Attached files

| file | filename |

|---|---|

| 8-K - 8-K - AgFeed Industries, Inc. | v230531_8k.htm |

AgFeed Industries, Inc. Presentation to Annual Shareholders’ Meeting NASDAQ: FEED NYSE Alternext: ALHOG Hendersonville, TN 2 August 2011

Safe Harbor Statement This presentation contains “forward-looking statements” within the meaning of the “safeharbor” provisions of the Securities Litigation Reform Act of 1995. Such statements involve known and unknown risks, uncertainties and other factors that could cause the actual results of the Company to differ materially from the results expressed or implied by such statements, including changes from anticipated levels of sales, future national or regional economic and competitive conditions, changes in relationships with customers, access to capital, difficulties in developing and marketing new products, marketing existing products, customer acceptance of existing and new products, and other factors. Accordingly, although the Company believes that the expectations re#ected in such forward-looking statements are reasonable, there can be no assurance that such expectations will prove to be correct. The Company has no obligation to update the forward-looking information contained in this presentation.

Vision Aligning global production resources to provide a reliable supply of safe pork and pork products Mission Establish AgFeed as a leader in supplying an expanding base of global customers with the highest quality pork while demonstrating leadership in food safety, production efficiency, sustainability and environmental stewardship

AgFeed: An Overview An international agribusiness aligning global production resources. Global Markets Harvest Hog Production AgFeed Industries, Inc. An International Agribusiness

AgFeed: Transformation AgFeed Industries, Inc. is a NASDAQ listed international agribusiness operating in the United States & China; ticker symbol FEED. It is also listed in Europe on the NYSE Alternext: ALHOG During the winter and spring of 2010, the Board embarked on a series of initiatives to fully transform the Company. The strategy was to capture the additional revenue and pro$t associated with the full supply/ value chain available to a vertically integrated market participant These initiatives were signaled by AgFeed’s announcement that it would be entering the harvest/ processing segment of the pork business and dramatically demonstrated by the acquisition of M2P2 - a leading U.S. hog production company in September 2010 One year after embarking on this strategic plan, we have transformed; our Board of Directors, Executive Management, base of operations & revenue, upgraded our information systems and audit team are now poised for the next steps in the ongoing transformation of the Company Last week, we announced the next signi$cant step in this process: the agreement to acquire operating businesses in the United States to anchor our harvest and processing operations. These are the necessary precursor to executing our global markets initiative, and the $nal step in the integrated strategy devised in early 2010.

AgFeed: Yesterday, Today & Tomorrow $173mm China U.S. $235mm $140mm $459mm $299mm 2009 2011e 2012e

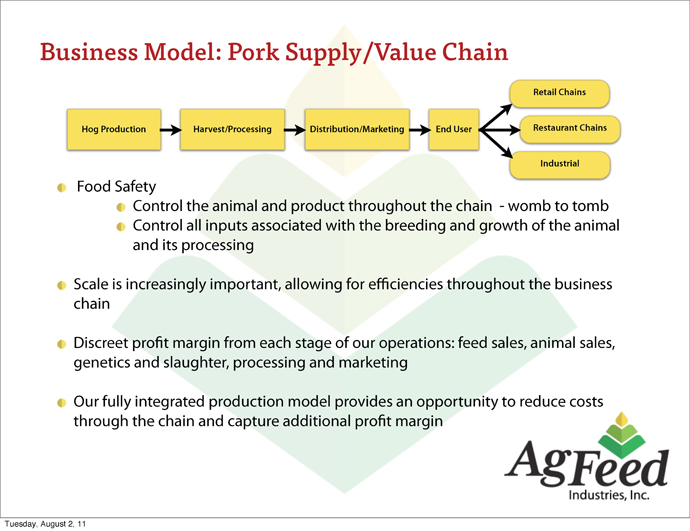

Business Model: Pork Supply/Value Chain Hog Production Harvest/Processing Distribution/Marketing End User Retail Chains Restaurant Chains Industrial Food Safety Control the animal and product throughout the chain - womb to tomb Control all inputs associated with the breeding and growth of the animal and its processing Scale is increasingly important, allowing for efficiencies throughout the business chain Discreet pro$t margin from each stage of our operations: feed sales, animal sales, genetics and slaughter, processing and marketing Our fully integrated production model provides an opportunity to reduce costs through the chain and capture additional pro$t margin

Global Pork Market: Macro Factors Pork is a staple of human consumption. Globally pork is consumed in signi$cantly greater volume than any other meat In 2010, approximately 1.2 billion hogs were slaughtered globally yielding close to 110,00,000 metric tons of pork One half of global hog production is in China. Second largest producer is the U.S. with 10% of global production Global demand is expected to increase by approximately 23% by 2020, over half of which will be driven by China Meat demand and production strains continue to increase as China’s 250 million middle class grows in addition to rapid urbanization Sources include: USDA, Rabobank, China Research and Intelligence, Access Asia Limited, Institute for Rural America & eFeedlink.com

Global Pork Market: Macro Factors Pork exporters are lead by the United States, EU, Canada & Brazil with the U.S., Brazil and Canada being the low cost producers 20% of U.S. hog production is dedicated to export providing an export market share of 38% Management expects domestic Chinese demand to grow by 7% - 8% p.a., thereby rapidly exceeding domestic production capacity and leading to growing export opportunities Sources include: USDA, Rabobank, China Research and Intelligence, Access Asia Limited, Institute for Rural America & eFeedlink.com

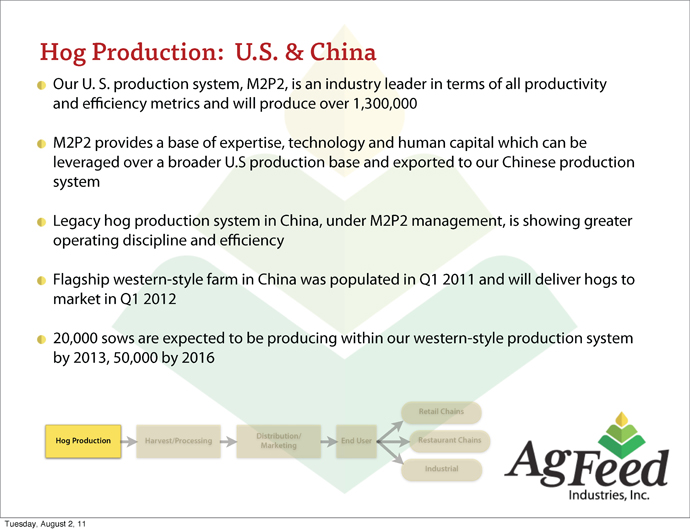

Hog Production: U.S. & China Our U. S. production system, M2P2, is an industry leader in terms of all productivity and efficiency metrics and will produce over 1,300,000 M2P2 provides a base of expertise, technology and human capital which can be leveraged over a broader U.S production base and exported to our Chinese production system Legacy hog production system in China, under M2P2 management, is showing greater operating discipline and efficiency Flagship western-style farm in China was populated in Q1 2011 and will deliver hogs to market in Q1 2012 20,000 sows are expected to be producing within our western-style production system by 2013, 50,000 by 2016 Hog Production Harvest/Processing Distribution/ Marketing End User Retail Chains Restaurant Chains Industrial

Harvest & Processing: Pending Acquisitions Harvest and Processing acquisitions announced last week represent AgFeed’s next step in deploying a fully integrated hog production system These acquisitions will add over $180 million in U.S. based revenue and over $13 million of EBITDA to our results annually The acquisition of talented management teams will be instrumental to the development of Harvest facilities tied to our western-style farms in China We anticipate building harvest facilities that will be located and scaled to serve the production output of our western-style farms in Dahua and Xinyu during 2013 We expect the fully integrated production model assuring veri$ably safe pork and standard processing will be attractive to major international distributors and processors targeting the Chinese and south Asian markets Hog Production Harvest/Processing Distribution/ Marketing End User Retail Chains Restaurant Chains Industrial

Global Markets: Marketing & Distribution AgFeed’s Global Market initiative represents the $nal step in our strategic actions to develop the company into an integrated market participant Align our global production resources to become a leading supplier to global customers Demand pull strategy for institutional, food service and high end retail markets Institutional requirements for quantity, quality and safety throughout the supply chain Protection of “brand equity” vital to our customers Leverage our Chinese “domestic” footprint to capitalize on the signi$cant growth available through exports to China Hog Production Harvest/Processing Distribution/ Marketing End User Retail Chains Restaurant Chains Industrial

Animal Nutrition: AANI Animal nutrition represents a building block in the foundation of healthy animals and a safe food supply Despite its strong distribution footprint AANI is not ideally situated to supply our hog production system. Today approximately 15% of AANI’s production is dedicated to our own production system Continued operating pressure with reduced nationwide herd size and high ingredient costs has put AANI’s customer base under pressure and has lead to deteriorating credit quality AgFeed’s hog production system can be more efficiently served through a dedicated food supply operation AANI is no longer considered a core asset and we will consider strategic alternatives Market conditions have led us to withdraw AANI’s form F-1

2nd Quarter 2011 U.S. hog production, M2P2, is performing according to plan The performance of our established Chinese hog production system has turned positive and is expected to generate an operating pro$t for the full year All operating metrics for our western-style Chinese based hog production system are above expectations We will report gross revenue of approximately $87 million for the second quarter Re#ecting the operating conditions for AANI previously referenced we have taken charges of $14.2 million during the 2nd quarter Subsequent to the end of the quarter we have exchanged the majority of warrants issued in May 2009 reducing our fully diluted shares outstanding by 349,447

Future Financing As previously communicated capital expenditure in China requires the issuance of equity re#ecting the limited availability of bank debt for agricultural projects and that our western model farms, their processes, procedures and technology are new to China The pending acquisitions not only require $nancing but afford the Company the opportunity to reshape its balance sheet With the harvest and processing acquisitions AgFeed will have a base of U.S. domiciled cash #ow which will provide opportunities to issue debt and achieve a better balance to our capital structure Our immediate objectives are to $nance the pending acquisitions and our expected capital requirements into 2012. This will require the issuance of both debt and equity In the medium term as our Chinese based western production system shows visible results we expect to gradually access local debt markets to fund some of our Chinese capital expenditures

Conclusion $0 $200 $400 $600 $800 2007 2008 2009 2010 2011e 2012 e millions We expect continued growth as we execute our plan to grow our hog production business while expanding our business reach throughout the pork value/supply chain. Our business model is designed to assure a reliable supply of safe pork and pork products to the consumer through our customers in retail chains, restaurant chains and industrial users China US