Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Clearwater Paper Corp | d8k.htm |

Clearwater Paper Corporation

Jefferies 2011 Global Industrial and A&D Conference

August 9, 2011

Exhibit 99.1 |

1

Forward-Looking Statements

This presentation contains, in addition to historical information, certain forward-looking

statements within the meaning of the Private Securities Litigation Reform Act of 1995,

including statements regarding our strategies to grow our business, the benefits of, and synergies

from, our Cellu Tissue acquisition, internal and external pulp purchases and transfers,

internal pulp production and requirements, customer purchases of Private Label tissue, production capacity of operating divisions, completion of additional converting and

paper making capacity and the expected financial returns from these investments, efficiency projects

and reductions to our cost structure, our share repurchase program and stock split and the

expected benefit thereof, our capital allocation objectives, our financial priorities, such as growing free cash flow and maintaining modest leverage, estimated annual

EBITA sensitivities, the cost and timing to complete new facilities, future growth and market

opportunities, sales volumes, input costs, and our financial condition and results of

operations. Words such as “anticipate,” “expect,” “intend,”

“will,” “plan,” “target,” “project,” “believe,” “schedule,” “estimate,” “may,” and similar expressions are intended to identify

such forward-looking statements. These forward-looking statements are based on

management’s current expectations, estimates, assumptions and projections that are subject to

change. Our actual results of operations may differ materially from those expressed or implied by the

forward-looking statements contained in this presentation. Important factors that could

cause or contribute to such differences include the risk factors described in Item 1A of Part I of our Form 10-K for the year ended December 31, 2010, as well as the

following:

•

an inability to successfully implement our expansion and operating strategies; •

difficulties with the integration process or the realization of the benefits expected from the

acquisition of Cellu Tissue;

•

difficulties with the completion of our new tissue making and converting facilities; •

the Cellu Tissue acquisition may expose our operations to unidentified liabilities; •

changes in the cost and availability of wood fiber used in the production of our products; •

changes in freight costs and disruptions in transportation services; •

changes in raw material costs and energy availability and costs; •

changes in customer product preferences and competitors’ product offerings; •

changes in the United States and international economies and in general economic conditions in the

regions and industries in which we operate;

•

cyclical industry conditions;

•

the loss of business from any of our three largest Consumer Products segment customers or a large

Pulp and Paperboard segment customer;

•

competitive pricing pressures for our products; •

reliance on a limited number of third party suppliers for raw materials; •

our qualification to retain, or ability to utilize, tax credits associated with alternative fuels or

cellulosic biofuels and the tax treatment associated with such credits; •

unforeseen environmental liabilities or expenditures; •

unanticipated manufacturing or operating disruptions, including equipment malfunction and damage to

our manufacturing facilitates caused by fire or weather-related events and IT system

failures; •

changes in the relationship between supply and demand in the forest products industry,

including the amount of available manufacturing capacity and wood fiber used in manufacturing

our products;

•

changes in expenses and required contributions associated with our pension plans; •

labor disruptions;

•

an inability to fund our debt obligations; •

restrictions on our business from debt covenants and terms; •

changes in laws, regulations or industry standards affecting our business; and •

changes in exchange rates between the U.S. dollar and other currencies. Forward-looking statements contained in this presentation present management’s views

only as of the date of this presentation. We undertake no obligation to publicly update

forward-looking statements, whether as a result of new information, future events or otherwise. |

2

•

We are a company formed two years ago with

more than 60 years of operating history

•

A leader in Private Label consumer tissue and

bleached paperboard

•

Focused on producing high quality products

that help our customers build their brands

•

Operate

in

two

segments

of

similar

size

1

–

Pulp

and

Paperboard

–

51%

–

Consumer

Products

–

49%

•

Financial overview

–

LTM 6/30/11 Net Sales: $1.7 billion

–

LTM 6/30/11 Adjusted EBITDA: $189.4

million

–

5 year average annual Free Cash Flow

(FCF) generation (2006-2010): $76.9 million

1

Last twelve months (LTM) net sales as of 6/30/11

Introduction to Clearwater Paper |

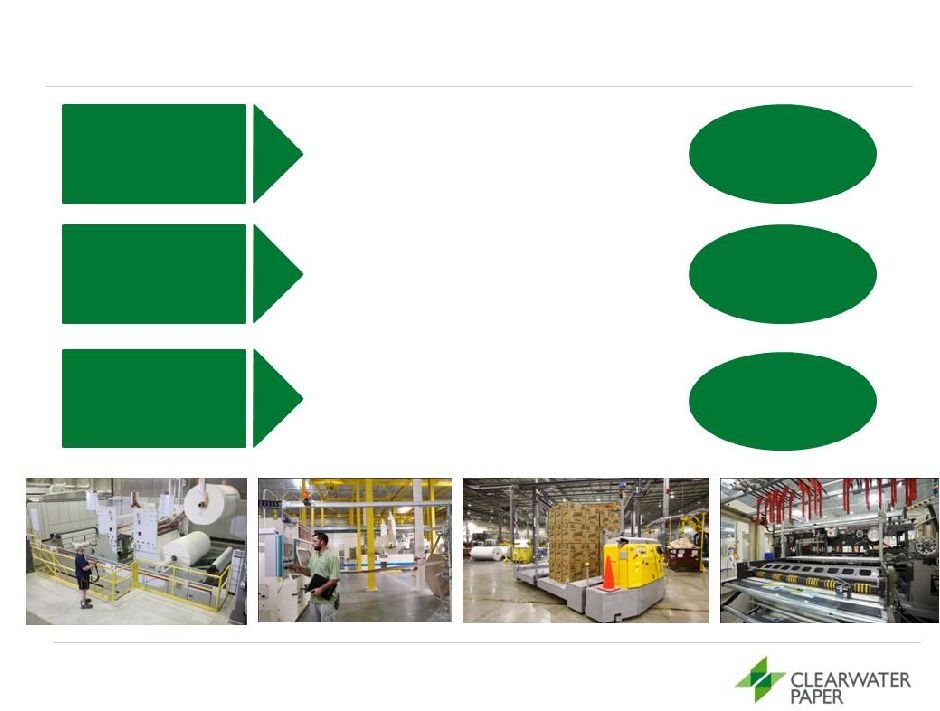

3

•

Lead Private Label quality

•

Expand geographically

•

Expand retail channel

penetration

Our Strategy

Grow our Tissue

Business

New Shelby

Facility and

CLU

Acquisition

•

Improve sales mix

•

Reduce costs

•

Continue to improve quality

LEAN

Manufacturing

and Capital

Improvements

=

=

Build a High

Performance

Culture

•

Develop common culture

•

Drive for results

•

Attract and retain high

performers

Core Values

and Talent

Management

=

Optimize

Profitability of

Paperboard

Business |

4

New Shelby Facility |

Shelby

•

ON BUDGET with original estimate of $260-

$280 million

•

ON TIME with original construction

projections

•

ON QUALITY with selection of Metso

technology

•

ON TASK with dedicated project team to

ensure results

5

•

First two converting lines operational

•

Consolidate third-party warehouse to

Shelby

•

Paper machine and remaining

converting lines operational

•

Commence product trials |

Shelby

6 |

Shelby

7 |

Shelby

8 |

9

Cellu Tissue Acquisition |

of the

total category 10

Expansion Opportunities

Clearwater Paper has been a strong influence in the development of private label

tissue in the Western U.S. An opportunity exists to grow private label

category development and company share in the Eastern U.S.

Source: SymphonyIRI InfoScan. 52 Weeks Ending May 29,

2011 Data excludes Cellu Tissue

WESTERN

GROCERY

23%

of the U.S. Population

Corporate Brand

39%

of the total category

Clearwater Paper

91%

of total corporate brand

MID-WESTERN

GROCERY

33%

of the U.S. Population

Corporate Brand

27%

of the total category

Clearwater Paper

66%

of total corporate brand

EASTERN

GROCERY

44%

of the U.S. Population

Corporate Brand

24%

of the total category

Clearwater Paper

28%

of total corporate brand

TOTAL U.S.

GROCERY

100%

of the U.S. Population

Corporate Brand

28%

Clearwater Paper

57%

of total corporate brand |

11

The acquisition of Cellu Tissue provides us with . . .

•

A national manufacturing footprint that allows greater

efficiencies

•

New retail channel opportunities

•

Estimated annual run rate synergies of $35-$40 million by the end

of 2012

Strategic Benefits of Acquisition |

Estimated Breakdown of Acquisition Synergies*

12

Manufacturing –

Moving parent rolls to converted

cases

Transportation –

Product spec changes and lower

miles

Warehousing –

Closing duplicate facilities

Procurement –

Purchasing power and economies

of scale

Fiber

–

Increased use of internal pulp

Wages

–

Streamlining processes and overhead

Dedicated team focused on delivering synergies!

* Estimated annual run rate synergies of $35-$40 million by the end of

2012 |

13

Consumer Tissue |

14

Attractive Industry Characteristics

Within

the

tissue

market,

Private

Label

penetration

has

also

grown

substantially

since

2002

2

The

tissue

market

has

grown

an

average

of

2%

annually

since

1996

1

Source: RISI and IRI

1 Based on converted short tons

2 Represents market share as a % of sales in U.S. grocery channel

|

15

Therefore they require:

•

National brand-like quality to support high quality store

brands

•

High quality packaging and branding support

•

Complete mix of product offerings to support retailer

assortment objectives

•

Category management support and expertise

•

Experience and execution to deliver a comprehensive

Private Label tissue program

Private Label is a Strategic Focus for Retailers |

Private Label Packaging Quality is More Important Than

Ever Before

16

Mid 60’s to 70’s

2011

•

Private Label tissue packaging has become

more brand-like in quality since the early

days of generic store brand tissue

•

Clearwater Paper manages over 1,300 retail

package sku’s for its customers |

Tissue is an Important Category for Retailers

SOURCE: 52 Week Sales Food, Drug, Mass without Wal-Mart, May 29, 2011,

Symphony IRI 17

Segment

% Category (cases)

Annual Sales

Bath Tissue

55%

$4.2B

Paper Towels

32%

$2.5B

Facial Tissue

7%

$795MM

Paper Napkins

6%

$360MM

Est.

Total Category

$7.86B |

The

Tissue Category – Lots of Options For Consumers . . . .

•

Single Ply

•

Double Ply

•

Triple Ply

•

Ultra Quality

•

Premium Quality

•

Value Quality

•

Economy Quality

•

Virgin Fiber

•

Recycled Fiber

18 |

The

Tissue Category – even more options…

19 |

20

Complex Category Segmentation Requires Expertise

•

Clearwater Paper is well represented in all segments of the tissue category,

including a leading presence in the value and economy product tier

•

Clearwater Paper is the category leader in providing a full-range of product

tier offerings nationwide

Quality

Tier

Bathroom Tissue

Household

Towels

Facial Tissue

Napkins

3 National

Brands

Private

Label 4,

6, 9, 12, 18, 24, 30 roll packs

Private Label

1,2,6,8,12,15 roll packs

Private Label

Multiple standard count

cartons

2 National Brands

Private Label

40,60,100,200 count

packs

30% of Bath

Segment

53% of Towel

Segment

24% of Facial

Segment

30% of Napkin

Segment

Private Label

4, 6, 9, 12, 18, 24, 30

roll packs

Private Label

1,2,3,6,8,12 roll packs

Private Label

Multiple standard

count cartons

Private Label

160,200 count packs

45% of Bath

Segment

24% of Towel

Segment

71% of Facial

Segment

10% of Napkin

Segment

No Leading National

Brand

Private Label

1, 4, 6, 9, 12, 24 roll packs

No Leading National

Brand

Private Label

1,3,6,8,12,15 roll packs

No Leading National

Brand

Private Label

No standard counts

No Leading National

Brand

Private Label

Multiple standard counts

23% of Bath

Segment

20% of Towel

Segment

4% of Facial

Segment

56% of Napkin

Segment

Small Niche

Brands

Private

Label 4, 6, 12

roll packs Private Label

1,3,6 roll packs

Small Niche Brands

Private Label

No standard counts

Small Niche Brands

Private Label

No standard counts

2% of Bath

Segment

3% of Towel

Segment

1% of Facial

Segment

4% of Napkin

Segment

ULTRA

highest

quality

attributes

PREMIUM

higher

quality

attributes

VALUE /

ECONOMY

lower

quality,

price driven

value

GREEN

RECYCLED

Niche

segment

for green

consumers

2 National Brands

2 National Brands

2 National Brands

2 National Brands

2 National Brands

Small Niche Brands

2 National Brands |

Clearwater Paper Adds Unique Value Through FSC and

Rainforest Alliance Certification

21 |

22

Paperboard |

23

Attractive Industry Characteristics

100

99

105

103

108

102

100

100

101

106

108

108

109

108

97

101

$880

$760

$810

$740

$713

$773

$728

$700

$727

$713

$772

$718

$861

$961

$1,031

$1,082

600

800

1,000

1,200

60

80

100

120

1995

1996

1997

1998

1999

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

U.S. Bleached Paperboard Demand (Indexed)²

U.S. Bleached Paperboard Price ($/short ton)³

Source: RISI.

1 Top 5 manufacturers in 1998 were International Paper, Westvaco,

Temple-Inland, Georgia-Pacific and Potlatch. Top 5 manufacturers in 2010 were International Paper, MeadWestvaco,

Georgia-Pacific, Evergreen Packaging and Clearwater Paper

2 Based on tons produced

3 Average price per short ton of 16 pt. SBS folding carton C1S

2010 North American Bleached

Paperboard (SBS) Production

Pulp

and

Paperboard

1

Capacity

Top 5 Manufacturers

Stable demand for U.S. paperboard products

Demand

Price |

Estimated Industry Mix

24

SOURCE: RISI / Company Websites / Internal Estimates

Cup

Liquid Packaging

Folding/CIS |

25

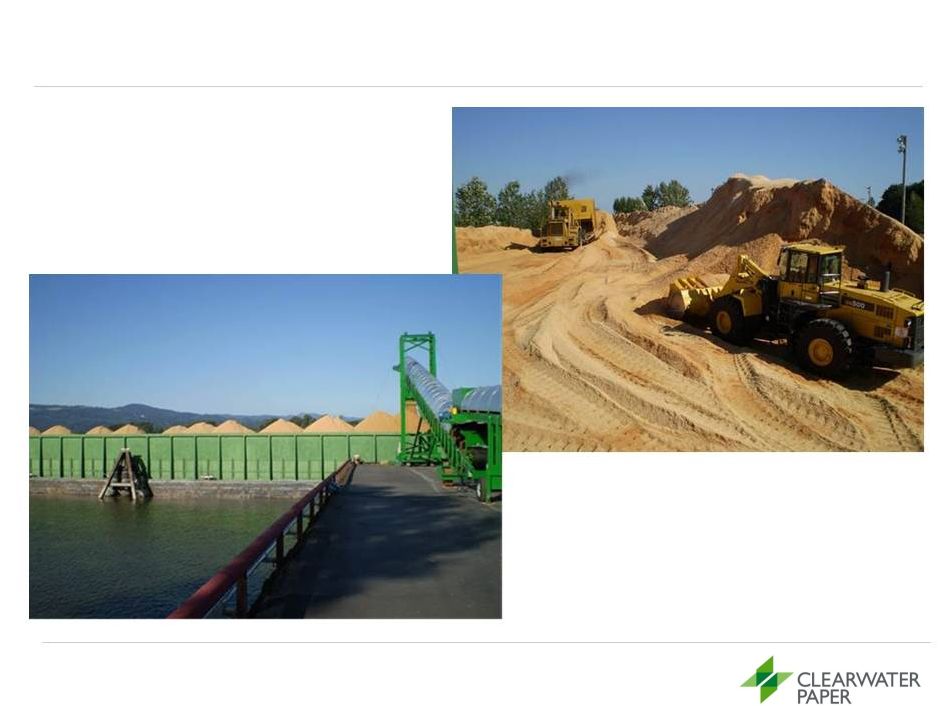

Efficiency and Optimization

•

Lean initiatives focusing on non-capital solutions for driving out

waste and improving quality

•

Cost reduction projects:

•

Lower Columbia reload facility for sawdust to increase fiber

supply

•

Chip screening at Lewiston to improve quality

•

Refocusing pulp mill operations as cost centers to

concentrate resources on improving efficiency

•

Strong pulp integration –

we produce 68% of our pulp

requirements |

Lower Columbia Reload Facility

26 |

27

Financial Overview |

Financial Priorities

•

Grow free cash flow through strong operating performance

•

Maintain

modest

leverage

in

the

range

of

Net

Debt/EBITDA

of

1x –

4x

•

Focus on appropriate liquidity levels for growth and business

cycles

•

Deploy capital effectively and perform post audits

28 |

Stock Repurchase

Debt Pay Down

Pension Payments

Dividend

Shorter

Longer

Illustrative of Projects Meeting Return Hurdle Rates

Greenfield

M&A

29

Our objective is to allocate capital using a dynamic framework to

create strong returns to shareholders

while providing appropriate

liquidity to meet growth objectives and compete effectively

Capital Allocation

Return Timeframe

Capital allocation CLW has deployed

Capital |

Recent Financial Announcements

Share Repurchase

•

Repurchase of up to $30 million of common stock

•

Expect to fund repurchase with cash on hand

•

May repurchase shares in the open market or as otherwise may be determined by

management, subject to market conditions, business opportunities, and other

factors •

Purchases

would

help

offset

share

dilution

from

equity

incentive

plans

2-for-1

Stock

Split

•

Stock dividend payable on August 26, 2011 to shareholders of record on August 12,

2011 •

11,519,260 shares outstanding at June 30, 2011. Immediately following the

distribution of the stock dividend, approximately 23 million shares

outstanding •

Split intended to improve share liquidity

•

Significant share price appreciation since spin also a factor

30 |

CPD

PPD

Adj. EBITDA Margin %

Financial Track Record

Adjusted EBITDA and Segment Adjusted EBITDA

5 Yr. Average (excluding LTM): $124

$41

$34

$53

$138

$87

$78

$70

$80

$35

$51

$111

$139

9.0%

8.8%

6.0%

13.9%

12.2%

11.4%

2006

2007

2008

2009

2010

LTM

$445

$452

$504

$554

$570

$825

$672

$731

$751

$696

$803

$876

2006

2007

2008

2009

2010

LTM

31

($ in millions)

Net Sales and Segment Net Sales

$1,117

$1,183

$1,255

$1,250

$101

$104

$75

$174

$1,373

$167

$1,701

$189

3

1

2

1

Excludes

intersegment

net

sales

and

transfers.

Net

sales

for

2010

for

CPD

includes

four

days

of

Cellu

Tissue

results.

Prior

periods

have

no

Cellu

Tissue

amounts

2 See

Appendix:

“Detailed

Financials”

for

the

definition

of

Adjusted

EBITDA

and

Segment

Adjusted

EBITDA

as

well

as

the

reconciliation

to

the

most

comparable

GAAP

measures

3 Adjusted EBITDA margin percentage calculated by dividing Adjusted EBITDA by

Net Sales 5 Yr. Average (excluding LTM): $1,236 |

Historical Cost Drivers -

Wood Fiber

32

Total Cost

:

% of Total

Cost of Sales

2009

2010

2008

$325.4 M

28%

$269.7 M

26%

$314.3 M

27%

1 Excludes intersegment amounts and CLU amounts prior to acquisition

•

Wood fiber includes pulp, wood chips, sawdust and saw logs

•

Historically, we were a net buyer of approximately 85,000 tons of pulp

annually. Going forward, we expect to be a net buyer of

approximately 400,000 tons of pulp annually •

Historically and prior to the Cellu Tissue acquisition, we produced approximately

800,000 tons of pulp representing about 92% of our total annual pulp

needs. We expect to continue to produce the same amount of pulp going

forward, which would represent approximately 68% of our total anticipated

annual pulp needs •

Generally we use a mix of pulp including northern softwood, southern softwood,

northern hardwood, eucalyptus and recycled

•

Commencing on January 1, 2011, we began accounting for the transfer of pulp from

the Pulp and Paperboard division to the Consumer Products division at cost

instead of market price because, over time, we intend to use all of our pulp

internally. Accordingly, there will be no intersegment

sales for this item going forward

$124.9 M

29%

Q2’11

LTM

6/30/11

$394.5 M

28%

Wood

Fiber

1 |

Historical Cost Drivers –

All Other

33

Total Cost:

% of Total

Cost of Sales

2009

2010

Energy

2008

Total Cost:

% of Total

Cost of Sales

Total Cost

:

% of Total

Cost of Sales

$143.0 M

12%

$114.7

10%

$97.3

9%

$92.0

8%

$123.2

10%

$100.3

9%

$117.3

10%

$ 61.9

5%

$70.0

7%

$82.4

7%

$123.2 M

12%

$132.3 M

11%

Maintenance

& Repair

Total Cost:

% of Total

Cost of Sales

Chemicals

1 Excludes related labor costs

Transportation

Q2’11

$31.8

7%

$36.6

8%

$22.3

5%

$44.3 M

10%

$111.5

8%

$131.1

9%

$87.4

6%

$151.8 M

11%

LTM

6/30/11

1 |

34

Cost Sensitivities

Change

EBITDA

Variable

Metric

$/Unit

($ Millions)

Purchased Pulp

$/Ton

$50.00

+/-

$20

Chips/Sawdust

$/Ton

$5.00

+/-

$9

Transportation

$/Gallon

$1.00

+/-

$9

Chemicals

$/Prod Ton

$5.00

+/-

$7

Natural Gas

$/mmbtu

$0.50

+/-

$5

Estimated Annual EBITDA Sensitivities

$0

$5

$10

$15

$20

$25

+/-

+/-

+/-

+/-

+/- |

35

($ in millions)

1

See

Appendix

“Detailed

Financials”

for

the

definition

of

EBITDA,

Adjusted

EBITDA

and

Free

Cash

Flow

as

well

as

a

reconciliation

to

the

most

comparable

GAAP

measures.

2009,

2010

and LTM

amounts are Adjusted EBITDA and all other periods represent EBITDA

2

See

Appendix

“Detailed

Financials”

or

supporting

schedules

3

We

converted

gallons

previously

claimed

un

the

Alternative

Fuel

Mixture

Tax

Credit,

or

AFMTC,

to

Cellulosic

Biofuel

Producer

Credit,

or

CBPC

Free Cash Flow

Free

cash

flow

on

an

LTM

basis

was

impacted

by

Shelby

capital,

taxes

paid

in

connection

with

our

transition

to

CBPC

and

pension

funding

2006

2007

2008

2009

2010

LTM through

6/30/11

EBITDA/Adjusted EBITDA

1

$100.6

$103.7

$75.4

$174.3

$166.8

$189.4

Capital Expenditures

(27.5)

(20.5)

(21.3)

(19.3)

(46.1)

(94.9)

Cash Taxes Paid

2

(12.4)

(14.1)

(5.6)

(41.3)

(28.6)

(55.3)

Cash Net Interest Expense

(13.0)

(13.0)

(13.1)

(15.1)

(15.9)

(30.1)

Working Capital Dec (Inc)

2

13.9

37.6

(21.2)

(99.6)

88.5

(57.6)

Other Cash Flow Items

2

6.9

(5.7)

6.6

88.2

(44.7)

(31.2)

Free Cash Flow

1

$68.5

$88.0

$20.8

$87.2

$120.0

(79.7)

3 |

36

($ in millions)

Balance Sheet

2009

2010

Q2 2011

Current Assets

Cash & Short-Term Investments

$190.8

$148.7

$128.1

Receivables, net

94.5

153.3

182.0

Taxes Receivable

101.3

10.4

12.2

Inventories

169.8

228.3

223.6

Prepaid Expenses and Other

15.9

48.8

50.2

$572.3

$589.5

$596.1

Long-Term Assets

Property, Plant & Equipment

364.0

654.5

696.8

Goodwill & Intangibles

-

285.9

282.5

Other

11.2

15.4

13.5

375.2

955.8

992.8

Total Assets

$947.5

$1,545.3

$1,588.9

Current Liabilities

Accounts Payable & Accrued Liabilities

109.8

184.6

183.2

Other

9.9

10.5

25.0

Long Term Liabilities

Long Term Debt

148.3

538.3

523.6

Deferred Taxes

-

61.1

75.5

Other Long Term Obligations

242.3

210.5

215.5

Accrued Taxes

73.5

72.0

73.4

Total Liabilities

$583.8

$1,077.0

$1,096.2

Total Stockholders' Equity

$363.7

$468.3

$492.7

Total Liabilities & Stockholders' Equity

$947.5

$1,545.3

$1,588.9

Cash and Short-Term Investments

$190.8

$148.7

$128.1

Available Revolver Amount

106.8

121.0

116.6

Total Liquidity

$297.6

$269.7

$244.7

Adjusted

EBITDA

to

Interest

Expense,

net

1

11.2X

7.4X

4.8X

Total

Debt/Adjusted

EBITDA

0.9

3.2

NA

1

See Appendix “Detailed Financials” for the definition of EBITDA, Adjusted EBITDA and Free

Cash Flow as well as a reconciliation to the most comparable GAAP measures. 2009, 2010 and

LTM amounts are Adjusted EBITDA and all other periods represent EBITDA Assets

Liabilities

1 |

37

Appendix:

Detailed Financials |

38

Income Statement

($ in millions)

1

See

Appendix

for

definition

of

EBITDA

and

a

reconciliation

to

most

comparable

GAAP

measure

2006

2007

2008

2009

FY 2010

Q2 2011

LTM Through

6/30/11

Net Sales

$1,116.9

$1,183.0

$1,255.3

$1,250.1

$1,373.0

$494.6

$1,658.9

Costs & Expenses

Materials, Labor, & Other Operating Expenses

1,033.6

1,083.8

1,179.4

1,052.2

1,173.8

433.3

1,433.6

Selling, General, & Administrative

45.5

46.8

47.4

71.1

100.4

27.5

117.0

Income from Canadian Lumber Settlement

8.5

-

-

-

-

-

-

Alternative fuel mixture tax credit

-

-

-

170.6

-

-

-

Earnings (Loss) Before Interest, Other,

Debt Retirement Costs and Income Taxes

$46.3

$52.4

$28.5

$297.4

$98.8

$33.8

$108.3

Margin (%)

4.1%

4.4%

2.3

%

23.8

%

7.2%

6.8%

6.5%

Depreciation and Amortization

54.3

51.3

47.0

47.4

47.7

18.9

61.5

EBITDA

1

$100.6

$103.7

$75.4

$338.7

$146.5

$52.4

$169.1

Margin (%)

9.0%

8.8%

6.0

%

27.1

%

10.7%

10.6%

10.2%

Interest Expense

13.0

13.0

13.1

15.5

22.6

11.0

36.5

Debt Retirement Cost

-

-

-

6.2

-

-

-

Other

-

-

-

-

-

0.2

0.7

Earnings Before Income Taxes

$33.3

$39.4

$15.3

$275.7

$76.2

$22.6

$71.1

Income Tax provision

12.4

14.1

5.6

93.2

2.4

8.6

(1.2)

Net Earnings

$20.9

$25.3

$9.7

$182.5

$73.8

$13.9

$72.3 |

39

Reconciliation of GAAP to Non-GAAP:

Net Cash from Operating Activities to Free Cash Flow

($ in millions)

1

2009

amount

excludes

$170.6

million

of

alternative

fuel

mixture

tax

credits

for

the

period

late

January

through

December

31,

2009

2006

2007

2008

2009

2010

LTM through

6/30/11

Net Cash Provided by Operating

Activities

1

$96.0

$108.5

$42.1

$54.2

$185.6

$65.4

Capital Expenditures

(27.5)

(20.5)

(21.3)

(19.3)

(46.1)

(94.9)

Non-cash Net Interest Expense

-

-

-

0.4

6.7

6.4

Non-cash Tax Expense

-

-

-

51.9

(26.2)

(56.6)

Free Cash Flow

1

$68.5

$88.0

$20.8

$87.2

$120.0

(79.7) |

40

Free Cash Flow –

Working Capital

($ in millions)

2006

2007

2008

2009

2010

LTM through

6/30/11

Dec (Inc) in Receivables

$(21.2)

$18.8

$(8.8)

$9.5

$(9.9)

$(23.0)

Dec (Inc) in Tax Receivables

-

-

-

(101.3)

$93.8

$(9.4)

Dec (Inc) in Inventories

32.1

(8.5)

(14.0)

(16.8)

(3.9)

(25.4)

Dec (Inc) in Prepaid Expenses

(0.7)

0.4

(0.5)

0.1

(5.0)

(0.9)

Inc (Dec) in Taxes Payable

4.6

18.1

0.8

(0.8)

-

(2.7)

Inc (Dec) in Accounts Payable

and Accrued Liabilities

(0.8)

8.9

1.3

9.7

13.5

3.8

Working Capital Dec (Inc)

$13.9

$37.6

$(21.2)

$(99.6)

$88.5

$(57.6) |

41

Free Cash Flow –

Other

($ in millions)

2006

2007

2008

2009

2010

LTM through

6/30/11

Equity-Based Compensation

Expense

$1.4

$3.3

$2.3

$5.6

$8.5

$8.4

Employee Benefit Plans

3.0

(1.0)

1.1

14.1

15.0

13.9

(Gain) Loss on Disposal of

Plant and Equipment

0.3

0.1

(0.2)

0.2

0.5

1.1

Change in Other Assets

-

-

(1.6)

(0.5)

0.1

6.0

Funding of Qualified Pension

Plans

(6.1)

-

-

-

(25.1)

(24.6)

Excess Tax Benefit from Share-

based Payment Arrangements

-

-

-

(0.1)

(0.9)

1.7

Change in Non-current Accrued

Taxes

-

-

-

73.5

(4.3)

(3.7)

Change in Deferred Taxes

8.3

(8.1)

4.9

(4.6)

(15.0)

(7.1)

Other

-

0.1

0.1

-

(23.5)

(26.9)

Other Cash Flow Items

$6.9

$(5.7)

$6.6

$88.2

$(44.7)

$(31.2) |

42

Reconciliation of GAAP to Non-GAAP:

Clearwater Paper EBITDA and Adjusted EBITDA

1 See last page of this Appendix for definitions of EBITDA and Adjusted

EBITDA ($ in millions)

2006

2007

2008

2009

2010

Q2 2011

LTM through

6/30/11

Net Earnings

$20.9

$25.3

$9.7

$182.5

$73.8

$13.9

$72.3

Income Tax Provision (Benefit)

12.4

14.1

5.6

93.2

2.4

8.6

(1.2)

Interest Expense

13.0

13.0

13.1

15.5

22.6

11.0

36.5

Earnings Before Interest and

Income Taxes

46.3

52.4

28.5

291.2

98.8

33.5

107.6

Depreciation & Amortization

54.3

51.3

47.0

47.4

47.7

18.9

61.5

EBITDA

1

$100.6

$103.7

$75.4

$338.7

$146.5

$52.4

$169.1

Alternative Fuel Mixture Tax

Credit

-

-

-

(170.6)

-

-

-

Debt Retirement Costs

-

-

-

6.2

-

-

-

Cellu Tissue Acquisition

Related Expenses

-

-

-

-

20.3

-

20.3

Adjusted EBITDA¹

$100.6

$103.7

$75.4

$174.3

$166.8

$52.4

$189.4 |

43

Reconciliation of GAAP to Non-GAAP:

Clearwater Paper Segment EBITDA and Segment Adjusted EBITDA

($ in millions)

1 See last page of this Appendix for definitions of Segment EBITDA and Segment

Adjusted EBITDA 2006

2007

2008

2009

2010

Q2 2011

LTM Through

6/30/11

Consumer Products

Operating Income

$25.7

$17.6

$37.3

$122.1

$63.7

$6.9

$38.8

Depreciation

15.8

16.3

15.7

16.0

17.0

12.2

33.0

Other, net

-

-

-

-

-

0.3

(0.2)

Segment EBITDA

1

$41.5

$33.9

$53.0

$138.1

$80.7

$19.4

$71.6

Cellu Tissue Acquisition

Related Expenses

-

-

-

-

6.4

-

6.4

Segment Adjusted EBITDA

1

$41.5

$33.9

$53.0

$138.1

$87.2

$19.4

$78.0

Pulp & Paperboard

Operating Income

$32.2

$45.0

$4.4

$191.9

$81.9

$34.5

$111.4

Depreciation

38.1

34.6

30.9

29.9

28.7

6.5

27.2

Segment EBITDA

1

$70.2

$79.6

$35.3

$221.8

$110.6

$41.0

$138.6

Alternative Fuel Mixture Tax

Credits

-

-

-

(170.6)

-

-

-

Segment Adjusted EBITDA

1

$70.2

$79.6

$35.3

$51.1

$110.6

$41.0

$138.6 |

44

Definitions of Non-GAAP Measures

Clearwater Paper Definitions of Non-GAAP Measures

EBITDA

is a non-GAAP measure that Clearwater Paper management uses to evaluate the

cash generating capacity of Clearwater Paper. The most directly comparable

GAAP measure is net earnings. EBITDA, as defined by Clearwater Paper management, is net earnings adjusted for net

interest

expense,

income

taxes,

and

depreciation

and

amortization.

It

should

not

be

considered

as

an

alternative

to

net

earnings

computed

under

GAAP.

Adjusted EBITDA

is a non-GAAP measure that Clearwater Paper management defines as EBITDA

adjusted for items that we do not believe are indicative of our core

operating performance, including acquisition related expenses and alternative fuel mixture tax credits. The most directly

comparable GAAP measure is net earnings. It should not be considered as an

alternative to net earnings computed under GAAP. Segment EBITDA

is a non-GAAP measure used by Clearwater Paper management. The most directly

comparable GAAP measure is segment operating

income.

Segment

EBITDA,

as

defined

by

Clearwater

Paper

management,

is

segment

operating

income

adjusted

for

segment

depreciation

and

amortization.

It

should

not

be

considered

as

an

alternative

to

segment

operating

income

computed

under

GAAP.

Segment

Adjusted

EBITDA

is

a

non-GAAP

measure

that

Clearwater

Paper

management

defines

as

Segment

EBITDA

adjusted

for

nonrecurring

expenses or income, including alternative fuel mixture tax credits. The most

directly comparable GAAP measure is segment operating income. It

should not be considered as an alternative to segment operating income computed

under GAAP. Free Cash Flow

is a non-GAAP measure that Clearwater Paper management uses to evaluate the

financial performance of Clearwater Paper. The most

directly

comparable

GAAP

measure

is

net

cash

from

operating

activities.

Free

Cash

Flow,

as

defined

by

Clearwater

Paper

management,

is

net cash from operating cash flows adjusted for capital expenditures, non-cash

interest expense and non-cash tax expense. It should not be considered

as an alternative to net cash from operating activities computed under GAAP. |

45

Appendix:

Estimated Pulp Flow and

Synergy Example |

46

Pulp Flows

1

Note:

Assumes 60,000 tons in external pulp sales

32%

68%

Pulp Sources

Internal

External

1

460,000 MT

87%

13%

By Division

Consumer

Products

30%

70%

Recycled/Virgin

40%

60%

Virgin

Idaho Pulp + Paperboard

NBSK

NBHK

Hardwood

BEK

NBHK

SBHK

Recycled

SOP, DIP,

Other

Softwood

NBSK

SBSK |

Synergy Opportunity Example

large

converting

winder

in

Neenah,

WI

(formerly

Cellu

Tissue)

can

more

efficiently produce Away-from-Home products and 1000 count bathroom

tissue Actions:

1.

Relocate a wrapper machine from Elwood, IL (formerly CLW) to Neenah, WI

2.

Reposition an underutilized case packer in Neenah, WI

3.

Redirect the existing 1000 count product from Lewiston, ID (formerly CLW) and

Thomaston, GA (formerly CLU) to Neenah, WI

4.

Increase the production schedule of the existing underutilized large converting

winder in Neenah, WI from 5 to 7 days

Expected Results:

1.

Creates

new

case

capacity

in

the

systems

at

Neenah,

Lewiston

and

Thomaston

2.

Reduces freight

3.

Improves paper machine trim

47

Underutilized |

48

Appendix:

Other Information |

30%

17%

16%

7%

6%

5%

4%

2%

2%

2%

1%

1%

1%

1%

1%

1%

0%

0%

0%

4%

0.0%

5.0%

10.0%

15.0%

20.0%

25.0%

30.0%

35.0%

49

2010 North American Tissue Market by Producer

Remaining Manufacturing Base Highly Fragmented

Large Brand Manufacturers

Source: Equity research.

1 Represents Clearwater Paper tissue parent roll capacity combined on a

pro forma basis with Cellu Tissue tissue parent roll production. 1

The Combined Company was the Sixth-Largest Manufacturer in

the

North American Tissue Market in 2010 |

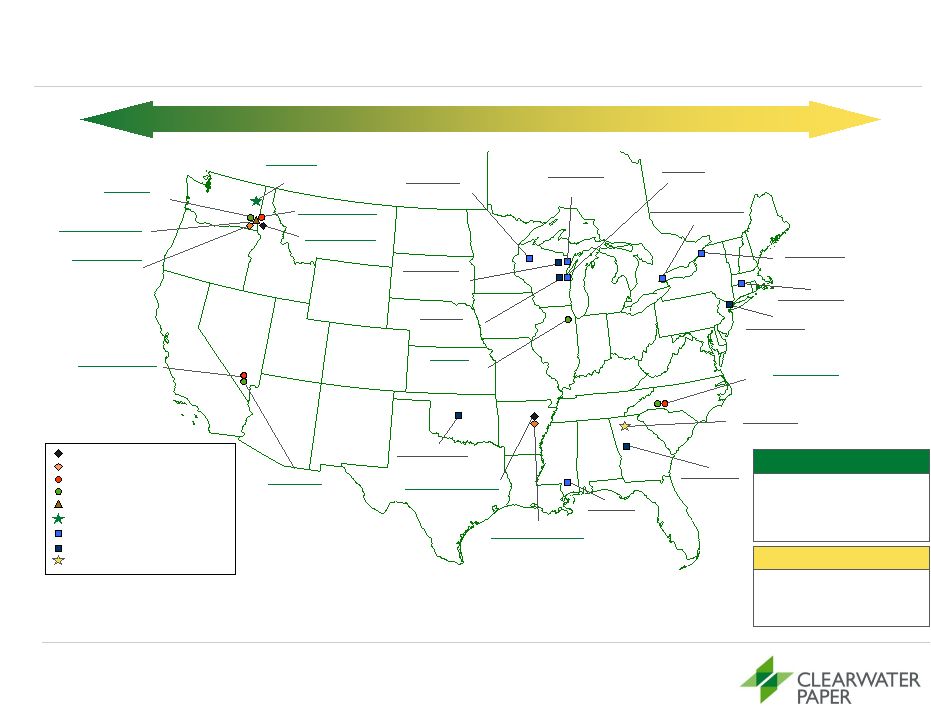

1 Clearwater Paper capacities exclude tissue facility under construction in

Shelby, NC expected to have 70,000 tons of annual capacity and converting

facility expected to be operational in FY 2012. 2 Excludes foam

capacity. 3 MG stands for machine-glazed paper.

50

National Manufacturing Footprint

Clearwater Paper

Cellu Tissue

Complementary Geographic Asset Bases

Bleached Paperboard

765,000 tons

Tissue Parent Roll

227,000 tons

Tissue Converting

221,000 tons

Pulp

845,000 tons

Sawmill

215,000 mbf

Clearwater Paper Capacities¹

Clearwater Paper Pulp

Clearwater Paper Sawmill

Clearwater Paper SBS

Cellu Tissue Tissue/MG Parent Roll3

Clearwater Paper Tissue Converting

Clearwater Paper Tissue Parent Roll

Cellu Tissue Headquarters

Cellu Tissue Tissue/MG Converting3

Clearwater Paper Headquarters

Spokane, WA

Corporate Headquarters

Lewiston, ID

Converting Capacity:

102,000 tons

Lewiston, ID (Sawmill)

Capacity: 215,000 mbf

Lewiston, ID (Pulp)

Capacity: 540,000 tons

Lewiston, ID (SBS)

Capacity:

435,000 tons

Lewiston, ID (Tissue)

Capacity: 189,000 tons

Las Vegas, NV (TAD)

Capacity: 38,000 tons

Las Vegas, NV

Converting Capacity:

51,000 tons

Cypress Bend, AR (Pulp)

Capacity: 305,000 tons

Cypress Bend, AR (SBS)

Capacity: 330,000 tons

Elwood, IL

Converting Capacity:

68,000 tons

Wiggins, MS

Capacity: 57,000 tons

Neenah, WI

Capacity: 85,000 tons

Ladysmith, WI

Capacity: 55,000 tons

Oklahoma City, OK

Converting Capacity:

19,000 tons

East Hartford, CT

Capacity: 29,000 tons

Gouverneur, NY

Capacity: 33,000 tons

Alpharetta, GA

Corporate Headquarters

Thomaston, GA

Converting Capacity:

58,000 tons

Long Island, NY

Converting Capacity:

38,000 tons

Shelby, NC (TAD)

Announced Capacity: 70,000 tons

Neenah, WI

Converting

Capacity:

99,000 tons

Menominee, MI

Capacity: 32,000 tons

St. Catharines, ON (TAD)

Capacity: 46,000 tons

Cellu Tissue Capacities ²

Tissue Parent Roll

250,000 tons

Tissue Converting

214,000 tons

MG Parent Roll

4

87,000 tons

MG Converting

4

27,000 tons

Menominee, MI

Converting

Capacity:

27,000 tons |

North American Tissue Capacity Change

51

Company

Date

Capacity

Furnish

Notes

Announced:

First Quality –

Anderson SC

Q3 2011

70,000

V

TAD

GP -

Crossett

Q2 2012

25,000*

V

TAD

First Quality –

Anderson SC

Q3 2012

70,000

V

TAD

CLW –

Shelby NC

Q4 2012

70,000

V

TAD

GP -

Pt. Hudson

Q4 2012

35,000*

V

TAD

Wausau

Q1 2013

75,000

R

AFH

P&G –

Box Elder, UT

Q3 2013

80,000

V

TAD

425,000

Potentials:

Kruger

70,000*

V

TAD

South Carolina Tissue

33,000*

V or R

South Georgia Tissue

33,000*

V or R

ST Paper –

Franklin, VA

70,000*

R

Empire

70,000*

R

* Estimated

Source: RISI and Other Industry |