Attached files

| file | filename |

|---|---|

| 8-K - Prestige Consumer Healthcare Inc. | a8-kpressreleaseaug22011.htm |

| EX-99.1 - PRESS RELEASE DATED AUGUST 4, 2011 - Prestige Consumer Healthcare Inc. | fy12-q1earningsreleaseexhi.htm |

q112investorpresenta

28-75-124

196-18-48

August 4, 2011

Review of First Quarter F’12 Results Matt Mannelly, CEO Ron Lombardi, CFO

Exhibit 99.2

Safe Harbor Disclosure

This presentation contains certain “forward-looking” statements within the meaning of the Private Securities Litigation Reform Act of 1995, such as statements about the Company’s growth strategies, investments in advertising and promotion, market position, product introductions and innovations, and future financial performance. Words such as "continue," "will," "believe," “intend,” “expect,” “anticipate,” “plan,” “potential,” “estimate,” “may,” “should,” “could,” “would,” and similar expressions identify forward-looking statements. Such forward-looking statements represent the Company’s expectations and beliefs and involve a number of known and unknown risks, uncertainties and other factors that may cause actual results to differ materially from those expressed or implied by such forward-looking statements. These factors include, among others, the failure to successfully commercialize new and enhanced products, the effectiveness of the Company’s advertising and promotions investments, continuing decline in the household cleaning products market, the severity of the cold/cough season, the effectiveness of the Company’s marketing and distribution infrastructure, and other risks set forth in Part I, Item 1A. Risk Factors in the Company’s Annual Report on Form 10-K for the year ended March 31, 2011. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date this presentation. Except to the extent required by applicable securities laws, the Company undertakes no obligation to update any forward-looking statement contained herein, whether as a result of new information, future events, or otherwise.

This presentation contains certain “forward-looking” statements within the meaning of the Private Securities Litigation Reform Act of 1995, such as statements about the Company’s growth strategies, investments in advertising and promotion, market position, product introductions and innovations, and future financial performance. Words such as "continue," "will," "believe," “intend,” “expect,” “anticipate,” “plan,” “potential,” “estimate,” “may,” “should,” “could,” “would,” and similar expressions identify forward-looking statements. Such forward-looking statements represent the Company’s expectations and beliefs and involve a number of known and unknown risks, uncertainties and other factors that may cause actual results to differ materially from those expressed or implied by such forward-looking statements. These factors include, among others, the failure to successfully commercialize new and enhanced products, the effectiveness of the Company’s advertising and promotions investments, continuing decline in the household cleaning products market, the severity of the cold/cough season, the effectiveness of the Company’s marketing and distribution infrastructure, and other risks set forth in Part I, Item 1A. Risk Factors in the Company’s Annual Report on Form 10-K for the year ended March 31, 2011. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date this presentation. Except to the extent required by applicable securities laws, the Company undertakes no obligation to update any forward-looking statement contained herein, whether as a result of new information, future events, or otherwise.

First Quarter Highlights

Solid financial performance for the quarter: Q1 Sales of $95.3 million, up 33.8%. Revenue growth of 10.7% for five Core OTC brands; Acquired brands gaining share. Fourth consecutive quarter of organic revenue increases for Core OTC brands. Reported EPS of $0.29 vs $0.19, up 53.7%; up 21.1% excluding one-time gain. Cash Flow from Operations of $15.4 million. Strategic focus on brand-building for core OTC products: higher levels of A&P spending and innovation driving gains. A&P Investment oriented toward sustained long-term organic growth and value creation. Acquisitions are fully integrated; we continue to invest in their future with new advertising campaigns and product innovation.

Solid financial performance for the quarter: Q1 Sales of $95.3 million, up 33.8%. Revenue growth of 10.7% for five Core OTC brands; Acquired brands gaining share. Fourth consecutive quarter of organic revenue increases for Core OTC brands. Reported EPS of $0.29 vs $0.19, up 53.7%; up 21.1% excluding one-time gain. Cash Flow from Operations of $15.4 million. Strategic focus on brand-building for core OTC products: higher levels of A&P spending and innovation driving gains. A&P Investment oriented toward sustained long-term organic growth and value creation. Acquisitions are fully integrated; we continue to invest in their future with new advertising campaigns and product innovation.

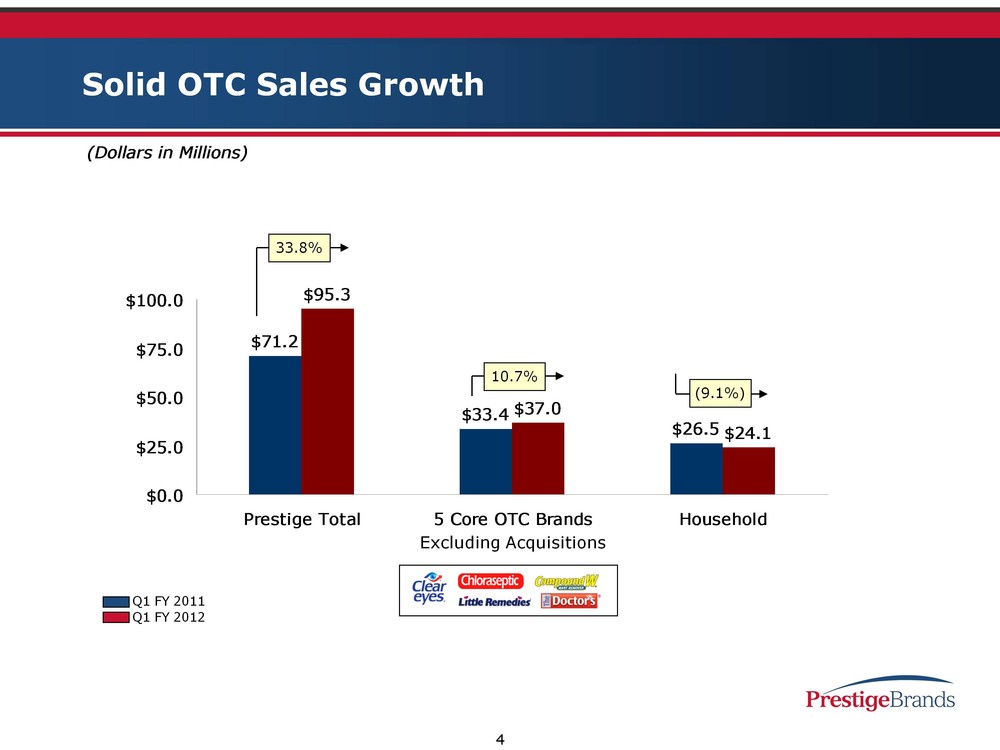

Solid OTC Sales Growth

Excluding Acquisitions

Q1 FY 2011

Q1 FY 2012

33.8%

10.7%

(9.1%)

Excluding Acquisitions

Q1 FY 2011

Q1 FY 2012

33.8%

10.7%

(9.1%)

Delivering Consistent Organic Growth

Four Straight Quarters of Organic Core OTC Growth Excluding Acquisitions

Q2 F’11

Q3 F’11

Q4 F’11

Q1 F’12

Q1 FY 2011

Q1 FY 2012

Net Sales

YoY % Growth

Four Straight Quarters of Organic Core OTC Growth Excluding Acquisitions

Q2 F’11

Q3 F’11

Q4 F’11

Q1 F’12

Q1 FY 2011

Q1 FY 2012

Net Sales

YoY % Growth

Consumption at Retail Driven by Effective A&P Investment

Notes: Consumption is based on IRI (FDM)for period ending June 12, 2011.

Category

Brand

Notes: Consumption is based on IRI (FDM)for period ending June 12, 2011.

Category

Brand

Resulting in Solid Market Share Gains Across the Portfolio of Brands

Notes: Market share is based on IRI (FDM) for quarter ending June 12, 2011. IRI accounts for approximately 55% of US revenue.

Market Share %

+1.0 pt

-0.1 pts

+1.8 pts

Notes: Market share is based on IRI (FDM) for quarter ending June 12, 2011. IRI accounts for approximately 55% of US revenue.

Market Share %

+1.0 pt

-0.1 pts

+1.8 pts

Household: Stabilization is the Goal

The overall market for household cleaning products continues to decline slightly across all household categories (2.7%).

Four Efforts to Stabilize Comet® STRENGTHEN: Consumer Value; New Comet® Twin Pack & Line Extensions. EXPAND: Distribution channels. DEEPEN: Dollar Store Penetration. LEVERAGE: Hispanic Markets; Comet® Lavender Powder now in 1,500 Wal-Marts.

Category

Brand

The overall market for household cleaning products continues to decline slightly across all household categories (2.7%).

Four Efforts to Stabilize Comet® STRENGTHEN: Consumer Value; New Comet® Twin Pack & Line Extensions. EXPAND: Distribution channels. DEEPEN: Dollar Store Penetration. LEVERAGE: Hispanic Markets; Comet® Lavender Powder now in 1,500 Wal-Marts.

Category

Brand

Brand Building for the Long-Term

Increased A&P Investment. Innovation in Product, Packaging & Delivery. New Products & Line Extensions.

Increased A&P Investment. Innovation in Product, Packaging & Delivery. New Products & Line Extensions.

PediaCare: Investing for the Future

“We Care For Kids”

PediaCare is among the first brands on store shelves to feature the new, safer dosage measures, the new industry standard. New packaging initiative for stronger on-shelf presence. Continued distribution gains for key products including Allergy, Gas.

“We Care For Kids”

PediaCare is among the first brands on store shelves to feature the new, safer dosage measures, the new industry standard. New packaging initiative for stronger on-shelf presence. Continued distribution gains for key products including Allergy, Gas.

Luden’s: 130 Years Young & Going Strong

Impressive distribution gains for Wild Cherry Sugar Free and Wild Honey helped brand increase market share in Q1. Investing in brand equity with print and online advertising, social media presence, digital marketing, and PR efforts. Launching innovative new products such as Luden’s® Vitamin C Drops, made with real orange juice.

Impressive distribution gains for Wild Cherry Sugar Free and Wild Honey helped brand increase market share in Q1. Investing in brand equity with print and online advertising, social media presence, digital marketing, and PR efforts. Launching innovative new products such as Luden’s® Vitamin C Drops, made with real orange juice.

Little Remedies: Marketing Today for Tomorrow’s Growth

“Everything You Need, Nothing You Don’t”

Professional Outreach Program: Advertising in professional trade magazines and professional websites, as well as doctor’s in-office education. Appearances at professional meetings / conferences. Consumer Advertising in print and online with increased budget. Consumer PR effort featuring Dr. Jim Sears of TV’s “The Doctors”. Trade Cooperative Effort with major retailer for parent education. Innovative New Products extend the line.

“Everything You Need, Nothing You Don’t”

Professional Outreach Program: Advertising in professional trade magazines and professional websites, as well as doctor’s in-office education. Appearances at professional meetings / conferences. Consumer Advertising in print and online with increased budget. Consumer PR effort featuring Dr. Jim Sears of TV’s “The Doctors”. Trade Cooperative Effort with major retailer for parent education. Innovative New Products extend the line.

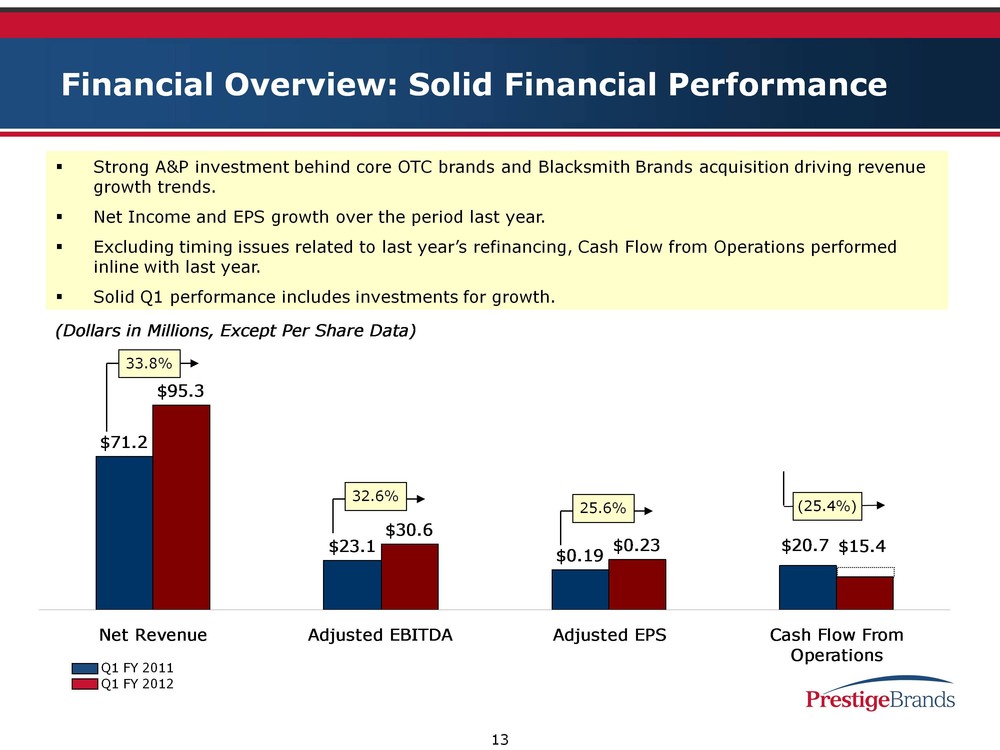

Financial Overview: Solid Financial Performance

32.6%

33.8%

25.6%

(25.4%)

Q1 FY 2011

Q1 FY 2012

Strong A&P investment behind core OTC brands and Blacksmith Brands acquisition driving revenue growth trends. Net Income and EPS growth over the period last year. Excluding timing issues related to last year’s refinancing, Cash Flow from Operations performed inline with last year. Solid Q1 performance includes investments for growth.

32.6%

33.8%

25.6%

(25.4%)

Q1 FY 2011

Q1 FY 2012

Strong A&P investment behind core OTC brands and Blacksmith Brands acquisition driving revenue growth trends. Net Income and EPS growth over the period last year. Excluding timing issues related to last year’s refinancing, Cash Flow from Operations performed inline with last year. Solid Q1 performance includes investments for growth.

Consolidated Financial Summary

Notes: Excludes adjustments detailed on page 15.

Net Revenue grew by $24.1 million or 33.8% over year ago. 10.7% growth in legacy core OTC. Acquisitions added $24.4 million. Excluding acquisitions, revenue was inline with last year as OTC gains were offset by lower HH revenue. As expected, gross margin was 1.0 pt lower than last year largely due to the impact of the acquired Blacksmith Brands A&P investment continues to drive growth. Acquisitions added $2.0 million. G&A increase of $1.7 million due to the impact of acquisitions, headcount additions to support growth and the timing of incentive compensation accruals. Adjusted Net Income increased by 27.0% after one-time items.

Notes: Excludes adjustments detailed on page 15.

Net Revenue grew by $24.1 million or 33.8% over year ago. 10.7% growth in legacy core OTC. Acquisitions added $24.4 million. Excluding acquisitions, revenue was inline with last year as OTC gains were offset by lower HH revenue. As expected, gross margin was 1.0 pt lower than last year largely due to the impact of the acquired Blacksmith Brands A&P investment continues to drive growth. Acquisitions added $2.0 million. G&A increase of $1.7 million due to the impact of acquisitions, headcount additions to support growth and the timing of incentive compensation accruals. Adjusted Net Income increased by 27.0% after one-time items.

Net Income and EPS Reconciliation

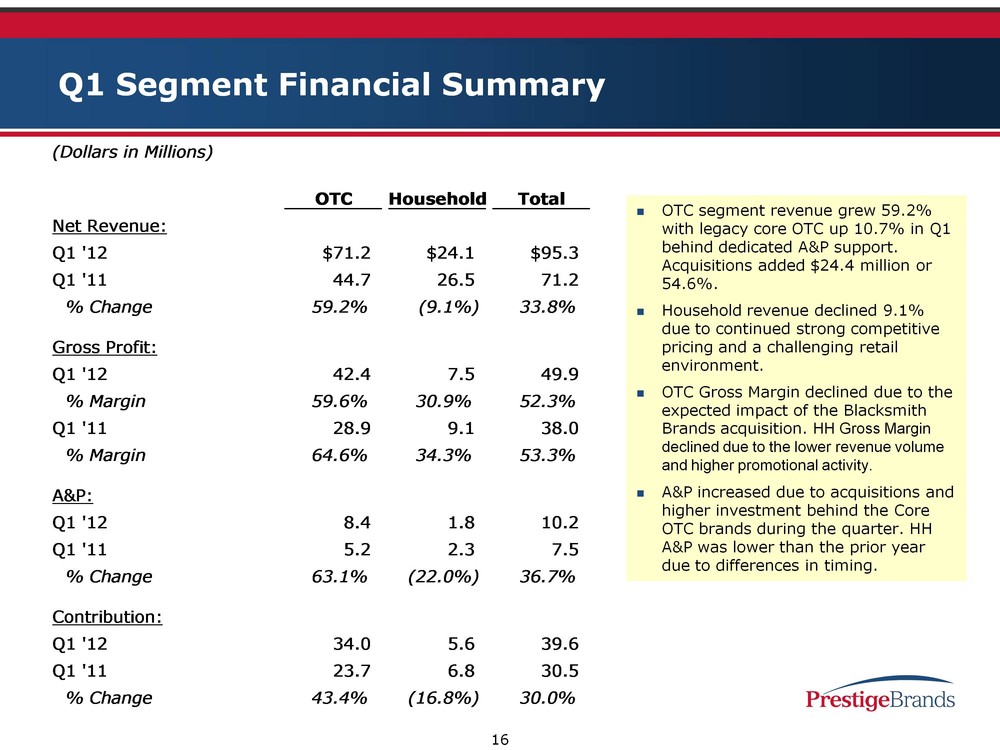

Q1 Segment Financial Summary

OTC segment revenue grew 59.2% with legacy core OTC up 10.7% in Q1 behind dedicated A&P support. Acquisitions added $24.4 million or 54.6%. Household revenue declined 9.1% due to continued strong competitive pricing and a challenging retail environment. OTC Gross Margin declined due to the expected impact of the Blacksmith Brands acquisition. HH Gross Margin declined due to the lower revenue volume and higher promotional activity. A&P increased due to acquisitions and higher investment behind the Core OTC brands during the quarter. HH A&P was lower than the prior year due to differences in timing.

OTC segment revenue grew 59.2% with legacy core OTC up 10.7% in Q1 behind dedicated A&P support. Acquisitions added $24.4 million or 54.6%. Household revenue declined 9.1% due to continued strong competitive pricing and a challenging retail environment. OTC Gross Margin declined due to the expected impact of the Blacksmith Brands acquisition. HH Gross Margin declined due to the lower revenue volume and higher promotional activity. A&P increased due to acquisitions and higher investment behind the Core OTC brands during the quarter. HH A&P was lower than the prior year due to differences in timing.

Prestige Strength: Cash Flow from Operations

Q1 cash flow is lower than last year due to the change in timing of payment on our Senior Secured Notes reducing cash flow by $5.2 million. Excluding this payment, cash flow was inline with last year. Debt Profile & Covenant Compliance: Total Indebtedness at 6/30/11, $469 million, reflects a Q1 pay down of $23.0 million The company is compliant with all covenant requirements.

Q1 cash flow is lower than last year due to the change in timing of payment on our Senior Secured Notes reducing cash flow by $5.2 million. Excluding this payment, cash flow was inline with last year. Debt Profile & Covenant Compliance: Total Indebtedness at 6/30/11, $469 million, reflects a Q1 pay down of $23.0 million The company is compliant with all covenant requirements.

Well Positioned For FY 2012

Brand building investments continued to lead to solid financial performance in Q1. A&P investments will increase during upcoming cough/cold season. Acquisition integration has been seamless. Work to do on Household stabilization. Cautiously optimistic for FY12 given economy, retail and consumer confidence.

Brand building investments continued to lead to solid financial performance in Q1. A&P investments will increase during upcoming cough/cold season. Acquisition integration has been seamless. Work to do on Household stabilization. Cautiously optimistic for FY12 given economy, retail and consumer confidence.

Clear Roadmap for Value Creation

Drive Core Organic Growth

Exclusive OTC M&A Focus

Strategic Portfolio Management

Drive Core Organic Growth

Exclusive OTC M&A Focus

Strategic Portfolio Management