Attached files

| file | filename |

|---|---|

| EX-5.1 - OPINION OF LATHAM & WATKINS LLP - SKULLCANDY, INC. | dex51.htm |

| EX-21.1 - LIST OF SUBSIDIARIES - SKULLCANDY, INC. | dex211.htm |

| EX-23.2 - CONSENT OF ERNST & YOUNG LLP - SKULLCANDY, INC. | dex232.htm |

Table of Contents

As filed with the Securities and Exchange Commission on July 18, 2011

Registration No. 333-171923

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 5 TO

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

SKULLCANDY, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 3651 | 56-2362196 | ||

| (State or other jurisdiction of incorporation or organization) | (Primary Standard Industrial Classification Code Number) | (I.R.S. Employer Identification No.) |

1441 West Ute Boulevard, Suite 250

Park City, Utah 84098

(435) 940-1545

(Address, including zip code, and telephone number, including area code, of the registrant’s principal executive offices)

Mitch Edwards

Chief Financial Officer and General Counsel

Skullcandy, Inc.

1441 West Ute Boulevard, Suite 250

Park City, Utah 84098

(435) 940-1545

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| Cary K. Hyden B. Shayne Kennedy Latham & Watkins LLP 650 Town Center Drive, 20th Floor Costa Mesa, California 92626 (714) 540-1235 |

John D. Wilson Shearman & Sterling LLP 525 Market Street, 15th Floor San Francisco, California 94105 (415) 616-1100 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ¨

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| ¨ Large accelerated filer |

¨ Accelerated filer | x | Non-accelerated filer | ¨ | Smaller reporting company |

CALCULATION OF REGISTRATION FEE

| Title of each Class of Securities to be Registered |

Amount to be Registered |

Proposed Maximum Offering Price Per Share(b) |

Proposed Maximum Offering Price(a) |

Amount of Registration Fee | ||||

| Common stock, $0.0001 par value |

9,763,298(a) | $19.00 | $185,502,662 | $21,537(c) | ||||

| (a) | Includes the additional shares that the underwriters have the option to purchase to cover over-allotments, if any. |

| (b) | Estimated solely for the purpose of calculating the registration fee in accordance with Rule 457(a) promulgated under the Securities Act of 1933, as amended. |

| (c) | A registration fee of $21,140 was previously paid based on an estimate of the aggregate offering price. |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until this registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

Table of Contents

Table of Contents

Table of Contents

Table of Contents

| Page | ||||

| 1 | ||||

| 9 | ||||

| 24 | ||||

| 25 | ||||

| 26 | ||||

| 27 | ||||

| 29 | ||||

| 31 | ||||

| Management’s Discussion and Analysis of Financial Condition and Results of Operations |

33 | |||

| 48 | ||||

| 60 | ||||

| 65 | ||||

| 89 | ||||

| 94 | ||||

| 100 | ||||

| 104 | ||||

| 106 | ||||

| Material U.S. Federal Tax Considerations for Non-U.S. Holders of our Common Stock |

108 | |||

| 112 | ||||

| 119 | ||||

| 119 | ||||

| 119 | ||||

| F-1 | ||||

You should rely only on the information contained in this prospectus and any free writing prospectus prepared by or on behalf of us that we have referred to you. We and the selling stockholders have not, and the underwriters have not, authorized anyone to provide you with additional or different information from that contained in this prospectus. If anyone provides you with additional, different or inconsistent information, you should not rely on it. We and the selling stockholders are offering to sell, and seeking offers to buy, shares of our common stock only in jurisdictions where offers and sales are permitted.

i

Table of Contents

This summary highlights information contained elsewhere in this prospectus. Because this is only a summary, it does not contain all of the information that may be important to you. You should read this entire prospectus and should consider, among other things, the matters set forth under “Risk Factors,” “Selected Consolidated Financial Data,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and related notes thereto appearing elsewhere in this prospectus before making your investment decision.

Our Company

Skullcandy is a leading audio brand that reflects the collision of the music, fashion and action sports lifestyles. Our brand symbolizes youth and rebellion, and embodies our motto, “Every revolution needs a soundtrack.” We believe we have revolutionized the headphone market by stylizing a previously-commoditized product and capitalizing on the increasing pervasiveness, portability and personalization of music. The Skullcandy name and distinctive logo have rapidly become icons and contributed to our leading market position, robust net sales growth and strong profitability and return on our invested capital. We increased our net sales from $9.1 million in 2006 to $160.6 million in 2010, representing a compound annual growth rate of approximately 105%.

We are a company founded on innovation. We redefined the headphone market by fusing bold color schemes, loud patterns, unique materials and creative packaging with the latest audio technologies and innovative functionalities. We offer a wide array of styles and price points and are expanding into complementary audio products and accessories.

We pioneered the distribution of headphones in specialty retailers focused on action sports and the youth lifestyle. Through this channel we reach consumer influencers, individuals who help establish and maintain the credibility and authenticity of our brand. Building on this foundation, we have successfully expanded our distribution to select consumer electronics, mass, sporting goods and mobile phone retailers. Skullcandy products are sold in the United States, as well as in more than 70 other countries around the world and through our website.

We were founded in 2003 by Rick Alden, the creator of several successful action sports companies and a lifelong industry enthusiast. Jeremy Andrus, our president and chief executive officer, and our talented management team share a passion for the Skullcandy lifestyle of action sports and music. Our principal offices are located in Park City, Utah and San Clemente, California, which are at the epicenters of some of the best snow peaks, skate parks and surf breaks in the world. We believe these close connections to the Skullcandy lifestyle strengthen the authenticity of our brand and increase the loyalty of our consumers.

Market Opportunity

We believe the increasing use of portable media devices and smartphones, and the growing popularity of action sports, support our anticipated long-term sales growth.

1

Table of Contents

The advent of portable media devices, such as Apple’s iPod, transformed the consumer electronics industry by dramatically increasing the portability and personalization of music, fueling an increased pervasiveness of these devices and their associated accessories, such as headphones. This transformation has continued as mobile phones have evolved into smartphones, capable of playing music and videos. In its report entitled Worldwide Smartphone 2010-2014 Forecast Update: December 2010, IDC Research estimates that the total number of smartphones shipped worldwide will increase by a compound annual growth rate of 24% from 2010 through 2014, and that in 2010 alone, the total number of smartphones shipped worldwide increased by 69% over 2009. This rapid growth is dramatically expanding the demand for headphones, especially ones with added functionality such as in-line microphones and volume controls. In addition, according to a January 2010 study conducted by The NPD Group entitled Headphones: Ownership & Application, consumers tend to own multiple sets of headphones and we believe that they replace them frequently.

Our brand also benefits from the increasing popularity of action sports, particularly within the youth culture. Our consumer influencers, teens and young adults that associate themselves with snowboarding, skateboarding, surfing and other action sports, influence a broader consumer base that identifies with authentic action sports lifestyle brands. In addition, music is an integral part of the action sports lifestyle and headphones have become an accessory worn to express individuality.

Our Competitive Strengths

We believe that the following strengths differentiate us from our competitors, allow us to take advantage of the large and growing market we participate in and enable us to generate a strong return on our invested capital:

Leading, Authentic Lifestyle Brand. Skullcandy fuses music, fashion and action sports, all of which permeate youth culture. We believe the power of our brand has driven our strong market share. According to The NPD Group’s Retail Tracking Service, we held the #1 position domestically in ear buds and the #2 position domestically in headphones, behind only Sony, based on unit and dollar sales in 2010.

Brand Authenticity Reinforced Through High Impact Sponsorships. We believe we were the first headphone brand to sponsor leading athletes, DJs, musicians, artists and events within action sports and the indie and hip-hop music genres. We believe this has increased our brand awareness and reinforced our credibility with our target consumers.

Track Record of Innovative Product Design. Our company was founded on innovation, and we employ innovative materials, such as wood, denim and polished polycarbonate, technologies and processes in the design and development of our products. In addition, we leverage our relationships with sponsored athletes, DJs, musicians and artists to incorporate their ideas into our designs to enhance our products.

Targeted Distribution Model. We control the distribution and mix of our products to protect our brand and enhance its authenticity. We pioneered the distribution of headphones in specialty retailers focused on action sports and the youth lifestyle. Building on this foundation, we have successfully expanded our distribution to select consumer electronics, mass, sporting goods and mobile phone retailers.

Proven Management Team and Deep-Rooted Company Culture. We have assembled a proven and talented management team that is led by Jeremy Andrus, our president and chief executive officer. Our management team shares a passion for action sports and music, and possesses substantial experience in product development, marketing, merchandising, operations and finance. Our culture and brand image enable us to successfully attract and retain highly talented employees who share our passion for action sports and music and understand our target market in an authentic and credible way.

2

Table of Contents

Growth Strategy

We intend to build upon our brand authenticity and product offering to continue to increase our net sales and profitability. Key elements of our growth strategy are to:

Further Penetrate Domestic Retail Channel. We plan to increase shelf space with our existing retailers and add select new specialty, consumer electronics, mass, sporting goods and mobile phone retailers to our customer base. In addition, we intend to increase the number of innovative in-store product displays and brand-building fixtures to emphasize our association with the action sports and the indie and hip-hop music lifestyles, and expand our online and in-store sales force training programs.

Accelerate Our International Growth. We currently sell our products internationally through third party distributors and believe that international expansion represents a substantial growth opportunity. We plan to replicate elements of our successful domestic marketing model by sponsoring internationally-based athletes, DJs, musicians, artists and events, and by creating localized marketing content to drive sales.

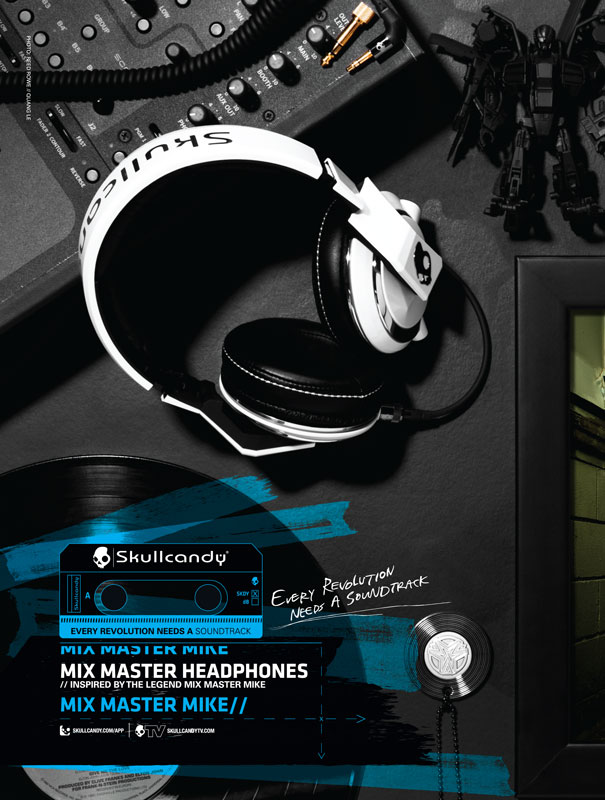

Grow Our Premium Product Offering. To date, the vast majority of our products have been priced in the $20 to $70 range. With our recently introduced $150 Aviator headphones and $250 Mix Master headphones, we have begun to expand our premium headphone offering and believe we can increase our share of this growing market. By offering premium products, we believe we can further strengthen our brand and broaden our reach to consumers with greater discretionary income.

Expand Complementary Product Categories. We have successfully tested and now plan to build more robust product assortments in certain complementary categories. For example, we plan to launch two new speaker dock models in the summer of 2011, increase our offering of protective cases for mobile devices, and introduce several gaming and mobile phone headphones that are currently in various stages of development.

Increase Our Online Sales. We plan to further engage our consumers and drive sales by adding, optimizing and broadening the content we offer through our interactive platforms. We believe our new content will allow us to dynamically interact with our loyal fan base, provide customized shopping experiences and drive our online sales. In addition, we plan to launch select international websites with localized content and e-commerce functionality.

Risks Related to Our Business

Investing in our common stock involves substantial risk. You should carefully consider all of the information in this prospectus prior to investing in our common stock. There are important risks related to our business that are described under “Risk Factors” elsewhere in this prospectus. Among these risks are the following:

| • | If our design and marketing efforts do not effectively extend the recognition and reputation of our brand, we may not be able to successfully implement our growth strategy. |

| • | If we are unable to continue to develop innovative and popular products, our brand image may be harmed and demand for our products may decrease. |

| • | Our manufacturing is concentrated with two key manufacturers, and if our relationship with either or both of them terminates or is otherwise impaired, we would likely experience increased costs, disruptions in the manufacture and shipment of our products and a material loss of net sales. |

| • | We may be unable to sustain our past growth or manage our future growth, which may have a material adverse effect on our future operating results. |

3

Table of Contents

| • | If we are unable to maintain and expand our network of sponsored athletes, DJs, musicians and artists, our ability to market and sell our products may be harmed. |

| • | Our plans to grow our international business may require significant operating expenditures, but such expenditures may not result in increased net sales. In addition, our European distribution relationship is governed by an exclusive agreement with 57 North that terminates in 2013. In 2010, sales to 57 North represented more than 10% of our net sales. |

| • | Two of our retailers, Target and Best Buy, account for a significant amount of our net sales, and the loss of, or reduced purchases from, these or other retailers could have a material adverse effect on our operating results. |

Recent Developments

In April 2011, we completed the purchase of substantially all the assets of Astro Gaming, Inc. for $10.8 million. Astro Gaming, Inc. is a leader in gaming headphones based in San Francisco, California. We paid the purchase price using cash on hand and borrowings of approximately $10.0 million under our credit facility. As of July 15, 2011, total borrowings were approximately $22.5 million and we had $5.5 million of additional availability under the credit facility.

In June 2011, we entered into a non-binding letter of intent with our European distributor, 57 North, to repurchase the rights we previously granted to 57 North pursuant to an exclusive distribution agreement for $15.0 million. This acquisition will enable us to take direct control of our European business, which we expect will allow us to capture revenue that would otherwise be earned by 57 North and accelerate our growth in this region through a rejuvenated marketing and brand building campaign. We cannot assure you that the letter of intent will lead to a binding agreement on the terms set forth in the letter of intent, if at all, and that any agreement entered into will be successfully consummated.

Corporate Information

We were incorporated in Delaware in 2003. Our principal executive offices are located at 1441 West Ute Boulevard, Suite 250, Park City, Utah 84098, and our telephone number is (435) 940-1545. Our principal website address is www.skullcandy.com. Information contained on our website does not constitute part of, and is not incorporated by reference into, this prospectus.

This prospectus contains references to our trademarks Skullcandy®, Ink’d®, 2XL® and our skull logo

. All other trademarks or tradenames referred to in this prospectus are the property of their respective owners.

. All other trademarks or tradenames referred to in this prospectus are the property of their respective owners.

4

Table of Contents

The Offering

| Common stock offered by us |

4,166,667 shares |

| Common stock offered by selling stockholders |

4,323,158 shares |

| Common stock outstanding after this offering |

26,782,309 shares |

| Over-allotment option |

The underwriters have a 30-day option to purchase up to an additional 1,273,473 shares from certain selling stockholders at the initial public offering price less the underwriting discounts and commissions. |

| Use of proceeds |

We intend to use the net proceeds from the sale of shares by us to repay certain indebtedness and for working capital and other general corporate purposes. We may also use a portion of the net proceeds to acquire other businesses, products, or technologies, including our repurchase of the rights previously granted to 57 North pursuant to an exclusive distribution agreement. We will not receive any proceeds from shares sold by the selling stockholders. See “Use of Proceeds.” |

| Proposed Nasdaq ticker symbol |

“SKUL” |

Unless otherwise noted, the number of shares of our common stock to be outstanding after consummation of this offering is based on 22,615,642 shares outstanding as of March 31, 2011, and excludes:

| • | 3,479,938 shares of common stock issuable upon the exercise of options outstanding as of March 31, 2011 at a weighted average exercise price of $8.72 per share; |

| • | 19,544 shares of restricted stock that were subject to a right of repurchase by us as of March 31, 2011; and |

| • | 2,352,000 shares of common stock reserved for future issuance under our employee benefit plans. |

Unless we specifically state otherwise, all information in this prospectus assumes:

| • | no exercise of the underwriters’ over-allotment option; |

| • | the automatic conversion of all of our outstanding shares of preferred stock into 4,507,720 shares of common stock immediately prior to the consummation of this offering; |

| • | the conversion of our convertible note into 3,862,124 shares of common stock simultaneously with the consummation of this offering; and |

| • | a 14-for-1 stock split of our outstanding common stock, which we intend to effect prior to the consummation of this offering. |

5

Table of Contents

Summary Consolidated Financial Data

The following table sets forth a summary of our historical consolidated financial data for the periods ended or as of the dates indicated. We have derived the consolidated statements of operations data for the years ended December 31, 2008, 2009 and 2010 from our audited consolidated financial statements appearing elsewhere in this prospectus. We have derived the consolidated statements of operations data for the three months ended March 31, 2010 and 2011 and the balance sheet data as of March 31, 2011 from our unaudited interim financial statements appearing elsewhere in this prospectus. This unaudited interim financial information has been prepared on the same basis as our audited annual consolidated financial statements and, in our opinion, reflects all adjustments, consisting only of normal recurring adjustments, that we consider necessary for a fair presentation of our financial position as of March 31, 2011 and operating results for the periods ended March 31, 2010 and 2011. The summary consolidated financial data in this section is not intended to replace our consolidated financial statements and the accompanying notes. Our historical results are not necessarily indicative of our future results. You should read this table together with our consolidated financial statements and the related notes thereto, “Selected Consolidated Financial Data” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” appearing elsewhere in this prospectus.

| Year ended December 31, | Three months ended March 31, |

|||||||||||||||||||

| 2008 | 2009 | 2010 | 2010 | 2011 | ||||||||||||||||

| (in thousands, except share and per share data) | ||||||||||||||||||||

| Consolidated Statements of Operations Data: |

||||||||||||||||||||

| Net sales |

$ | 80,380 | $ | 118,312 | $ | 160,583 | $ | 21,658 | $ | 36,018 | ||||||||||

| Cost of goods sold |

41,120 | 60,847 | 75,078 | 10,660 | 17,703 | |||||||||||||||

| Gross profit |

39,260 | 57,465 | 85,505 | 10,998 | 18,315 | |||||||||||||||

| Selling, general and administrative expenses |

18,040 | 28,574 | 67,602 | 7,572 | 14,399 | |||||||||||||||

| Income from operations |

21,220 | 28,891 | 17,903 | 3,426 | |

3,916 |

| |||||||||||||

| Other (income) expense |

(54 | ) | (111 | ) | 14,556 | 1,526 | (13 | ) | ||||||||||||

| Interest expense |

586 | 8,340 | 8,387 | 2,189 | 1,998 | |||||||||||||||

| Income (loss) before income taxes |

20,688 | 20,662 | (5,040 | ) | (289 | ) | 1,931 | |||||||||||||

| Income taxes |

7,669 | 8,318 | 4,653 | 512 | 852 | |||||||||||||||

| Net income (loss) |

13,019 | 12,344 | (9,693 | ) | (801 | ) | 1,079 | |||||||||||||

| Deemed dividend on convertible preferred stock and preferred dividends |

– | (9,993 | ) | (30 | ) | (7 | ) | (9 | ) | |||||||||||

| Net income (loss) available to common stockholders |

$ | 13,019 | $ | 2,351 | $ | (9,723 | ) | $ | (808 | ) | $ | 1,070 | ||||||||

| Net income (loss) per share: |

||||||||||||||||||||

| Basic |

$ | 0.77 | $ | 0.17 | $ | (0.69 | ) | $ | (0.06 | ) | $ | 0.08 | ||||||||

| Diluted |

0.53 | 0.12 | (0.69 | ) | (0.06 | ) | 0.05 | |||||||||||||

| Weighted average shares outstanding |

||||||||||||||||||||

| Basic |

16,955,036 | 13,908,216 | 14,001,358 | 13,839,966 | |

14,177,352 |

| |||||||||||||

| Diluted |

24,766,700 | 19,584,866 | |

14,001,358 |

|

|

13,839,966 |

|

19,676,916 | |||||||||||

| Pro forma net income per share (unaudited):(1) |

||||||||||||||||||||

| Basic |

$ | (0.25 | ) | $ | 0.08 | |||||||||||||||

| Diluted |

(0.25 | ) | 0.08 | |||||||||||||||||

| Pro forma weighted average common shares outstanding (unaudited): |

||||||||||||||||||||

| Basic |

24,260,075 | 24,032,696 | ||||||||||||||||||

| Diluted |

24,260,075 | 25,024,538 | ||||||||||||||||||

6

Table of Contents

| As of March 31, 2011 | ||||||||||||

| Actual | Pro forma(2)(3) | Pro forma as adjusted(4) |

||||||||||

| (in thousands) | ||||||||||||

| Consolidated Balance Sheet Data: |

||||||||||||

| Cash and cash equivalents |

$ | 5,965 | $ | 1,562 | $ | 33,983 | ||||||

| Working capital |

38,721 | 34,318 | 66,739 | |||||||||

| Total assets |

80,386 | 73,938 | 106,359 | |||||||||

| Total debt |

76,314 | 43,331 | 11,420 | |||||||||

| Redeemable convertible preferred stock |

2,534 | – | – | |||||||||

| Total stockholders’ equity (deficit) |

(20,210 | ) | 8,859 | 73,191 | ||||||||

| As of December 31, | Three months ended March 31, |

|||||||||||||||||||

| Other Financial Data: |

2008 | 2009 | 2010 | 2010 | 2011 | |||||||||||||||

| EBITDA (5) |

$ | 21,360 | $ | 29,306 | $ | 3,964 | $ | 2,031 | $ | 4,164 | ||||||||||

| Adjusted EBITDA (5) |

21,360 | 30,838 | 38,964 | 3,552 | 4,164 | |||||||||||||||

| (1) | Please see note 2 to our consolidated financial statements included elsewhere in this prospectus for an explanation of the method used to calculate basic and diluted pro forma net income per share for the year ended December 31, 2010 and three months ended March 31, 2011. |

| (2) | Our convertible note bears interest at 15% per annum, 5% of which is paid in cash and 10% of which is accrued and added to the principal balance on a quarterly basis. Upon conversion, the portion of the principal balance attributable to accrued interest must be paid in cash. The pro forma columns reflect our payment of $4.4 million accrued and unpaid cash interest as of March 31, 2011 and the reduction of deferred debt issuance costs and debt discounts related to the convertible note. |

| (3) | The pro forma balance sheet data gives effect to the conversion of (i) all of our outstanding shares of preferred stock into 4,507,720 shares of common stock and (ii) the conversion of the convertible note into 3,862,124 shares of common stock, as holders of the convertible note have delivered executed notices to the Company exercising their option to have the convertible note converted into common stock simultaneously with the consummation of the offering. |

| (4) | The pro forma as adjusted balance sheet data gives effect to (i) the conversion of preferred stock and the convertible note, (ii) the sale of 4,166,667 shares of common stock in this offering at an assumed initial public offering price of $18.00 per share, which is the midpoint of the price range set forth on the cover page of this prospectus, and (iii) the application of the net proceeds as described in “Use of Proceeds,” after deducting underwriting discounts and commissions and estimated offering expenses payable by us. A $1.00 increase (decrease) in the assumed initial public offering price of $18.00 per share, which is the midpoint of the price range set forth on the cover page of this prospectus, would increase (decrease), as applicable, our pro forma as adjusted cash and cash equivalents, working capital, total assets and total stockholders’ equity by approximately $3.9 million, assuming that the number of shares offered by us, as set forth on the cover page of this prospectus, remains the same and after deducting the underwriting discounts and commissions and estimated offering expenses payable by us. A 1.0 million increase (decrease) in the number of shares offered by us would increase (decrease) our pro forma as adjusted cash and cash equivalents, working capital, total assets and total stockholders’ equity by approximately $16.7 million, assuming an initial public offering price of $18.00 per share, which is the midpoint of the price range set forth on the cover of this prospectus, and after deducting the underwriting discounts and commissions and estimated offering expenses payable by us. The pro forma as adjusted information discussed above is illustrative only and will be adjusted based on the actual public offering price and terms of this offering determined at pricing. |

7

Table of Contents

| (5) | EBITDA, for the periods presented, represents net income (loss) before interest expense, income taxes and depreciation and amortization. In 2009, Adjusted EBITDA gives effect to the recording of $1.5 million of compensation which reflects amounts paid to certain employees in excess of the fair value of the shares redeemed in connection with the securities purchase and redemption agreement. Adjusted EBITDA gives further effect to the recording of compensation expense associated with one-time charges of $17.5 million in management incentive bonuses and $2.9 million payable as additional consideration to certain employee stockholders pursuant to the securities purchase and redemption agreement, and to the recording of additional other expense of $14.6 million, which represents the fair value of amounts payable as additional consideration to non-employee stockholders pursuant to the securities purchase and redemption agreement in 2010. For a more detailed description of this transaction, see “Certain Relationships and Related Party Transactions—Series C Convertible Preferred Stock Financing and Stock Redemption—Securities Purchase and Redemption Agreement.” These expenses were one-time charges associated with a historical capital transaction and management believes they do not correlate to the underlying performance of our business. As a result, we believe that adjusted EBITDA provides important additional information for measuring our performance, provides consistency and comparability with our past financial performance, facilitates period to period comparisons of our operations, and facilitates comparisons with other peer companies, many of which use similar non-GAAP financial measures to supplement their GAAP results. Our management team uses this metric to evaluate our business and we believe it is a measure used frequently by securities analysts and investors. Adjusted EBITDA does not represent, and should not be used as a substitute for income from operations or net income (loss) as determined in accordance with GAAP. Our definitions of EBITDA and adjusted EBITDA may differ from that of other companies. |

The following table reconciles net income (loss) to EBITDA and adjusted EBITDA on a historical basis:

| Year ended December 31, | Three months ended March 31, |

|||||||||||||||||||

| 2008 | 2009 | 2010 | 2010 | 2011 | ||||||||||||||||

| (in thousands) | ||||||||||||||||||||

| Net income (loss) |

$ | 13,019 | $ | 12,344 | $ | (9,693 | ) | $ | (801 | ) | $ | 1,079 | ||||||||

| Income taxes |

7,669 | 8,318 | 4,653 | |

512 |

|

852 | |||||||||||||

| Interest expense |

586 | 8,340 | 8,387 | 2,189 | 1,998 | |||||||||||||||

| Other (income) expense |

(54 | ) | (111 | ) | (60 | ) | 5 | (13 | ) | |||||||||||

| Depreciation and amortization |

140 | 415 | 677 | 126 | 248 | |||||||||||||||

| EBITDA |

21,360 | 29,306 | 3,964 | 2,031 | 4,164 | |||||||||||||||

| Compensation expense |

– | 1,532 | 20,384 | – | – | |||||||||||||||

| Other (income) expense |

– | – | 14,616 | 1,521 | – | |||||||||||||||

| Adjusted EBITDA |

$ | 21,360 | $ | 30,838 | $ | 38,964 | $ | 3,552 | $ | 4,164 | ||||||||||

8

Table of Contents

An investment in our common stock involves a high degree of risk. You should consider carefully the following risks and other information contained in this prospectus before you decide whether to buy our common stock. If any of the events contemplated by the following discussion of risks should occur, our business, results of operations and financial condition could suffer significantly. As a result, the market price of our common stock could decline, and you may lose all or part of your investment in our common stock.

Risks Related to Our Business

If our design and marketing efforts do not effectively extend the recognition and reputation of our brand, we may not be able to successfully implement our growth strategy.

We believe that our ability to extend the recognition and favorable perception of our brand is critical to implement our growth strategy, which includes further penetrating our domestic retail channel, accelerating our international growth, growing our premium product offering, expanding complementary product categories and increasing our online sales. To extend the reach of our brand, we believe we must devote significant time and resources to product design, marketing and promotions. These expenditures, however, may not result in a sufficient increase in net sales to cover such expenses.

Furthermore, we must balance our growth with the effect it has on the authenticity of our brand. For example, our credibility and brand image could be weakened if our consumers perceive our distribution channels to be too broad or our retailers to not fit with our lifestyle image. Similarly, the introduction of new, low cost product lines, such as our 2XL headphones, may cause our consumers to perceive a decrease in the authenticity or quality of our products. If any of these events occur, our consumer base and our net sales may decline and we may not be able to successfully implement our growth strategy.

If we are unable to continue to develop innovative and popular products, our brand image may be harmed and demand for our products may decrease.

The consumer electronics and action sports lifestyle are subject to constantly and rapidly changing consumer preferences based on industry trends and performance features. Our success depends largely on our ability to anticipate, gauge and respond to these changing consumer preferences and trends in a timely manner, while preserving and strengthening the perception and authenticity of our brand. We must continue to develop innovative, trend-setting and stylish products that provide better design and performance attributes than the products of our competitors. Market acceptance of new designs and products is subject to uncertainty and we cannot assure you that our efforts will be successful. For example, our growth strategy includes growing our premium product offering, which may not achieve broad market acceptance. The inability of new product designs or new product lines to gain market acceptance could adversely affect our brand image, our business and financial condition. Achieving market acceptance for new products may also require substantial marketing efforts and expenditures to increase consumer demand, which could constrain our management, financial and operational resources. If new products we introduce do not experience broad market acceptance, our net sales and market share could decline.

Our manufacturing is concentrated with two key manufacturers, and if our relationship with either or both of them terminates or is otherwise impaired, we would likely experience increased costs, disruptions in the manufacture and shipment of our products and a material loss of net sales.

We have no long-term contracts with our manufacturers and as a result, our manufacturers could cease to provide products to us with no notice. Two of our manufacturers, Antonio Precision Products Manufactory and Guangzhou Sun Young Electronics Company, together accounted for approximately 70% and 69% of our cost of goods sold in 2010, and for the three months ended March 31, 2011, respectively. Each of these manufacturers is the sole source supplier for the products that it produces. We purchase from

9

Table of Contents

these two manufacturers on a purchase order basis with orders generally filled between 30 and 75 days after our purchase order is placed. A loss of either or both of these manufacturers or other key manufacturers would result in delayed deliveries to our retailers and distributors, would adversely impact our net sales and may require the establishment of new manufacturing relationships. Additionally, we cannot be certain that we will not experience operational difficulties with our manufacturers, including reductions in the availability of production capacity, errors in complying with product specifications, insufficient quality control, failures to meet production deadlines, increases in manufacturing costs and increased lead times. For example, during 2010, we experienced increased lead times from a majority of our manufacturers in China.

We have recently created a manufacturer selection and qualification program and are actively looking for new manufacturing sources in other countries and other regions of China. Qualifying new manufacturing sources may result in increased costs, disruptions and delays in the manufacture and shipment of our products while seeking alternative manufacturing sources, and a corresponding loss of net sales. In addition, any new manufacturer may not perform to our expectations or produce quality products in a timely, cost-efficient manner, either of which could make it difficult for us to meet our retailers’ and distributors’ orders on satisfactory commercial terms.

Moreover, certain natural disasters or outbreaks of illnesses could halt or disrupt production at the affected facilities, delay the completion of orders, cause the cancellation of orders, delay the introduction of new products or cause us to miss a selling season applicable to some of our products. The failure of any manufacturer to perform to our expectations could result in supply shortages or delivery delays, either of which could harm our business.

We may be unable to sustain our past growth or manage our future growth, which may have a material adverse effect on our future operating results.

We have experienced rapid growth since our inception in 2003. We increased our net sales from $9.1 million in 2006 to $160.6 million in 2010, and from $21.7 million for the three months ended March 31, 2010 to $36.0 million for the three months ended March 31, 2011. Our future success will depend upon various factors, including the strength of our brand image, broad market acceptance of our current and future products, competitive conditions, our ability to manage increased net sales, if any, the implementation of our growth strategy and our ability to manage our anticipated growth. We intend to finance our anticipated growth through cash flows generated from sales to our existing retailers and distributors, borrowings under our credit facility and the net proceeds from this offering. However, if our net sales decline, we may not have the cash flow necessary to pursue our growth strategy.

We anticipate significantly expanding our infrastructure and adding personnel, particularly in our legal and finance departments, which will cause our selling, general and administrative expenses to increase in absolute dollars and which may cause our selling, general and administrative expenses to increase as a percentage of net sales. Because these expenses are generally fixed, particularly in the short-term, if we do not achieve our anticipated growth, our operating results may be adversely impacted. If we continue to experience growth in our operations, our operational, administrative, financial and legal procedures and controls may need to be expanded. As a result, we may need to train and manage an increasing number of employees, which could distract our management team from our business plan. Our future success will depend substantially on our ability to manage our anticipated growth. If we are unable to anticipate or manage our growth effectively, our operating results could be adversely affected.

If we are unable to maintain and expand our network of sponsored athletes, DJs, musicians and artists, our ability to market and sell our products may be harmed.

A key element of our marketing strategy has been to sponsor best-in-class athletes, DJs, musicians and artists, which we believe contributes to our authenticity and brand image. We do not have contractual relationships with the majority of our sponsored athletes, DJs, musicians and artists, and we cannot assure you that they will continue to support our brand or that they will not support one of our competitors.

10

Table of Contents

We compensate the sponsored athletes, DJs, musicians and artists that we do have contracts with for promoting our products. Sponsorship arrangements are typically structured to give our sponsored team members financial incentives to maintain a highly visible profile with our products. Our contracts typically have a one year term, with some providing for a two year term, and grant us an unlimited license for the use of their names and likenesses, and typically require them to maintain exclusive association with our headphones. In turn, we agree to make cash payments to our sponsored team members for wearing our products during various public appearances, in magazine shoots and on the podium after certain competitive victories. In addition to cash payments, we also generally provide limited complimentary products for their use, and reimburse certain travel expenses incurred in conjunction with promoting our products.

We cannot assure you that we will be able to maintain our existing relationships with any of our sponsored team members in the future or that we will be able to attract new athletes, DJs, musicians or artists to endorse our products. Additionally, certain competitors with greater access to capital may increase the cost for these relationships to levels we may choose not to match. If this were to occur, our sponsored team members may terminate their relationships with us and endorse our competitors’ products, and we may be unable to obtain endorsements from other comparable individuals.

We may also select individuals who are unable to perform at expected levels or who do not maintain the level of recognition we expect. Negative publicity concerning any of our athletes, DJs, musicians or artists could harm our brand and adversely impact our net sales. If we are unable to secure prominent athletes, DJs, musicians and artists and arrange endorsements of our products on terms we deem to be reasonable, we may be required to modify our marketing platform and to rely more heavily on other forms of marketing and promotion, which may not prove to be as effective.

Our plans to grow our international business may require significant operating expenditures, but such expenditures may not result in increased net sales.

We believe that our success in international markets is partially dependent on being “locally” relevant, but we have limited experience with the action sports and youth lifestyle in Europe and Asia. We plan to identify the best-in-class internationally-based athletes, DJs, musicians and artists that will best represent our lifestyle brand and arrange for such persons to endorse our products. We also plan to launch websites in Europe and Asia which will be available in the local language with local content and expect that our products will have region-specific packaging that we believe will help sell through of our products. Each of these efforts will require significant management time and resources, and we cannot assure you that we will be successful in expanding our brand in international markets.

In addition, our European distribution is currently controlled by a third party over which we have limited control. Our distribution relationship is governed by an exclusive agreement with 57 North which terminates in 2013. In each of 2010, and the three months ended March 31, 2011, 57 North accounted for more than 10% of our net sales. In September 2009, we entered into an arbitration proceeding with 57 North as a result of certain disputes regarding the terms governing our distribution agreement. During the arbitration process, sales to Europe declined as a result of the uncertainty surrounding our relationship with 57 North. The arbitration process was resolved in the third quarter of 2010. In June 2011, we entered into a non-binding letter of intent to repurchase the rights granted by the distribution agreement from 57 North for $15.0 million. We cannot assure you that the letter of intent will lead to a binding agreement on the terms set forth in the letter of intent, if at all, and that any agreement entered into will be successfully consummated. Even if we consummated the transaction, we may not be successful in our distribution efforts in Europe.

Over time, we plan to assume direct control of certain international markets, which will require increased operating expenditures to establish the infrastructure. We have limited experience with international distribution and we cannot assure you that we will manage it successfully. If we are not able to manage our international

11

Table of Contents

distribution efficiently, our international retailers and distributors may experience delays in receipt of our products and we may have to find alternate distribution arrangements, which could result in increased expenditures and a reduction in margins.

Two of our retailers account for a significant amount of our net sales, and the loss of, or reduced purchases from, these or other retailers could have a material adverse effect on our operating results.

Target and Best Buy each accounted for more than 10% of our net sales in 2010. Best Buy accounted for more than 10% of our net sales for the three months ended March 31, 2011. We do not have long-term contracts with any of our retailers, including Target and Best Buy, and all of our retailers generally purchase from us on a purchase order basis. As a result, these retailers generally may, with no notice or penalty, cease ordering and selling our products, or materially reduce their orders. If certain retailers, including Target or Best Buy, individually or in the aggregate, choose to no longer sell our products, to slow their rate of purchase of our products or to decrease the number of products they purchase, our results of operations would be adversely affected.

We may not be able to compete effectively, which could cause our net sales and market share to decline.

The consumer electronics industry is highly competitive and includes many new competitors as well as increased competition from established companies expanding their product portfolio. We face competition from consumer electronics brands that have historically dominated the stereo headphone market. These include large companies with strong worldwide brand recognition, such as Sony, JVC and Bose. These competitors have significant competitive advantages, including greater financial, distribution, marketing and other resources, longer operating histories, better brand recognition among certain groups of consumers, and greater economies of scale. In addition, these competitors have long-term relationships with many of our larger retailers that are potentially more important to those retailers. As a result, these competitors may be better equipped to influence consumer preferences or otherwise increase their market share by:

| • | quickly adapting to changes in consumer preferences; |

| • | readily taking advantage of acquisition and other opportunities; |

| • | discounting excess inventory that has been written down or written off; |

| • | devoting greater resources to the marketing and sale of their products, including significant advertising, media placement and product endorsement; |

| • | adopting aggressive pricing policies; and |

| • | engaging in lengthy and costly intellectual property and other disputes. |

Well established sports brand companies, such as adidas and Nike, have also recently introduced headphone products. Similar to the large electronic companies we compete with, these sport brand companies have significant competitive advantages, including greater financial, distribution, marketing and other resources, longer operating histories, better brand recognition among certain groups of consumers, and greater economies of scale.

We also face competition from other lifestyle brand companies, such as Beats by Dr. Dre, which is owned by Monster Cable, and Nixon. These companies have recently introduced products that compete directly with our headphones and market their lifestyle-branded consumer electronics within the action sports and the indie and hip-hop markets.

Recently, some retailers have begun to introduce their own private label headphones. If any of our retailers introduce such headphones, it could reduce the volume of product they buy from us, as well as decrease the shelf space they allocate to our products. The introduction of private label headphones could decrease the demand for our products and have an adverse effect on our net sales and results of operations.

12

Table of Contents

The industry in which we compete generally has low barriers to entry that allow the introduction of new products or new competitors at a fast pace. If we are unable to protect our brand image and authenticity, while carefully balancing our growth, we may be unable to effectively compete with these new market entrants or new products. The inability to compete effectively against new and existing competitors could have an adverse effect on our net sales and results of operations.

We may be adversely affected by the financial condition of our retailers and distributors.

Some of our retailers and distributors have experienced financial difficulties in the past. A retailer or distributor experiencing such difficulties will generally not purchase and sell as many of our products as it would under normal circumstances and may cancel orders. In addition, a retailer or distributor experiencing financial difficulties generally increases our exposure to uncollectible receivables. We extend credit to our retailers and distributors based on our assessment of their financial condition, generally without requiring collateral. While such credit losses have historically been within our reserves, we cannot assure you that this will continue to be the case. Financial difficulties on the part of our retailers or distributors could have a material adverse effect on our results of operations and financial condition.

Changes in the mix of retailers and distributors to whom we sell our products could impact our gross margin and brand image, which could have a material adverse effect on our results of operations.

We sell our products through a mix of retailers, including specialty, consumer electronics, mass, sporting goods and mobile phone retailers, and to distributors. Any changes to our current mix of retailers and distributors could adversely affect our gross margin and could negatively affect both our brand image and our reputation. We generally realize lower gross margins when we sell through our distributors, and therefore our gross margins may be adversely impacted if we increase product sales made through our distributors as opposed to through our retailers. In addition, we sell certain products at higher margins than others and any significant changes to our product mix made available to our retailers could adversely affect our gross margin. For the three months ended March 31, 2011, sales to retailers and distributors represented 67.1% and 32.9%, respectively of our net sales. The balance of our net sales occurred through our website. A negative change in our gross margin or our brand image could have a material adverse effect on our results of operations and financial condition.

We face business, political, operational, financial and economic risks because a portion of our net sales are generated internationally and substantially all of our products are manufactured outside of the United States.

For the year ended December 31, 2010 and the three months ended March 31, 2011, international sales were $31.0 million, or 19.3% of net sales and $7.6 million, or 21.1% of net sales, respectively. In addition, substantially all of our products are manufactured in China. As a result, we face business, political, operational, financial and economic risks inherent in international business, many of which are beyond our control, including:

| • | difficulties obtaining domestic and foreign export, import and other governmental approvals, permits and licenses, and compliance with foreign laws, which could halt, interrupt or delay our operations if we cannot obtain such approvals, permits and licenses, and that could have a material adverse effect on our results of operations; |

| • | difficulties encountered by our international distributors or us in staffing and managing foreign operations or international sales, including higher labor costs, which could increase our expenses and decrease our net sales and profitability; |

| • | transportation delays and difficulties of managing international distribution channels, which could halt, interrupt or delay our operations; |

| • | longer payment cycles for, and greater difficulty collecting, accounts receivable, which could reduce our net sales and harm our financial results; |

13

Table of Contents

| • | trade restrictions, higher tariffs, currency fluctuations or the imposition of additional regulations relating to import or export of our products, especially in China, where substantially all of our products are manufactured, which could force us to seek alternate manufacturing sources or increase our expenses, either of which could have a material adverse effect on our results of operations; |

| • | political and economic instability, including wars, terrorism, political unrest, boycotts, curtailment of trade and other business restrictions, any of which could materially and adversely affect our net sales and results of operations; and |

| • | natural disasters, which could have a material adverse effect on our results of operations. |

Any of these factors could reduce our net sales, decrease our gross margin or increase our expenses. Should we establish our own operations in international territories where we currently utilize a distributor, we will become subject to greater risks associated with operating outside of the United States.

Any shortage of raw materials or components could impair our ability to ship orders of our products in a cost-efficient manner or could cause us to miss the delivery requirements of our retailers or distributors, which could harm our business.

The ability of our manufacturers to supply our products is dependent, in part, upon the availability of raw materials and certain components. Our manufacturers may experience shortages in the availability of raw materials or components, which could result in delayed delivery of products to us or in increased costs to us. For example, we are dependent on the supply of certain components for our production of iPhone compatible headphones. These components are in high demand and we have experienced supply shortages in the past. Any shortage of raw materials or components or inability to control costs associated with manufacturing could increase the costs for our products or impair our ability to ship orders in a timely cost-efficient manner. As a result, we could experience cancellation of orders, refusal to accept deliveries or a reduction in our prices and margins, any of which could harm our financial performance and results of operations.

Our business could suffer if any of our manufacturers fail to use acceptable labor practices.

We do not control our manufacturers or their labor practices. The violation of labor or other laws by a manufacturer utilized by us, or the divergence of an independent manufacturer’s labor practices from those generally accepted as ethical or legal in the United States, could damage our reputation or disrupt the shipment of finished products to us if such manufacturer is ordered to cease its manufacturing operations due to violations of laws or if such manufacturer’s operations are adversely affected by such failure to use acceptable labor practices. If this were to occur, it could have a material adverse effect on our financial condition and results of operations.

If we experience problems with our distribution network for domestic retailers, our ability to deliver our products to the market could be adversely affected.

We rely on our newly contracted distribution facility in Auburn, Washington, operated by UPS Supply Chain Solutions, for the majority of our domestic product distribution. Our distribution facility utilizes computer controlled and automated equipment, which means the operations are complicated and may be subject to a number of risks related to security or computer viruses, the proper operation of software and hardware, power interruptions or other system failures. We have experienced some of these problems in the past and we cannot assure you that we will not experience similar problems in the future. We expect to contract with UPS Supply Chain Solutions to open additional facilities in Shenzhen, China in 2011 and in Louisville, Kentucky in 2012 that would utilize the same equipment and would be subject to the same risks. Furthermore, we have a limited history of order fulfillment and inventory management from the Auburn facility and could encounter problems that disrupt our distribution. We maintain business interruption insurance, but it may not adequately protect us from the adverse effects that could be caused by significant disruptions in our distribution facility, such as the long-term loss of retailers or an erosion of our brand image. In addition, our distribution capacity is dependent on the

14

Table of Contents

timely performance of services by third parties, including the shipping of product to and from the Auburn facility. If we encounter problems with the Auburn facility, our ability to meet retailer expectations, manage inventory, complete sales and achieve objectives for operating efficiencies could be materially adversely affected.

If we are unable to obtain intellectual property rights and/or enforce those rights against third parties who are violating those rights, our business could suffer.

We rely on various intellectual property rights, including patents, trademarks, trade secrets and trade dress to protect our brand name, reputation, product appearance and technology. If we fail to obtain, maintain, or in some cases enforce our intellectual property rights, our competitors may be able to copy our designs, or use our brand name, trademarks or technology. As a result, if we are unable to successfully protect our intellectual property rights, or resolve any conflicts effectively, our results of operations may be harmed.

We are susceptible to counterfeiting of our products, which may harm our reputation for producing high-quality products and force us to incur expenses in enforcing our intellectual property rights. Such claims and lawsuits can be expensive to resolve, require substantial management time and resources, and may not provide a satisfactory or timely result, any of which would harm our results of operations. It can be particularly difficult and expensive to detect and stop counterfeiting, whether in the United States or abroad. Despite our efforts to enforce our intellectual property, counterfeiters may continue to violate our intellectual property rights by using our trademarks or imitating or copying our products, which could harm our brand, reputation and financial condition. Since our products are sold internationally, we are also dependent on the laws of a range of countries to protect and enforce our intellectual property rights. These laws may not protect intellectual property rights to the same extent or in the same manner as the laws of the United States.

We also face competition from competitors in the United States and abroad that are not “counterfeiters” but that may be using our patented technology, using confusingly similar trademarks, or copying the “look-and-feel” of our products. We may have to engage in expensive and distracting litigation to enforce and defend our patents, trademarks, trade dress, or other intellectual property rights. Our enforcement of our intellectual property rights also places such assets at risk. For example, it is common for a competitor that is accused of infringing a patent, trademark, or other intellectual property right to challenge the validity of that intellectual property right. If that intellectual property right is invalidated, it is no longer available to assert against other competitors. Finally, competitors may also circumvent a patent by designing around the patent.

Further, we are a party to licenses that grant us rights to intellectual property, including trademarks, that are necessary or useful to our business. For example, we license the right to market certain products with the tradenames and imagery of brands such as Paul Frank, the NBA, RocNation, Tokidoki and Snoop Dogg. One or more of our licensors may allege that we have breached our license agreement with them, and accordingly seek to terminate our license. If successful, this could result in our loss of the right to use the licensed intellectual property, which could adversely affect our ability to commercialize our technologies or products, as well as harm our competitive business position and our business prospects.

On March 29, 2011, Volcom, Inc. filed a complaint in the U.S. District Court, Central District of California, alleging that, among other things, RocNation’s logo infringes the Volcom stone logo. While we were not named in the complaint, our Aviator headphones carry the RocNation logo that is alleged to infringe the Volcom logo. We cannot assure you that we will not be subsequently named by Volcom in its complaint. Moreover, even if we are not named, if RocNation fails to successfully defend itself against Volcom in this matter, we could lose our ability to use the RocNation logo on our Aviator headphones and we may have to take action to modify our existing supply of Aviator headphones, either of which could have a material impact on sales of the Aviator headphone. Pursuant to our license agreement with RocNation we are indemnified for any claims alleging violation or infringement of any copyright, trademark or other intellectual property right arising out of our use of the RocNation logo.

15

Table of Contents

Claims that we violate a third party’s intellectual property rights may give rise to burdensome litigation, result in potential liability for damages or impede our development efforts.

We cannot assure you that our products or activities do not violate the patents or other intellectual property rights of third parties. Patent infringement, trade secret misappropriation and other intellectual property claims and proceedings brought against us, whether successful or not, could result in substantial costs and harm our reputation. Such claims and proceedings can also distract and divert management and key personnel from other tasks important to the success of our business. Examples of such claims include a recently filed action asserting that our speaker docks infringe another company’s design patent and another recently filed action asserting that the hiring and employment of one of our new employees constitutes misappropriation of another company’s trade secrets. In addition, intellectual property litigation could force us to do one or more of the following:

| • | cease developing, manufacturing, or selling products that incorporate the challenged intellectual property; |

| • | obtain and pay for licenses from the holder of the infringed intellectual property right, which licenses may not be available on reasonable terms, or at all; |

| • | redesign or reengineer products; |

| • | change our business processes; and |

| • | pay substantial damages, court costs and attorneys’ fees, including potentially increased damages for any infringement or violation found to be willful. |

In the event of an adverse determination in an intellectual property suit or proceeding, or our failure to license essential technology, our sales could be harmed and/or our costs could increase, which could harm our financial condition.

Our current executive officers are critical to our success and the loss of any of these individuals, or other key personnel, could harm our business and brand image.

We are heavily dependent upon the contributions, talent and leadership of our current executive officers. The loss of any executive officers or the inability to attract or retain qualified executive officers could delay the development and introduction of, and harm our ability to sell, our products and damage our brand, which could have a material adverse effect on our results of operations. Our future success also depends on our ability to attract and retain additional qualified design and marketing personnel. We face significant competition for these individuals worldwide and we may not be able to attract or retain these employees.

Our credit facility provides our lenders with a first-priority lien against substantially all of our assets and contains financial covenants and other restrictions on our actions and it could therefore limit our operational flexibility.

Our credit facility contains certain financial covenants and other restrictions that limit our ability, among other things, to:

| • | undergo a merger or consolidation; |

| • | sell certain assets; |

| • | create liens; |

| • | guarantee certain obligations of third parties; |

16

Table of Contents

| • | make certain investments or capital expenditures; |

| • | materially change our line of business; |

| • | declare dividends or make certain distributions; |

| • | make advances, loans or extensions of credit; and |

| • | incur additional indebtedness or prepay existing indebtedness. |

In addition, we have granted the lenders a first-priority lien against substantially all of our assets. Failure to comply with the operating restrictions or financial covenants in the credit facility could result in a default which could cause the lender to accelerate the timing of payments and exercise its lien on substantially all of our assets. This could cause us to cease operations and result in a complete loss of your investment in our common stock.

If the popularity or growth of the portable media device and smartphone markets stagnates, our business and financial condition may be negatively affected.

We have experienced rapid growth in the past due in part to the popularity of, and increase in demand for, portable media devices and smartphones. We expect that sales of such products will continue to drive a substantial portion of our net sales in the future. The markets for portable media devices and smartphones continue to evolve rapidly and are dominated by several large companies. Increased competition in the headphones market from established portable media device companies or a decline in demand or popularity for such products due to technological change or otherwise, our business and financial condition may be negatively affected.

Our online operations are subject to numerous risks that could have an adverse effect on our results of operations.

Although online sales through our website constitute a small portion of our total net sales, our online operations subject us to certain risks that could have an adverse effect on our results of operations. These risks include, negatively impacting our relationships with our retailers and distributors, liability for online content, and risks related to the computer systems that operate our website and related support systems, such as computer viruses and electronic break-ins or similar disruptions. In addition, certain risks beyond our control, such as governmental regulation of the Internet, additional companies competing with us for online sales, online security breaches and general economic conditions specific to the Internet and online commerce could have an adverse effect on our results of operations. We can provide no assurance that our online operations will meet our sales and profitability plans and the failure to do so could negatively impact our results of operations.

Our net sales and operating income fluctuate on a seasonal basis and decreases in sales or margins during our peak seasons could have a disproportionate effect on our overall financial condition and results of operations.

Historically, we have experienced greater net sales in the second half of the year relative to those in the first half, due to a concentration of shopping around the fall and holiday seasons. As a result, our net sales and gross margins are typically higher in the third and fourth quarters and lower in the first and second quarters, as fixed operating costs are spread over the differing levels of sales volume. Given the strong seasonal nature of our sales, appropriate forecasting is critical to our operations. We anticipate that this seasonal impact on our net sales is likely to continue and any shortfall in expected third and fourth quarter net sales would cause our annual results of operations to suffer significantly.

Our results of operations could be materially harmed if we are unable to accurately forecast demand for our products.

To ensure adequate inventory supply, we must forecast inventory needs and place orders with our manufacturers before firm orders are placed by our retailers and distributors. In addition, a portion of our net

17

Table of Contents

sales are generated by orders for immediate delivery, particularly during our historical peak season from August through December. If we fail to accurately forecast retailer and distributor demand we may experience excess inventory levels or a shortage of product to deliver to our retailers or distributors.

Factors that could affect our ability to accurately forecast demand for our products include:

| • | changes in consumer demand for our products; |

| • | lack of consumer acceptance for our new products; |

| • | product introductions by competitors; |

| • | changes in general market conditions or other factors, which may result in cancellations of advance orders or a reduction or increase in the rate of reorders; |

| • | weakening of economic conditions or consumer confidence in future economic conditions, which could reduce demand for discretionary items; and |

| • | terrorism or acts of war, or the threat thereof, which could adversely affect consumer confidence and spending or interrupt production and distribution of product and raw materials. |

Inventory levels in excess of retailer and distributor demand may result in inventory write-downs or write-offs and the sale of excess inventory at discounted prices, which would have an adverse effect on our gross margin. In addition, if we underestimate the demand for our products, our manufacturers may not be able to produce a sufficient number of products to meet such unanticipated demand, and this could result in delays in the shipment of our products and damage to our reputation and retailer or distributor relationships.

The difficulty in forecasting demand also makes it difficult to estimate our future results of operations and financial condition from period to period. A failure to accurately predict the level of demand for our products could adversely impact our profitability.

Our management team and most of our board of directors have limited experience in managing and governing a public company, and regulatory compliance may divert our attention from the administration of our business.

Our management team has limited experience managing a publicly-traded company or complying with the increasingly complex laws pertaining to public companies. In particular, our chief executive officer has not previously managed a publicly-traded company. In addition, most of our current directors have limited experience serving on the boards of public companies and three directors have recently joined our board of directors. In order to have an effective board, these new directors and any other directors that join our board after the consummation of this offering will need to integrate with our other directors and management and become familiar with our operations and growth strategies. We may not successfully or efficiently manage the increased legal, regulatory and reporting requirements associated with being a public company, including significant regulatory oversight and reporting obligations under federal securities laws. Our failure to comply with all applicable requirements could lead to the imposition of fines and penalties, distract our management team from attending to the administration of our business, result in a loss of investor confidence in our financial reports and have an adverse effect on our business and stock price.

We may be subject to product liability or warranty claims that could result in significant direct or indirect costs, or we could experience greater returns from retailers than expected, which could harm our net sales.

We generally provide a limited lifetime warranty on all of our products. In addition, if a consumer breaks his or her headphones, we generally offer such consumer the option to buy another pair of headphones at a 50%

18

Table of Contents

discount to the retail price. The occurrence of any quality problems due to defects in our products could make us liable for damages and warranty claims in excess of our current reserves. In addition to the risk of direct costs to correct any defects, warranty claims or other problems, any negative publicity related to the perceived quality of our products could also affect our brand image, decrease retailer and distributor demand and our operating results and financial condition could be adversely affected.

We have entered into contracts with various customers granting a conditional right of return allowance with respect to defective products. We have also executed an open return program with a major retailer allowing for an unlimited amount of returns. Estimates for these items are based on actual experience and are recorded at the time net sales are recognized. If we experience a greater number of returns than expected, our net sales could be harmed.

We expect to incur significant expenses as a result of being a public company, which may negatively impact our financial performance.

We expect to incur significant legal, accounting, insurance and other expenses as a result of becoming a public company. The Sarbanes-Oxley Act of 2002, or SOX, as well as related rules implemented by the Securities and Exchange Commission, or SEC, and The Nasdaq Stock Market, have required changes in corporate governance practices of public companies. Compliance with these laws, rules and regulations, including compliance with Section 404 of SOX and the recently enacted Dodd-Frank Wall Street Reform and Consumer Protection Act, will increase our expenses, including our legal and accounting costs, and make some activities more time-consuming and costly. We also believe these laws, rules and regulations will make it more expensive for us to obtain director and officer liability insurance, and in the future we may be required to accept reduced policy limits and coverage or incur substantially higher costs to obtain the same or similar coverage. As a result, it may be more difficult for us to attract and retain qualified persons to serve on our board of directors or as officers. Furthermore, any additional increases in legal, accounting, insurance and certain other expenses that we may experience in the future could negatively impact our financial performance and have a material adverse effect on our results of operations and financial condition.

If we fail to implement effective internal controls, our ability to produce accurate financial statements could be impaired, which could adversely affect our operating results and our ability to operate our business.