Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - BANC OF CALIFORNIA, INC. | d8k.htm |

April

2011 Exhibit 99.1 |

1

Important Disclosures

Forward-Looking Statements These

materials contain various forward-looking statements that are based on assumptions and describe our future plans and strategies and our expectations. These forward-

looking statements are generally identified by words such as “believe,”

“expect,” “intend,” “anticipate,” “estimate,” “project,” or similar words. Our ability to predict results or the

actual effect of future plans or strategies is uncertain. Factors which could cause actual

results to differ materially from those anticipated include, but are not limited to the

continuation or worsening of current recessionary conditions, as well as continued turmoil in

the financial markets; our ability to implement our acquisition strategy and the

applicability of the FDIC Statement of Policy on Qualifications for Failed Bank Acquisitions

to us; the credit risks of lending activities, which may be affected by further deterioration

in the real estate market, may lead to decreased loan delinquencies, losses and nonperforming

assets in our loan portfolios, and may result in our allowance for loan losses not

being adequate to cover actual losses, and require us to materially increase our reserves;

changes in general economic conditions, either nationally or in our market area; changes

in the levels of general interest rates, and the relative differences between short- and

long-term interest rates, deposit interest rates, our net interest margin and funding sources;

fluctuations in the demand for loans, the number of unsold homes and other properties and

fluctuations in commercial and residential real estate values in our market area;

results of examinations of us by the Office of Thrift Supervision or by other regulatory

authorities, including our compliance with our Memorandum of Understanding and the

possibility that any such regulatory authority may, among other things, require us to increase

our allowance for loan losses, write-down asset values, increase our capital levels, or

affect our ability to borrow funds or maintain or increase deposits, which could adversely

affect our liquidity and earnings; legislative or regulatory changes that adversely affect

our business, including changes in the interpretation of regulatory capital or other rules;

our ability to control operating costs and expenses; our ability to successfully integrate any

assets, liabilities, customers, systems, and management personnel we have acquired or may in

the future acquire into our operations and our ability to realize related revenue

synergies and cost savings within expected time frames and any goodwill charges related

thereto; staffing fluctuations in response to product demand or the implementation of

corporate strategies that affect our work force and potential associated charges; errors in

our estimates in determining fair value of certain of our assets, which may result in

significant declines in valuation; the network and computer systems on which we depend could

fail or experience a security breach; our ability to retain key members of our senior

management team; costs and effects of litigation, including settlements and judgments;

increased competitive pressures among financial services companies; changes in consumer

spending, borrowing and savings habits; adverse changes in the securities markets; earthquake,

fire or other natural disasters affecting the condition of real estate collateral; the

availability of resources to address changes in laws, rules, or regulations or to respond to

regulatory actions; inability of key third-party providers to perform their obligations to us;

changes in accounting policies and practices, as may be adopted by the financial institution

regulatory agencies or the Financial Accounting Standards Board or their application to

our business or final audit adjustments, including additional guidance and interpretation on

accounting issues and details of the implementation of new accounting methods; war or

terrorist activities; other economic, competitive, governmental, regulatory, and technological factors affecting our operations, pricing, products, and services and the other risks

described as detailed in the Company’s reports filed with the SEC, including our Annual

Report on Form 10-K for the fiscal year ended December 31, 2010 and subsequently filed

Quarterly Reports on Form 10-Q and Current Reports on Form 8-K. As used herein, the

“Company,” “we,” “us” and “our” refer to First PacTrust Bancorp, Inc. and the “Bank” refers

to Pacific Trust Bank, a wholly owned subsidiary of the Company. Analysts

Information

The “rating” and “price target” information set forth on page 12 herein

was obtained from reports published by the respective securities analysts listed. The Company has no

affiliation with these analysts and did not participate in the preparation of their

reports. By including this rating and price target information herein, the Company does not in any

way endorse or support such information or assume any responsibility for its accuracy.

Nor does the inclusion of this information represent an opinion, forecast, estimate or

prediction of the Company regarding the future performance of the Company or its stock price

or the advisability of investing in the Company’s stock. There may be analysts other

than those listed herein who have issued, or in the future may issue, ratings and price

targets for the Company’s stock that differ materially from those contained herein. The

ratings and price targets contained herein are the most recent available and are subject to

change, and the Company assumes no responsibility or obligation to update this material

for any such change or to continue to include ratings and/or price targets issued by any analysts, including those listed herein.

|

2

NAME (CHARTER TYPE)

12/31/2007

12/31/2008

12/31/2009

MOST

RECENT

California Bank & Trust (STATE)

1

1

1

1

Pacific Western Bank (STATE)

2

2

2

2

Imperial Capital Bank (STATE)

3

3

FAIL

FAIL

La Jolla Bank (FEDERAL)

4

4

3

FAIL

San Diego National Bank (FEDERAL)

5

5

FAIL

FAIL

Bank of Internet USA (FEDERAL)

6

6

4

3

PACIFIC TRUST BANK (FEDERAL)

7

7

6

5

Torrey Pines Bank (STATE)

8

8

5

4

1st Pacific Bank of California (STATE)

9

10

9

FAIL

Metro United Bank (STATE)

10

9

7

6

Regents Bank (FEDERAL)

11

12

10

7

Silvergate Bank (STATE)

12

11

8

8

Balboa Thrift and Loan Association (STATE)

13

13

12

11

Discovery Bank (STATE)

14

16

NA

NA

Security Business Bank of S.D. (STATE)

15

14

13

12

Home Bank of California (STATE)

16

17

14

15

California Community Bank (STATE)

17

15

11

10

Neighborhood National Bank (FEDERAL)

18

18

16

14

San Diego Trust Bank (STATE)

19

NA

15

13

Rancho Santa Fe Thrift & Loan (STATE)

20

20

NA

NA

Borrego Springs Bank (FEDERAL)

NA

19

20

16

San Diego Private Bank (STATE)

NA

NA

17

17

First Business Bank (FEDERAL)

NA

NA

18

18

Seacoast Commerce Bank (STATE)

NA

NA

19

19

Coronado First Bank (STATE)

NA

NA

NA

20

Community Roots

Chartered by the U.S. Office of Thrift Supervision

Insured by the FDIC

Founded in 1941 with 70 years of continuous

operations (public since 2002)

Former credit union for Rohr, Inc.

95 employees and 18,000 depository relationships

Branch Network

10 banking locations, including 7 full service branches

11

th

branch to open in June 2011

Member of CU Service Center Network with over

4,100 shared branch locations throughout the U.S.

0.80% cost of deposits with no brokered funds

Funding costs continue to trend down

Credit Underwriting

Average FICO score at origination of 739

Average LTV at origination of 58%

No construction or subprime loans. Limited land loans

31 non-performing loans ($19.6 million, net of SVAs),

31 as TDRs ($22.3 million), and 8 OREO assets ($6.4

million)

Attractive Market

1

st

Deed of Trust SFR mortgages focused in beach

cities throughout the San Diego area (i.e., La Jolla,

Coronado, Rancho Santa Fe, Del Mar and Carlsbad)

Rebounding home prices in San Diego since Q3-09

Strong Capital Partners

Completed $60 million capital raise led by TCW & COR

Capital

Ranking for Largest Community Bank Franchises in San Diego by Assets *

*Source: FDIC Website as of 6/30/2010.

Overview |

3

CAMEL Summary -3/31/11

ASSETS

CAPITAL

MANAGEMENT

EARNINGS

LIQUIDITY

Positioned for growth

Exceeds regulatory capital standards

for “well-capitalized”

banks. Capital

to support up to $1.0 billion of

organic growth without need for

new capital. Capacity to acquire

added capital for accretive

transactions ($250 million shelf)

Significant capacity to originate or

acquire meaningful volumes of CRE

and small business (C&I) loans

Management team with diverse

experience in executing

consolidation strategy in Southern

California market

Key Metrics

$13.94 Tangible Common Equity per share

$135.7 million Tangible Common Equity

16.3% Tangible Common Equity (Bank)

16.0% Tier 1 Risk-Based (Bank)

17.3% Total Risk-Based (Bank)

$157.3 million market cap

$835.0 million of assets

$681 million total gross loans, 83% first deed of

trust SFRs

1.75% loan loss reserve

$74 million security portfolio, plus $23.7 million

in interest bearing deposits

Prudent approach to underwriting & lending and

proven ability to transform “thrifts”

into

community banks.

Executive team responsible for 17 bank

acquisitions / integrations in California

Deep expertise with unassisted and FDIC

assisted acquisitions.

$2.0 million core earnings in Q1 2011

Net interest margin 3.63% (Q1)

$0.105 first quarter dividend

$634 million deposits, no brokered deposits

0.80% cost of deposits

$60 million of FHLB borrowings

$102 million in cash and securities |

4

1. Organic Growth

2. Traditional M&A

3. FDIC-Based M&A

Increase market penetration within the

Bank’s primary footprint and expand into

neighboring regions

—

Acquire prime branch locations from

distressed sellers or the FDIC

—

Open new retail banking locations and

staff with well known community

bankers to attract core deposits

—

Enhance loan and deposit product set

—

Establish high quality C&I and

community banking relationships

Diversify portfolio and prudently deploy

capital by originating high quality

commercial real estate and C&I loans

—

Hire great talent with strong

production and risk management skills

—

Exploit high market demand resulting

from limited supply of lenders in

Southern California

—

Strengthened balance sheet, strong

credit and pricing with reduced

concentration risk

Selectively explore traditional

acquisitions

Focus on banks with the following

characteristics

—

Privately held or limited trading

liquidity

—

Subscale (< $1.5 billion in assets)

—

Broken business models

—

Enlightened boards and management

teams that understand the “new

paradigm”

in banking as well as the

value of partnering with a strong

community bank.

Strategic benefits to franchise

development

—

Markets

—

Products

—

People

Pursue strategic transactions with FDIC

assistance

—

Focus on smaller banks (i.e., $500

million in assets and less) in attractive

markets

—

FDIC’s troubled list is currently over

800 banks

Acquire attractive assets from the FDIC

—

Acquired La Jolla branch in November

2010 from FDIC

—

Acquired San Marcos branch in

February 2011 from FDIC

—

Additional properties and notes may

become available

Growth Strategy |

5

Keys to Success

Mission Statement:

To be the premier

community bank in

Southern California

serving the needs of

growing families, high net

worth individuals,

professionals, small to mid

sized businesses and their

owners

Market

Opportunity

Management

Team

Access to

Capital

Strong

Balance

Sheet

Scalable

Business |

6

Officer

Position

Experience

Greg Mitchell

President & CEO

First Pac Trust Bancorp

Transformed a thrift with six branches and $700

million in assets to what became California

National Bank. 68 branches and $7.7 billion in

assets

Investment banker focusing on regional banks

in the Western United States

Former regulator with OTS, founder of Capital

Assistance Group for troubled thrifts during

RTC

Richard Herrin

Chief Administrative

Officer

FDIC regulator until 2010; Special Operations

Group overseeing distressed financial institutions;

Receiver In Charge of failed banks; Asset

Management Group for Western Region

Southern California community banker with

deep credit, operations and asset management

experience

Matt

Bonaccorso

Chief Credit Officer

Managed the Western operation of Special

Assets Group at U.S. Bank

30+ years of banking experience including eight

years as Chief Credit Officer at California National

Bank

Hans Ganz

President & CEO, Pacific

Trust Bank

Grew First Pacific Trust Bank from a four branch

credit union with $200 million of assets to a

publicly traded thrift with 9 branches and $900

million of assets

Deep expertise in residential lending focused in the

Southern California market

Recent Additions to

Management Team include

Gaylin Anderson (Chief Retail

Officer), and Chang Liu (Chief

Lending Officer) and Joseph

Abraham (Credit Services)

Team members have successfully

transformed a small Southern

California based thrift into a

regional bank with 68 branches

and $7+ billion in assets and

robust levels of organic loan

production

Team members have overseen

the acquisition and integration of

more than 17 banks in California

Team members possess deep

skill and insights in unassisted

and assisted acquisitions as well

as other FDIC opportunities

Equity ownership of insiders

exceeds 30% of fully-diluted

shares outstanding

Management Team |

7

5%

11.14%

6%

14.92%

10%

16.17%

0.00%

4.00%

8.00%

12.00%

16.00%

20.00%

Tier 1 Leverage Ratio

Tier 1 Risked Based

Capital

Total Risk-Based

Capital

Well Capitalized Minimum

FPTB

Access to Capital

Pacific Trust Bank’s equity capitalization exceed “well-

capitalized”

levels by $40 million

—Could support

more than $450+ million in added CRE assets without exceeding concentration

limits

—Eligible to

apply for up to $32 million of additional Tier 1 capital via the Small Business

Lending Fund

—100% of capital

would be tangible equity with no TRUPS, goodwill or debt

Strong institutional investor base led by Trust Company of the

West and COR Capital

Example Opportunity

Small Business Lending Fund (SBLF)

Enacted into law by President Obama as part of the

Small Business Jobs Act of 2010, the SBLF

encourages lending to small businesses by providing

Tier 1 capital to qualified community banks with less

than $10 billion in assets. Banks with less than $1

billion in capital as of 12/31/09 will be given priority

of approval. The U.S. Treasury will charge a rate of

as low as 1% for five years to banks that increase

lending to small business by 10%.

Subject to the support of its regulators and approval

by the Department of Treasury, First PacTrust:

qualifies for participation in SBLF;

meets the regulatory conditions for

approval;

qualifies for priority approval; and

is eligible to receive up to $32 million in

Tier 1 capital

Note: Ratios as of 12/31/10.

Bancorp maintains 16.3% tangible equity to total assets

|

8

Southern California Banks with Assets < $1.0 Billion*

Market Opportunity

1.

Banks with less than $500 million to $1 billion in assets

in Southern California are sub-scale and face increasing

difficulties achieving profitability. These include

concentration risks, regulatory pressure to consolidate,

and difficulties raising capital.

2.

First PacTrust is well positioned to be a leading

consolidator of the market with a liquid, public

currency, strong management team, scalable balance

sheet and profitable business with attractive dividend.

Banks facing increased regulatory and earnings

pressure are more and more likely to seek better-

capitalized, well-equipped partners such as First

PacTrust Bancorp.

—

There are nearly 150 potential consolidation targets

with < $1 Billion in assets headquartered within First

PacTrust’s footprint.

—

First PacTrust can offer public stock in a transaction

that provides tax efficiency to potential targets.

—

Most of the other acquirers are either too large to

focus on sub $500 million to $1 billion banks or are

private, cash buyers without the ability to provide

targets with continuing bank exposure.

Service Area

Number

Assets ($mm)

Assets/Bank ($mm)

Los Angeles Service Areas

88

$24,555,905

$279,044

San Diego/Orange County Service Areas

58

$14,865,761

$256,306

Grand Total

146

$39,421,666

$270,011

*Source:

FDIC website with 9/30/10 reported data.

Los Angeles Service Area include Long Beach, Santa Ana, Oxnard, Thousand Oaks, and

Ventura. San Diego/Orange County Service areas include Riverside, San

Bernardino, Ontario, Carlsbad, and San Marcos.

Rationale

Belief |

9

$102 million of cash and securities including fed funds,

agencies and RMBS/Re-REMICs

—

Marked to market accounting based on independent

valuations provided by Red Pine-

Houlihan Lokey

—

Strong investment returns historically including 2008-

2011

$634 million in deposits

—

No brokered deposits

—

Green accounts tie deposit accounts to borrowers

outstanding balance increasing relationship with

clients

—

$60 million FHLB borrowings

—

Stable, growing funding base

Ability to take advantage of massive displacement of

quality bankers ,premium retail banking locations and

disaffected consumers (organic growth)

Project moderate growth in low cost deposits as PacTrust

rolls-out small business and community banking

initiatives

Strong Balance Sheet

No debt or preferred stock (repaid TARP in 2010)

17.27% Total Risk Based Capital

$37 million in excess capital

Eligible for Small Business Lending Fund, active shelf

registration and strong relationships with potential

capital partners

$653 million of performing loans comprised primarily of

first deeds of trust on SFR

—

Performing loans held at book value

—

Receive independent valuation of every SFR at least

twice per year from Data Quick

$34.1million of non-performing assets including non-

performing loans and OREO

—

All NPAs receive updated appraisal upon entry into

NPA category and are marked at no more than 90% of

appraised value

Assets

Liabilities |

10

1.

Community banks with strong and scalable balance

sheets, solid capital levels with access to capital markets,

and proven management teams in achieving organic and

acquisitive growth will thrive in the current economic

and regulatory environment and have the ability to

produce superior returns to shareholders

2.

With the capacity to originate or acquire more high-

quality CRE and C&I loans, Pacific Trust Bank is

positioned to take advantage of limited competition and

high demand with the “small ticket”

commercial real

estate segment

3.

Due to its large SFR loan concentration and lack of

competition, First PacTrust can advance its other

commercial lending businesses

Numerous failures of both community and regional

banks in Southern California have left a massive void in

the lending market

Majority of displaced customers are “highly dissatisfied”

with their new bank

Due to the scarcity in supply of loan originators, First

PacTrust will benefit from advantageous credit and

pricing terms

Having previously overseen billions in bank assets, First

PacTrust’s management team has extensive experience

underwriting in these asset classes

—

As numerous local banks seek additional capital to

strengthen balance sheets, absorb losses from legacy

positions, and meet regulatory capital requirements,

they are unable to meet the credit needs of credit-

worthy clients

—

Many banks are prevented from lending in CRE & C&I

asset classes due to concentration limits

—

Regulations limit exposure to each asset class to no

more than 350% its Tier 1 equity

Rationale

Belief

Scalable Business |

Price

$16.17

As of 04/26/11

Yield / Div.

2.60%

/

$0.42

Market Cap

$157.3M

Avg Volume (3M)

29,657

Tangible Book Value

$136.1M

Volatility

28%

Shares Outstanding

9,729,066

Beta

0.50

Analyst

Date Initiated

Rating

Price Target

Baird

10/15/2010

Overweight

$21.00

Wunderlich

01/25/2011

Buy

$20.00

Raymond James

12/30/2010

Buy

$19.00

B. Riley

4/12/2011

Buy

$19.00

DA Davidson

2/18/11

Buy

$19.00

FIG Partners

12/27/2010

Overweight

$17.50

Sandler O'Neill

12/30/2010

Buy

$16.50

Relative Performance

October

November

December

2011

2010

Execution

Q3 Earnings

reported

$3.0 million

Net income ,

$0.66 EPS

Annc’d

purchase

of La Jolla

branch

from FDIC

Annc’d

completion

of $60M

private

placement

Annc’d

100% div.

increase

from 5 cents/q

to 10 cents/q

Bancorp sold

subordinated

debt at $3.5M

gain to

Book value

Full

repayment

of $19.3M

in TARP

funds

Annc’d

Purchase of

San Marcos

branch

from FDIC

Acquisition

of

Whole Bank(s)

Branch

acquisitions

and de novo

openings

Commercial

lending

rollout

Asset

purchases

Upgrade

systems and

infrastructure

Current Activities

Market Beginning to Recognize

Execution

Note:

Market info as of 04/26/2011. The “rating” and “price target” information set

forth herein was obtained from reports published by the respective securities analysts listed. The

Company has no affiliation with these analysts and did not participate in the preparation of their

reports. By including this rating and price target information herein, the Company does

not in any way endorse or support such information or assume any responsibility for its accuracy. Nor does the inclusion of this information represent an

opinion, forecast, estimate or prediction of the Company regarding the future performance of the

Company or its stock price or the advisability of investing in the Company’s stock.

There may be analysts other than those listed herein who have issued, or in the future may issue, ratings and price targets for the Company’s stock that differ

materially from those contained herein. The ratings and price targets contained herein

are the most recent available and are subject to change, and the Company assumes no

responsibility or obligation to update this material for any such change or to continue to include ratings and/or price targets issued by any analysts, including those listed

herein.

11 |

12

Dividend Paying Banks, < $2.5b in Assets, Raised > $30m since 1/2009

FPTB stock

price would

need to

appreciate

21% to reach

peer median

Company Name

Ticker

City

State

Stock Price ($)

TBV ($)

Price /

TBV

Bank of Commerce Holdings

BOCH

Redding

CA

4.40

4.75

88.5

CNB Financial Corporation

CCNE

Clearfield

PA

13.68

8.31

164.6

First of Long Island Corporation

FLIC

Glen Head

NY

25.72

17.99

143.0

Lakeland Financial Corporation

LKFN

Warsaw

IN

21.45

15.27

140.5

MidSouth Bancorp, Inc.

MSL

Lafayette

LA

14.16

10.57

134.0

Orrstown Financial Services, Inc.

ORRF

Shippensburg

PA

26.59

17.50

151.9

Pacific Continental Corporation

PCBK

Eugene

OR

9.50

8.22

115.6

Sterling Bancorp

STL

New York

NY

10.55

5.93

177.9

Tower Bancorp, Inc.

TOBC

Harrisburg

PA

22.11

19.41

113.9

Univest Corp of Pennsylvania

UVSP

Souderton

PA

16.74

12.73

131.5

Washington Banking Company

WBCO

Oak Harbor

WA

13.95

9.71

143.7

Average

136.8

Median

140.5

First PacTrust Bancorp, Inc.

FPTB

Chula Vista

CA

16.17

13.94

116.0

Trading price as of April 26, 2011

Source: Bloomberg

Market Valuation of Peers |

13

Delivering Strong Earnings During

Growth Phase

$2.0 million in core earnings in the first quarter of 2011

—

Historically strong core earnings have enabled First PacTrust Bancorp to charge-off or

reserve for credit losses while providing cumulative net earnings for the period

2008-2011 $0.42 (annualized)/ share cash dividend (5% Q1 increase)

Net interest margin of 3.63% for the quarter ended 3/31/2011

Note: Core earnings equals pre-tax earnings, plus provisions, less private placement expenses, less

gain on sale of securities.

Opportunity for further NIM expansion as FHLB advances and higher-cost CDs mature in

2011 |

14

Business Plan

Grow core earnings by prudently

deploying capital into CRE and C&I

lending

Open 3-5 de novo branches in

Southern California

Complete $200 -

$500 million of

accretive M&A activity (where

prudent)

Purchase high quality assets at

distressed prices

4% + NIM

Low 50s efficiency ratio

1.2% ROAA

Reach critical mass (~$1 billion

assets) in each of Los Angeles

County, Orange County, and San

Diego County

Secure dividend with growth that

exceeds inflation

2011 Goals

5 Year Objectives |

15

Why Invest in First PacTrust Bancorp?

First PacTrust is a profitable bank with a strong dividend

First PacTrust is well-positioned to be a lead bank consolidator in Southern

California —

With a scalable balance sheet, access to fresh capital, First PacTrust Bancorp is uniquely

positioned to benefit from distress in the Southern California banking

environment —

First-rate management team with a solid track record of managing and growing larger

institutions

in

the

region

will

continue

to

“unlock”

value

and

exploit

opportunities

—

Publicly traded currency

—

Scalable balance sheet and strong opportunities to prudently originate new loans in CRE,

construction, and C&I asset classes

First PacTrust offers investors an attractive investment opportunity

—

Currently trading at slight premium to tangible book value --

a significant discount to peers

—

Top notch management team

—

Quantifiable loan portfolio |

Appendix

Appendix |

17

Chula Vista Main Branch

Chula Vista Admin Center

El Cajon Branch

Balboa Branch

Rancho Bernardo Branch

Temecula Branch

Riverside Branch

Chula Vista

Riverside

Mini Branches

Franchise Map and Branches |

18

Loan Breakdown as of 3/31/11

Pacific Trust Bank’s

loan portfolio consists predominantly of 1-4 family loans making up 83% of the Bank’s gross loans. $676

million of gross loans Loans were originated at an average 58% LTV

All underwritings used full appraisals and were

reviewed by senior management

Delinquency rate of watch list loans is low and

declining

100% of SFR portfolio is revalued twice per year

1-4 Unit Residential

Balance

1

st

TD

$341,421,568

1

st

TD “Green”

Accts

$221,168,034

2

nd

TD

$657,548

Total

$562,589,602

Non-Residential

$54,556,989

Multifamily

$32,594,522

Consumer

$19,629,646

Land

$6,038,750

C&I

$904,432

Pacific Trust Bank Loan

Composition |

19

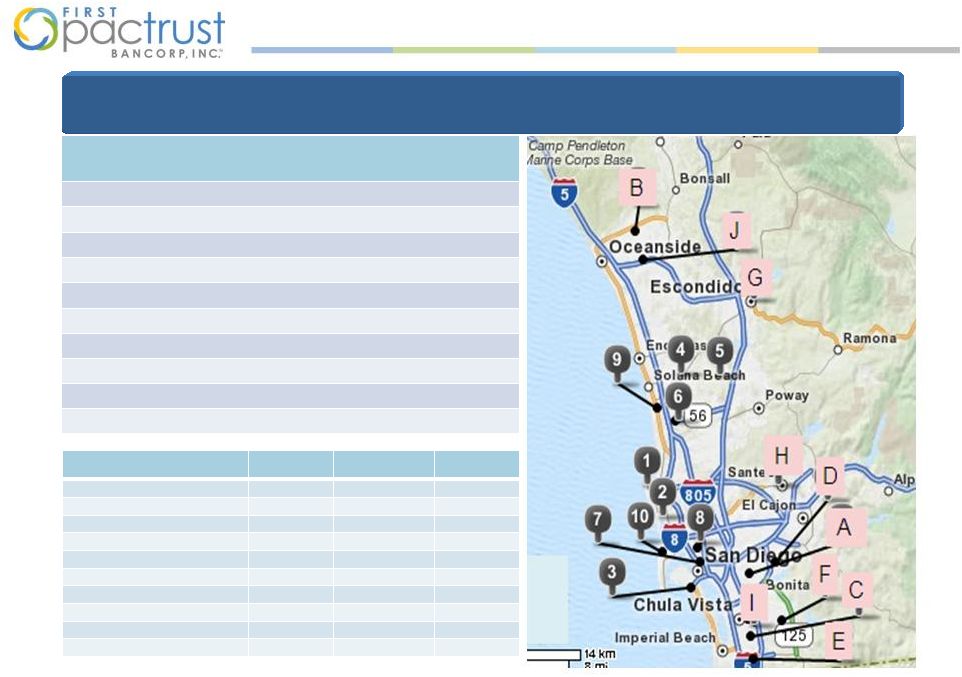

A

large

concentration

of

Bank

SFR

loans

are

secured

by

collateral

located

in

highly

desirable

beach

communities

,

whereas

the

majority

of

foreclosure

activity

in

San

Diego

County

has

taken

place

in

southern

or

eastern

parts

of

the

County

away

from

the coast.

Pacific Trust Bank Location of SFR

Loans

Area

# of

Loans

Bal

Avg Bal

WA LTV

1. La Jolla

74

$106.8M

$1.4M

48%

2. Pacific Beach

75

$55.2M

$735K

55%

3. Coronado

40

$41.4M

$1.0M

46%

4. Rancho Santa Fe (92067)

13

$19.2M

$1.5M

59%

5. Rancho Bernardo (92127)

14

$12.1M

$867K

70%

6. North City West

19

$9.7M

$513K

61%

7. Downtown

18

$9.2M

$512K

80%

8. Hillcrest

18

$9.1M

$504K

62%

9. Del Mar

10

$8.2M

$821K

28%

10. Ocean Beach

13

$7.7M

$594K

75%

City

# Foreclosure

Avg Mortgage

Mkt %

A. Encanto

336

$237K

3.45%

B. Oceanside (92057)

280

$262K

2.88%

C. Chula Vista (91911)

279

$254K

2.87%

D. Spring Valley

276

$249K

2.84%

E. S. San Diego (92154)

266

$262K

2.73%

F. Chula Vista (91913)

254

$329K

2.61%

G. Escondido (92027)

251

$271K

2.58%

H. Santee

220

$273K

2.26%

I. Chula Vista (91910)

219

$300K

2.25%

J. Oceanside (92056)

217

$298K

2.20% |

20

San Diego Market

Leading Southern

California recovery

Home price increase

9%

since 2009 as

measured by S&P Case

Shiller Home Price

index

Stable economy with

vast and growing

military presence and

robust tech industry

(1) Source: S&P Case Shiller Home Price Index for San Diego County.

0%

20%

40%

60%

80%

100%

120%

140%

160%

180%

2003

2004

2005

2006

2007

2008

2009

2010

2011

2003

2004

2005

2006

2007

2008

2009

2010

2009: 106%

2003: 101%

2008: 80%

2004: 84%

2007: 66%

2005: 67%

2006: 64%

58% Avg LTV

San

Diego

County

Home

Prices

(1)

Bank’s Primary Market Area

Recovering

First

PacTrust’s

primary

market

area

of

San

Diego

has

exhibited

strong

recovery

rates

in

home

prices.

2010: 100% |

21

Pacific

Trust

Bank

has

$11.9

million

of

loan

loss

reserves

which

provide

strong

coverage

against

$26

million in Core NPLs The $2.5 million in REOs consist of 6 properties.

*

(1)

Numbers are Bank level gross of SVA

(2)

An additional $8.3M in NPA held at FPTB including 2 land loans

totaling $4.4M and 2 REO totaling $3.9M (3)

Gross Non-performing Assets (NPA) = Non-performing Loans (NPLs) +

OREOs. (4)

Core NPL= Loans including TDR +90 Days DQ. Core NPL is $26

million at March 31, 2011. (5)

Allowance for Loan Losses includes $8.0M of GVA and $3.9M in SVA.

Non-Performing Asset Overview-

PACIFIC TRUST BANK* |

22

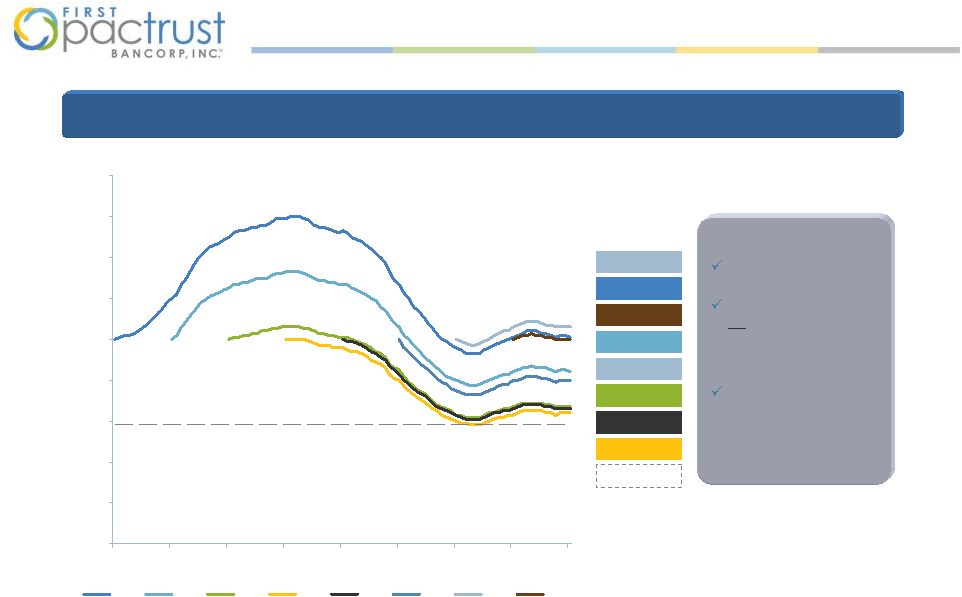

Pacific Trust Bank’s

60-89 Day DQs declined for the third consecutive quarter while 90+ Day DQs increased due

to delayed restructurings of a number of loans *

Delinquent Mortgages-

PACIFIC TRUST BANK*

*Non-performing loans increased by $7.7 million, to $27.6 million, or 3.31% of total assets during

the first quarter of 2011. The increase was largely due to the following loans: a $3.7

million multi-family loan and related $1.0 million HELOC, and a

$1.8 million land loan |

23

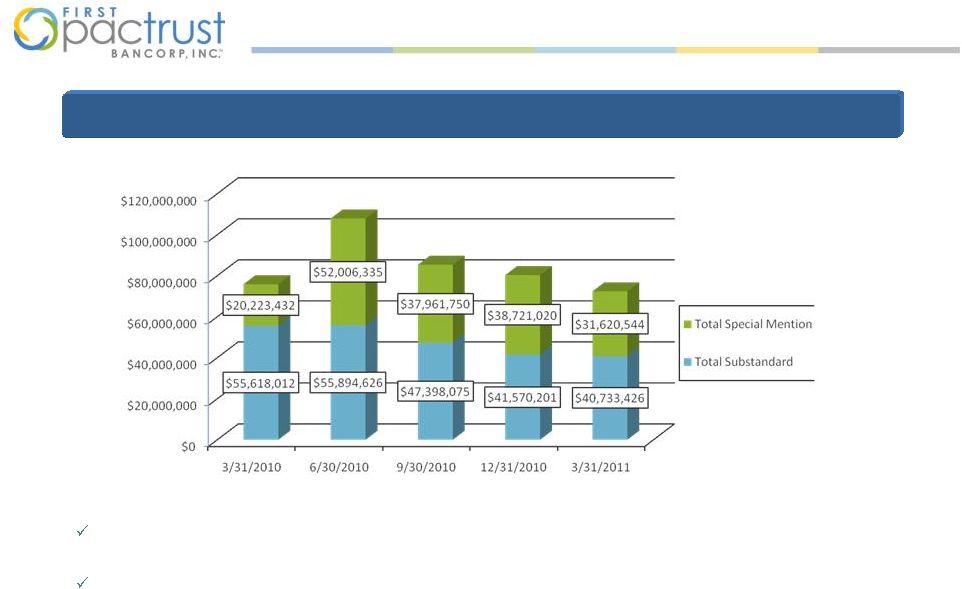

Total classified loans totaled $72.3MM at March 31, 2011 compared to $80.2M in 4Q10.

Reduction reflects to transfer of 2 loans totaling $4.4 million to Bancorp.

Loans rated Substandard include loans on non-accrual and impaired TDR.

Classified Loans-

PACIFIC TRUST BANK

Pacific Trust Bank’s

classified loans decreased in 3Q10 and 4Q10 from its peak in 2Q10. |

24

Most of the Bank’s Classified Loans are performing and earning interest

income. •

82% of Special Mention loans are performing.

•34% of Substandard loans are performing.

•18% of classified loans are TDR that are performing and earning interest

income Reason for SM

Classification

# of

Loans

Balance

% of SM

Loans

60 Days DQ

9

$5,813,499

18%

Current but past due 1

or more times in past 6

months

10

$4,037,359

13%

BK with LTV >80%

2

$775,060

2%

DSC under 1.0

1

$3,765,950

12%

DQ Property Taxes (two

installments)

14

$10,912,810

35%

Performing TDR on

accrual

12

$3,810,156

12%

Performing TDR on

non-accrual

3

$2,505,710

8%

Total SM Loans :

51

$31,620,544

Reason for Sub

Classification

# of Loans

Balance

% of Sub

Non-Performing

35

$25,965,589

64%

Performing:

TDR on non-accrual (not

yet made 6 consecutive

payments)

6

$3,791,710

9%

Impaired TDR on accrual

1

$3,090,050

8%

Rated Sub due to borrower

relationship to distressed

loan

13

$7,886,079

19%

Total Performing:

20

$14,767,839

36%

Total Sub Loans

55

$40,733,428

Summary of Classified Loans-PACIFIC TRUST BANK

|

25

25 TDRs valued at $14.3 million

are performing and earning

interest income

6 TDRs with balance of $9.9 million

are nonperforming

17 TDR valued at $16 million are

on non-accrual and interest

income is recognized on a cash

basis until they perform for 6

consecutive months

Weighted average interest rate of

performing TDR is 4.61%

(1) All balances are gross of SVA

TDR-

PACIFIC TRUST BANK

Payments

# of Loans

Book Value

Avg Loan Size

Weighted

Avg Int Rate

1 Payment

2

$1,447,574

$723,787

3.03%

2 Payments

0

$0

N/A

N/A

3 Payments

0

$0

N/A

N/A

4 Payments

3

$3,103,712

$1,034,571

3.69%

5 Payments

0

$0

N/A

N/A

6 Payments

1

$547,200

$547,200

5.20%

7 Payments

0

$0

N/A

N/A

8 Payments

3

$3,370,143

$1,123,381

5.93%

9 Payments

1

$320,000

$320,000

5.60%

10 Payments

1

$511,500

$511,500

5.13%

11 Payments

4

$1,477,439

$369,360

5.55%

12+ Payments

10

$4,107,275

$410,728

5.28%

Total

25

$14,884,843

$595,394

4.61%

Performing TDR are well seasoned with solid yields |

26

Call

Report

data

shows

$214

million

of

“HELOCS”

which

are

primarily

1st TD mortgages to high net worth borrowers.

1st TD HELOCs have:

—

Average FICO score at origination of 743

—

Weighted average original LTV ratio of 56%

—

Average Debt-to-Income ratio of 34.9%

Pacific Trust Bank’s quarterly risk management practices for 1st TD HELOC include:

—

A reduction in credit limits if a loan’s refreshed LTV ratio exceeds 100%

—

Suspension of credit line if net advances exceed principal pay downs

Most of our “HELOCS”

are FIRST TRUST DEED

“GREEN”

ACCOUNTS

HELOC-

PACIFIC TRUST BANK |

27

All OREO is carried at levels

no more than 91% of the most

recent appraised value.

Pacific Trust Bank holds 6 OREO assets (all single-

family homes) with a net value of $2.5 million

Bancorp holds 2 OREO assets including 1 land loan

and 1 SFR with an aggregate value of $4.0 million

OREOs-

BANCORP AND BANK

As of 3/31/2011 |

28

This presentation contains certain financial information determined by methods

other than in accordance with accounting principles generally accepted in

the United States (“GAAP”). These non-GAAP financial measures include tangible common equity, tangible

common equity per share and core earnings.

Tangible

common

equity

and

tangible

common

equity

per

share

are

calculated

by

excluding

preferred

equity

from

stockholders’

equity

(of

which

we

currently

have

none)

and

excluding

any

intangible

assets

(of

which

we

currently

have

none)

from

assets.

We

believe

that

this is consistent with the treatment by the Office of Thrift Supervision, our

regulatory agency, which excludes any intangible assets from the

calculation of risk-based capital ratios. Accordingly, management believes that these non-GAAP financial measures provide

information to investors that is useful in understanding the basis of our

risk-based capital ratios. Management also believes that core earnings

is a useful measure of assessing our operating performance. Reconciliations

of the non-GAAP measures to the comparable GAAP measures are provided below. Non-GAAP

Financial Information 3/31/11

Stockholders’

equity

$

135,650

Less: Intangible assets

0

Tangible common equity

135,650

3/31/11

Stockholders’

equity

per

share

$

13.94

Less: Effect of intangible assets

0.00

Tangible common equity per share

13.94

The

following

table

presents

a

reconciliation

of

tangible

common

equity

per

share

to

stockholders’

equity

per

share:

The

following

table

presents

a

reconciliation

of

tangible

common

equity

to

stockholders’

equity

(dollars

in

thousands): |

29

3/31/11

Net income

$

693

Add: Change of Control expense (net of tax)

541

Add: Non-core problem loan expenses (net of tax)

745

Core earnings

1,979

The following table presents a reconciliation of core earnings to net income

(dollars in thousands): Non-GAAP Financial Information

(Continued) |