Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - BROCADE COMMUNICATIONS SYSTEMS INC | d8k.htm |

| EX-99.1 - PRESS RELEASE - BROCADE COMMUNICATIONS SYSTEMS INC | dex991.htm |

Brocade Q2 FY 2011 Earnings

Q2

FY

2011

EARNINGS

May 19, 2011

5/19/2011

©

2011 Brocade Communications Systems, Inc.

Page 1

Exhibit 99.2 |

| Prepared comments provided by Rob Eggers, Investor Relations

Thank you for your interest in Brocade’s Q2 Fiscal 2011 earnings

presentation, which includes prepared remarks, slides, and a press

release detailing fiscal second quarter 2011 financial results. The press release

was issued shortly after 1:00 p.m. Pacific time on May 19, 2011,

via Marketwire. The press release, along with

these prepared comments and slides, has been made available on Brocade’s

Investor Relations website at www.brcd.com

and has been furnished to the SEC on Form 8-K.

|

| Brocade Q2 FY 2011 Earnings

Cautionary Statements and Disclosures

This

presentation

includes

forward-looking

statements

regarding

Brocade’s

financial

results,

plans

and

business

outlook

as

well

as

worldwide

SAN,

Ethernet

and

Federal

government

IT

spending,

which

are

only

predictions

and

involve

risks

and

uncertainties

such

that

actual

results

may

vary

significantly.

These

and

other

risks

are

set

forth

in

more

detail

in

our

Form

10-Q

for

the

fiscal

quarter

ended

January

29,

2011

and

our

Form

10-K

for

the

fiscal

year

ended

October

30,

2010.

These

forward-looking

statements

reflect

beliefs,

assumptions,

outlook,

estimates

and

predictions

as

of

today,

and

Brocade

expressly

assumes

no

obligation

to

update

any

such

forward-looking

statements.

In

addition,

this

presentation

includes

various

third-party

estimates

regarding

the

total

available

market

and

other

measures,

which

do

not

necessarily

reflect

the

views

of

Brocade.

Further,

Brocade

does

not

guarantee

the

accuracy

or

reliability

of

any

such

information

or

forecast.

Certain

financial

information

is

presented

on

a

non-GAAP

basis.

The

most

directly

comparable

GAAP

information

and

a

reconciliation

between

the

non-GAAP

and

GAAP

figures

are

provided

in

the

accompanying

press

release,

which

has

been

furnished

to

the

SEC

on

Form

8-K

and

posted

on

Brocade’s

website,

and

is

included

in

the

appendix

to

this

presentation.

Please see risk factors on Forms 10-K and 10-Q filed with the SEC

5/19/2011

©

2011 Brocade Communications Systems, Inc.

Page 2 |

Brocade Q2 FY 2011 Earnings

Agenda

Prepared comments followed by live Q&A call

Richard Deranleau

CFO

Mike Klayko

CEO

5/19/2011

©

2011 Brocade Communications Systems, Inc.

Page 3 |

| Today’s prepared comments include remarks by Mike Klayko, Brocade CEO,

regarding the

company’s quarterly results, its strategy, and a review of operations, as

well as industry trends and market/technology drivers related to its

business; and by Richard Deranleau, Brocade CFO, who will provide a

financial review. A live question-and-answer conference call will

be webcast beginning at 2:30 p.m. Pacific time on May 19 at www.brcd.com and will be archived on the Brocade

Investor Relations web site for

approximately 12 months. Participants are invited to submit questions via

e-mail at ir@brocade.com

up to 60 minutes prior to the conference call and to ask live questions during

the call. |

Brocade Q2 FY 2011 Earnings

Fiscal 2011: Q2 Earnings

Mike Klayko, CEO

5/19/2011

©

2011 Brocade Communications Systems, Inc.

Page 4 |

| Prepared comments provided by Mike Klayko, CEO

|

Brocade Q2 FY 2011 Earnings

Q2 Executive Summary

Q2 Results

•

$550M revenues, up ~10% Yr./Yr.

•

18.2% non-GAAP operating margin*

•

$0.13 non-GAAP EPS* (diluted)

Business Highlights

•

SAN product revenue grew 17%

Yr./Yr. driven by Director/Server

•

Enterprise/Service Provider Ethernet

businesses revenue grew 24%

Yr./Yr. led by EMEA, Americas, and

APAC

•

Non-GAAP gross margins*

expanded to 63.5%

•

Operating cash flows of $114M,

up 68% Yr./Yr.

* Non-GAAP, please see GAAP reconciliation in appendix

5/19/2011

©

2011 Brocade Communications Systems, Inc.

Page 5 |

| Brocade reported Q2 revenues of approximately $550M and non-GAAP

diluted earnings per share (EPS) of $.13, which exceeded our prior

guidance of $.10 for the quarter. Our revenues in the

quarter represented almost a 10% increase year-over-year (Yr./Yr.) and a

slight increase sequentially from our strong Q1. Highlights in the

quarter included growth in our Enterprise and Service Provider Ethernet

businesses, which grew 24% Yr./Yr. collectively. Other positive signs in

the quarter included an increase in overall non-GAAP gross margins driven

by improved non-GAAP gross margins for both the Ethernet and SAN products,

which were at 51%

and 72% respectively. Richard will provide more details on gross

margins in the CFO section of the

prepared comments. Our Server products business demonstrated continued momentum

by growing nearly 21% Yr./Yr. Adoption of virtualization and migration

to cloud computing are contributing factors to the growth in our adapter

and embedded switch business. On the topics of virtualization and cloud,

I would like to reiterate how excited I am about Brocade’s unique

strategy and differentiated offerings to address what we believe is a new innovation cycle

in networking that will last through this decade. We believe that Brocade has

established a clear leadership position by out-innovating the rest

of the industry to deliver purpose-built, cloud- optimized

network solutions into the hands of customers beginning last year. Virtualization and

clouds are not merely buzz words; they are the tangible means to

help customers migrate to IT

architectures that enable new levels of business agility and financial

efficiency. I’ll cover these topics in greater detail in the next

section. |

Brocade Q2 FY 2011 Earnings

Brocade FY 2011 Playbook

1.

Differentiate through Innovation

2.

Grow the Ethernet Business

and Top Line Profitably

3.

Maintain SAN Leadership

4.

Generate More Awareness

5.

Be an Employer of Choice

5/19/2011

©

2011 Brocade Communications Systems, Inc.

Page 6 |

| Now I will provide an update on the progress we’ve made on our

FY 11 Playbook, which outlines our objectives to:

•Differentiate through Innovation

•Grow the Ethernet Business and Top Line Profitably

•Maintain SAN Leadership

•Generate More Awareness

•Be an Employer of Choice |

Brocade Q2 FY 2011 Earnings

1. Differentiate through Innovation

BROCADE TECHNOLOGY DAY SUMMIT 2011

BROCADE TECHNOLOGY DAY SUMMIT 2011

5/19/2011

©

2011 Brocade Communications Systems, Inc.

Page 7 |

| Perhaps

there

was

no

better

way

to

showcase

our

innovation

progress

and

demonstrate

our

leadership

than

through

our

Technology

Day

Summit,

which

we

hosted

here

at

our

San

Jose

campus

earlier

this

month.

The

theme

for

the

event

was

how

Brocade

is

enabling

IT

transformation through

cloud-

optimized

networks

for

all

cloud

segments—private,

public,

and

hybrid.

Fundamentally,

we

believe

that

the

simplicity,

uptime,

and

capabilities

of

any

network

will

ultimately

define

application

performance

and

user

experience

in

the

cloud.

We

also

believe

that

our

15-year

heritage

in

storage

networking,

our

leadership

in

creating

and

defining

the

Ethernet

fabric

category,

as

well

as

our

laser

focus

on

all

things

networking,

uniquely

position

Brocade

as

the

company

best

capable

of

helping

customers

migrate

smoothly

to

a

world

where

information

and

applications

reside

and

can

be

accessed

anywhere—in

other

words,

the

cloud. |

Brocade Q2 FY 2011 Earnings

Brocade Private Cloud Innovations

5/19/2011

©

2011 Brocade Communications Systems, Inc.

Page 8 |

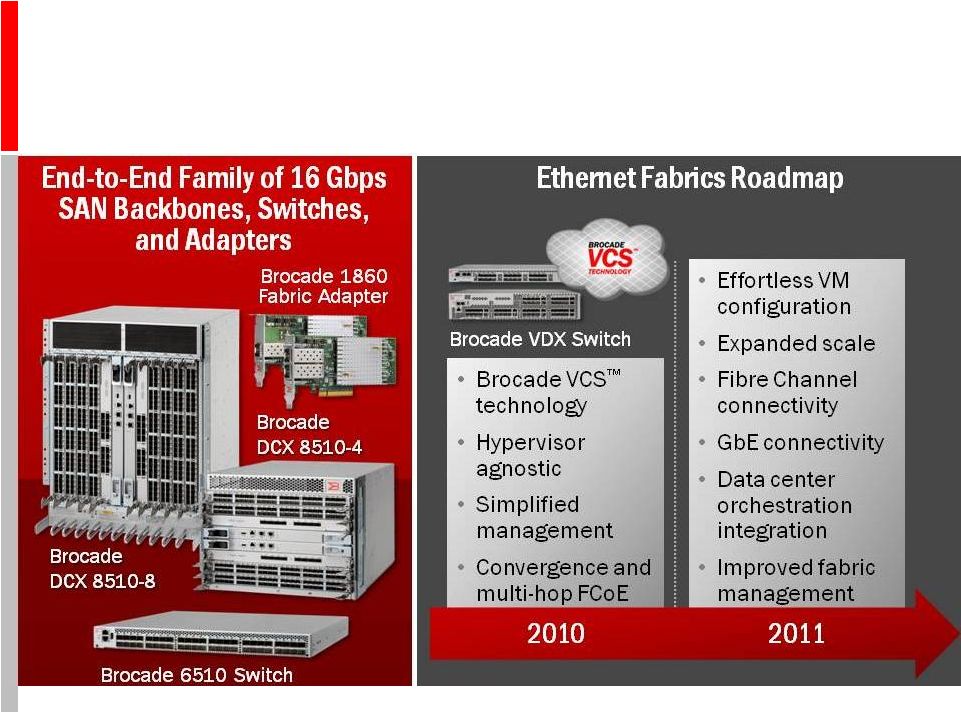

| As part of the Technology Day Summit, we made several significant

announcements for the three cloud areas. I’ll briefly recap those

starting with private cloud innovation, which was highlighted by Brocade

again leading the Fibre Channel industry to the next technology transition by introducing

the industry’s first and complete 16 Gbps Fibre Channel portfolio. This

includes new SAN backbones/switches, enhancements to the unified

management platform to address virtualization and cloud computing needs,

and the next generation of server connectivity enabled through a new

product category we’ve defined as Fabric Adapters. In addition, we also

outlined a rich roadmap for our Ethernet fabric offerings that are

designed to enhance these solutions in terms of scale,

distance, performance, and versatility. |

Brocade Q2 FY 2011 Earnings

Brocade Public Cloud Innovations

5/19/2011

©

2011 Brocade Communications Systems, Inc.

Page 9 |

| In terms of public cloud innovation, we demonstrated how

Brocade is leading the Service Provider

business model transformation through public cloud-optimized offerings by

delivering new hardware and software solutions. Specifically, we

announced the general availability of the world’s most powerful and

dense 10 and 100 Gigabit Ethernet blades for Brocade MLX and Brocade MLXe

Series routers at industry-leading price points to enable massive

scalability for highly virtualized public clouds. We also introduced

significant software advancements across our router line designed to

enable seamless IPv4–to–IPv6 interoperability and new MPLS capabilities, which are

all critical in helping Service Providers fundamentally change their businesses

and make them more profitable through public clouds.

|

Brocade Q2 FY 2011 Earnings

Brocade Hybrid Cloud Innovations

•

Ethernet fabrics

•

Fibre Channel

fabrics

•

Multiprotocol

Fabric Adapters

•

High-performance

app delivery

•

Virtual Compute

Blocks

•

Universal Distance

Extension

•

Cloud ID

•

Open management

frameworks

•

Unified education,

support, and

services

AVAILABLE

TODAY

ROADMAP

CloudPlex

™

Architecture Roadmap

Dave Stevens, CTO, at the Brocade

Technology Day Summit 5/19/2011

©

2011 Brocade Communications Systems, Inc.

Page 10 |

| Finally, in the area of hybrid cloud innovation, we outlined a vision

for the “Virtual Enterprise” enabled through the Brocade

CloudPlex™ architecture. This open, extensible architectural

framework will help customers build the next generation of distributed and

virtualized data centers in a simple, evolutionary way. We believe that

the CloudPlex architecture is unique in that it is both the foundation

for integrated compute blocks and also designed to embrace a customer’s existing

multivendor infrastructure to unify all of the assets into a single compute and

storage domain. As we discussed, Brocade is already delivering on

several of the components of the CloudPlex

architecture with others being completed on our development roadmap.

|

Brocade Q2 FY 2011 Earnings

2. Grow the Ethernet Business

•

24% Yr./Yr. revenue

growth in

Enterprise/Service

Provider Ethernet

businesses

•

51% Ethernet product

non-GAAP gross margins*

•

Demonstrating progress

toward key business

initiatives

Increasing profitability through key initiatives

* Non-GAAP, please see GAAP reconciliation in appendix

5/19/2011

©

2011 Brocade Communications Systems, Inc.

Page 11 |

| Drilling down in our Ethernet business further, I am pleased to

announce that we grew revenue in our products and services Yr./Yr. and

sequentially, led by the growth in our Enterprise and Service Provider

businesses. Our Federal Ethernet business did not recover in Q2 as

expected due to key deals being deferred largely because of budgetary

delays. However, as we experienced last fiscal year, we expect the

Federal business to rebound in future quarters as these transactions

close. The revenue growth compounded with the improvements in gross

margins validate that we’re making progress on the key business

initiatives we outlined in 2010. |

Brocade Q2 FY 2011 Earnings

De Persgroep

Deploying Europe’s first Ethernet fabric switching solution

72 Brocade VDX 6720 Ethernet fabric switches

deployed across a fabric-based architecture

created a single logical chassis with a single

distributed control plane across multiple

racks of servers.

•Improved performance

and reliability •Reduced capital and operating costs

•Simplified

virtual machine migration “As

we

look

to

accelerate

our

virtualization

strategy,

Brocade’s

approach

provides

virtual

machines

a

greater

sphere

of

mobility

and

gives

us

a

blueprint

for

future

growth.

”

Wim

Vanhoof,

ICT

Infrastructure

Manager,

De

Persgroep

Brocade VDX 6720–24 Switch

Brocade VDX 6720–60 Switch

5/19/2011

©

2011 Brocade Communications Systems, Inc.

Page 12 |

| Customer demand drove excellent momentum across our entire Ethernet

solutions portfolio. For example, we recently announced an Ethernet

fabric win at De Persgroep, one of Europe’s largest media companies

that delivers news to 9.4 million daily readers and online visitors. De Persgroep

deployed the Brocade VDX 6720 switches to manage and simplify its IT environment

that includes more than 1,000 servers, 3,500 users, and 325 terabytes of

data to manage significant data traffic growth—which has already

grown 650% in just the last four years. De Persgroep presented at our

Technology Day Summit and discussed its Ethernet fabric deployment and the

reasons for selecting Brocade. These included the fact that Brocade

Ethernet fabrics delivered improved performance and reliability while

reducing management and operating cost—and we were able to deliver this today. |

Brocade Q2 FY 2011 Earnings

Hurricane Electric

Hurricane Electric remains ahead

of the IPv6 curve with Brocade

World’s largest IPv6 Internet backbone future-

readies its business to support massive

bandwidth demands and device growth by

implementing Brocade IPv6 routers and switches.

“With an infrastructure of our magnitude, we absolutely

required a simple, yet powerful and

scalable routing infrastructure to support massive routing table space,

IPv6, 10 GbE and a base to support for 100 GbE in the future. We rely on

Brocade to provide us the right balance of performance, future IPv6

routing table scalability and total cost of ownership to ensure a solid

network investment.

”

Martin Levy, Director of IPv6 Strategy, Hurricane Electric

Brocade MLXe

with 100 GbE

5/19/2011

©

2011 Brocade Communications Systems, Inc.

Page 13 |

| Another example is our win at Hurricane Electric, which now operates

the largest IPv6 Internet backbone in the world using Brocade networking

technology. As of January 2011, Hurricane

Electric became the first Internet backbone worldwide to connect

to 1200 IPv6 networks. IPv6 is an

important issue for network administrators as experts warn that IPv4 addressing

capacity has reached its limit, which will eventually require a

transition to the newer technology. However, as we

discussed at our Technology Day Summit, we have outlined a smooth transition

strategy that will ensure years of IPv4–to–Pv6

interoperability enabled through software enhancements to Brocade IP

routers and application delivery switches. |

Brocade Q2 FY 2011 Earnings

Partner Traction and Momentum

Avnet CEO Roy Vallee discusses Avnet’s

unique long-term partnership with Brocade.

Avnet CEO Roy Vallee discusses Avnet’s

unique long-term partnership with Brocade.

Robin Johnson, CIO of Dell, discusses the

implementation of Dell PowerConnect

Brocade IP technology that has yielded a

40% OpEx reduction.

Robin Johnson, CIO of Dell, discusses the

implementation of Dell PowerConnect

Brocade IP technology that has yielded a

40% OpEx reduction.

5/19/2011

©

2011 Brocade Communications Systems, Inc.

Page 14 |

| Partnerships are also critical to the overall success of our Ethernet

business and in this area we had several significant updates in Q2. Most

recently, Dell announced the general availability of several Brocade

Ethernet switches—referred to as the Dell PowerConnect B-Series—as part of a

larger networking, server, and storage portfolio update aimed at

data center deployments in

enterprise and small-to-medium customers. And in fact, Dell not only

partners with us to sell these

solutions, they are also a Brocade customer, deploying Brocade solutions in

their own IT environments. In Q2, Brocade also announced a new OEM

relationship with LG-Ericsson that will enable both companies to

jointly pursue business opportunities in the high-growth Korean

information and communications technology market. Specifically, LG-Ericsson

has launched a number of Brocade networking solutions under its

“iPECS” brand and made them available in

Korea starting in April.

Turning now to our channel partners, our recent strategic focus has been to

provide them the necessary tools and training to enable them to take

full advantage of virtualization and cloud computing opportunities.

Brocade has launched a number of education initiatives and certifications

designed to increase channel partner expertise in data center network and

Ethernet fabric solutions. We are also working with key distributors in

this area on joint programs such as the “Avnet

Accelerator,” a collaborative effort between Brocade and Avnet to

enable resellers to design and implement advanced data center solutions

for customers who face mounting challenges associated with

virtualization and application proliferation. |

Brocade Q2 FY 2011 Earnings

3. Maintain SAN Leadership

First to market with 16 Gbps Fibre Channel

5/19/2011

©

2011 Brocade Communications Systems, Inc.

Page 15 |

| Moving onto the SAN business, Q2 was a strong quarter with revenue for

products and support/services

growing

nearly

14%

Yr./Yr.

We

were

particularly

pleased

with

the

broad-based

demand across our OEM and channel partners, which was driven by strength in sales of

SAN backbones/directors as well as Server products. We are also excited about

the impact that our new, cloud-optimized 16 Gbps Fibre Channel portfolio

will have in the marketplace as it is ideal for highly virtualized and cloud

environments. |

Brocade Q2 FY 2011 Earnings

“Over the years, Brocade networking solutions

have become an integral component in

improving the scalability, efficiency and agility

of our customers’

Hitachi storage

environments for mission-critical data and

applications. We are excited about Brocade’s

next generation Fibre Channel solutions, which

promise to help our customers to more easily

on-board our industry-leading storage solutions

and achieve improved performance,

centralized management and faster

connectivity between

data centers.

”

Sean Moser, Vice President,

Storage Software Product Management, Hitachi Data Systems

OEM Highlights

5/19/2011

©

2011 Brocade Communications Systems, Inc.

Page 16 |

| In terms of OEM updates, a clear Q2 highlight was the fact that Hitachi

Data Systems (HDS), has

now

joined

EMC,

HP,

and

IBM

as

a

“10%

Customer,”

meaning

that

each

company

accounted for at least 10% of Brocade’s total revenue in the quarter. These

partners will be critical in helping us transition the SAN industry to the

next-generation technology—16 Gbps Fibre Channel. Recent industry

research validates that Fibre Channel continues to be the foundation for

virtualized storage and private cloud/VDI implementations, with Forrester

Research documenting that 76% of customers surveyed said they are using Fibre

Channel as the preferred storage networking technology for virtualization,

far exceeding other technologies. Forrester’s data is consistent with

similar market research over the last three years from other firms

including

Gartner,

TheInfoPro,

and

the

Enterprise

Strategy

Group.

With availability of our 16 Gbps Fibre Channel portfolio expected to begin later

this calendar year, Brocade again expects to enjoy a significant

time-to-market advantage, which we experienced

through

previous

transitions,

namely

from

2

to

4

and

4

to

8

Gbps

Fibre

Channel

technologies. |

Brocade Q2 FY 2011 Earnings

4. Generate More Awareness

Brocade launches new global campaign

5/19/2011

©

2011 Brocade Communications Systems, Inc.

Page 17 |

| In addition to investments in new products, technologies, and more direct

engagements with customers, Brocade continues to invest in raising our

company’s global brand awareness. At the Technology Day Summit, we

introduced a new corporate campaign called “The Data Center Is

Here”

with

“Here”

representing

any

place

computing

or

information

storage

exists,

inside

or

outside the data center. “The Data Center Is Here”

also carries another message in that

Brocade is the only company delivering Ethernet fabrics to the market

today—it’s here. And we believe that we are gaining credibility

with large customers because of our heritage and first-to- market

advantage in fabrics and the data center solutions. |

Brocade Q2 FY 2011 Earnings

APAC Leadership Summit 2011

Executive Roadshow

Momentum and strategic investment in this critical market

5/19/2011

©

2011 Brocade Communications Systems, Inc.

Page 18 |

| We

are

also

generating

more

awareness

by

meeting

with

customers,

partners,

and

other

key

influencers in key regions. In Q2, Brocade held our APAC Executive Roadshow where

our senior executive team fanned out across eight countries to meet with

nearly one thousand customers and media/analysts. One of our core messages

was to reiterate how important Asia Pacific is to Brocade’s overall

business. Reflective of that is the doubling of our headcount in the region

over the last several quarters. During this roadshow, we also launched a broad-reaching

technology/ product evaluation program designed to enable eligible customers to

quickly deploy Ethernet fabrics as the foundation for highly virtualized

data centers. |

Brocade Q2 FY 2011 Earnings

The eighth annual Best Places

to Work awards recognized

Brocade as a top employer in

the Bay Area

5. Be an Employer of Choice

5/19/2011

©

2011 Brocade Communications Systems, Inc.

Page 19 |

| Finally, we are also increasing our company profile by continuing to be

recognized as a top destination for talented employees. In Q2 we were

recognized by the San Francisco Business Times/Silicon Valley Business

Journal as one of the “Best Companies to Work for in the Bay Area.”

This is the third consecutive year we

received this honor, and it follows the recognition earlier this

year by Fortune Magazine as Brocade being one of

the “100 Best Companies to Work For”

in the United States. |

Brocade Q2 FY 2011 Earnings

Q2 2011 Summary

•

24% growth Yr./Yr. for

Enterprise/Service Provider

Ethernet businesses revenue

•

17% growth Yr./Yr. for Storage

product revenue

•

Continue to be an award-winning

employer of choice

•

Clear leadership and first-to-market

advantage in a new cycle of

networking innovation

5/19/2011

©

2011 Brocade Communications Systems, Inc.

Page 20 |

| Brocade executed well in Q2 delivering solid results in our overall

Ethernet business and stronger- than-expected performance in our

SAN business. The improvements in Ethernet and SAN product non- GAAP

gross margins were clearly a highlight of the quarter, which helped us achieve overall gross

margins and operating margins above our guidance. We believe that the networking

industry is in the beginning stages of a new innovation cycle driven by

the IT imperatives of virtualization and cloud computing. Brocade has

established a clear leadership position and first-to-market advantage by

delivering award-winning Ethernet fabric solutions to customers well ahead

of the competition. We are

also leading the storage networking industry through the transition to 16 Gbps

Fibre Channel to ensure that customers have options in determining the

networking technologies that best suit their

data center and IT requirements. In summary, there are new opportunities

emerging in the networking industry that we have not seen in the

previous decade and we believe Brocade has the right strategy,

technologies, and offerings to capitalize on this new and exciting era of

innovation. |

Brocade Q2 FY 2011 Earnings

Q2 FY 2011 Financials

Richard Deranleau, CFO

5/19/2011

©

2011 Brocade Communications Systems, Inc.

Page 21 |

| Prepared comments provided by Richard Deranleau, CFO

|

Brocade Q2 FY 2011 Earnings

Financial Highlights

* Non-GAAP, please see GAAP reconciliation in appendix

Growing top line profitably and reducing term debt

Q2 11

Revenues

Overall revenue/growth

$550M / +9.8% Yr./Yr.

Storage product revenue growth

+17% Yr./Yr.

Enterprise/Service Provider Ethernet business revenue growth

+24% Yr./Yr.

Profitability

Non-GAAP EPS* (diluted)

$0.13

GAAP EPS (diluted)

$0.06

Generating cash/reducing debt

Operating cash flow

$114M

Total debt payments

$59M

Term loan balance

$252M

5/19/2011

©

2011 Brocade Communications Systems, Inc.

Page 22 |

| In

Q2,

Brocade

generated

revenues

of

$549.9M,

which

were

up

9.8%

Yr./Yr.

and

up

slightly

Qtr./Qtr.

from

a

strong Q1, in line with the guidance we shared with you on our last earnings call.

Storage product revenues were up over 17% Yr./Yr. driven by double-digit

growth in backbones/directors, switches, embedded switches, and server

adapters. Storage revenues were slightly lower sequentially, but performing better than historical

seasonality, with lower backbone/director revenue partially offset by higher switch

revenue. Ethernet business revenues were up 1.4% Yr./Yr. and up 3.7%

Qtr./Qtr. with Enterprise and Service Provider Ethernet segments showing

good progress again in the quarter. Non-GAAP earnings per share on a

diluted basis were $0.13 for Q2, driven by stronger gross margins and slower

growth in operating expenses. Q2 results included approximately one-half cent benefit from a lower-

than-expected tax rate resulting primarily from the settlement of an IRS audit

for FY07 and FY08. Excluding this benefit, our non-GAAP EPS for Q2 would

have been $0.12, which is higher than the guidance we provided of $0.10 for

the quarter. We

generated

strong

operating

cash

flow

of

$113.7M

in

Q2,

better

than

our

outlook,

which

we

used

to

pay

down our term loan and build our cash balance. In Q2 we repaid $58.9M of our senior

secured debt of which $50.0M was in excess of the mandatory amount due,

bringing our acquisition term debt down to $252M. Total Q2 diluted shares

were 501.5M shares and within our expected range when we provided our outlook for the

quarter. |

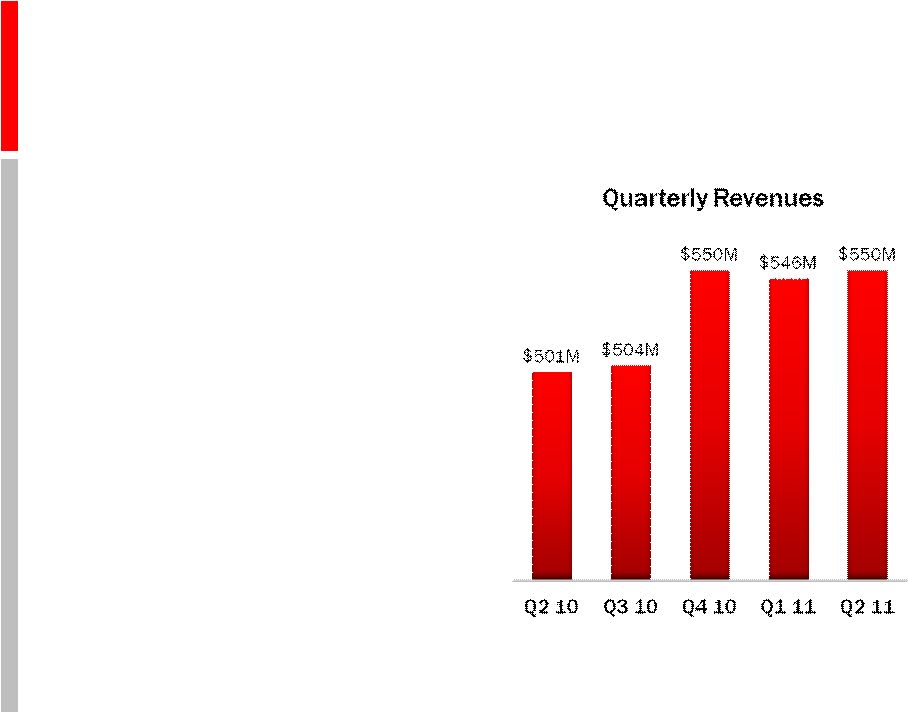

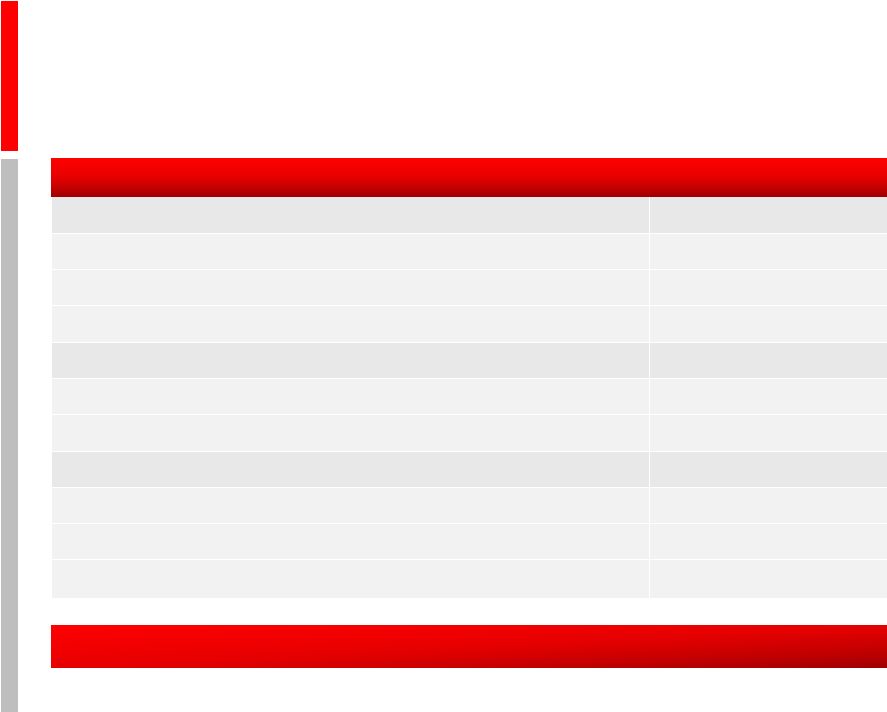

Brocade Q2 FY 2011 Earnings

Key Financial Metrics

* Non-GAAP, please see GAAP reconciliation in appendix

Q2 10

Q3 10

Q4 10

Q1 11

Q2 11

Revenue

$501M

$504M

$550M

$546M

$550M

Sequential growth

(7.1)%

.5%

9.3%

(0.8)%

.7%

Year-over-year growth

(1.1)%

2.1%

5.5%

1.2%

9.8%

Non-GAAP gross margin*

62.7%

60.4%

62.3%

62.0%

63.5%

Non-GAAP operating margin*

20.5%

17.3%

20.4%

17.1%

18.2%

Non-GAAP EPS*—diluted

$0.13

$0.13

$0.14

$0.12

$0.13

GAAP EPS—diluted

$0.05

$0.05

$0.05

$0.06

$0.06

Continuing to manage the business to our 2-year target model

5/19/2011

©

2011 Brocade Communications Systems, Inc.

Page 23 |

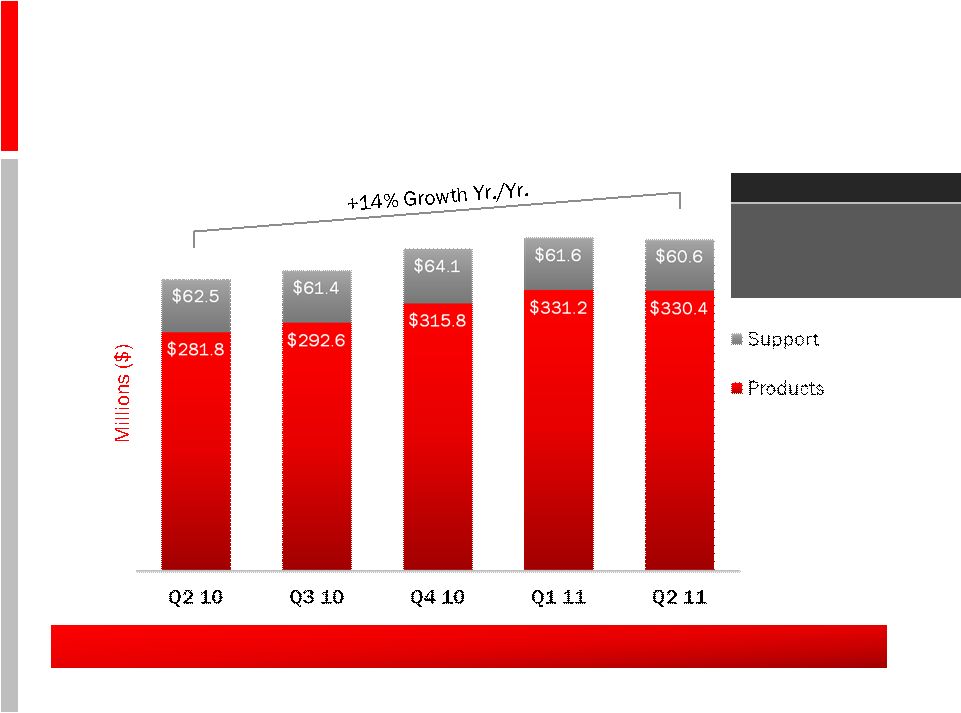

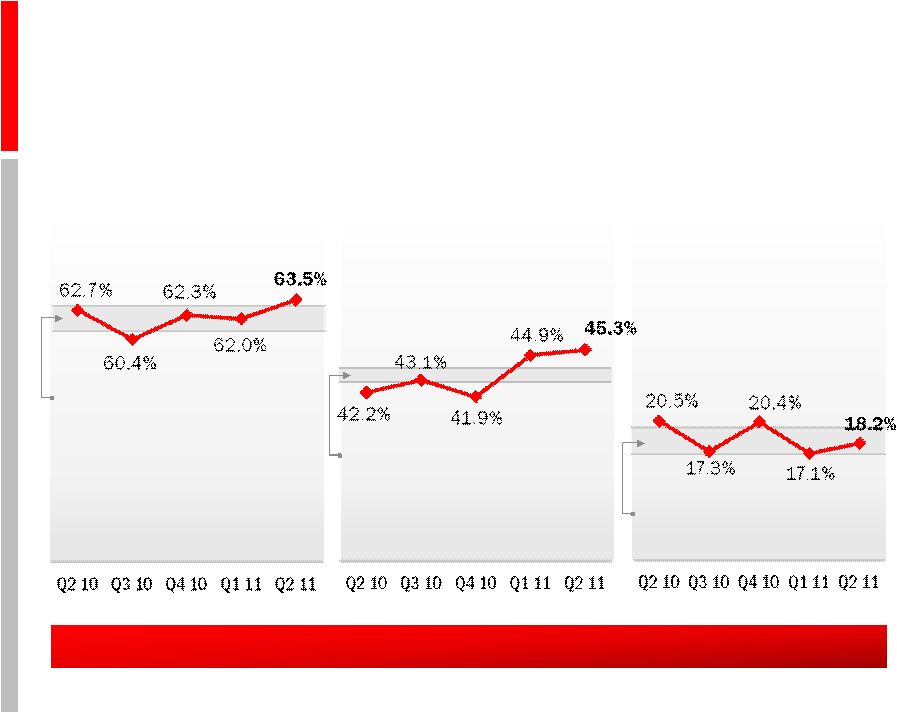

| Turning first to the top line, Q2 revenues were $549.9M in a quarter

where we saw our Storage business outperform expected seasonal patterns. We

added a fourth 10% customer this quarter in HDS, achieving a record revenue

quarter with this partner. Storage product revenues were up 17% Yr./Yr. driven by higher

backbone/director and Server product sales, which were up 22% and 21%, respectively,

compared to Q2 10. Switches were also up 12% compared to the same period last

year. Ethernet

business

revenues

were

up

3.7%

sequentially

and

up

1.4%

Yr./Yr.

We

saw

strong

Yr./Yr.

revenue

growth in our Enterprise and Service Provider Ethernet businesses of 24% offset by

continued weakness in Federal Ethernet revenue. At the beginning of the

quarter, we assumed Federal spending would be improving in our Q2. However,

the ultimate budget delays and the deferral of key deals negatively impacted our Federal

business in the quarter. On a geographic basis, we saw better-than-expected

performances in EMEA, continued strength in APAC, and improvement in

non-Federal Americas. Global Services revenues were up 2.4% sequentially

driven by higher professional services and Ethernet support revenue.

Non-GAAP Gross Margins of 63.5% were better than our guidance range of 61.5% to

62.0% for the quarter driven by stronger-than-expected Storage

performance and improving Ethernet gross margins. Non-GAAP gross margins

in the quarter were above our 2-year target model range of 61% to 63%.

Q2 non-GAAP operating expenses as a percentage of revenue were 45.3%, slightly

higher quarter-over- quarter but lower than the guidance of 45.5% to

46.0% for the quarter. Non-GAAP operating margins were 18.2%,

above

the

guidance

of

15.5%

to

16.0%

for

the

quarter,

and

comfortably

within

our

2-year

target

model

range of 17% to 20%. The sequential improvement in operating margins was driven by

the higher gross margins.

The Q2 11 effective non-GAAP tax rate was 20.7% and effective GAAP tax benefit

was (2.3%). The Non- GAAP tax rate in Q2 reflects a one-time benefit

from the settlement of IRS audits that resulted in a benefit of

approximately

3

points

to

the

rate

and

contributed

approximately

one-half

cent

to

non-GAAP

EPS. |

Brocade Q2 FY 2011 Earnings

Revenue: SAN, Ethernet, and Global Services

Stable mix across business segments

5/19/2011

©

2011 Brocade Communications Systems, Inc.

Page 24 |

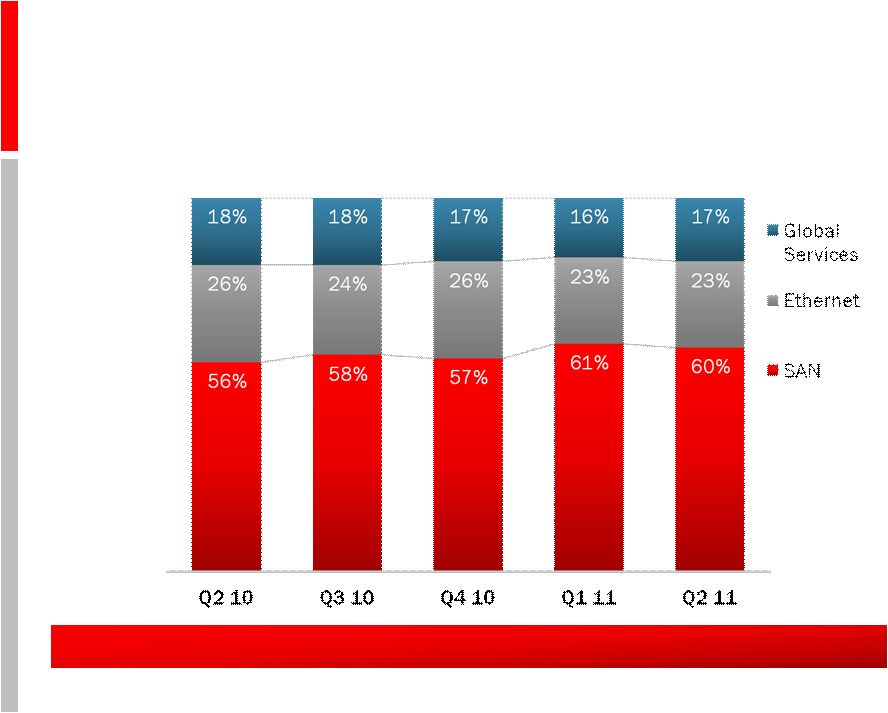

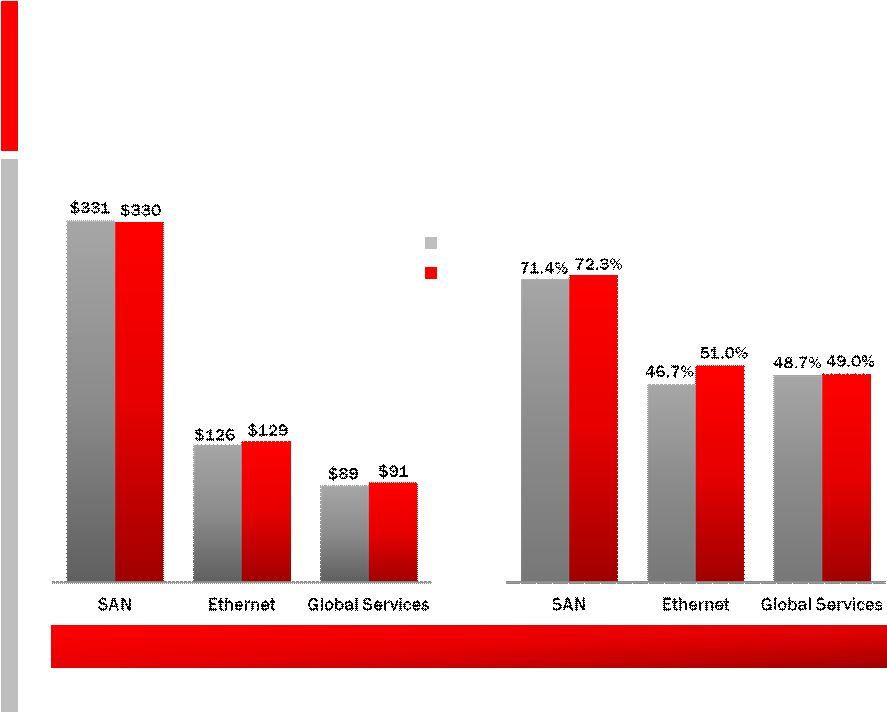

| Turning to revenues by business unit, our Storage product revenue was

$330.4M in the quarter, a

slight

decrease

sequentially,

better

than

seasonal

trends,

and

an

increase

of

17%

from

Q2

10.

Storage

product revenue represented 60% of total revenues in Q2, versus 61% in Q1.

Our Ethernet product revenue was $128.7M in the quarter, an increase of 2.0% from

the previous quarter and essentially flat from Q2 10. Ethernet product

revenue represented 23% of total revenue, unchanged from Q1. Our Global

Services revenue was $90.9M in the quarter and represented 17% of revenues,

up from 16% in Q1. Global Services revenue was up 2.4% sequentially driven

primarily by higher professional services and Ethernet support revenue and

was essentially flat versus Q2 10. |

Brocade Q2 FY 2011 Earnings

Total Ethernet Business Revenue

$156.7

$149.5

$170.5

$153.2

$158.9

Total +1.4%

Support +5.6%

Products +0.4%

Q2 Yr./Yr. Compares

5/19/2011

©

2011 Brocade Communications Systems, Inc.

Page 25 |

| Looking at our Ethernet business, including hardware and

Ethernet-based support and services, Q2 revenues were $158.9M up 1.4%

Yr./Yr. and up 3.7% from Q1 11. From a product segment view, stackables

continued to grow as a percentage of Ethernet revenues and represented

43%

of

revenues

in

Q2,

a

slight

improvement

compared

to

42%

in

Q1.

We

are

also

pleased

with

our Brocade ADX Layer 4–7 product revenue in Q2, which grew nearly 30%

Yr./Yr. |

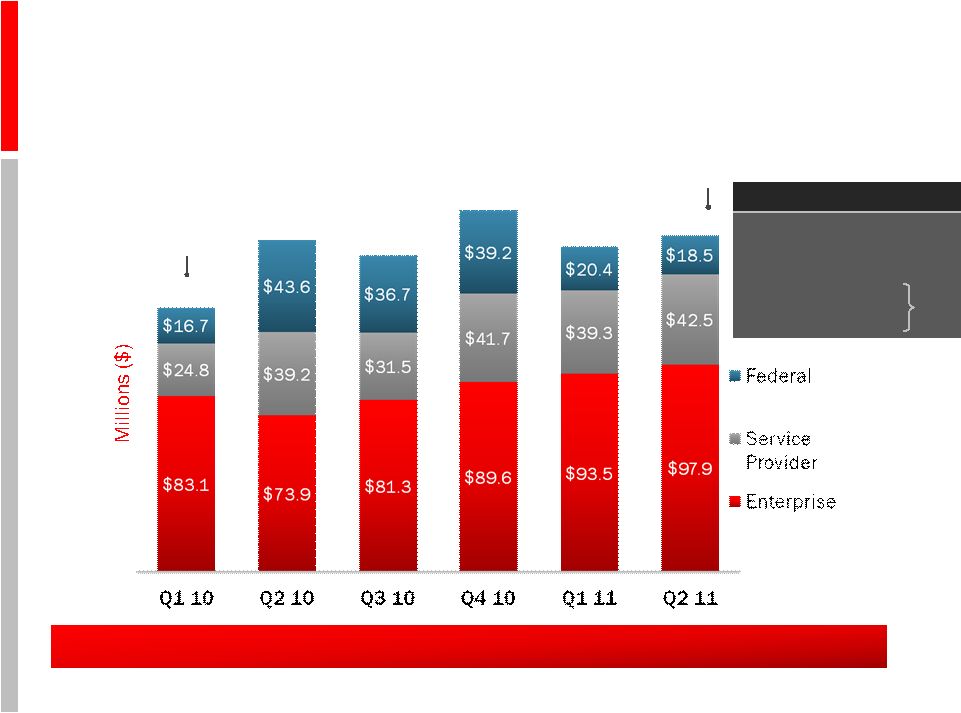

Brocade Q2 FY 2011 Earnings

Total Ethernet Business Revenue

By customer segment

Note: Service Provider segment consists of end users that are identified as a

service provider through SIC codes or other analysis on a quarterly basis

Strong Yr./Yr. growth across Enterprise and Service Provider

$156.7

$149.5

$170.5

$153.2

$158.9

Total +1%

Federal -58%

Enterprise

Service Provider

Q2 Yr./Yr. Compares

$124.6

Federal

FY 10 budget

approved

Dec. ‘09

Federal

FY 11 budget

approved

Apr. ‘11

24%

5/19/2011

©

2011 Brocade Communications Systems, Inc.

Page 26 |

| As we drill down into the Ethernet business details, we are pleased with

the Yr./Yr. growth in our Service Provider and Enterprise segments in Q2.

Revenue from Enterprise and Service Provider businesses collectively were up

24% Yr./Yr. and up nearly 6% sequentially, showing strength across our product portfolio

and customer base. Revenue from enterprise customers, excluding Federal, was up 4.7%

sequentially, grew 32.5% Yr./Yr., and represented 61% of our total Ethernet

business in Q2. Revenue from our Service Provider business grew 8.4%

Yr./Yr., and represented 27% of our total Ethernet business in Q2. We saw good growth

in our new accounts with both initial sales in the quarter as well as repeat

business. Our Federal Ethernet business was $18.5M, down 9.3% from Q1 and

down 58% Yr./Yr. from a strong Q2 10, reflecting continued softness in

Federal spending and the deferral of several key deals due to the timing of the

Federal budget approval. As you may recall, in Q2 10 we experienced a significant

improvement in Federal revenue Qtr./Qtr. after the Federal budget was signed

in December 2009. This makes the current Yr./Yr. comparable more challenging

as the current Federal fiscal year’s budget was not approved until April. |

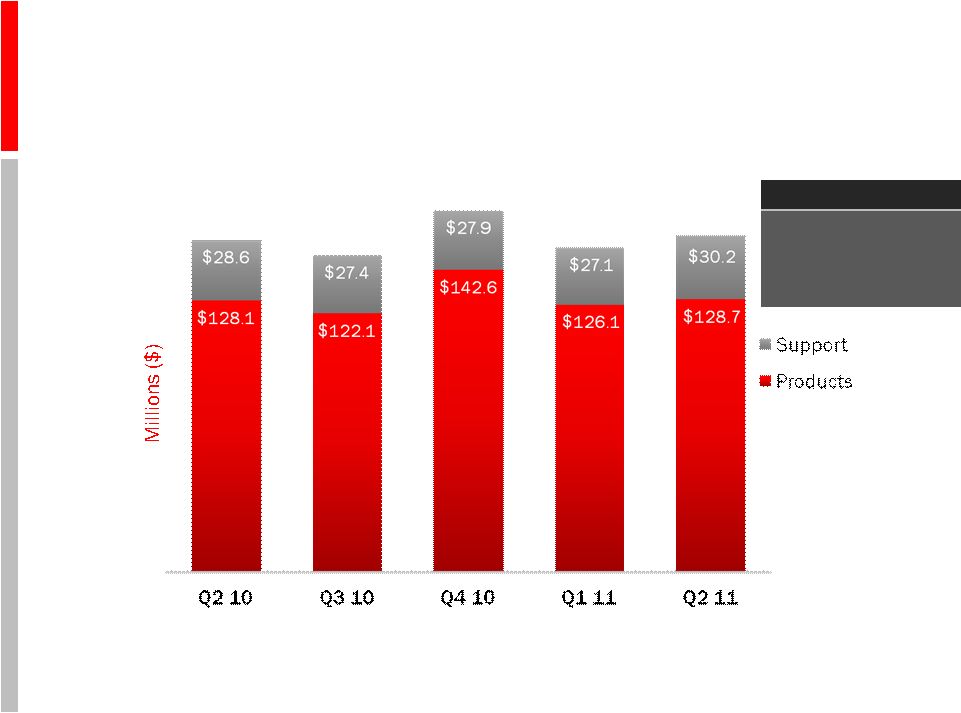

Brocade Q2 FY 2011 Earnings

Total SAN Business Revenue

Strong Yr./Yr. growth in SAN business

$344.3

$354.0

$379.9

$392.8

$391.0

Total +14%

Support -3%

Products +17%

Q2 Yr./Yr. Compares

5/19/2011

©

2011 Brocade Communications Systems, Inc.

Page 27 |

| Looking at our SAN business, including hardware and SAN-based support

and services, Q2 revenue of $391.0M was down slightly from Q1 and up 13.6%

from Q2 10. Demand for Brocade’s leading SAN products was strong,

resulting in SAN product revenue of $330.4M in the quarter. The increase

year-over-year was driven by revenue growth across all of our product families, led by

backbone/director and Server products.

Our Server product group, including embedded switches and Server

adapter products (HBAs and Mezzanine

Cards), posted revenues of $48.4M, up 20.9% Yr./Yr. and down slightly from our

record in Q1. Embedded switches revenues were up 15.5% Yr./Yr. while our

Server adapter product (HBAs and Mezzanine Cards)

revenues were up over 110% Yr./Yr.

As we look at our multiprotocol and converged networking products including the

Brocade 8000, FCoE blades for our flagship Brocade DCX storage chassis,

Brocade VDX switches and CNAs, total converged product revenue growth was

more than 100% Yr./Yr. We feel that our product portfolio, including the recently

announced Brocade 1860 Fabric Adapters, continues to demonstrate

our leadership in multiprotocol and

cloud-optimized networks. |

Brocade Q2 FY 2011 Earnings

Revenue: 10% Customers,

Other OEM, Channel/Direct

HDS joins 10% Customers in Q2 2011

5/19/2011

©

2011 Brocade Communications Systems, Inc.

Page 28 |

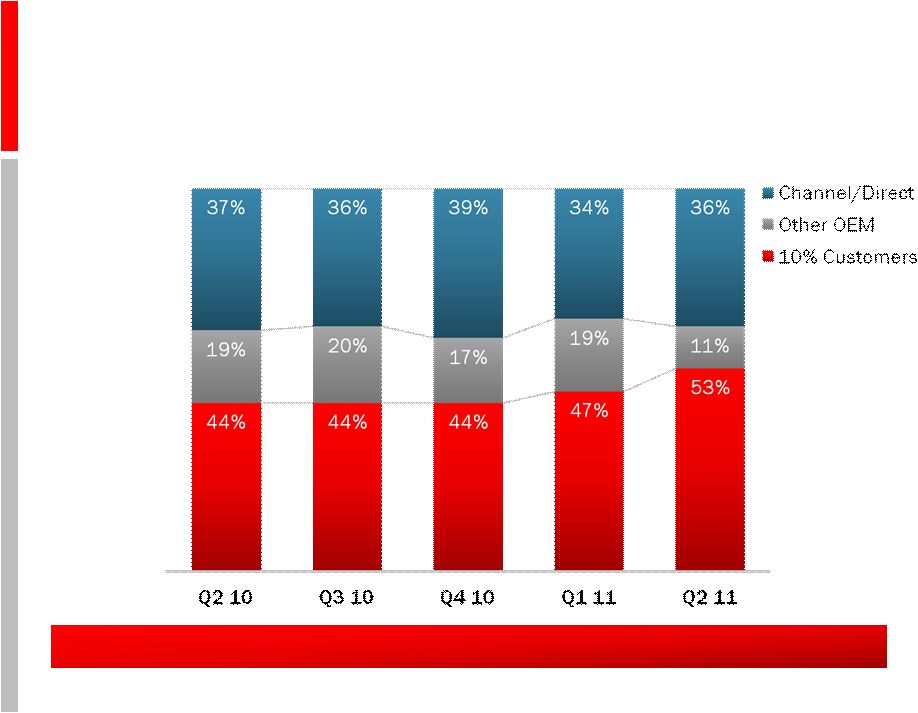

| In Q2, Brocade had four customers that each contributed revenue greater

than 10%: EMC, HDS, HP, and IBM. Collectively, our four

greater-than-10% customers contributed 53% of revenues in Q2, up from 47% in

Q1, when we had three 10% customers, and up from 44% in the quarter a year ago, when

again we had three 10% customers. Other OEMs represented 11% of revenues in

Q2 versus 19% in Q1, when the figure included HDS. Channel and Direct were

36% of revenues in Q2, an increase from 34% in Q1, reflecting a mix shift

from the OEMs to the channel/direct business sequentially. |

Brocade Q2 FY 2011 Earnings

Segment Revenues and

Gross Margin Snapshot

Q1 11 vs. Q2 11 revenue mix and non-GAAP gross margin*

* Non-GAAP, please see GAAP reconciliation in appendix

Q1 11

Q2 11

Revenues by Segment ($M)

Non-GAAP Gross Margin*

by Segment

Gross margin expansion across all segments

5/19/2011

©

2011 Brocade Communications Systems, Inc.

Page 29 |

| Non-GAAP gross margins of 63.5% were above our guidance range of

61.5% to 62.0% for the quarter, driven primarily by the strong Storage

performance and improving Ethernet margins. Company non-GAAP gross

margins were up 150 basis points from Q1.

Q2

Storage

non-GAAP

gross

margins

were

72.3%,

up

from

71.4%

in

Q1,

reflecting

a

favorable

customer

mix,

including a shift to direct and channel revenue. The impact of higher Storage gross

margins on the overall non-GAAP gross margins was approximately +50

basis points in the quarter. Q2 Ethernet non-GAAP gross margins were

51.0%, up from 46.7% in Q1 and are at the highest level since Q2 10. The

higher Ethernet gross margins reflect good progress on the initiatives to improve gross margins

we laid out at our September 2010 Analyst Day. The impact of higher Ethernet gross

margins on overall non- GAAP gross margins was approximately +100 basis

points in Q2. Global Services non-GAAP gross margins were 49.0% in Q2,

up versus 48.7% in Q1, primarily due to higher professional services and

support revenue. |

Brocade Q2 FY 2011 Earnings

Ethernet Non-GAAP Gross Margin* Progress

Comparison to Q3 10 and 2-year target model

* Non-GAAP, please see GAAP reconciliation in appendix

** Pricing/other includes all pricing and mix impact

Q3 10

Q2 11

Executing on Ethernet gross margin initiatives

Pricing/

Other **

Volumes

Inventory

Mgmt.

+3%

+1–4%

+2.3%

+2.7%

+2–4%

+0.7%

+1–2%

+0.9%

2-Yr. Target Model

Gross margin initiatives est.

Actual

Product

Costs

54–59%

5/19/2011

Page 30

©

2011 Brocade Communications Systems, Inc. |

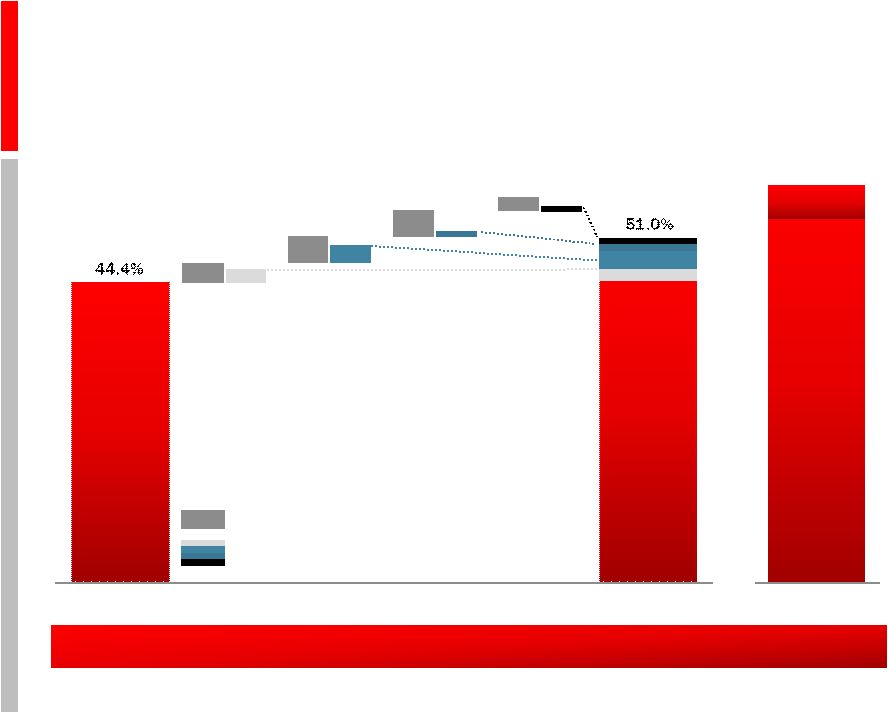

| In looking at our Ethernet gross margins, we are pleased with the

progress we have made since we laid out our plans at our 2010 Analyst Day

last September. We had identified several areas of focus to improve our Ethernet gross margins from our Q3

10 levels to reach our 2-year target model of 54% to 59%. In the 3 quarters

since we set that goal, we have made very good progress, including

improving the management of inventory [+2.3 pts], generating higher volumes to improve fixed cost

absorption [+0.7 pts], lowering product costs including new product offerings

[+2.7 pts], and managing the business to a more stable pricing

environment/mix/other [+0.9 pts].

We continue to be focused on these Ethernet gross margin initiatives outlined

above and plan to drive improvements going forward to be within our

target of 54% to 59% by Q4 this year.

|

Brocade Q2 FY 2011 Earnings

Operating Performance vs. 2-Year Target

Model

* Non-GAAP, please see GAAP reconciliation in appendix

Overachievement on gross margin improved operating margin

Non-GAAP Operating

Margins*

Non-GAAP Operating Expenses*

as a Percentage of Revenues

2-year target model:

43–44%

2-year target model:

17–20%

Non-GAAP Gross Margin*

2-year target model:

61–63%

5/19/2011

©

2011 Brocade Communications Systems, Inc.

Page 31 |

| Since we introduced our 2-year target model at the September 2010

Analyst Day, we have been able to manage the business to the target model

ranges for both non-GAAP gross margin and non-GAAP

operating margin for each quarter in a challenging business environment.

On a non-GAAP basis, total operating expenses were 45.3% of revenues in Q2

versus 44.9% in Q1. The dollar increase in operating expenses

sequentially reflects the investment in our sales organization and marketing spend made during the first

half of FY11. With the investment in sales largely completed, we would expect

to manage our spending to within our 2-year target model going

forward.

Non-GAAP operating margins were 18.2% in Q2, an improvement over Q1 driven

by the overachievement of gross margins compared to our model and

guidance. Our 2-year target model for operating margins is 17% to 20%, and we are pleased that we

have been able to operate within that model, delivering 17.6% operating margin

in the first half. |

Brocade Q2 FY 2011 Earnings

Balance Sheet and Cash Flow Highlights

as of April 30, 2011

Strong cash flows drive healthy balance sheet

* Adjusted EBITDA is as defined in the term debt credit agreement

Q2 10

Q3 10

Q4 10

Q1 11

Q2 11

Cash from operations

$67.7M

$55.3M

$106.4M

$118.2M

$113.7M

Capital expenditures

$62M

$47M

$46M

$23M

$27M

Free cash flow

$6M

$9M

$61M

$95M

$87M

Debt payments

$202.2M

$30.6M

$30.2M

$39.7M

$58.9M

Cash, equivalents, and

short term investments

$290M

$296M

$336M

$416M

$466M

Senior secured debt

$1.01B

$0.99B

$0.96B

$0.92B

$0.86B

Adjusted EBITDA*

$116.4M

$101.5M

$127.7M

$114.5M

$122.5M

Stock repurchase

$20M

$5M

$0

$0

$0

Senior secured leverage ratio

1.95x

1.97x

1.92x

2.00x

1.84x

Covenant

2.5x

2.5x

2.5x

2.5x

2.5x

Fixed charge coverage ratio

1.8x

1.7x

1.7x

1.8x

2.3x

Covenant

1.25x

1.25x

1.25x

1.5x

1.5x

5/19/2011

©

2011 Brocade Communications Systems, Inc.

Page 32 |

| Cash from operations was $113.7M in Q2, down slightly

quarter-over-quarter and better than our previous guidance. Total

capital expenditures in the quarter were $27M, lower than our outlook. Free cash

flow was nearly $87M in the quarter, down slightly Qtr./Qtr. Cash and

equivalents grew to $466M, up $50M from $416M in Q1. In Q2, we reduced our term debt principal by $58.9M,

including $50.0M in excess of the mandatory payment. As we

stated during our Analyst Day last year, we continue to focus on increasing operating cash flow and our priorities for cash

will be focused on paying down our term debt first, continuing to build our

cash reserves, and repurchasing stock on an opportunistic basis and

subject to debt covenants.

Adjusted EBITDA in the quarter was $122.5M, which was an improvement from the

Q1 level of $114.5M. The Senior Secured Leverage Ratio of 1.84x and the

Fixed Charge Coverage Ratio of 2.28x are both within the covenant requirements of our term

credit agreement.

|

Brocade Q2 FY 2011 Earnings

Net Debt: Defined as Total Debt Less Total Cash

Decreased by $679M from Q1 09 to Q2 11

More than

63% reduction

in 2+ years

5/19/2011

©

2011 Brocade Communications Systems, Inc.

Page 33 |

| Net Debt has declined from $1,073M at the end of Q1 09 to $394M at

the end of Q2 11. This represents a $679M or 63% reduction over the last

two plus years, demonstrating Brocade’s ability to generate cash and

reduce our long-term debt. Our term debt loan balance is now down to

$252M. |

| Brocade Q2 FY 2011 Earnings

Q3 2011 Planning Assumptions

IT market conditions

•

Caution around macro economic conditions (Japan, China, Europe)

•

Federal budget closure will improve Federal IT spending

•

SAN TAM expected to grow 4–6% in FY

11 •

Expect to grow faster than market in Ethernet

Margins/pricing

•

Overall non-GAAP gross margins within 2-year target, but lower

Qtr./Qtr. due to mix

•

Small pricing declines in SAN and Ethernet

Taxes

•

Outlook tax rate does not include discrete items

OEM inventories

•

Expect to come down Qtr./Qtr. with 16 Gbps launch

5/19/2011

©

2011 Brocade Communications Systems, Inc.

Page 34 |

| Now, as we look to Q3 11, here are some assumptions to consider in

developing your financial models:

We continue to monitor the stability and health of international markets,

specifically Japan, China, and Europe. We are cautious about the

current global and country-specific dynamics, such as the effects from the Japanese earthquake and tsunami,

inflationary risks in China, and the continuing sovereign debt risk in Europe,

all of which may impact our business and that of our partners. As a

result of this uncertain macro environment and using a balanced viewpoint, we are issuing revenue guidance

with a wider range than previous quarters. We expect

our Federal Ethernet business to return to more normal levels starting in Q3 as we close several deals that were

deferred primarily due to the timing of the Federal budget approval. We

believe that the SAN total available market will grow 4% to 6% annually in FY11, consistent with what we outlined at Analyst

Day. Our Storage product revenues were up 4.1% during the first half of FY11

compared to the first half of FY10. For Q3 11, we anticipate that

Brocade SAN revenue will be up 3% to 5% Yr./Yr.

Exiting Q2, OEM inventory was approximately 2.5 weeks. As the OEMs launch their

16 Gbps offerings, we plan to work with them to reduce 8 Gbps

inventories over the second half of 2011, to help ensure a smooth transition to 16 Gbps.

We expect to grow faster than the Ethernet market in Q3. We anticipate that our

new Brocade VDX and VCS technology solutions will continue to ramp and

will have a larger contribution to revenue/gross margin in FY12 as we continue to see this market

evolve and see a longer selling cycle with Ethernet fabrics. We expect

company non-GAAP gross margins to be within our 2-year target model in Q3 as the product revenue mix moves to

more Ethernet products and Storage non-GAAP gross margins return to Q4

10/Q1 11 levels, reflecting a more historical customer/product mix. We expect

quarterly ASP declines in our SAN and Ethernet businesses to be in the low-single digits in Q3.

From a tax rate perspective, we do not forecast discrete events due to the

inherent uncertainty of their timing, but expect no change to our

structural rate for planning purposes.

|

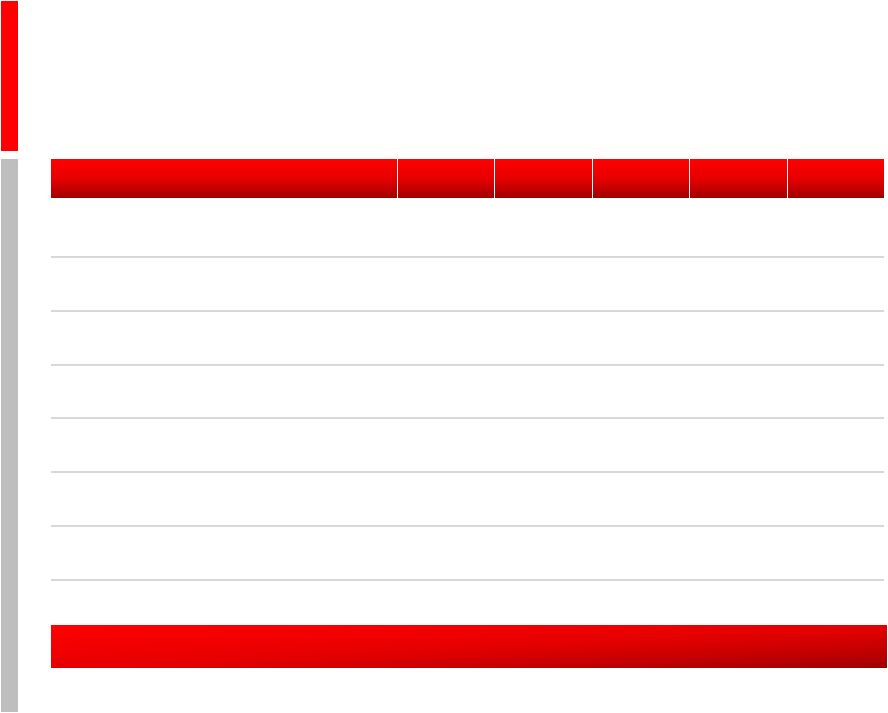

Brocade Q2 FY 2011 Earnings

Q3 2011 Financial Outlook

As of May 19, 2011

* Non-GAAP estimates assume exclusion of the same category of items

excluded from Q1 11 non-GAAP results Q3 11

Revenue range (up 7%–11% Yr./Yr.)

$540M–560M

Non-GAAP gross margin*

62.0%–62.5%

Non-GAAP operating expenses*

45.0%–45.5%

Non-GAAP operating margin*

16.5%–17.5%

Other income/other expense

($21M)

Non-GAAP tax rate*

~25%

Fully diluted shares outstanding

512M–517M

Non-GAAP EPS*

$0.10–$0.11

Operating cash flow

$60M–$75M

Capital expenditures

$30M–$33M

Free cash flow

$30M–$42M

5/19/2011

©

2011 Brocade Communications Systems, Inc.

Page 35 |

| Given these planning assumptions, in Q3 11 we expect:

•

Overall revenue to be $540M to $560M, down 2% to up 2% Qtr./Qtr. and up 7% to

11% Yr./Yr.

•

Non-GAAP gross margins to be 62.0% to 62.5% •

Non-GAAP operating expenses to be 45.0% to 45.5% •

Non-GAAP operating margins to be 16.5% to 17.5% •

Other income/expense net to be approximately ($21M) •

Non-GAAP tax rate to be approximately 25% •

Diluted shares outstanding to be in a range of 512M to 517M shares •

Non-GAAP EPS to be 10 cents to 11 cents •

Operating cash flow of $60M to $75M •

Capital expenditures of $30M to $33M •

Free cash flow of $30M to $42M, in a seasonally weak cash flow quarter |

Brocade Q2 FY 2011 Earnings

Financial Summary

Richard Deranleau, CFO

5/19/2011

©

2011 Brocade Communications Systems, Inc.

Page 36 |

| We are looking forward to answering your questions in the Q&A

session of our conference call.

|

Brocade Q2 FY 2011 Earnings

Jason Nolet

VP Data Center

and Enterprise

Networking

Live Q&A Call

May 19, 2011, 2:30PM Pacific Time

Richard

Deranleau

CFO

John McHugh

CMO

Ian Whiting

SVP WW Sales

Mike Klayko

CEO

Dave Stevens

CTO

5/19/2011

©

2011 Brocade Communications Systems, Inc.

Page 37 |

| Prepared comments provided by Rob Eggers, Investor Relations That

concludes Brocade’s prepared comments. At 2:30 p.m. Pacific Time on May 19 Brocade will host a webcast conference call

at www.brcd.com primarily devoted to answering

questions submitted via e-mail to ir@brocade.com and taken live from

participants via telephone. Thank you

for your interest in Brocade.

|

Brocade Q2 FY 2011 Earnings

Appendix and Reconciliations

5/19/2011

©

2011 Brocade Communications Systems, Inc.

Page 38 |

Brocade Q2 FY 2011 Earnings

Quarterly Net Income

GAAP/Non-GAAP Reconciliation

(In Thousands)

Q2 10

Q3 10

Q4 10

Q1 11

Q2 11

Net income on a GAAP basis

22,380

21,961

23,416

27,179

27,613

Adjustments:

Legal fees associated with indemnification obligations

and other related expenses, net

277

(74)

(666)

124

–

Stock-based compensation expense

30,146

24,682

25,275

19,906

22,530

Amortization of intangible assets

30,657

30,657

30,657

30,656

29,489

Loss on sale of property

(47)

–

–

–

–

Restructuring costs and facilities lease loss

–

–

1,059

–

–

Legal fees associated with certain pre-acquisition litigation

17

13

243

77

216

Provision for certain pre-acquisition litigation

–

1,604

–

–

–

Interest due to adoption of new standard

348

–

–

–

–

Income tax effect of adjustments

(21,044)

(15,217)

(13,975)

(17,208)

(17,037)

Non-GAAP net income

62,734

63,626

66,009

60,734

62,811

5/19/2011

©

2011 Brocade Communications Systems, Inc.

Page 39 |

Brocade Q2 FY 2011 Earnings

Adjusted EBITDA and Sr. Secured Leverage Ratio

As defined in the term credit agreement

Consolidated Senior Secured Leverage Ratio

Q2 FY 10

Q3 FY 10

Q4 FY 10

Q1 FY 11

Q2 FY 11

$ Thousand

Actual

Actual

Actual

Actual

Actual

Consolidated Net Income

$22,380

$21,961

$23,416

$27,179

$27,613

plus

(i) Consolidated Interest Charges

$19,522

$22,061

$22,202

$21,546

$20,745

(ii) Provision for Federal, state, local and foreign income taxes

payable $0

$0

$5,988

$0

$0

(iii) Depreciation and amortization expense

$46,600

$50,493

$51,532

$52,522

$51,712

(iv) Fees, costs and expenses incurred on or prior to the Acquisition Closing

Date in connection with the Acquisition and the financing thereof

$0

$0

$0

$0

$0

(v) Any cash restructuring charges and integration costs in connection with

the Acquisition, in an aggregate amount not to exceed $75,000,000

$0

$0

$0

$0

$0

(vi) Non-cash restructuring charges incurred in connection with the

Transaction, all as approved by Arrangers

$1,084

$1,006

$930

$848

$779

(vii) Other non-recurring expenses reducing such Consolidated Net Income

which do not represent a cash item in such period or any future period

(in each case of or by the Borrower and its Subsidiaries for such

Measurement Period)

($47)

$0

$574

$175

$1,735

(viii) Any non-cash charges for stock compensation expense in compliance

with FAS 123R and amortization of the fair value of unvested options

under the Acquired Business’

employee stock option plan assumed by the Borrower

$30,146

$24,682

$25,275

$19,906

$22,530

(ix)

Legal fees and expenses relating to the Borrower’s indemnification

obligations for the benefit of its former officers and directors

in connection

with its historical stock option litigation

724

376

$22

$15

$0

minus

(i)

Federal, state, local and foreign income tax credits

($840)

($15,096)

$0

$5,717

$611

(ii)

All non-cash items increasing Consolidated Net Income (in each case of or

by the Borrower and its Subsidiaries for such Measurement Period)

($3,127)

($4,026)

($2,212)

$1,995

$1,992

Consolidated EBITDA

$116,442

$101,457

$127,727

$114,479

$122,511

4 Quarter Trailing Consolidated EBITDA

$520,429

$502,567

$500,309

$460,105

$466,174

Consolidated Senior Secured Debt

$1,015,957

$989,803

$959,491

$919,312

$859,983

Consolidated Senior Secured Leverage Ratio (x)

1.95

1.97

1.92

2.00

1.84

5/19/2011

©

2011 Brocade Communications Systems, Inc.

Page 40 |

Brocade Q2 FY 2011 Earnings

Q2 2011 Cash and Debt Covenant

Adjusted EBITDA* Performance

(In Millions)

Reducing Debt Position

(In Millions)

Within Debt Covenant

Increasing Cash Balance**

(In Millions)

* Adjusted EBITDA is as defined in the term debt credit

agreement ** Cash, equivalents and short term investments

5/19/2011

©

2011 Brocade Communications Systems, Inc.

Page 41 |

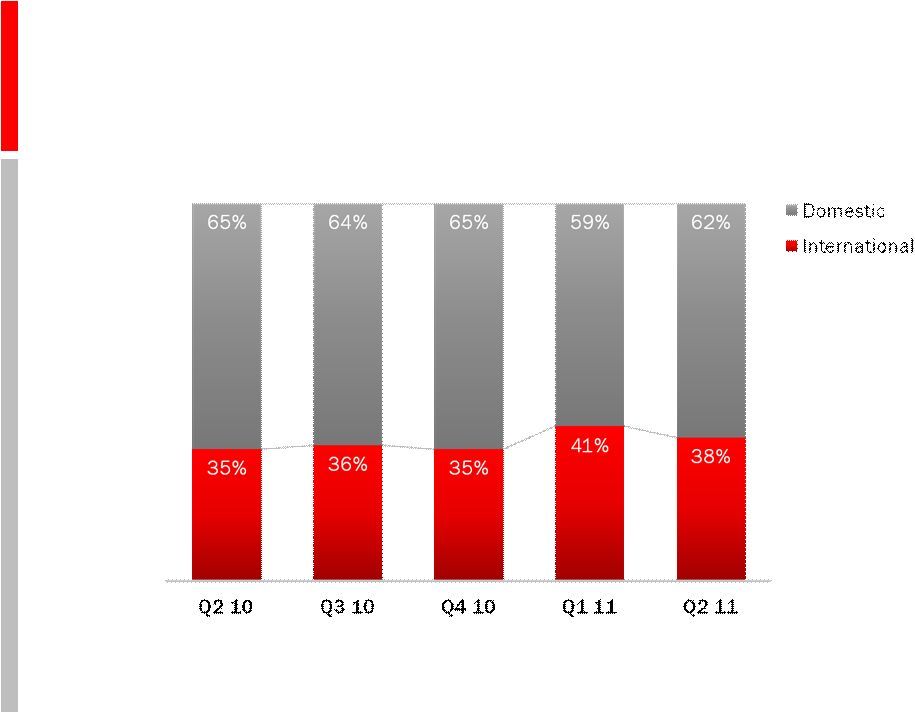

Brocade Q2 FY 2011 Earnings

Domestic and International

Reported Revenue

Reported revenue on a ship-to basis

5/19/2011

©

2011 Brocade Communications Systems, Inc.

Page 42 |

Brocade Q2 FY 2011 Earnings

Segment Revenue Detail

Product segment as a percent of revenue

* Reallocation of SAN common hardware altered historic SAN percentages

Q2 10

Q3 10

Q4 10

Q1 11

Q2 11

SAN Business

*

Directors

40%

37%

39%

44%

42%

Switches

46%

49%

46%

41%

43%

Server

14%

14%

15%

15%

15%

Ethernet Business

Chassis

64%

65%

63%

58%

57%

Stackables

36%

35%

37%

42%

43%

5/19/2011

©

2011 Brocade Communications Systems, Inc.

Page 43 |

Brocade Q2 FY 2011 Earnings

Thank You

www.brcd.com

5/19/2011

©

2011 Brocade Communications Systems, Inc.

Page 44 |