Attached files

First Quarter

2011 Update

March 31, 2011

Bryn Mawr Bank

Corporation

NASDAQ: BMTC

Strong -

Stable -

Secure

Exhibit 99.3 |

1

Safe Harbor

This presentation contains statements which, to the extent that they are not

recitations of historical fact may constitute forward-looking statements for

purposes of the Securities Act of 1933, as amended, and the Securities

Exchange Act of 1934, as amended.

Please see the section titled Safe Harbor at the end of the presentation for more

information regarding these types of statements.

The

information

contained

in

this

presentation

is

correct

only

as

of

April

28,

2011

Our business, financial condition, results of operations and prospects may have

changed since that date, and we do not undertake to update such

information. . |

2

Bryn Mawr Bank Corporation

Profile

Founded in 1889 –

121 year history

A unique business model with a traditional commercial bank ($1.7

billion)

and a trust company ($3.6 billion) under one roof at March 31, 2011

Wholly owned subsidiary –

The Bryn Mawr Trust Company

Largest community bank in Philadelphia’s affluent western suburbs

Celebrated 25 years on the NASDAQ in August 2010 |

3

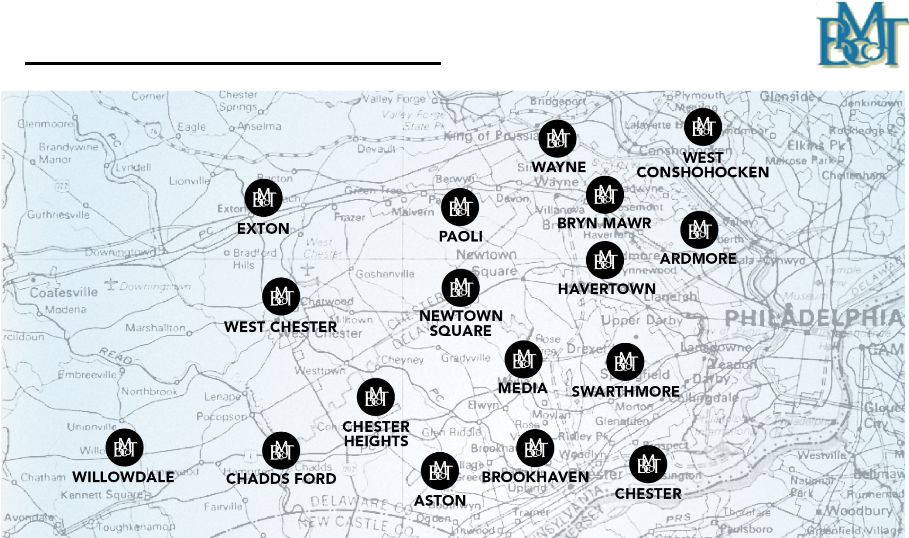

Southeast PA Footprint

•

17 BMTC Full Service Branch Locations |

4

Investment Considerations

Quarterly dividend of $0.15 per share

A great brand & franchise

Solid financial fundamentals and well capitalized

Outstanding target market demographics

New business initiatives driving growth

$3.60 billion wealth management business that provides a significant

source of non-interest income |

5

Acquisition of Private Wealth

Management Group of Hershey Trust

Company

Announced on February 18, 2011

Transaction

closing

expected

during

the

2

nd

Quarter

of

2011

pending

regulatory approvals

Total purchase price of $18.25 million

$8.15 million cash at closing, $6.5 million unregistered shares,

$3.6 million

in escrow for contingent payments

Will add approximately $1.1 billion in assets under management to BMTC

Wealth Division and 500 relationships |

6

First Quarter 2011 BMTC Performance

Closing price on December 31, 2010:

$17.45

Closing price on March 31, 2011:

$20.57

2011 dividends declared per share:

$0.15

Security or Index

YTD 2011 Return

BMTC*

18.72%

NASDAQ Community Bank Index*

1.46%

KBW Bank Index*

-0.23%

*Source: Bloomberg |

7

Growth Initiatives |

8

2011 Strategies

3-5-3 Strategic Plan

$3

billion

in

banking

assets

-

$5

billion

in

wealth

assets

–

3

years

Organic growth –

opportunistic expansion

Inorganic

growth

–

additional

acquisitions

The Corporation intends to implement or continuing implementing the following

strategic initiatives over the next few years:

|

9

2011 Strategies -

continued

Focus on the net interest margin

Continued emphasis on strong credit quality

Raise capital as needed

Lower the efficiency ratio

Complete an additional bank and/or wealth acquisition

|

10

Financial Review |

11

Financial Highlights

1

st

Qtr

2011

4

th

Qtr

2010

3

rd

Qtr

2010

2

nd

Qtr

2010

1

st

Qtr

2010

Portfolio Loans & Leases

($ in millions)

$1,219

$1,197

$1,176

$899

$893

Total Deposits

($ in millions)

$1,316

$1,341

$1,260

$953

$914

Total Wealth Assets

($ in billions)

$3.60

$3.41

$3.29

$3.10

$3.11

Tangible Book Value Per Share

$11.65

$11.21

$11.03

$11.62

$10.56

Tangible Common Equity Ratio

8.65%

8.01%

7.95%

9.66%*

7.82%

*Tangible common equity ratio at 6/30/2010 includes the net proceeds of the $24.7

million registered direct stock offering and excludes the effect of the

7/1/2010 FKF merger. |

12

Financial Highlights -

continued

1

st

Qtr

2011

4

th

Qtr

2010

3

rd

Qtr

2010

2

nd

Qtr

2010

1

st

Qtr

2010

Net Income (Loss)

($ in millions)

$4.72

$5.57

$(1.02)*

$2.41

$2.22

Dividends Declared

$0.15

$0.14

$0.14

$0.14

$0.14

Diluted Earnings (Loss) Per

Common Share

$0.38

$0.46

$(0.08)

$0.25

$0.25

Non-performing Loans as a

% of Portfolio Loans and

Leases

0.88%

0.79%

0.82%

1.11%

0.77%

Allowance for Loan and

Lease Losses

0.87%**

0.86%**

0.88%**

1.09%

1.09%

* Includes approximately $4.3 million of pretax merger and due diligence related

expenses. **Includes the acquired FKF loan portfolio, recorded at fair value,

without its previously recorded allowance for loan and lease loss

|

13

4.06%

3.80%

3.66%

3.73%

4.03%

3.2%

3.4%

3.6%

3.8%

4.0%

4.2%

4.4%

Mar-10

Jun-10

Sep-10

Dec-10

Mar-11

Quarterly Net Interest Margin

On a tax-equivalent basis |

14

Capital Considerations

Maintains a “well capitalized”

capital position

Active Dividend Reinvestment and Stock Purchase Plan with Request for

Waiver program

Selectively add capital as needed to maintain capital levels and

fund asset

growth and acquisitions |

15

Capital Position -

Bryn Mawr Bank Corporation

3/31/2011

12/31/2010

Tier I

12.07%

11.30%

Total (Tier II)

14.52%

13.71%

Tier I Leverage

9.80%

8.85%

Tangible Common Equity

8.65%

8.01% |

16

Wealth Division Review |

17

Wealth Assets Under Management, Administration,

Supervision and Brokerage

($ in billions)

Excludes Community Bank’s assets from 2006 -

2007

$2.18

$2.28

$2.15

$2.87

$3.41

$3.60

$1.2

$2.2

$3.2

$4.2

2006

2007

2008

2009

2010

3/31/2011 |

18

Wealth Management Fees

($ in millions)

Excludes Community Bank’s fees from 2006 -

2007

$12.4

$13.5

$13.8

$14.2

$15.5

$4.2

$2.0

$6.0

$10.0

$14.0

$18.0

2006

2007

2008

2009

2010

3/31/2011 |

19

Wealth Division Highlights

Bryn Mawr Asset Management

“Lift out”

strategy

Four investment advisers hired

Approximately $231 million in assets as of March 31, 2011

Additional opportunities being evaluated

Institutional Trust and Escrow Services

Strong pipeline of new business |

20

BMTC of Delaware

The Delaware Advantage

Directed trusts

$526 million in assets at March 31, 2011

New location –

Greenville, DE

Lau Associates

$610 million in assets at March 31, 2011

New location –

Greenville, DE

Wealth Division Highlights -

continued |

21

Credit Review |

22

Portfolio Loan & Lease Growth

($ in millions)

2010 includes the addition of the First Keystone loan portfolio.

$681

$803

$900

$886

$1,197

$1,219

$200

$400

$600

$800

$1,000

$1,200

$1,400

2006

2007

2008

2009

2010

3/31/2011 |

23

Loan Composition at March 31, 2011

($ in millions)

$392

$240

$220

$278

$55

$34

Commercial Mortgages

Commercial & Industrial

Home Equity Lines & Loans & Consumer Loans

Residential Mortgages

Construction

Leases |

24

Small Ticket National Leasing Business

Leases outstanding: $34 million at March 31, 2011

Average yield of 10.3% at March 31, 2011

Net lease charge-offs decreased $2.7 million in 2010 compared to 2009

Delinquency rate has fallen 169 basis points over the past 12 months to

1.37% at March 31, 2011 |

25

Summary

Outstanding franchise in a stable market

Focus on Wealth Services, Business Banking and Private Banking

Investing in growth opportunities today for earnings growth

tomorrow

Sound business strategy, strong asset quality, well capitalized

and solid risk management procedures serve as a foundation for

potential strategic expansion |

26

Thank You

Joseph Keefer, EVP

610-581-4869

jkeefer@bmtc.com

Duncan Smith, CFO

610-526 –2466

jdsmith@bmtc.com

Ted Peters, Chairman

610-581-4800

tpeters@bmtc.com

Frank Leto, EVP

610-581-4730

fleto@bmtc.com

Aaron

Strenkoski,

VP

–

Finance

/

Investor

Relations

–

610-581-4822

–

astrenkoski@bmtc.com |

27

Safe Harbor

This presentation contains statements which, to the extent that they are not recitations of

historical fact may constitute forward-looking statements for purposes of the Securities Act of

1933, as amended, and the Securities Exchange Act of 1934, as amended. Such forward-

looking statements may include financial and other projections as well as statements

regarding Bryn Mawr Bank Corporation’s (the “Corporation”) that may include future

plans, objectives, performance, revenues, growth, profits, operating expenses or the

Corporation’s underlying assumptions. The words “may”, “would”,

“should”, “could”, “will”, “likely”, “possibly”,

“expect,” “anticipate,” “intend”, “estimate”,

“target”, “potentially”, “probably”, “outlook”, “predict”,

“contemplate”, “continue”, “plan”, “forecast”,

“project” and “believe” or other similar words, phrases or concepts may

identify forward-looking statements. Persons reading or present at this presentation are

cautioned that such statements are only predictions, and that the Corporation’s actual

future results or performance may be materially different.

Such forward-looking statements involve known and unknown risks and uncertainties. A

number of factors, many of which are beyond the Corporation’s control, could cause our

actual results, events or developments, or industry results, to be materially different from any

future results, events or developments expressed, implied or anticipated by such

forward-looking statements, and so our business and financial condition and results of

operations could be materially and adversely affected. |

28

Safe Harbor (continued)

Such factors include, among others, our need for capital, our ability to control

operating costs and expenses, and to manage loan and lease delinquency

rates; the credit risks of lending activities and overall quality of the

composition of our loan, lease and securities portfolio; the impact of

economic conditions, consumer and business spending habits, and real estate market

conditions on our

business

and

in

our

market

area;

changes

in

the

levels

of

general

interest

rates,

deposit

interest rates, or net interest margin and funding sources; changes in banking

regulations and policies and the possibility that any banking agency

approvals we might require for certain activities will not be obtained in a

timely manner or at all or will be conditioned in a manner that would impair

our ability to implement our business plans; changes in accounting policies and

practices; the inability of key third-party providers to perform their

obligations to us; our ability to attract and retain key personnel;

competition in our marketplace; war or terrorist activities; material

differences in the actual financial results, cost savings and revenue enhancements

associated with

our

acquisition

of

First

Keystone

Financial,

Inc.

and

First

Keystone

Bank

and

the

anticipated

acquisition of the Private Wealth Management Group of the Hershey Trust Company;

and other factors as described in our securities filings. All

forward-looking statements and information made herein

are

based

on

Management’s

current

beliefs

and

assumptions

as

of

April

28,

2011

and

speak only as of that date. The Corporation does not undertake to update

forward-looking statements. |

29

Safe Harbor (continued)

For a complete discussion of the assumptions, risks and uncertainties related to

our business, you are encouraged to review our filings with the Securities

and Exchange Commission, including our most recent annual report on Form

10-K, as well as any changes in risk factors that we may identify in our

quarterly or other reports filed with the SEC. This

presentation

is

for

discussion

purposes

only,

and

shall

not

constitute

any

offer

to

sell

or

the

solicitation

of

an

offer

to

buy

any

security,

nor

is

it

intended

to

give

rise

to

any

legal

relationship

between

the

Corporation

and

you

or

any

other

person,

nor

is

it

a

recommendation

to

buy

any

securities or enter into any transaction with the Corporation.

The information contained herein is preliminary and material changes to such

information may be made at any time. If any offer of securities is made, it

shall be made pursuant to a definitive offering memorandum or prospectus

(“Offering Memorandum”) prepared by or on behalf of the

Corporation, which would contain material information not contained herein and

which shall supersede, amend and supplement this information in its

entirety. Any decision to invest in the Corporation’s securities

should be made after reviewing an Offering Memorandum, conducting such

investigations as the investor deems necessary or appropriate, and consulting the investor’s

own legal, accounting, tax, and other advisors in order to make an independent

determination of the suitability and consequences of an investment in such

securities. |

30

Safe Harbor (continued)

No offer to purchase securities of the Corporation will be made or accepted prior

to receipt by an investor of an Offering Memorandum and relevant

subscription documentation, all of which must be reviewed together with the

Corporation’s then-current financial statements and, with respect to

the subscription documentation, completed and returned to the Corporation in its

entirety. Unless purchasing in an offering of securities registered

pursuant to the Securities Act of 1933, as amended,

all

investors

must

be

“accredited

investors”

as

defined

in

the

securities

laws

of

the

United States before they can invest in the Corporation.

|