Attached files

| file | filename |

|---|---|

| 8-K - URANIUM RESOURCES, INC. 8-K - WESTWATER RESOURCES, INC. | a6722379.htm |

| EX-99.1 - EXHIBIT 99.1 - WESTWATER RESOURCES, INC. | a6722379ex99-1.htm |

| EX-99.2 - EXHIBIT 99.2 - WESTWATER RESOURCES, INC. | a6722379ex99-2.htm |

| EX-99.3 - EXHIBIT 99.3 - WESTWATER RESOURCES, INC. | a6722379ex99-3.htm |

Exhibit 1.1

EXPLORATION AGREEMENT

By and Between

URI, Inc.

And

Cameco Texas Inc.

May 10 , 2011

TABLE OF CONTENTS

Page

|

ARTICLE 1

|

DEFINITIONS AND INTERPRETATION

|

1

|

|

1.1

|

Defined Terms

|

1

|

|

1.2

|

Construction

|

4

|

|

1.3

|

Headings

|

5

|

|

ARTICLE 2

|

GRANT OF RIGHTS AND REQUIREMENTS FOR VESTING

|

5

|

|

2.1

|

Rights Granted

|

5

|

|

2.2

|

Initial Reimbursement

|

5

|

|

2.3

|

Exploration Expenses

|

5

|

|

2.4

|

Phase One Minimum Work Requirement

|

6

|

|

2.5

|

Phase Two Option to Acquire 50% Interest

|

7

|

|

2.6

|

Phase Three Option to Acquire 70% Interest

|

7

|

|

2.7

|

Additional Expenditures; Other Joint Expenditures

|

7

|

|

2.8

|

In Lieu Payments

|

7

|

|

2.9

|

Exercise of Lease Option

|

8

|

|

2.10

|

Joint Venture

|

8

|

|

2.11

|

Default in Funding

|

9

|

|

2.12

|

Cameco Termination Rights During Phases

|

9

|

|

2.13

|

Geological and Other Data

|

10

|

|

ARTICLE 3

|

OTHER ARRANGEMENTS DURING THE EARN-IN PERIOD

|

10

|

|

3.1

|

Exploration Activities

|

10

|

|

3.2

|

Elections at Phase Ends; Termination

|

13

|

|

3.3

|

Operations Carried Out by Exploration Operator

|

14

|

|

3.4

|

Radioactive Materials Licenses

|

14

|

|

3.5

|

Toll Milling Arrangements

|

14

|

|

ARTICLE 4

|

OBLIGATIONS OF EXPLORATION OPERATOR

|

15

|

|

4.1

|

Conduct of Operations

|

15

|

|

4.2

|

Insurance

|

15

|

|

4.3

|

Compliance with Laws

|

15

|

i

|

4.4

|

Inspection

|

15

|

|

4.5

|

Taxes

|

15

|

|

4.6

|

Liens and Encumbrances

|

16

|

|

4.7

|

Reclamation and Restoration

|

16

|

|

4.8

|

Independent Contractor

|

16

|

|

4.9

|

Access for Reclamation

|

17

|

|

4.10

|

Data

|

17

|

|

4.11

|

Proof of Expenditures

|

17

|

|

4.12

|

Transfer of Permits

|

17

|

|

ARTICLE 5

|

REPRESENTATIONS AND WARRANTIES OF URI

|

18

|

|

5.1

|

Representations and Warranties

|

18

|

|

ARTICLE 6

|

REPRESENTATIONS AND WARRANTIES OF CAMECO

|

19

|

|

6.1

|

Representations and Warranties of Cameco

|

19

|

|

ARTICLE 7

|

NOTICES

|

20

|

|

7.1

|

Notices

|

20

|

|

ARTICLE 8

|

INDEMNIFICATION

|

21

|

|

8.1

|

By URI

|

21

|

|

8.2

|

By Cameco

|

21

|

|

8.3

|

Notification

|

21

|

|

ARTICLE 9

|

TERM AND TERMINATION

|

22

|

|

9.1

|

Term and Termination

|

22

|

|

9.2

|

Termination Generally

|

22

|

|

9.3

|

Termination for Default

|

22

|

|

9.4

|

Return of Data

|

23

|

|

9.5

|

Release

|

23

|

|

9.6

|

Surrender of Possession and Removal of Equipment

|

23

|

ii

|

ARTICLE 10

|

PREEMPTIVE RIGHTS

|

24

|

|

10.1

|

Preemptive Rights in this Agreement

|

24

|

|

10.2

|

Exceptions to Preemptive Right

|

25

|

|

10.3

|

Preemptive Rights in Other Properties

|

25

|

|

ARTICLE 11

|

ENTIRE AGREEMENT/AMENDMENT

|

27

|

|

11.1

|

Entire Agreement

|

27

|

|

11.2

|

No Implied Covenants

|

27

|

|

ARTICLE 12

|

FORCE MAJEURE

|

27

|

|

12.1

|

Effect of Occurrence

|

27

|

|

12.2

|

Definition of Force Majeure

|

27

|

|

ARTICLE 13

|

GENERAL PROVISIONS

|

28

|

|

13.1

|

Governing Law

|

28

|

|

13.2

|

Parties in Interest; Assignment

|

28

|

|

13.3

|

Other Business Opportunities

|

28

|

|

13.4

|

No Partnership

|

29

|

|

13.5

|

Confidentiality

|

29

|

|

13.6

|

Memorandum for Recording

|

29

|

|

13.7

|

Public Announcements; Technical Reports

|

29

|

|

13.8

|

Waiver; Amendment

|

30

|

|

13.9

|

Severability

|

30

|

|

13.10

|

No Tax Partnership

|

31

|

|

13.11

|

Attorneys’ Fees

|

31

|

|

13.12

|

Further Documents

|

31

|

|

13.13

|

Dispute Resolution; Arbitration

|

31

|

|

13.14

|

Guarantees

|

33

|

|

13.15

|

Counterparts

|

33

|

|

13.16

|

Rule Against Perpetuities

|

33

|

|

13.17

|

No Third Party Beneficiaries

|

33

|

|

13.18

|

Remedies

|

33

|

|

13.19

|

Limitation on Damages

|

34

|

iii

EXHIBITS

|

Exhibit A

|

KMF Option Agreement

|

|

Exhibit B

|

Joint Venture Agreement Form

|

|

Exhibit C

|

Initial Program and Budget

|

|

Exhibit D

|

Short Form Memorandum for Recording

|

|

Exhibit E

|

Toll Processing Agreement

|

|

Exhibit F

|

Guaranty Form

|

|

Exhibit G

|

Joint Venture Ownership, Contribution, Management

|

|

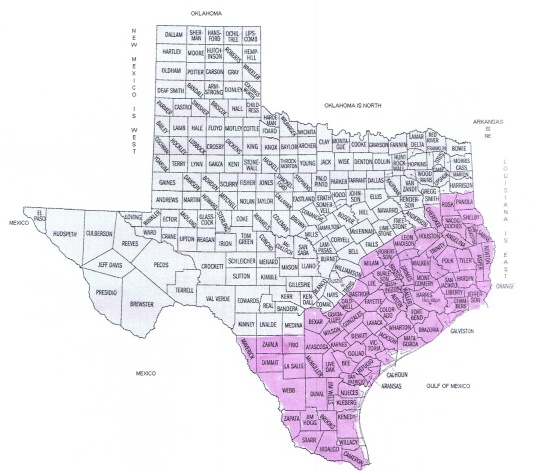

Exhbit H

|

South Texas Preemptive Right Counties

|

iv

EXPLORATION AGREEMENT

THIS EXPLORATION AGREEMENT is made and entered into effective as of May ___, 2011, by and between URI, Inc., a Delaware corporation, whose address for purposes hereof is 405 State Highway 121 Bypass, Building A, Suite 110, Lewisville, Texas 75067 (hereinafter referred to as “URI”), and Cameco Texas Inc., a Texas corporation, whose address for purposes hereof is 2020 Carey Avenue, Suite 600, Cheyenne, Wyoming 82001 (hereinafter referred to as “Cameco”). URI and Cameco will be collectively referred to hereinafter as the “Parties,” and individually referred to as a “Party.”

RECITALS

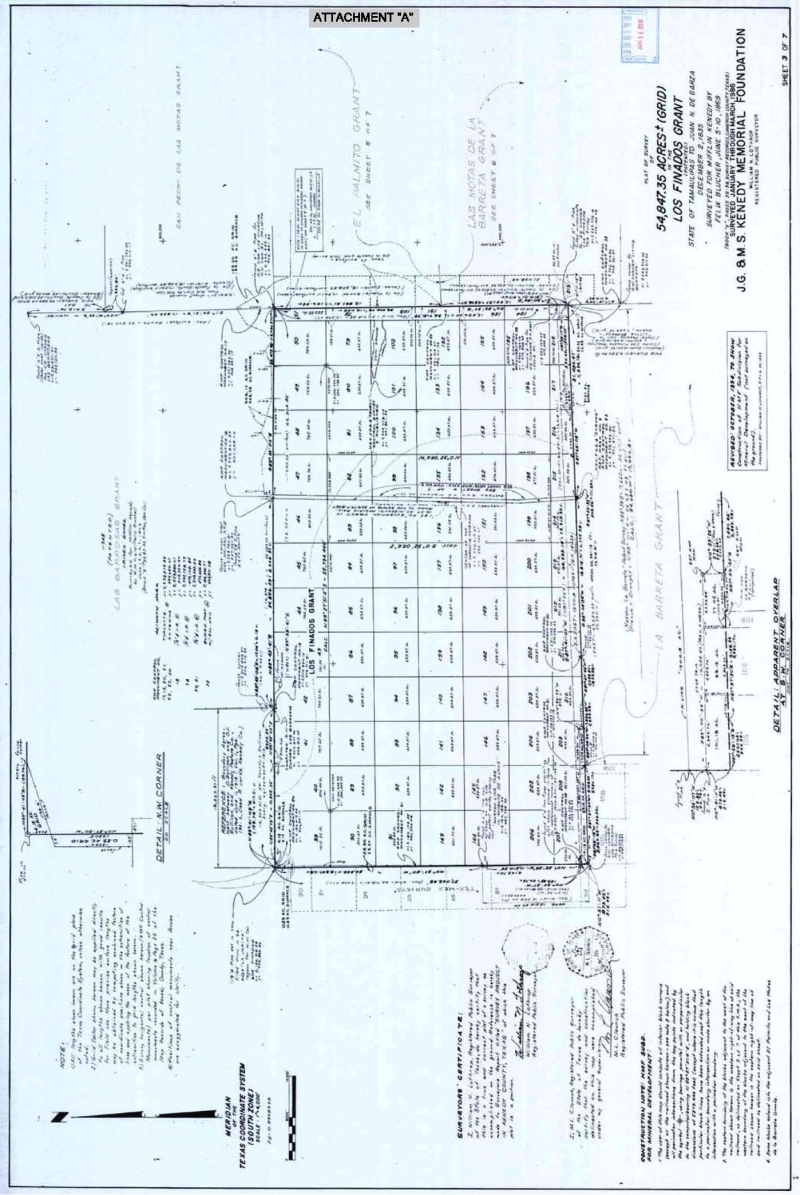

A. Pursuant to the terms and conditions of that Uranium Mining Lease Option dated effective December 1, 2010, between the Kenedy Memorial Foundation (“KMF”) and URI, a copy of which, as amended, is attached hereto as Exhibit A (the “KMF Option Agreement”), URI has the right (i) to conduct exploration and development activities on certain fee lands comprising a portion of the Kenedy Ranch in Kenedy County, Texas (the “Kenedy Ranch”), specifically, all of the Rita Division and part of the Jaboncillos Division of the Kenedy Ranch, as more particularly described in the KMF Option Agreement (the “Exploration Lands”), and (ii) the right to exercise an option to enter into one or more in-situ uranium mining leases (“Lease(s)”) with KMF covering a portion or portions of the Exploration Lands (the “Lease Option”).

B. URI and Cameco now desire to enter into this Agreement, pursuant to which URI grants to Cameco (i) the right to participate with URI in exploring, evaluating and developing the Exploration Lands and (ii) an option to earn an undivided 40%, 50% or 70% interest in and to the Leases. If Cameco acquires that interest, the Parties shall enter into a joint venture agreement for the joint exploration, development and, if warranted, mining, production and marketing of Valuable Minerals from the Exploration Lands covered by each of the Leases, all for the consideration and upon the terms and conditions described herein.

AGREEMENT

NOW, THEREFORE, for and in consideration of Cameco’s firm commitment to (i) reimburse URI for 30% of the $1,000,000 bonus payment made by URI to KMF upon execution of the KMF Option Agreement (the “Bonus Payment”), and (ii) expend not less than $1,000,000 in Exploration Expenses during Phase One, and other good and valuable consideration, the receipt and sufficiency of which the Parties hereby confirm and acknowledge, and the mutual promises, covenants, and conditions herein contained and recited, the Parties hereto agree as follows:

ARTICLE 1

DEFINITIONS AND INTERPRETATION

1.1 Defined Terms. As used in this Agreement, the following terms shall have the meanings assigned to them in this ARTICLE 1.

1

“Acquisition Right” shall mean Cameco’s exclusive and irrevocable right to acquire an undivided 40%, 50% or 70% interest in the Leases simultaneously with the exercise of the Lease Option. The term “Vested Acquisition Right” refers to a right earned by Cameco to acquire either the 40% or 50% or 70% Acquisition Right as a result of having fully funded Phase One, Phase Two or Phase Three, as set forth in Sections 2.4 through 2.6. The term “Fixed Acquisition Right” refers to the Vested Acquisition Right at which Cameco has elected to fix its Acquisition Right at less than 70% pursuant to Sections 2.5(a) or 2.6(a).

“Affiliate” shall mean any person, partnership, joint venture, company, corporation or other form of enterprise which directly or indirectly controls, is controlled by, or is under common control with, a party to this Agreement. For purposes of the preceding sentence, and as used elsewhere in this Agreement, “control” means possession, directly or indirectly, of the power to direct or cause direction of management and policies through ownership of voting rights; provided that members of the board of directors of a Party hereto or of any Affiliate of a Party, and shareholders owning less than 20% of the publicly held ultimate parent companies of the Parties shall not be deemed to be an Affiliate hereunder.

“Agreement” shall mean this Exploration Agreement, the recitals and all exhibits attached hereto and by this reference incorporated herein.

“Anniversary Date” shall mean the date falling one or more years after the Effective Date.

“Annual Period” shall mean each period of one year under the KMF Option Agreement which commences on the effective date of the KMF Option Agreement and ends on the anniversary of that date during each following calendar year.

“Earn-In Period” shall mean, unless extended pursuant to Section 12.1, the period of time commencing on the Effective Date and continuing until the later of (i) the date upon which Cameco has fulfilled the Minimum Work Requirement set forth in Section 2.4, (ii) the date upon which Cameco has made an election of a Fixed Acquisition Right, (iii) November 30, 2013 and (iv) the date Cameco has otherwise relinquished its rights hereunder.

“Effective Date” shall mean May ___, 2011.

“Environmental Compliance” shall mean actions taken in connection with activities or operations on the Exploration Lands to avoid, mitigate or remediate an Adverse Environmental Event, as defined in the KMF Option Agreement, or to otherwise comply with the requirements of all Environmental Laws or contractual commitments related to reclamation or restoration of the Exploration Lands.

“Environmental Laws” shall mean Environmental Protection Laws, as defined in the KMF Option Agreement.

“Environmental Liabilities” shall mean any liability arising out of, based on or resulting from (i) an Adverse Environmental Event, as defined in the KMF Option Agreement; or (ii) disposal or treatment of or the arrangement for the disposal or treatment of Polluting Substances originating or transported from the Exploration Lands to an off-site treatment, storage or disposal facility.

2

“Exploration” shall mean all activities directed toward ascertaining the existence, location, quantity, quality or commercial value of deposits of Valuable Minerals, and all related Environmental Compliance.

“Exploration and Related Work” shall mean and include all operations conducted by the Exploration Operator on or relating to the conduct of an Exploration Program or Programs, or otherwise for purposes of exploration for Valuable Minerals from the Exploration Lands including, without limitation, all of the activities described in Sections 2 and 8.11 of the KMF Option Agreement.

“Exploration Expenses” are defined in Section 2.3.

“Exploration Operator” shall mean the Party actually conducting on-the-ground Exploration and Related Work from time to time under this Agreement, as more particularly described in Section 3.3 and ARTICLE 4.

“Exploration Program” shall mean a staged drilling program designed to evaluate a property for the presence of an economically recoverable uranium ore body, which may encompass drilling, logging, access, reclamation and restoration work, data analysis, geological and engineering evaluation, permitting and any other associated activities necessary for evaluation of the Exploration Lands.

“Exploration Well” shall mean any well drilled for the purposes of determining the existence of favorable geologic environments for the formation of uranium ore bodies or the existence of the ore bodies themselves.

“Joint Venture Agreement” shall have the meaning set forth in Section 2.10.

“KMF Option Agreement” shall have the meaning set forth in Recital A.

“KMF Option Agreement Exploration Obligations” shall mean the obligations to timely perform the minimum Exploration Program required during each Annual Period under the KMF Option Agreement either by expenditure of the minimum exploration amounts required to be incurred or completion of the minimum number of Exploration Wells required to be drilled.

“Lease” or “Leases” shall have the meaning set forth in Recital A.

“Minimum Work Requirement” shall mean expenditure by Cameco for Exploration and Related Work (as set forth in Sections 2.4-2.6, inclusive, below) of a minimum of (i) $1 million during Phase One, (ii) an additional $1 million during Phase Two and (iii) an additional $1.5 million during Phase Three.

“Phase” means a period during which Cameco must meet the Minimum Work Requirement under Section 2.4, 2.5(b) or 2.6(b).

3

“Phase One” means the period running from the Effective Date until Cameo has expended $ 1 million in Exploration Expenses in accordance with the Initial Program and Budget described in Section 3.1(a).

“Phase Two” means the period running from the last day of Phase One through the date Cameco expends an additional $1 Million in Exploration Expenses in accordance with a Program and Budget approved pursuant to Section 3.1(b).

“Phase Three” means the period running from the last day of Phase Two through the date Cameco expends an additional $1.5 Million in Exploration Expenses in accordance with a Program and Budget approved pursuant to Section 3.1(c).

“Polluting Substance” shall have the same meaning as ascribed in the KMF Option Agreement.

“Qualified Person” means an individual who (a) is an engineer or geoscientist with at least five years experience in mineral exploration, mine development or operation or mineral project assessment, or any combination of these; (b) has experience relevant to the subject matter of the mineral project and of the Technical Report the individual is to prepare; and (c) is a member in good standing of a professional association. The parties acknowledge and agree that the definition of “Qualified Person” under this Agreement will be deemed to be automatically modified if the definition of that term is modified in the National Instrument 43-101, “Standards of Disclosure for Mineral Projects” applicable to all companies listed on a Canadian stock exchange.

“Senior Management” shall mean corporate executive officers such as the CEO, President, Executive Vice President or Vice President of Operations, or other corporate officer of a Party or its parent Affiliate with full authority to negotiate on behalf of the Party. “Senior Management” shall not include the project manager or other personnel whose primary responsibilities relate to management of operations under this Agreement or on or concerning the Exploration Lands.

“Technical Report” means a report prepared, filed and certified in accordance with this Agreement and National Instrument 43-101F, applicable to all companies listed on a Canadian stock exchange, any technical information or report required to be filed with the United States Securities and Exchange Commission or any comparable report required by any other regulatory authority or other stock exchange.

“Valuable Minerals” shall mean Leased Substances, as defined in the KMF Option Agreement.

“Venture” means the business relationship of the Parties under the Joint Venture Agreement.

“$” shall mean United States currency.

1.2 Construction. Whenever the singular or masculine or neuter is used in this Agreement, the same will be construed as meaning plural or feminine or body politic or corporate or vice versa, as the context so requires. Use of the word “including” in this Agreement means “including without limitation.” Each of the Exhibits and schedules attached to this Agreement is incorporated into the Agreement by this reference. Any reference to Cameco earning an interest in the Leases, where the Leases have not yet been executed, are intended to mean earning an exclusive and irrevocable right to acquire an undivided interest in the Leases upon their execution.

4

1.3 Headings. Any heading, caption or index contained herein will not be used in any way in construing or interpreting any provision hereof.

ARTICLE 2

GRANT OF RIGHTS AND REQUIREMENTS FOR VESTING

2.1 Rights Granted. URI hereby grants to Cameco (exclusively) the right to enter upon the Exploration Lands during the Earn-In Period for the purpose of participating with URI in Exploration Programs as contemplated under the KMF Option Agreement, and the right to earn an undivided 40%, 50% or 70% interest in the Leases (the “Acquisition Right”) by (a) making the payments referred to in Section 2.2; and (b) incurring certain required amounts of Exploration Expenses as set forth in Sections 2.4, 2.5 and 2.6.

2.2 Initial Reimbursement. Simultaneous with the execution and delivery of this Agreement, or, if URI has not paid the Bonus Payment to KMF pursuant to the KMF Option Agreement as of the Effective Date, then promptly after URI makes that Bonus Payment to KMF, Cameco shall pay URI the sum of $300,000, as described in the first paragraph of this Agreement. Also simultaneous with the execution and delivery of this Agreement, Cameco shall reimburse URI for all funds expended by URI for matters qualifying as Exploration Expenses pursuant to Section 2.3 prior to such execution and delivery, as set forth in Exhibit C hereto, such amount not to exceed $200,000, and shall receive credit for such reimbursement toward fulfillment of the Phase One Minimum Work Requirement. The Parties shall also determine the costs each has incurred for expenditures in connection with the Exploration Lands that do not qualify as Exploration Expenses but which the Parties have agreed to share equally (such as due diligence and title costs) and any imbalance shall be reimbursed to the Party who has incurred such costs by the other Party.

2.3 Exploration Expenses. Qualifying Exploration Expenses are defined and described in this Section 2.3. To the extent, if any, that any such allowed Exploration Expenses do not qualify toward fulfillment of the KMF Option Agreement Exploration Obligations under the KMF Option Agreement, they shall be accounted for as provided in Section 3.1(g).

(a) “Exploration Expenses” that satisfy Cameco’s Minimum Work Requirement to earn the Vested Acquisition Rights shall mean the following costs or fees, expenses, liabilities and charges paid or incurred by Cameco:

(i) All costs and expenses for activities included in an Exploration Program that qualify toward fulfilling the KMF Option Agreement Exploration Obligations set forth in Section 3 of the KMF Option Agreement;

5

(ii) Surface damage and other payments required under the KMF Option Agreement (other than taxes) and costs incurred in performing any reclamation or other restoration or clean-up work, if any, required by any federal, state or local agency or authority or the KMF Option Agreement that do not qualify toward fulfilling the KMF Option Agreement Exploration Obligations, but have been authorized by an approved Program and Budget or otherwise unanimously agreed to by the Parties.

(b) Actual salaries, wages, expenses and benefits (other than any equity-based compensation or bonuses) paid or provided to employees or consultants of the Exploration Operator for operations directly relating to the Exploration Lands, including salaries and fringe benefits of those who are temporarily assigned to and directly employed on work relating to the Exploration Lands for the periods of time such employees are engaged in such activities and reasonable transportation expenses for all such employees to and from their regular place of work to the Exploration Lands (for clarity, the amount of salary, wages, expenses and benefits of an employee that shall be deemed to be “Exploration Expenses” shall be that portion of the employee’s total compensation that is proportionate to such employee’s time spent engaged in activities related to the Exploration Lands relative to the time spent by such employee on other business of the Party being credited with such Exploration Expenses.)

(c) To the extent that the Party other than the Exploration Operator supplies employees to perform any activities approved in the Program and Budget for a particular Phase, the costs enumerated in Section 2.3(b) related to any such employees shall be chargeable as an Exploration Expense.

(d) Equipment owned and supplied by the Exploration Operator shall be chargeable as an Exploration Expense at rates no greater than comparable market rental rates available in the area of the Exploration Lands.

(e) Insurance carried by the Exploration Operator shall be charged as an Exploration Expense only to the extent it is separately attributable to operations on the Exploration Lands and qualifies as an expense chargeable to the KMF Option Agreement Exploration Obligations.

(f) Deficiencies in Exploration Expenses by Cameco that are rectified by the payment of funds pursuant to Section 2.8 shall qualify as Exploration Expenses.

(g) Taxes paid by Cameco pursuant to Section 4.5 are included in Exploration Expenses.

(h) The management fee charged pursuant to Section 3.3 and any charges for overhead, general and administrative expenses that do not qualify as KMF Option Agreement Exploration Obligations are excluded from qualifying Exploration Expenses.

2.4 Phase One Minimum Work Requirement. Cameco shall fund at least $1,000,000 in Exploration Expenses during Phase One and, upon timely funding such Exploration Expenses, shall earn a 40% Vested Acquisition Right.

6

2.5 Phase Two Option to Acquire 50% Interest. Upon fulfilling its obligation to fund Phase One, Cameco may elect, in accordance with the provisions of Section 3.2(a), either of the following alternatives:

(a) Cameco may elect to fix its interest at a 40% Fixed Acquisition Right, in which case Sections 2.7, 2.9(a)(i), 3.1(d) and 3.1(e) and 3.3 shall apply.

(b) Cameco may elect to fund an Exploration Program for Phase Two by funding at least $1,000,000 in additional Exploration Expenses pursuant to the approved Program and Budget agreed to by the Parties pursuant to Section 3.1(b) and thereby, upon timely completing such Exploration Expenses, earn an additional 10% Vested Acquisition Right (for a total 50% Vested Acquisition Right). Once Cameco elects to fund Phase Two, the obligation shall be unconditional, subject to Sections 2.8 and 2.12(a).

2.6 Phase Three Option to Acquire 70% Interest. If Cameco has elected to fund Phase Two, upon completion of that funding, Cameco may elect, in accordance with the provisions of Section 3.2(a), either of the following alternatives:

(a) Cameco may elect to fix its interest at a 50% Fixed Acquisition Right, in which case Sections 2.7, 2.9(a), 3.1(d) and 3.1(e), and 3.3 shall apply.

(b) Cameco may elect to incur at least $1,500,000 in additional Exploration Expenses pursuant to the approved Program and Budget adopted pursuant to Section 3.1(c) and thereby, upon timely completing the funding of such Exploration Expenses, earn an additional 20% Vested Acquisition Right (for a total 70% Vested Acquisition Right). Once Cameco elects to fund Phase Three, the obligation shall be unconditional, subject to Sections 2.8 and 2.12(b).

2.7 Additional Expenditures; Other Joint Expenditures. The Parties anticipate that the $3,500,000 in Exploration Expenses described in Sections 2.4, 2.5(b) and 2.6(b), above, will allow them to make a decision as to whether to exercise the Lease Option. If Cameco elects a 40% or 50% Fixed Acquisition Right, or if Cameco has a 70% Vested Acquisition Right and if neither Party elects to terminate the Agreement within 15 days after the final percentage interests are fixed, each Party shall be responsible, going forward, for funding, in accordance with the provisions of Section 3.1(d), its proportionate share (70/30, 40/60 or 50/50) of the remaining required amounts of Exploration Expenses under the KMF Option Agreement until such time as the Lease Option is exercised, unless the Party gives notice of termination pursuant to Section 2.11 or 3.2.

2.8 In Lieu Payments.

(a) If at any time it is determined that Cameco has failed to fund the Minimum Work Requirement during either Phase One or Phase Two (after Cameco has elected to fund expenditures during Phase Two), and if such failure is not excused by force majeure, Cameco shall nevertheless have the right and duty to cure such failure by making a payment to URI which shall equal the Minimum Work Requirement for the Phase in question less the Exploration Expenses actually funded by Cameco and attributable to that Phase, within 30 days after a deficiency is determined to exist. Any such payment shall satisfy the Minimum Work Requirement for the Phase to which the payment relates and such payment shall constitute a qualifying Exploration Expense pursuant to Section 2.3(f).

7

(b) The foregoing shall also apply to expenditures by Cameco as Exploration Operator in Phase Three under Section 4.11 after any reported expenditure has later been determined not to be a valid Exploration Expense, or if the amount of required Exploration Expenses has been determined to be deficient, provided Cameco has expended at least $1,400,000 (or such lesser amount as is mutually agreed to by the Parties) in connection with Phase Three.

(c) This Section 2.8 shall not apply to a failure of a Party to meet a cash call by the Exploration Operator pursuant to Section 3.3, and any such cash call failure, or a failure by Cameco to cure any deficiency under this Section 2.8, within ten (10) business days shall constitute a default pursuant to Section 2.11.

2.9 Exercise of Lease Option.

(a) Either Party may propose exercise of the Lease Option at any time prior to the Election Date under the KMF Option Agreement. If there is any disagreement whether to exercise the Lease Option, each Party shall provide to the other the data and analysis on which it bases its position, and representatives of the Parties shall meet and engage in good faith discussions whether to exercise the Lease Option. Except as set forth in the following subsections, exercise of the Lease Option requires the unanimous approval of the Parties, subject to the rights of the Parties to terminate this Agreement prior to exercise of the Lease Option pursuant to Section 3.2(e):

(i) If Cameco has elected a 40% Fixed Acquisition Right, then URI shall have the unilateral right to exercise the Lease Option; and

(ii) If Cameco has earned a 70% Vested Acquisition Right, Cameco shall have the unilateral right to require URI to exercise the Lease Option.

(b) If the Lease Option is exercised after Phase One and at a time that Cameco has not elected a Fixed Acquisition Right (that is to stop funding 100% of the Exploration Expenses), Cameco can earn a 70% Vested Acquisition Right immediately prior to the time of exercise of the Lease Option by committing irrevocably to fund 100% of the initial Program and Budget under the Joint Venture Agreement described in Section 2.10 to the extent of any amount not yet funded by Cameco as Exploration Expenses under Phase Two and Phase Three of this Agreement.

2.10 Joint Venture. If neither Party has elected to terminate the Agreement and the Parties decide to exercise the Lease Option pursuant to Section 2.9, URI and Cameco shall, simultaneous with the exercise of the Lease Option, enter into a joint venture agreement (the “Joint Venture Agreement”) governing ongoing activities on the Exploration Lands under the Leases, as attached hereto as Exhibit B. The terms of the Joint Venture Agreement are subject to any adjustment required by Sections 2.5(a), 2.6(b) or 2.9(b), and as set forth in the chart attached hereto as Exhibit G.

8

2.11 Default in Funding. If the Parties have made the elections that result in each of them being responsible for funding their proportionate shares of Exploration Expenses through the date of exercise of the Lease Option under either Section 2.5(a), 2.6(a) or 2.7, and then subsequently either Party fails to timely fund its share of such expenses and fails to either cure that default or contest in good faith the existence of any default within ten business days after receiving notice of such default from the other Party, the non-defaulting Party, if it chooses to fund the defaulting Party’s share of such Exploration Expenses, shall have the right to recover amounts due and unpaid and other damages, if any, including interest at the maximum rate authorized by law and all reasonable attorneys’ fees and costs and other costs of collection, whether or not a formal collection action is initiated. In addition, in the event of such a failure, if the non-defaulting Party has not recovered the amounts due, if the Parties enter into the Joint Venture Agreement, the amount of the Parties’ Initial Contributions under Section 5.1 thereof (as reflected on Exhibit G to this Agreement) shall be adjusted, and the defaulting Party’s initial Participating Interest (as set forth in Section 6.1 thereof and reflected on Exhibit G to this Agreement) shall be reduced pursuant to Section 6.4 thereof as if there had been a failure in contributing to a Program and Budget (and the other Party’s initial Participating Interest shall be increased proportionately). The non-defaulting Party shall have no obligation to fund the defaulting Party’s share of such Exploration Expenses, however, but may instead elect to terminate this Agreement, with no obligation or liability to the defaulting Party, including without limitation no obligation or liability to the defaulting Party if as a result the defaulting Party is unable fulfill the KMF Option Agreement Exploration Obligations.

2.12 Cameco Termination Rights During Phases. In addition to its termination rights under Section 3.2, Cameco may terminate this Agreement as follows:

(a) During either Phase One or Phase Two, by giving URI notice of such termination and by paying to URI the Shortfall.

(b) During Phase Three, if the Minimum Work Requirement for that Phase has been substantially completed and Cameco pays to URI the Shortfall. Notice of any such termination shall be given by Cameco and the termination shall be effective no later than May 31, 2013. If Cameco terminates the Agreement after May 31, 2013, then, in addition to payment of the Shortfall, Cameco must pay its proportionate share of any KMF Option Agreement Exploration Obligations for the Annual Period in which termination becomes effective that have become unconditional obligations under the KMF Option Agreement. For purposes of this Section and Section 2.12(d), “substantially completed” means less than $100,000 (or such greater amount as the parties unanimously agree) of the Minimum Work Requirement for Phase Three has not been expended.

(c) “Shortfall” means the difference between the Exploration Expenses actually incurred by Cameco prior to such termination (including carryover amounts, if any, from previous Phases) and the required amount of Exploration Expenses for the Phase in which the termination occurs.

(d) After the Parties become obligated for joint expenditures as described in Section 3.1(d), if the KMF Option Agreement Exploration Obligations for the Annual Period in which the termination becomes effective have been substantially completed and Cameco pays to URI Cameco’s proportionate share of the difference between the amount in the Program and Budget approved for such joint operations and the Exploration Expenses actually incurred by Cameco prior to such termination (including carryover amounts, if any, from previous Phases).

9

2.13 Geological and Other Data. Upon execution of this Agreement, URI shall make available to Cameco all records, information and data in its possession or reasonably available to it relating to title to the Exploration Lands or environmental conditions at or pertaining to the Exploration Lands, and all maps, assays, surveys, technical reports, drill logs, samples, mine, mill, processing and smelter records, and metallurgical, geological, geophysical, geochemical, and engineering data, and interpretive reports derived therefrom, concerning the Exploration Lands, and Cameco, at its expense, may copy any such records, information and data that Cameco desires. URI makes no representation or warranty as to the accuracy, reliability or completeness of any such records, information or data, and Cameco shall rely on the same at its sole risk.

ARTICLE 3

OTHER ARRANGEMENTS DURING THE EARN-IN PERIOD

3.1 Exploration Activities.

(a) Phase One. The Phase One Exploration and Related Work described in Exhibit C attached hereto (the “Initial Program and Budget”) shall be performed by URI as the Exploration Operator in accordance with the provisions of ARTICLE 4.

(b) Phase Two. If Cameco elects to fund Phase Two, 100% of Exploration Expenditures during Phase Two shall be funded by Cameco and the Exploration Program shall be performed by URI as Exploration Operator pursuant to a program and budget jointly approved by the Parties (“Program and Budget”), as follows:

(i) At least 30 days prior to the end of Phase One, Cameco shall provide to URI a proposed Exploration Program and Budget for Phase Two. Within 15 days after its receipt of the proposed Program and Budget for Phase Two, URI shall provide to Cameco any comments on or proposed changes to that proposed Program and Budget. If Cameco has any objections to any of URI’s comments or proposed changes, it shall notify URI, and representatives of the Parties shall arrange for a meeting or conference call to attempt to resolve their differences and, upon resolution of such differences, the Phase Two Program and Budget shall be deemed adopted.

(ii) If a Program and Budget is not agreed to within 30 days after first conferring, the Senior Management of the Parties shall meet at a mutually agreeable location, in an endeavor to resolve the matter. If the Senior Management are not able to agree on a Program and Budget within 30 days after first conferring, the Parties shall be deemed deadlocked, the Exploration Operator shall perform only such operations as are necessary to maintain the KMF Option Agreement in effect, any expenses incurred shall be joint expenses pursuant to Section 2.7, in accordance with the interests of the Parties after Phase One (although Cameco shall not be deemed to have elected a Fixed Acquisition Right), and either Party may elect to terminate the Agreement and surrender its interest in the KMF Option Agreement and Leases pursuant to Sections 3.2(a), 3.2(b) or 3.2(e).

10

(iii) Presentation by Cameco of a proposed Program and Budget pursuant to this Section 3.1(b) shall not be deemed an election by Cameco to fund Phase Two; that election shall be made in accordance with the provisions of Section 3.2(a).

(c) Phase Three. If Cameco makes the election under Section 2.6(b) to earn an additional 20% Vested Acquisition Right:

(i) Phase Three shall be funded by Cameco pursuant to a Program and Budget adopted as follows: At least 30 days prior to the end of Phase Two, Cameco shall provide to URI a proposed Program and Budget for Phase Three. Within 15 days after its receipt of the proposed Program and Budget for Phase Three, URI shall provide any comments on or proposed changes to that proposed Program and Budget. Cameco shall consider those comments and proposed changes in good faith, but ultimately shall have the authority to determine the final Program and Budget for Phase Three in its sole discretion.

(ii) Exploration and Related Work set forth in the adopted Program and Budget for Phase Three shall be performed by Cameco as Exploration Operator (unless Cameco has elected to retain URI as the Exploration Operator during Phase Three).

(iii) Presentation by Cameco of a proposed Program and Budget pursuant to this Section 3.1(c) shall not be deemed an election by Cameco to fund Phase Three; that election shall be made in accordance with the provisions of Section 3.2(a).

(d) Joint Funding Phase.

(i) If Exploration Expenses beyond those Cameco agrees to exclusively fund (whether after Phase Three or after an earlier Phase due to an election to acquire a Fixed Acquisition Right under Section 2.5(a) or 2.6(a)) are agreed to be incurred by the Parties, they shall be incurred pursuant to a Program and Budget adopted and approved as follows: At least 30 days after Cameco’s interest has become fixed, the Proposing Party, as defined in Section 3.1(d)(iii) below, shall provide to the other Party a proposed Program and Budget for the period running from the end of the Earn-In Period to the end of the third Annual Period under the KMF Option Agreement (the “Additional Phase”). Within 15 days after its receipt of that proposed Program and Budget, the other Party shall provide any comments or proposed changes to that Program and Budget. The Proposing Party shall consider those comments and proposed changes in good faith, but ultimately shall have the authority to determine the final Program and Budget for the Additional Phase in its sole discretion.

(ii) During the Additional Phase, the Parties agree that they shall fund the Exploration and Related Work described in the approved Program and Budget for the Additional Phase on a joint basis, in proportion to their percentage interests in the right to acquire the Leases.

11

(iii) If the Additional Phase commences because Cameco elects not to proceed with exclusive funding beyond Phase One, URI shall be the Proposing Party and the Exploration Operator. If the Additional Phase commences because Cameco elects not to proceed with exclusive funding beyond Phase Two, Cameco shall become the Exploration Operator, neither party shall be deemed a Proposing Party and the provisions of Section 3.1(b) shall govern selection of the Program and Budget for the Additional Phase. If the Additional Phase commences after Cameco has acquired a 70% Vested Acquisition Right because the Parties determine that additional work beyond the Phase Three Program and Budget is necessary in order to determine whether to exercise the Lease Option, Cameco shall be the Exploration Operator during the Additional Phase (unless Cameco has elected to retain URI as the exploration operator during the Additional Phase) and shall be the Proposing Party as to the Program and Budget, provided that no such Program and Budget shall require Exploration Work beyond that required to maintain the KMF Option Agreement in effect unless the Parties unanimously agree otherwise.

(e) Budget Revision. If a Program and Budget for Phase Two or Phase Three proposed by Cameco is agreed upon, and Cameco thereafter makes the election pursuant to Section 2.5(a) or 2.6(a) not to fund the Phase, URI shall then have the right to propose a revised Program and Budget to be adopted and agreed to in the same manner as set forth in Sections 3.1(b) or 3.1(d).

(f) KMF Option Agreement. The Parties recognize that KMF Option Agreement Exploration Obligations for an Annual Period under the KMF Option Agreement may exceed the required Minimum Work Requirement for the Phases and that certain costs that qualify under Section 2.3 as Exploration Expenses may not necessarily meet the requirements under the KMF Option Agreement for KMF Option Agreement Exploration Obligations. As a result, the Parties agree as follows:

(i) The Parties shall be jointly responsible for ensuring that (A) each approved Program and Budget for each Phase and for jointly-funded Exploration operations includes an Exploration Program that will be in compliance with the KMF Option Agreement Exploration Obligations, and (B) the KMF Option Agreement Exploration Obligations are timely met.

(ii) Any divergence between Exploration Expenses qualifying toward the Minimum Work Requirement and KMF Option Agreement Exploration Obligations that have become unconditional during Phase One, Phase Two or Phase Three shall be accounted for pursuant to Section 3.1(g).

(g) Excess Expenditures. During Phases One and Two, URI shall not spend more than the amounts set forth in either the Initial Program and Budget or any subsequently approved Program and Budget without Cameco’s prior written approval. With respect to any such approved Exploration Expenses in excess of the approved budgeted amount or which do not qualify as KMF Option Agreement Exploration Obligation expenses, Cameco may elect either to (i) fund 100% of the excess or non-qualifying Exploration Expenses, in which case all such expenditures shall count toward the Minimum Work Requirements in Phases Two or Three, or (ii) fund only its percentage share as of end of the Phase in which the excess or non-qualifying Exploration Expense occurred, in which case such expenditures shall not count toward the Minimum Work Requirements in Phases Two or Three, and with respect to which URI shall be obligated to fund (or reimburse Cameco for) its percentage share as of end of the Phase in which the excess or non-qualifying Exploration Expenses were incurred. Cameco shall not incur Exploration Expenditures in excess of $3,500,000, except as provided in this Section 3.1(g) or pursuant to a Program and Budget adopted for operations after Phase Three, as provided in Section 3.1(d), which excess shall be jointly funded pursuant to that Section. Any authorized Exploration Expenses in excess of $3,500,000 or as to which Cameco has made the election in clause (ii) of this Section 3.1(g) shall be funded as a joint expense pursuant to Section 3.1(d).

12

3.2 Elections at Phase Ends; Termination.

(a) Phase One and Two End.

(i) Within 60 days after the end of each of Phase One and Phase Two, Cameco shall notify URI in writing whether it elects to:

(A) Fund the next Phase or not or fix its interest at either a 40% or 50% Fixed Acquisition Right, as the case may be; or

(B) Terminate this Agreement;

(ii) If Cameco does not elect to terminate this Agreement and does elect to fund the next Phase, the next Phase shall be undertaken as provided in Section 3.3 pursuant to a Program and Budget approved pursuant to Section 3.1(b) or (c).

(iii) If Cameco does not elect to terminate this Agreement and does elect its Fixed Acquisition Right, the subsequent Exploration and Related Work shall be undertaken as provided in Section 3.1(d).

(b) URI Election. If Cameco does not give notice of termination of the Agreement pursuant to Section 3.2(a), then, within 15 days after receipt of the notice or 75 days after the end of the applicable Phase in the absence of any notice, URI may elect to terminate the Agreement by providing written notice to Cameco and Section 3.2(d) shall apply.

(c) Phase Three End. Within fifteen days after completion of the Phase Three Program and Budget, the Parties will determine whether or not to terminate this Agreement, exercise the Lease Option or incur additional Exploration Expenses. If the Parties jointly determine that they need to incur Exploration Expenses in excess of $3,500,000 prior to exercising the Lease Option, either Cameco or URI may elect to terminate the Agreement, Section 3.1(d) shall apply as to KMF Option Agreement Exploration Obligations and other Exploration Expenses that cannot be avoided by such termination, and Sections 3.2(d) and (e) shall apply as to termination.

(d) Surrender Elections and Obligations. If URI elects to terminate the Agreement, Cameco may elect to acquire a 100% interest in the KMF Option Agreement, including the option to acquire the Leases, for no additional consideration. If Cameco elects to terminate the Agreement, URI shall have the right to retain the KMF Option Agreement, free and clear of any claim of Cameco in or to the Leases. Upon receipt of notice of election by a Party to terminate the Agreement, the other Party shall give written notice as to its election for acquiring a 100% interest in the KMF Option Agreement, and the terminating Party shall promptly assign or release its interest in the KMF Option Agreement to the electing Party. If one Party surrenders its interest to the other pursuant to this paragraph, the Parties shall promptly notify KMF. If this Agreement is terminated without one party acquiring the entire interest in the KMF Option Agreement pursuant to this paragraph, URI shall promptly terminate the KMF Option Agreement by notice to KMF.

13

(e) Condition as to Termination. At any time prior to the Election Date under the KMF Option Agreement, either Party may, upon payment of its share of Exploration Expenditures required under the KMF Option Agreement that have then become unconditional, terminate this Agreement, and Section 3.2(d) shall apply. Without limitation, this provision applies to terminations under Sections 2.9, 3.1(b)(ii) or 3.2(c).

3.3 Operations Carried Out by Exploration Operator. During Phase One, URI will serve as the Exploration Operator and carry out the performance of Exploration and Related Work in accordance with the provisions of the Initial Program and Budget. If this Agreement is not terminated after Phase One, URI will also serve as the Exploration Operator during Phase Two and carry out the performance of Exploration and Related Work in accordance with the approved Program and Budget for Phase Two. At the end of Phase Two, Cameco will become the Exploration Operator unless it gives notice to URI at least 15 days prior to the end of Phase Two that it desires to retain URI as the Exploration Operator for Phase Three. At the end of Phase Three, Cameco will become or remain Exploration Operator unless URI was designated as the Phase Three Exploration Operator and Cameco gives notice to URI at least 15 days prior to the end of Phase Three that it desires for URI to remain as the Exploration Operator for the Additional Phase. The Exploration Operator shall be entitled to make cash calls on a monthly basis upon the other Party for amounts due from the other Party pursuant to Sections 2.4, 2.5(b), 2.6(b) and 2.7 as required in order conduct the Exploration and Related Work set forth in the Initial Program and Budget or the approved Program and Budget then in effect. The Exploration Operator shall promptly disclose and deliver to the other Party, whenever requested by the other Party, all records, information and data concerning the Exploration Lands derived from its conduct of Exploration and Related Work. As compensation for the performance of Exploration and Related Work carried out as Exploration Operator, and in lieu of any charges for overhead, general and administrative expenses, URI shall receive a fee equivalent to 8% of the Exploration Expenses incurred each month; such fee to be reduced to 5% for (a) any Exploration Expenses in excess of the Minimum Work Requirement incurred during either Phase One or Phase Two, and (b) any Exploration Expenses in excess of $1,500,000 incurred if URI is acting as the Exploration Operator during Phase Three.

3.4 Radioactive Materials Licenses. During the Earn-In Period, URI shall use its commercially reasonable efforts, at its sole expense, to arrange for the amendment of its existing radioactive materials licenses at its Rosita and Kingsville Dome processing facilities to allow for the processing of uranium ores from the Exploration Lands.

3.5 Toll Milling Arrangements. Simultaneous with the execution and delivery of the Joint Venture Agreement pursuant to Section 2.10, Cameco and URI agree to enter into a toll milling agreement substantially in the form of the attached Exhibit E.

14

ARTICLE 4

OBLIGATIONS OF EXPLORATION OPERATOR

4.1 Conduct of Operations. All of the Exploration and Related Work which may be performed by the Exploration Operator hereunder shall be performed in accordance with all of the terms and provisions of the KMF Option Agreement, good industry practices and in a good and worker-like manner.

4.2 Insurance. The Exploration Operator agrees to carry such insurance, covering all persons working at or on the Exploration Lands for Exploration Operator, as will fully comply with the requirements of the laws of the State of Texas pertaining to worker’s compensation and occupational disease and disabilities as are now in force or as may be hereafter amended or enacted. In addition, so long as it is carrying out activities on the Exploration Lands, Exploration Operator agrees to carry liability insurance as required under the KMF Option Agreement with respect to such operations in amounts not less than those required under the KMF Option Agreement, and otherwise in accordance with the applicable provisions of the KMF Option Agreement. Exploration Operator shall require that each of its consultants or contractors who perform any Exploration and Related Work comply with the provisions of this Section 4.2.

4.3 Compliance with Laws. Exploration Operator agrees to conduct and perform all Exploration and Related Work on or for the benefit of the Exploration Lands under this Agreement in compliance with all applicable federal, state and local laws, rules and regulations, including, without limitation, such laws, rules and regulations pertaining to social security, unemployment compensation, wages and hours and conditions of labor, and Environmental Laws, and Exploration Operator shall defend, indemnify and hold the other Party, its officers, directors, employees, Affiliates, successors and assigns, harmless from and against payment of any damages or penalties occasioned by Exploration Operator’s failure to comply with said laws.

4.4 Inspection. The non-Exploration Operator Party, if it is not performing Exploration and Related Work, and its authorized agents, at such Party’s sole risk and expense, shall have the right, exercisable during regular business hours, at a mutually convenient time, in compliance with the Exploration Operator’s safety rules and regulations, and in a reasonable manner so as not to interfere with the Exploration Operator’s operations, to go upon the Exploration Lands for the purpose of confirming that the Exploration Operator is conducting its operations in the manner required by this Agreement. Such other Party shall defend, indemnify and hold the Exploration Operator, its officers, directors, employees, Affiliates, successors and assigns, harmless from all claims for damages arising out of any death, personal injury or property damage sustained by the other Party, its agents or employees, while in or upon the Exploration Lands, whether or not such other Party, its agents or employees are in or upon the Exploration Lands pursuant to this Section 4.4, unless such death, injury or damage is due to Exploration Operator’s gross negligence or willful misconduct. If requested by Exploration Operator, the other Party, its agents and employees will confirm in writing their waiver of claims against the Exploration of Operator pursuant to this Section.

4.5 Taxes. During the Earn-In Period, the Exploration Operator (pursuant to an approved Program and Budget) shall be responsible for payment of all taxes levied or assessed upon or against the Exploration Lands and any facilities or improvements located thereon to the extent, but only to the extent, that the Optionee (as defined in the KMF Option Agreement) is responsible for such taxes under the KMF Option Agreement; provided, however, that the Party acting as Exploration Operator shall not be responsible for any interest, late fees or penalties associated with such payments for which the other Party receives notices of due dates and fails to timely forward copies of such notices to the Exploration Operator.

15

4.6 Liens and Encumbrances. Exploration Operator shall keep the title to the Exploration Lands free and clear of all liens and encumbrances resulting from its performance of Exploration and Related Work; provided, however, that, to the extent allowed under the KMF Option Agreement, the Exploration Operator may refuse to pay any claims asserted against it which it disputes in good faith. At its sole cost and expense, Exploration Operator shall contest any suit, demand or action commenced to enforce such a claim and, if the suit, demand or action is decided by a court or other authority of ultimate and final jurisdiction against Exploration Operator or the Exploration Lands, Exploration Operator shall promptly pay the judgment and shall post any bond and take all other action necessary to prevent any sale or loss of the Exploration Lands or any part thereof.

4.7 Reclamation and Restoration. The Exploration Operator shall reclaim the surface and restore the Exploration Lands, to the extent disturbed by the Exploration Operator during the term of this Agreement, as required under the KMF Option Agreement and in accordance with applicable federal and state laws, rules and regulations. Costs of reclamation are chargeable as Exploration Expenses under approved Programs and Budgets. The Exploration Operator’s reclamation and remediation obligations shall survive the termination of this Agreement, provided, however, that if the Parties enter into the Joint Venture Agreement, the reclamation and restoration obligations associated with any disturbances of the Exploration Lands made by either Party as Exploration Operator during the term of this Agreement shall become obligations of the Venture.

4.8 Independent Contractor. Notwithstanding exclusive funding by Cameco or joint funding by the Parties of Exploration and Related Work, all Exploration and Related Work conducted hereunder shall be performed by Exploration Operator as an independent contractor, and Exploration Operator’s employees shall at all times be under Exploration Operator’s sole direction and control. The purpose of Programs and Budgets is to set forth the desired results of Exploration and Related Work, and Exploration Operator shall be responsible for directing its employees as to the means for accomplishing such results. Neither Exploration Operator nor anyone contracted with or employed by Exploration Operator shall be deemed for any purpose to be the agent, servant, employee, or representative of the other Party in the performance of such Exploration and Related Work. Nothing in this Section 4.8 shall be construed to mean that Exploration Operator is a partner of the other Party. Neither Exploration Operator nor its employees or agents is entitled to worker’s compensation benefits from or through the other Party. Exploration Operator shall be responsible for and shall withhold or pay, or both, as may be require by law, all taxes pertaining to the employment of its personnel and/or performance of Exploration and Related Work. All fines, penalties or other charges imposed or assessed against Exploration Operator by reason of its violation of, or failure to comply with, any provisions of such law, together with all expenses of defending litigation in respect thereto, shall be paid by Exploration Operator. Exploration Operator also assumes full responsibility for the payment of all payroll burdens, fringe benefits and payroll taxes, whether federal, state, municipal or otherwise, as to its employees, servants or agents engaged in the performance of the Exploration and Related Work. Further, Exploration Operator shall make all contributions to pension funds that may be required to be made on behalf of its employees, servants or agents under any collective bargaining agreement to which they are subject, and shall defend, indemnify and hold the other Party, its officers, directors, employees, Affiliates, successors and assigns, harmless from any claims arising as a result of its failure to do so. Such indemnity obligation shall survive the termination of this Agreement.

16

4.9 Access for Reclamation. If this Agreement is terminated and the KMF Option Agreement is surrendered to one Party pursuant to the terms hereof, the Party holding the KMF Option Agreement hereby agrees to grant to the other such access to the Exploration Lands following termination as is reasonably necessary to complete reclamation and restoration work related to work performed by the surrendering party while acting as the Exploration Operator. The surrendering Party shall not be liable for its failure to perform or complete any reclamation and restoration work required under this Section 4.9 if such failure arises out of other Party’s unwillingness or inability to provide the surrendering Party with the access to the Exploration Lands necessary to complete such work.

4.10 Data. The Exploration Operator shall provide to the other Party (a) a progress report on a weekly basis, (b) monthly progress reports, and (c) a comprehensive summary report twice during each Annual Period. The semi-annual comprehensive report, which shall be delivered by the Exploration Operator to the other Party not later than July 31st and February 1st of each year (beginning July 31, 2011), shall include information relating to title to the Exploration Lands, environmental conditions at or pertaining to the Exploration Lands, and all maps, assays, surveys, drill logs, samples, and metallurgical, geological, geophysical, geochemical and engineering data (and interpretive reports derived therefrom), developed by the Exploration Operator with respect to the Exploration Lands during the immediately previous six-month period. Neither Party makes any representation or warranty as to the accuracy, reliability or completeness of any data and information provided to the other Party pursuant to this Section 4.10, and the other Party shall rely on the same at its sole risk.

4.11 Proof of Expenditures. The Exploration Operator for each Phase shall provide the other Party with a written statement of Exploration Expenses, within 20 days after the end of that Phase, and shall make available for review by the other Party during normal business hours, after providing such a written statement, backup invoices, statements and the like verifying such expenditures promptly upon the other Party’s written request. Any dispute as to whether Exploration Expenses are valid or whether the required amount of Exploration Expenses has been incurred shall be resolved in accordance with the provisions of Section 13.13.

4.12 Transfer of Permits. If at any time during the Earn-in Period Cameco replaces URI as the Exploration Operator, URI agrees that it shall use commercially reasonable efforts to transfer to Cameco all Permits (as defined in Section 5.1(d)), other than URI’s Radioactive Materials License from the State of Texas, which it has obtained which pertain to its activities on the Exploration Lands. With respect to any Permit for which a consent to transfer to Cameco is required but has not been obtained, URI agrees to allow Cameco, to the extent not prohibited under applicable laws, rules and regulations, to operate under each such Permit until the date upon which the transfer of such Permit to Cameco has been approved by the appropriate governmental authority or Cameco notifies URI that Cameco has obtained such Permit in its own name. URI shall use commercially reasonable efforts to facilitate the transfer of all such Permits to Cameco.

17

ARTICLE 5

REPRESENTATIONS AND WARRANTIES OF URI

5.1 Representations and Warranties. URI represents and warrants to Cameco as of the Effective Date as follows, and covenants that these representations and warranties will be true and correct throughout the Earn-In Period and until the date of execution of the Joint Venture Agreement:

(a) Organization and Standing. URI is a corporation duly organized, validly existing, and in good standing under the laws of the State of Delaware, and is qualified to conduct business as a foreign corporation under the laws of the State of Texas.

(b) Corporate Power. URI has the requisite power and authority (i) to enter into this Agreement and all other agreements contemplated hereby, and (ii) to carry out and perform its obligations under the terms and provisions of this Agreement and all agreements contemplated hereby.

(c) Authorization. All requisite corporate action on the part of URI, and its officers, directors, and shareholders, necessary for the execution, delivery, and performance of this Agreement and all other agreements of URI contemplated hereby, have been taken. This Agreement and all agreements and instruments contemplated hereby are, and when executed and delivered by URI (assuming valid execution and delivery by Cameco), will be, legal, valid, and binding obligations of URI enforceable against URI in accordance with their respective terms. The execution, delivery and performance of this Agreement will not violate any order of any court or other agency of government; or any provision of any indenture, agreement (oral or written) or other instrument to which URI is a party or by which its properties or assets are bound; or be in conflict with, result in a breach of or constitute (with due notice and lapse of time) a default under any such indenture, agreement or other instrument. There is to URI’s knowledge no law, rule or regulation, nor is there any judgment, decree or order of any court or governmental authority binding on URI which would be contravened by the execution, delivery, performance, or enforcement of this Agreement or any instrument or agreement required hereunder. Notwithstanding the foregoing, no representation is made as to (i) the remedy of specific performance or other equitable remedies for the enforcement of this Agreement or any other agreement contemplated hereby or (ii) rights to indemnity under this Agreement for securities law liability. Additionally, this representation is limited by applicable bankruptcy, insolvency, moratorium, and other similar laws affecting generally the rights and remedies of creditors and secured parties.

(d) Permits and Licenses. Prior to commencement by it of Exploration and Related Work on the Exploration Property, URI will obtain all permits, licenses, approvals, authorizations and qualifications of all federal, state and local authorities required for it to carry on its operations at or on the Exploration Lands (collectively, “Permits”). To the best of its knowledge, URI is not in violation of and has no liability (other than liability for compliance with existing permits and laws, including but not limited to performance of reclamation) under any statute, rule or regulation of any governmental authority applicable to the Exploration Lands.

18

(e) Consents. To the best of its knowledge, URI has obtained all consents, approvals, authorizations, declarations, or filings required by or under any federal, state, local, or other authority, stock exchange or any other third party whether by way of a contract with Cameco or otherwise, in connection with the valid execution, delivery, and performance by Cameco of this Agreement and the consummation of the transactions contemplated hereby.

(f) Brokerage or Finder’s Fee. All negotiations relative to this Agreement and the transactions contemplated hereby have been carried on by URI in such manner as not to give rise to any valid claim against Cameco or any other third party for a brokerage commission, finder’s fee, or other fee or commission arising by reason of the transactions contemplated by this Agreement.

(g) Representations. No statements, warranties, or representations made by URI herein contain any untrue statement of a material fact or omit to state a material fact necessary in order to make the statements made, in light of the circumstances under which such statements were or will be made, not misleading.

ARTICLE 6

REPRESENTATIONS AND WARRANTIES OF CAMECO

6.1 Representations and Warranties of Cameco. Cameco represents and warrants to URI as of the Effective Date as follows, and covenants that these representations and warranties will be true and correct throughout the Earn-In Period and until the date of execution of the Joint Venture Agreement:

(a) Organization and Standing. Cameco is a corporation duly organized, validly existing, and in good standing under the laws of the State of Texas.

(b) Corporate Power. Cameco has the requisite corporate power and authority (i) to enter into this Agreement and all other agreements contemplated hereby, and (ii) to carry out and perform its obligations under the terms and provisions of this Agreement and all agreements contemplated hereby.

(c) Authorization. All requisite corporate action on the part of Cameco, and its officers and directors, necessary for the execution, delivery and performance of this Agreement and all other agreements of Cameco contemplated hereby have been taken. This Agreement and all agreements and instruments contemplated hereby, when executed and delivered by Cameco (assuming valid execution and delivery by URI), will be the legal, valid, and binding obligations of Cameco enforceable against Cameco in accordance with their terms. The execution, delivery and performance of this Agreement will not violate any order of any court or other agency of government; or any provision of any indenture, agreement or other instrument to which Cameco is a party or by which its properties or assets are bound; or be in conflict with, result in a breach of or constitute (with due notice and lapse of time) a default under any such indenture, agreement or other instrument. There is to Cameco’s knowledge no law, rule or regulation, nor is there any judgment, decree or order of any court or governmental authority binding on Cameco which would be contravened by the execution, delivery, performance or enforcement of this Agreement or any instrument or agreement required hereunder. Notwithstanding the foregoing, no representation is made as to (i) the remedy of specific performance or other equitable remedies for the enforcement of this Agreement or any other agreement contemplated hereby or (ii) rights to indemnity under this Agreement for securities law liability. Additionally, this representation is limited by applicable bankruptcy, insolvency, moratorium, and other similar laws affecting generally the rights and remedies of creditors and secured parties.

19

(d) Consents. To the best of its knowledge, Cameco has obtained all consents, approvals, authorizations, declarations, or filings required by or under any federal, state, local, or other authority, stock exchange or any other third party whether by way of a contract with Cameco or otherwise, in connection with the valid execution, delivery, and performance by Cameco of this Agreement and the consummation of the transactions contemplated hereby.

(e) Brokerage or Finder’s Fee. All negotiations relative to this Agreement and the transactions contemplated hereby have been carried on by Cameco in such manner as not to give rise to any valid claim against URI or any third party for a brokerage commission, finder’s fee or other fee or commission arising by reason of the transactions contemplated by this Agreement.

(f) Representations. No statements, warranties or representations made by Cameco herein contain any untrue statement of material fact or omit to state a material fact necessary in order to make the statement made in light of the circumstances under which such statements were made or will be made, not misleading.

ARTICLE 7

NOTICES

7.1 Notices. All notices given in connection herewith shall be in writing, and all such notices and deliveries to be made pursuant hereto shall be given or made in person, by certified or registered mail, by reputable overnight courier, or by facsimile acknowledged upon receipt. Such notices and deliveries shall be deemed to have been duly given and received when actually delivered in person or sent by facsimile (during normal business hours), on the next business day following the date they are sent by courier, or three business days after registered or certified mailing when deposited in a receptacle for United States mail, postage prepaid, and addressed as follows:

(a) If to Cameco:

Cameco Texas Inc.

2020 Carey Avenue, Suite 600

Cheyenne, Wyoming 82001

Attention: President

Telephone No.: (307) 316-7600

Facsimile No.: (307) 635-2749

20

(b) If to URI:

URI, Inc.

641 East FM 1118

Kingsville, Texas 78363

Attn: Richard A. Van Horn

Senior Vice President – Operations

Telephone No.: (361) 595-5731

Facsimile No.: (361) 595-0403

With a copy to:

URI, Inc.

405 State Highway 121 Bypass, Building A, Suite 110,

Lewisville, Texas 75067

Attention: President

Telephone No.: (972) 219-3330

Facsimile No.: (972) 219-3311

ARTICLE 8

INDEMNIFICATION

8.1 By URI. URI agrees to defend, indemnify and hold harmless Cameco, its successors, Affiliates, assigns, officers, directors and employees from and against any and all claims, actions, suits, losses, liabilities, damages, assessments, judgments, costs and expenses (including reasonable attorneys’ fees) and the costs of defending the same, arising out of or related to (i) any breach by URI of any representation, covenant or warranty set forth herein, or (ii) the failure to comply with its obligations pursuant to ARTICLE 4 on or in connection with the Exploration Lands while it is serving as the Exploration Operator to the extent caused by URI’s gross negligence or willful misconduct and not covered by insurance.

8.2 By Cameco. Cameco agrees to defend, indemnify and hold harmless URI, its successors, Affiliates, assigns, officers, directors and employees from and against any and all claims, actions, suits, losses, liabilities, damages, assessments, judgments, costs and expenses (including reasonable attorneys’ fees) and the costs of defending the same, arising out of or related to (i) any breach by Cameco of any representation, covenant or warranty set forth herein, or (ii) the failure to comply with its obligations under ARTICLE 4 on or in connection with the Exploration Lands while it is serving as the Exploration Operator to the extent caused by Cameco’s gross negligence or willful misconduct and not covered by insurance.

21

8.3 Notification. If any claim or demand is asserted against a Party (the “Indemnified Party”) in respect of which such Indemnified Party may be entitled to indemnification under this Agreement, or if an Indemnified Party otherwise believes it may be entitled to indemnification under this Agreement, written notice of such claim or demand (together with a reasonable description thereof) shall promptly be given to the other Party (the “Indemnifying Party”). Failure to provide such notice promptly shall not relieve the Indemnifying Party of any of its obligations hereunder except to the extent the Indemnifying Party is materially prejudiced thereby. The Indemnifying Party shall have the right, but not the obligation, by notifying the Indemnified Party within 30 days after its receipt of the notice of the claim or demand, to assume the entire control of (subject to the right of the Indemnified Party to participate, at the Indemnified Party’s expense and with counsel of the Indemnified Party’s choice) the defense, compromise, or settlement of the matter, including, at the Indemnifying Party’s expense, employment of counsel of the Indemnifying Party’s choice. Any damages suffered by the Indemnified Party caused by a failure by the Indemnifying Party to defend, compromise, or settle a claim or demand in a reasonable and expeditious manner requested by the Indemnified Party, after the Indemnifying Party has given notice that it will assume control of the defense, compromise, or settlement of the matter, shall be included in the damages for which the Indemnifying Party shall be obligated to indemnify the Indemnified Party. Any settlement or compromise of a matter by the Indemnifying Party shall include a full release of claims against the Indemnified Party which has arisen out of the indemnified claim or demand, and shall be made only with the consent of the Indemnified Party, such consent not to be unreasonably withheld or delayed. The Indemnified Party may participate in the defense of any claim at its expense, and until the Indemnifying Party has agreed to defend such claim, the Indemnified Party may file any motion, answer or other pleading or take such other action as it deems appropriate to protect its interests or those of the Indemnifying Party. If the Indemnifying Party does not elect to contest any third-party claim, the Indemnifying Party shall be bound by the results obtained with respect thereto by the Indemnified Party, including any settlement of such claim.

ARTICLE 9

TERM AND TERMINATION

9.1 Term and Termination. This Agreement will remain in effect during the Earn-In Period, after which (if Cameco does not acquire an undivided 40%, 50% or 70% interest in the Leases pursuant to Sections 2.4, 2.5 or 2.6) it will terminate automatically, unless it is sooner terminated as a result of the exercise of the Acquisition Right by Cameco or pursuant to the provisions of this ARTICLE 9.

9.2 Termination Generally. Either Party may terminate this Agreement pursuant to Section 2.11 or Section 3.2. In addition, Cameco may terminate this Agreement as provided in Section 2.12. Upon termination of this Agreement pursuant to this Section 9.2, neither party shall have any further obligations or liabilities under this Agreement to the other or with respect to the Exploration Lands, except with respect to obligations under Sections 4.3, and 4.5-4.8 arising from a Party acting as Exploration Operator prior to termination, the indemnity obligations set forth in Section 4.4 and ARTICLE 8, the obligations set forth in Sections 3.2(d), 9.4, 9.5 and 9.6 and any funding by Cameco required pursuant to Section 2.12.

22