Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT - ROWAN COMPANIES PLC | v225015_8k.htm |

Designed Rowan Companies, Inc. for Success Investor Presentation June, 2011 Rowan Companies, Inc. Investor Presentation June, 2011 ROWAN . C C OMP ANIES ,I N * *Photo provided by Hyundai Heavy Industries.

Forward -Lookin g Statements This report contains forward looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, including, without limitation, statements as to the expectations, beliefs and future expected financial performance of the Company that are based on current expectations and are subject to certain risks, trends and uncertainties that could cause actual results to differ materially from those projected by the Company . Among the factors that could cause actual results to differ materiall y are the followin g: oil, natural gas and other commodity prices; the level of offshore expenditures by energy companies; energy demand; the general economy, including inflation; weather conditions in the Company’s principal operating areas; and environmental and other laws and regulations . Other relevant factors have been disclosed in the Company’s filings with the U. S. Securities and Exchange Commission . 2

Rowan is Focusin g on Offshore Drilling 3

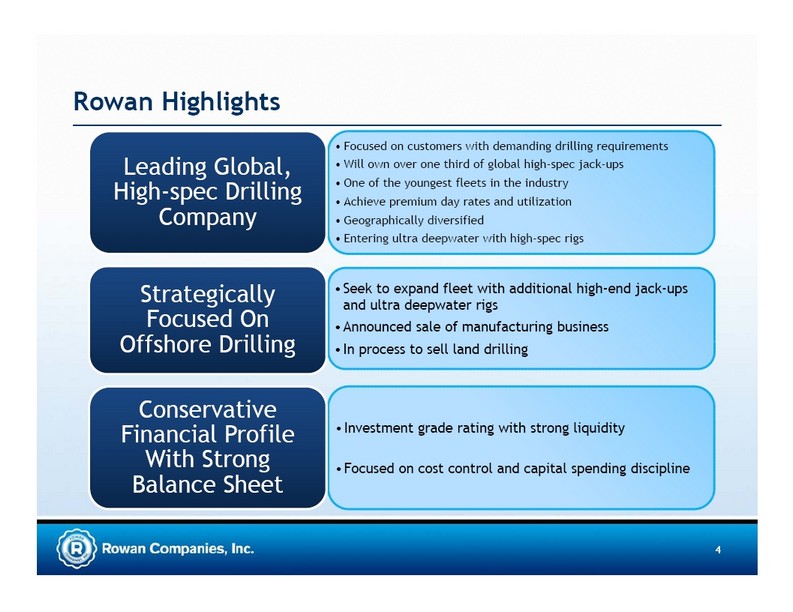

Rowan Highlights • Focused on customers with demanding drilling requirements Leading Global, • Will own over one third of global high-spec jack-ups High -spec Drilling • One of the youngest fleets in the industr y • Achieve premium day rates and utilization Company • Geographically diversified • Entering ultra deepwater with high-spec rigs Strategically •Seek to expand fleet with additional high-end jack-ups and ultra deepwater rigs Focused On •Announced sale of manufacturing business Offshore Drilling •In process to sell land drilling Conservative Financial Profile •Investment grade rating with strong liquidity With Strong •Focused on cost control and capital spending discipline Balance Sheet 4

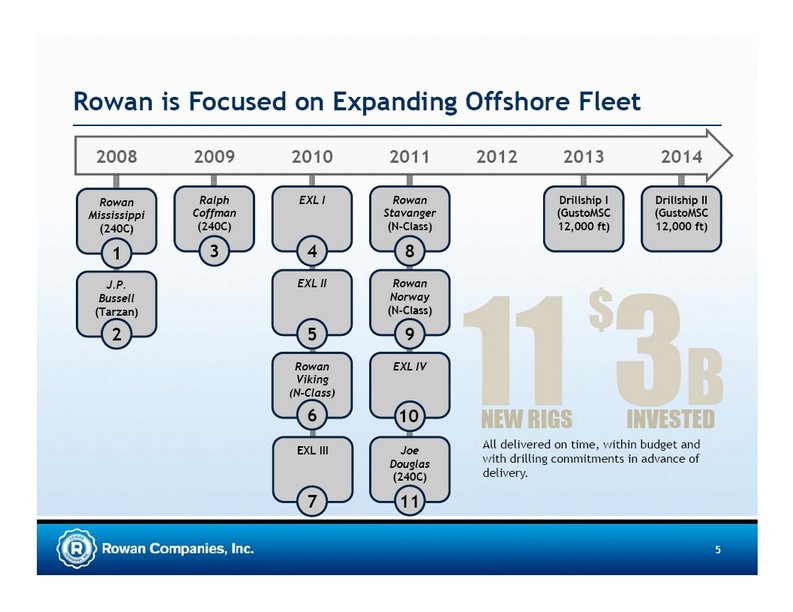

Rowan is Focused on Expandin g Offshore Fleet 2008 2009 2010 2011 2012 2013 2014 Rowan Ralph EXL I Rowan Drillship I Drillship II Mississippi Coffman Stavanger (GustoMSC (GustoMSC (240C) (240C) (N-Class) 12,000 ft) 12,000 ft) 1 3 4 8 J.P. EXL II Rowan Bussell Norway (Tarzan) (N-Class) $ 2 5 9 Rowan EXL IV Viking (N-Class) B 6 10 NEW RIGS INVESTED All delivered on time, within budget and EXL III Joe Douglas with drilling commitments in advance of (240C) delivery . 7 11 5

Rowan is Diversif ying into the Ultra Deepwater High-Spec Ultra Deepwater Jack-ups Drillships Photo provided by Hyundai Heavy Industries. 6

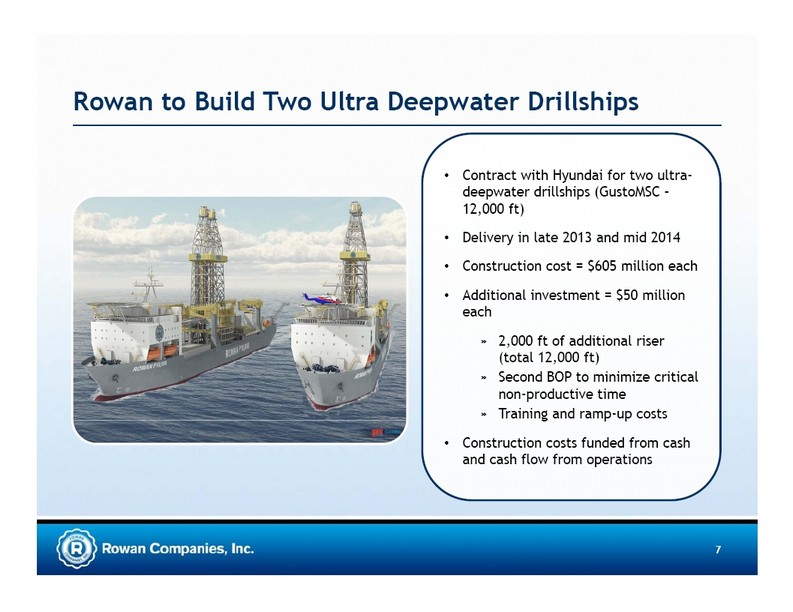

Rowan to Build Two Ultra Dee pwater Drillshi ps • Contract with Hyundai for two ultra-deepwater drillships (GustoMSC – 12,000 ft) • Delivery in late 2013 and mid 2014 • Construction cost = $605 million each • Additional investment = $50 million each » 2,000 ft of additional riser (total 12,000 ft) » Second BOP to minimize critical non-productive time » Trainin g and ramp-up costs • Construction costs funded from cash and cash flow from operations 7

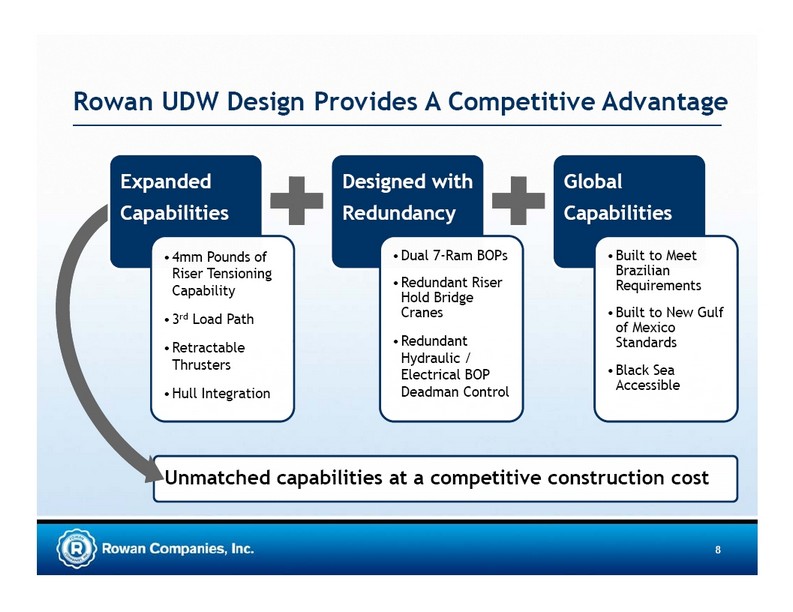

Rowan UDW Desi gn Provides A Com petitive Advanta ge Expanded Designed with Global Capabilities Redundancy Capabilities •4mm Pounds of •Dual 7-Ram BOPs •Built to Meet Riser Tensioning Brazilian •Redundant Riser Requirements Capability Hold Bridge Cranes •Built to New Gulf •3rd Load Path of Mexico •Redundant Standards •Retracta ble Hydraulic / Thrusters •Black Sea Electrical BOP Accessible •Hull Integration Deadman Control Unmatched capabilities at a competitive construction cost 8

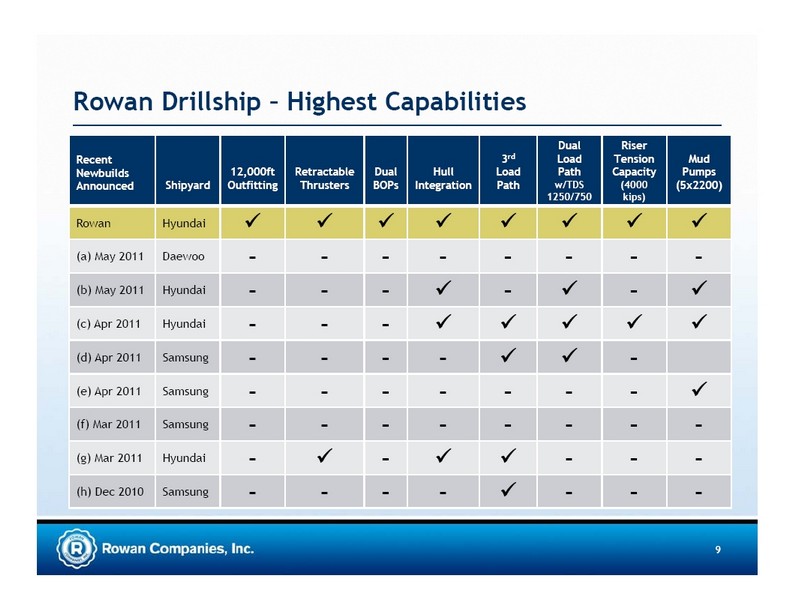

Rowan Drillshi p – Highest Capabilities Dual Riser Recent 3rd Load Tension Mud Newbuilds 12,000ft Retractable Dual Hull Load Path Capacity Pumps Announced Shipyard Outfitting Thrusters BOPs Integration Path w/TDS (4000 (5x2200) 1250/750 kips) Rowan Hyundai 9 9 9 9 9 9 9 9 (a) May 2011 Daewoo – – – – – – – –(b) May 2011 Hyundai – – – 9 – 9 – 9 (c) Apr 2011 Hyundai – – – 9 9 9 9 9 (d) Apr 2011 Samsung – – – – 9 9 –(e) Apr 2011 Samsung – – – – – – – 9 (f) Mar 2011 Samsung – – – – – – – – (g) Mar 2011 Hyundai – 9 – 9 9 – – –(h) Dec 2010 Samsung – – – – 9 – – – 9

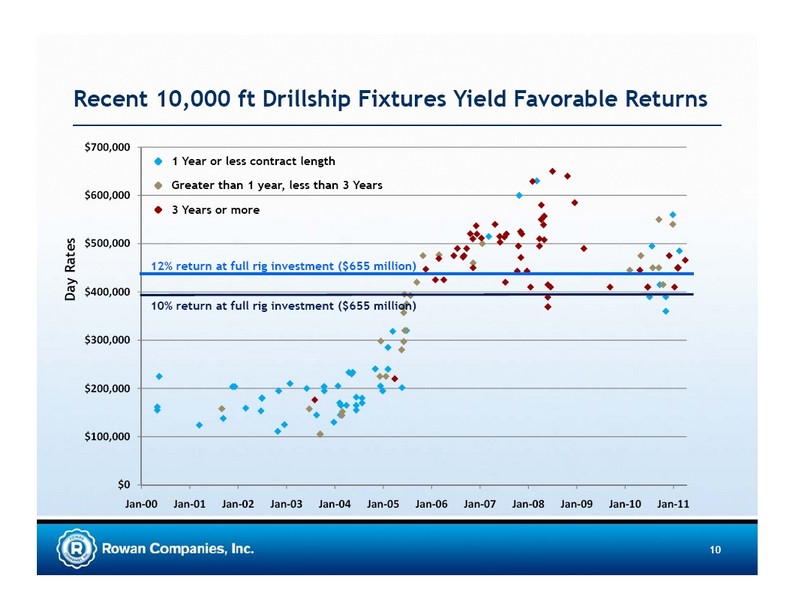

Recent 10,000 ft Drillship Fixtures Yield Favorable Returns $700,000 1 Year or less contract length Greater than 1 year, less than 3 Years $600,000 3 Years or more ates $500,000 R 12% return at full rig investment ($655 million) Day $400,000 10% return at full rig investment ($655 million) $300,000 $200,000 $100,000 $0 Jan‐ 00 Jan‐ 01 Jan‐ 02 Jan‐ 03 Jan‐ 04 Jan‐ 05 Jan‐ 06 Jan‐ 07 Jan‐ 08 Jan‐ 09 Jan‐ 10 Jan‐ 11 10

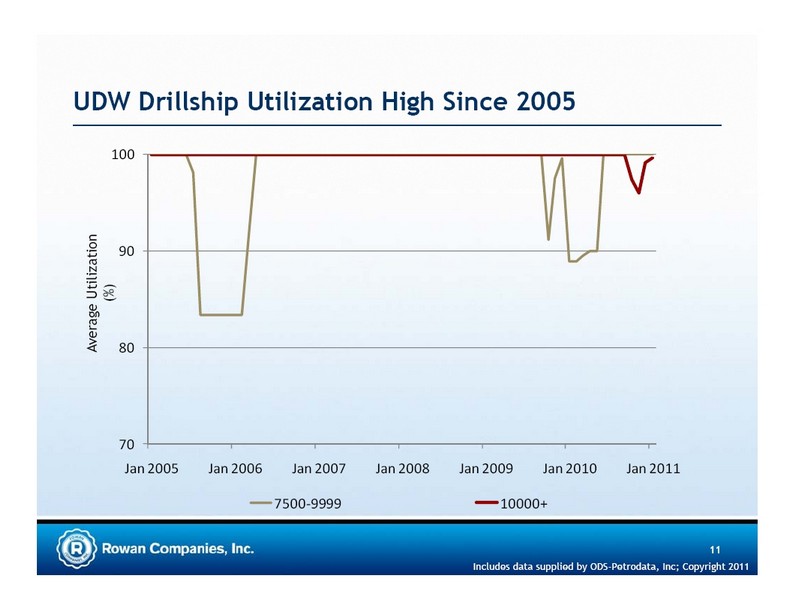

UDW Drillshi p Utilization High Since 2005 100 ation 90 z Utili (%) erage v A 80 70 Jan 2005 Jan 2006 Jan 2007 Jan 2008 Jan 2009 Jan 2010 Jan 2011 7500‐ 9999 10000+ 11 Includes data supplied by ODS-Petrodata, Inc; Copyright 2011

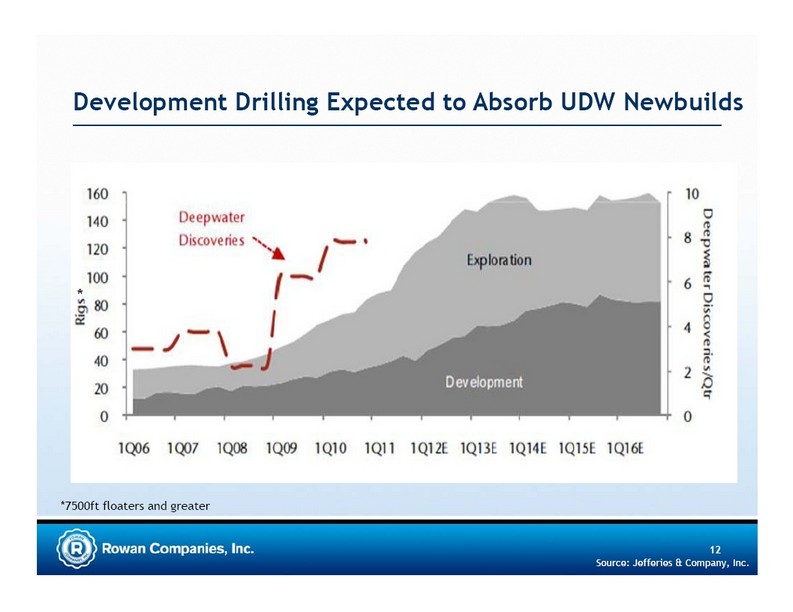

Develo pment Drilling Expected to Absorb UDW Newbuilds * *7500ft floaters and greater 12 Source: Jefferies & Company, Inc.

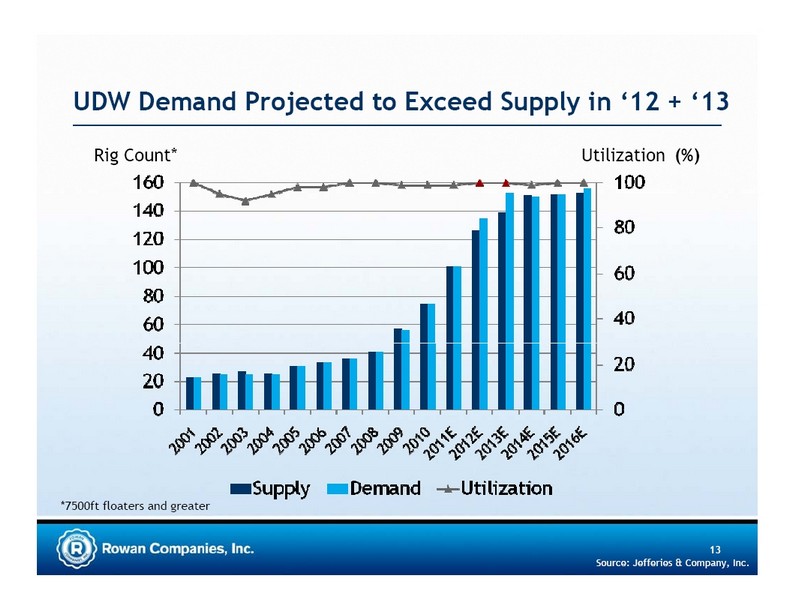

UDW Demand Projected to Exceed Supply in ‘12 + ‘13 Rig Count* Utilization (%) *7500ft floaters and greater 13 Source: Jefferies & Company, Inc.

Rowan has Advanta ges in Enterin g UDW Market • Long standing brand reputation for operational excellence and customer satisfaction • Strong global marketing coverage • Very high-spec drillship design with capability advantages and built-in redundancies • Core team of highly experienced and respected deepwater professionals already in place • 100% success contracting newbuilds before delivery 14

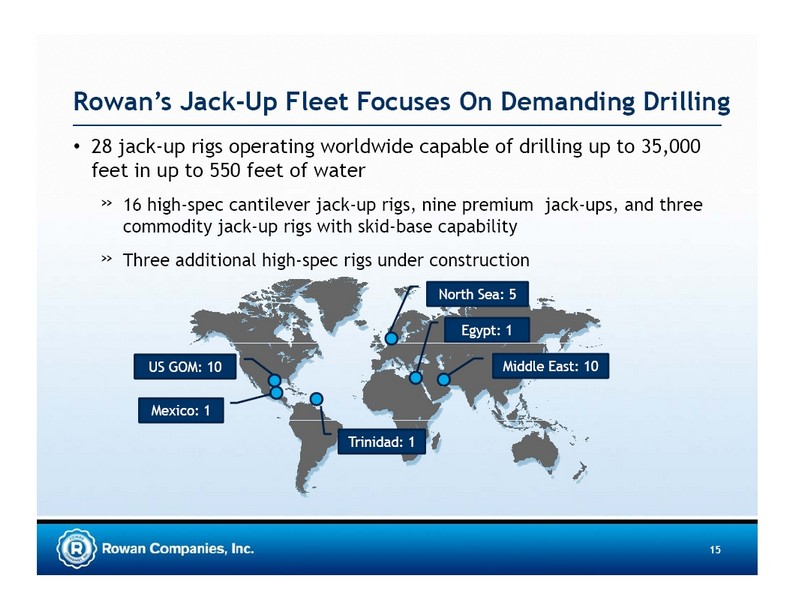

Rowan’s Jack -Up Fleet Focuses On Demandin g Drillin g • 28 jack-up rigs operating worldwide capable of drilling up to 35,000 feet in up to 550 feet of water » 16 high-spec cantilever jack-up rigs, nine premium jack-ups, and three commodity jack-up rigs with skid-base capability » Three additional high-spec rigs under construction North Sea: 5 Egypt: 1 US GOM: 10 Middle East: 10 Mexico: 1 Trinidad: 1 15

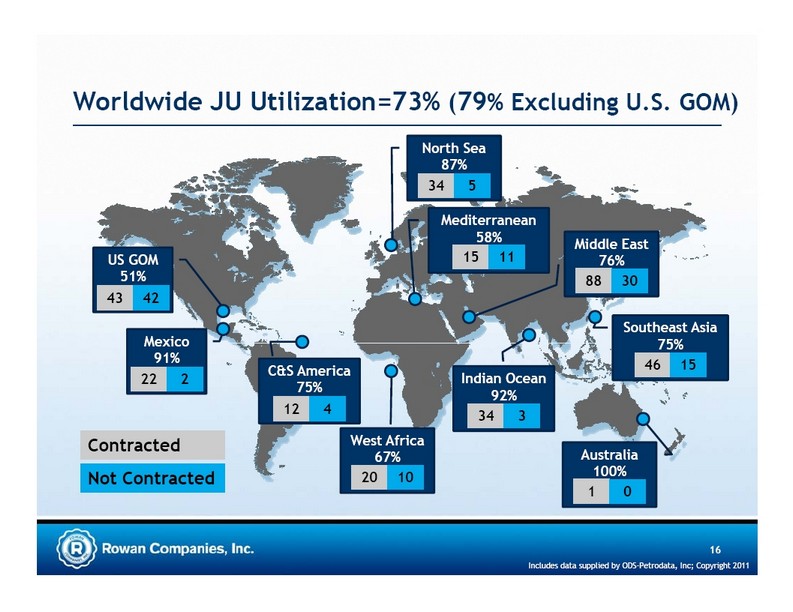

Worldwide JU Utilization=73% (79% Excludin g U.S. GOM ) North Sea 87% 34 5 Mediterranean 58% Middle East US GOM 15 11 76% 51% 88 30 43 42 Southeast Asia Mexico 75% 91% C&S America 46 15 22 2 Indian Ocean 75% 92% 12 4 34 3 Contracted West Africa 67% Australia Not Contracted 20 10 100% 1 0 16 Includes data supplied by ODS-Petrodata, Inc; Copyright 2011

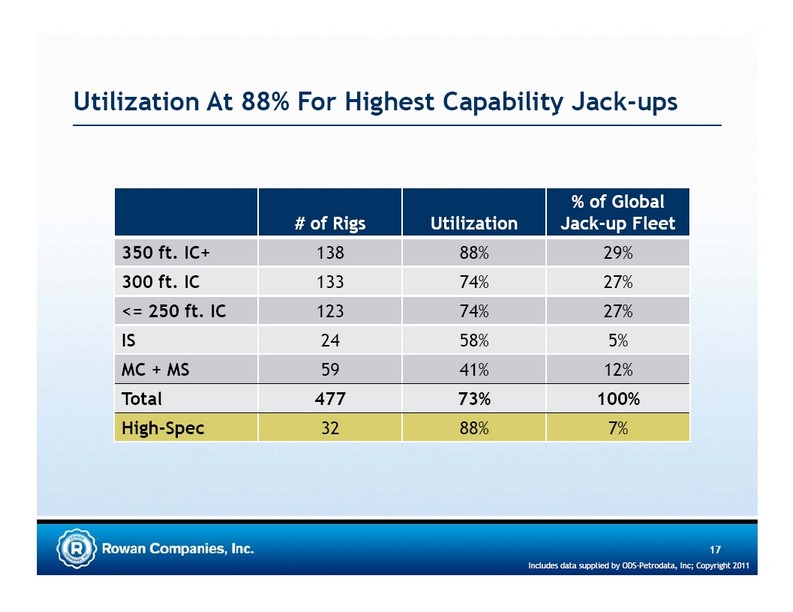

Utilization At 88% For Highest Capabilit y Jack -ups % of Global # of Rigs Utilization Jack-up Fleet 350 ft. IC+ 138 88% 29% 300 ft. IC 133 74% 27% <= 250 ft. IC 123 74% 27% IS 24 58% 5% MC + MS 59 41% 12% Total 477 73% 100% High-Spec 32 88% 7% 17 Includes data supplied by ODS-Petrodata, Inc; Copyright 2011

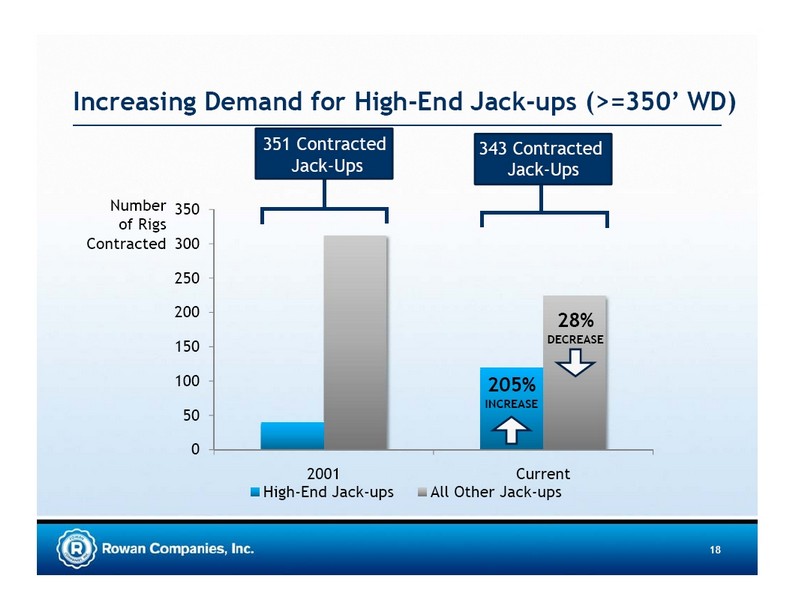

Increasin g Demand for High-End Jack -ups (>=350’ WD) 351 Contracted 343 Contracted Jack-Ups Jack-Ups Number 350 of Rigs Contracted 300 250 200 28% 150 DECREASE 100 205% INCREASE 50 0 2001 Current High-End Jack-ups All Other Jack-ups 18

What’s Drivin g Demand for Higher-Spec Rigs? • Operators are requiring greater rig capabilities to drill more challenging wellbore designs and large pipe programs » Deep shelf gas » Long reach horizontals » HPHT • IOCs and NOCs are more focused on achieving lower wellbore costs rather than the lowest day rate • Operators are requiring higher standards post-Macondo 19

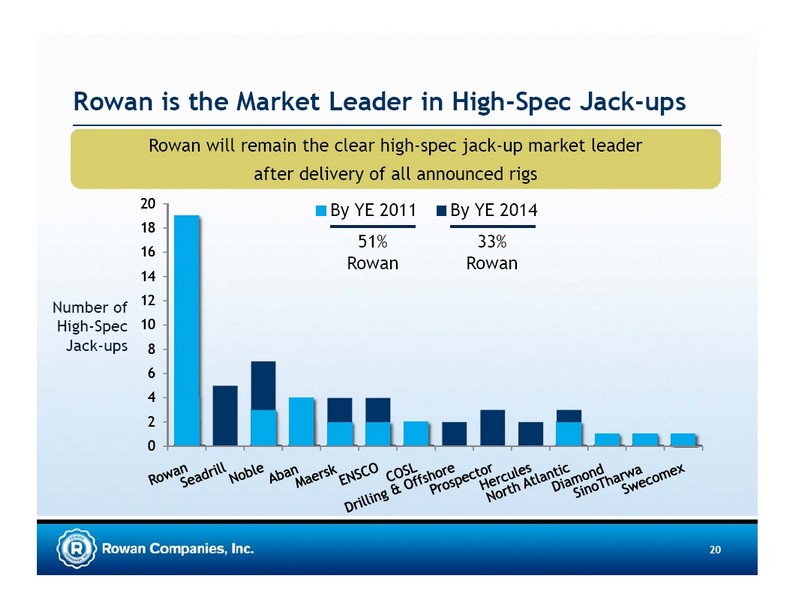

Rowan is the Market Leader in High-Spec Jack -ups By YE 2011, Rowan will own 19 of the 37 high-spec jack-ups (51%) Rowan will remain the clear high-spec jack-up market leader after delivery of all announced rigs 20 By YE 2011 By YE 2014 18 51% 33% 16 Rowan Rowan 14 Number of 12 High-Spec 10 Jack-ups 8 6 4 2 0 20

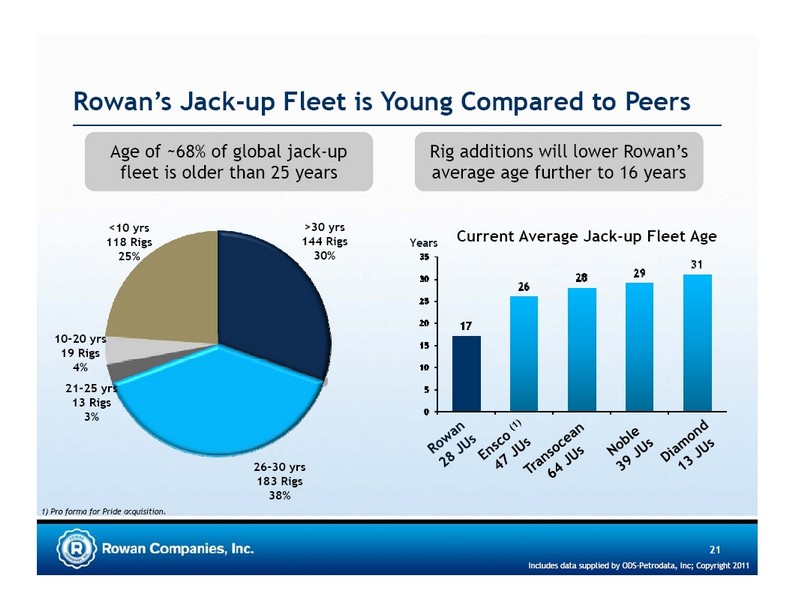

Rowan’s Jack -up Fleet is Youn g Compared to Peers Age of ~68% of global jack-up Rig additions will lower Rowan’s fleet is older than 25 years average age further to 16 years <10 yrs >30 yrs 118 Rigs 144 Rigs Years Current Average Jack-up Fleet Age 25% 30% 10-20 yrs 19 Rigs 4% 21-25 yrs 13 Rigs 3% 26-30 yrs 183 Rigs 38% 1) Pro forma for Pride acquisition. 21 Includes data supplied by ODS-Petrodata, Inc; Copyright 2011

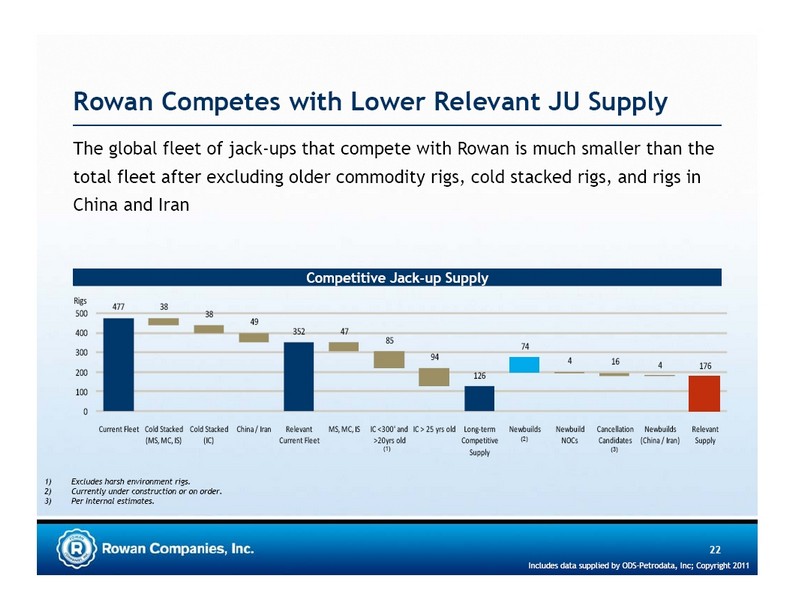

Rowan Competes with Lower Relevant JU Supply The global fleet of jack-ups that compete with Rowan is much smaller than the total fleet after excluding older commodity rigs, cold stacked rigs, and rigs in China and Iran Competitive Jack-up Supply Rigs 477 38 500 38 49 400 352 47 85 74 300 94 4 16 4 176 200 126 100 0 Current Fleet Cold Stacked Cold Stacked China / Iran Relevant MS, MC, IS IC <300' and IC > 25 yrs old Long‐ term Newbuilds Newbuild Cancellation Newbuilds Relevant (MS, MC, IS) (IC) Current Fleet >20yrs old Competitive (2) NOCs Candidates (China / Iran) Supply (1) (3) Supply 1) Excludes harsh environment rigs. 2) Currently under construction or on order. 3) Per Internal estimates. 22 Includes data supplied by ODS-Petrodata, Inc; Copyright 2011

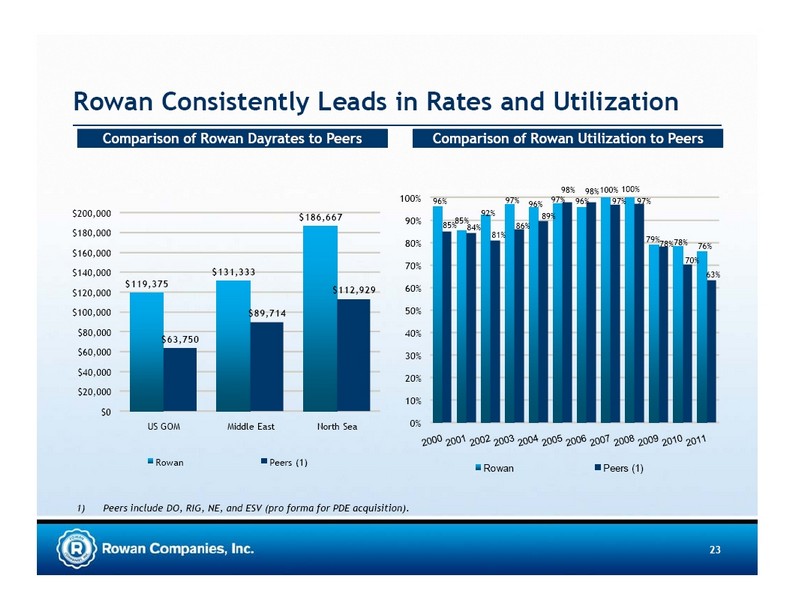

Rowan Consistentl y Leads in Rates and Utilization Comparison of Rowan Dayrates to Peers Comparison of Rowan Utilization to Peers 98% 98%100% 100% 100% 96% 97% 97% 96% 97% 97% 96% $200,000 $186,667 92% 89% 90% 85% 85% 84% 86% $180,000 81% 80% 79% 78% 78% 76% $160,000 70% 70% $140,000 $131,333 63% $119,375 60% $120,000 $112,929 $100,000 $89,714 50% $80,000 40% $63,750 $60,000 30% $40,000 20% $20,000 10% $0 US GOM Middle East North Sea 0% Rowan Peers (1) Rowan Peers (1) 1) Peers include DO, RIG, NE, and ESV (pro forma for PDE acquisition) . 23

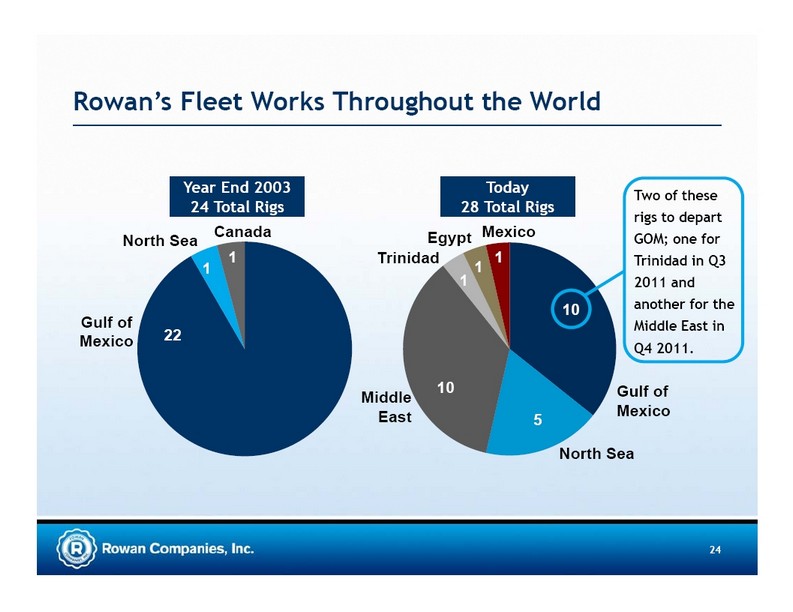

Rowan’s Fleet Works Throu ghout the World Year End 2003 Today Two of these 24 Total Rigs 28 Total Rigs rigs to depart Canada Egypt Mexico North Sea GOM; one for 1 Trinidad 1 Trinidad in Q3 1 1 1 2011 and 10 another for the Gulf of Middle East in Mexico 22 Q4 2011. 10 Gulf of Middle East Mexico 5 North Sea 24

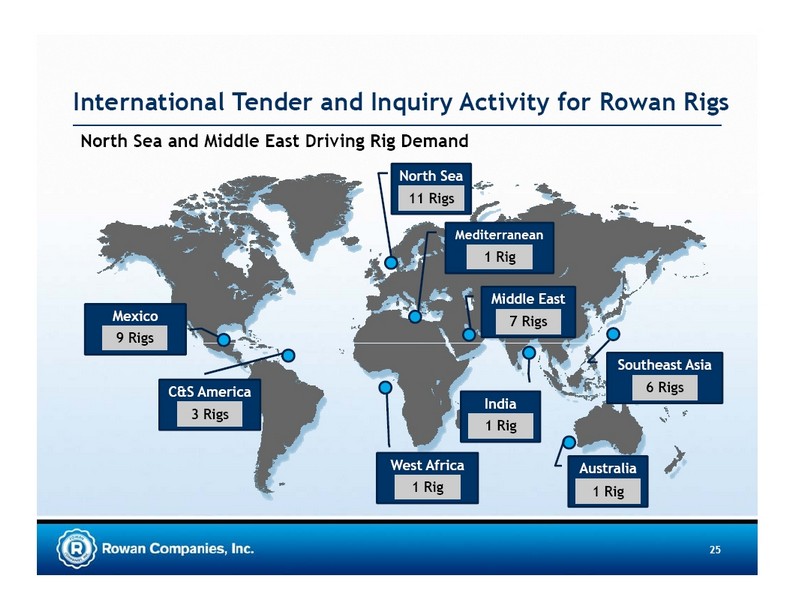

International Tender and Inquiry Activit y for Rowan Rigs North Sea and Middle East Driving Rig Demand North Sea 11 Rigs Mediterranean 1 Rig Middle East Mexico 7 Rigs 9 Rigs Southeast Asia C&S America 6 Rigs India 3 Rigs 1 Rig West Africa Australia 1 Rig 1 Rig 25

Three High-Spec N-Class Rigs Committed R o w a n V i k i n g Rig committed to Total UK for 19 months of work in the low $220s per day R o w a n S t a v a n g e r Rig committed to Talisman Norway for accommodation work in the low $330s per day and for drilling in the UK and Norway with the day rate ranging from the mid $260s to mid $330s R o w a n N o r w a y Rig committed to Xcite Energy for ~240 days of work in the UK North Sea in the low $250s per day Tracking Multiple Contract Opportunities for N-Class Rigs • Current demand in the North Sea for approximately 14-18 rigs over the next three years • Operators are anxious to see increased competition and a high grading of equipment in the area 26

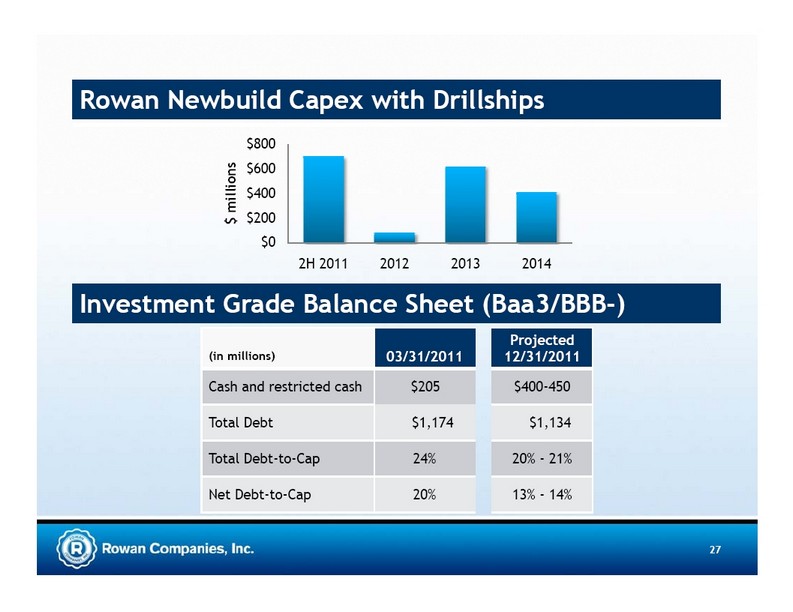

Rowan Newbuild Capex with Drillshi ps $800 ions $600 mill $400 $200 $ $0 2H 2011 2012 2013 2014 Investment Grade Balance Sheet (Baa3/BBB -) Projected (in millions) 03/31/2011 12/31/2011 Cash and restricted cash $205 $400-450 Total Debt $1,174 $1,134 Total Debt-to-Cap 24% 20% - 21% Net Debt-to-Cap 20% 13% - 14% 27

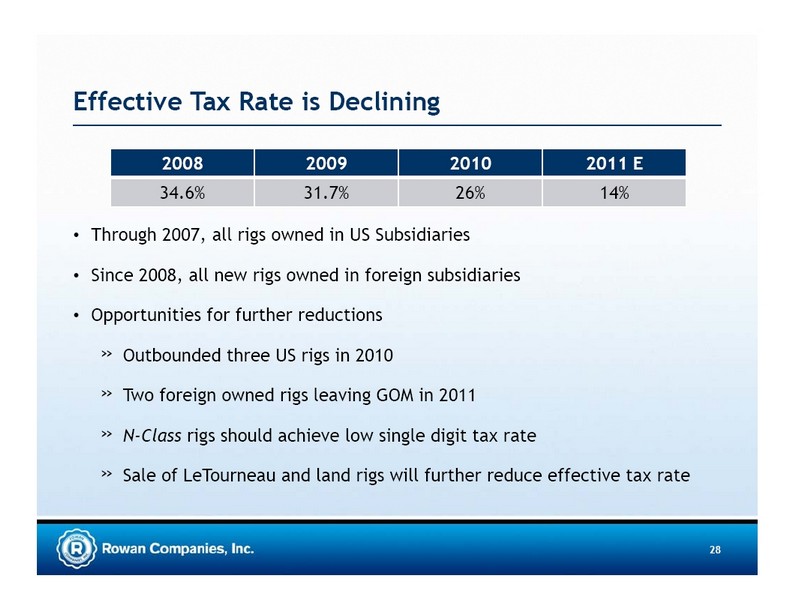

Effective Tax Rate is Declining 2008 2009 2010 2011 E 34.6% 31.7% 26% 14% • Through 2007, all rigs owned in US Subsidiaries • Since 2008, all new rigs owned in foreign subsidiaries • Opportunities for further reductions » Outbounded three US rigs in 2010 » Two foreign owned rigs leaving GOM in 2011 » N-Class rigs should achieve low single digit tax rate » Sale of LeTourneau and land rigs will further reduce effective tax rate 28

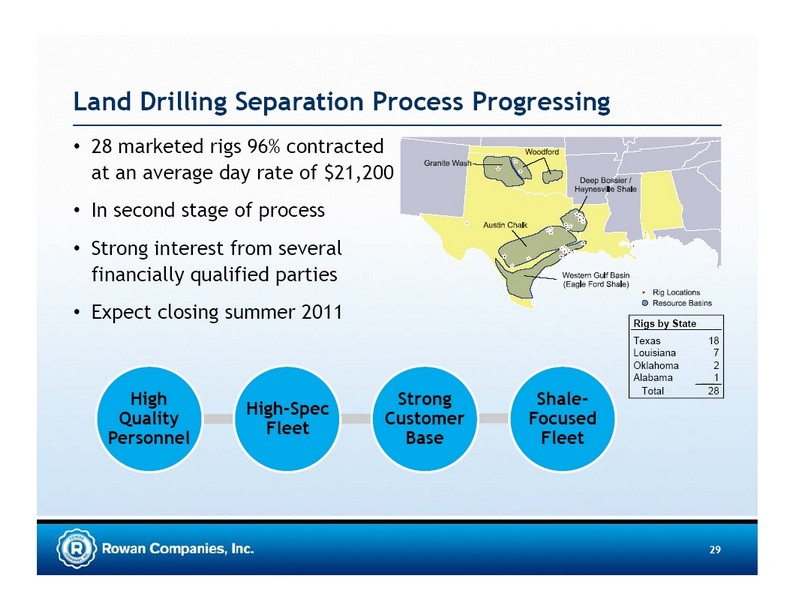

Land Drillin g Separation Process Progressin g • 28 marketed rigs 96% contracted at an average day rate of $21,200 • In second stage of process • Strong interest from several financially qualified parties • Expect closing summer 2011 Rigs by State Texas 18 Louisiana 7 Oklahoma 2 Alabama 1 High Strong Shale- Total 28 High-Spec Quality Customer Focused Fleet Personnel Base Fleet 29

LeTourneau Sale to Joy Global Announced • Joy Global to acquire 100% of LeTourneau from Rowan for $1.1 billion in cash ($875 million after tax) • Closing estimated by early July 2011 • Transaction is … » Consistent with Rowan’s long stated strategy —to focus on expanding offshore drilling business » An excellent fit with Joy Global and should be beneficial for both LeTourneau and its employees Mining Products Drilling Products Offshore Products Drilling Systems 30

Rowan is Designed for Success Leading Global, Strategically Conservative High-spec Drilling Focused On Financial Profile Company Offshore Drilling With Strong Balance Sheet 31

Rowan Companies , Inc. 2800 Post Oak Blvd. Suite 5450 Houston , TX 77056 713.621.7800 www.rowancompanies .com Investor Contact: Suzanne M. McLeod Director, Investor Relations smcleod@rowancompanies .com 32