Attached files

| file | filename |

|---|---|

| 8-K - FORM 8K - SALISBURY BANCORP, INC. | form8k-116299_salisbury.htm |

Exhibit 99.1

Presentation Materials

Good afternoon and thank you very much for being here.

I want to begin today by paraphrasing some of my comments from last year’s Annual Shareholder Meeting.

At that time, we stated that the volatility in global economic matters and in the stock market would be very challenging. We noted that the slower economy reduced the demand for loans and created weakness in the real estate markets. We told you that we would face these challenges, and focus on preserving asset quality while we sought prudent financial solutions to assist our customers through their short term economic challenges, while protecting the interests of our shareholders.

Those comments from last year continue to reflect the challenges we are currently facing and expect to face in the year ahead.

Despite our continuing efforts and conventional underwriting standards, we have experienced higher levels of delinquencies and “non-performing assets,” which reflect the weakened economy in the markets we serve. One only has to drive through the small towns and villages that comprise our market area to see the empty storefronts and the volume of “For Sale” signs in the front yards of many of the homes in our communities. It was just a few short years ago when homes were sold before the sign even went up and sellers could almost expect a bidding war from prospective buyers.

Although our market area has not experienced the steep decline in real estate values that many parts of our country have seen, there has been a reduction in values none-the-less. As our loan portfolio is heavily weighted with loans secured by real estate, it follows that when there is weakness in our real estate markets, there are negative implications for the Bank.

I assure you that your management team is keenly aware of each of our non-performing loan relationships and we actively evaluate each situation in order to effectuate the best possible outcome for our customer and for our shareholders.

Despite these economic and credit quality headwinds, we accomplished a great deal during 2010:

|

|

•

|

Earnings per common share increased from $1.25 to $1.90; a 52% increase over 2009

|

|

|

•

|

Net income increased from $2.5 million to $3.7 million; a 48% increase over 2009

|

|

|

•

|

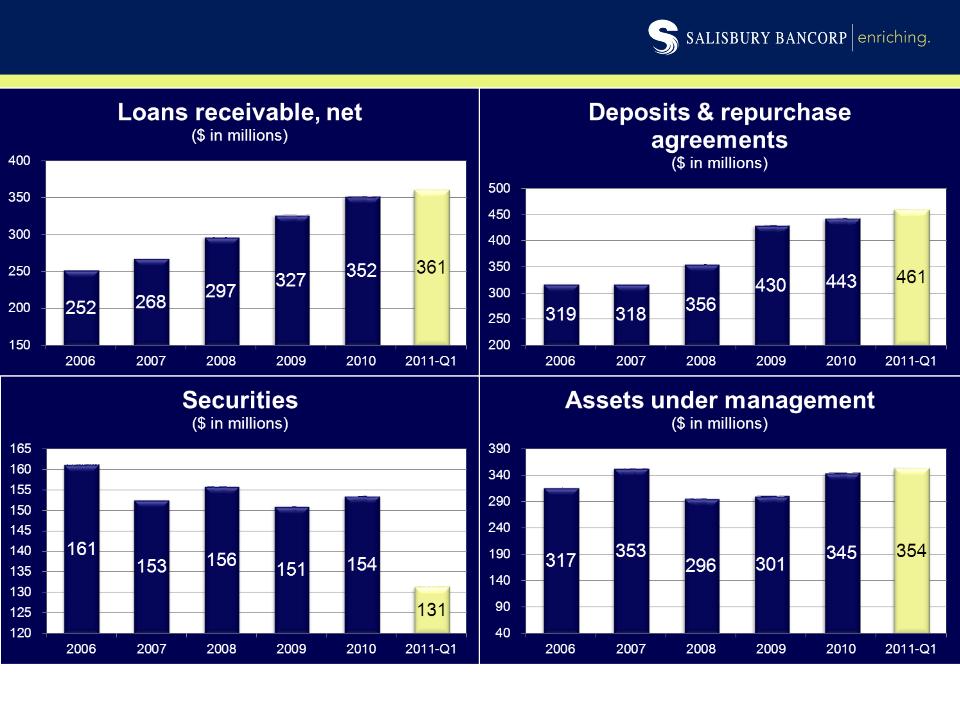

Our loan portfolio increased from $327 million to $352 million; a 7.6% increase over year-end 2009

|

|

|

•

|

Deposits increased from $418 million to $430 million; a 2.9% increase over year-end 2009

|

|

|

•

|

Assets under management in our Trust and Wealth Advisory area increased from $301 million to $345 million; a 14.6% increase over year-end 2009

|

|

|

•

|

Non-interest income increased from $4.1 million to $5.3 million; a 29% increase over year-end 2009

|

|

|

•

|

Non-interest expense decreased from $17.5 million to $17.1 million; a 2.3% decrease over year-end 2009

|

In addition to these positive financial results, we made some important investments for the future of our company. I have repeatedly said that our most important asset is our people and in this largely commoditized business of banking, it is our team that separates us from our competitors.

We invest a great deal of time and resources developing our staff and we maintain high standards for every new teammate that we hire. During 2010, we continued to strengthen our team and I would like to briefly mention two key additions.

Art Bassin became a Director of the Bank and the Company in June. Art’s educational background and experience as described in our proxy speak for themselves. It is his critical thinking and innate ability to quickly grasp difficult concepts combined with a high degree of common sense that will undoubtedly serve our shareholders well.

In addition, we added Michael Dixon to the Bank’s Executive Management Team. Michael formerly was the President of Robert H. Franke & Associates, a Trust and Wealth Advisory

consulting practice serving community banks across the country. Michael’s primary responsibility is to lead the growth and profitability of the Trust and Wealth Advisory area, and secondarily provide oversight to the Marketing and Business Development areas of the bank.

We also made important infrastructure investments in terms of strengthening and positioning our franchise for our future. We relocated our branch in Sheffield, MA to create a state of the art full service facility, in contrast to the previous location, which was extremely limited in terms of space and functionality. This new office will position us to effectively compete for new business and build relationships in that market. In January 2010, we opened a branch in Millerton, NY and our team there has done an outstanding job as they have grown deposits by $10 million or 40% through year-end 2010.

Your Company’s performance will continue to be impacted by interest rates, competition, regulatory mandates, and the economic environment. Despite all of these factors conjoining to create strong headwinds in 2010, your company achieved positive financial momentum as evidenced by the results I spoke about a few minutes ago. This momentum was achieved as a result of our team: united in purpose; and focused on the basics of community banking, obtaining core deposits, originating high quality loans, and growing assets under management in the Trust and Wealth Advisory area. Simply put, that core growth, combined with a rigorous expense reduction strategy were the key drivers of our improved performance. Our success will continue to be based upon this single and straightforward formula. We must continue to grow in a profitable way, stay focused on what we do best, and relentlessly adhere to our core values. All current and prospective team members understand that at the end of the day, our primary responsibility is to provide superior service to our customers, and to build long term total return to you, our shareholders.

We have put together a few slides which I hope will put into perspective our performance during 2010, and through the first quarter of 2011. We will be happy to entertain questions after that.

Salisbury Bancorp, Inc.

May 18, 2011

2011 Annual

Shareholders Meeting

2

Forward Looking Statements

These materials presented by the Company and the Bank, and oral statements made by executive officers of the Company

and the Bank, may include forward-looking statements relating to such matters as:

and the Bank, may include forward-looking statements relating to such matters as:

(a) assumptions concerning future economic and business conditions and their effect on the economy in general and on the

markets in which the Company and the Bank do business; and

markets in which the Company and the Bank do business; and

(b) expectations for revenues and earnings for the Company and Bank.

Such forward-looking statements are based on assumptions rather than historical or current facts and, therefore, are

inherently uncertain and subject to risk. For those statements, the Company claims the protection of the safe harbor for

inherently uncertain and subject to risk. For those statements, the Company claims the protection of the safe harbor for

forward-looking statements contained in the Private Securities Litigation Act of 1995. The Company notes that a

variety of factors could cause the actual results or experience to differ materially from the anticipated results or other

expectations described or implied by such forward-looking statements. The risks and uncertainties that may effect the

operation, performance, development and results of the Company's and Bank's business include the following:

variety of factors could cause the actual results or experience to differ materially from the anticipated results or other

expectations described or implied by such forward-looking statements. The risks and uncertainties that may effect the

operation, performance, development and results of the Company's and Bank's business include the following:

(a) the risk of adverse changes in business conditions in the banking industry generally and in the specific markets in

which the Bank operates;

which the Bank operates;

(b) changes in the legislative and regulatory environment that negatively impacts the Company and Bank through increased

operating expenses;

operating expenses;

(c) increased competition from other financial and non-financial institutions;

(d) the impact of technological advances; and

(e) other risks detailed from time to time in the Company's filings with the Securities and Exchange Commission.

Such developments could have an adverse impact on the Company's and the Bank's financial position and results of

operations.

operations.

Unaudited data

All of the financial data presented herein is unaudited.

3

Discussion Topics

§ Salisbury Today

§ 2010 Business Highlights

§ 2010 Financial Performance

§ 2011 Objectives

§ 2011 First Quarter Highlights

4

|

Headquartered in Lakeville, CT ($ in millions)

|

Dec-10

|

Dec-09

|

Change %

|

|

Assets

|

$ 575

|

$ 562

|

2%

|

|

Loans Receivable (net)

|

$ 352

|

$ 327

|

8%

|

|

Deposits

|

$ 430

|

$ 418

|

3%

|

|

Trust Assets Under Management

|

$ 345

|

$ 301

|

15%

|

|

Employees (full time equivalents)

|

133

|

139

|

(4%)

|

Corporate Strategies and Priorities

§ Be market share leader in each community we serve

§ Strengthen existing customer relationships and attract new customers

§ Improve profitability

§ Enhance employee competencies

§ Enhance shareholder value

Salisbury Today

5

Salisbury Today

|

Community Deposit Market Share

|

||

|

Branch

|

June, 30,

2010 |

June, 30,

2009 |

|

Lakeville, CT

|

90.48%

|

91.35%

|

|

Canaan, CT

|

82.76%

|

77.68%

|

|

Dover Plains, NY

|

40.28%

|

38.71%

|

|

Millerton, NY

|

43.57%

|

N/A

|

|

Salisbury, CT

|

51.51%

|

46.56%

|

|

Sharon, CT

|

48.38%

|

48.31%

|

|

Sheffield, MA

|

16.21%

|

13.80%

|

|

S. Egremont, MA

|

100.00%

|

100.00%

|

6

2010 Business Highlights

|

Core Business

|

Goals

|

Results

|

|

Loans, net

|

+ $27.4 million

|

+ $25.2 million

|

|

Deposits and Repos

|

($18.6) million

|

+ $13.9 million

|

|

Trust and Wealth

Advisory (AUM) |

+ $33 million

|

+ $44 million

|

|

Trust and Wealth

Advisory (Fees) |

+2.23 million

|

+ 2.10 million

|

7

|

• May

|

Michael Dixon Joined Bank as Executive Vice President

|

|

• June

|

Arthur Bassin appointed Director

|

|

• July

|

Contracted with Wright Investors Services

|

|

• August

|

Relocated Sheffield Office to new and improved location and facility

|

Non-Financial

2010 Business Highlights

8

|

Key Indicators

|

2010

|

2009

|

% change

|

|

Earnings per

common share |

$1.90

|

$1.25

|

+ 52%

|

|

Net Income

|

$3.7 mm

|

$2.5 mm

|

+ 48%

|

|

Non-interest

Income |

$5.3 mm

|

$4.1 mm

|

+ 29%

|

|

Non-interest

Expense |

$17.1 mm

|

$17.5 mm

|

(2.3%)

|

2010 Business Highlights

9

2010 Financial Performance

10

2010 earnings

•Improvements in all earnings drivers

2010 Financial Performance

11

2010 Financial Performance

2010 Financial Performance

2010 Financial Performance

2010 Financial Performance

15

Loan portfolio

• Highly concentrated in real estate

collateral

• Conservative underwriting standards

2010 Financial Performance

16

Credit Risk

2010 Financial Performance

17

Non-performing loans

•Weakness in regional economy is

affecting our customers

affecting our customers

•Include non-accrual loans and

accruing loans past due 90+ days

accruing loans past due 90+ days

•Represents 3% of loan portfolio

•92% collateralized with real estate

•56% are past due 90+ days

•20% remain current

2010 Financial Performance

18

Regulatory Capital

•Bancorp and Bank capital ratios are above

present “well capitalized” limits

present “well capitalized” limits

•Bancorp has $8.8MM preferred stock

(CPP)

(CPP)

•100% of CPP capital retained by Bancorp

(none down-streamed to Bank)

(none down-streamed to Bank)

•CPP matures in March 2014

•Provides Bancorp with capital safety net

2010 Financial Performance

19

2011 Objectives

|

• Core Business Growth - Deposits, Loans, Trust and Wealth Advisory

|

|

• Asset Quality Improvement

|

|

• Productivity and Operating Efficiencies

|

|

• Net Interest Income

|

|

• Strengthen customer relationships by enhancing share of wallet

|

20

|

Three Months ending

|

03/31/11

|

03/31/10

|

|

Statement of Income ($ in thousands)

|

|

|

|

Net Income available to common shareholders

|

$ 828

|

$ 479

|

|

Per Common Share Data

|

|

|

|

Net Income per common share

|

$ 0.49

|

0.28

|

|

Common dividends paid

|

0.28

|

0.28

|

|

Statistical Data

|

|

|

|

Net interest margin

|

3.56%

|

3.25%

|

|

Efficiency Ratio

|

69.77%

|

78.07%

|

|

Return on Average Assets

|

0.59%

|

0.34%

|

|

Return on Average Common Shareholders’ Equity

|

7.24%

|

4.40%

|

|

Financial Condition ($ in mm)

|

|

|

|

Assets

|

$ 577

|

$ 563

|

|

Loans Receivable (net)

|

361

|

330

|

|

Deposits and Repurchase Agreements

|

461

|

430

|

|

Trust Assets Under Management

|

354

|

309

|

|

Other

|

|

|

|

Employees (full time equivalents)

|

128

|

133

|

2011 First Quarter Highlights

21

|

Non-Financial

|

|

• Introduced enhanced shareholder relations website

|

|

• Implemented back office reorganization, consolidating departments to

improve efficiencies |

|

• Installed new platform automation, improving branch efficiency while

enhancing the customer experience. |

2011 First Quarter Highlights