Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - MITEL NETWORKS CORP | d8k.htm |

Profitable Growth

& Shareholder Value Creation

Steve Spooner

CFO

Exhibit 99.1 |

slide 2

Mitel | Confidential

Analyst Day (July 6/11) FLS/Safe Harbor

Forward Looking Statements

Some of the statements in this presentation, including the information regarding

financial performance targets, are forward-looking statements within the

meaning of applicable U.S. and Canadian securities laws. Statements that include the words "target," "outlook," "may,"

"will," "should," "could," "estimate,"

"continue," "expect," "intend," "plan," "predict," "potential," "believe," "project," "anticipate" and similar

statements of a forward-looking nature, or the negatives of those statements,

identify forward-looking statements. In particular, this presentation

may contain forward-looking statements pertaining to, among other matters: our future economic performance, profitability and

financial condition; general global economic conditions; our business strategy;

plans and objectives for future operations; our industry and the growth in

the markets in which we compete; the costs of operating as a public company; and our research and development

expenditures. These forward-looking statements reflect currently available

information or our current views with respect to future events and are

based

on

assumptions

and

subject

to

risks

and

uncertainties.

In

making

these

statements,

we

have

made

assumptions

regarding,

among other things:

No unforeseen changes occurring in the competitive landscape that would affect our

industry generally or Mitel in particular: A stable or recovering economic

environment; No significant event occurring outside the ordinary course of

our business; Stable foreign exchange and interest rates;

No asset impairments;

No material changes in effective tax rates; and

No negative impact from the implementation and execution of our new business

strategies. Actual

events

or

Mitel's

results,

performance,

financial

position

or

achievements

could

differ

materially

from

those

contemplated,

expressed

or implied by such forward-looking statements as a result of various risks and

uncertainties, including, without limitation: Our ability to achieve or

sustain profitability in the future; Fluctuations in our quarterly and

annual revenues and operating results; Fluctuations in foreign exchange

rates; Current and ongoing global economic instability;

Intense competition;

Our reliance on channel partners for a significant component of our sales;

Our dependence upon a small number of outside contract manufacturers to manufacture

our products; |

slide 3

Mitel | Confidential

Analyst Day (July 6/11) FLS/Safe Harbor continued…

Our ability to successfully implement and achieve our business strategies; and

Our ability to realize our deferred tax assets

Additional

risks

are

discussed

under

the

heading

"Risk

Factors"

in

Mitel's

Annual

Report

on

Form

10-K,

which

has

been

filed

with

the

U.S.

Securities and Exchange Commission on July 1, 2011, and filed with Canadian

securities authorities on July 4, 2011. Except as required by law,

Mitel is under no obligation to update any forward-looking statement, whether as a result of new information, future events or otherwise.

Non-GAAP Financial Measurements

To supplement our consolidated financial statements which have been prepared in

accordance with United States generally accepted accounting principles

("U.S. GAAP"), Mitel uses non-GAAP measures of operating results, net income and income per share, which are

adjusted

to

exclude

certain

costs,

expenses,

gains

and

losses

we

believe

appropriate

to

enhance

an

overall

understanding

of

our

past

financial performance and also our prospects for the future. These adjustments to

our current period and comparative prior period U.S. GAAP

results

are

made

with

the

intent

of

providing

both

management

and

investors

a

more

complete

understanding

of

Mitel's

underlying

operational results and trends and our marketplace performance. For example, the

non-U.S. GAAP results are an indication of our baseline

performance

before

gains,

losses

or

other

charges

that

are

considered

by

management

to

be

outside

of

our

core

operating

results.

In

addition, these adjusted non-U.S. GAAP results are among the primary indicators

management uses as a basis for our planning and forecasting of future

periods. The presentation of this additional information is not meant to be considered in isolation or as a substitute for

net income or diluted net income per share prepared in accordance with U.S.

GAAP. Adjusted EBITDA

Adjusted EBITDA is defined as consolidated net income (loss) before (1) interest

expense, (2) income tax recovery, (3) amortization and depreciation, (4)

foreign exchange gain (loss), (5) fair value adjustment on derivative instruments, (6) special charges and restructuring

costs, (7) stock-based compensation, (8) gain (loss) on litigation settlement,

and (9) debt retirement costs. For a reconciliation of Adjusted EBITDA to

net income, the most directly comparable U.S. GAAP measure, see attached "Reconciliation of Net Income to Adjusted EBITDA."

Adjusted EBITDA is not a measure calculated in accordance with U.S. GAAP. Adjusted

EBITDA should not be considered as an alternative to net income, income from

operations or any other measure of financial performance calculated and presented in accordance with U.S.

GAAP. We prepare Adjusted EBITDA to eliminate the impact of items that we do not

consider indicative of our core operating performance. We

encourage

you

to

evaluate

these

adjustments

and

the

reasons

we

consider

them

appropriate,

as

well

as

the

material

limitations

of

non-

GAAP

measures

and

the

manner

in

which

we

compensate

for

those

limitations.

See

"Selected

Financial

Data"

in

Mitel's

Annual

Report

on

Form

10-K,

which

has

been

filed

with

the

U.S.

Securities

and

Exchange

Commission

July

1,

2011,

and

Canadian

securities

authorities

on

July 4, 2011. |

slide 4

Mitel | Confidential

Pillars of Mitel Shareholder Value Creation

Driving top line growth

Commitment to innovation

Expanding gross margins

Leverage in the operating model

Business simplification |

slide 5

Mitel | Confidential

Driving Top Line Growth

Leveraging market share leadership in core markets

Deploying a proven go-to-market model in US region

Upgrading sales leadership

Recruiting/on-boarding mid-market channel

Focused strategies in emerging markets

Capitalizing on portfolio strengths

Enhancing our brand |

slide 6

Mitel | Confidential

Commitment to Innovation

Freedom Architecture

Leadership in Virtualization

Single software stream

Common desktop portfolio

Portfolio focus

Leveraging best-of-breed partners |

slide 7

Mitel | Confidential

Expanding Gross Margins

Mitel Strategy Should Drive Margin Accretion

Legacy platforms

Legacy sets

Legacy services

Historical

Emerging/Future

Software platforms

IP sets

Software applications

Software assurance

FY 06

FY08

Target

FY11

42%

47%

48%

51-53% |

Leverage in the Operating Model

Continued Focus on Operational Excellence

Design cost reductions

Supply chain/back office

Outsourcing (IT, Finance, Sustaining R&D)

Facilities

Scale

Opex cost base track record

$

% revenue

$291M

$249M

42%

38%

35-37%

*Opex defined as R&D and SG&A, excluding amortization of acquired

intangibles, restructuring charges, stock-based charges and

one-time items FY08

Target

FY11

slide 8

Mitel | Confidential |

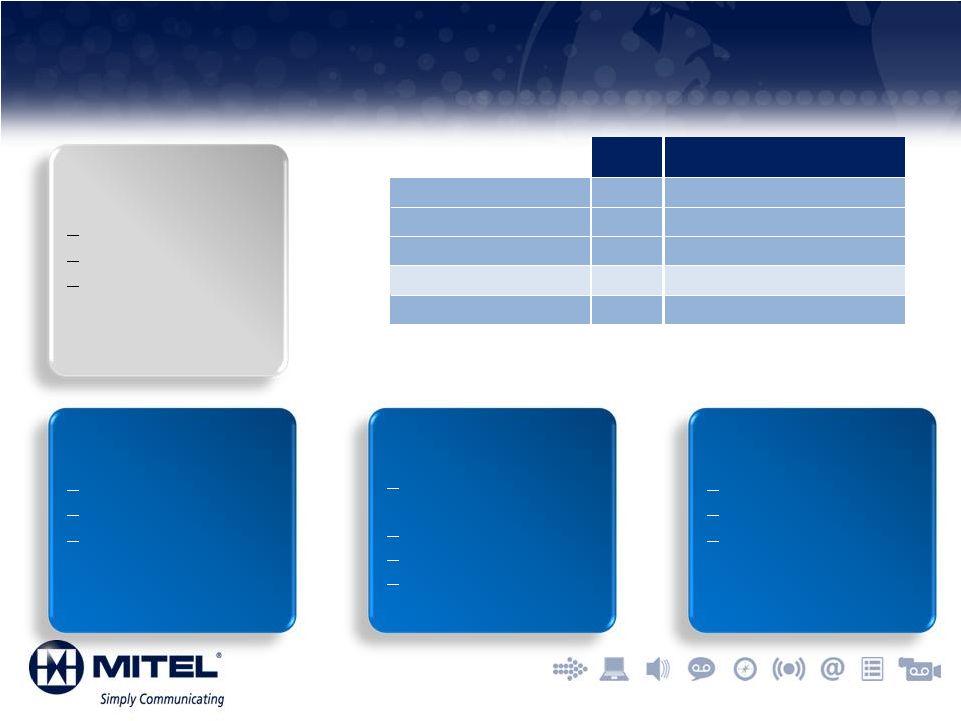

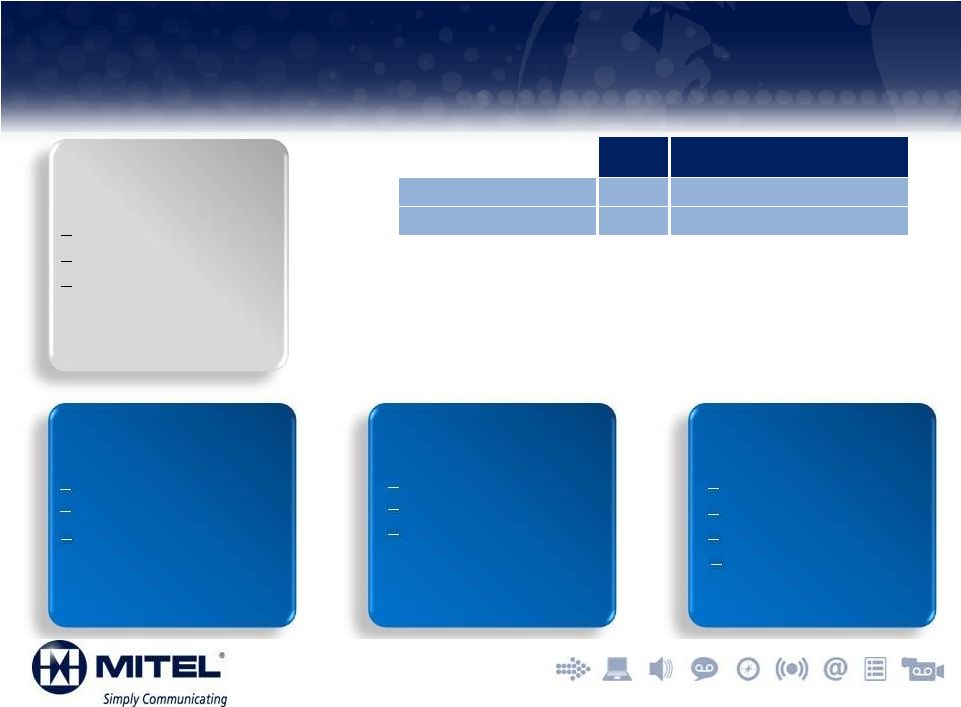

Long-Term Target

Model – Mitel Communications Solutions

Key Metrics

Market Share

% virtualized

Software Mix

Growth Drivers

TDM to IP

Virtualization

Portfolio strength

GM% Drivers

Product/service

mix

Service Assurance

Software mix

Product cost

reduction

Op Margin Drivers

GM% expansion

Growth/scale

Improved

execution

FY11*

Long-Term Target Model

Revenue/Growth Rate

$485M

8-10%

Gross Margin

54%

56% - 58%

R&D

11%

9% - 10%

SG&A

23%

20% - 21%

Segment Margin**

20%

27% - 29%

*FY11 preliminary, unaudited

**excluding corporate overheads

slide 9

Mitel | Confidential |

FY11*

Long-Term Target Model

Revenue/Growth Rate

$80M

5-7%

Gross Margin

47%

48% - 49%

R&D

nil

nil

SG&A

22%

20% - 21%

Segment Margin**

25%

27% - 29%

*FY11 preliminary, unaudited

**excluding corporate overheads

Key Metrics

#

of

customers

Monthly

Recurring

Revenue (MRR)

Growth Drivers

SIP

Trunking

Hosted

Mobility

GM% Drivers

Migration to

bundled services

New service

offerings

Improved cost

management

Op Margin Drivers

GM% expansion

Growth/scale

Improved

execution

Long-Term Target Model –

Mitel Network Solutions

slide 10

Mitel | Confidential |

FY11*

Long-Term Target Model

Revenue/Growth Rate

$85M

3-5%

Gross Margin

15%

13% - 14%

R&D

nil

nil

SG&A

8%

8%

Segment Margin**

7%

5% - 6%

*FY11 preliminary, unaudited

**excluding corporate overheads

Key Metrics

Revenue growth

GM%

Segment Margin

Growth Drivers

Core business

growth

New product

offerings

Op Margin Drivers

GM% expansion

Growth/scale

Improved

execution

Long-Term Target Model –

Mitel DataNet/CommSource

slide 11

Mitel | Confidential

GM% Drivers

Product/service

mix

Supplier

cost

negotiations |

slide 12

Mitel | Confidential

FY11*

Long-Term Target Model

Spend $

$58M

% revenue

9%

7-8%

*FY11 preliminary, unaudited

Scale/Critical Mass

Finance/Legal/IT

Facilities

Centers of

Excellence

Tools/Automation

1 ERP

Hosted Apps

Outsourcing

Simplification

Online Store

Licensing

Portfolio

Back-office

Long-Term Target Model –

Corporate SG&A

Key Metrics

Spend % Revenue

Revenue/Head

Corporate % Total

Spend |

slide 13

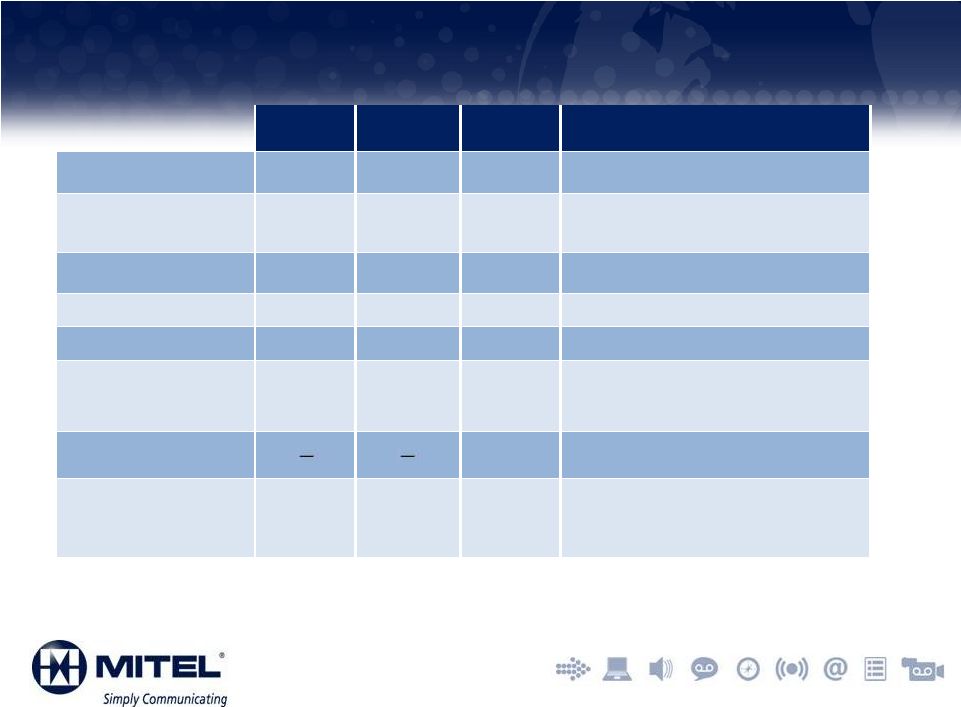

Mitel | Confidential

Long-Term Target Model –

Mitel

FY09

FY10

FY11

Long-Term Target Model

Gross Margin

46.9%

48.4%

47.9%

51% - 53%

Operating

Expenses

39%

37%

38%

35% - 37%

R&D

8%

8%

8%

8% - 9%

SG&A

31%

29%

30%

27% - 28%

Operating Margin

8%

11%

10%

15% - 18%

Adjusted EBITDA

Margin

10%

14%

12%

17% - 19%

Tax Rate

-

~12%

Non-GAAP Net

Margin

4%

8%

6%

13% - 15%

Notes:

-

Where relevant, metrics exclude one-time items, stock-based compensation and

amortization of intangibles. -

Items may not sum due to rounding.

-

Tax rate for FY09, FY10 , FY11 omitted as non-meaningful.

|

slide 14

Mitel | Confidential

Recap

Exciting Market Opportunity

–

We have not executed well of late

–

We are fixing our go-to-market model

Product

Portfolio

2

nd

to None

Mitel’s

Technology

Vision…

what

customers

are

asking

for

Simple Focused Structure

Clear Investment Priorities

Strengthened Leadership

Attractive, Achievable Target Operating Model |

|

Thank you

The

information

conveyed

in

this

presentation,

including

oral

comments

and

written

materials,

is

confidential

and

proprietary

to

Mitel®

and

is intended

solely

for

Mitel

employees

and

members

of

Mitel’s

reseller

channel.

If

you

are

not

a

Mitel

employee

or

a

Mitel

authorizedPARTNER,

you

are

not

the

intended

recipient

of

this

information

and

are

not

invited

to

the

conference,

and

cannot

participate

in

or listen

to

and/or

view

the

presentation.

Please

delete

or

return

any

related

material.

Mitel

will

enforce

its

rights

to

protect

its

confidential

and proprietary

information,

and

failure

to

comply

with

the

foregoing

may

result

in

legal

action

against

you

or

your

company. |