Attached files

| file | filename |

|---|---|

| EX-10.1 - SHARE EXCHANGE AGREEMENT - NightCulture, Inc. | xxx_8k-ex1001.htm |

| EX-99.3 - PROFORMAS - NightCulture, Inc. | xxx_8k-ex9903.htm |

| EX-99.1 - NIGHT CULTURE, INC. FINANCIAL STATEMENTS - NightCulture, Inc. | xxx_8k-ex9901.htm |

| EX-10.2 - MEMORANDUM OF UNDERSTANDING - NightCulture, Inc. | xxx_8k-ex1002.htm |

| EX-3.2 - BYLAWS - NightCulture, Inc. | xxx_8k-ex0302.htm |

| EX-99.2 - NIGHT CULTURE, INC. FINANCIAL STATEMENTS - NightCulture, Inc. | xxx_8k-ex9902.htm |

| 8-K - CURRENT REPORT ON FORM 8-K - NightCulture, Inc. | xxx_8k-073111.htm |

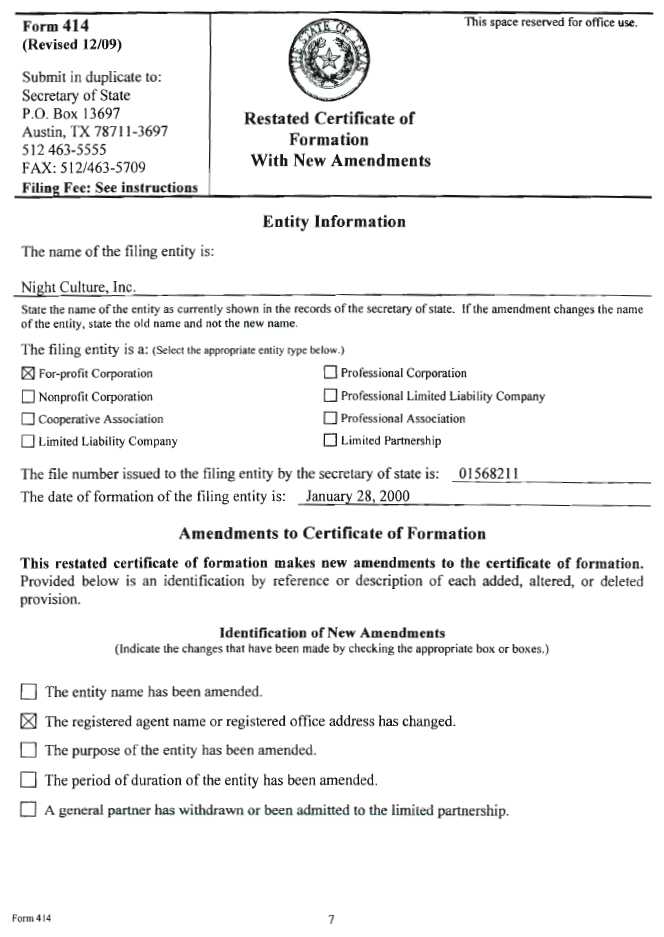

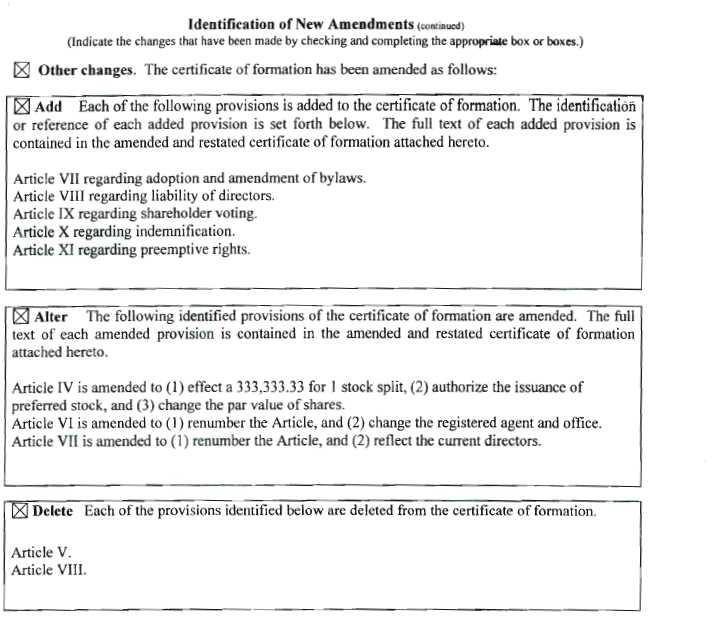

Exhibit 3.1

Statement of Approval

Each new amendment has been made in accordance with the provisions of the Texas Business Organizations Code. The amendments to the certificate of formation and the restated certificate of formation have been approved in the manner required by the Code and by the governing documents of the entity.

Required Statements

The restated certificate of formation, which is attached to this form, accurately states the text of the certificate of formation being restated and each amendment to the certificate of formation being restated that is in effect, and as further amended by the restated certificate of formation. The attached restated certificate of formation does not contain any other change in the certificate of formation being restated except for the information permitted to be omitted by the provisions of the Texas Business Organizations Code applicable to the filing entity.

A. x This document becomes effective when the document is filed by the secretary of state.

B. q This document becomes effective at a later date, which is not more than ninety (90) days from the date of signing. The delayed effective date is: ____________________________

C. q This document takes effect upon the occurrence of the future event or fact, other than the passage of time. The 90th day after the date of signing is: _____________________________

The following event or fact will cause the document to take effect in the manner described below:

|

|

Execution

The undersigned affirms that the person designated as registered agent in the restated certificate of formation has consented to the appointment. The undersigned signs this document subject to the penalties imposed by law for the submission of a materially false or fraudulent instrument and certifies under penalty of perjury that the undersigned is authorized under the provisions of law governing the entity to execute the filing instrument.

Date: April 8, 2011

|

By: /s/ Michael Long

Signature of authorized person

Michael Long

Printed or typed name of authorized person (see instructions)

|

Attach the text of the amended and restated certificate of formation to the completed statement form. Identify the attachment as "Restated Certificate of Formation of [Name of Entity]."

AMENDED AND RESTATED CERTIFICATE OF FORMATION

OF

NIGHT CULTURE, INC.

ARTICLE I

NAME

The name of the Corporation is NIGHT CULTURE, INC.

ARTICLE II

PERIOD OF DURATION

The period of the duration of the Corporation is perpetual.

ARTICLE III

PURPOSES AND POWERS

The purpose for which the Corporation is organized is to engage in any and all lawful business for which corporations may be incorporated under the Texas Business Organizations Code.

ARTICLE IV

CAPITALIZATION

The total number of shares of stock which the Corporation shall have the authority to issue is Five Hundred One Million (501,000,000) shares, consisting of Five Hundred Million (500,000,000) shares of Common Stock having a par value of $0.001 per share and One Million (1,000,000) shares of Preferred Stock having a par value of $0.001 per share.

A. Preferred Stock

The Board of Directors is authorized, subject to the limitations prescribed by law and the provisions of this Article, to provide for the issuance of the shares of Preferred Stock in series, and by filing a certificate pursuant to the applicable law of the State of Texas, to establish from time to time the number of shares to be included in each such series and to fix the designation, powers, preferences and rights of the shares of each such series and the qualifications, limitations or restrictions thereof.

|

1.

|

The authority of the Board with respect to each series shall include, butnot be limited to, determination of the following:

|

1

|

a.

|

The number of shares constituting that series and the distinctive designation of that series;

|

|

b.

|

The dividend rate on the shares of that series, whether dividends shall be cumulative, and if so, from which date or dates, and the relative rights of priority, if any, of payment of dividends on shares of that series;

|

|

c.

|

Whether that series shall have voting rights, in addition to the voting rights provided by law, and if so, the terms of such voting rights;

|

|

d.

|

Whether that series shall have conversion privileges and, if so, the terms and conditions of such conversion, including provision for adjustment of the conversion rate in such events as the Board of Directors shall determine;

|

|

e.

|

Whether or not the shares of that series shall be redeemable and, if so, the terms and conditions of such redemption, including the date or dates upon or after which they shall be redeemable and the amount per share payable in case of redemption, which amount may vary under different conditions and at different redemption dates;

|

|

f.

|

Whether that series shall have a sinking fund for the redemption or purchase of shares of that series and, if so, the terms and amount of such sinking fund;

|

|

g.

|

The rights of the shares of that series in the event of voluntary or involuntary liquidation, dissolution or winding up of the Corporation, and the relative rights of priority, if any, of payment of shares of that series; and

|

|

h.

|

Any other relative rights, preferences and limitations of that series.

|

|

2.

|

Dividends on outstanding shares of Preferred Stock shall be paid or declared and set apart for payment, before any dividends shall be paid or declared and set apart for payment on Common Stock with respect to the same dividend period.

|

|

3.

|

If upon any voluntary or involuntary liquidation, dissolution or winding up of the Corporation, the assets available for distribution to holders of shares of Preferred Stock of all series shall be insufficient to pay such holders the full preferential amount to which they are entitled, then such assets shall be distributed ratably among the shares of all series of Preferred Stock in accordance with the respective preferential amounts (including unpaid cumulative dividends, if any) payable with respect thereto.

|

2

|

4.

|

Unless otherwise provided in any resolution of the Board of Directors providing for the issuance of any particular series of Preferred Stock, no holder of Preferred Stock shall have any pre-emptive right as such holder to subscribe for, purchase or receive any part of any new or additional issue of capital stock of any class or series, including unissued and treasury stock, or obligations or other securities convertible into or exchangeable for capital stock of any class or series, or warrants or other instruments evidencing rights or options to subscribe for, purchase or receive any capital stock of any class or series, whether now or hereafter authorized and whether issued for cash or other consideration or by way of dividend.

|

B. Common Stock

|

1.

|

Subject to the prior and superior rights of the Preferred Stock and on the conditions set forth in the foregoing parts of this Article or in any resolution of the Board of Directors providing for the issuance of any particular series of Preferred Stock, and not otherwise, such dividends (payable in cash, stock or otherwise) as may be determined by the Board of Directors may be declared and paid on the Common Stock from time to time out of any funds legally available therefor.

|

|

2.

|

Except as otherwise provided by law, by this Certificate of Formation or by the resolution or resolutions of the Board of Directors providing for the issue of any series of the Preferred Stock, the Common Stock shall have the exclusive right to vote for the election of directors and for all other purposes, each holder of the Common Stock being entitled to one vote for each share held.

|

|

3.

|

Upon any liquidation, dissolution or winding up of the Corporation, whether voluntary or involuntary, and after the holders of the Preferred Stock of each series shall have been paid in full the amount to which they respectively shall be entitled, or a sum sufficient for such payments in assets of the Corporation shall be distributed pro rata to the holders of the Common Stock in accordance with their respective rights and interests, to the exclusion of the holders of the Preferred Stock.

|

ARTICLE V

PRINCIPAL AND REGISTERED OFFICE

The address of the principal office of the Corporation is 16107 Kensington Dr. #103, Sugar Land, Texas 77479. The address of the registered office is 16107 Kensington Dr. #103, Sugar Land, Texas 77479 and the name of its registered agent at such address is Michael Long.

3

ARTICLE VI

DIRECTORS

The Corporation shall be governed by a Board of Directors consisting of such number of directors as shall be fixed the Corporation's bylaws.

The number of directors constituting the current Board of Directors is two and the name and address of each person who is to serve as director until the next annual meeting of shareholders and until such director's successor is elected and qualified or, if earlier, until such director's death, resignation, or removal as director, are as follows:

|

NAME

|

ADDRESS

|

|

Michael Long

|

16107 Kensington Dr., Suite 103

|

|

Sugar Land, Texas 77479

|

|

|

Surain Adyanthaya

|

2201 Sunset Blvd.

|

|

Houston, Texas 77005

|

ARTICLE VII

BYLAWS

The initial Bylaws of the Corporation shall be adopted by its Board of Directors. Except as may be provided in the Bylaws of the Corporation, the power to alter, amend, repeal the Bylaws or to adopt new Bylaws of the Corporation shall be vested in the Board of Directors of the Corporation; provided, however, that the Bylaws made by the Board of Directors and the power so conferred may be repealed or changed by actions of the shareholders.

ARTICLE VIII

LIABILITY

A Director of the Corporation shall not be liable to the Corporation to its Shareholders for monetary damages for an act or omission made in the Director's capacity as a director, except for the following:

|

|

(A)

|

a breach of the Director's duty of loyalty to the Corporation or its Shareholders;

|

|

|

(B)

|

an act or omission not in good faith or that involves intentional misconduct or a knowing violation of the law;

|

|

|

(C)

|

a transaction from which the Director received an improper benefit, whether or not the benefit resulted from an action taken within the scope of the Director's office;

|

4

|

|

(D)

|

an act or omission for which the liability of the Director is expressly provided by statute; or

|

|

|

(E)

|

an act related to an unlawful stock repurchase or payment of dividend.

|

Any repeal or amendment of this Article by the Shareholders of the Corporation shall be prospective only, and shall not adversely affect any limitation on the liability of a Director of the Corporation existing at the time of such repeal or amendment. In addition to the circumstances in which a Director shall not be liable pursuant to the provisions of this Section VIII, a Director shall not be liable to the fullest extent permitted by any provision of the statutes of Texas hereafter enacted that further limit the liability of a Director.

ARTICLE IX

SHAREHOLDER VOTING

Shareholders shall not have the right to Cumulative Voting of their shares for the election of Directors of the Corporation, nor for any other purposes.

Directors of the Corporation shall be elected by a plurality of the votes cast by the holders of shares entitled to vote in the election of directors of the Corporation at a meeting of shareholders at which a quorum is present.

Any action of the Corporation which, under the provisions of the Texas Business Corporation Act or any other applicable law, is required to be authorized or approved by the holders of any specified fraction which is in excess of one-half or any specified percentage which is in excess of 50% of the outstanding shares (or of any class or series thereof) of the Corporation shall, notwithstanding any law, be deemed effectively and properly authorized or approved if authorized or approved by the vote of the holders of more than 50% of the outstanding shares entitled to vote thereon (or, if the holders of any class or series of the Corporation's shares shall be entitled by the Texas Business Organizations Code or any other applicable law to vote thereon separately as a class, by the vote of the holders of more than 50% of the outstanding shares of each such class or series). Without limiting the generality of the foregoing, the foregoing provisions of this Article IX shall be applicable to any required shareholder authorization or approval of: (a) any amendment to the Articles of Incorporation; (b) any plan of merger, share exchange, or reorganization involving the Corporation; (c) any sale, lease, exchange, or other disposition of all, or substantially all, the property and assets of the Corporation; and (d) any voluntary dissolution of the Corporation.

Except as otherwise provided in this Article IX or as otherwise required by the Texas Business Organizations Code or other applicable law, with respect to any matter, the affirmative vote of the holders of a majority of the Corporation's shares entitled to vote on that matter and represented in person or by proxy at a meeting of shareholders at which a quorum is present shall be the act of the shareholders.

5

Nothing contained in this Article IX is intended to require shareholder authorization or approval of any action of the Corporation whatsoever unless such approval is specifically required by the other provisions of the Certificate of Formation, the bylaws of the Corporation, or by the Texas Business Organizations Code or other applicable law.

Any action which may be taken, or which is required by law or the Certificate of Formation or bylaws of the Corporation to be taken, at any annual or special meeting of shareholders may be taken without a meeting, without prior notice, and without a vote, if a consent or consents in writing, setting forth the action so taken, shall have been signed by the holder or holders of shares having not less than the minimum number of votes that would be necessary to take such action at a meeting at which the holders of all shares entitled to vote on the action were present and voted.

ARTICLE X

INDEMNIFICATION OF DIRECTORS AND OFFICERS

The Corporation shall indemnify any and all persons who may serve or who have served at any time as directors or officers or who, at the request of the Board of Directors of the Corporation, may serve or at any time have served as directors or officers of another corporation in which the Corporation at such time owned or may own shares of stock or of which it was or may be a creditor, and their respective heirs, administrators, successors and assigns, against any and all expenses, including amounts paid upon judgments, counsel fees and amounts paid in settlement (before or after suit is commenced), actually and necessarily by such persons in connection with the defense or settlement of any claim, action, suit or proceeding in which they, or any of them, are made parties, or a party, or which may be asserted against them or any of them, by reason of being or having been directors or officers of the Corporation, or of such other corporation, except in relation to matters as to which any such director or officer of the Corporation, or of such other corporation or former director or officer or person shall be adjudged in any action, suit or proceeding to be liable for his own negligence or misconduct in the performance of his duty. Such indemnification shall be in addition to any other rights to which those indemnified may be entitled under any law, by law, agreement, vote of shareholder or otherwise.

ARTICLE XI

DENIAL OF PREEMPTIVE RIGHTS

No holder of any shares of capital stock of the Corporation, whether now or hereafter authorized, shall, as such holder, have any preemptive or preferential right to receive, purchase, or subscribe to (a) any unissued or treasury shares of any class of stock (whether now or hereafter authorized) of the Corporation, (b) any obligations, evidences of indebtedness, or other securities of the Corporation convertible into or exchangeable for, or carrying or accompanied by any rights to receive, purchase, or subscribe to, any such unissued or treasury shares, (c) any right of subscription to or to receive, or any warrant or option for the purchase of, any of the foregoing securities, or (d) any other securities that may be issued or sold by the Corporation.

Dated: April 8, 2011

|

NIGHT CULTURE, INC.

By: /s/ Michael Long

Michael Long, President

|

6