Attached files

| file | filename |

|---|---|

| EX-32.2 - EX-32.2 - WESTWATER RESOURCES, INC. | a2202818zex-32_2.htm |

| EX-32.1 - EX-32.1 - WESTWATER RESOURCES, INC. | a2202818zex-32_1.htm |

| EX-31.2 - EX-31.2 - WESTWATER RESOURCES, INC. | a2202818zex-31_2.htm |

| EX-23.2 - EX-23.2 - WESTWATER RESOURCES, INC. | a2202818zex-23_2.htm |

| EX-23.1 - EX-23.1 - WESTWATER RESOURCES, INC. | a2202818zex-23_1.htm |

| EX-31.1 - EX-31.1 - WESTWATER RESOURCES, INC. | a2202818zex-31_1.htm |

| EX-10.48 - EX-10.48 - WESTWATER RESOURCES, INC. | a2202818zex-10_48.htm |

Use these links to rapidly review the document

TABLE OF CONTENTS

URANIUM RESOURCES, INC. AND CONSOLIDATED SUBSIDIARIES

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

| (Mark One) | ||

ý |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

For the fiscal year ended December 31, 2010 |

||

or |

||

o |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

For the transition period from to |

||

Commission file number 001-33404

URANIUM RESOURCES, INC.

(Exact name of Registrant as specified in its charter)

| DELAWARE (State of Incorporation) |

75-2212772 (I.R.S. Employer Identification No.) |

|

405 State Highway Bypass 121, Building A, Suite 110 Lewisville, Texas (Address of principal executive offices) |

75067 (Zip code) |

(972) 219-3330

(Registrant's telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class | Name of Each Exchange on Which Registered | |

|---|---|---|

| Common Stock, $0.001 par value per share | NASDAQ Capital Market |

Securities registered pursuant to Section 12(g) of the Act: None

(Title of class)

Indicate by check mark if the Registrant is a well-known seasoned issuer as defined in Rule 405 of the Securities Act. Yes o No ý

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No ý

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes o No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of Registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of "accelerated filer and large accelerated filer" in Rule 12b-2 of the Exchange Act.

| Large accelerated filer o | Accelerated filer o | Non-accelerated filer ý (Do not check if a smaller reporting company) |

Smaller reporting company o |

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No ý

The aggregate market value of the Common Stock held by non-affiliates of the Registrant at June 30, 2010, was approximately $21,613,583. Number of shares of Common Stock, $0.001 par value, outstanding as of March 14, 2011: 93,395,030 shares.

DOCUMENTS INCORPORATED BY REFERENCE

Items 10, 11, 12, 13 and 14 of Part III of this Form 10-K report are incorporated by reference to the Registrant's Definitive Proxy Statement for the Registrant's 2011 Annual Meeting of Stockholders.

ANNUAL REPORT ON FORM 10-K

FOR THE FISCAL YEAR ENDED DECEMBER 31, 2010

i

ii

iii

The "Company" or "Registrant" or "URI" is used in this report to refer to Uranium Resources, Inc. and its consolidated subsidiaries. This 10-K contains "forward-looking statements." These statements include, without limitation, statements relating to management's expectations regarding the Company's ability to remain solvent, capital requirements, mineralized materials, timing of receipt of mining permits, production capacity of mining operations planned for properties in South Texas and New Mexico and planned dates for commencement of production at such properties, business strategies and other plans and objectives of the Company's management for future operations and activities and other such matters. The words "believes," "plans," "intends," "strategy," "projects," "targets," or "anticipates" and similar expressions identify forward-looking statements. The Company does not undertake to update, revise or correct any of the forward-looking information. Readers are cautioned that such forward-looking statements should be read in conjunction with the Company's disclosures under the heading: "Risk Factors" beginning on page 9[?].

Certain terms used in this Form 10-K and other industry terms are defined in the "Glossary of Certain Terms" appearing at the end of Part I hereto.

Uranium Resources, Inc. (URI) is a uranium exploration, development and production company. We were organized in 1977 to acquire and develop uranium mines in South Texas using the in-situ recovery mining process (ISR). Since its founding, URI has produced over 8 million pounds U3O8 from five Texas projects, two of which have been fully restored and returned to the land owners. The Company currently has two fully licensed ISR processing facilities in Texas: Kingsville Dome and Rosita. Since 1986, the Company has built a significant asset base in New Mexico that includes 101.4 million pounds U3O8 of in-place mineralized uranium material on 183,000 acres of uranium mineral holdings. We have a Nuclear Regulatory Commission (NRC) license to build a 3 million pound U3O8 per year ISR processing facility at Crownpoint, New Mexico. As of March 14, 2011 we had 40 employees. As a result of low uranium prices, we ceased production in 2009. Our plan is to preserve cash and maintain liquidity to allow the Company to be in a position to resume uranium production when sustained prices support such activities.

URI holds a NRC source materials license to build and operate an ISR uranium processing facility on company-owned property at Crownpoint, New Mexico. The license allows for ISR mining at the Churchrock and Crownpoint projects that together hold nearly 34 million pounds U3O8 of in-place mineralized uranium material. The license allows for the production of up to 1 million pounds per year from Churchrock until a successful commercial demonstration of restoration is made; after which the quantity of production can be increased and mining on other properties can begin. Total production under the license is limited to 3 million pounds U3O8 per year. This project has been delayed due to depressed uranium prices and by a lawsuit to determine whether the U.S. Environmental Protection Agency ("USEPA") or the State of New Mexico has the jurisdiction to issue the Underground Injection Control (UIC) program permits. On June 15, 2010 the United States Court of Appeals for the Tenth Circuit en banc held that the Company's Section 8 property in Churchrock, New Mexico is not Indian Country. The ruling means that the authority to issue a UIC permit to URI falls under the jurisdiction of the State of New Mexico and not the U.S. Environmental Protection Agency (USEPA). The opposing parties had the right to petition the Supreme Court for review until September 13, 2010; however no petitions were filed as of the deadline and the ability for opposing parties to petition the United States Supreme Court has expired. The Company is in the process of preparing feasibility studies on its New Mexico properties and believes that subject to sustained increases in uranium prices,

1

available sources of financing and activation of our permits and licenses that we could begin plant construction and wellfield development as early as 2012 with production following in 2013.

Overall in New Mexico, the Company owns 183,000 acres of mineral holdings that contain approximately 101.4 million pounds U3O8 of in-place mineralized uranium material that has been verified by an independent engineering firm. A substantial amount of our acreage remains unexplored or currently has insufficient data to estimate in-place mineralized materials. These properties were acquired during the 1980s and 1990s along with a vast database of exploration logs and drill results that were developed by Conoco, Homestake Mining, Mobil Oil, Kerr-McGee, Phillips Petroleum, United Nuclear and Westinghouse Electric Corporation. Three of our properties were in various stages of being developed as conventional underground mines in the early 1980s with a total designed capacity to produce approximately 4.5 million pounds U3O8 per year. We also possess a 16.5% royalty interest on a partial section of the Mount Taylor Mine owned by Rio Grande Resources, a division of General Atomics.

Since 2007, we have digitized approximately 18,800 drill logs in order to secure the data and allow for easier analysis of drill hole information. These logs total nearly 23 million feet of hole drilled in the 1970s and 1980s with an estimated drilling and logging replacement cost of $700 million.

The Company plans to develop its uranium assets in New Mexico using the most economic and efficient method for each project and will be subject to improvements in uranium prices. These mining methods may include the use of ISR, old stope leaching, and conventional mining and milling techniques.

Texas Production History and Current Status

The Company developed and produced over 560,000 pounds U3O8 from the Longoria and Benavides projects in the early 1980s. These properties were fully restored between 1986 and 1991. From 1988 through 1999, we produced approximately 6.1 million pounds U3O8 from two South Texas projects: 3.5 million pounds from the Kingsville Dome project and 2.6 million pounds U3O8 from the Rosita project. In 1999, we shut-down production at both projects due to depressed uranium prices. We had no revenue from uranium sales between 2000 and the fourth quarter of 2004, and therefore had to rely on equity infusions to fund operations and maintain our critical employees and assets.

After uranium prices rose significantly in 2004, we placed our South Texas Vasquez property into production during the fourth quarter of that year. In April 2006, Kingsville Dome returned to production followed by a startup of Rosita in June 2008. From 2004 to the end of 2009, these three projects produced a total of 1.4 million pounds of U3O8.

The Vasquez project was mined out in 2008 and is now in restoration. Rosita production was shut-in in October 2008 due to depressed pricing and technical challenges in the first new wellfield that made mining uneconomical. The decline in uranium prices throughout 2008 also led to a decision in October 2008 to defer new wellfield development at Rosita and Kingsville Dome. Production continued in two existing wellfields at Kingsville Dome and was completed in July 2009. The Company has not had any operating mines in Texas since that time, and is currently evaluating the factors for resuming production at our South Texas projects.

The Company's strategy with regard to restarting production in South Texas is to insure that production, once resumed, is sustainable in the 300,000 to 500,000 pound range. The Company believes its existing South Texas reserve base from its existing production areas at Kingsville Dome and Rosita and the reserves identified at its Rosita South and adjacent Rosita production acreage will enable it to produce at that level for up to two years. The Company is in the process of finalizing the necessary permits for its Rosita South and adjacent Rosita acreage and expects the required permits will be granted. Production could begin within 6 - 12 months after a decision to restart is made and will be dependent upon sustainable realized uranium prices stabilizing at profitable levels.

2

Longer-term, the Company plans to expand its resources through acquisition of additional South Texas properties and through exploration activities. The first phase of the exploration component of this plan was initiated with the Company signing a three-year exploration agreement covering 53,500 acres in Kenedy County, Texas. The exploration agreement includes an option to lease the acreage for uranium production.

The Company raised additional capital in mid-2010 in underwritten public offerings of 27,142,830 shares of common stock that resulted in net proceeds of approximately $10.2 million, after deducting underwriting discounts and commissions and offering expenses.

The Company raised additional capital in November 2010 through an underwritten public offering. A total of 8,222,500 shares of common stock were sold in the offering with net proceeds of approximately $9.0 million, after deducting underwriting discounts and commissions and offering expenses.

On June 15, 2010 the United States Court of Appeals for the Tenth Circuit en banc held that the Company's Section 8 property in Churchrock, New Mexico is not Indian Country. As a result, the authority to issue a UIC permit to URI falls under the jurisdiction of the State of New Mexico and not the U.S. Environmental Protection Agency (USEPA). The opposing parties had the right to petition the Supreme Court for review until September 13, 2010; however no petitions were filed and the time to petition the United States Supreme Court has expired. As a result of this ruling the question of jurisdiction over the UIC permitting process has been concluded in favor of the State of New Mexico which will allow the Company to move forward with the development of our Churchrock/Crown Point project after many years of delay."

On September 29, 2010, we settled the litigation titled Saenz v. URI Inc., by agreeing to pay to the plaintiffs $1.375 million, which includes amounts for prior royalties. The payment was made in February 2011 and amendments to the leases were executed and the suit was dismissed.

In November 2010, the United States Supreme Court denied the opponents' petition to review a March 2010, 10th Circuit Court of Appeals' ruling that upheld the Company's U.S. Nuclear Regulatory Commission ("NRC") license to conduct in-situ recovery (ISR) uranium mining at the Churchrock/Crownpoint project, which cleared the last remaining legal challenge to our NRC license.

On November 3, 2010, the Company signed a non-binding letter of intent with Power Resources, Inc. doing business as Cameco Resources ("CR"), a subsidiary of Cameco, for a three-phase exploration program funded by CR and an option for a production joint venture on a large ranch in South Texas. The agreement is contingent upon URI successfully completing the negotiation and execution of final definitive agreements between the Company and CR.

In early 2010, the Company adopted a new strategic plan which emphasized cash preservation and maintaining liquidity to allow the Company to be in a position to resume uranium production when sustained prices support such activities. As part of this plan the Company completed financings that we believe will provide sufficient working capital for the Company to maintain its liquidity into 2012. Key operational elements of the strategic plan for our Texas properties include (1) positioning the Company to return to production in Texas should the price of uranium return to a level sufficient to generate positive cash flow; (2) complete an analysis of the exploration potential in South Texas and enhance the Company's exploration capabilities; (3) continue to maintain our restoration activities in South Texas in accordance with the Company's existing agreements and regulatory requirements and (4) analyze any synergistic opportunities and potential asset monetization prospects in Texas. In New Mexico, our strategic plan calls for continuing to advance our discussions with others in the region that also hold

3

uranium assets, as well as with entities that would benefit from the production of the uranium. In addition, we will continue our communication efforts with the local communities, State and local governments and the Navajo Nation to address legacy issues while continuing education efforts on the safety of today's uranium mining practices with the objective of bridging the gap that currently exists between uranium mining entities and others with stakeholder interests in the State.

Uranium Reserves/Mineralized Material

In accordance with the SEC's Guideline on Non-Reserve Mineralized Material, and as shown in the following table, we estimate 101.4 million pounds of in-place mineralized uranium material on our New Mexico properties as of December 31, 2010. The estimate for each New Mexico property is based on studies and geologic reports prepared by prior owners, along with studies and reports prepared by geologists engaged by the Company. The estimates presented below were reviewed and affirmed by Behre Dolbear & Company (USA) an independent private engineering firm in their report dated February 26, 2008. Since the date of the report, the Company has maintained its ownership position of these properties, the properties have not been subject to any production activities and the estimates remain unchanged.

SUMMARY OF IN-PLACE NON-RESERVE MINERALIZED

MATERIAL IN NEW MEXICO

Property

|

Tonnage Millions |

Grade Percent |

Non-Reserve Mineralized Material Millions of Lbs U3O8 |

||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

Mancos |

5.2 | 0.11 | % | 11.3 | |||||||

Churchrock |

7.8 | 0.12 | % | 18.6 | |||||||

Nose Rock |

7.6 | 0.15 | % | 21.9 | |||||||

West Largo |

2.8 | 0.30 | % | 17.2 | |||||||

Roca Honda |

3.9 | 0.19 | % | 14.7 | |||||||

Crownpoint |

4.8 | 0.16 | % | 15.3 | |||||||

Ambrosia Lake |

0.71 | 0.17 | % | 2.4 | |||||||

Total |

101.4 | ||||||||||

The Company believes the Mancos, Churchrock and Crownpoint properties will be amenable to ISR mining methods, the Roca Honda to conventional mining and the Nose Rock, West Largo and Ambrosia Lake to ISR and/or conventional mining methods.

The following table summarizes our estimates of Proven Reserves for our Kingsville Dome and Rosita properties in South Texas. These estimates have been produced by the Company's professional engineering and geologic staff.

SUMMARY OF IN-PLACE RESERVES IN SOUTH TEXAS

Property

|

Tonnage Millions |

Grade Percent |

Proven Uranium Reserves Millions of Lbs U3O8 at 12/31/10 |

||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

Kingsville Dome |

0.035 | 0.071 | % | 0.050 | |||||||

Rosita |

0.133 | 0.080 | % | 0.224 | |||||||

Rosita South(1) |

0.129 | 0.077 | 0.198 | ||||||||

Rosita(1) |

0.112 | 0.086 | 0.192 | ||||||||

Total |

0.664 | ||||||||||

- (1)

- The Company is in the process of finalizing the necessary permits for these areas and expects the required permits will be granted.

4

In March 2006 we entered into contracts with Itochu Corporation and UG USA, Inc. (superseding prior agreements), each of which calls for delivery of one-half of our actual production from our Texas properties (excluding certain large potential exploration plays). The terms of these new contracts are summarized below.

The Itochu Contract. Under the Itochu contract all production from the Vasquez property was sold at a price equal to the average spot price for the eight weeks prior to the date of delivery less $6.50 per pound, with a floor for the spot price of $37.00 per pound and a ceiling of $46.50 per pound. Other Texas production will be sold at a price equal to the average spot price for the eight weeks prior to the date of delivery less $7.50 per pound, with a floor for the spot price of $37.00 per pound and a ceiling of $43.00 per pound. On non-Vasquez production the price paid will be increased by 30% of the difference between the actual spot price and the $43.00 ceiling up to and including $50.00 per pound. If the spot price is over $50.00 per pound, the price on all Texas production will be increased by 50% of such excess. The floor and ceiling and sharing arrangement over the ceiling applies to 3.65 million pounds of deliveries, after which there is no floor or ceiling. Itochu has the right to cancel any deliveries on six-month's notice. Since the inception of the new contract through December 31, 2010 we have delivered approximately 510,000 pounds to Itochu.

The UG Contract. Under the UG contract all production from the Vasquez property and other Texas production will be sold at a price equal to the month-end long-term contract price for the second month prior to the month of delivery less $6 per pound until (i) 600,000 pounds have been sold in a particular delivery year and (ii) an aggregate of 3 million pounds of uranium has been sold. After the 600,000 pounds in any year and 3 million pounds total have been sold, UG will have a right of first refusal to purchase other Texas production at a price equal to the average spot price for a period prior to the date of delivery less 4%. In consideration of UG's agreement to restructure its previously existing contract, we paid UG $12 million in cash. Through December 31, 2010 we have delivered approximately 482,000 pounds to UG.

Joint Venture for Churchrock Property

On December 5, 2006, HRI-Churchrock, Inc., a wholly-owned subsidiary of the Company, entered into a Joint Venture with a wholly-owned subsidiary of Itochu to develop jointly our Churchrock property in New Mexico. The Joint Venture provided Itochu an opportunity to participate in New Mexico uranium production in exchange for renegotiating their sales contract with the Company. The new contract included a provision to allow the Company to receive up to an additional $2.10 per pound for certain South Texas uranium production sold to Itochu.

Under the terms of the Joint Venture Itochu elected to terminate the Joint Venture. As a result of the termination of the joint venture, the Company now retains 100% ownership of the 18.6 millions pounds of in place mineralized uranium material and depending on the level of spot prices, our sales price under the Itochu contract could be reduced by up to $2.10 per pound for future deliveries. We presently have no committed source of financing for development of this project.

Overview of the Uranium Industry

The only significant commercial use for uranium is as a fuel for nuclear power plants for the generation of electricity. According to the World Nuclear Association ("WNA"), as of February 2011, there were 443 nuclear power plants operating in the world with an annual consumption of about 163 million pounds of uranium. In addition, the WNA lists 62 reactors under construction, 156 being planned and 322 being proposed.

5

Based on reports by Ux Consulting Company, LLC, or Ux, the preliminary estimate for worldwide production of uranium in 2010 is 120 million pounds. Ux reported that the gap between production and demand was filled by secondary supplies, such as inventories held by governments, utilities and others in the fuel cycle, including the highly enriched uranium, or HEU, inventories which are a result of the agreement between the US and Russia to blend down nuclear warheads. These secondary supplies are currently meeting over 25% of worldwide demand but are depleting.

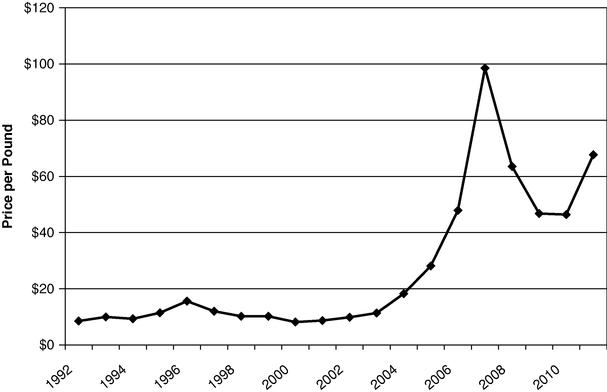

Spot market prices rose from $21.00 per pound in January 2005 to a high of $136.00 per pound in June 2007 in anticipation of sharply higher projected demand as a result of a resurgence in nuclear power and the depletion or unavailability of secondary supplies. The sharp price increase was driven in part by high levels of utility buying, which resulted in most utilities covering their requirements through 2009. A decrease in near-term utility demand coupled with rising levels of supplies from producers and traders led to downward pressure on uranium prices since the third quarter of 2007. The spot market price for uranium at the start of 2010 was $44.50 per pound and ranged between a low of $40.50 per pound in March to a high at year-end of $62.50 per pound. As of March 14, 2011, the spot price was $60.00 per pound and the long-term contract price was $73.00 per pound.

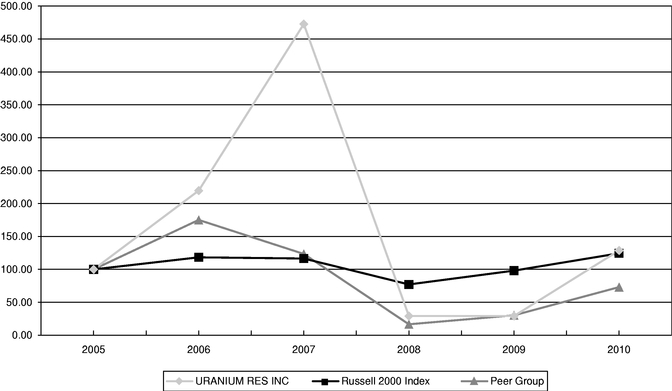

The following graph shows annual average spot prices per pound from 1992 to 2010 and the average price for the period January 1, 2011 to March 14, 2011, as reported by Ux Consulting.

Ux Average Annual U3O8 Spot Price

The ISR mining process is a form of solution mining. It differs dramatically from conventional mining techniques. The ISR technique avoids the movement and milling of significant quantities of rock and ore as well as mill tailing waste associated with more traditional mining methods. It is generally more cost-effective and environmentally benign than conventional mining. Historically, the majority of United States uranium production resulted from either open pit surface mines or underground mining.

6

The ISR process was first tested for the production of uranium in the mid-1960s and was first applied to a commercial-scale project in 1975 in South Texas. It was well established in South Texas by the late 1970's, where it was employed in about twenty commercial projects, including two operated by us.

In the ISR process, groundwater fortified with oxygen and other solubilizing agents is pumped into a permeable ore body causing the uranium contained in the ore to dissolve. The resulting solution is pumped to the surface. The fluid-bearing uranium is then circulated to an ion exchange column on the surface where uranium is extracted from the fluid onto resin beads. The fluid is then reinjected into the ore body. When the ion exchange column's resin beads are loaded with uranium, they are removed and flushed with a salt-water solution, which strips the uranium from the beads. This leaves the uranium in slurry, which is then dried and packaged for shipment as uranium concentrates.

For greater operating efficiency and lower capital expenditures, when developing new wellfields we use a wellfield-specific remote ion exchange methodology as opposed to a central plant as we had done historically. Instead of piping the solutions over large distances through large diameter pipelines and mixing the waters of several wellfields together, each wellfield is being mined using a dedicated satellite ion exchange facility. This allows ion exchange to take place at the wellfield instead of at the central plant. A wellfield consists of a series of injection wells, production (extraction) wells and monitoring wells drilled in specified patterns. Wellfield pattern is crucial to minimizing costs and maximizing efficiencies of production. The satellite facilities allow mining of each wellfield using its own native groundwater.

Environmental Considerations and Permitting

Uranium mining is regulated by the federal government, states and, in some cases, by Indian tribes. Compliance with such regulation has a material effect on the economics of our operations and the timing of project development. Our primary regulatory costs have been related to obtaining licenses and permits from federal and state agencies before the commencement of mining activities. The current environmental regulatory requirements for the ISR industry are well established. Many ISR mines have gone full cycle without any significant environmental impact. However, the public anti-nuclear lobby can make environmental permitting difficult and timing unpredictable.

U.S. regulations pertaining to climate change continue to evolve in both the U.S. and internationally. We do not anticipate any adverse impact from these regulations that would be unique to our operations.

Radioactive Material License. Before commencing operations in both Texas and New Mexico, we must obtain a radioactive material license. Under the federal Atomic Energy Act, the United States Nuclear Regulatory Commission has primary jurisdiction over the issuance of a radioactive material license. However, the Atomic Energy Act also allows for states with regulatory programs deemed satisfactory by the Commission to take primary responsibility for issuing the radioactive material license. The Commission has ceded jurisdiction for such licenses to Texas, but not to New Mexico. Such ceding of jurisdiction by the Commission is hereinafter referred to as the "granting of primacy."

The Texas Commission of Environmental Quality (TCEQ) is the administrative agency with jurisdiction in Texas over the radioactive material license. For operations in New Mexico, radioactive material licensing is handled directly by the United States Nuclear Regulatory Commission.

See "Properties" and "Legal Proceedings" for the status of our radioactive material license for New Mexico and Texas.

Underground Injection Control Permits ("UIC"). The federal Safe Drinking Water Act creates a nationwide regulatory program protecting groundwater. This law is administered by the United States Environmental Protection Agency (the "USEPA"). However, to avoid the burden of dual federal and

7

state regulation, the Safe Drinking Water Act allows for the UIC permits issued by states to satisfy the UIC permit required under the Safe Drinking Water Act under two conditions. First, the state's program must have been granted primacy. Second, the USEPA must have granted, upon request by the state, an aquifer exemption. The USEPA may delay or decline to process the state's application if the USEPA questions the state's jurisdiction over the mine site.

Texas has been granted primacy for its UIC programs, and the Texas Commission on Environmental Quality administers UIC permits. The TCEQ also regulates air quality and surface deposition or discharge of treated wastewater associated with the ISR mining process.

New Mexico has also been granted primacy for its UIC program. The Navajo Nation has been determined eligible for treatment as a state, but it has not requested the grant of primacy from the USEPA for uranium related UIC activity. Until the Navajo Nation has been granted primacy, ISR uranium mining activities within Navajo Nation jurisdiction will require a UIC permit from the USEPA. Despite some procedural differences, the substantive requirements of the Texas, New Mexico and USEPA underground injection control programs are very similar.

Properties located in Indian Country remain subject to the jurisdiction of the USEPA. Some of our properties are located in areas that may be in Indian Country.

See "Properties" and "Legal Proceedings" for a description of the status of our UIC permits in Texas and New Mexico.

Other. In addition to radioactive material licenses and UIC permits, we are also required to obtain from governmental authorities a number of other permits or exemptions, such as for wastewater discharge, for land application of treated wastewater, and for air emissions.

In order for a licensee to receive final release from further radioactive material license obligations after all of its mining and post-mining clean up have been completed, approval must be issued by the TCEQ for Texas properties along with concurrence from the United States Nuclear Regulatory Commission and for properties in New Mexico by the United States Nuclear Regulatory Commission.

In addition to the costs and responsibilities associated with obtaining and maintaining permits and the regulation of production activities, we are subject to environmental laws and regulations applicable to the ownership and operation of real property in general, including, but not limited to, the potential responsibility for the activities of prior owners and operators.

Reclamation and Restoration Costs and Bonding Requirements

At the conclusion of mining, a mine site is decommissioned and decontaminated, and each wellfield is restored and reclaimed. Restoration involves returning the aquifer to its pre-mining use and removing evidence of surface disturbance. Restoration can be accomplished by flushing the ore zone with native ground water and/or using reverse osmosis to remove ions, minerals and salts to provide clean water for reinjection to flush the ore zone. Decommissioning and decontamination entails dismantling and removing the structures, equipment and materials used at the site during the mining and restoration activities.

The Company is required by the State of Texas regulatory agencies to obtain financial surety relating to certain of its future restoration and reclamation obligations. The Company has a combination of bank Letters of Credit (the "L/Cs) and performance bonds issued for the benefit of the Company to satisfy such regulatory requirements. The L/Cs were issued by Bank of America and the performance bonds have been issued by United States Fidelity and Guaranty Company ("USF&G"). The L/Cs relate primarily to our operations at our Kingsville Dome and Vasquez projects and amounted to $5,858,000 and $5,761,000, at December 31, 2010 and 2009, respectively. The L/Cs are collateralized in their entirety by certificates of deposit.

8

The performance bonds were $2,834,000 on December 31, 2010 and 2009, and related primarily to our operations at Kingsville Dome and Rosita. USF&G has required that the Company deposit funds collateralizing a portion of the bonds, and we have deposited approximately $884,000 and $386,000 at December 31, 2010 and 2009, respectively, as cash collateral for such bonds. In September 2010, the Company received notice from the bonding company requesting that the Company either increase the collateral supporting the bonds to 100% of the bond amount by making equal quarterly payments of $500,000 or cause the release of the bonds by the fourth quarter of 2011. The amount of bonding issued by the carrier exceeded the amount of collateral by $2.0 million and $2.5 million at December 31, 2010 and 2009, respectively. In the event that the carrier is required to perform under its bonds or the bonds are called by the state agencies, the Company would be obligated to pay any expenditure in excess of the collateral.

We estimate that our actual reclamation liabilities for prior operations at Kingsville Dome, Vasquez and Rosita at December 31, 2010, are about $7.6 million of which the net present value of $5.0 million is recorded as a liability on our balance sheet as of December 31, 2010.

The Company's financial surety obligations are reviewed and revised periodically by the Texas regulators.

In New Mexico, surety bonding will be required before commencement of mining and will be subject to annual review and revision by the United States Nuclear Regulatory Commission and the State of New Mexico or the USEPA.

Water is essential to the ISR process. It is readily available in South Texas. In Texas, water is subject to capture, and we do not have to acquire water rights through a state administrative process. In New Mexico, water rights are administered through the New Mexico State Engineer and can be subject to Indian tribal jurisdictional claims. New water rights or changes in purpose or place of use or points of diversion of existing water rights, such as those in the San Juan and Gallup Basins where our properties are located, must be obtained by permit from the State Engineer. Applications may be approved subject to conditions that govern exercise of the water rights.

Jurisdiction over water rights becomes an issue in New Mexico when an Indian nation, such as the Navajo Nation, objects to the State Engineer's authority and claims tribal jurisdiction over Indian Country. This issue may result in litigation between the Indian nation and the state, which may delay action on water right applications, and can require applications to the appropriate Indian nation and continuing jurisdiction by the Indian nation over use of the water. The foregoing issues have arisen in connection with certain of our New Mexico properties.

In New Mexico, we hold approved water rights to provide sufficient water to conduct mining at the Churchrock project and Section 24 for the Crownpoint project for the projected life of these mines. We also hold two unprotested senior water rights applications that, when approved by the New Mexico State Engineer, would provide sufficient water for future extensions of the Crownpoint project.

A primary area of competition is in the identification and acquisition of properties with high prospects of potential producible reserves. We compete with multiple exploration companies for both properties as well as skilled personnel. There is global competition for uranium properties, capital, customers and the employment and retention of qualified personnel. In the production and marketing of uranium, there are a number of producing entities, some of which are government controlled and all of which are significantly larger and better capitalized than we are. Many of these organizations also have substantially greater financial, technical, manufacturing and distribution resources than we have.

9

Our uranium production also competes with uranium recovered from the de-enrichment of highly enriched uranium obtained from the dismantlement of United States and Russian nuclear weapons and imports to the United States of uranium from the former Soviet Union and from the sale of uranium inventory held by the United States Department of Energy. In addition, there are numerous entities in the market that compete with us for properties and are attempting to become licensed to operate ISR facilities. If we are unable to successfully compete for properties, capital, customers or employees or alternative uranium sources, it could have a materially adverse effect on our results of operations.

With respect to sales of uranium, the Company competes primarily based on price. We market uranium to utilities and commodity brokers and are in direct competition with supplies available from various sources worldwide. We believe we compete with multiple operating companies in the mining and sale of uranium.

Our Internet website address is www.uraniumresources.com. Our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports of Form 8-K, and amendments to those reports filed or furnished pursuant to section 13(a) of 15(d) of the Exchange Act, are available free of charge through our website under the tab "Investor Relations" as soon as reasonably practicable after they are electronically filed with, or furnished to, the Securities and Exchange Commission. We also make available on our website copies of materials regarding our corporate governance policies and practices, including our Code of Ethics, Nominating and Governance Committee Charter, Audit Committee Charter and Compensation Committee Charter. You may also obtain a printed copy of the foregoing materials by sending written request to: Uranium Resources, Inc., 405 State Highway 121 Bypass, Building A, Suite 110, Lewisville, Texas 75067, Attention: Information Request or by calling 972.219.3330. The information found on our Internet website is not part of this or any report filed or furnished to the SEC.

The factors identified below are important factors (but not necessarily all of the important factors) that could cause actual results to differ materially from those expressed in any forward-looking statement made by, or on behalf of, the Company. Where any such forward-looking statement includes a statement of the assumptions or bases underlying such forward-looking statement, we caution that, while we believe such assumptions or bases to be reasonable and make them in good faith, assumed facts or bases almost always vary from actual results, and the differences between assumed facts or bases and actual results can be material, depending upon the circumstances. Where, in any forward-looking statement, the Company, or its management, expresses an expectation or belief as to the future results, such expectation or belief is expressed in good faith and believed to have a reasonable basis, but there can be no assurance that the statement of expectation or belief will result, or be achieved or accomplished. Taking into account the foregoing, the following are identified as important risk factors that could cause actual results to differ materially from those expressed in any forward-looking statement made by, or on behalf of, the Company.

General Risks and Uncertainties

We are not producing uranium at this time, nor do we expect to begin production in the near future unless uranium prices recover to sustained profitable levels. As a result, we currently have no sources of operating cash. If we cannot monetize certain existing Company assets, partner with another Company that has cash resources, find other means of generating revenue other than uranium production and/or have the ability to access additional sources of private or public capital we may not be able to remain in business.

We will not commence production at our existing properties until uranium prices recover to sustainable profitable levels. Until such uranium price recovery we will have no way to generate cash

10

inflows unless we monetize certain Company assets or find other means to generate cash. In addition, our Vasquez project has been depleted of its economically recoverable reserves and our Rosita and Kingsville Dome projects have limited identified economically recoverable reserves. Our future uranium production, cash flow and income are dependent upon our ability to bring on new, as yet unidentified wellfields and to acquire and develop additional reserves. We can provide no assurance that our properties will be placed into production or that we will be able to continue to find, develop, acquire and finance additional reserves.

Our ability to function as an operating mining company will be dependent on our ability to mine our properties at a profit sufficient to finance further mining activities and for the acquisition and development of additional properties. The volatility of uranium prices makes long-range planning uncertain and raising capital difficult.

In addition to ceasing all production, we have deferred all activities for delineation and development of new wellfields at our South Texas projects. This decision limits our ability to be ready to begin production when uranium prices improve to profitable levels. Our ability to operate on a positive cash flow basis will be dependent on mining sufficient quantities of uranium at a profit sufficient to finance our operations and for the acquisition and development of additional mining properties. Any profit depends on the long and short-term market prices of uranium, which are subject to significant fluctuation. Uranium prices have been and will continue to be affected by numerous factors beyond our control. These factors include the demand for nuclear power, political and economic conditions in uranium producing and consuming countries, uranium supply from secondary sources and uranium production levels . A significant, sustained drop in uranium prices may make it impossible to operate our business at a level that will permit us to cover our fixed costs or to remain in operation.

Exploration and development of uranium properties are risky and subject to great uncertainties.

The exploration for and development of uranium deposits involves significant risks. It is impossible to ensure that the current and future exploration programs and/or feasibility studies on our existing properties will establish reserves. Whether a uranium ore body will be commercially viable depends on a number of factors, including, but not limited to: the particular attributes of the deposit, such as size, grade and proximity to infrastructure; uranium prices, which cannot be predicted and which have been highly volatile in the past; mining, processing and transportation costs; perceived levels of political risk and the willingness of lenders and investors to provide project financing; labor costs and possible labor strikes; and governmental regulations, including, without limitation, regulations relating to prices, taxes, royalties, land tenure, land use, importing and exporting materials, foreign exchange, environmental protection, employment, worker safety, transportation, and reclamation and closure obligations. Most exploration projects do not result in the discovery of commercially mineable deposits of uranium and there can be no assurance that any of our exploration stage properties will be commercially mineable or can be brought into production.

Potential impact on the uranium markets of the earthquake in Japan.

The aftermath of the catastrophic earthquake and tsunami that struck parts of Japan and the subsequent developments at the Fukushima Nuclear Power Plant has created heightened concerns regarding the ability to safeguard the material used to fuel the operations of this nuclear power facility. The potential impact on the perception of the safety of nuclear power resulting from this event may cause an increased volatility of uranium prices in the near to mid-term as well as uncertainty involving the expansion of nuclear power in certain countries around the world. A reduction in the current and future generation of electricity from nuclear power could result in a reduced requirement for uranium to fuel nuclear power plants which may negatively impact the Company in the future.

11

The only market for uranium is nuclear power plants world-wide, and there are a limited number of customers.

We are dependent on a limited number of electric utilities that buy uranium for nuclear power plants. Because of the limited market for uranium, a reduction in purchases of uranium by electric utilities for any reason (such as plant closings) would adversely affect the viability of our business.

The price of alternative energy sources affects the demand for and price of uranium.

The attractiveness of uranium as an alternative fuel to generate electricity may to some degree be dependent on the relative prices of oil, gas, coal and hydro-electricity and the possibility of developing other low cost sources for energy. If the price of alternative energy sources decrease or new low-cost alternative energy sources are developed, the demand for uranium could decrease, which may result in the decrease in the price of uranium.

Public acceptance of nuclear energy is uncertain.

Maintaining the demand for uranium at current levels and future growth in demand will depend upon acceptance of nuclear technology as a means of generating electricity. Lack of public acceptance of nuclear technology would adversely affect the demand for nuclear power and potentially increase the regulation of the nuclear power industry.

We may not be able to mine a substantial portion of our uranium in New Mexico until a mill is built in New Mexico.

A substantial portion of our uranium in New Mexico lends itself most readily to conventional mining methods and may not be able to be mined unless a mill is built in New Mexico. We have no immediate plans to build, nor are we aware of any third party's plan to build, a mill in New Mexico and there can be no guaranty that a mill will be built. In the event that a mill is not built a substantial portion of our uranium may not be able to be mined. Our inability to mine all or a portion of our uranium in New Mexico would have a material adverse effect on future operations.

We do not have a committed source of financing for the development of our New Mexico Properties, including the Churchrock Property, which is the property we expect to develop first in New Mexico.

With the election by Itochu to terminate the Churchrock Joint Venture we do not have a committed source of financing for the development of our Churchrock property. There can be no assurance that we will be able to obtain financing for this project or our other New Mexico projects. Our inability to develop the New Mexico properties would have a material adverse effect on our future operations.

Our operations are subject to environmental risks.

We are required to comply with environmental protection laws and regulations and permitting requirements, and we anticipate that we will be required to continue to do so in the future. We have expended significant resources, both financial and managerial, to comply with environmental protection laws, regulations and permitting requirements and we anticipate that we will be required to continue to do so in the future. The material laws and regulations within the U.S. that the Company must comply with include the Atomic Energy Act, Uranium Mill Tailings Radiation Control Act of 1978, or UMTRCA, Clean Air Act, Clean Water Act, Safe Drinking Water Act, Federal Land Policy Management Act, National Park System Mining Regulations Act, and the State Mined Land Reclamation Acts or State Department of Environmental Quality regulations, as applicable.

12

We are required to comply with the Atomic Energy Act, as amended by UMTRCA, by applying for and maintaining an operating license from the NRC and the state of Texas. Uranium operations must conform to the terms of such licenses, which include provisions for protection of human health and the environment from endangerment due to radioactive materials. The licenses encompass protective measures consistent with the Clean Air Act and the Clean Water Act. We intend to utilize specific employees and consultants in order to comply with and maintain our compliance with the above laws and regulations. Mining operations may be subject to other laws administered by the federal Environmental Protection Agency and other agencies.

The uranium industry is subject not only to the worker health and safety and environmental risks associated with all mining businesses, but also to additional risks uniquely associated with uranium mining and milling. The possibility of more stringent regulations exists in the areas of worker health and safety, storage of hazardous materials, standards for heavy equipment used in mining or milling, the disposition of wastes, the decommissioning and reclamation of exploration, mining and in-situ sites, climate change and other environmental matters, each of which could have a material adverse effect on the cost or the viability of a particular project.

We cannot predict what environmental legislation, regulation or policy will be enacted or adopted in the future or how future laws and regulations will be administered or interpreted. The recent trend in environmental legislation and regulation, generally, is toward stricter standards, and this trend is likely to continue in the future. This recent trend includes, without limitation, laws and regulations relating to air and water quality, mine reclamation, waste handling and disposal, the protection of certain species and the preservation of certain lands. These regulations may require the acquisition of permits or other authorizations for certain activities. These laws and regulations may also limit or prohibit activities on certain lands. Compliance with more stringent laws and regulations, as well as potentially more vigorous enforcement policies or stricter interpretation of existing laws, may necessitate significant capital outlays, may materially affect our results of operations and business, or may cause material changes or delays in our intended activities.

Our operations may require additional analysis in the future including environmental, cultural and social impact and other related studies. Certain activities require the submission and approval of environmental impact assessments. Environmental assessments of proposed projects carry a heightened degree of responsibility for companies and directors, officers, and employees. We cannot provide assurance that we will be able to obtain or maintain all necessary permits that may be required to continue our operation or our exploration of our properties or, if feasible, to commence development, construction or operation of mining facilities at such properties on terms which enable operations to be conducted at economically justifiable costs. If we are unable to obtain or maintain permits or water rights for development of our properties or otherwise fail to manage adequately future environmental issues, our operations could be materially and adversely affected.

Because mineral exploration and development activities are inherently risky, we may be exposed to environmental liabilities and other dangers. If we are unable to maintain adequate insurance, or liabilities exceed the limits of our insurance policies, we may be unable to continue operations.

The business of mineral exploration and extraction involves a high degree of risk. Few properties that are explored are ultimately developed into production. Unusual or unexpected formations, formation pressures, fires, power outages, labor disruptions, flooding, explosions, cave-ins, landslides and the inability to obtain suitable or adequate machinery, equipment or labor are other risks involved in extraction operations and the conduct of exploration programs. Previous mining operations may have caused environmental damage at certain of our properties. It may be difficult or impossible to assess the extent to which such damage was caused by us or by the activities of previous operators, in which case, any indemnities and exemptions from liability may be ineffective. If any of our properties are

13

found to have commercial quantities of uranium, we would be subject to additional risks respecting any development and production activities.

Although we carry liability insurance with respect to our mineral exploration operations, we may become subject to liability for damage to life and property, environmental damage, cave-ins or hazards against which we cannot insure or against which we may elect not to insure because of cost or other business reasons. In addition, the insurance industry is undergoing change and premiums are being increased. If we are unable to procure adequate insurance, we might be forced to cease operations.

Our inability to obtain financial surety would threaten our ability to continue in business.

Future bonding requirements to comply with federal and state environmental and remediation requirements and to secure necessary licenses and approvals will increase significantly when future development and production occurs at our sites in Texas and New Mexico. The amount of the bonding for each producing property is subject to annual review and revision by regulators. We expect that the issuer of the bonds will require us to provide cash collateral equal to the face amount of the bond to secure the obligation. In the event we are not able to raise, secure or generate sufficient funds necessary to satisfy these bonding requirements, we will be unable to develop our sites and bring them into production, which inability will have a material adverse impact on our business and may negatively affect our ability to continue to operate.

Because we have limited capital, inherent mining risks pose a significant threat to us compared with our larger competitors.

Because we have limited capital, we are unable to withstand significant losses that can result from inherent risks associated with mining, including environmental hazards, industrial accidents, flooding, interruptions due to weather conditions and other acts of nature which larger competitors could withstand. Such risks could result in damage to or destruction of our infrastructure and production facilities, as well as to adjacent properties, personal injury, environmental damage and processing and production delays, causing monetary losses and possible legal liability.

We will need to obtain additional financing in order to implement our business plan, and the inability to obtain it could cause our business plan to fail.

As of December 31, 2010, we had approximately $15.4 million in cash. We may require additional financing in order to complete our plan of operations. We may not be able to obtain all of the financing we require. Our ability to obtain additional financing is subject to a number of factors, including the market price of uranium, market conditions, investor acceptance of our business plan, and investor sentiment. These factors may make the timing, amount, terms and conditions of additional financing unattractive or unavailable to us. In recognition of current economic conditions and the shut-down of production, we have significantly reduced our spending, delayed or cancelled planned activities and substantially changed our current corporate structure. However, these actions may not be sufficient to offset the detrimental effects of the weak economy and cessation of production, which could result in material adverse effects on our business, revenues, operating results, and prospects.

Our business could be harmed if we lose the services of our key personnel.

Our business and mineral exploration programs depend upon our ability to employ the services of geologists, engineers and other experts. In operating our business and in order to continue our programs, we compete for the services of professionals with other mineral exploration companies and businesses. In addition, several entities have expressed an interest in hiring certain of our employees. Our ability to maintain and expand our business and continue our exploration programs may be impaired if we are unable to continue to employ or engage those parties currently providing services

14

and expertise to us or identify and engage other qualified personnel to do so in their place. To retain key employees, we may face increased compensation costs, including potential new stock incentive grants and there can be no assurance that the incentive measures we implement will be successful in helping us retain our key personnel.

Approximately 27.1% of our Common Stock is controlled by one record owner and management.

Approximately 22.9% of our common stock is controlled by three significant stockholders. In addition, our directors and officers are the beneficial owners of approximately 4.2% of our common stock. This includes, with respect to both groups, shares that may be purchased upon the exercise of outstanding options. Such ownership by the Company's principal shareholders, executive officers and directors may have the effect of delaying, deferring, preventing or facilitating a sale of the Company or a business combination with a third party.

The availability for sale of a large amount of shares may depress the market price of our Common Stock.

As of December 31, 2010, 92,430,306 shares of our Common Stock were currently outstanding, all of which are freely transferable. Approximately 5,704,000 shares of Common Stock are reserved for issuance upon the exercise of outstanding options and warrants. The availability for sale of a large amount of shares or conversion of the Company's outstanding warrants by any one or several shareholders may depress the market price of our Common Stock and impair our ability to raise additional capital through the public sale of our Common Stock. We have no arrangement with any of the holders of the foregoing shares to address the possible effect on the price of our Common Stock of the sale by them of their shares.

Terms of subsequent financings may adversely impact our stockholders.

In order to finance our future production plans and working capital needs, we may have to raise funds through the issuance of equity or debt securities. We currently have no authorized preferred stock. Depending on the type and the terms of any financing we pursue, stockholder's rights and the value of their investment in our Common Stock could be reduced. For example, if we have to issue secured debt securities, the holders of the debt would have a claim to our assets that would be prior to the rights of stockholders until the debt is paid. Interest on these debt securities would increase costs and negatively impact operating results. If the issuance of new securities results in diminished rights to holders of our Common Stock, the market price of our Common Stock could be negatively impacted.

Shareholders would be diluted if we were to use Common Stock to raise capital.

As previously noted, we may need to seek additional capital in the future to satisfy our working capital requirements. This financing could involve one or more types of securities including common stock, convertible debt, preferred stock or warrants to acquire common or preferred stock. These securities could be issued at or below the then prevailing market price for our Common Stock. Any issuance of additional shares of our Common Stock could be dilutive to existing stockholders and could adversely affect the market price of our Common Stock.

Item 1B. Unresolved Staff Comments.

None.

15

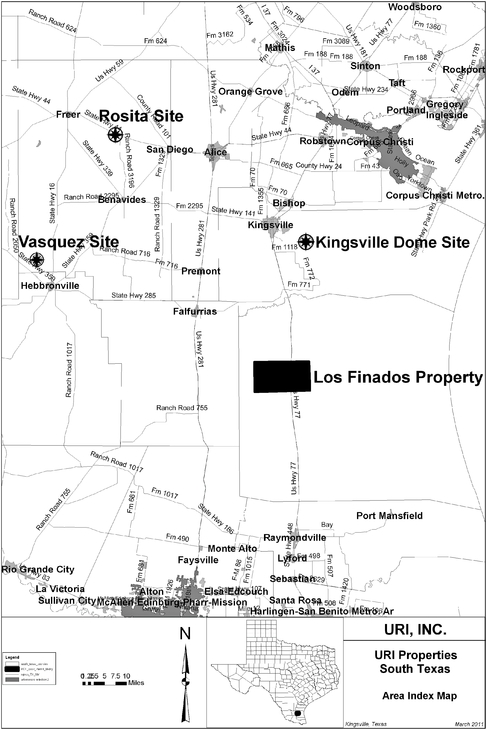

We currently control three production properties and two exploration properties in the state of Texas. These properties are owned by the Company's wholly owned subsidiary, URI, Inc. The Kingsville Dome, Rosita and Vasquez production properties and the Los Finados exploration property are shown in Figure No. 2.1 and are described below.

Figure No 2.1. Texas Properties Location Map

16

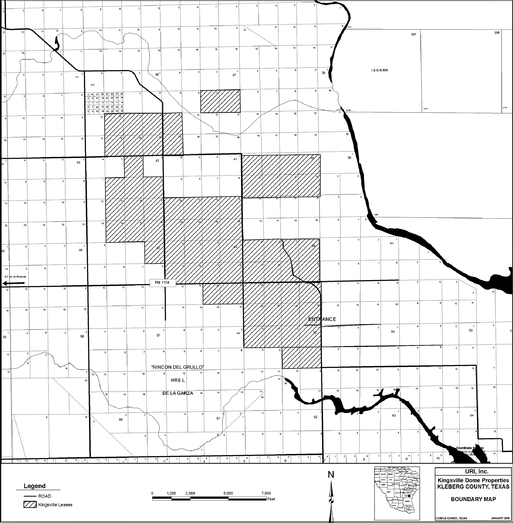

Kingsville Dome (Figure 2.2)

The Property. The Kingsville Dome property consists of mineral leases from private landowners on about 2,434 gross and 2,227 net acres located in central Kleberg County, Texas. The leases provide for royalties based upon a percentage of uranium sales of 6.25%. The leases have expiration dates ranging from 2000 to 2007, however we hold most of these leases through our continuing restoration activities; and with a few minor exceptions, all the leases contain clauses that permit us to extend the leases not held by production by payment of a per acre royalty ranging from $10 to $30. We have paid such royalties on all material acreage. Mineralization is found in the Goliad formation at depths of 600 to 750 feet.

Production History. Initial production commenced in May 1988. From then until July 1999, we produced a total of 3.5 million pounds. Production was stopped in July 1999, because of depressed uranium prices. We resumed production at Kingsville Dome in April 2006 and produced 94,100 pounds of uranium in 2006; 338,100 pounds in 2007, 254,000 pounds in 2008 and 56,000 pounds in 2009. We had no production in 2010. We made approximately $3.6 million in capital expenditures in 2008, $159,000 in 2009 and $150,000 in 2010.

Permitting Status. A radioactive material license and underground injection control permit have been issued. As new areas are proposed for production, additional authorizations under the area permit are required. See "Legal Proceedings."

Restoration and Reclamation. During 2010, we conducted restoration activities as required by the permits and licenses on this project spending approximately $903,000 on restoration activities. In 2009 and 2008, we spent approximately $963,000 and $349,000, respectively. Since we began our groundwater activities in 1998, we have processed and cleaned approximately 2.2 billion gallons of groundwater at the Kingsville Dome project.

17

Figure No. 2.2. Kingsville Dome Property

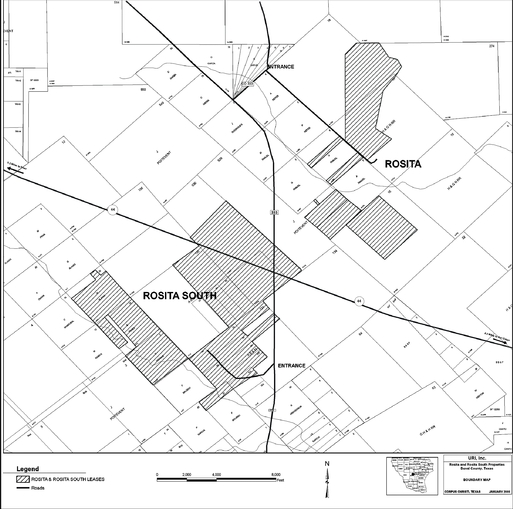

Rosita (Figure 2.3)

The Property: The Rosita property consists of mineral leases from private landowners on about 3,377 gross and net acres and the Rosita South property consists of mineral leases from private land owners on about 2,130 gross acres and 1,984 net acres located in north-central Duval County, Texas. The leases provide for sliding scale royalties based on a percentage of uranium sales. Royalty percentages on average increase from 6.25% up to 18.25% when uranium prices reach $80.00 per pound. The leases have expiration dates ranging from 2012 to 2015. We are holding these leases by payment of rental fees ranging from $10 to $30 per acre. Mineralization is found in the Goliad Formation at depths of 125 to 350 feet.

Production History: Initial production commenced in 1990. From then until July 1999, URI produced a total of 2.64 million pounds. Production was stopped in July of 1999 because of depressed uranium prices. Production from a new wellfield at Rosita wellfield was begun in June 2008. However, technical difficulties that raised the cost of production coupled with a sharp drop in uranium prices led to the decision to shut-in this wellfield in October 2008 after 10,200 pounds were produced. We had no production from Rosita in 2009 or 2010.

Our capital expenditures were approximately $137,000, $40,000 and $4.5 million in 2010, 2009 and 2008, respectively primarily for plant refurbishment and wellfield development.

18

Restoration and Reclamation. We are conducting restoration and reclamation activities at this project and are currently in stabilization in our first two PA's. During 2010, our primary groundwater activity consisted of collecting groundwater samples throughout the year for stability testing. We spent $0 in 2010 and approximately $247,000 and $465,000 on restoration activities in 2009 and 2008, respectively. Since we began our groundwater activities in 2000, we have processed and cleaned approximately 1.3 billion gallons of groundwater at the Rosita project.

Permitting Status: A radioactive material license and an underground injection control permit have been issued for the Rosita property. Production could resume in areas already included in existing Production Area Authorizations. As new areas are proposed for production, additional authorizations under the permit will be required.

Figure No. 2.3. Rosita Property

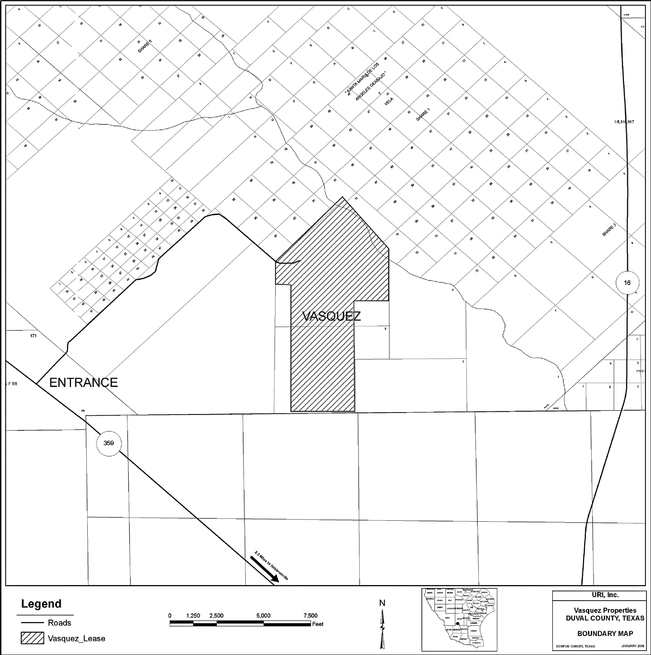

Vasquez (Figure 2.4)

The Property. We have a mineral lease on 872 gross and net acres located in southwestern Duval County, in South Texas. The primary term expired in February 2008; however, we held the lease by production and are currently in restoration. The lease provides for royalties based upon 6.25% of uranium sales below $25.00 per pound and royalty rate increases on a sliding scale up to 10.25% for uranium sales occurring at or above $40.00 per pound. Mineralization is found in the Oakville formation at depths of 200 to 250 feet.

19

Production History. We commenced production from this property in October 2004. Our capital expenditures in 2010 were approximately $78,000. We had approximately $194,000 in capital expenditures at Vasquez in 2009. We had approximately $355,000 in capital expenditures at Vasquez and produced 36,600 pounds of uranium in 2008. We had no production from Vasquez in 2010.

Restoration and Reclamation. We are conducting ongoing restoration and reclamation activities at this project and have spent $470,000, $591,000 and $224,000 in 2010, 2009 and 2008, respectively for such activities. Since the commencement of groundwater restoration activities at the end of 2007, we have treated approximately 244 million gallons of groundwater.

Permitting Status. All of the required permits for this property have been received.

Figure No. 2.4. Vasquez Property

20

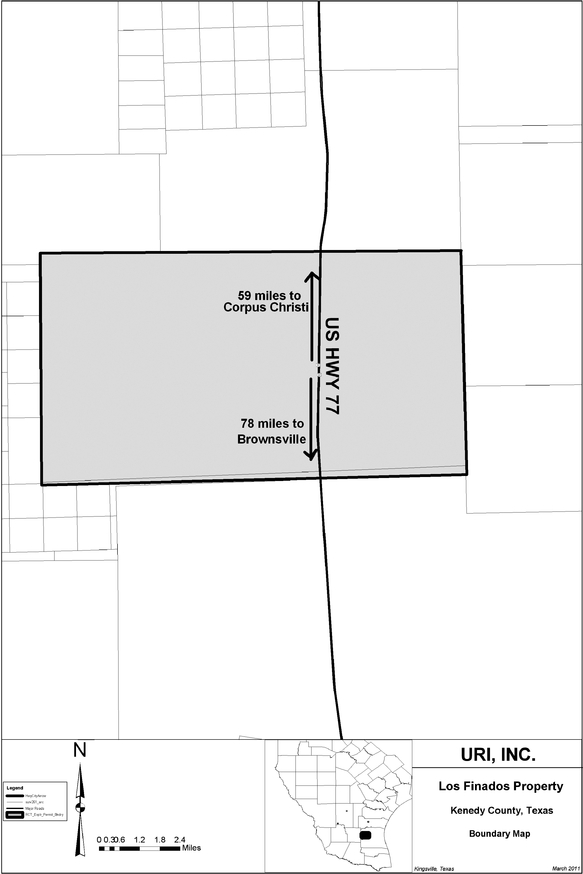

Los Finados Project (Figure 2.5)

On December 30, 2010, we entered into a three year lease option agreement with a large Texas landowner for the exploration of 53,500 acres in Kenedy County, Texas. The agreement includes an option to lease the acreage for future uranium production.

The property is located within the prolific South Texas uranium district which has been a major producer of uranium for half a century. Situated near uranium mining operations which produce from the Goliad Formation, the property also hosts several oil and gas fields and is bisected by a major depositional channel system. These provide the geologic, stratigraphic, and geochemical components for uranium deposition and water-saturated host sand with good rock permeability. Locally, water samples taken from a number of wells on the property contain levels of uranium or uranium decay products that indicate anomalously high concentrations of uranium in nearby rock.

The lease option agreement included a $1 million fee paid at signing. It requires a minimum exploration obligation of one hundred exploration wells or $1.0 million investment in the first year, an additional two hundred exploration wells or $1.5 million investment in the second year and, in the third year, an additional two hundred exploration wells or $2.0 million investment. Investment or drilling in excess of the minimum requirement in any year counts toward the following year's requirements. The uranium mining lease can be acquired at any time at a cost of $200 per acre. Royalties on uranium sales are determined by a sliding scale ranging from 10% to 20.5% based on the price received. In a separate letter agreement, the parties established guidelines for securing a major partner for the exploration projects, which is a condition for exercise of the lease option.

In connection with the planned exploration program for this project we have signed a non-binding letter of intent with Cameco Resources, a subsidiary of Cameco (NYSE: CCJ), for a three-phase exploration program that will be funded by Cameco Resources with an option for a production joint venture. Upon execution of the final exploration agreement, Cameco Resources would pay URI $300,000.

21

Figure No. 2.5. Los Finados Property

22

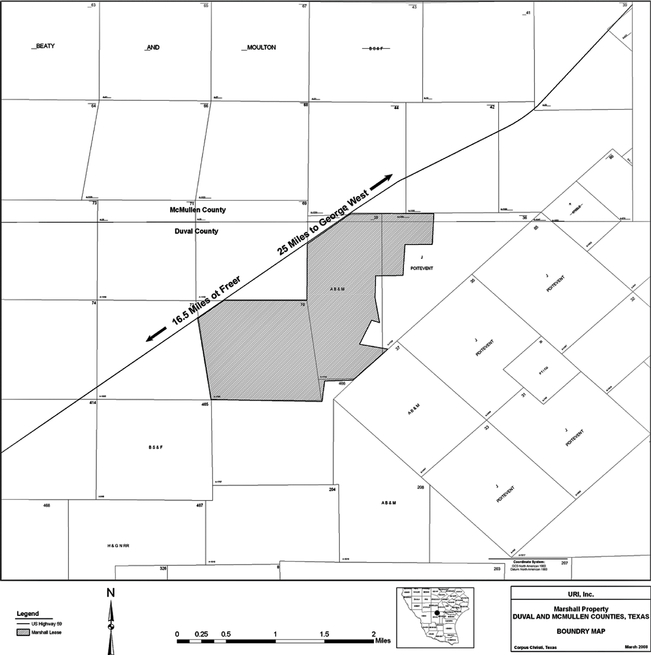

Marshall Exploration Property (figure 2.6).

The Marshall Property is a Goliad and Oakville prospect consisting of 2,467 gross and net acres. It is located in Duval and McMullen counties, Texas. During 2008 we drilled 280 exploration holes and discovered significant mineralization. Further evaluation will need to be conducted to determine if this property can be mined using ISR methods.

Figure No. 2.6. Marshall Exploration Property

23

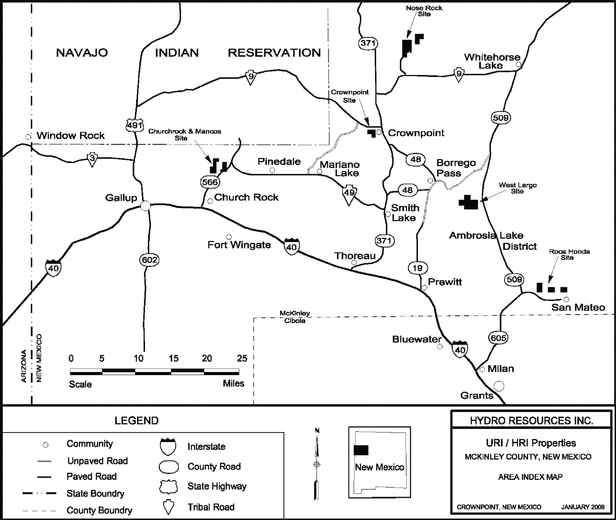

General. We have various interests in properties located in New Mexico, these properties are owned by the Company's wholly owned subsidiary, Hydro Resources, Inc. ("HRI") (Figure 2.7). We have fee lands, patented and unpatented mining claims, mineral leases and some surface leases. We have spent $13.3 million to date on permitting for New Mexico. Additional expenditures will be required and could be material. We are unable to estimate the amount. We expect that these costs will be incurred over multiple years. See "Legal Proceedings" for a discussion of the current status of our license for New Mexico

Figure No. 2.7. Location of New Mexico Properties

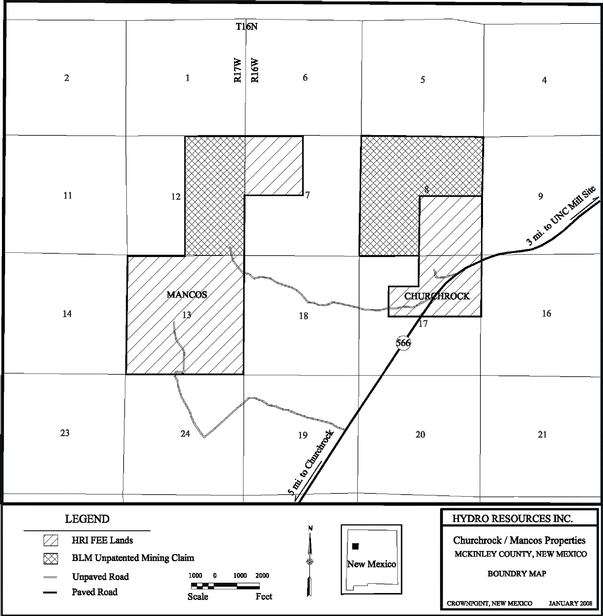

Churchrock/Mancos (Figure 2.8)

The Property. The Churchrock project encompasses about 2,200 gross and net acres. The properties are located in McKinley County, New Mexico and consist of three parcels, known as Section 8, Section 17 and Mancos. None of these parcels lies within the area generally recognized as constituting the Navajo Reservation. See, "Item 3. Legal Proceedings." Access to the Churchrock property is via State Highway 566 and access to Mancos is via 4-wheel drive ranch roads west of State Highway 566.

We own the mineral estate in fee for the NE 1/4 and the SW 1/4 of the NW 1/4 of Section 17, T16N, R16W. In Section 8, T16N, R16W, we own the SE 1/4 in fee and hold the minerals in the rest of the

24

section with 26 unpatented federal mining claims (UNC1A thru UNC 26). For the Mancos Property, we own the minerals in Section 13, T16N, R17W, in fee, the minerals in the NW 1/4 of Section 7, T16N, R16W, in fee and hold the minerals in the E 1/2 of Section 12, T16N, R17W, with 20 unpatented federal mining claims (KP1A thru KP5A, KP19, KP36, 121617-14A thru 121617-18A, 121617-20A thru 121617-23A and 121617-32A thru 121617-35A). The federal unpatented mining claims are all held through the payment of a $125.00 assessment fee each year on each claim.

Mineralization occurs in the Westwater Member of the Morrison Formation at depths of 800 to 1700 feet.

The surface estate on Section 17, Mancos Section 13 and Mancos Section 7 is owned by the United States Government and held in trust for the Navajo Nation. On those sections we have royalty obligations ranging from 5% to 61/4% and a 2% overriding royalty obligation to the Navajo Nation for surface use agreements. The total royalties on Section 8 depend on the sales' price of uranium. Aggregate royalties are potentially as much as 39.25% at the current price of uranium.

Development Plan. We anticipate that Churchrock will be the first of our New Mexico properties we will develop. We spent about $139,000, $219,000 and $421,000 in 2010, 2009 and 2008, respectively, for permitting activities and land holding costs. In December 2006, we entered into a joint venture with Itochu to jointly develop this property and in March 2009 the joint venture was terminated.

Water Rights. The State Engineer approved our water rights application in October 1999 and granted us sufficient water rights for the life of Churchrock.

Permitting Status. We have the radioactive material license for Section 8. This license is subject to the continuing proceedings described under "Legal Proceedings." With respect to the UIC permits, see "Legal Proceedings." We do not plan to pursue permits for Mancos at this time.

25

Figure No. 2.8. Churchrock / Mancos Property Mineral Ownership

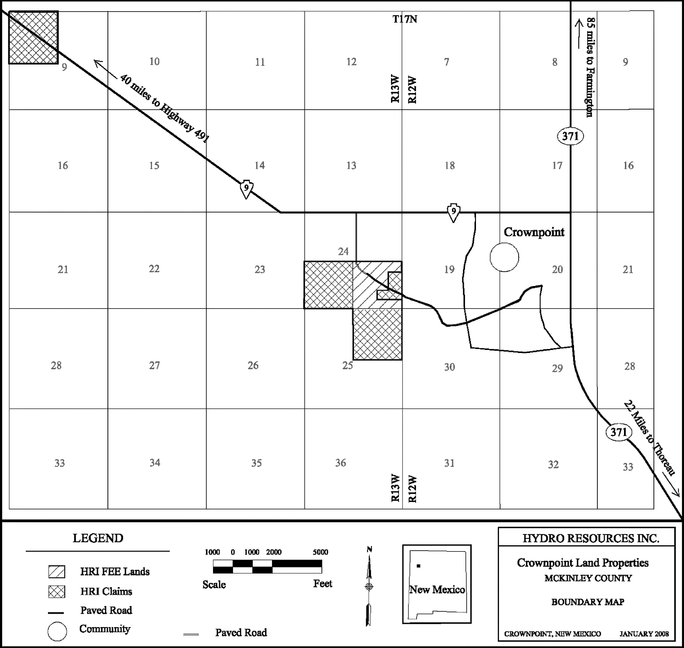

Crownpoint (Figure 2.9)

The Property. The Crownpoint properties are located in the San Juan Basin, 22 miles northeast of our Churchrock deposits and 35 miles northeast of Gallup, New Mexico, adjacent to the town of Crownpoint, New Mexico. The properties consist of 619 gross and 521.8 net acres. We hold the minerals in the NW 1/4 of Section 9, T17N, R13W with 9 unpatented federal mining claims (CP-1 thru CP9) and the minerals in the SW 1/4 of Section 24, T17N, R13W with 10 unpatented federal mining claims (CP-10 thru CP-19). In the SE 1/4 of Section 24, T17N, R13W we own in fee a 40% interest in the minerals on approximately 139 acres and hold 100% of the minerals on 20 additional acres with two unpatented federal mining claims (Consol I and Consol II). In the NE 1/4 of Section 25, T17N, R13W we hold the minerals with eight unpatented federal mining claims (Hydro-1 thru Hydro-8). The federal unpatented mining claims are held through the payment of a $140.00 assessment fee each year on each claim. Access is via paved road from State Highway 371, through the town of Crownpoint to Church Road to the main gate of the property.

26

Mineralization is found in the Westwater Member of the Morrison Formation at a depth of from 2,100 to 2,300 feet. Three pilot shafts were commenced on the property in the early 1980's but were never completed. Surface facilities dating from those activities including buildings and their associated electrical/water infrastructure are still in-place and are currently used as offices and storage facilities.

Development Plan. We spent about $3,000, $3,000 and $127,000 in 2010, 2009 and 2008, respectively, for permitting activities and land holding costs.

Water Rights. The State Engineer approved our water rights application in 2004 and granted us sufficient water rights for ISR operations for the life of Crownpoint Section 24 mining. We have two additional pending applications for appropriations of water, which give us the first two "positions in line" on the hearings list for the San Juan Basin. These additional pending water rights applications may involve a claim of jurisdiction by the Navajo Nation.

Permitting Status. See "Legal Proceedings" for a discussion of the radioactive material license for Crownpoint. The surface estate on Section 19 and 29 is owned by the United States Government and held in trust for the Navajo Nation and may be subject to the same jurisdictional dispute with respect to the UIC permit as for Section 8 and 17 in Churchrock.

27

Figure No. 2.9. Crownpoint Property Mineral Ownership

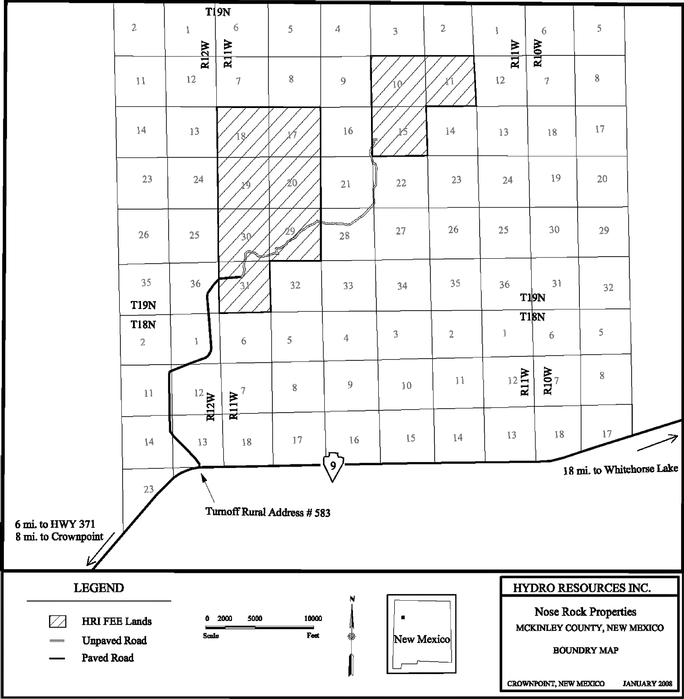

Nose Rock (Figure 2.10)

The Nose Rock property consists of approximately 6,400 acres and is located about 12 miles northeast of Crownpoint, New Mexico. The minerals are held in fee on Sections 10, 11, 15, 17, 18, 19, 20, 29, 30 and 31 all in T19N, R11W. Access to the property is via a 41/2 mile private paved road north of Tribal Road 9. The property was developed by Philips Uranium Corporation in the early 1980's and includes two circular concrete-lined shafts that have been completed to a depth of 3,300 feet. Both shafts have been plugged at surface and just above the Westwater. There is no usable surface infrastructure on site. Mineralization occurs in the Westwater Member of the Morrison Formation.

28

Figure No. 2.10. Nose Rock Property Mineral Ownership

29

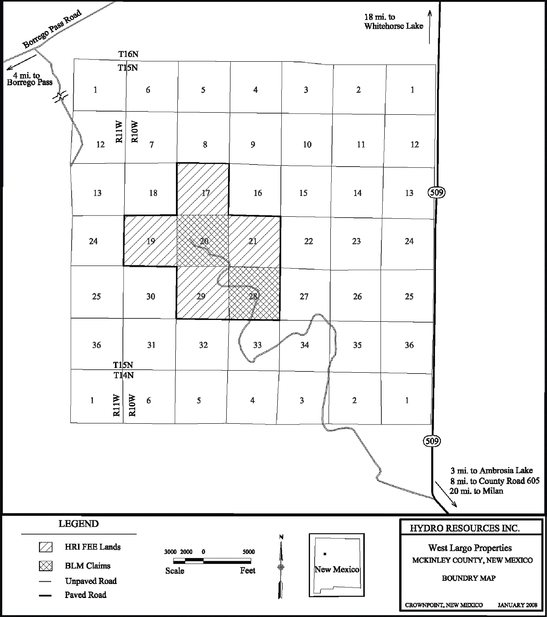

West Largo (Figure 2.11)

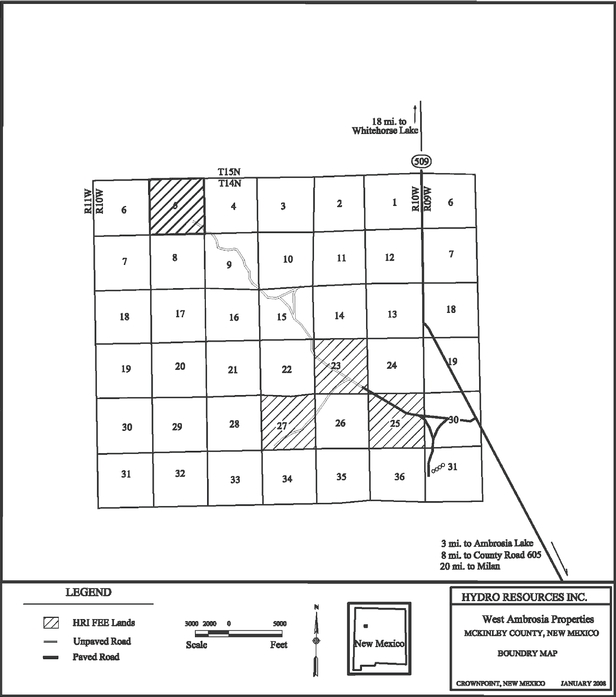

The West Largo property is comprised of six contiguous sections of land located in McKinley County, New Mexico about 21 miles north of the town of Milan, New Mexico and about three miles west of State Highway 509. Access is via a nine-mile 4-wheel drive road from State Highway 509. The minerals on sections 17, 19, 21 and 29 T15N, R10W are held in fee and the minerals on sections 20 and 28 T15N, R10W are held by 75 unpatented federal mining claims (ID21 thru ID91 and ID95 thru ID98). The federal unpatented mining claims are held through the payment of a $125.00 assessment fee each year on each claim.

Mineralization occurs in the Westwater Member of the Morrison Formation at depths ranging from 2,000 to 2,750 feet depending on surface topography. Over 1,000 drill holes were used to define the mineralization in the late 1970's and early 1980's. Other than this exploration drilling, there has been no development on this property.

Figure 2.11. West Largo Property Mineral Ownership

30

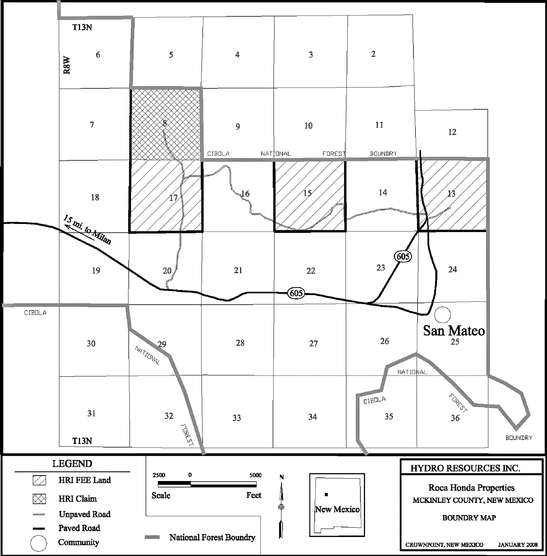

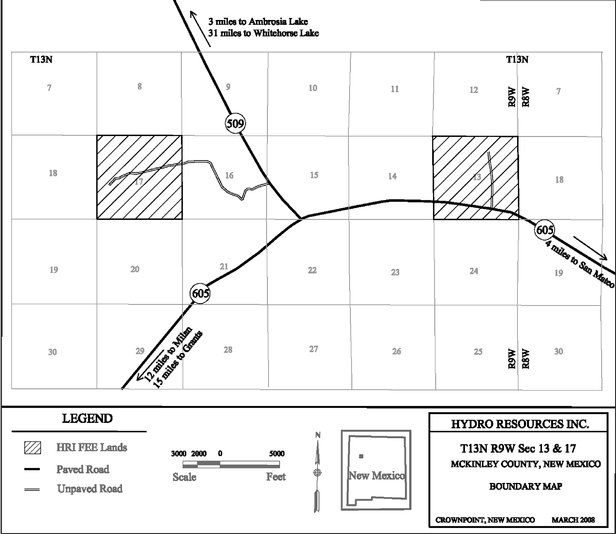

Roca Honda (Figure 2.12)