Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Mattersight Corp | d8k.htm |

| EX-99.1 - PRESS RELEASE - Mattersight Corp | dex991.htm |

REVOLUTIONARY

ANALYTICS.

BREAKTHROUGH

RESULTS.™

eLoyalty Q1 2011

Earnings Webinar

May 12, 2011

Exhibit 99.2 |

REVOLUTIONARY

ANALYTICS.

BREAKTHROUGH

RESULTS.™

eLoyalty

Confidential

and

Restricted

©

2010

eLoyalty

Corporation

2

Safe Harbor Language

During today’s call we will be making both historical and

forward-looking statements in order to help you better

understand our business. These forward-looking statements

include references to our plans, intentions, expectations,

beliefs, strategies and objectives. Any forward-looking

statements speak only as of today’s date. In addition, these

forward-looking statements are subject to risks and

uncertainties that could cause actual results to differ

materially from those stated or implied by the forward-

looking statements. The risks and uncertainties associated

with our business are highlighted in our filings with the SEC,

including our Annual Report filed on Form 10-K for the year

ended January 1, 2011, our quarterly reports on Form 10-Q,

as well as our press release issued earlier today.

eLoyalty undertakes no obligation to publicly update or

revise any forward-looking statements in this call. Also, be

advised that this call is being recorded and is copyrighted by

eLoyalty Corporation. |

REVOLUTIONARY

ANALYTICS.

BREAKTHROUGH

RESULTS.™

eLoyalty

Confidential

and

Restricted

©

2010

eLoyalty

Corporation

Background

On March 17

th

we signed a definitive agreement with Teletech

to sell our ICS business

We expect we will complete this transaction before the end of

Q2

Given this divestiture, the primary focus of the call will be

–

Divestiture Update

–

Behavioral Analytics Overview and Outlook

3 |

Agenda

Q1 Overview

ICS Divestiture Update

Behavioral Analytics Discussion

Q2 Guidance

Q&A |

REVOLUTIONARY

ANALYTICS.

BREAKTHROUGH

RESULTS.™

eLoyalty

Confidential

and

Restricted

©

2010

eLoyalty

Corporation

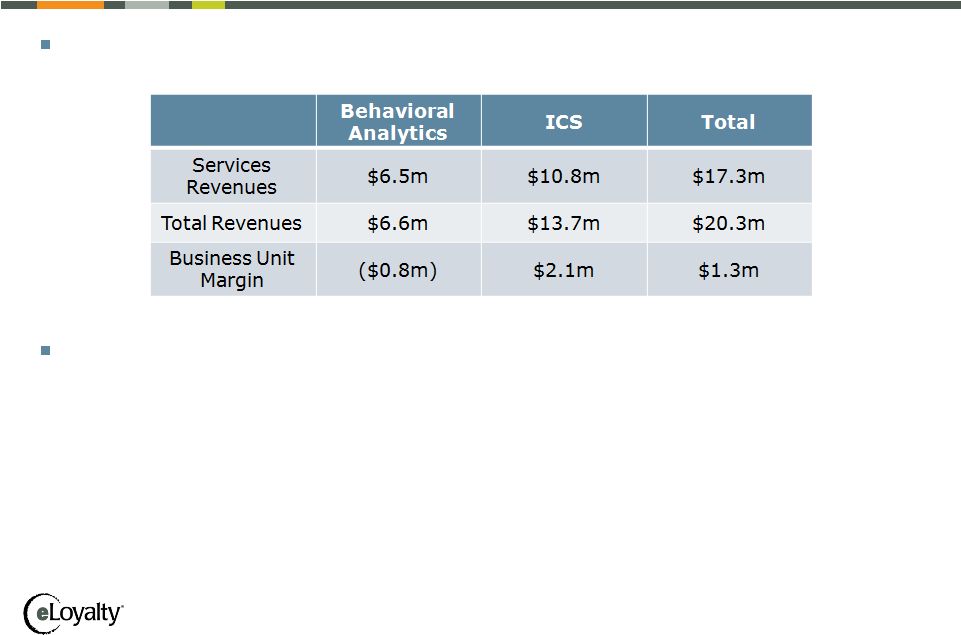

Q1 Review

Q1 Business Unit Overview

Q1 G&A Expenses

–

Q1 G&A Expenses were $3.4 million, excluding stock-based

compensation of $0.3 million

–

This total includes ~$1.5 million related to the ICS divestiture

–

Based on closing the ICS sale, our goal is to reduce our G&A

expenses to ~$1.4 million/quarter by the fourth quarter

5 |

Agenda

Q1 Overview

ICS Divestiture Update

Behavioral Analytics Discussion

Q2 Guidance

Q&A |

REVOLUTIONARY

ANALYTICS.

BREAKTHROUGH

RESULTS.™

eLoyalty

Confidential

and

Restricted

©

2010

eLoyalty

Corporation

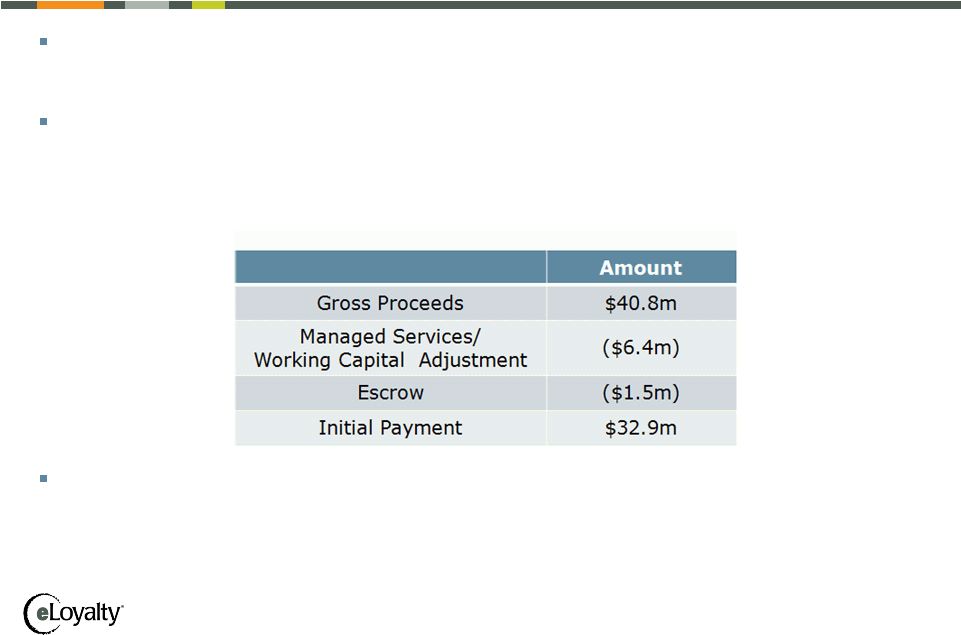

ICS Divestiture Update

On March 17

th

we signed a definitive agreement with Teletech to sell our ICS

business

Subject

to

Shareholder

Approval

on

May

19

th

and

other

customary

closing

conditions, we expect the sale to close before the end of Q2

After the divestiture the company will operate as Mattersight Corporation with

website address www.mattersight.com

Estimated Proceeds

7 |

Agenda

Q1 Overview

ICS Divestiture Update

Behavioral Analytics Discussion

Q2 Guidance

Q&A |

REVOLUTIONARY

ANALYTICS.

BREAKTHROUGH

RESULTS.™

eLoyalty

Confidential

and

Restricted

©

2010

eLoyalty

Corporation

Behavioral Analytics

TM

Backlog (in Millions)

9

Bookings Notes

–

Q3 2010 Bookings were $6.9 million

–

Q4 2010 Bookings were $32.9 million

–

Q1 2011 Bookings were $1.8 million

Backlog

1

Notes

–

Backlog increased 25% on a year over year basis

–

Average remaining duration of the backlog is 35 months; up from 32 months in Q1, 2010

–

Revenue retention rate of Behavioral Analytics subscriptions is ~ 95%

$90.0

$80.0

$70.0

$60.0

$50.0

$40.0

$30.0

$20.0

$10.0

$-

Q1

2010

Q2

2010

Q3

2010

Q4

2010

Q1

2011

$63.9

$59.4

$58.9

$84.5

$80.1 |

REVOLUTIONARY

ANALYTICS.

BREAKTHROUGH

RESULTS.™

eLoyalty

Confidential

and

Restricted

©

2010

eLoyalty

Corporation

2011 Outlook

2011 Revenue Outlook

Sales Team Outlook

–

Started the year with 9 sales personnel

–

Added 9 people to the team year to date

–

Goal is to add 5-6 more over the remainder of the year

P&L Outlook

–

Revenue growth will drive significant P&L leverage

–

Over the next few quarters we expect we will drop 40% to 50% of each incremental

revenue dollar to the bottom line

–

Over the remainder of 2011 we will favor investing in growth over near term

profitability

10

Quarter

Sequential Subscription

Revenue Growth

Q2

5%

Q3

5% to 10%

Q4

10% -

15% |

Behavioral

Analytics: A Managed Analytics Service for the Enterprise

11

Capture

Conversations

Desktop Data

Context Data

Analyze in the Cloud

Millions of Algorithms

Delivered as a Service

Highly Secure Environment

Create

Value

Service

Customer

Retention

Fraud

Back Office

Analytics

Collections

Sales

REVOLUTIONARY

ANALYTICS.

BREAKTHROUGH

RESULTS.™

eLoyalty

Confidential

and

Restricted

©

2010

eLoyalty

Corporation |

REVOLUTIONARY

ANALYTICS.

BREAKTHROUGH

RESULTS.™

eLoyalty

Confidential

and

Restricted

©

2010

eLoyalty

Corporation

Business Model Overview

Enterprise Analytics Footprint

–

Initial deployments in service, sales and collections calls centers; have also deployed

analytics applications for Fraud; Customer Retention and the Back Office

Analytics as a Service in the Cloud

–

We deliver our analytics from the Cloud and virtually all of our

revenues are recurring

Significant Returns for Our Customers

–

Unique Analytics and Delivery Model generates 2x to 10x returns for our customers; these

returns create very high referancablity rates

Impressive Customer List

–

3 of the top 5 HMOs; 3 of the top 4 P&Cs; Top 3 Retail Bank; Largest PBM; Center for

Medicare Large and Sticky Customer Relationships

–

Average $1 million+/year per customer in recurring revenues; and

we expect many customer

relationships will exceed 10 years

Significant Revenue Visibility

–

$80 million of contract Backlog with a 95% revenue retention rate

Increasing Revenue Momentum

–

Signed $42 million of contracts over the past 3 quarters with a strong pipeline

12 |

Agenda

Q1 Overview

ICS Divestiture Update

Behavioral Analytics Discussion

Q2 Guidance

Q&A |

REVOLUTIONARY

ANALYTICS.

BREAKTHROUGH

RESULTS.™

eLoyalty

Confidential

and

Restricted

©

2010

eLoyalty

Corporation

Q2 2011 Guidance

We currently expect Q2 Behavioral Analytics Services revenues

will be ~$6.7 million

We currently expect Q2 ICS Services revenues will be ~$12.0

million

14 |

Agenda

Q1 Overview

ICS Divestiture Update

Behavioral Analytics Discussion

Q2 Guidance

Q&A |

REVOLUTIONARY

ANALYTICS.

BREAKTHROUGH

RESULTS.™

eLoyalty

Confidential

and

Restricted

©

2010

eLoyalty

Corporation

16

Thank You

Kelly Conway

–

(847) 582-7200

–

Kelly_Conway@eLoyalty.com

Bill Noon

–

(847) 582-7019

–

Bill_Noon@eLoyalty.com |

REVOLUTIONARY

ANALYTICS.

BREAKTHROUGH

RESULTS.™

eLoyalty

Confidential

and

Restricted

©

2010

eLoyalty

Corporation

17

Notes

1

eLoyalty uses the term “backlog”

to reflect the estimated future amount of Managed services revenue related to its

Managed services contracts. The value of these contracts is based on anticipated usage

volumes over the anticipated term of the agreement.

The anticipated term of the agreement is based on the contractually agreed

fixed term of the contract, plus agreed upon, but optional, extension periods.

Anticipated volumes may be greater or less than anticipated.

In addition, these contracts typically are cancellable without cause based on the customer

making a substantial early termination payment or forfeiture of prepaid contract

amounts. The reported backlog is expected to be recognized as follows:

$19.6m in 2011; $27.0m in 2012; $19.4m in 2013; $14.1m in 2014 and

thereafter. |