Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - API Technologies Corp. | d8k.htm |

Lender Presentation

Lender Presentation

May 12, 2011

Exhibit 99.1 |

2

Disclaimer Statement

Disclaimer Statement

API Technologies Corp. (“API Technologies” or the

“Company”) makes no express or implied representation or warranty as to the

accuracy or completeness of the information contained in this

presentation or in any additional evaluation materials, whether written

or oral, made available in connection with any further investigation of

the Company. The Company expressly disclaims any and all

liability that may be based on such information, errors therein or

omissions therefrom. In furnishing this presentation, the Company

makes no obligation to provide the recipient with access to any

additional evaluation materials or to update the information contained

herein. This presentation shall neither be deemed an indication of the

state of affairs of the Company nor constitute an indication that

there has been no change in the business affairs of the Company since

the date hereof or since the dates as of which information is

given in this presentation.

This presentation is proprietary and confidential and may not be

reproduced or distributed to others at any time without API

Technologies’ prior written consent.

This presentation may include certain forward looking

statements and projections. Any such statements and projections reflect various

estimates and assumptions concerning anticipated results. No

representations or warranties are made by the Company or any of its

affiliates or representatives as to the accuracy of any such statements

or projections. Whether or not any such forward looking

statements or projections are in fact achieved will depend upon future

events, many of which are not within the Company’s control.

Accordingly, actual results may vary from the projected results and

such variations may be material. Some of the factors that could

affect projected results are included in the Company’s filings

with the Securities and Exchange Commission. Any statements

contained herein describing documents and agreements are summaries only

and are qualified in their entirety by reference to such

documents and agreements.

In addition, this presentation sets forth certain pro forma financial

information. This pro forma financial information gives effect to the

Company’s acquisition of Spectrum Control, Inc. (“Spectrum

Control”) as well as certain other recently completed acquisitions,

including the acquisition of SenDEC Corporation

(“SenDEC”). Such pro forma financial information is based on certain assumptions

and adjustments and does not purport to present API Technologies’

actual results of operations or financial condition had the

transactions reflected in such pro forma financial information occurred

at the beginning of the relevant period, in the case of income

statement information, or at the end of such period, in the case of

balance sheet information, nor is it necessarily indicative of the

results of operations that may be achieved in the future. In addition,

the assumptions underlying certain pro forma financial

information reflect projected cost savings. API Technologies’

ability to achieve these cost savings will depend upon the Company’s

success in implementing cost reduction plans and in integrating

Spectrum Control into its business. API Technologies cannot make

any assurances that these cost savings will be realized within the time

frames expected or at all, and the Company may incur unexpected

costs in integrating Spectrum Control that offset these expected cost savings.

|

3

Agenda

Agenda

Morgan Stanley

Transaction Overview

Vintage Capital Management

Brian Kahn, Managing Partner

Executive Summary

API Technologies

Bel Lazar, President & COO

Company Overview

API Technologies

Bel Lazar, President & COO

Key Investor Highlights

Spectrum Control

Jack Freeman, CFO

Financial Overview

Morgan Stanley

Syndication Summary

Public-Side Q&A |

Transaction Overview

Transaction Overview |

5

Transaction Overview

Transaction Overview

On March 28, 2011, API Technologies entered into a definitive agreement to acquire

Spectrum

Control

for

a

total

enterprise

value

of

approximately

$270MM

(1)

–

$20.00 per share in cash

–

9.0x

LTM

EBITDA

acquisition

multiple

(1)(2)

The acquisition of Spectrum Control will add a wide range of RF / microwave systems

and solutions products to API Technologies’

portfolio, increasing its SAM

(3)

and customer mind

share

The acquisition will be financed with a $200MM first lien term loan and $103MM in

equity from

a

recently

completed

private

placement

with

3

rd

party

investors

–

3.4x

pro

forma

leverage

including

identified

cost

reductions

(4)

–

45% pro forma Debt / Cap

The transaction is expected to close at the end of May 2011

(1)

Excludes fees and expenses

(2)

Based on LTM Adjusted EBITDA of $30.0MM as of February 28, 2011

(3)

Serviceable Addressable Market

(4)

Based

on

LTM

Pro

Forma

Adjusted

EBITDA

of

$59.8MM

as

of

February

28,

2011

including

$7.9MM

of

identified cost reductions |

6

Transaction Details

Transaction Details

Sources & Uses (as of February 28, 2011)

Sources

$MM

Uses

$MM

Cash Flow Revolver of $20MM

–

Cash Acquisition of Spectrum Control

270.3

Term Loan B

200.0

Refinance Spectrum Control Debt

3.4

Cash

Equity

from

3

Party

Investors

102.6

Refinance API Technologies Debt

9.8

Cash from Spectrum Control

3.7

Fees and Expenses (including OID)

14.7

Cost

of

Achieving

Synergies

(1)

2.9

Cash to Balance Sheet

5.2

Total

306.3

Total

306.3

(1)

Change

of

control

payments

to

officers

and

executives

aswell

as

severance

payments

to

employees

(2)

Based

on

LTM

Pro

Forma

Adjusted

EBITDA

of

$59.8MM

as

of

February

28,

2011

including

$7.9MM

of

identified cost reductions

Pro Forma Capital Structure (as of February 28, 2011)

$MM

02/28/11

Adjustments

PF 02/28/11

Cash and Cash Equivalents

13.2

5.2

18.4

Cash Flow Revolver of $20MM

–

–

–

Term Loan B

–

200.0

200.0

Existing API Technologies Debt

11.5

(9.8)

1.7

Total Debt

11.5

201.7

Net Debt / (Cash)

(1.7)

183.3

Equity

151.9

91.6

243.5

Total Capitalization

163.4

445.2

Debt / Capitalization

45.3%

Pro Forma Coverage Ratios

(2)

Total Debt / EBITDA

3.4x

EBITDA / Interest Expense

5.2x

rd |

Executive Summary

Executive Summary |

8

API Technologies Overview

API Technologies Overview

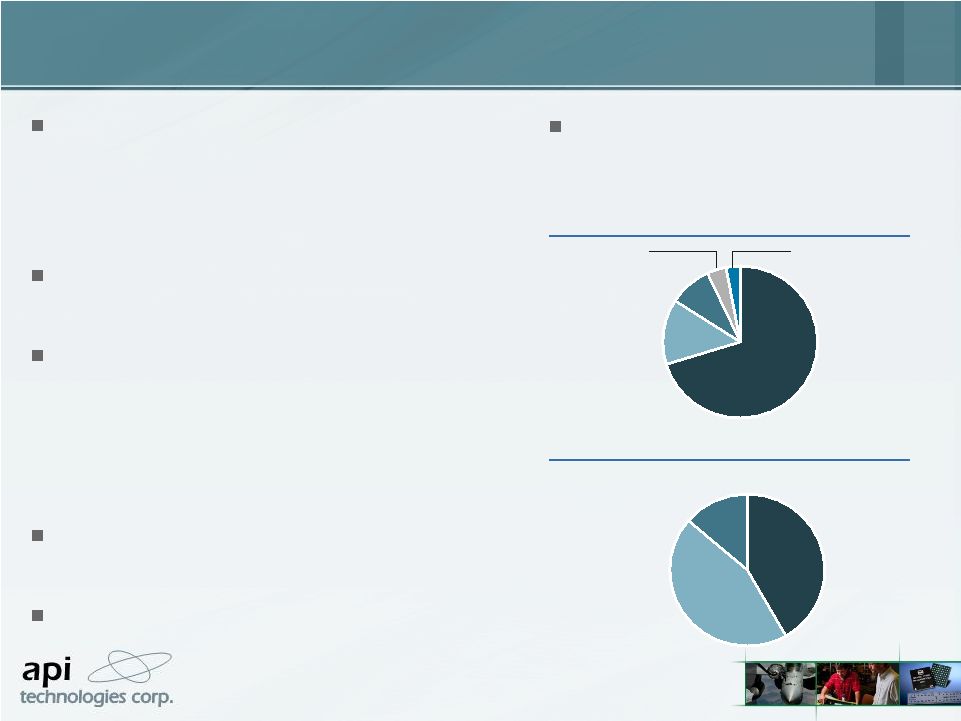

API Technologies designs, develops and

manufactures systems, subsystems, modules, and

secure communications for technically demanding

defense, aerospace, and commercial applications in

the U.S. and internationally

Long-standing strong relationships with all major U.S.

defense suppliers, starting at the design-in phase and

continuing throughout the product life cycle

LTM

(1)

Pro Forma Revenue of $206MM

LTM

(1)

Pro Forma Adjusted EBITDA of $22MM

–

EBITDA margin of 10.7%

6 design and 4 manufacturing facilities in the U.S.,

Canada and the U.K.

672 employees

Headquartered in Orlando, FL

45% owned by Vintage Capital Management

(1)

LTM period ending February 28, 2011

(2)

Electronics Manufacturing Services

LTM

(1)

End

Market

Mix

11%

82%

Defense

Industrial

Commercial /

Consumer

4%

LTM

(1)

Product

Mix

15%

10%

75%

EMS

(2)

Systems &

Subsystems

Solutions

Secure Communications

Aerospace

3% |

9

Spectrum Control Overview

Spectrum Control Overview

16%

17%

5%

60%

Defense

Medical /

Industrial

Communications

Commercial

Aircraft

Consumer 2%

13%

7%

80%

RF &

Microwave

Sensors

Power Systems Management

(1)

LTM period ending February 28, 2011

LTM

(1)

End

Market

Mix

LTM

(1)

Product

Mix

Leader in the design and development of custom

electronics solutions for the defense, aerospace,

communications, industrial, and medical industries

worldwide

One of the widest ranges of RF / microwave solutions

and product offerings worldwide, combined with an

emerging portfolio of complementary products such as

sensors, measurement and power systems

management products

LTM

(1)

Revenue of $167MM

LTM

(1)

Adjusted EBITDA of $30MM

–

EBITDA margin of 17.9%

14 manufacturing sites in the U.S., China, and Mexico

and 12 R&D centers in the U.S.

1,678 employees

Headquartered in Fairview, PA |

10

A Powerful Strategic Combination

A Powerful Strategic Combination

Transforms

API

Technologies

from

an

EMS

(1)

oriented supplier to a proprietary and

differentiated product and solutions focused

company

Adds

$2Bn

RF

/

microwave

SAM

(2)

and

creates a

scalable defense electronics platform

Broadens product offering and provides access

to new growth platforms and programs

–

Deepens value proposition and increases

customer mind share with top tier defense

companies

Provides for the realization of significant cost

savings and cross-selling opportunities

Improves stability and operating margins

44%

14%

42%

LTM

(3)

End Market Mix

LTM

(3)

Product Mix

LTM

(3)

Pro Forma Revenue and

Adjusted EBITDA of $373MM and

$60MM,

respectively

(16.0%

margin)

(4)

EMS

(1)

RF / Microwave /

Sensors / Power

Systems Management

Systems & Subsystems

Solutions

14%

9%

71%

Commercial /

Consumer 3%

Defense

Medical /

Industrial

Communications

Aerospace 4%

(1)

Electronics Manufacturing Services

(2)

Serviceable Addressable Market

(3)

LTM period ending February 28, 2011

(4)

Including $7.9MM of identified cost reductions |

11

Investor Highlights Summary

Investor Highlights Summary

Niche, Market Leading

Positions

Experienced Management

Team

Diverse, Blue-Chip

Customer Base

Attractive End Markets

Significant Cost Reductions /

Synergies

Compelling Financial

Profile

Long-standing, deep relationships with a broad group of leading defense and

commercial companies Over 1,500 customers with exposure to multiple end

markets Diverse and attractive mix of over 350 programs / projects

Digitization of the battlefield drives favorable long-term outlook for defense

electronics manufacturers Attractive

positions

on

growth

defense

platforms

–

e.g.,

C4ISR,

Electronic

Warfare,

IPMEIR,

Missile

Defense, RADAR and UAVs

Niche, high margin opportunities in the medical, industrial, commercial and

consumer industries ~$8MM in identified cost reductions through public

company and corporate cost takeouts and low risk consolidations

Substantial cross-selling opportunities with increased customer mind

share Vertical integration provides capability to function as

self-sufficient supply chain Highly flexible, low cost production base

Strong

cash

flow

profile

driven

by

capex

requirements

below

2%

of

sales

Average industry experience / tenure of 25 years

Extensive

experience

in

the

successful

integration

of

businesses

worldwide

VCM is an operations focused owner with a history of success integrating and

streamlining assets Sole

/

long-term

design-in

or

primary

source

positions

(89%

of

LTM

(1)

sales)

One

of

the

largest

selections

of

RF

/

microwave

filters

for

high

reliability

applications

High degree of technical proficiency and well proven design systems

(1)

LTM period ending February 28, 2011 |

Company Overview

Company Overview |

13

Corporate History

Corporate History

Over 40 years of operating history

Organic growth supplemented with ~1 bolt-on acquisition per year

Focused on growing product content and moving up the defense electronics supply

chain in order to generate higher margins

Formation

1968

1998

Potter

Production

.

1999

AMP Signal

Conditioning

Products

1972

1999

2002

2003

2004

2006

2007

2009

2010

2011

2004

Salisbury

Engineering

(February)

REMEC

Components

(October)

2007

EMF

Systems

2009

Micro

Networks

2010

DRS Signal Solutions

(June)

Sage Laboratories

(June)

Summit Instruments

(October)

2005

JDK Controls

(October)

Amplifonix

(February)

Formation

Filtran

TM Systems

Keytronics

Cryptek

Islip

Transformer

Kuchera

SenDEC

(January)

Formation

SatCon

Electronics

2008

NHI

2006

Advanced

Thermal

Products

2002

FSY

Microwave |

14

Design and manufacture of

electronics and electro-

mechanical systems

Information assurance products

and services for defense and

commercial customers

API Technologies’

Diverse Product Offering

API Technologies’

Diverse Product Offering

(1)

Electronics Manufacturing Services

(2)

LTM period ending February 28, 2011

Secure Communications

EMS

(1)

LTM

(2)

PF Revenue: $155MM

(75% of total)

LTM

(2)

PF Revenue: $20MM

(10% of total)

Custom and off-the-shelf

systems, hybrids, components

and services

Systems & Subsystems

Solutions

LTM

(2)

PF Revenue: $31MM

(15% of total)

Netgard™

Encryption Suite

Lightweight

Com Suite

ION™SA5600

Secure Appliance

TEMPEST VoIP

Phone

Raytheon Circuit

Board Re-Design

IFTE Shelter

Night Vision Test Set

CRATE Adapter

NHi-1565

Dual Transceiver

API™

Tunable

Filter

API™

Hawk i™

Video Aiming Device

Custom Magnetics |

15

API Technologies’

Key Capabilities and

Differentiators

API Technologies’

Key Capabilities and

Differentiators

High degree of technical proficiency which allows early engagement with customers

on new products –

One in six employees is an engineer

–

Winner

of

the

2011

Edison

Award

for

Best

New

Product

and

multiple

“Top

Preferred

Supplier”

award

winner

Products are typically designed in, which ties API Technologies to the customer and

locks in future product sales

–

>95% re-compete win rate; 50% win rate on new contract bids

Decades-long relationships with key defense contractors, including Boeing,

General Dynamics, Lockheed Martin, Northrop Grumman and Raytheon

Supplier of systems and subsystems for major defense programs, including most

jamming and counter jamming programs, radar programs both transmit and

receive functions, portable electronic shelter test equipment and most major

missile programs. Also a supplier to some critical commercial applications,

including custom security devices for a major financial institution

Highly flexible production facilities that can produce quick turnaround single

product prototypes or readily scale for large volume, mil spec production

runs |

16

API Technologies' Key Customer Relationships

API Technologies' Key Customer Relationships

Key Relationships

Top 10 Customers

Tenure

(Years)

Anaren Microwave

6

Boeing

> 20

Canadian Government

> 20

Leading Financial Institution

2

MKS Instruments

12

Northrop Grumman

16

Raytheon

> 20

Syracuse Research

7

Telephonics

6

U.S. Department of Defense

>20

Strong, long-standing relationships

Develop products collaboratively with customers

Direct supplier to the U.S., U.K., and Canadian

governments, with several cleared facilities |

17

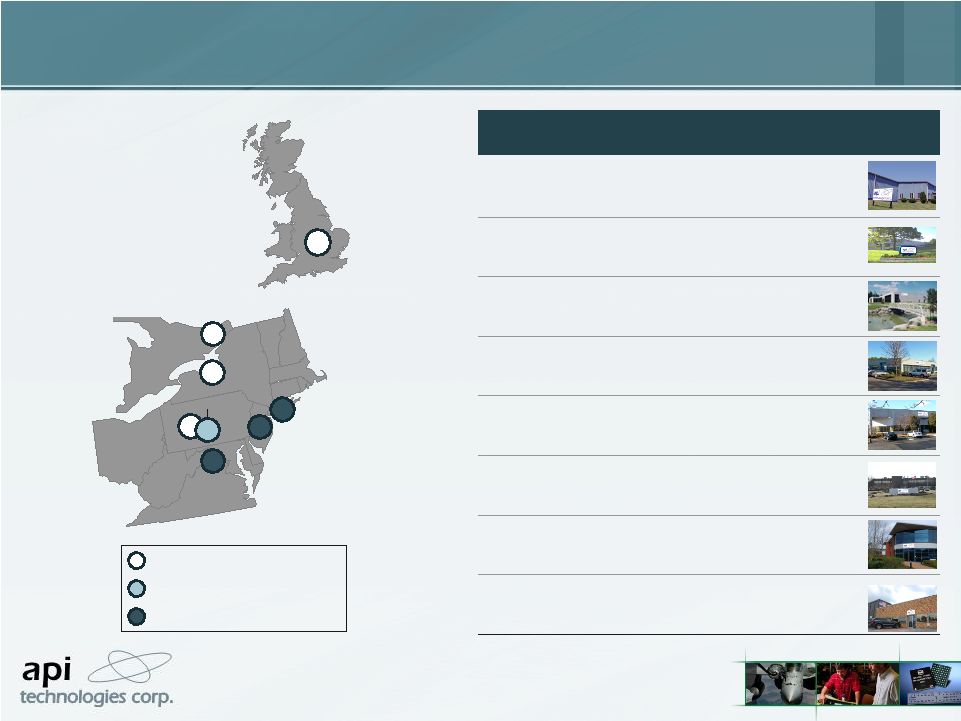

API Technologies’

Manufacturing Footprint

API Technologies’

Manufacturing Footprint

(1)

Approximately 20 miles from Windber facility

(2) Electronics Manufacturing Services

Ronkonkoma, NY

Fairport, NY

Kanata, ON

Windber, PA

Sterling, VA

South Plainfield, NJ

Design & Manufacturing

Manufacturing

Design

Facility

Size

(Sq. Ft.)

Key Products

Alum Bank, PA

(1)

10,000

Subsystems & Systems,

Magnetics

Fairport, NY

80,000

EMS

(2)

Kanata, Canada

30,000

Secure Communications,

Filters & Magnetics

Ronkonkoma, NY

4,100

Subsystems & Systems

South Plainfield, NJ

7,000

Secure Communications

Sterling, VA

17,000

Secure Communications

Waterwells, U.K.

23,000

Secure Communications

Windber, PA

107,000

Flagship Facility, EMS

(2)

,

Subsystems & Systems,

Secure Communications

Waterwells, U.K.

Alum Bank, PA |

18

Spectrum Control’s Highly Diverse Product

Offering

Spectrum Control’s Highly Diverse Product

Offering

Thin Film Hybrids

SAW Modules

Filters and Components

High Power Amplifiers

Data Acquisition (A/D-

D/A)

Integrated Assemblies

and Subsystems

Antennas

Specialty Connectors

Power Film Modules

Filtered Interconnect

Devices

EMI Filters, Components

and Modules

Advanced Ceramics and

Assemblies

Inertia Sensors

Inertial Measurement

Systems

Precision Position

Sensors

Temperature Sensing

Probes & Assemblies

AC Power Strips and

Solutions

AC & DC Sequenced

Power Distribution

AC & DC Power

Monitoring Solutions

Customized Solutions for

Extreme Military

Applications

RF / Microwave

LTM

(1)

Revenue: $82MM

(49% of total)

Advanced Specialty

Products

Sensors

Power Systems

Management

(1)

LTM period ending February 28, 2011

LTM

(1)

Revenue: $51MM

(31% of total)

LTM

(1)

Revenue: $23MM

(14% of total)

LTM

(1)

Revenue: $11MM

(7% of total)

RF / Microwave

Non –

RF / Microwave |

19

15%

14%

35%

14%

22%

11%

10%

13%

16%

24%

12%

14%

17%

8%

54%

11%

10%

10%

90%

Spectrum Control’s Highly Diverse End Markets

Spectrum Control’s Highly Diverse End Markets

Based on LTM

(1)

Revenue

RF / Microwave

Military Comm.

Commercial

Military

Radar

Military

Force Protection

Other

Military

Advanced Specialty Products

Military Aircraft

Military

Comm.

Comm.

Equipment

Aircraft

Comm.

Other Military

Industrial

Comm.

Other Comm.

Sensors

Military Defense

Other Commercial

Other

Military

Med Comm.

Industrial /

Control Comm.

Power Systems Management

Military

Commercial

(1)

LTM period ending February 28, 2011 |

20

Sole / long-term design-in or primary source positions

One

of

the

largest

selections

of

RF

/

microwave

filters

for

high

reliability

applications

worldwide

and a

broad selection of custom integrated microwave assemblies

Extensive vertical integration, including self-sourcing of raw material and

packages, which drives market-leading turnaround times

Highly effective and well proven design systems

–

Team of over 165 creative innovators

–

Large percentage of proprietary processes and technologies

Highly flexible, low-cost facilities

–

Low cost manufacturing facilities in Wesson, MS, Mexico and China

–

All processes, documentation and equipment are standard throughout operations

Deep

customer

relationships

driven

by

total

involvement

early

in

product

design

cycles

and

a

dedicated

focus on customer service

Spectrum Control’s Key Capabilities and

Differentiators

Spectrum Control’s Key Capabilities and

Differentiators |

21

Spectrum Control’s Highly Diverse Customer

Base

Spectrum Control’s Highly Diverse Customer

Base

Key Defense Relationships

Key Commercial Relationships

Top 10 Customers

Tenure

(Years)

Alcatel / Lucent

15

Ciena

10

General Dynamics

> 20

Goodrich

> 20

Harris

7

Lockheed Martin

> 20

Northrop Grumman

> 20

Raytheon

> 20

Rockwell Collins

> 20

Syracuse Research

7

Strong, long-standing relationships

No customer represents more than 10% of sales

Top 10 customers represent less than 40% of sales

Has several DoD-cleared facilities |

22

Spectrum Control’s Highly Diverse Program

Exposure

Spectrum Control’s Highly Diverse Program

Exposure

Defense

Commercial

Communications Equipment (BGAN, CATV, Data Storage, DISA/GOVT

Comm., LNB Converters, Optical Networking, VOIP, Wireless Systems)

Aircraft (A350, A380, B737, B787, VLS)

Medical (Heart Pump, Robotic Surgery, Vascular Injection Systems)

Industrial/Control (Alternative Energy, Cattle Tracking, HVAC, Industrial

Measuring, Mercury I/II Encoder, Refrigeration)

Radar (Airport, Weather)

Missile Defense (Hell Fire, HTS, Hydra, Missile Separation Testing,

Patriot, THAAD)

Communications (AEHF, FAB-T, Falcon, JTRS, Liberty, NMT, WIN-T)

Aircraft (Eurofighter Radar, F16, F18, JSF, UAV’s)

Radar (AEGIS, ARPDD, LAMPS, MMRS, SARS)

Electronic Warfare (AIDEWS, ASPIS, ELINT, Global Hawk, IFM, Peace

Pioneer, Surveillance Receiver)

Force Protection (G/Ator, LCMR, Symphony)

Land Vehicles (DCSS Gen II) |

23

Spectrum Control’s Long History of Revenue

Growth, Profitability and Free Cash Flow Generation

Spectrum Control’s Long History of Revenue

Growth, Profitability and Free Cash Flow Generation

57.2

63.0

80.5

98.4

125.7

136.5

130.7

132.3

163.9

167.3

0

20

40

60

80

100

120

140

160

180

2002

2003

2004

2005

2006

2007

2008

2009

2010

LTM

0

2

4

6

8

10

12

14

16

18

Revenue and Adjusted EBITDA Margin

Free Cash Flow

(1)

1.8

4.2

8.1

7.6

5.1

16.9

14.3

15.3

21.9

23.9

0

5

10

15

20

25

2002

2003

2004

2005

2006

2007

2008

2009

2010

LTM

(1)

Free

Cash

Flow

=

Adjusted

EBITDA

–

Capital

Expenditures

(2)

LTM period ending February 28, 2011

(3)

Spectrum Control no longer has a presence in New Orleans

(2)

(2)

$MM; FY 11/30

$MM; FY 11/30

% Margin

Hurricane Katrina

(3) |

24

Spectrum Control’s Manufacturing Footprint

Spectrum Control’s Manufacturing Footprint

Manufacturing Footprint

Key

RF/Microwave

Sensors

Advanced Specialty Products

Low Cost Manufacturing Centers

Power Systems Management

Corporate

State College, PA

State College, PA

Corporate Office

Fairview, PA

RF/Microwave

Key Products

22,000

Size (Ft²)

Auburn, NY

Facility

Short Metal Fabrication, Film

Capacitor Winding, CNC Multi-

Aris Connector Machining

Key Products

55,000

Size (Ft²)

Wesson, MS

Facility

Commercial Product

Manufacturing –

All Businesses.

Able to produce defense products

under MLA’s

Key Products

50,000

Size (Ft²)

Juarez, Mexico

Facility

Sensors

Key Products

16,000

Size (Ft²)

Grass Valley, CA

Facility

Sensors

Key Products

22,000

Size (Ft²)

Saint Mary’s, PA

Facility

Facility

Key Products

Sensors

12,000

Size (Ft²)

Akron, OH

Fairview, PA

Facility

Advanced Specialty Products

Key Products

43,000

Size (Ft²)

Corporate Offices, Centralized

Services

Key Products

10,000

Size (Ft²)

Fairview, PA

Facility

RF/Microwave, Advanced

Specialty Products, Power

Systems Management

Key Products

250,000

Size (Ft²)

State College, PA

Facility

RF/Microwave

Key Products

15,000

Size (Ft²)

Delmar, DE

Facility

RF/Microwave

Key Products

20,000

Size (Ft²)

Philadelphia, PA

Facility

RF/Microwave

Key Products

43,000

Size (Ft²)

Marlborough, MA

Facility

Key Products

RF/Microwave

39,000

Size (Ft²)

Nashua, NH

Facility

RF/Microwave

Key Products

7,000

Size (Ft²)

Columbia, MD

Facility

Commercial Product

Manufacturing –

All Businesses.

Material Procurement Center for

all businesses

Key Products

70,000

Size (Ft²)

Dongguan, China

Facility

RF/Microwave

Key Products

51,000

Size (Ft²)

Palm Bay, FL

Facility

Owned Facility

*

*

*

*

*

*

*

*

*

* |

Key

Investor Highlights Key Investor Highlights |

26

Investor Highlights Summary

Investor Highlights Summary

Niche, Market Leading

Positions

Experienced Management

Team

Diverse, Blue-Chip

Customer Base

Attractive End Markets

Significant Cost Reductions /

Synergies

Compelling Financial

Profile

Long-standing, deep relationships with a broad group of leading defense and

commercial companies Over 1,500 customers with exposure to multiple end

markets Diverse and attractive mix of over 350 programs / products

Digitization of the battlefield drives favorable long-term outlook for defense

electronics manufacturers Attractive

positions

on

growth

defense

platforms

–

e.g.,

C4ISR,

Electronic

Warfare,

IPMEIR,

Missile

Defense,

RADAR and UAVs

Niche, high margin opportunities in the medical, industrial, commercial and

consumer industries ~$8MM in identified cost reductions through public

company and corporate cost takeouts and low risk consolidations

Substantial cross-selling opportunities with increased customer mind

share Vertical integration provides capability to function as

self-sufficient supply chain Highly flexible, low cost production base

Strong cash flow profile driven by capex requirements below 2% of

sales Sole

/

long-term

design-in

or

primary

source

positions

(89%

of

LTM

(1)

sales)

One

of

the

largest

selections

of

RF

/

microwave

filters

for

high

reliability

applications

High degree of technical proficiency and well proven design systems

(1)

LTM period ending February 28, 2011

Average industry experience / tenure of 25 years

Extensive

experience

in

the

successful

integration

of

businesses

worldwide

VCM is an operations focused owner with a history of success integrating and

streamlining assets |

27

Secure Communications

45%

5%

50%

Other

Primary

Source

RF / Microwave

Advanced Specialty Products

28%

17%

55%

60%

6%

34%

Sensors

Power Systems Management

54%

46%

100%

Sole

Source

Primary

Source

Other

Sole

Source

Other

Primary

Source

Primary

Source

(1)

Electronics Manufacturing Services

(2)

LTM period ending February 28, 2011

One

of

the

largest

selections

of

high

reliability

RF

/

microwave

systems

and

solutions

offerings

worldwide, with 7 filter platforms

~90%

of

EMS

(1)

business

is

“Copy

Exact,”

resulting

in

high

customer

switching

costs

Differentiated products with a large percentage of sole source positions

Niche, Market Leading Positions

Niche, Market Leading Positions

Sole

Source

Sole

Source

EMS

60%

5%

35%

Other

Primary

Source

Sole

Source

Systems & Subsystems

Solutions

10%

10%

80%

Primary

Source

Other

Sole

Source

Sole

Source

API Technologies

(2)

Spectrum Control

(2) |

28

Diverse, Blue-Chip Customer Base

Diverse, Blue-Chip Customer Base

Long-standing, deep relationships built on

customer collaboration

Over 1,500 customers

Serve all the key defense contractors and a

range of leading commercial companies

Direct supplier to the U.S., U.K and

Canadian governments

Exposed to multiple end markets

Top 10 Customers

Tenure

# of Programs / Projects

> 20

6

> 20

6

7

29

Leading Financial

Institution

2

1

> 20

22

12

21

> 20

12

> 20

38

7

7

6

3 |

29

Pro Forma Program / Project Exposure

(1)

25.5%

1.6%

5.5%

5.5%

49.8%

Major Jamming and Anti-jamming Programs

Black Secure Communication Programs

Major U.S. DoD Air-to-Air Missile Programs

Major Financial Institution/Security Device

U.S. Government R&D Programs, 1.5%

Data Storage, 1.4%

Ship Turbine Generators Electronics, 1.3%

Major Helicopter and Fighter Jets Programs, 1.3%

Military Radios, 1.2%

Optical Network, 1.1%

Counter Mortar Radar, 1.0%

Portable Jamming Device, 0.9%

Wireless Data Storage, 0.8%

RF/SatCom Program, 0.8%

Other

HVAC, 0.8%

Diverse and Attractive Program / Project

Exposure

Diverse and Attractive Program / Project

Exposure

Over 350 programs / projects

Top 15 programs / projects represent only 50% of sales

(1)

Based on pro forma revenues for the LTM period ending February 28, 2011

|

30

297

328

365

377

400

411

432

480

513

531

526

143

145

150

153

155

204

215

221

220

233

113

118

126

130

137

75

76

74

71

69

316

345

437

468

479

535

601

667

666

693

685

671

571

586

598

611

553

0

150

300

450

600

750

FY01

FY02

FY03

FY04

FY05

FY06

FY07

FY08

FY09

FY10

FY11

FY12E

FY13E

FY14E

FY15E

FY16E

Department of Defense Budget

Source: Department of Defense Comptroller

$Bn

Supplementals (“OCO”War Funding)

Base Discretionary Budget Authority

Construction, Housing & Other

Military Personnel

Procurement

Operation & Maintenance

RDT&E, Total Discretionary Base Budget

Attractive End Markets

Attractive End Markets

10.6

11.6

12.5

13.3

8.6

9.5

0.0

2.0

4.0

6.0

8.0

10.0

12.0

14.0

16.0

2010A

2011E

2012E

2013E

2014E

2015E

Cyber / Intel Funding Forecast

$Bn

Source: INPUT Research

Positioned to benefit from the continued digitization of the battlefield

–

High content on future platforms

–

Retrofitting and upgrade of existing equipment and technologies

Growing numbers of applications in secure data transmission and precision remote

object guidance are driving increased demand for RF and microwave

technologies Next generation communications systems are driving a critical

need for bandwidth across defense, aerospace and industrial end

markets Further diversified into growing, high margin opportunities within

the medical, industrial, commercial and consumer industries |

31

Public Company Costs

–

Audit fees

–

Director fees

–

Financial public relations

–

D&O insurance

Corporate Head Office Costs

–

HQ operating expenses

–

President & CEO

–

CFO

Cost Reduction and Consolidation Activities

–

Segment consolidations

–

Facility consolidations

–

Transfer of commercial product

platforms to China / Mexico

–

Centralization of sales, marketing,

planning and purchasing

–

Elimination of external machining

New Corporate Staff

–

New President & COO

–

New CFO

Significant Cost Reductions / Synergies

Significant Cost Reductions / Synergies

(1)

LTM period ending February 28, 2011

Cost Reductions Summary

59.8

(1.1)

5.9

1.6

1.4

51.9

44

46

48

50

52

54

56

58

60

62

64

LTM

Adj. EBITDA

Public

Company Costs

Corporate Head

Office Costs

Cost

Reductions

& Consolidation

Activities

New

Corporate

Staff

LTM

Adj. EBITDA +

Synergies

Cost Reductions / Synergies = $7.9MM

$MM

(1)

(1) |

32

Highly Flexible, Low Cost Production

Base

Highly Flexible, Low Cost Production

Base

Production Base

Differentiators

Description

Vertical Integration

Self-sufficient and autonomous supply chain at Spectrum Control

Extremely quick new design turnarounds

Short

product

lead-times

-

less

than

4

weeks

High Flexibility

Non-unionized work force with at will contracts

Majority of facilities operate single shifts

Low Cost

Facilities in Wesson, MS, Mexico and China

Mexico facility has certifications to produce cost-sensitive ITAR

controlled products

Low Capital Requirements

CapEx / Sales of ~1.5% |

33

Experienced Management Team

Experienced Management Team

Jack Freeman, CFO of Spectrum Control

Appointed to the position of CFO of Spectrum Control in 1990

Previously was a Principal with the Certified Public Accounting firm of Root,

Spitznas & Smiley, Inc. Holds a B.A. in Accounting from Gannon

University and CPA and CMA certifications Ken Fiske, CEO, SenDEC

Founded SenDEC in 1972

Previously worked for Xerox Corporation as an engineer, technical specialist, and

engineering manager Completed advanced studies at both the University of

Rochester and the Rochester Institute of Technology Steve Pudles, CEO, API

Defense USA Joined API in 2008, bringing more than 25 years of electronics

industry experience Previously

was

President

and

CEO

of

Nu

Visions

Manufacturing

and

Executive

Vice

President

of

OnCore

Manufacturing

Holds a M.S. and B.S. of Engineering from Stevens Institute of Technology

Bob McKenna, Senior Vice President, Spectrum Control

Joined Spectrum Control in 1991 and became SVP of New Business Development in

2001 Has progressed through positions in administration, operations (P/L)

and global sales Holds a B.S. Degree from Gannon University and graduate

studies at St. Mary’s and Edinboro Universities Bel Lazar, President

& COO of API Technologies Over 25 years of experience in the defense,

semiconductor and technology sectors Most recently served as the Senior Vice

President of Operations at Microsemi Corporation Previously spent over 22

years at International Rectifier in expanding leadership and general management roles, culminating

as Vice President of the Company’s Aerospace & Defense business unit

Has completed over 25 consolidations within the Aerospace & Defense

electronics sector Holds a B.S. in Engineering from California State

University, Northridge, a M.S. degree in Computer Engineering from the

University of Southern California, and a Juris Doctor degree from Southwestern

University School of Law |

Financial Overview

Financial Overview |

35

Presentation of Historical Financials

Presentation of Historical Financials

Historical results for 2010 and the LTM period ended February 28, 2011 are

presented on a combined pro forma basis for API Technologies and Spectrum

Control –

API Technologies’

results are pro forma for its acquisitions of SenDEC and the Kuchera Companies

(“Kuchera”) Historical results for 2007, 2008 and 2009 are

presented on a combined basis for API Technologies, SenDEC

and

Spectrum

Control

without

adjusting

for

API

Technologies’

acquisitions

of

Kuchera

and

Cryptek

–

For

FYE

06/30/09,

Kuchera

Defense

had

revenues

of

$48MM

and

gross

profit

of

$11MM

(1)

–

For

FYE

12/31/08,

Kuchera

Industries

had

revenues

of

$21MM

and

gross

profit

of

$7MM

(1)

–

For

FYE

12/31/08,

Cryptek

had

revenues

of

$34MM

and

gross

profit

of

$10MM

(2)

Adjusted EBITDA is presented excluding:

–

Stock based compensation

–

One-time charges including restructuring charges and acquisition related

expenses –

Discontinued operations

–

Already completed cost take-outs and consolidations at API Technologies, the

benefits of which are not fully reflected in its most recent reported

financial results –

Identified cost savings associated with the acquisition of Spectrum Control

Historicals results are presented on a November 30 fiscal year basis:

–

API Technologies results derived from filed May 30 year end 10-Ks and

10-Qs –

SenDEC

results

derived

from

monthly

accounts

(3)

–

Spectrum

Control

results

derived

from

filed

November

30

year

end

10-Ks

and

10-Qs

(1)

See

API

Technologies’

8-K

filed

on

March

2,

2010

(2)

See

API

Technologies’

8-K

filed

on

December

24,

2009

(3)

SenDEC had a financial year end of July 31 prior to its acquisition by API

Technologies |

36

Historical Financials

Historical Financials

$MM; FYE 11/30

Not Pro Forma

(1)

2007A

2008A

2009A

2010A

PF LTM 2/28/11

API Technologies

27.2

29.9

32.8

110.0

101.1

SenDEC

47.5

32.6

47.4

107.5

104.8

Spectrum Control

136.5

130.7

132.3

163.9

167.3

Revenue

$211.2

$193.2

$212.4

$381.4

$373.1

API Technologies

7.1

4.3

8.0

28.1

24.5

SenDEC

10.3

4.6

7.9

16.3

15.5

Spectrum Control

36.4

32.8

34.4

44.1

45.4

Synergies

–

–

–

–

2.1

Gross Profit

$53.8

$41.7

$50.3

$88.5

$87.5

% Margin

25.5%

21.6%

23.7%

23.2%

23.5%

API Technologies

0.8

0.1

2.6

9.9

12.9

SenDEC

5.9

0.0

2.9

9.4

9.1

Spectrum Control

22.7

18.8

19.2

28.3

30.0

Synergies

–

–

–

–

7.9

Pro Forma Adjusted EBITDA

(2)

$29.4

$19.0

$24.7

$47.6

$59.8

% Margin

13.9%

9.8%

11.6%

12.5%

16.0%

API Technologies

0.8

0.6

0.2

2.5

2.4

SenDEC

0.5

0.9

0.6

2.0

3.6

Spectrum Control

5.8

4.4

4.0

6.4

6.1

Capex

$7.1

$5.9

$4.7

$10.9

$12.1

% Revenues

3.4%

3.0%

2.2%

2.9%

3.2%

(1)

2007

–

2009

are

not

pro

forma

for

API

Technologies’

acquisitions

of

Cryptek

and

Kuchera

(2)

See EBITDA reconciliation on page 38

Note: Information for SenDEC reflects only that portion of SenDEC’s business

acquired by API Technologies |

37

Pro Forma Balance Sheet

Pro Forma Balance Sheet

$MM; as of 2/28/11

API Technologies

(1)

Spectrum

Control

(2)

Adjustments

Pro Forma

Assets

Current Assets

Cash

13.2

3.7

1.5

18.4

Marketable Securities

0.3

–

–

0.3

Accounts Receivable

21.1

28.6

–

49.7

Inventory

36.0

39.3

–

75.2

Prepaid Expenses and Others

1.6

4.4

–

6.0

Total Current Assets

$72.2

$76.0

$1.5

$149.6

Property and Equipment, Net

16.9

28.6

–

45.5

Other Assets

New Goodwill

–

–

150.9

150.9

Existing Goodwill

87.0

45.9

(45.9)

87.0

Intangibles

8.6

9.3

50.3

68.2

Other Assets

–

1.7

–

1.7

Transaction Costs / Financing Fees

–

–

6.7

6.7

Total Other Assets

$95.7

$56.9

$162.0

$314.6

Total Assets

$184.7

$161.5

$163.5

$509.7

Liabilities

and

Shareholders’

Equity

Current Liabilities

Accounts Payable

19.7

11.3

–

31.0

Accrued Expenses and Other

1.3

1.5

–

2.8

Total Current Liabilities

$21.0

$12.9

–

$33.9

Deferred Taxes

0.3

11.3

18.6

30.2

Other Noncurrent Liabilities

–

0.4

–

0.4

Total Debt

Existing Bank Debt

0.7

3.4

(4.1)

–

Existing Seller Note Payable

9.1

–

(9.1)

–

Mortgage Loan & Capital Lease Payable

1.7

–

–

1.7

New Senior Secured Term Loan B

–

–

200.0

200.0

Total Debt

$11.5

$3.4

$186.8

$201.7

Shareholders’

Equity

Common Stock

151.9

133.5

(41.9)

243.5

Total Shareholders’

Equity

$151.9

$133.5

($41.9)

$243.5

Total Liabilities & Shareholder’s Equity

$184.7

$161.5

$163.5

$509.7

(3)

(3)

(3)

(4)

(5)

(4)

(6)

Memo:

Liquid

assets

(7)

cover

56%

of

total

debt;

Hard

assets

(8)

cover

78%

of

total

debt |

EBITDA

Reconciliation EBITDA Reconciliation

$MM; FY 11/30

Not Pro forma

(1)

2007A

2008A

2009A

2010A

LTM 2/28/11

API Technologies (Stand Alone)

EBITDA (Unadjusted)

(1.1)

(7.4)

(0.9)

3.5

(3.8)

+ Stock Based Compensation

1.0

0.9

1.1

1.4

0.8

+ Restructuring Charges

(2)

–

0.7

0.4

3.5

3.3

+ Acquisitions Related Charges

(3)

–

–

1.1

1.4

6.6

+ Provision for Inventory Writedown

(4)

–

2.8

–

–

–

+ Costs from NanoOpto

(Discontinued Operations)

(5)

0.9

3.1

0.9

–

–

Adjusted API Technologies EBITDA

0.8

0.1

2.6

9.9

7.0

+ Corporate Office Cost Reductions (Toronto)

(6)

–

–

–

–

1.3

+

Existing

Consolidations

Still

to

be

Realized

(7)

–

–

–

–

2.1

+ New API Cost Reduction Plan

(8)

–

–

–

–

2.5

= Pro Forma Adjusted API Technologies EBITDA

$0.8

$0.1

$2.6

$9.9

$12.9

SenDEC

(Stand Alone)

EBITDA (Unadjusted)

2.5

(0.1)

2.9

7.9

0.4

+ Stock Based Compensation

2.1

–

–

0.1

0.1

+ Extraordinary Bonus

(9)

1.2

0.1

–

1.3

1.3

+ Acquisition Related Charges

(3)

–

–

–

–

7.3

= Adjusted SenDEC

EBITDA

$5.9

$0.0

$2.9

$9.4

$9.1

Spectrum Control

EBITDA (Unadjusted)

22.7

18.5

19.3

27.3

28.9

+ Stock Based Compensation

0.0

0.3

0.4

0.6

0.7

+ Acquisition Related Charges

(10)

–

–

–

0.4

0.4

-

Gain

on

Insurance

Recovery

(11)

–

–

(0.5)

–

–

= Adjusted Spectrum Control EBITDA

$22.7

$18.8

$19.2

$28.3

$30.0

= Pro Forma Adjusted EBITDA (without synergies)

$29.4

$19.0

$24.7

$47.6

$51.9

+

Spectrum

Synergies

(Run-Rate)

(12)

–

–

–

–

7.9

= Pro Forma Adjusted EBITDA (with synergies)

$29.4

$19.0

$24.7

$47.6

$59.8

38

(1)

2007 – 2009 are not pro forma for acquisitions, of Cryptek and Kuchera

(2)

Related to cost cutting initiatives to rationalize the number of API Technologies’ facilities

from 8 to 3 following the acquisitions of Cryptek and Kuchera (3)

Fees and expenses related to the acquisitions of Cryptek, Kuchera and SenDEC

(4)

Accounting charge versus prior period regarding treatment of slow moving inventory

(5)

API Technologies sold the assets of NanoOpto on June 15, 2010

(6)

Elimination of legacy SenDEC corporate office costs post the acquisition

(7)

Run rate cost savings from completed consolidation of Long Island facility to Windber, PA

(8)

Identified headcount reductions to be completed by May 31, 2011

(9)

Distributions to former equity owners of SenDEC

(10)

Fees and expenses related to the acquisitions of Summit Instruments, Sage Laboratories and DRS –

Signal Solutions (11)

Excess of insurance recoveries over the carrying value of certain assets destroyed in two separate

involuntary conversions (12)

See page 31 for details

|

Syndication Summary

Syndication Summary |

40

Targeted Transaction Timetable

Targeted Transaction Timetable

April

Sun

Mon

Tue

Wed

Thu

Fri

Sat

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

May

Sun

Mon

Tue

Wed

Thu

Fri

Sat

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

March 28, 2011

API Technologies entered into a definitive agreement to acquire

Spectrum Control

May 4, 2011

Spectrum Control proxy filed with the SEC

May 7, 2011

End of Spectrum Control Go-Shop Period

May 12, 2011

Bank Meeting

May 26, 2011

Lender Commitments Due

May 27, 2011

Spectrum

Control

Shareholders’

Meeting

Week of May 30, 2011

Closing of Acquisition and Credit Facilities

Bank Holiday

End of Go-Shop Period

Key Dates |

41

Preliminary Summary of Terms

Preliminary Summary of Terms

Summary of Indicative Terms

Borrower:

API Technologies Corp.

Facilities:

Tranche

Amount

Maturity

Pricing

Unused Fee

Revolver

$20 million

3 Years

TBD

50 bps

Term Loan B

$200 million

7 Years

TBD

N/A

Lead Arranger:

Morgan Stanley

Admin Agent:

Morgan Stanley

Guarantors:

All existing and future wholly-owned direct and indirect material U.S. and

Canadian subsidiaries Security:

First priority lien on substantially all assets of the Borrower and the

Guarantors Term Loan Amortization:

1% per annum with balance due at maturity

Optional Prepayments:

101% soft-call for Year 1; pre-payable at par thereafter

Mandatory Prepayments:

•

To include 100% of debt issuances, 100% of asset sales and 50% of excess cash flow

with step- downs to 25% and 0% based on leverage

Financial Covenants:

•

Usual and customary for transactions of this type, including the following:

(i) Maximum Total Leverage

(ii) Minimum Interest Coverage

Negative Covenants:

Usual and customary for transactions of this type, including limitations on

indebtedness, liens, asset sales, mergers and consolidation, restricted

payments, capital expenditures, sale leasebacks, investments and

acquisitions |

Public-Side Questions & Answers

Public-Side Questions & Answers |

Appendix

Appendix |

44

Net Income to EBITDA Reconciliation

Net Income to EBITDA Reconciliation

(1)

Not

pro

forma

for

API

Technologies’

acquisitions

of

Cryptek

and

Kuchera

$MM; FY 11/30

Not Pro Forma

(1)

2007A

2008A

2009A

2010A

LTM 2/28/11

API Technologies (Stand Alone)

Net Income: (Unadjusted)

(2.2)

(7.4)

(6.4)

(6.1)

(11.8)

+ Income Taxes

0.1

(0.5)

0.1

0.0

0.2

+ Interest Expense

0.1

0.2

0.2

4.4

7.2

+ Depreciation & Amortization

0.9

1.2

0.9

1.6

1.6

+/-

Discontinued Operations

-

-

6.1

3.8

(0.2)

+/-

Other Expense (Income), Net

0.0

(0.8)

(1.7)

(0.2)

(0.9)

API Technologies Unadjusted EBITDA

$(1.1)

$(7.4)

$(0.9)

$3.5

$(3.8)

SenDEC (Stand Alone)

Net Income: (Unadjusted)

0.9

(0.9)

1.0

4.0

(1.4)

+ Income Taxes

0.4

(0.4)

0.6

2.5

0.2

+ Interest Expense

0.3

0.2

0.1

0.3

0.3

+ Depreciation & Amortization

0.9

1.1

1.2

1.2

1.3

+/-

Other Expense (Income), Net

(0.0)

(0.0)

(0.1)

0.0

0.0

SenDEC Unadjusted EBITDA

$2.5

$(0.1)

$2.9

$7.9

$0.4

Spectrum Control

Net Income: (Unadjusted)

11.1

8.9

8.6

12.8

13.7

+ Income Taxes

6.4

4.6

4.8

7.5

7.7

+ Interest Expense

0.6

0.4

0.2

0.1

0.1

+ Depreciation & Amortization

4.8

5.2

5.7

6.9

7.3

+/-

Other Expense (Income), Net

(0.3)

(0.5)

0.0

0.0

0.1

Spectrum Control Unadjusted EBITDA

$22.7

$18.5

$19.3

$27.3

$28.9

= Pro Forma Unadjusted EBITDA

$24.1

$11.1

$21.4

$38.8

$25.4 |