Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - ECB BANCORP INC | d8k.htm |

KBW 2011

COMMUNITY BANK CONFERENCE

AUGUST 3, 2011

Exhibit 99.01 |

Forward-Looking Statements

ECB Bancorp, Inc.

Statements in this presentation relating to plans, strategies, economic

performance and trends, projections of results of specific

activities or investments, expectations or beliefs about future events or results, and other statements that are not

descriptions of historical facts, may be forward-looking statements

within the meaning of the Private Securities Litigation Reform

Act of 1995, Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934.

Forward-looking information is inherently subject to risks and

uncertainties, and actual results could differ materially from

those currently anticipated due to a number of factors, which include, but are not limited to, risk factors discussed

in the Company's Annual Report on Form 10-K and in other documents

filed by the Company with the Securities and Exchange Commission

from time to time. Forward-looking statements may be identified by terms such as "may", "will",

"should",

"could",

"expects",

"plans",

"intends",

"anticipates",

"believes", "estimates", "predicts",

"forecasts", "potential" or "continue,"

or similar terms or the negative of these terms, or other statements concerning opinions or

judgments of the Company's management about future events.

Factors that could influence the accuracy of such

forward-looking statements include, but are not limited to

pressures on the earnings, capital and liquidity of financial

institutions in general, resulting from current and future conditions

in the credit and equity markets, the financial success or

changing strategies of the Company's customers, actions of government regulators, the level of market interest rates,

weather and similar conditions, particularly the effect of hurricanes

on the Company's banking and operations facilities and on the

Company's customers and the communities in which it does business, changes in general economic conditions

and the real estate values in our banking market (particularly changes

that affect our loan portfolio, the abilities of our borrowers

to repay their loans, and the values of loan collateral). Although the Company believes that the expectations

reflected in the forward-looking statements are reasonable, it

cannot guarantee future results, levels of activity, performance

or achievements. All forward-looking statements attributable to the Company are expressly qualified in

their entirety by the cautionary statements in this paragraph.

The Company has no obligations, and does not intend to update

these forward-looking statements. |

ECB Bancorp

Profile ECB Bancorp, Inc.

•

Based in Engelhard, NC; East Carolina Bank founded in 1919

•

15

th

largest bank headquartered in North Carolina

o

$941 mm in assets as of 6/30/11

o

Target small to mid-sized businesses & individuals

•

Legacy of consistent growth and asset quality

o

Over 11% annual CGR of assets (organic) from 2001 to mid-2011

o

One of the lowest NPAs-to-total assets ratios of publicly traded banks in

NC o

25 offices in both coastal and inland markets with good demographics

o

Recently

announced

transaction

with

HamptonRoads

Bankshares

will

add five

branches and penetrate

several key new markets

•

Enhanced capital base and other key corporate strengths uniquely

position us to prosper and grow in the

current environment

o

Recently announced $75 million capital raise

o

Projected to boost equity-to-assets ratio from 6.9% to 11.5% on a pro

forma basis and total capital ratio from 13.45% to 15.7%.

o

Solid asset quality and additional capital allows us to build from a position of

strength •

Attractive footprint in Eastern NC |

Key Corporate

Strengths ECB Bancorp, Inc.

•

Financial strength

•

Attractive/expanding market area

•

Proven leadership team

•

Aggressive growth plan |

Financial

Strength - Capitalization

ECB Bancorp, Inc.

7/28/2011

Post Closing

•

Stock Symbol

–

ECBE (NASDAQ):

$13.30 per share

•

52 Week Range

$14.55 -

$10.41

•

Shares Outstanding

o

Common

2,849,841

7,537,341

o

TARP

$17,949

$0

•

Common Market Capitalization

$37.3 million

$98.9 million

•

Average Daily Volume 1 month

6,724 shares

•

Price to Tangible Book(6/30/11)

57.6%

81.1%

•

Capital Ratios

o

Leverage

8.38%

11.51%

o

Tier 1

12.17%

14.32%

o

Total Capital

13.45%

15.57% |

Financial

Strength - Stable Core Funding

ECB Bancorp, Inc.

•

Approximately 15% of deposits are non-interest bearing deposits

•

Approximately 34% of our deposits are demand deposits

•

Most recent quarter average cost of demand deposits: 0.64%

•

Most recent quarter average cost of funds: 1.17%

December 31, 2007

June 30, 2011

Total Deposits: $526 million

Jumbo CDs

16.0%

Retail CDs

31.4%

Savings

5.1%

Demand -

noninterest

bearing

15.2%

Demand - interest

bearing

32.3%

Jumbo CDs

30.8%

Retail CDs

27.9%

Savings

3.5%

Demand -

noninterest

bearing

18.2%

Demand - interest

bearing

19.6%

Total Deposits: $813 million |

Financial

Strength - Diversified Loan Portfolio

ECB Bancorp, Inc.

•

Approximately 82.7% of our portfolio is secured by real estate

•

Our top ten loan relationships account for only 10.3% of the total portfolio

in dollars

•

Most recent quarter average portfolio yield: 5.22%

•

Variable rate loans account for approximately 60% of our loan portfolio

•

Average loan size: $86,250

December 31, 2007

June 30, 2011

Gross Loans: $454 million

Gross Loans: $543 million

Commercial &

other

21.7%

Credit cards &

Related plans

0.4%

Consumer

3.2%

RE –

Commercial,

residential & other

53.3%

RE –

Construction,

land development

& other

21.3%

RE –

Commercial,

residential & other

66.8%

Consumer

3.2%

Credit cards &

Related plans

0.4%

Commercial & other

15.3%

RE –

Construction,

land development &

other

15.5% |

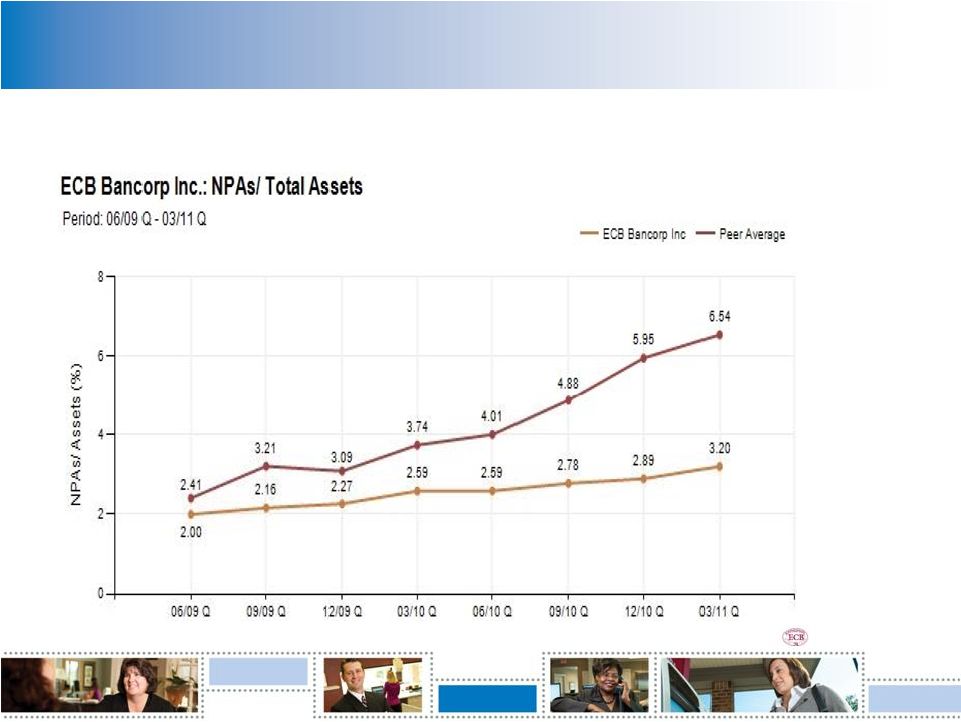

Financial

Strength ECB Bancorp, Inc.

Overall Increase in Problem Assets Has Been Much Lower Than

Most Other Banks |

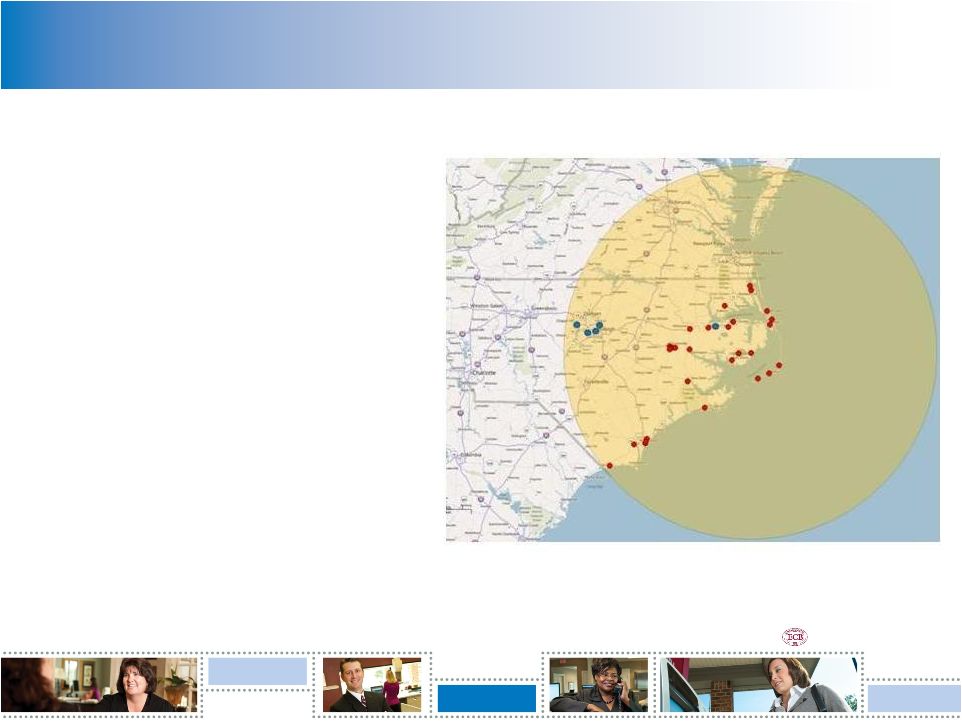

Attractive/Expanding Market Area

ECB Bancorp, Inc.

•

25 locations in coastal and in-land

North Carolina markets

•

Pending purchase of five new Bank

of Hampton Roads branches allows

development into new areas

•

Intermediate target market (over

next 3 to 5 years) is a 200 mile arc

from Engelhard

•

Area would cover Richmond and

portions of VA, and westward in NC

to include Raleigh and Triangle

cities

•

Likely near-term de novo markets

include Raleigh, Durham, Chapel

Hill, Fayetteville, Jacksonville, New

Bern, and Elizabeth City |

Dynamic Growth

Plan …Historical Growth Has Been Good

ECB Bancorp, Inc. |

ECB’s

Growth Strategy ECB Bancorp, Inc. |

Questions and

Answers ECB Bancorp, Inc. |

New Leadership

Team ECB Bancorp, Inc.

•

A. Dwight Utz:

President & CEO

Key

Competencies:

Strategic

Leadership,

Retail

Banking

Expertise,

Sales

&

Service

Strategies,

Human

Resources

Management, Small Business Banking. Years in banking/financial services: 39

•

Thomas M. Crowder:

EVP & CFO

Key

Competencies:

Large

Regional

Bank

Experience,

Regulatory

and

Risk

Management,

Capital

Markets,

Mergers

& Acquisitions/Valuation, Entrepreneurial/Business Ownership Experience. Years

in banking/financial services: 33 •

James J. Burson:

EVP & Chief Revenue Officer

Key Competencies: P&L responsibility experience in Large Regional Bank,

Building Relationships Through Sales and Service, Strategic Planning,

Building Sustainable Revenue Growth. Years in banking/financial services: 28

•

T. Olin Davis:

EVP & Chief Credit Officer

Key Competencies: Disciplined, Conservative Philosophy, Strong Leadership,

Visionary, Key Reason For Strong Asset Quality. Only legacy member of

Executive Management Team. Years in banking/financial services: 34

•

Lorie Y. Runion:

Sr. VP & Chief Administrative Officer

Key competencies: Strategic Planning, Marketing, Human Resources, Talent

Development. Years in banking/financial services: 33

•

William S. Sampson:

Sr. VP & Chief Information Officer

Key competencies: Exceptional Technical Knowledge, M&A Integration,

Mobile Banking and Other Technology Based

Platforms

For

Delivering

Banking

Services,

Was

Key

Part

of

Recent

Core

Processing

Conversion.

Years

in

banking/financial services: 8 |

Second Quarter

Earnings Release ECB Bancorp, Inc. |

Second Quarter

Earnings Release ECB Bancorp, Inc. |

Second Quarter

Earnings Release ECB Bancorp, Inc. |

Second Quarter

Earnings Release ECB Bancorp, Inc. |

Second Quarter

Earnings Release ECB Bancorp, Inc. |

Second Quarter

Earnings Release ECB Bancorp, Inc. |

Second Quarter

Earnings Release ECB Bancorp, Inc. |