Attached files

Xerium Technologies, Inc.

June 2011

Selected Data –

Earnings Call

EXHIBIT 99.2 |

Forward Looking Statements

•

This presentation contains forward-looking statements involving risks and

uncertainties, both known and unknown, that may cause the actual

results to differ materially from those indicated.

•

Actual results may differ materially due to a number of factors,

including

those factors discussed in our earnings press release dated August 8, 2011,

and other factors discussed in our filings with the SEC. Copies of these

filings are available from the SEC and in the investor relations

section of our

website at www.xerium.com.

•

These slides, the associated remarks and comments made during our

second quarter 2011 financial results conference call, our earnings release

dated August 8, 2011 and the reconciliation of certain non-GAAP financial

information posted in the investor relations section of our website are

integrally related and are intended to be presented and understood

together.

2 |

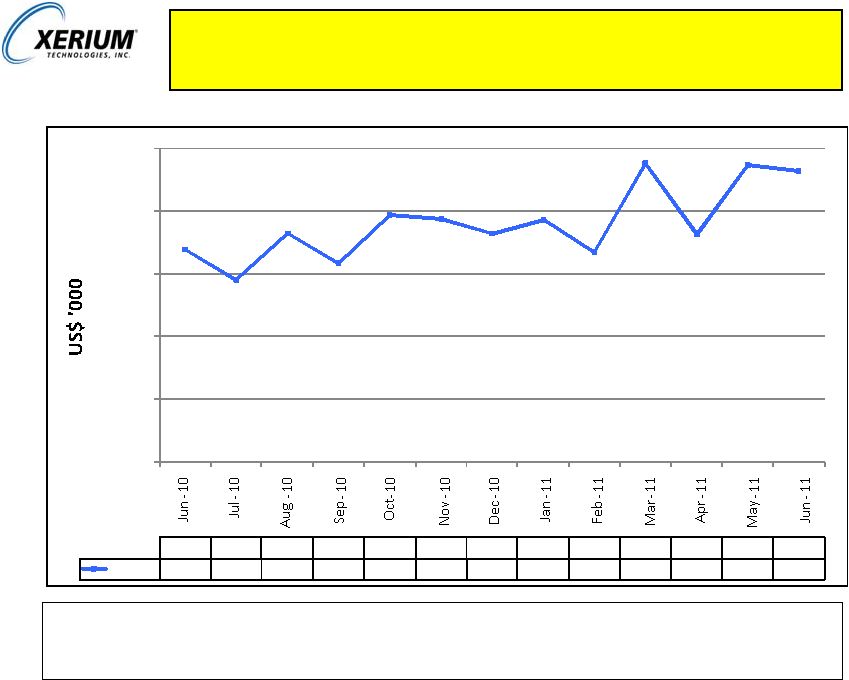

Bookings Analysis –

Total Xerium

New order bookings for Q2 2011 are $142.9M compared to Q2 2010 of $143.7M, a $0.8M

decrease. Bookings in 2011 have been positively influenced as compared

to 2010 by the USD/Euro exchange rate.

3

35,000

40,000

45,000

50,000

55,000

60,000

Jun-10

Jul-10

Aug-10

Sep-10

Oct-10

Nov-10

Dec-10

Jan-11

Feb-11

Mar-11

Apr-11

May-11

Jun-11

Bookings

49,462

47,518

43,925

51,232

48,259

48,137

46,369

53,238

50,082

52,033

42,836

51,661

48,435 |

Bookings

Analysis

–

Roll

Coverings

Rolls new order bookings of $56.0M in Q2 2011 are 17.4% higher than Q2 2010 levels

of $47.7M. Bookings in 2011 have been positively influenced as compared to

2010 by the USD/Euro exchange rate.

4

10,000

12,000

14,000

16,000

18,000

20,000

Jun-10

Jul-10

Aug-10

Sep-10

Oct-10

Nov-10

Dec-10

Jan-11

Feb-11

Mar-11

Apr-11

May-11

Jun-11

Bookings

16,789

15,809

17,279

16,341

17,890

17,758

17,276

17,739

16,713

19,549

17,263

19,475

19,304 |

Bookings

Analysis

–

Paper

Machine

Clothing

New order bookings of $86.9M are lower than Q2 2010 levels of $96.0M. PMC

bookings are being constrained to prevent lead time extension.

Bookings in 2011 have been positively

influenced as compared to 2010 by the USD/Euro exchange rate.

5

15,000

20,000

25,000

30,000

35,000

40,000

Jun-10

Jul-10

Aug-10

Sep-10

Oct-10

Nov-10

Dec-10

Jan-11

Feb-11

Mar-11

Apr-11

May-11

Jun-11

Bookings

32,673

31,709

26,646

34,891

30,370

30,395

29,095

35,502

33,370

32,484

25,572

32,187

29,132 |

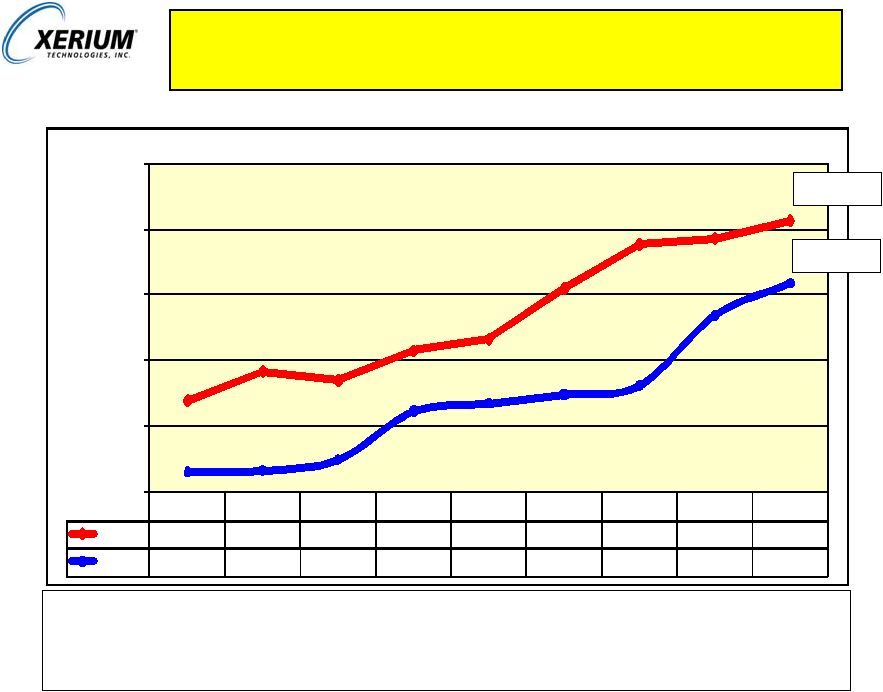

New

Product Sales as a Percent of Revenue Meaningful progress

continues on Xerium’s goal to increase its technological leadership. Our

goal is to derive 60% of XRM’s sales revenue from new products (those

developed within the prior

five

years)

that

make

a

measurable

improvement

in

customer

performance

while

simultaneously reducing our operating costs.

6

09 Q2

09 Q3

09 Q4

10 Q1

10 Q2

10 Q3

10 Q4

11 Q1

11 Q2

Clothing

23.9%

28.4%

27.0%

31.5%

33.3%

41.0%

47.7%

48.6%

51.3%

Rolls

13.1%

13.3%

14.9%

22.3%

23.5%

24.8%

26.2%

36.9%

41.8%

10%

20%

30%

40%

50%

60%

$ 51.1M

$ 21.2M |

Xerium’s New Product Categorization

7

New products are categorized by their level of innovation and strategic purpose

|

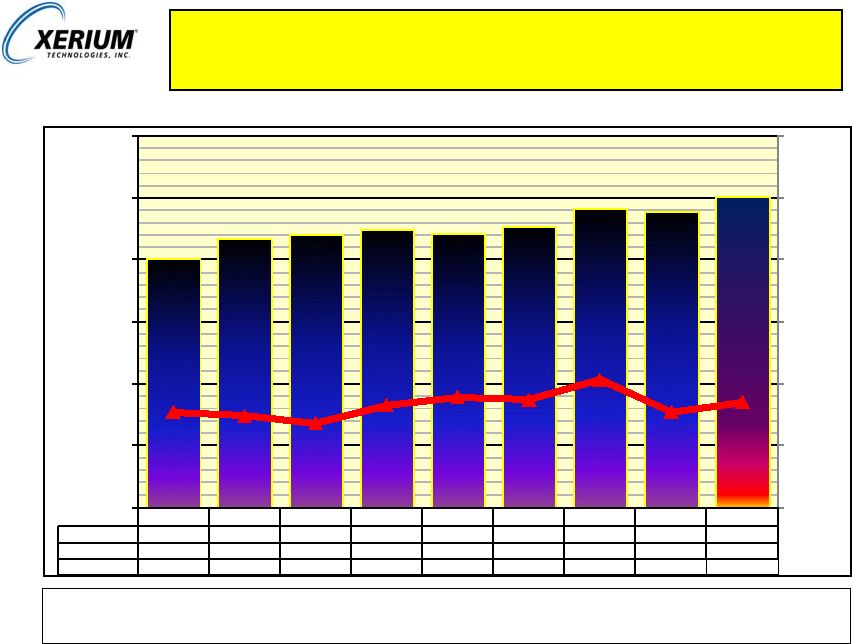

Total

Xerium Quarterly Sales and Gross Margin 000’s

Q2

2011

sales

increased

13.3%

over

Q2

2010

and

5.0%

over

Q1

2011

primarily

due

to

higher

product demand. Gross margin dollars increased 7.3% over Q1 2011.

8

'09 Q2

'09 Q3

'09 Q4

'10 Q1

'10 Q2

'10 Q3

'10 Q4

'11 Q1

'11 Q2

Qtr Sales $

120.8

130.3

132.4

135.0

132.8

135.9

144.6

143.2

150.4

Year

-

over-Year

(29.1%)

(18.2%)

(11.4%)

15.9%

9.9%

4.3%

9.2%

6.1%

13.3%

Gross Margin

37.7%

37.4%

36.8%

38.3%

38.9%

38.7%

40.3%

37.7%

38.5%

30.0%

35.0%

40.0%

45.0%

50.0%

55.0%

60.0%

$0

$30

$60

$90

$120

$150

$180 |

S G

& A as a Percent of Revenue, excluding Operational & Financial

Restructuring Expenses (A)

Excludes operational restructuring expenses

(B)

Excludes operational restructuring expenses and financial restructuring

expenses. Note –

a reconciliation of SG&A as a percentage of revenue excluding (A) operational

restructuring expenses and (B) operational and financial restructuring

expenses is available in the investor relations section of the Company’s website at www.xerium.com.

In 2011, SG&A as a percent of sales is 26.3% as compared to Q1 2011 of

27.9%. The improvement is driven primarily by a favorable Value Added

Tax (“VAT”) ruling in South America, decreased legal, insurance,

and consulting fees, and decreased incentive compensation. 9

'09 Q2

'09 Q3

'09 Q4

'10 Q1

'10 Q2

'10 Q3

'10 Q4

'11 Q1

'11 Q2

SG&A % (A)

20.9%

27.0%

31.3%

35.4%

28.9%

26.9%

25.1%

27.9%

26.3%

SG&A% (B)

20.7%

25.5%

26.4%

28.4%

28.6%

26.9%

25.1%

27.9%

26.3%

15%

20%

25%

30%

35%

40%

‘09 Q2

Sales = $120.8

‘10 Q2

Sales = $132.8

‘11 Q2

Sales = $150.4

‘09 Q2

Sales = $120.8

‘10 Q2

Sales = $132.8

‘11 Q2

Sales = $150.4 |

Trailing Twelve Month (“TTM”) Adjusted EBITDA

10

Q2-09

Q3

Q4

Q1-10

Q2

Q3

Q4

Q1-11

Q2-11

Adjusted EBITDA by Qtr

32,325

27,916

24,753

24,476

25,230

29,093

35,251

26,145

30,195

Adjusted EBITDA LTM

107,535

107,455

105,561

109,470

102,375

103,552

114,050

115,719

120,684

$100,000

$105,000

$110,000

$115,000

$120,000

$125,000

$130,000

$135,000

$140,000

$0

$5,000

$10,000

$15,000

$20,000

$25,000

$30,000

$35,000

$40,000

Note: Adjusted EBITDA at each quarter was the amount as calculated per the definition in the New

Credit Facility with the exception that we have added back financial restructuring costs

incurred in Q1 ($9.6M) and Q2 ($15.3M) of 2010 as part of the reorganization. A reconciliation of Trailing Twelve Month Adjusted

EBITDA to Net Income (Loss) is available in the investor relations section of the Company’s

website at www.xerium.com. |

Trade Working Capital (“TWC”) as a Percent of

Revenue

'09 Q2

'09 Q3

'09 Q4

'10 Q1

'10 Q2

'10 Q3

'10 Q4

'11 Q1

'11 Q2

Revenue 000's

120.8

130.3

132.4

135.0

132.8

135.9

144.6

143.2

150.4

TWC% Qx4

29.4%

27.8%

25.3%

25.6%

24.3%

26.5%

24.6%

27.7%

27.9%

$100

$110

$120

$130

$140

$150

$160

15%

20%

25%

30%

35%

Year-to-date

TWC

%

has

increased

primarily

due

to

currency,

higher

sales

demand,

prebuild

to

support annual sales targets and accelerated raw material purchases in advance of

anticipated oil driven price increases.

11

(Note: a reconciliation of Trade Working Capital to Revenue is available in the investor relations

section of the Company’s website at www.xerium.com. |

Total Xerium Annual Capital Expenditures

2008

2009

2010

2011

CAPEX

39.0

19.5

27.9

12.0

2011 Budget

32.4

$0

$15

$30

$45

000's

2011 investments focus on new products and existing equipment capacity and

performance upgrades.

12 |