Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - OCCIDENTAL PETROLEUM CORP /DE/ | form8k-20110428.htm |

| EX-99.1 - EXHIBIT 99.1 - OCCIDENTAL PETROLEUM CORP /DE/ | ex99_1-20110428.htm |

| EX-99.2 - EXHIBIT 99.2 - OCCIDENTAL PETROLEUM CORP /DE/ | ex99_2-20110428.htm |

| EX-99.3 - EXHIBIT 99.3 - OCCIDENTAL PETROLEUM CORP /DE/ | ex99_3-20110428.htm |

| EX-99.5 - EXHIBIT 99.5 - OCCIDENTAL PETROLEUM CORP /DE/ | ex99_5-20110428.htm |

EXHIBIT 99.4

Occidental Petroleum Corporation

First Quarter 2011 Earnings Conference Call

April 28, 2011

First Quarter 2011 Earnings Conference Call

April 28, 2011

1

2

First Quarter 2011 Earnings - Highlights

First Quarter 2011 Earnings - Highlights

• Core Results - $1.6 Billion vs. $1.1 Billion in 1Q10

– Core EPS $1.96 (diluted) vs. $1.35 in 1Q10.

• Non-core items amounted to a net after-tax charge of

$44 mm, which included:

$44 mm, which included:

– pre-tax gain of $225 mm from the sale of the Argentine operations;

– pre-tax gain of $22 mm from the sale of an interest in a Colombia

pipeline, and;

pipeline, and;

– pre-tax charges of $163 mm related to the early redemption of $1.4

billion face value of debt;

billion face value of debt;

– pre-tax write-off of $35 mm for the entire accumulated cost of

exploration properties in Libya, and;

exploration properties in Libya, and;

– non-recurring charges for state and foreign taxes of $62 mm.

• Net Income - $1.5 Billion vs. $1.1 Billion in 1Q10

– EPS $1.90 (diluted) vs. $1.31 in 1Q10.

2

3

*See the Investor Relations Supplemental Schedules for the 2010 quarterly realized prices and production and

sales volumes reflecting these changes.

sales volumes reflecting these changes.

First Quarter 2011 Earnings - Oil & Gas Operations

First Quarter 2011 Earnings - Oil & Gas Operations

• We reorganized our Permian operations into two

business units.

business units.

– One unit will hold the CO2 flood assets and the other will

operate the conventional production.

operate the conventional production.

– In connection with these, we moved the production from

Southwest Texas, which was previously part of Midcontinent

and other, into the Permian.

Southwest Texas, which was previously part of Midcontinent

and other, into the Permian.

– Midcontinent and other includes production from the recently

acquired South Texas and North Dakota properties.

acquired South Texas and North Dakota properties.

• Natural Gas Liquids account for about 10% of our oil and

gas volumes and sell at a discount to crude oil.

gas volumes and sell at a discount to crude oil.

– Starting this quarter, we are reporting NGL and crude oil

production and sales volumes separately as opposed to the

previously disclosed combined liquids volumes.*

production and sales volumes separately as opposed to the

previously disclosed combined liquids volumes.*

3

4

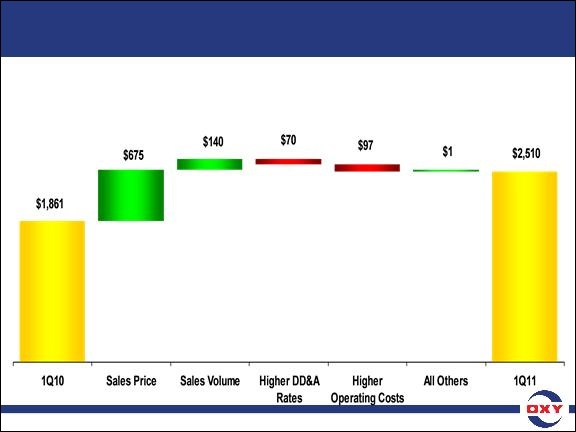

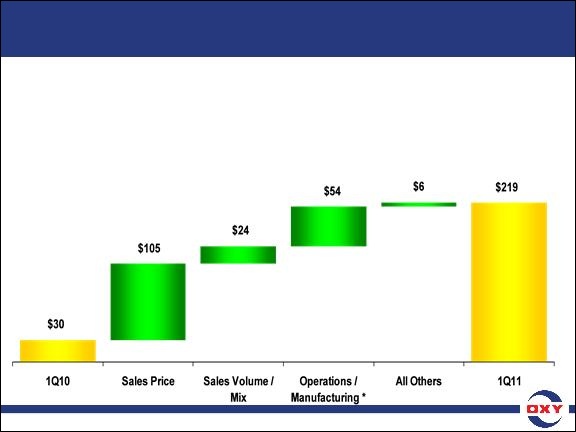

($ in millions)

• Core Results for 1Q11 of $2.5 Billion vs. $1.9 Billion in 1Q10

– Realized prices increased 24% for crude oil in 2011 and 11% for NGL prices on a year-over-

year basis but domestic natural gas prices declined 25% from 1Q10.

year basis but domestic natural gas prices declined 25% from 1Q10.

First Quarter 2011 Earnings - Oil & Gas

Segment Variance Analysis - 1Q11 vs. 1Q10

Segment Variance Analysis - 1Q11 vs. 1Q10

4

5

First Quarter 2011 Earnings - Oil & Gas Segment

1Q11 4Q10

Oil and Gas Production Volumes (mboe/d) 730 714

• The production guidance we gave you in last quarter’s conference call of 740

to 750 mboe/d was at an $85 average oil price assumption.

to 750 mboe/d was at an $85 average oil price assumption.

• The actual average 1Q11 oil price reduced our production volumes by about

10 mboe/d, including 1 mboe/d at THUMS in Long Beach.

10 mboe/d, including 1 mboe/d at THUMS in Long Beach.

• As previously disclosed, our Iraq production was lower by ~ 9 mboe/d due to

less than planned spending levels as we are in start-up phase of operations.

less than planned spending levels as we are in start-up phase of operations.

• Inclement weather, mainly in Texas, caused an additional reduction of about

7 mboe/d.

7 mboe/d.

• These reductions were offset by less than expected production loss from the

Elk Hills maintenance shutdown and operational enhancements providing

higher than expected production in Colombia, Yemen, Qatar and the new

assets resulting in production of 730 mboe/d.

Elk Hills maintenance shutdown and operational enhancements providing

higher than expected production in Colombia, Yemen, Qatar and the new

assets resulting in production of 730 mboe/d.

• 1Q11 production volumes of 730 mboe/d compared to 4Q10 production of 714

mboe/d, included 25 mboe/d from new domestic acquisitions in South Texas

and the North Dakota Williston Basin.

mboe/d, included 25 mboe/d from new domestic acquisitions in South Texas

and the North Dakota Williston Basin.

5

6

750

(10)

740

(9)

731

(7)

724

Earlier 1Q11 Guidance Range

Price Impact

Guidance Adjusted for Price

Iraq Spending Impact

Weather Impact

Actual Production Volume

(thousand boe/d)

Oil & Gas

Production

Production

1Q11 Oil & Gas Production Guidance Reconciliation

740

(10)

730

(9)

721

(7)

714

730

First Quarter 2011 Earnings - Oil & Gas Segment

6

7

First Quarter 2011 Earnings - Oil & Gas Segment

1Q11 1Q10

• Oil and Gas Sales Volumes (mboe/d) 728 685

• + 6% year-over-year

• Sales volumes of 728 mboe/d, which was higher than our

guidance of 725 mboe/d, differ from production volumes

due to the timing of liftings, principally caused by Iraq

where liftings are expected in the latter half of 2011.

guidance of 725 mboe/d, differ from production volumes

due to the timing of liftings, principally caused by Iraq

where liftings are expected in the latter half of 2011.

7

8

725

(10)

715

(7)

708

14

722

728

Earlier 1Q11 Guidance

Price Impact

Guidance Adjusted for Price

Weather Impact

Lifting timing

Actual Sales Volume

(thousand boe/d)

Oil & Gas

Sales

Sales

1Q11 Oil & Gas Sales Guidance Reconciliation

First Quarter 2011 Earnings - Oil & Gas Segment

8

9

1Q11 1Q10

Reported Segment Earnings ($mm) $2,468 $1,861

WTI Oil Price ($/bbl) $94.10 $78.71

NYMEX Gas Price ($/mcf) $4.27 $5.39

Oxy’s Realized Prices

Worldwide Oil ($/bbl) $92.14 $74.09

Worldwide NGLs ($/bbl) $52.64 $47.48

US Natural Gas ($/mcf) $4.21 $5.62

First Quarter 2011 Earnings - Oil & Gas Segment

9

10

First Quarter 2011 Earnings - Oil & Gas

Segment - Cash Production Costs and Taxes

Segment - Cash Production Costs and Taxes

First Quarter 2011 Earnings - Oil & Gas

Segment - Cash Production Costs and Taxes

Segment - Cash Production Costs and Taxes

• Oil and gas cash production costs were $11.30 a barrel

for 1Q11, compared with last year's twelve-month costs

of $10.19 a barrel.

for 1Q11, compared with last year's twelve-month costs

of $10.19 a barrel.

– The increase reflects increased workovers and maintenance

activity and higher costs for energy.

activity and higher costs for energy.

• Taxes - other than on income, which are directly related

to product prices, were $2.25 per barrel for 1Q11,

compared to $1.83 per barrel for all of 2010.

to product prices, were $2.25 per barrel for 1Q11,

compared to $1.83 per barrel for all of 2010.

• Total exploration expense was $84 mm in 1Q11. This

amount included the Libya write off of $35 mm, which is

included in non-core items discussed earlier.

amount included the Libya write off of $35 mm, which is

included in non-core items discussed earlier.

10

11

($ in millions)

*Lower energy and feedstock costs

• Core Results for 1Q11 were $219 mm vs. $30 mm in 1Q10,

and greater than our earlier guidance.

and greater than our earlier guidance.

– These results are among the best ever reported for the Chemical segment’s first quarter

operations, which is historically a weak quarter due to seasonal factors.

operations, which is historically a weak quarter due to seasonal factors.

– 1Q11 operations were positively impacted by strong export demand and improved

supply/demand balances across most products resulting in higher margins, including

higher demand for calcium chloride resulting from the severe winter storms in the Northeast

and Midwest sections of the US.

supply/demand balances across most products resulting in higher margins, including

higher demand for calcium chloride resulting from the severe winter storms in the Northeast

and Midwest sections of the US.

First Quarter 2011 Earnings - Chemical

Segment Variance Analysis - 1Q11 vs. 1Q10

Segment Variance Analysis - 1Q11 vs. 1Q10

11

12

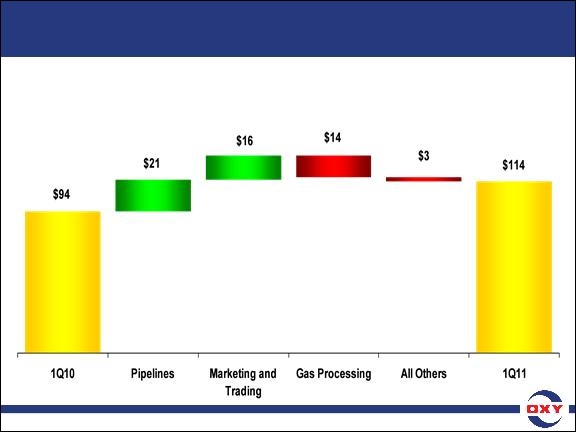

($ in millions)

• Core Results for 1Q11 of $114 mm vs. $94 mm in 1Q10

– The sequential decrease in Midstream segment earnings from $202 mm in 4Q10 was mainly

due to lower marketing and trading income.

due to lower marketing and trading income.

First Quarter 2011 Earnings - Midstream

Segment Variance Analysis - 1Q11 vs. 1Q10

Segment Variance Analysis - 1Q11 vs. 1Q10

12

13

First Quarter 2011 Earnings -

Capital Spending and Rig Activity

Capital Spending and Rig Activity

• Capital spending for 1Q11 was $1.3 billion.

– Of this, about 88% was in Oil and Gas, 10% in Midstream and the

remainder in Chemicals.

remainder in Chemicals.

• We are currently operating 16 rigs in the Permian and 24

rigs in California, compared to 5 and 11 rigs,

respectively, in 1Q10.

rigs in California, compared to 5 and 11 rigs,

respectively, in 1Q10.

13

14

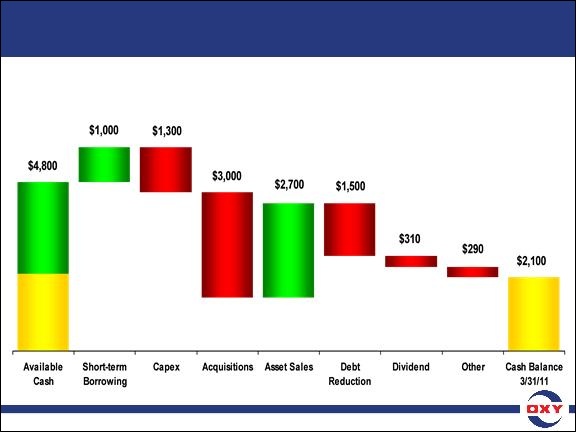

Cash Flow

From

Operations

$2,200

From

Operations

$2,200

Beginning

Cash

$2,600

12/31/10

Cash

$2,600

12/31/10

($ in millions)

– Free cash flow from continuing operations after capex and dividends

but before acquisition and debt activity was about $500 million.

but before acquisition and debt activity was about $500 million.

Note: See attached GAAP reconciliation.

First Quarter 2011 Earnings -

2011 YTD Cash Flow

2011 YTD Cash Flow

14

15

First Quarter 2011 Earnings - Acquisitions

First Quarter 2011 Earnings - Acquisitions

• Our acquisition expenditures in 1Q11 were $3 billion.

– The acquisitions included the previously announced South

Texas purchase and properties in California and the Permian.

Texas purchase and properties in California and the Permian.

– Excluding the South Texas purchase, the new properties did not

materially impact the 1Q11 production volumes.

materially impact the 1Q11 production volumes.

• During 2Q11, we will make a payment of about $500

million in connection with the signing of the Shah Field

Development Project.

million in connection with the signing of the Shah Field

Development Project.

– This amount represents development costs incurred by the

project prior to the effective date of our participation.

project prior to the effective date of our participation.

– Future development costs will be reflected in capital

expenditures.

expenditures.

15

16

First Quarter 2011 Earnings -

Shares Outstanding and Debt

Shares Outstanding and Debt

Shares Outstanding (mm) 1Q11 3/31/11

Weighted Average Basic 812.6

Weighted Average Diluted 813.4

Basic Shares Outstanding 812.6

Diluted Shares Outstanding 813.4

3/31/11 12/31/10

Debt/Capital 12% 14%

• Our remaining outstanding debt has an average interest

rate of 3.7%.

rate of 3.7%.

16

17

First Quarter 2011 Earnings -

Oil and Gas Production & Sales - 2Q11 Outlook

Oil and Gas Production & Sales - 2Q11 Outlook

• At 1Q11 average oil prices of about $95 WTI, we expect 2Q11

oil and gas production volumes to be as follows:

oil and gas production volumes to be as follows:

– Domestic volumes are expected to increase to about 425 mboe/d,

compared with 1Q11 production of 404 mboe/d;

compared with 1Q11 production of 404 mboe/d;

– Latin America is expected to be comparable to 1Q11 volumes;

– In the Middle East region, an overwhelming majority of the value, using

SEC’s standardized measure, and income comes from Qatar, including

Dolphin, and Oman where operations are running normally;

SEC’s standardized measure, and income comes from Qatar, including

Dolphin, and Oman where operations are running normally;

– With regard to 2Q11 production from the Middle East region:

• We expect no production for Libya;

• Production levels in Iraq are not easily predictable due to volatile

spending levels at this early stage of that project. This is caused by

the nature of the contract, which allows immediate recovery of

expenditures through cost recovery barrels. As a result, the level of

development spending in any given period has an immediate impact

on volumes for that period;

spending levels at this early stage of that project. This is caused by

the nature of the contract, which allows immediate recovery of

expenditures through cost recovery barrels. As a result, the level of

development spending in any given period has an immediate impact

on volumes for that period;

17

18

First Quarter 2011 Earnings -

Oil and Gas Production & Sales - 2Q11 Outlook

Oil and Gas Production & Sales - 2Q11 Outlook

– With regard to 2Q11 production from the Middle East region (cont’d):

• In Yemen, almost all of our production comes from concessions

operated by others. In addition, the Masila Field contract, which

produces, net to us, about 11 mboe/d, is approaching expiration at

the end of 2011 and capital spending is being phased out. These

factors make the forecasting of production volumes very difficult.

operated by others. In addition, the Masila Field contract, which

produces, net to us, about 11 mboe/d, is approaching expiration at

the end of 2011 and capital spending is being phased out. These

factors make the forecasting of production volumes very difficult.

• For the remainder of the Middle East, we expect production to be

comparable to 1Q11 volumes.

comparable to 1Q11 volumes.

• Total sales volumes are expected to be about 725

mboe/d, which do not include any volumes from Iraq or

Libya.

mboe/d, which do not include any volumes from Iraq or

Libya.

• A $5.00 increase in WTI would reduce our PSC volumes

by about 3,500 boe/d.

by about 3,500 boe/d.

18

19

First Quarter 2011 Earnings - Capex Increase

• We are increasing our total year capital program to $6.8

billion, with about $500 million of the increase related to

the Shah Field development program subsequent to the

effective date of our participation and the remainder

principally in California for spending attributable to

additional permits being obtained.

billion, with about $500 million of the increase related to

the Shah Field development program subsequent to the

effective date of our participation and the remainder

principally in California for spending attributable to

additional permits being obtained.

19

20

First Quarter 2011 Earnings - 2Q11 Outlook

• Commodity Price Sensitivity - Earnings

– At current market prices, a $1.00 per barrel change in oil prices

impacts oil and gas quarterly earnings before income taxes by

about $34 mm;

impacts oil and gas quarterly earnings before income taxes by

about $34 mm;

– The average 1Q11 WTI oil price was $94.10 per barrel;

– A $1.00 per barrel change in WTI prices impacts NGL quarterly

earnings before income taxes by $4 mm.

earnings before income taxes by $4 mm.

– A swing of $0.50 per mm BTU in domestic gas prices has a $34 mm

impact on quarterly pretax income;

impact on quarterly pretax income;

– The current NYMEX gas price is around $4.25 p/mcf.

• We expect 2Q11 exploration expense to be about $85 mm

for seismic and drilling for our exploration programs.

for seismic and drilling for our exploration programs.

20

21

First Quarter 2011 Earnings - 2Q11 Outlook

First Quarter 2011 Earnings - 2Q11 Outlook

• The Chemical segment 2Q11 earnings are expected to be

comparable to 1Q11.

comparable to 1Q11.

– We expect continuation of 1Q11 trends with sufficient gains from

strong exports and seasonal demand improvement offsetting the

reduced contributions from the calcium chloride business.

strong exports and seasonal demand improvement offsetting the

reduced contributions from the calcium chloride business.

• We expect our combined worldwide tax rate in 2Q11 to

be about 39 percent.

be about 39 percent.

21

22

First Quarter 2011 Earnings - California Update

First Quarter 2011 Earnings - California Update

• We are continuing the program as discussed in last

quarter’s conference call, which is progressing with

satisfactory results.

quarter’s conference call, which is progressing with

satisfactory results.

• Permitting is still an issue but we have recently obtained

some permits that make us optimistic about increasing

our 2H11 capital spending.

some permits that make us optimistic about increasing

our 2H11 capital spending.

• Governor Brown has been working to speed up the

permitting process.

permitting process.

– We expect that his effort will be successful, which should enable

us to increase our activity and add more jobs in the state.

us to increase our activity and add more jobs in the state.

• In 1Q11, we drilled and completed 26 shale wells outside

of the Elk Hills field.

of the Elk Hills field.

22

23

23

|

Occidental Petroleum Corporation

|

||

|

Free Cash Flow

|

||

|

Reconciliation to Generally Accepted Accounting Principles (GAAP)

|

||

|

($ Millions)

|

||

|

Three Months

|

||

|

2011

|

||

|

Consolidated Statement of Cash Flows

|

||

|

Cash flow from operating activities

|

2,222

|

|

|

Cash flow from investing activities

|

(1,741

|

)

|

|

Cash flow from financing activities

|

(959

|

)

|

|

Change in cash

|

(478

|

)

|

|

Free Cash Flow

|

||

|

Cash flow from operating activities

|

2,222

|

|

|

Capital spending

|

(1,325

|

)

|

|

Cash dividends paid

|

(310

|

)

|

|

Distribution to noncontrolling interest

|

(121

|

)

|

|

Free cash flow from continuing operations

|

466

|

|