Normal Ovary and Their Transformation in Primary and Metastatic Ovarian Cancer." The biochemical changes observed provide insight into the biochemical consequences of transformation and provide candidate biomarkers of ovarian oncogenesis.

|

|

NanoTerra

|

In July 2011, NanoTerra announced a partnership with US Equity Holdings to form a joint venture called Microline PV LLC that will seek to commercialize NanoTerra’s screen-printing technology for the manufacturing of solar cells.

|

|

Produced Water

Absorbents

|

In July 2011, Produced Water Absorbents announced the completion of an $11 million round of financing led by Energy Ventures.

|

|

|

|

|

Solazyme

|

On May 27, 2011, Solazyme completed an IPO by selling 10,975,000 shares of common stock at $18 per share.

|

|

On June 20, 2011, Solazyme announced the successful test flight of a MH 60S Seahawk helicopter fueled with a 50:50 blend of algal-derived Solajet HRJ-5® jet fuel.

|

|

|

On June 30, 2011, Solazyme announced it expanded its distribution channels for its Algenist line of cosmetics to include Sephora Canada and The Shopping Channel.

|

|

|

On July 28, 2011, Solazyme announced a distribution agreement with Space NK to bring its Algenist line of cosmetics to the United Kingdom.

|

|

|

On August 8, 2011, Solazyme and Bunge signed a framework agreement to build a commercial renewable oil plant in Brazil focused on the production of triglyceride oils.

|

2