Attached files

| file | filename |

|---|---|

| EX-99.1 - PRESS RELEASE DATED APRIL 21, 2011 - ManpowerGroup Inc. | exhibit_99-1.htm |

| 8-K - FORM 8-K - ManpowerGroup Inc. | form_8-k.htm |

Exhibit 99.2

ManpowerGroup

2011 1st Quarter

April 21, 2011

ManpowerGroup 2011 1st Quarter Results April 2011

Forward-Looking Statement

This presentation includes forward-looking statements,

including earnings projections which are subject to risks and

uncertainties. Actual results might differ materially from those

projected in the forward-looking statements. Additional

information concerning factors that could cause actual results

to materially differ from those in the forward-looking statements

is contained in the Manpower Inc. Annual Report on Form 10-K

dated December 31, 2010, which information is incorporated

herein by reference, and such other factors as may be

described from time to time in the Company’s SEC filings.

including earnings projections which are subject to risks and

uncertainties. Actual results might differ materially from those

projected in the forward-looking statements. Additional

information concerning factors that could cause actual results

to materially differ from those in the forward-looking statements

is contained in the Manpower Inc. Annual Report on Form 10-K

dated December 31, 2010, which information is incorporated

herein by reference, and such other factors as may be

described from time to time in the Company’s SEC filings.

ManpowerGroup 2011 1st Quarter Results April 2011

N/A

Operating Income $86M

OP Margin 1.7%

Revenue $5.1B

Gross Margin 16.9%

EPS $0.43

Q1 Highlights

Throughout this presentation, the difference between reported variances and Constant Currency (CC) variances

represents the impact of currency on our financial results. Constant Currency is further explained on our Web site.

represents the impact of currency on our financial results. Constant Currency is further explained on our Web site.

Consolidated Financial Highlights

24%

22% CC

20 bps

163%

152% CC

90 bps

N/A

3

ManpowerGroup 2011 1st Quarter Results April 2011

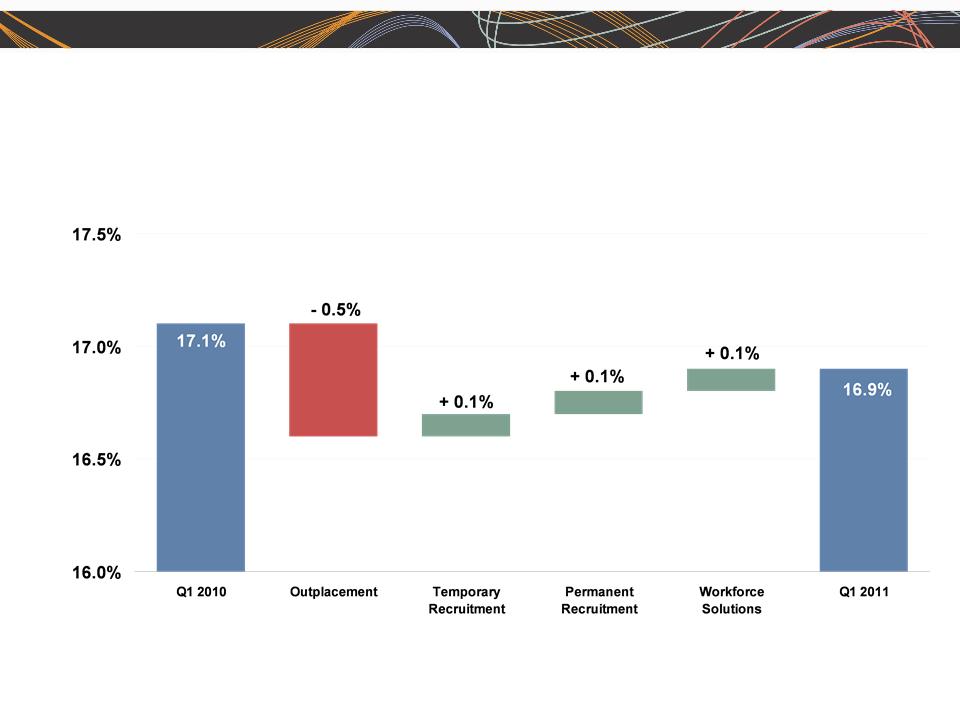

Consolidated Gross Margin Change

4

ManpowerGroup 2011 1st Quarter Results April 2011

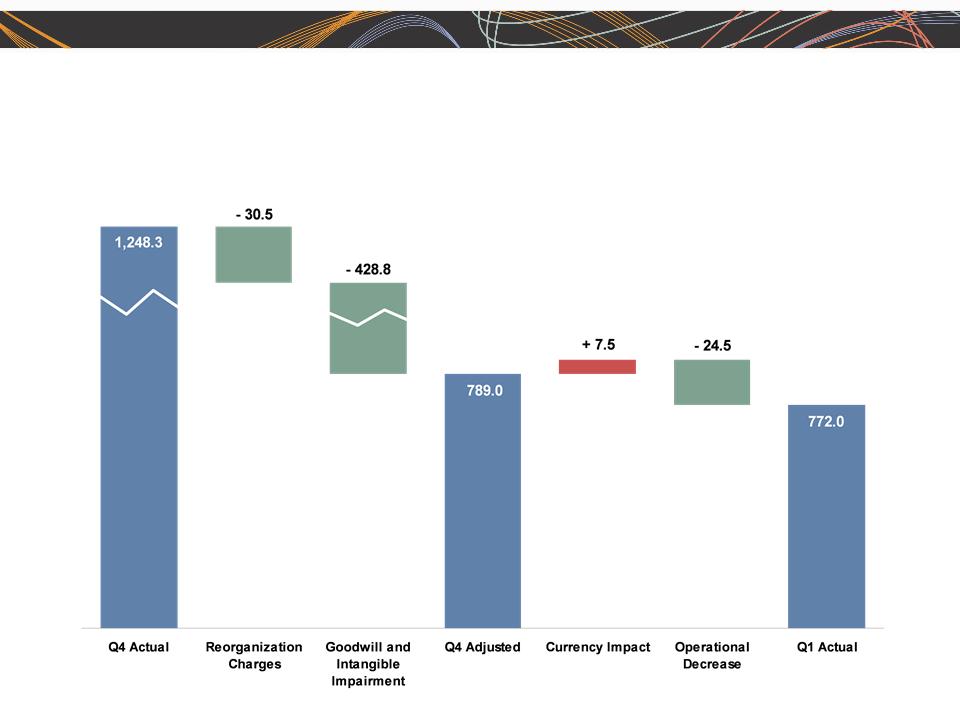

SG&A Expense Sequential Bridge - Q1 vs. Q4

(in millions of USD)

(in millions of USD)

5

ManpowerGroup 2011 1st Quarter Results April 2011

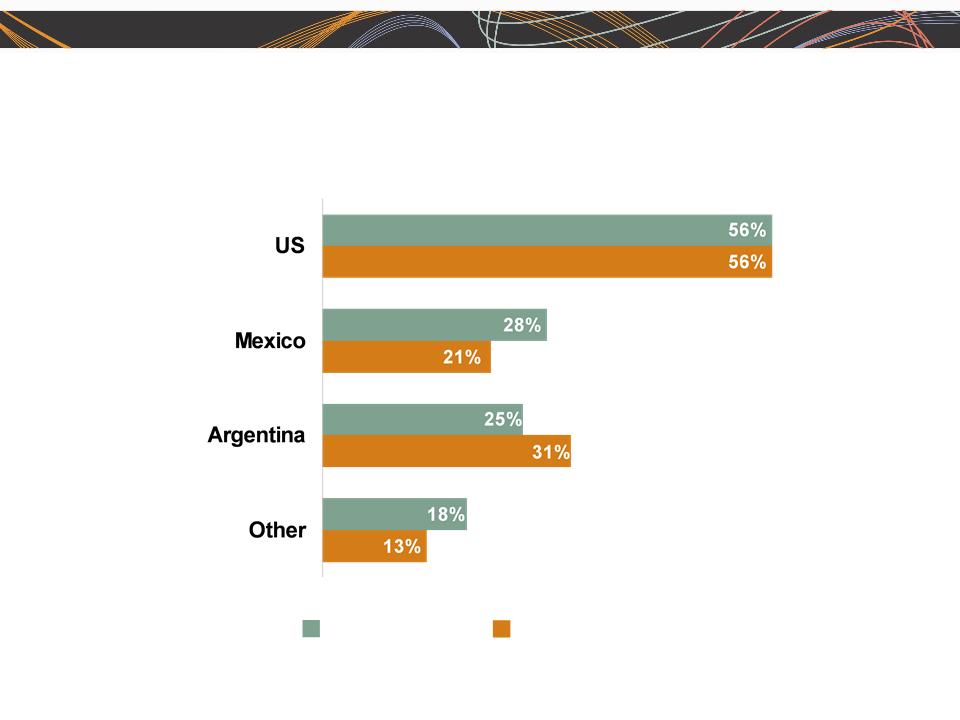

(1) Included in these amounts is the US, which had revenue of $751M (+56%) and OUP of $9M.

42% CC

Americas Segment

(22% of Revenue)

(22% of Revenue)

Q1 Financial Highlights

43%

OUP Margin

1.9%

220 bps

Revenue

$1.1B

OUP

$22M

Operating Unit Profit (OUP) is the measure that we use to evaluate segment performance.

OUP is equal to segment revenues less direct costs and branch and national

headquarters operating costs.

OUP is equal to segment revenues less direct costs and branch and national

headquarters operating costs.

(1)

N/A

N/A

6

ManpowerGroup 2011 1st Quarter Results April 2011

Americas - Q1 Revenue Growth YoY

Revenue Growth - CC

Revenue Growth

% of Segment

Revenue

68%

11%

7%

14%

7

ManpowerGroup 2011 1st Quarter Results April 2011

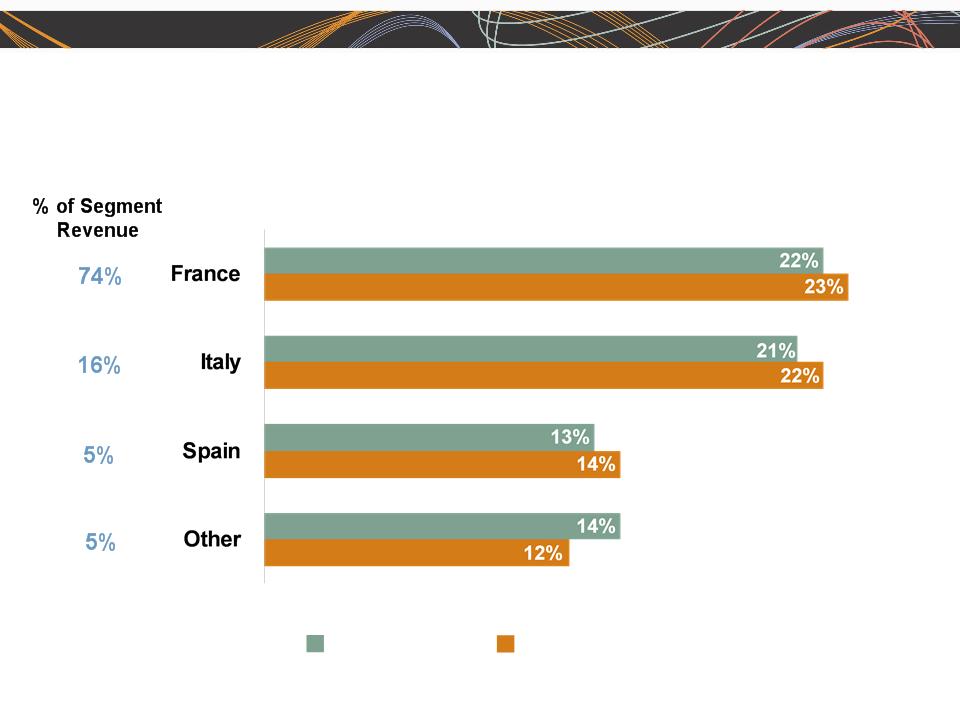

Southern Europe Segment

(36% of Revenue)

(36% of Revenue)

Q1 Financial Highlights

OUP Margin

1.5%

Revenue

$1.8B

OUP

$27M

21%

22% CC

110 bps

344%

339% CC

(1) Included in these amounts is France, which had revenue of $1.4B (+23% CC) and OUP of $12M.

(1)

8

ManpowerGroup 2011 1st Quarter Results April 2011

Southern Europe - Q1 Revenue Growth YoY

Revenue Growth - CC

Revenue Growth

9

ManpowerGroup 2011 1st Quarter Results April 2011

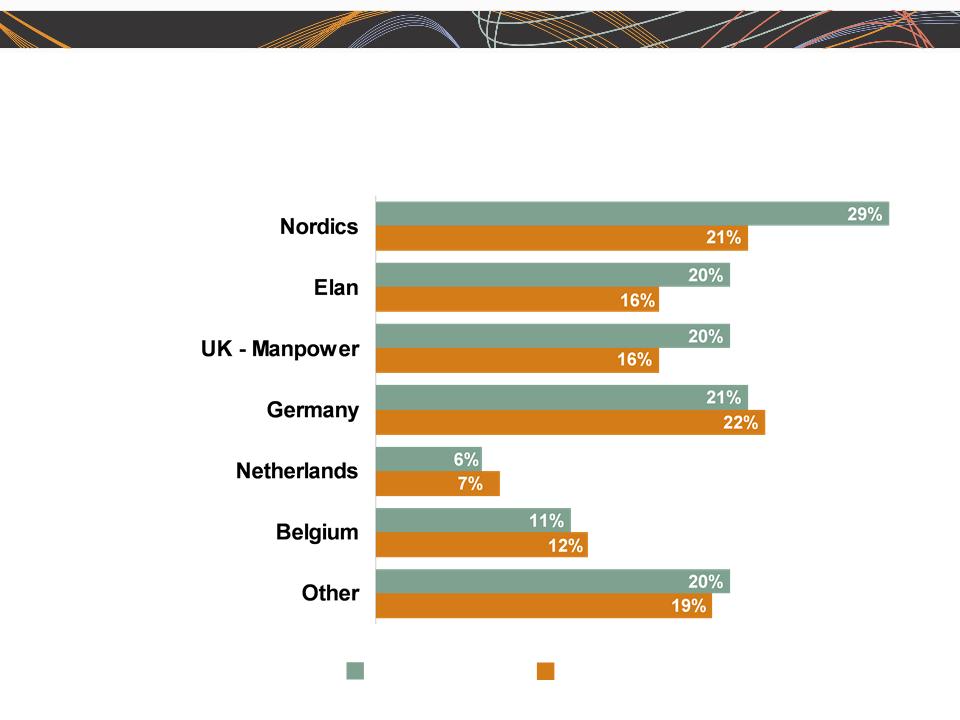

Northern Europe Segment

(28% of Revenue)

(28% of Revenue)

Q1 Financial Highlights

OUP Margin

2.9%

Revenue

$1.5B

OUP

$42M

19%

17% CC

130 bps

121%

112% CC

10

ManpowerGroup 2011 1st Quarter Results April 2011

Northern Europe - Q1 Revenue Growth YoY

Revenue Growth - CC

Revenue Growth

% of Segment

Revenue

20%

18%

14%

13%

10%

18%

7%

11

ManpowerGroup 2011 1st Quarter Results April 2011

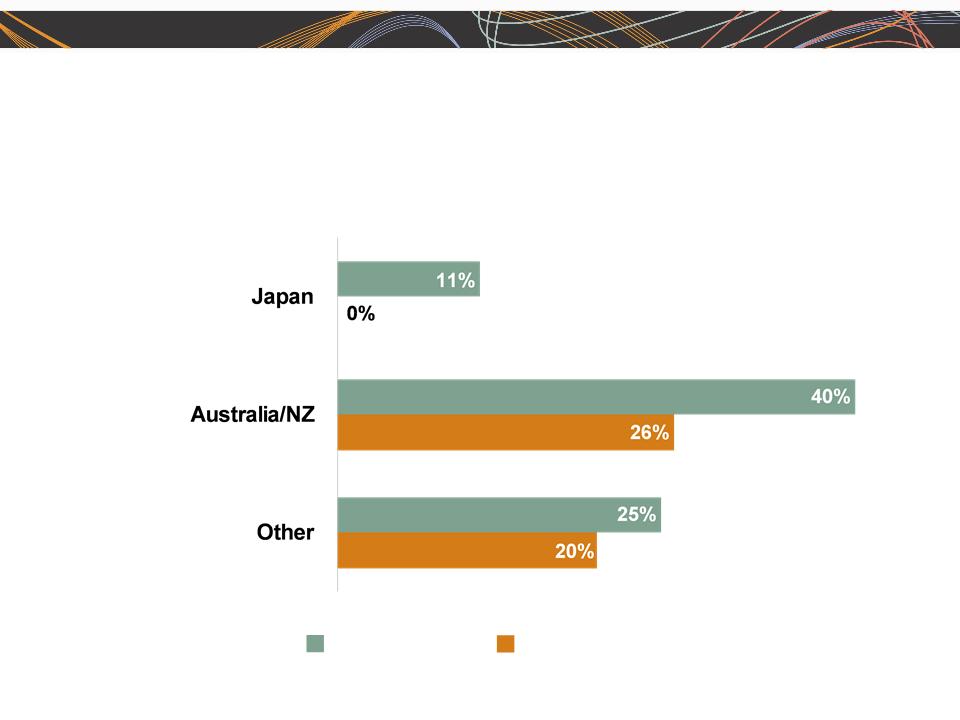

APME Segment

(12% of Revenue)

(12% of Revenue)

Q1 Financial Highlights

OUP Margin

2.7%

Revenue

$603M

OUP

$17M

21%

11% CC

20 bps

32%

21% CC

12

ManpowerGroup 2011 1st Quarter Results April 2011

APME - Q1 Revenue Growth YoY

Revenue Growth - CC

Revenue Growth

% of Segment

Revenue

48%

28%

24%

13

ManpowerGroup 2011 1st Quarter Results April 2011

74%

74% CC

Right Management Segment

(2% of Revenue)

(2% of Revenue)

Q1 Financial Highlights

OUP Margin

4.0%

Revenue

$82M

OUP

$3M

21%

23% CC

810 bps

14

ManpowerGroup 2011 1st Quarter Results April 2011

Cash Flow Summary - Q1

2011

2010

Cash from Operations

(160)

(43)

Capital Expenditures

(11)

(8)

Free Cash Flow

(171)

(51)

($ in millions)

Other

7

Change in Cash

(123)

(71)

5

Change in Debt

1

Effect of Exchange Rate Changes

31

(26)

10

15

ManpowerGroup 2011 1st Quarter Results April 2011

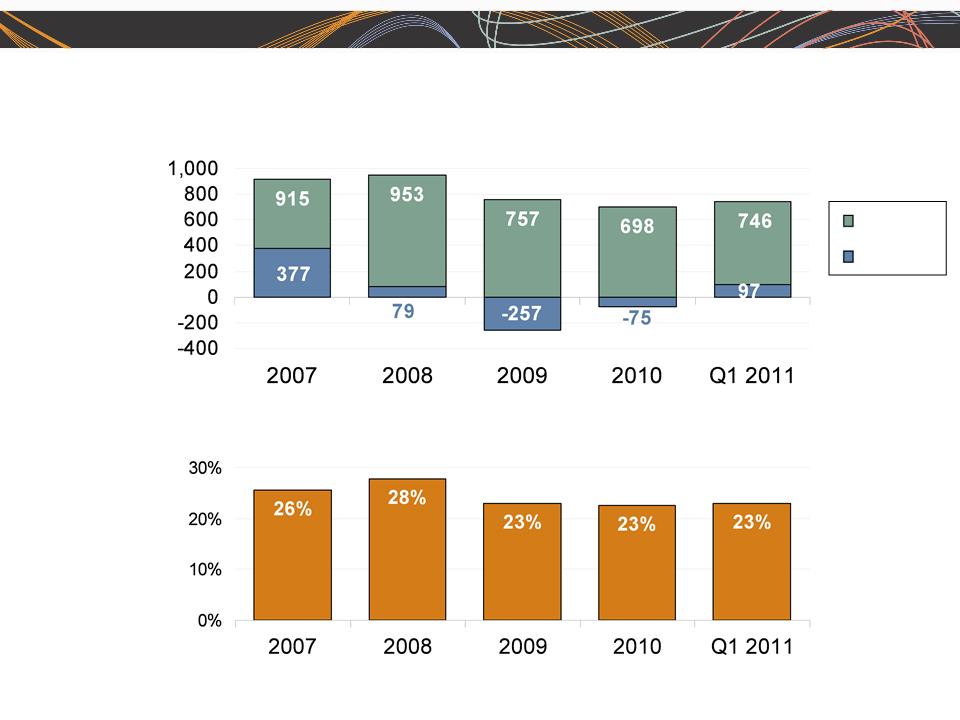

Balance Sheet Highlights

Total Debt

($ in millions)

Total Debt to

Total Capitalization

Total Debt

Net Debt

16

ManpowerGroup 2011 1st Quarter Results April 2011

(b)

(b)

Credit Facilities as of March 31, 2011

($ in millions)

($ in millions)

(a)

(a)

This $400M agreement requires, as of March 31, 2011 that we comply with a Debt-to-EBITDA ratio of less than 4.50 to 1 and a fixed charge

coverage ratio of greater than 1.25 to 1. As defined in the agreement, we had a Debt-to-EBITDA ratio of 1.52 and a fixed charge coverage

ratio of 2.61 as of March 31, 2011. As of March 31, 2011 there were $2.2M of standby letters of credit issued under the agreement.

coverage ratio of greater than 1.25 to 1. As defined in the agreement, we had a Debt-to-EBITDA ratio of 1.52 and a fixed charge coverage

ratio of 2.61 as of March 31, 2011. As of March 31, 2011 there were $2.2M of standby letters of credit issued under the agreement.

Represents subsidiary uncommitted lines of credit & overdraft facilities, which total $415.6M. Total subsidiary borrowings are limited to $300M

due to restrictions in our Revolving Credit Facility, with the exception of Q3 when subsidiary borrowings are limited to $600M.

due to restrictions in our Revolving Credit Facility, with the exception of Q3 when subsidiary borrowings are limited to $600M.

Interest

Rate

Maturity

Date

Total

Outstanding

Remaining

Available

Euro Notes:

- Euro 200M

4.86%

Jun 2013

283

-

- Euro 300M

4.58%

Jun 2012

424

-

Revolving Credit Agreement

2.79%

Nov 2012

-

398

378

Uncommitted lines and Other

Various

Various

39

Total Debt

746

776

17

ManpowerGroup 2011 1st Quarter Results April 2011

Down 13-15%

(Down 10-12% CC)

Up 23-25%

(Up 10-12% CC)

Up 17-19%

(Up 7-9% CC)

Up 25-27%

(Up 11-13% CC)

Up 13-15%

(Up 12-14% CC)

Up 20-22%

(Up 10-12% CC)

Second Quarter Outlook

Revenue

Americas

Southern Europe

APME

Right Management

Total

Gross Profit Margin

17.0-17.2%

Operating Profit Margin

2.4-2.6%

Tax Rate

48% (38% excl. reclassification of

France business tax)

France business tax)

EPS

$0.74-$0.82 (Favorable $.08 Currency)

Northern Europe

18

ManpowerGroup 2011 1st Quarter Results April 2011

The Human Age is Creating Complexity

• There are new demands for:

ØProductivity

ØInnovation

ØTalent

19

ManpowerGroup 2011 1st Quarter Results April 2011

The Human Age

• Our Opportunity

– ManpowerGroup is uniquely qualified to help our

clients and candidates navigate this new

complexity to win in the world of work with:

clients and candidates navigate this new

complexity to win in the world of work with:

• Our differentiated competitive position

• Our trusted brand and strong values

• Our unmatched global footprint

• Our unparalleled thought leadership position

• Our deep understanding of talent and business

20

ManpowerGroup 2011 1st Quarter Results April 2011

21

Core

Staffing

Staffing

On-Site

Specialty Services

Consulting

Assessment

Career Management

Human Resource

Services

Services

Talent Based

Outsourcing

Outsourcing

Permanent Recruitment

Sophistication of Offerings Increasing Exponentially

Recruitment Process

Outsourcing

Outsourcing

Talent

Management

Management

Borderless Talent

Solutions

Solutions

ManpowerGroup 2011 1st Quarter Results April 2011

We Are ManpowerGroup

22

ManpowerGroupTM is the world leader in innovative workforce solutions. We leverage our

global reach and local expertise of tens of thousands of people across more than 80

countries, making it possible for businesses to access the talent they need when they need it.

global reach and local expertise of tens of thousands of people across more than 80

countries, making it possible for businesses to access the talent they need when they need it.

ManpowerGroupTM Solutions provides clients with human resources outsourcing services

primarily in the areas of large-scale recruiting and outcome-based workforce-intensive

initiatives, thereby sharing in the risk and reward with our clients.

primarily in the areas of large-scale recruiting and outcome-based workforce-intensive

initiatives, thereby sharing in the risk and reward with our clients.

ExperisTM is the global leader in professional resourcing and project-based workforce

solutions. With operations in more than 50 countries, we deliver 53 million hours of

professional talent specializing in IT, Finance and Engineering to accelerate clients’

businesses each year.

solutions. With operations in more than 50 countries, we deliver 53 million hours of

professional talent specializing in IT, Finance and Engineering to accelerate clients’

businesses each year.

Right Management® is the global leader in talent and career management workforce

solutions. Through our innovative and proprietary process, we leverage our expertise to

successfully increase productivity and optimize business performance..

solutions. Through our innovative and proprietary process, we leverage our expertise to

successfully increase productivity and optimize business performance..

Manpower® is the global leader in contingent and permanent recruitment workforce

solutions. We provide the personal flexibility and agility businesses need with a continuum of

staffing solutions.

solutions. We provide the personal flexibility and agility businesses need with a continuum of

staffing solutions.

ManpowerGroup 2011 1st Quarter Results April 2011

Ù One Global Operating Model with Fixed &

Flexible Components

Flexible Components

Ù Deep Vertical Expertise at the Global &

Local Levels

Local Levels

Ù Efficiencies Driven through a Research and

Sourcing Center (RSC)

Sourcing Center (RSC)

Ù Consolidation of Existing Brands and Global

Best Practices

Best Practices

23

Key Differentiators

Questions