Attached files

| file | filename |

|---|---|

| 8-K - CAMBER ENERGY, INC. | lucas8k061011.htm |

1 LUCAS ENERGY NYSEAmex: LEI Lucas Energy, Inc. Presentation June 2011

1 LUCAS ENERGY NYSEAmex: LEI Lucas Energy, Inc. Presentation June 2011

NYSEAmex: LEI www.lucasenergy.com 2 LUCAS ENERGY NYSEAmex: LEI

Certain statements made during this presentation are forward - looking and are subject to risks and uncertainties . The forward - looking statements made are based on our beliefs, assumptions and expectations of future performance, taking into account all information currently available to us . Actual results could differ materially from the forward - looking statements made during this presentation . When we use the words "believe," "expect," "anticipate," "plan," "will," "intend" or other similar expressions, we are identifying forward - looking statements . The forward - looking statements made during this presentation are subject to the safe harbor of the Private Securities Litigation Reform Act of 1995 . We refer you to our filings with the Securities and Exchange Commission for a more detailed discussion of the risks that may have a direct bearing on our operating results, performance and financial condition . 3 LUCAS ENERGY – Safe Harbor NYSEAmex: LEI

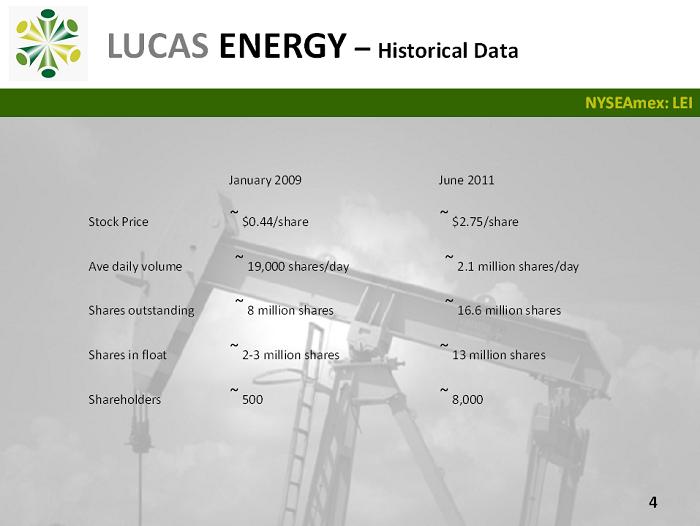

4 LUCAS ENERGY – Historical Data NYSEAmex: LEI January 2009 June 2011 Stock Price ˜ $0.44/share ˜ $2.75/share Ave daily volume ˜ 19,000 shares/day ˜ 2.1 million shares/day Shares outstanding ˜ 8 million shares ˜ 16.6 million shares Shares in float ˜ 2 - 3 million shares ˜ 13 million shares Shareholders ˜ 500 ˜ 8,000

5 LUCAS ENERGY – Oil Prices NYSEAmex: LEI $50.00 $60.00 $70.00 $80.00 $90.00 $100.00 $110.00 Jul - 10 Aug - 10 Sep - 10 Oct - 10 Nov - 10 Dec - 10 Jan - 11 Feb - 11 Mar - 11 Apr - 11 Actual Wellhead Oil Prices $/bbl

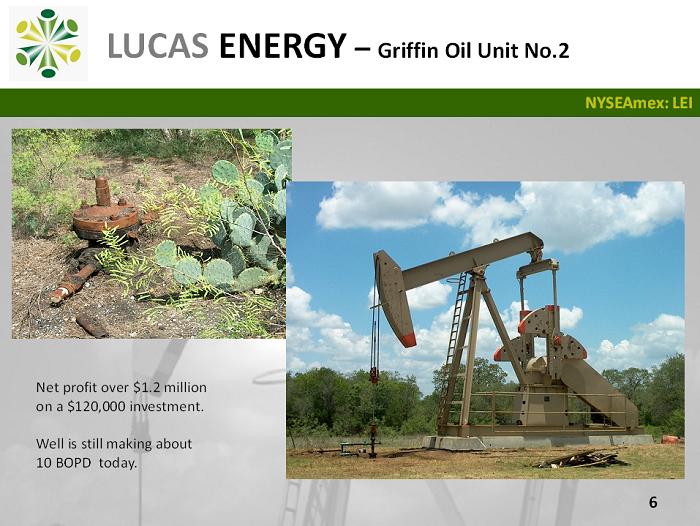

6 LUCAS ENERGY – Griffin Oil Unit No.2 NYSEAmex: LEI Net profit over $1.2 million on a $120,000 investment. Well is still making about 10 BOPD today.

7 LUCAS ENERGY – Hagen EF No.1H & No.2H NYSEAmex: LEI

8 LUCAS ENERGY – Business Plan NYSEAmex: LEI » Acquire acreage with low producing, shut in, or abandoned wells. » Improve production from old wells. » Look for underlying potential. » Develop underlying potential if within LEI budget. » Seek joint venture partners for larger cost development projects.

9 LUCAS ENERGY - Assets NYSEAmex: LEI » Austin Chalk/Eagle Ford Trend – Atascosa, Gonzales, Karnes, Wilson, Jasper, & Sabine Counties, Texas; and McKinley County, New Mexico. » About 33,000 gross acres. » About 20,000 gross acres in Texas. » About 4,400 net acres in Eagle Ford.

10 LUCAS ENERGY - Focus NYSEAmex: LEI

11 LUCAS ENERGY – Joint Ventures NYSEAmex: LEI » Hilcorp – 4 th largest privately owned oil company in America. Sold out Eagle Ford acreage to Marathon. » Nordic Oil USA I LLLP – oil and gas partnership. » Hall Phoenix Oil & Gas – Private investment group. » Marathon Oil Company – Large oil and gas company.

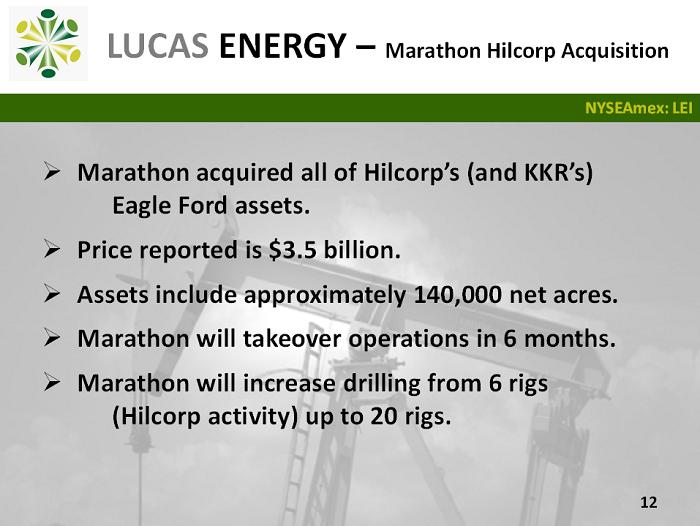

12 LUCAS ENERGY – Marathon Hilcorp Acquisition NYSEAmex: LEI » Marathon acquired all of Hilcorp’s (and KKR’s) Eagle Ford assets. » Price reported is $3.5 billion. » Assets include approximately 140,000 net acres. » Marathon will takeover operations in 6 months. » Marathon will increase drilling from 6 rigs ( Hilcorp activity) up to 20 rigs.

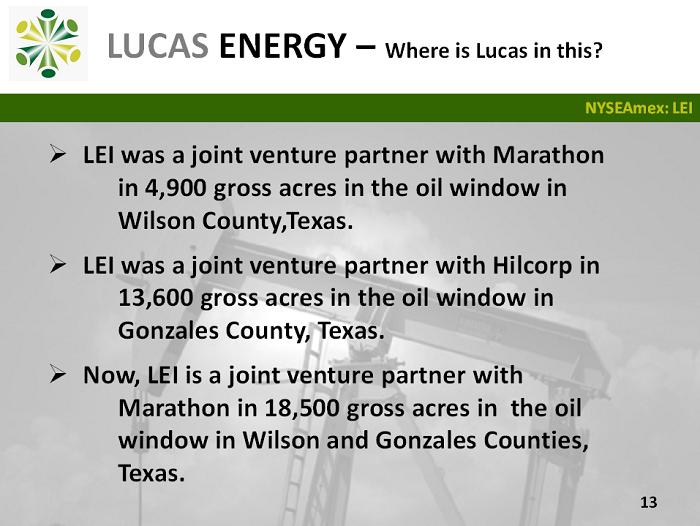

13 LUCAS ENERGY – Where is Lucas in this? NYSEAmex: LEI » LEI was a joint venture partner with Marathon in 4,900 gross acres in the oil window in Wilson County,Texas . » LEI was a joint venture partner with Hilcorp in 13,600 gross acres in the oil window in Gonzales County, Texas. » Now, LEI is a joint venture partner with Marathon in 18,500 gross acres in the oil window in Wilson and Gonzales Counties, Texas.

14 LUCAS ENERGY – Potential benefits to Lucas NYSEAmex: LEI » LEI has increased it joint venture position with Marathon, a larger partner. » Increased development activity as Marathon is more aggressive in the oil window. » Increased valuation of LEI’s Eagle Ford properties.

15 LUCAS ENERGY – Potential Evaluation NYSEAmex: LEI Marathon paid $3.5 billion less $0.5 billion proved producing = $3.0 billion divided by 140,000 net acres = $21,400 per net acre. Lucas has 4,400 net acres times $21,400 per net acres = $94 million divided by 22,460,000 shares = $4.20 per share (fully diluted) Eagle Ford only.

16 LUCAS ENERGY – Annual Volumes NYSEAmex: LEI 0 10,000 20,000 30,000 40,000 50,000 60,000 2005 - 06 2006 - 07 2007 - 08 2008 - 09 2009 - 10 2010 - 11 Gross Annual Production

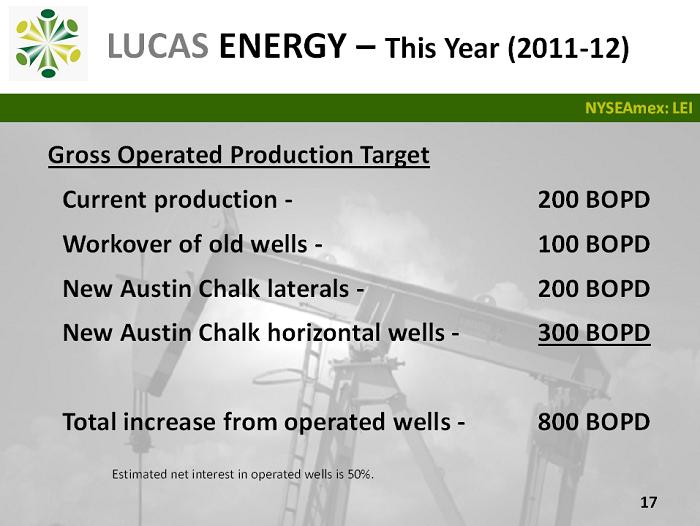

17 LUCAS ENERGY – This Year (2011 - 12) NYSEAmex: LEI Gross Operated Production Target Current production - 200 BOPD Workover of old wells - 100 BOPD New Austin Chalk laterals - 200 BOPD New Austin Chalk horizontal wells - 300 BOPD Total increase from operated wells - 800 BOPD Estimated net interest in operated wells is 50%.

18 LUCAS ENERGY – This Year (2011 - 12) NYSEAmex: LEI Gross Non - operated Production Target Current production - 400 BOPD New Eagle Ford horizontal wells - 600 BOPD Total increase from operated wells - 1,000 BOPD Estimated net interest in non - operated wells is 11%.

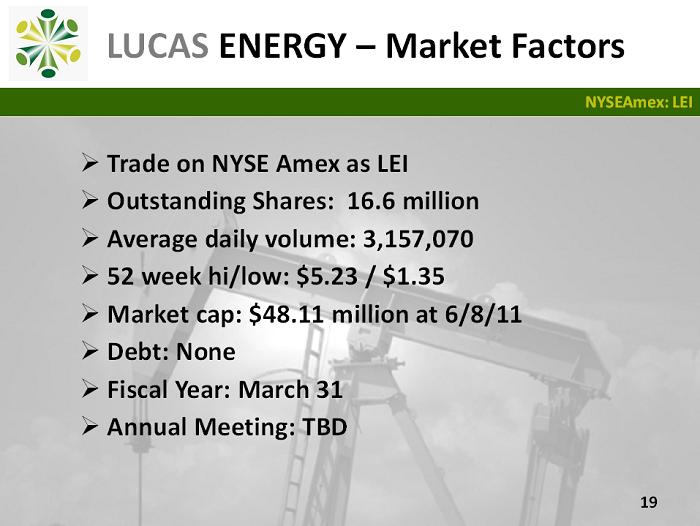

19 LUCAS ENERGY – Market Factors NYSEAmex: LEI » Trade on NYSE Amex as LEI » Outstanding Shares: 16.6 million » Average daily volume: 3,157,070 » 52 week hi/low: $5.23 / $1.35 » Market cap: $48.11 million at 6/8/11 » Debt: None » Fiscal Year: March 31 » Annual Meeting: TBD

Corporate Office 3555 Timmons Lane, Suite 1550 Houston, Texas 77027 Tel (713) 528 - 1881 Fax (713) 337 - 1510 www.lucasenergy.com 20 LUCAS ENERGY - Contact Info NYSEAmex: LEI