Attached files

| file | filename |

|---|---|

| 8-K - HORIZON BANCORP INC /IN/ | hb_8k0518.htm |

Forward-Looking Statements

This presentation may contain forward-looking statements regarding the financial

performance, business, and future operations of Horizon Bancorp and its affiliates

(collectively, “Horizon”). For these statements, Horizon claims the protection of the safe

harbor for forward-looking statements contained in the Private Securities Litigation

Reform Act of 1995. Forward-looking statements provide current expectations or

forecasts of future events and are not guarantees of future results or performance. As a

result, undue reliance should not be placed on these forward-looking statements, which

speak only as of the date hereof.

performance, business, and future operations of Horizon Bancorp and its affiliates

(collectively, “Horizon”). For these statements, Horizon claims the protection of the safe

harbor for forward-looking statements contained in the Private Securities Litigation

Reform Act of 1995. Forward-looking statements provide current expectations or

forecasts of future events and are not guarantees of future results or performance. As a

result, undue reliance should not be placed on these forward-looking statements, which

speak only as of the date hereof.

We have tried, wherever possible, to identify such statements by using words such as

“anticipate,” “estimate,” “project,” “intend,” “plan,” “believe,” “will” and similar

expressions, and although management believes that the expectations reflected in such

forward-looking statements are accurate and reasonable, actual results may differ

materially from those expressed or implied in such statements. Risks and uncertainties

that could cause our actual results to differ materially include those set forth in “Item 1A

Risk Factors” of Part I of Horizon’s Annual Report on Form 10-K for the fiscal year

ended December 31, 2010. Statements in this presentation should be considered in

conjunction with such risk factors and the other information publicly available about

Horizon, including the information in the filings we make with the Securities and

Exchange Commission.

“anticipate,” “estimate,” “project,” “intend,” “plan,” “believe,” “will” and similar

expressions, and although management believes that the expectations reflected in such

forward-looking statements are accurate and reasonable, actual results may differ

materially from those expressed or implied in such statements. Risks and uncertainties

that could cause our actual results to differ materially include those set forth in “Item 1A

Risk Factors” of Part I of Horizon’s Annual Report on Form 10-K for the fiscal year

ended December 31, 2010. Statements in this presentation should be considered in

conjunction with such risk factors and the other information publicly available about

Horizon, including the information in the filings we make with the Securities and

Exchange Commission.

Horizon does not undertake, and specifically disclaims any obligation, to publicly release

any updates to any forward-looking statement to reflect events or circumstances

occurring or arising after the date on which the forward-looking statement is made, or to

reflect the occurrence of unanticipated events, except to the extent required by law.

any updates to any forward-looking statement to reflect events or circumstances

occurring or arising after the date on which the forward-looking statement is made, or to

reflect the occurrence of unanticipated events, except to the extent required by law.

Horizon’s Corporate Profile

• Shares Outstanding 3.3 Million

• Market Cap* $89.9 Million

• Total Assets** $ 1.4 Billion

• Total Deposits** $ 1.0 Billion

• Branches 22

• Ownership

– Insiders 10%

– Employee Benefit Plans 15%

– Institutional & Mutual Funds 22%

*Based on price at the close of business on April 30, 2011 at $27.00 per share

**Total assets and deposits as of March 31, 2011

1

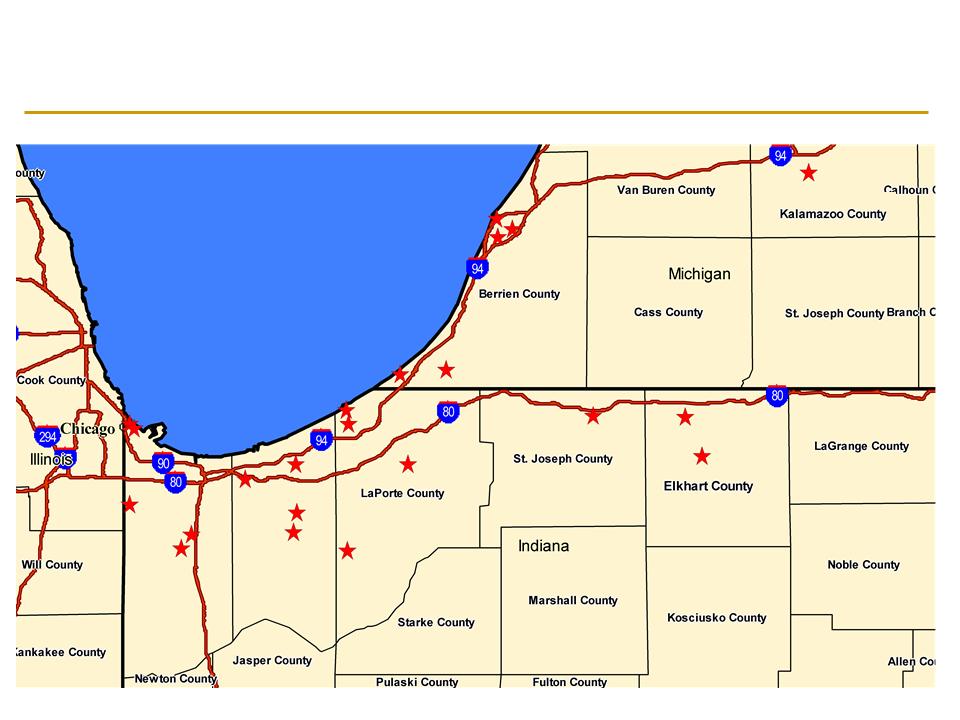

Horizon Locations

Michigan City

2

Diversified Employment Base

3

4

Ranked #1

Retirement Community for Chicago Area

Retirement Community for Chicago Area

Why Recommend HBNC to Your Clients?

• Attractive Current Valuation

• Dividends and Reinvesting for Growth

• Consolidator in Banking Industry

• Strong Capital Position

• Positioned to Meet Regulatory Requirements

• Successful Acquisition and Organic Growth

Track Record

Track Record

• Robust Capabilities for Managing Expansion

• Focus on Growth Accretive to Earnings

5

Horizon is an Attractive Value

|

|

Horizon

Bancorp*

|

Median Indiana

Banks**

|

|

Dividend Yield

|

2.5%

|

1.9%

|

|

Price to Book

|

91.7%

|

82.0%

|

|

Price to Tangible Book

|

100.5%

|

90.1%

|

|

Price to Earnings

(LTM) |

9.0x

|

14.0x

|

*Horizon Bancorp data as of March 31, 2011

**Peer Data Source: KBW Report as of March 2011 Covering Indiana Publicly Traded

6

The Current Banking Environment

and Horizon’s Response

7

New Regulations Will Have

Adverse Affect on the Industry

Adverse Affect on the Industry

• Lower Revenues

– Consumer Finance Protection Bureau

– Durbin amendment

– Mortgage pricing

• Higher Costs

– Implementation & systems up-grades

– Compliance & training

– Lost opportunity

• Higher Capital

– Lower returns on equity

– Importance of capital allocation

8

9

Companies That Effectively

Deal with Change

&

Execute Well

Lead the Industry!

Deal with Change

&

Execute Well

Lead the Industry!

Horizon is an Industry Leader

• Great Team of Employees

– We execute well

– We look for solutions

– We look for opportunities

• Good Historical Performance - Indicator of

Future Ability

Future Ability

• Positive Feedback from Shareholders &

Investors

Investors

• Well-Defined Growth Strategy

10

11

Horizon Strives to Increase Revenue

Organic Growth

• Commercial Lending Team Expanded

• Treasury Management Team Expanded

• New Retail Mortgage Sales Manager

• Increase in Trust Administrators

• Opening New Banking Markets

12

Experts Agree Significant

Banking Industry Consolidation

is Inevitable

Banking Industry Consolidation

is Inevitable

Challenges Confronting Community Banks

• Poor Earnings Run Rate

• Capital Constraints

• Asset Quality Challenges

• Limited Growth Opportunities

• Increase in Regulatory Burden

• Increase in Director Liability

• Limited Capacity to Manage the Magnitude of

Change

Change

• No Succession Plan

13

Once in a Lifetime Opportunity

Horizon Offers

• Cooperative, Non-Hostile Approach to

Business Combinations

Business Combinations

• Open, Clear Communication with Acquired

Companies’ Employees

Companies’ Employees

• Excellent Corporate Culture: People are Proud

to Work for Horizon

to Work for Horizon

• Ability to Leverage Strengths of Acquired

Branches and Companies

Branches and Companies

14

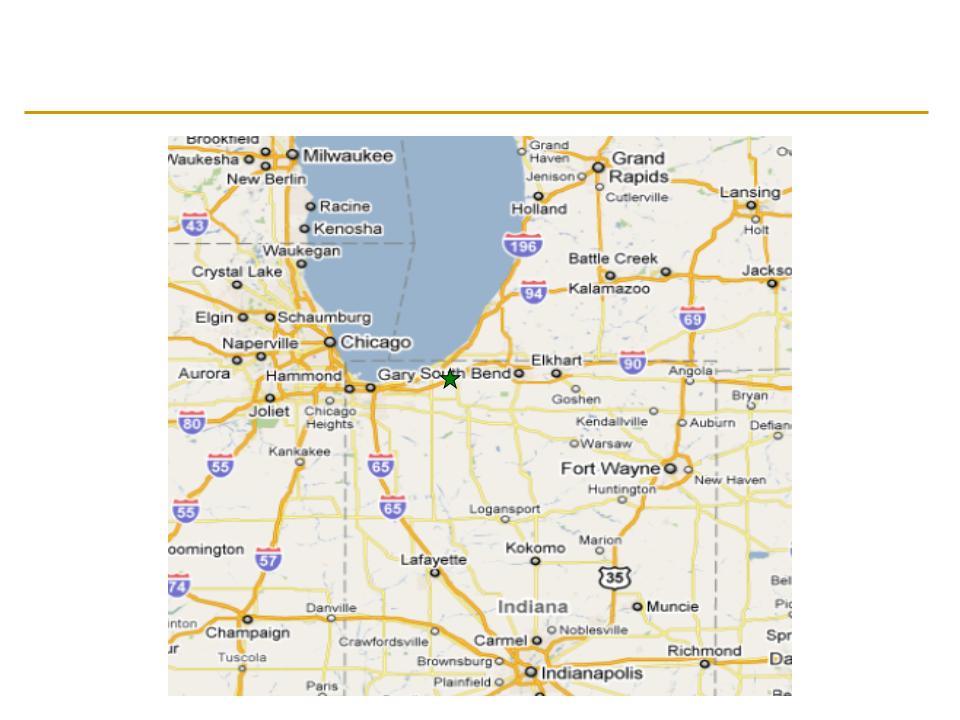

Central Location Supports Growth Opportunities

• Lake Michigan Corridor Primed for Growth

• Super Regional Banks Cutting Back - Market Share

Opportunities

Opportunities

• Consolidation Opportunities Increasing for Good

Performing Banks

Performing Banks

• Location, location, location: Horizon can expand

north, south, east and west without compromising

core service area

north, south, east and west without compromising

core service area

15

Target Region for Expansion

Michigan City

16

Horizon’s Story

Financial Strength

Consistent Performance

Superior Returns

Financial Strength

Consistent Performance

Superior Returns

17

Balanced & Complementary

Business Model

Business Model

#1 - Business Banking

#2 - Retail Banking

#3 - Retail Mortgage Banking

#4 - Wealth Management

#5 - Mortgage Warehousing

Complementary Revenue Streams that are

Counter-Cyclical to Varying Economic Cycles

Counter-Cyclical to Varying Economic Cycles

18

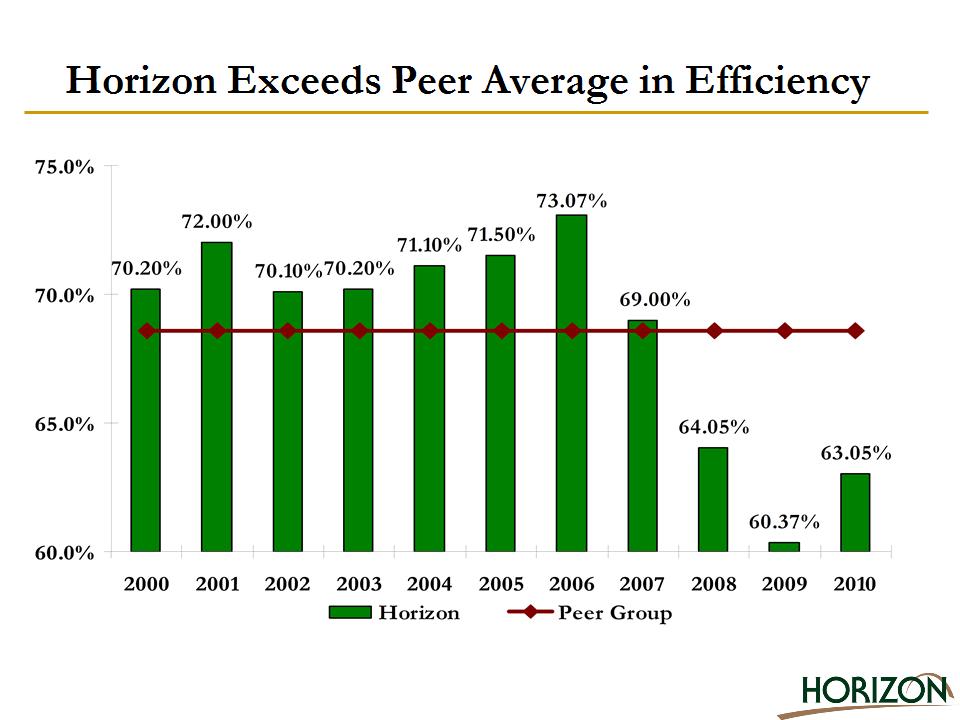

Peer Data Source: KBW Report dated January 2011 covering Indiana Publicly Traded Banks; peer data represents a peer average and is as of

December 2010 for all periods reviewed.

December 2010 for all periods reviewed.

19

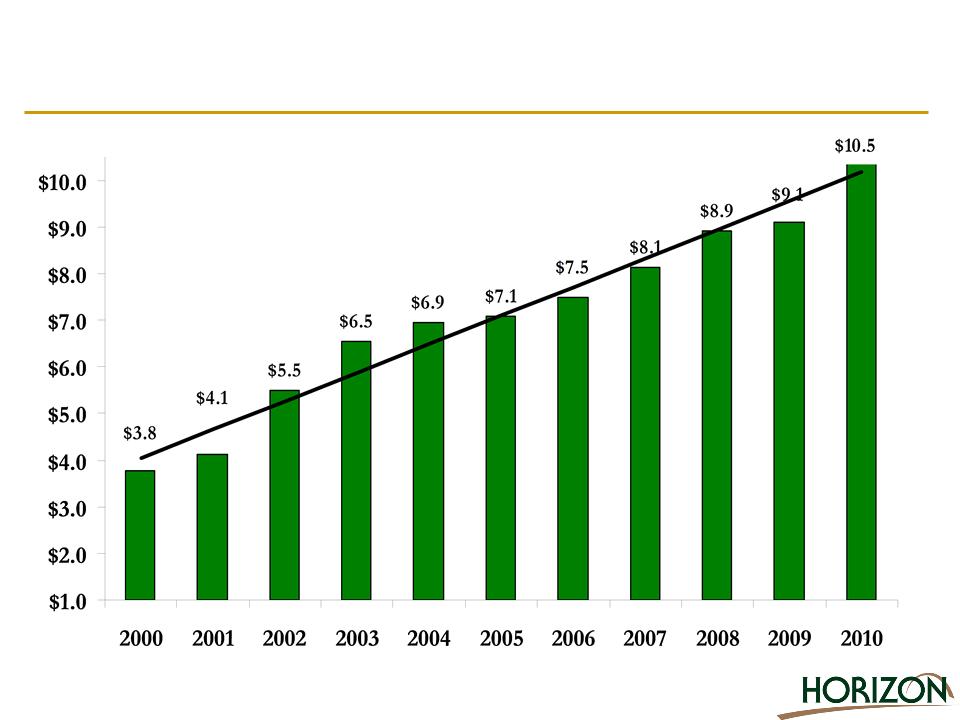

Record Earnings “Eleven” Consecutive Years

CAGR 10.70%

Dollars in Millions

20

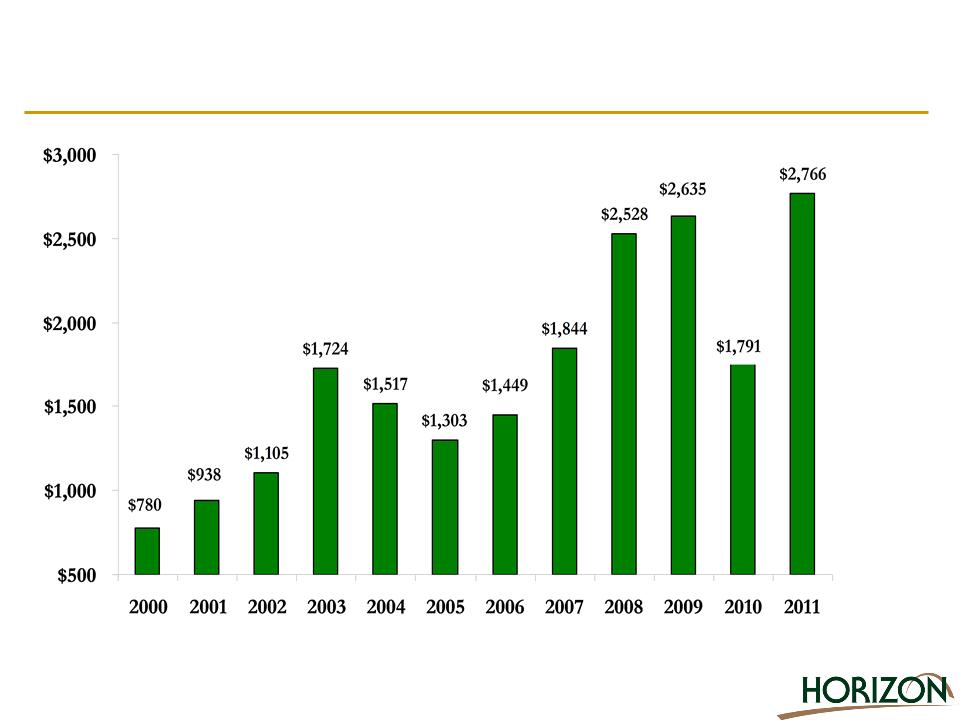

Horizon Has Record First Quarter Earnings

Dollars in Thousands

First quarter only

21

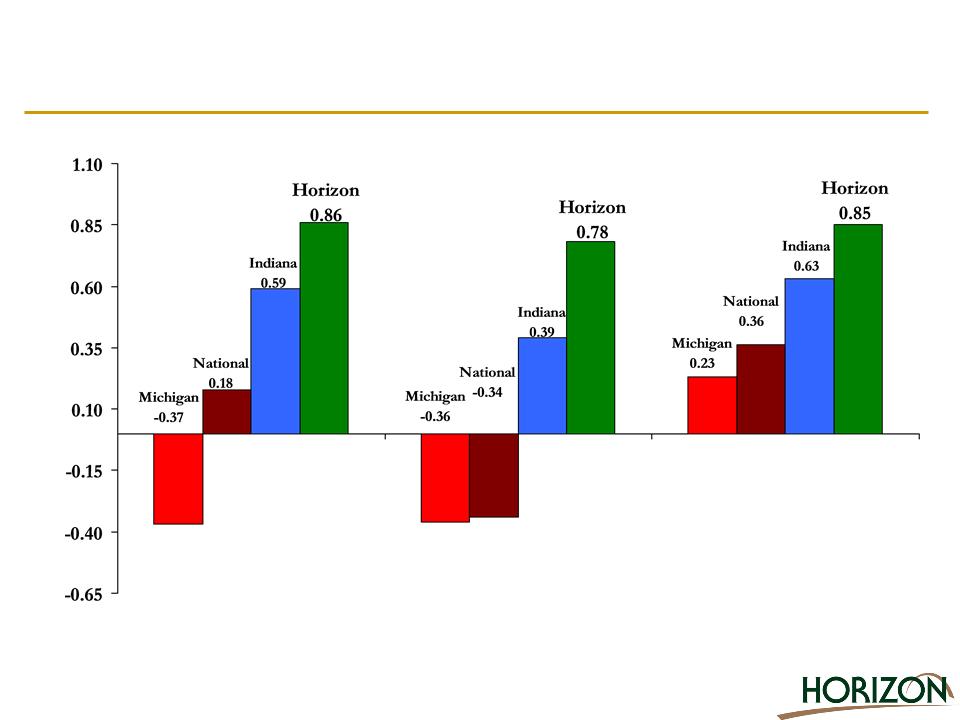

Horizon More Profitable Than State & National Peers

As Measured By Return On Average Assets

As Measured By Return On Average Assets

Source: Uniform Bank Performance Reports. Indiana and Michigan are state averages for all insured

commercial banks. National is all insured commercial banks with assets between $1 billion and $3 billion.

commercial banks. National is all insured commercial banks with assets between $1 billion and $3 billion.

2008

2009

2010

22

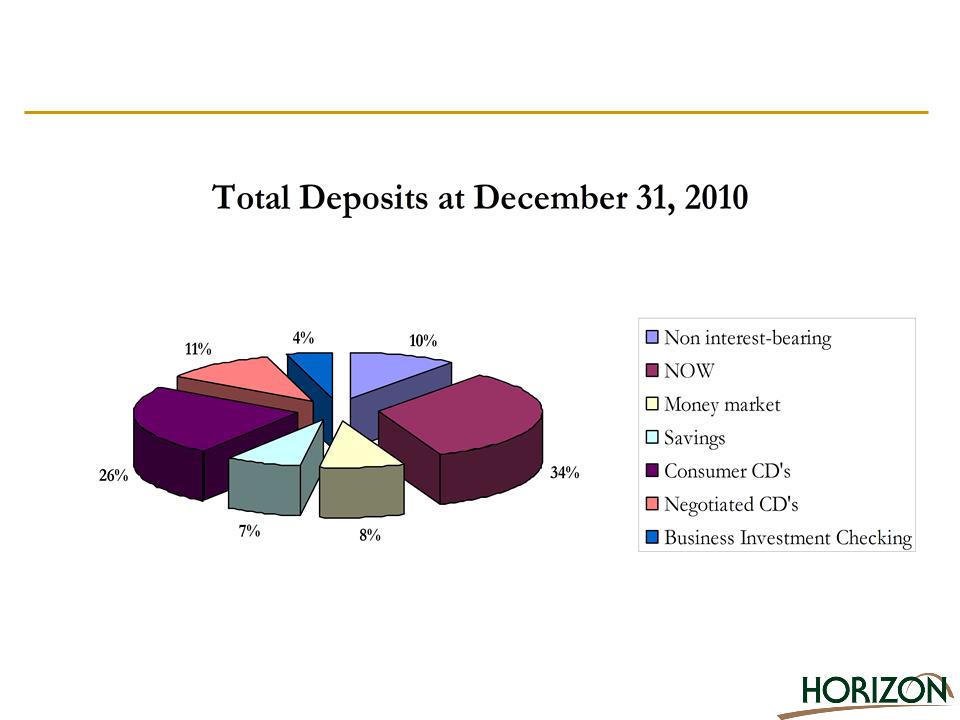

Balanced Deposit Mix

23

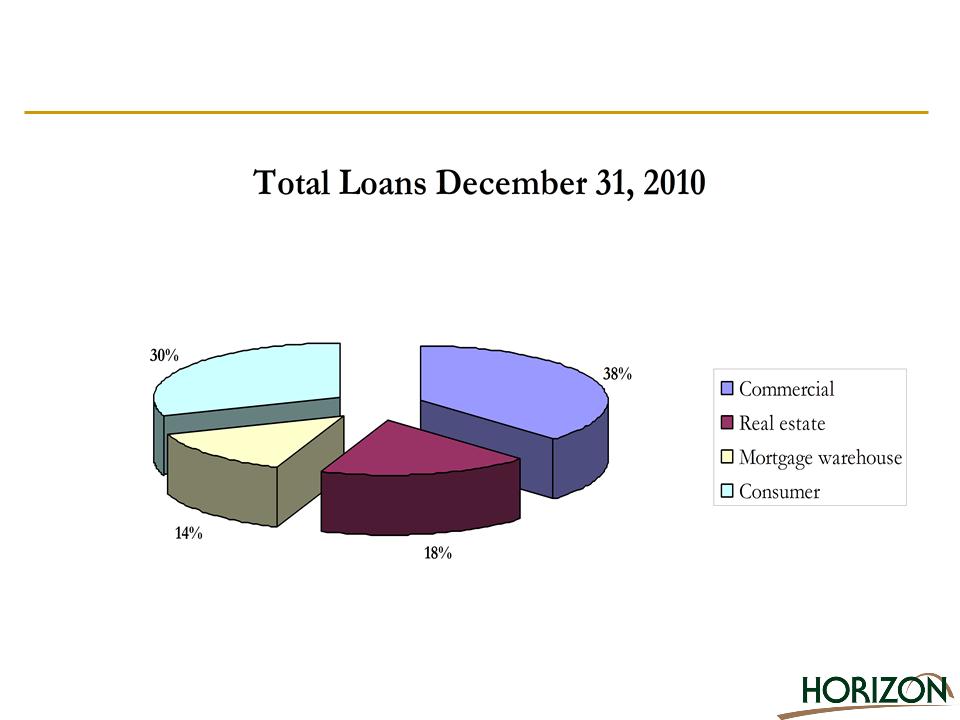

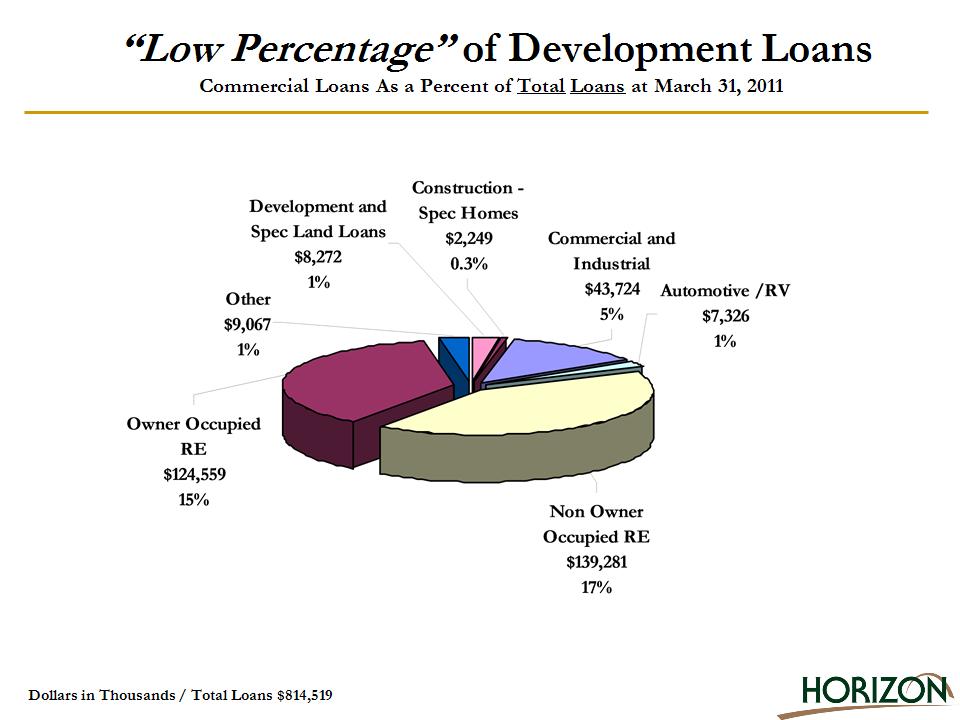

Balanced Loan Mix

24

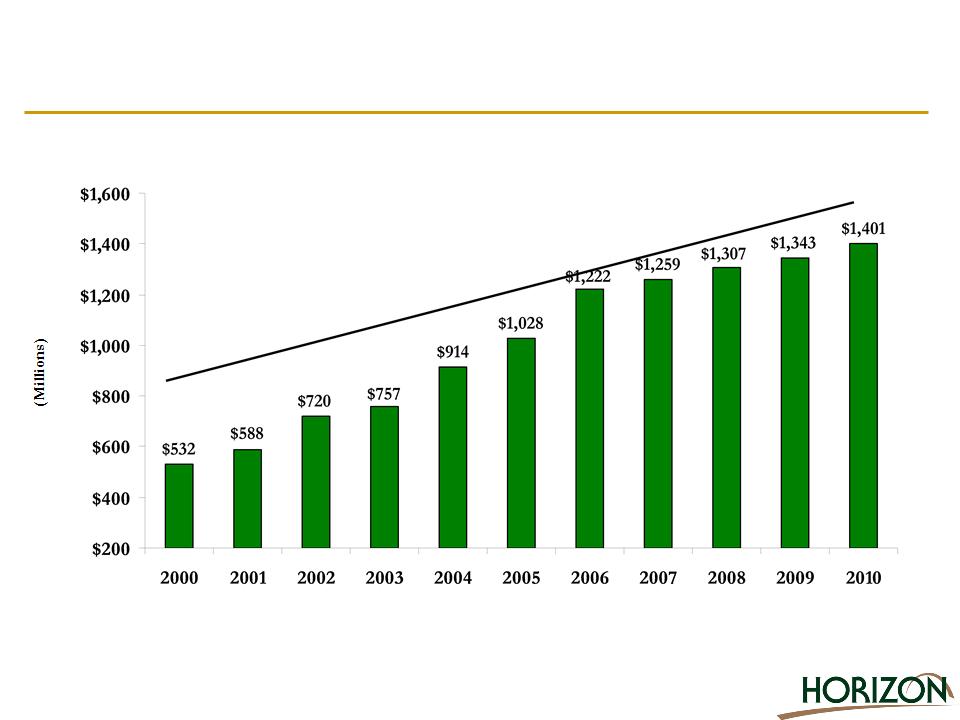

Steady Asset Growth

CAGR 10.17%

2000 to 2010

25

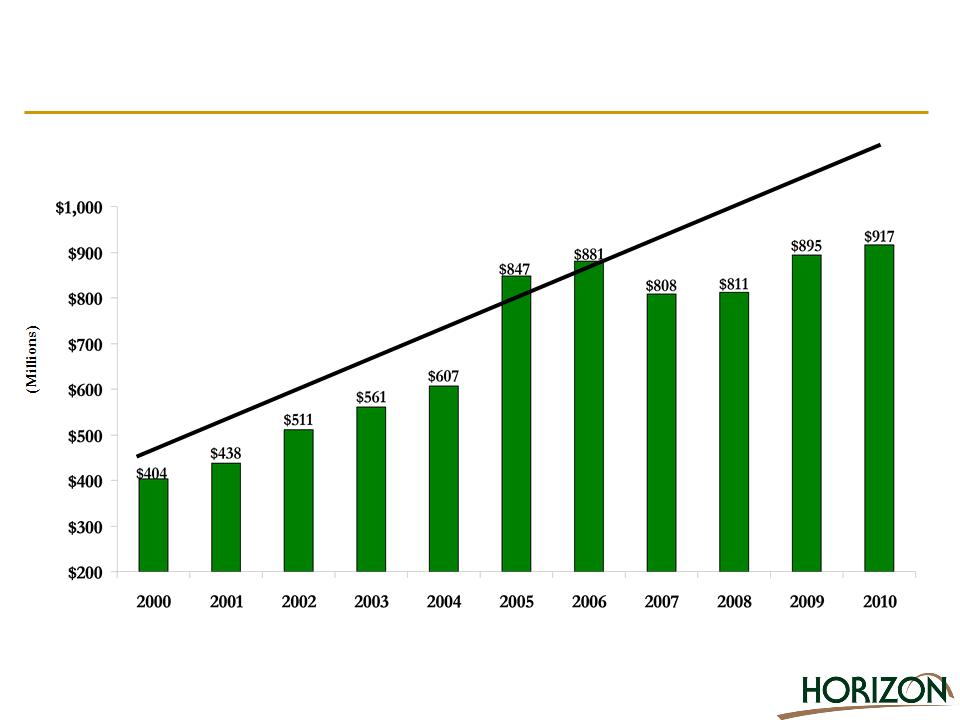

Increasing Core Deposits

CAGR 8.54%

2000 to 2010

26

Horizon’s Sound Credit Culture

and

Asset Quality

27

Sound Credit Culture

• Team of Seasoned Underwriters

– Average Tenure > 20 years

• Primarily an In-Market and Full Recourse Lender

• Predominately a Secured Lender

• Retail & Business Focus

– Average Commercial Loan Size Approximately $250,000

– Sweet Spot - Retail and Business Focus

• We Manage Lending Limits

– House Limit $10 million

– Legal Limit > $20 million

– Five Loan Relationships with Balances > $5 million

28

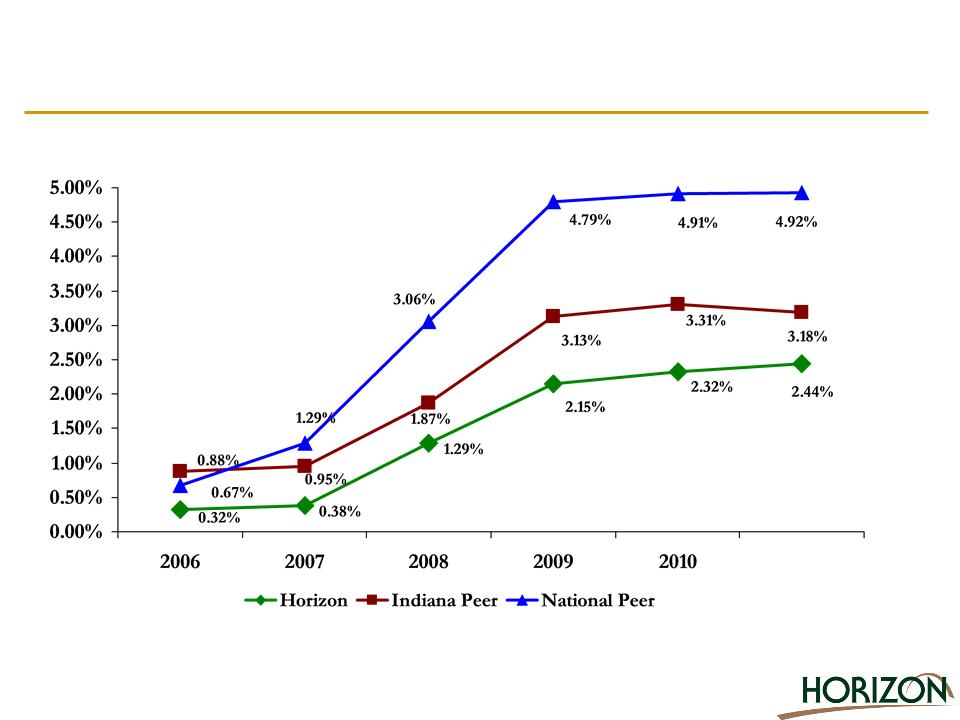

Horizon Outperforms Peer Groups

Non-Performing Loans Plus OREO to Gross Loans Plus OREO

Source: FDIC Uniform Bank Performance Reports as of 12/31/10. Peer is a custom group of 17 publicly traded banks headquartered in the

state of Indiana. National peer group consists of insured commercial banks having assets between 1 billion and 3 billion.

state of Indiana. National peer group consists of insured commercial banks having assets between 1 billion and 3 billion.

2011 1st Qtr

29

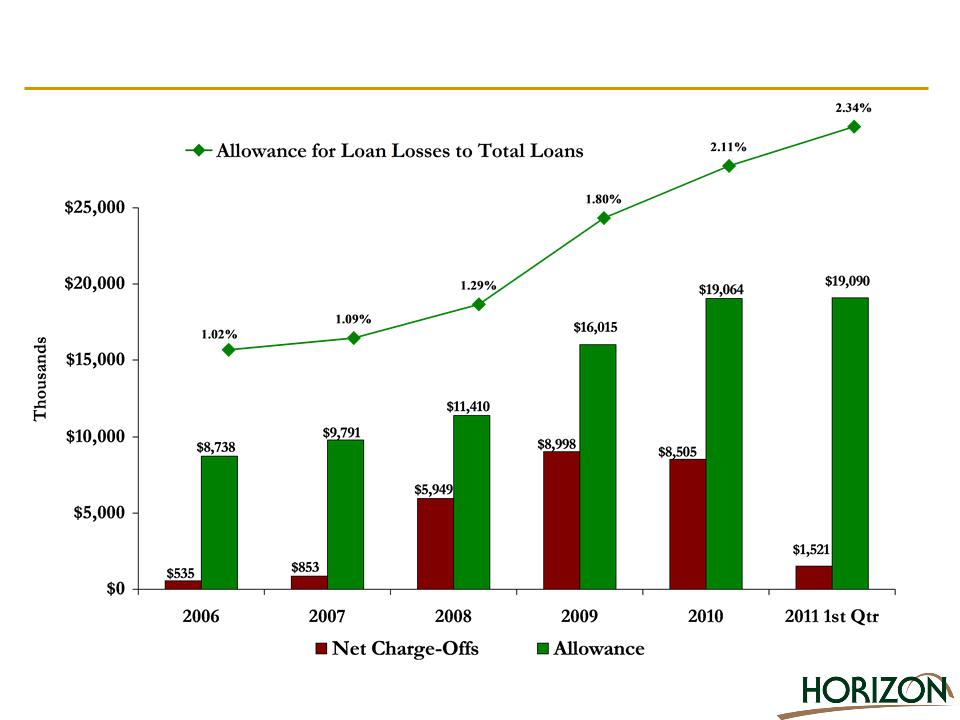

Horizon Builds Loan Loss Reserve

30

31

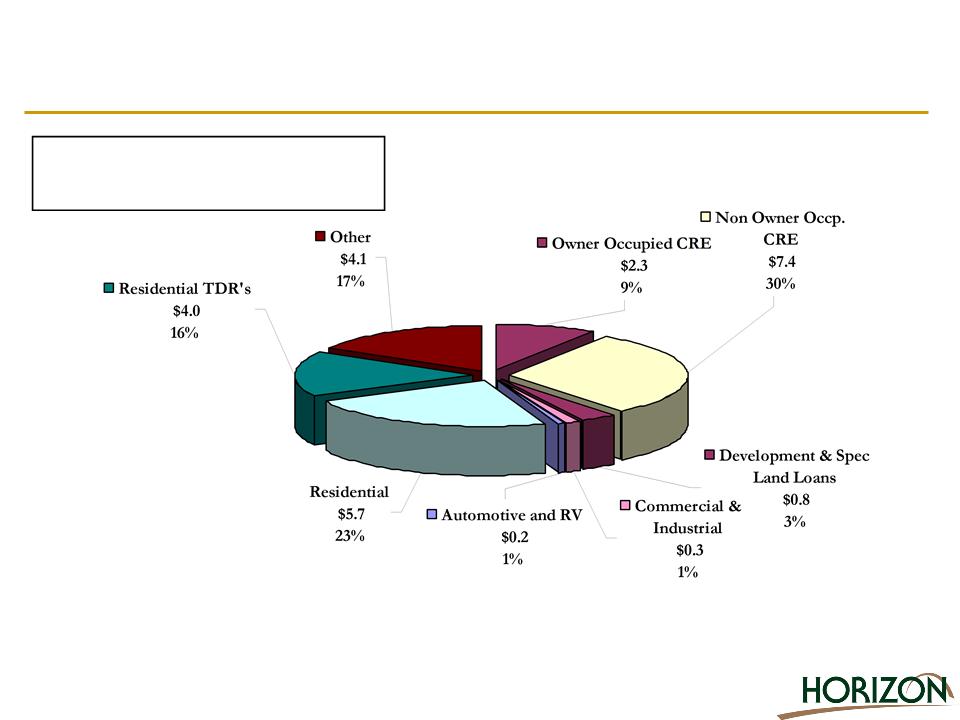

Diversity in Non-Performing & Real Estate Owned

Non-Performing and REO By Classification at March 31, 2011

Dollars in Millions

Non-Performing Loans - $22.1

Other Real Estate Owned - $2.3

32

Invest in Horizon

33

Excellent Financial Metrics

• Consistent & Stable Quarterly Dividend Payments

– Over twenty-five years of uninterrupted dividends

– Cash reserves at the holding company

• Solid Earnings Performance

• Efficient Operations

• Good Historical Growth

– Assets

– Deposits

– Earnings

34

Horizon is Highly Regarded

In Our Communities

In Our Communities

• Nine out of Ten Customers - Would Refer a Friend

• Best Bank - The News Dispatch Readers Poll - Ten out

of Last Eleven Years

of Last Eleven Years

• Best Trust Company - NW Indiana Business Quarterly

• Best Place to Work - NW Indiana Business Quarterly

• Family Friendly Work Policies - Clarian Award

• Ranked in the Top 200 Community Banks for

Financial Performance - US Banker Magazine - June

2008, 2009 & 2010

Financial Performance - US Banker Magazine - June

2008, 2009 & 2010

35

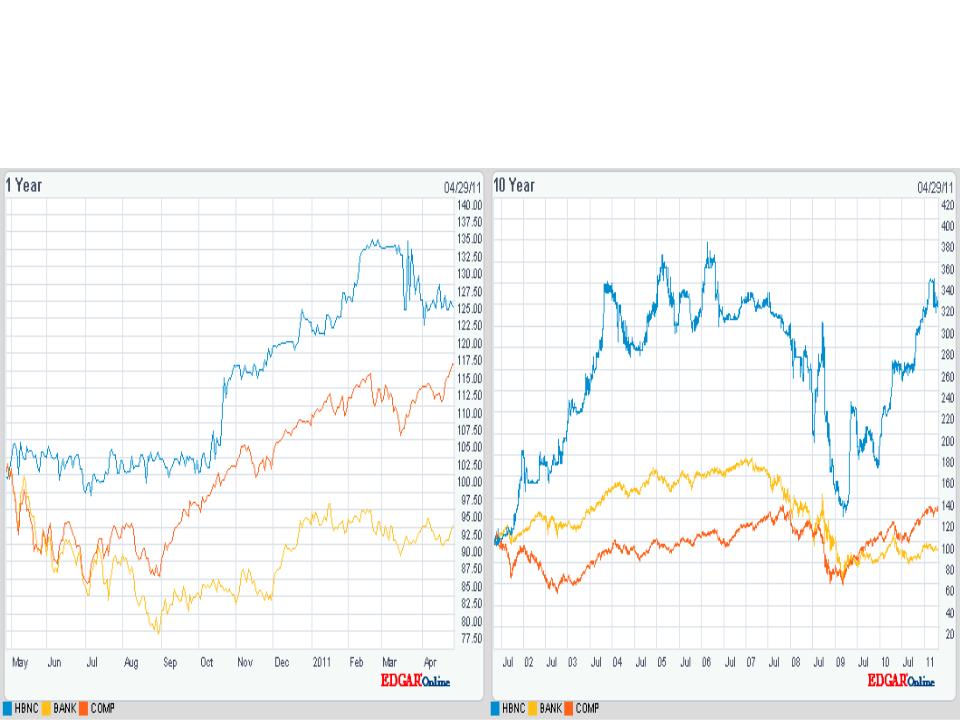

Horizon Outperforms NASDAQ’s Bank

& Composite Indices

Bauer Financial - “Recommends”

All Five-Star and Four-Star Institutions

Source: www.bauerfinancial.com - Telephone 800.388.6686

"Because peace of mind matters"

A NASDAQ Traded Company - Symbol HBNC

38