Attached files

| file | filename |

|---|---|

| 8-K - STAAR SURGICAL CO | v224367_8k.htm |

STAAR Surgical Annual Shareholder Meeting May 27, 2011

Agenda for Shareholder Meeting• Welcome/Introductions• Voting– Four proposals for shareholder vote– Announcement of voting results• Adjourn Shareholder’s Meeting• Presentation on Company’s progress• Shareholder Questions• Conclude meeting

Don Bailey• Chairman of Board• Chairman of Nominating & Governance• Member of Audit Committee• Director and Chairman since 2005• Currently CEO and Director of QuestcorPharmaceuticals (QCOR)• Former CEO and Chairman of Comarco (10yrs)

Donald Duffy• Chairman of Audit Committee• Director and Audit Chairman since 2003• Former CFO of IOLab, former ophthalmicsubsidiary of J&J• Former CFO of J&J Ultrasound division• Over 20 years experience in J&J financialpositions

Mark Logan• Director since November 2010• Former Chairman & CEO of VisX• Former Chairman & CEO of Insmed Pharma• Former EVP & COO & Director of B&L• Current Chairman of Board at Vivus, Inc.• Over 35 years of health care experienceincluding areas of ophthalmic medicaldevices (refractive surgery) and FDA

David Morrison• Director since May 2001• Chairman of Compensation Committee• Member of Nominating and Governance• Former President and COO of Chiron Vision Ophthalmics• Former President of International Operationsand Co‐ COO of CooperVision• Over 35 years of executive managementexperience

John Moore• Director since January 2008• Member of Nominating and Governance• Member of Compensation Committee• Former CEO of Notal Vision• Former CEO of Laser Diagnostic Technologies• Over 25 years experience with ophthalmicmedical device companies

Randy Meier• Director since June 2009• Member of Audit Committee• Current EVP and CFO of Teleflex Inc.• Current Director of BioMarin Pharmaceuticals• Former President and COO of AMO• Former EVP and CFO of Valeant Pharmaceuticals• Held various executive roles within financial and banking institutions

Shareholder Voting • Vote on Four Proposals – Election of Directors – Ratification of BDO as public accounting firm – Advisory vote on Executive Compensation – Advisory vote on frequency of advisory votingon Executive Compensation • Announce results

Motion to adjourn Annual Meeting

STAAR Surgical(NASDAQ: STAA)May 2011

Key Challenges Entering 2010• Adverse legal judgments of $11.4M• $5M note from acquisition of Canon interest in Japan business• 1.7 million preferred shares at $4 on balancesheet ($6.8M)• 34.9M outstanding shares/41 .8M fully diluted• Share price of $3.10• $6.3M in cash + $7.4M in restricted cash

Key Accomplishments in 2010Beginning of 2010 End of 2010• $11.4M judgments • Settled for $4M from STAAR • $5M note due in December • Prepaid note • $1.7M Preferred Shares • Retired Preferred• 34.9M shares/41 .8M fully• 35.1M shares/39 .7M fully diluted* diluted*• Share price at $3.10 • Share price at $6.10 • $6.3M in cash + $7.4M • $9.4M in cash• Ugly Balance Sheet • Strong Balance Sheet*Estimate on a non‐ GAAP basis.

Other Key 2010 Accomplishments• Finalized Five Year Strategic Plan to grow the Company• Successfully divested Domilens business• Added to Russell 3000 Index• 3 good analysts picked up coverage• Added key managers to Team• CE Mark Approval for Visian V4b ICL

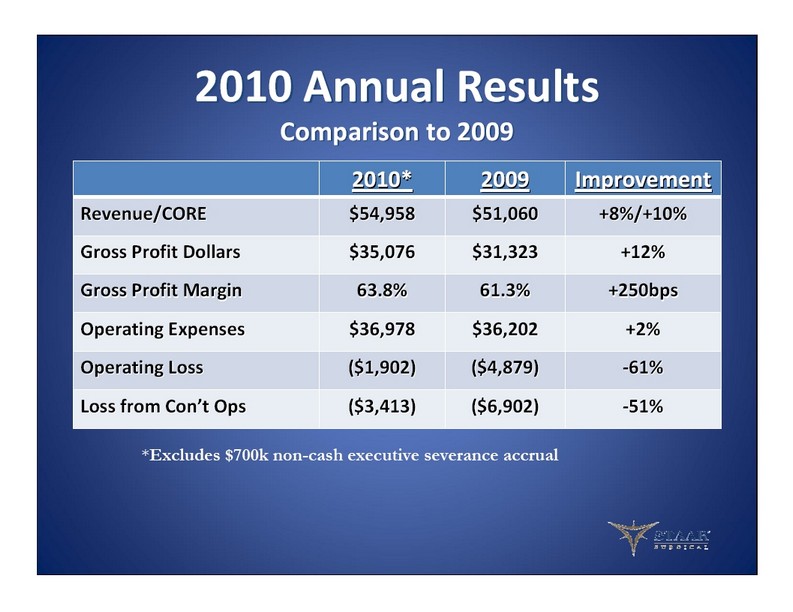

2010 Annual ResultsComparison to 20092010* 2009 ImprovementRevenue/CORE $54,958 $51,060 +8%/+10% Gross Profit Dollars $35,076 $31,323 +12% Gross Profit Margin 63.8% 61.3% +250bps Operating Expenses $36,978 $36,202 +2% Operating Loss ($1,902) ($4,879) ‐ 61% Loss from Con’t Ops ($3,413) ($6,902) ‐ 51%*Excludes $700k non-cash executive severance accrual

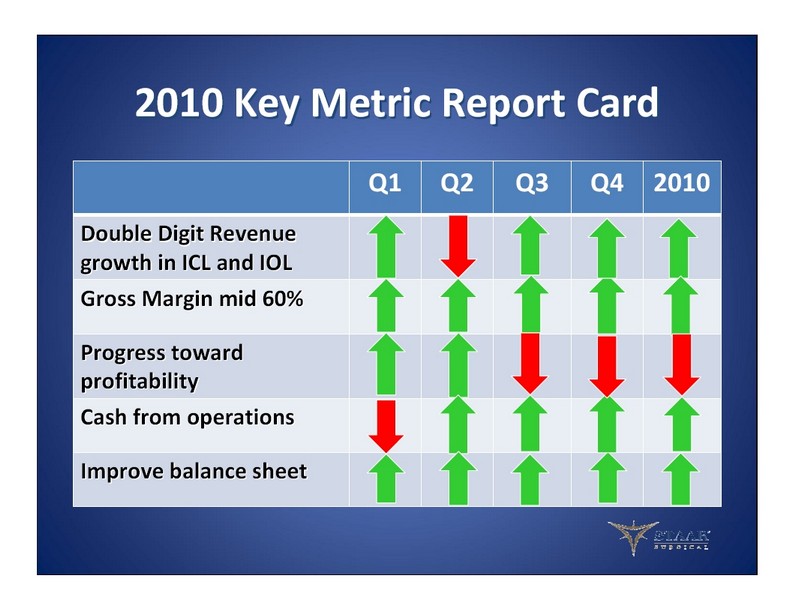

2010 Key Metric Report CardQ1 Q2 Q3 Q4 2010Double Digit Revenuegrowth in ICL and IOL Gross Margin mid 60%Progress toward profitability Cash from operationsImprove balance sheet

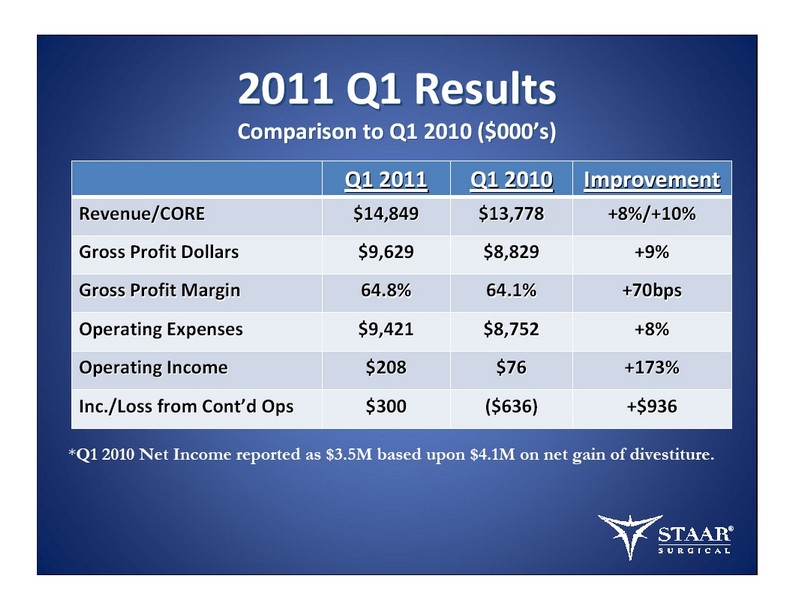

2011 Q1 ResultsComparison to Q1 2010 ($000’s)Q1 2011 Q1 2010 ImprovementRevenue/CORE $14,849 $13,778 +8%/+10% Gross Profit Dollars $9,629 $8,829 +9% Gross Profit Margin 64.8% 64.1% +70bps Operating Expenses $9,421 $8,752 +8% Operating Income $208 $76 +173% Inc./Loss from Cont’d Ops $300 ($636) +$936*Q1 2010 Net Income reported as $3.5M based upon $4.1M on net gain of divestiture .®

2011 Key Metric Report CardQ1 Q2 Q3 Q4 2011Double Digit RevenueGrowth* Grow ICL Sales by 25%*Continuous Expansion of GM %, End year at 66%Profitable in 3 of 4 quartersand for the full year*Through 4 months 2011: Revenue +10% and ICLs +24.48%®

2011 STAAR News• First Profitable quarter in 10 years• Revenues growing 10% after four months– ICLs growing 24.48%• Growth from the rollout of the Visian V4b– 10% from expanded range first four months• CE Mark Approval of the Visian V4c• CE Mark Approval of the nanoFLEX IOL– nanoFLEX Toric IOL could be approved this year• Two NEW Approvals this week:– Visian ICL approved in Brazil – CE Mark on Preload injector for the Single Piece Acrylic

STAAR’s Position Today• Two Large Market Opportunities• Sustainable Competitive Advantages• Double Digit Revenue Growth• Expanding Gross Margins• New Technology Introductions in 2011• Strong ICL and IOL Product Pipelines• No Debt/Profitable®

STAAR SurgicalAnnual Shareholder MeetingTHANK YOU!Your Questions?