Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - DOVER Corp | form8k-072211.htm |

| EX-99.2 - EXHIBIT 99.2 - DOVER Corp | form8k-072211ex992.htm |

| EX-99.1 - EXHIBIT 99.1 - DOVER Corp | form8k-072211ex991.htm |

Exhibit 99.3

Dover Corporation

Second Quarter 2011

Conference Call

Second Quarter 2011

Conference Call

July 22, 2011

10:30 am ET

2

Forward Looking Statements

We want to remind everyone that our comments

may contain forward-looking statements that are

inherently subject to uncertainties. We caution

everyone to be guided in their analysis of Dover

Corporation by referring to our Form 10-K for a list

of factors that could cause our results to differ from

those anticipated in any such forward-looking

statements.

may contain forward-looking statements that are

inherently subject to uncertainties. We caution

everyone to be guided in their analysis of Dover

Corporation by referring to our Form 10-K for a list

of factors that could cause our results to differ from

those anticipated in any such forward-looking

statements.

We would also direct your attention to our internet

site, www.dovercorporation.com, where

considerably more information can be found.

site, www.dovercorporation.com, where

considerably more information can be found.

|

Revenue

|

$ 2.2B

|

↑ 21%

|

$ 4.1B

|

↑ 22%

|

|

EPS (cont.)

|

$1.31

|

↑ 44%

|

$2.28

|

↑ 47%

|

|

Bookings

|

$2.2B

|

↑ 15%

|

$4.5B

|

↑ 21%

|

|

Seg. Margins

|

17.4%

|

↑ 50 bps

|

16.5%

|

↑ 50 bps

|

|

Organic Rev.

|

|

↑ 14%

|

|

↑ 16%

|

|

Acq. Growth

|

|

↑ 4%

|

|

↑ 4%

|

|

FCF (a)

|

$136M

|

↓ 26%

|

$215M

|

↓ 7%

|

3

Dover’s Q2 2011 Performance

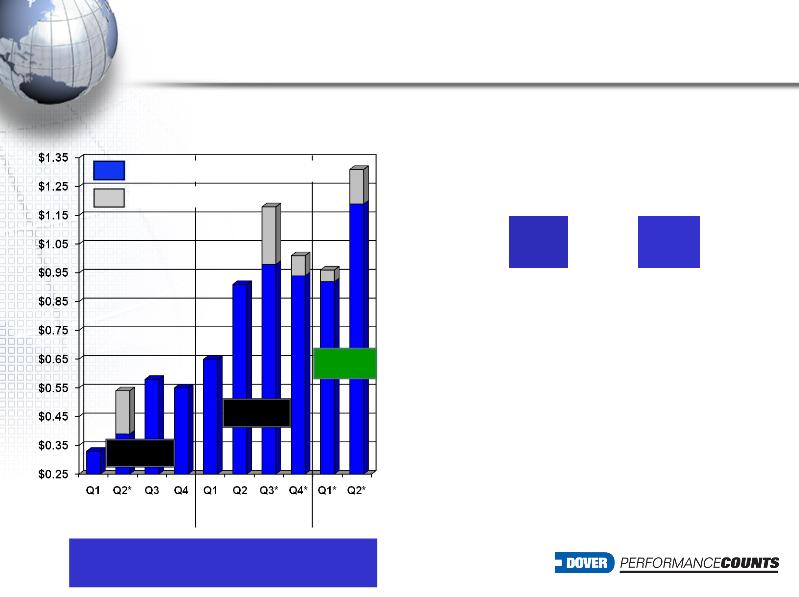

Continuing Earnings Per Share

2009

FY $3.74

• Strong results are broad-based, as all segments

achieved double-digit growth in revenue and

earnings

achieved double-digit growth in revenue and

earnings

•Solid organic revenue growth, with Fluid

Management, Industrial Products and Electronic

Technologies all over 15%

Management, Industrial Products and Electronic

Technologies all over 15%

•Segment operating margin of 17.4% is Dover’s

best ever

best ever

• Bookings strength is primarily driven by oil & gas

and global infrastructure resulting in a book-to-bill

of 1.03

and global infrastructure resulting in a book-to-bill

of 1.03

Q2

Q2/Q2

2010

FY $1.99

2011

* Includes discrete tax benefits of $0.15 EPS in

Q2 2009, $0.20 EPS in Q3 2010, $0.07 in Q4 2010, $0.04

in Q1 2011 and $0.12 in Q2 2011

Q2 2009, $0.20 EPS in Q3 2010, $0.07 in Q4 2010, $0.04

in Q1 2011 and $0.12 in Q2 2011

YTD $2.28

1H

1H/1H

Adjusted continuing earnings per share

Discrete tax benefits

(a) See Form 10-Q for free cash flow reconciliation

4

Revenue

|

Q2 2011

|

Industrial

Products |

Engineered

Systems |

Fluid

Management |

Electronic

Technologies |

Total

Dover

|

|

Organic

|

20%

|

8%

|

16%

|

17%

|

14%

|

|

Net Acquisitions

|

2%

|

-

|

14%

|

-

|

4%

|

|

Currency

|

1%

|

4%

|

2%

|

2%

|

3%

|

|

Total

|

23%

|

12%

|

32%

|

19%

|

21%

|

|

1H 2011

|

Industrial

Products |

Engineered

Systems |

Fluid

Management |

Electronic

Technologies |

Total

Dover

|

|

Organic

|

20%

|

11%

|

18%

|

21%

|

16%

|

|

Net Acquisitions

|

1%

|

-

|

14%

|

-

|

4%

|

|

Currency

|

1%

|

3%

|

1%

|

2%

|

2%

|

|

Total

|

22%

|

14%

|

33%

|

23%

|

22%

|

5

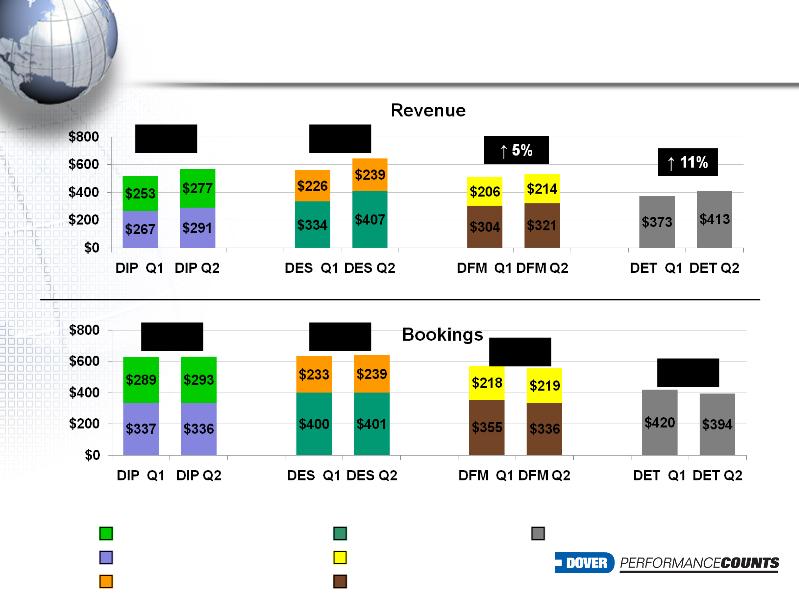

Sequential Results - Q1 11 / Q2 11

Material Handling

Fluid Solutions

Mobile Equipment

Energy

Product Identification

Engineered Products

↑ 9%

↑ 15%

Electronic Technologies

↑ 1%

↑ 1%

↓ 3%

↓ 6%

$ in millions

6

Industrial Products

•Revenue and bookings growth

was broad-based, led by strong

downstream energy activity and

solid infrastructure markets

was broad-based, led by strong

downstream energy activity and

solid infrastructure markets

•Margin impacted by product

mix, increased investment in

sales and marketing, and the

one-time gain on a property sale

in Q2 2010

mix, increased investment in

sales and marketing, and the

one-time gain on a property sale

in Q2 2010

•Book-to-bill at 1.11

•Backlog grew 40% to $702

million

million

$ in millions

|

|

Q2

2011

|

Q2

2010

|

%

Change

|

|

Revenue

|

$567

|

$462

|

+23%

|

|

Earnings

|

$ 73

|

$ 62

|

+19%

|

|

Margin

|

12.9%

|

13.3%

|

↓ 40 bps

|

|

Bookings

|

$628

|

$512

|

+23%

|

Quarterly Comments

|

|

1H

2011

|

1H

2010

|

%

Change

|

|

Revenue

|

$1,086

|

$891

|

+22%

|

|

Earnings

|

$ 138

|

$113

|

+22%

|

|

Margin

|

12.7%

|

12.6%

|

↑ 10 bps

|

|

Bookings

|

$1,254

|

$947

|

+32%

|

7

Engineered Systems

•All companies posted revenue

gains with retail refrigeration

having the largest positive impact

gains with retail refrigeration

having the largest positive impact

• Strong earnings leverage and

operating margin performance at

Engineered Products were offset

by new product launch related

costs at Product ID

operating margin performance at

Engineered Products were offset

by new product launch related

costs at Product ID

•Product ID’s results improve

sequentially within the quarter on

increased sales activities

sequentially within the quarter on

increased sales activities

•Bookings up 6%, led by strong

activity at SWEP, partially offset by

a moderating refrigeration case

market; book-to-bill is 0.99

activity at SWEP, partially offset by

a moderating refrigeration case

market; book-to-bill is 0.99

$ in millions

Quarterly Comments

|

|

Q2

2011

|

Q2

2010

|

%

Change

|

|

Revenue

|

$646

|

$577

|

+12%

|

|

Earnings

|

$ 94

|

$ 85

|

+11%

|

|

Margin

|

14.6%

|

14.7%

|

↓ 10 bps

|

|

Bookings

|

$640

|

$602

|

+6%

|

|

|

1H

2011

|

1H

2010

|

%

Change

|

|

Revenue

|

$1,206

|

$1,061

|

+14%

|

|

Earnings

|

$ 161

|

$ 139

|

+16%

|

|

Margin

|

13.4%

|

13.1%

|

↑ 30 bps

|

|

Bookings

|

$1,273

|

$1,191

|

+7%

|

8

Fluid Management

•Revenue growth was broad-

based, especially at our

businesses serving the oil & gas

markets

based, especially at our

businesses serving the oil & gas

markets

•Operating margin improvement

driven by volume; especially

strong revenue growth in Energy

driven by volume; especially

strong revenue growth in Energy

•Fluid Solutions continues to

perform at a high level with strong

activity in their petro-chemical and

energy markets

perform at a high level with strong

activity in their petro-chemical and

energy markets

•Book-to-bill of 1.04

$ in millions

Quarterly Comments

|

|

Q2

2011

|

Q2

2010

|

%

Change

|

|

Revenue

|

$535

|

$404

|

+32%

|

|

Earnings

|

$131

|

$ 96

|

+37%

|

|

Margin

|

24.6%

|

23.8%

|

↑ 80 bps

|

|

Bookings

|

$555

|

$418

|

+33%

|

|

|

1H

2011

|

1H

2010

|

%

Change

|

|

Revenue

|

$1,043

|

$784

|

+33%

|

|

Earnings

|

$ 245

|

$183

|

+34%

|

|

Margin

|

23.5%

|

23.3%

|

↑ 20 bps

|

|

Bookings

|

$1,127

|

$806

|

+40%

|

9

Electronic Technologies

•Revenue growth was driven by

strong solar equipment deliveries,

and continued strong demand for

MEMS microphones; telecom end

-markets were soft

strong solar equipment deliveries,

and continued strong demand for

MEMS microphones; telecom end

-markets were soft

•Operating margin increase was

driven by good leverage on higher

volume

driven by good leverage on higher

volume

•Sound Solutions acquisition

closed in early July and will

operate as Knowles Sound

Solutions

closed in early July and will

operate as Knowles Sound

Solutions

•Strong bookings gains at

Knowles were offset by weaker

electronic equipment orders,

especially solar equipment,

resulting in book-to-bill of 0.95

Knowles were offset by weaker

electronic equipment orders,

especially solar equipment,

resulting in book-to-bill of 0.95

$ in millions

Quarterly Comments

|

|

Q2

2011

|

Q2

2010

|

%

Change

|

|

Revenue

|

$413

|

$346

|

+19%

|

|

Earnings

|

$ 77

|

$ 60

|

+29%

|

|

Margin

|

18.6%

|

17.2%

|

↑ 140 bps

|

|

Bookings

|

$394

|

$394

|

Flat

|

|

|

1H

2011

|

1H

2010

|

%

Change

|

|

Revenue

|

$786

|

$637

|

+23%

|

|

Earnings

|

$137

|

$104

|

+31%

|

|

Margin

|

17.4%

|

16.4%

|

↑ 100 bps

|

|

Bookings

|

$814

|

$753

|

+8%

|

Q2 2011 Overview

|

|

Q2 2011

|

|

Net Interest Expense

|

$28.1 million, up $1 million from last year, due

to higher outstanding debt |

|

Corporate Expense

|

$35.3 million, up $3 million from last year, and

in-line with expectations |

|

Effective Tax Rate (ETR)

|

Q2 rate was 20.2%. Rate reflects $0.12 EPS

benefit on resolution of certain domestic tax matters. Adjusting for this benefit, the normalized rate would have been 27.4% |

10

11

FY 2011 Guidance - Update

• Revenue:

– Core revenue: ≈ 12.0% - 14.0%

– Acquisitions: ≈ 6.0%

– Total revenue: ≈ 18.0% - 20.0%

• Corporate expense: ≈ $135 million (unchanged)

• Interest expense: ≈ $116 million (unchanged)

• Full-Year Tax Rate: ≈ 27% - 27.5%*

• Capital expenditures: ≈ 2.8% - 3.0% of rev. (unchanged)

• Free cash flow for full year: ≈ 10% - 11% of rev. (unchanged)

* Excludes Q1 & Q2 discrete tax benefits of $0.16 EPS

(Sound Solutions = 3%)

• 2010 EPS - Continuing Ops $3.74

– Less 2010 tax benefits: ($0.27)

• 2010 Adjusted EPS - Continuing Ops $3.47

– Volume, mix, price (inc. FX): $0.67 - $0.76

– Net benefits of productivity: $0.26 - $0.30

– Acquisitions: $0.06 - $0.07

– Investment / Compensation: ($0.16 - $0.20)

– Corporate expense: -

– Interest: ($0.03)

– Tax (including discrete tax benefits(1) and lower rate): $0.23

• 2011 EPS - Continuing Ops $4.50 - $4.60

12

2011 EPS Guidance Bridge - Cont. Ops

(inc. Sound Solutions: -$0.03 to -$0.05)

(1) $0.04 in Q1 2011 and $0.12 in Q2 2011

2011 & 2012 Knowles Sound Solutions

13

|

|

2H 2011

|

FY 2012

|

|

Revenue

|

$190M - $200M

|

$400M - $410M

|

|

EPS

|

-$0.03 to -$0.05 (a)

|

+$0.18 to +$0.22

|

Q3 2011 EPS dilution is expected to be -$0.06 to -$0.08; Q4

2011 EPS accretion is expected to be $0.03

2011 EPS accretion is expected to be $0.03

(a)

Marginal tax rate for Knowles Sound Solutions is expected

to be ≈ 15% - 20%

to be ≈ 15% - 20%

Note: