Attached files

| file | filename |

|---|---|

| EX-31.1 - Envela Corp | v218775_ex31-1.htm |

| EX-32.1 - Envela Corp | v218775_ex32-1.htm |

| EX-32.2 - Envela Corp | v218775_ex32-2.htm |

| EX-31.2 - Envela Corp | v218775_ex31-2.htm |

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

FOR ANNUAL AND TRANSITION REPORTS PURSUANT TO SECTIONS 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

x

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the fiscal year ended December 31, 2010

|

o

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

Commission File No. 001-11048

_______________________________

DGSE COMPANIES, INC.

(Exact name of registrant as specified in its charter)

|

Nevada

|

88-0097334

|

|

(State or other jurisdiction of

|

(I.R.S. Employer

|

|

incorporation or organization)

|

Identification No.)

|

11311 Reeder Road

Dallas, Texas 75229

972-484-3662

(Address, including zip code, and telephone

number, including area code, of registrant's

principal executive offices)

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act:

|

Common Stock, par value $.01 per share

|

|

(Title of Class)

|

__________________

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

YES [ ] NO [ √ ]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act.

YES [ ] NO [ √ ]

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

YES [ √ ] NO [ ]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [ √ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or smaller reporting company. See definitions of “larger accelerated filer,” “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer [ ] Accelerated filer [ ]

Non-accelerated filer [ ] (Do not check if a smaller reporting company) Smaller Reporting Company [ √ ]

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

YES [ ] NO [ √ ]

|

Aggregate market value of the 3,774,762 shares of Common Stock held by non-affiliates

of the registrant at the closing sales price as reported on the NYSE Amex on June 30, 2010

|

$ | 11,965,995 | ||

|

Number of shares of Common Stock outstanding as of the close of business on

April 13, 2010:

|

9,986,100 |

Documents incorporated by reference:

Portions of the definitive proxy statement relating to the 2011 Annual Meeting of Stockholders of DGSE Companies, Inc. are incorporated by reference into Part III of this report.

TABLE OF CONTENTS

| Page | |||||

| PART I | |||||

|

Item 1.

|

Business

|

1 | |||

|

Item 1A.

|

Risk Factors

|

4 | |||

|

Item 1B.

|

Unresolved Staff Comments

|

10 | |||

|

Item 2.

|

Properties

|

10 | |||

|

Item 3.

|

Legal Proceedings

|

10 | |||

|

PART II

|

|||||

|

Item 5.

|

Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

|

11 | |||

|

Item 7.

|

Management's Discussion and Analysis of Financial Condition and Results of Operations

|

13 | |||

|

Item 7A.

|

Quantitative and Qualitative Disclosure about Market Risk

|

21 | |||

|

Item 8.

|

Financial Statements and Supplementary Data

|

21 | |||

|

Item 9.

|

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure

|

21 | |||

|

Item 9A.

|

Controls and Procedures

|

22 | |||

|

Item 9B.

|

Other Information

|

23 | |||

|

PART III

|

|||||

|

Item 14.

|

Principal Accountant Fees and Services

|

23 | |||

|

PART IV

|

|||||

|

Item 15.

|

Exhibits and Financial Statement Schedules

|

24 |

ITEM 1. BUSINESS.

Overview

Unless the context indicates otherwise, references to "we," "us", "our"and”DGSE” refers to the consolidated business operations of DGSE Companies, Inc., the parent, and all of its direct and indirect subsidiaries.

We buy and sell jewelry, bullion products and rare coins. Our customers include individual consumer, dealers and institutions throughout the United States. Our products and services are marketed through our facilities in Dallas and Euless, Texas; Mt. Pleasant, South Carolina; Woodland Hills, California and through our internet web sites DGSE.com; CGDEinc.com; SGBH.com; SuperiorPreciousMetals.com; SuperiorEstateBuyers.com; USBullionExchange.com; Americangoldandsilverexchange.com; and FairchildWatches.com.

We operate eight primary internet sites and over 900 related landing sites on the World Wide Web. Through the various sites we operate a virtual store, real-time auction of rare coin and jewelry products, free quotations of current prices on all commonly traded precious metal and related products, trading in precious metals, a mechanism for selling unwanted jewelry, rare coins and precious metals and wholesale prices and information exclusively for dealers on pre-owned fine watches. Over 7,500 items are available for sale on our internet sites including $2,000,000 in diamonds.

On May 9, 2007 we purchased all of the tangible assets of Euless Gold and Silver, Inc., located in Euless, Texas. We opened a new retail store in the former Euless Gold & Silver facility and it operates under the name of Dallas Gold & Silver Exchange.

On May 30, 2007, we completed the acquisition of Superior Galleries, Inc. located in Beverly Hills, California. In June 2008, we moved Superior Galleries operations from Beverly Hills to Woodland Hills, California. Superior’s principal line of business is the sale of rare coins on a retail and wholesale basis. Superior’s retail and wholesale operations are conducted in virtually every state in the United States. Superior also conducted live and internet auctions for customers seeking to sell their own coins prior to management’s decision to discontinue the live auction operations. Superior markets its services nationwide through broadcast and print media and independent sales agents, as well as on the internet through third party websites, and through its own website at SGBH.com.

On August 3, 2007 we announced the launch of Americangoldandsilverexchange.com along with the simultaneous activation of over 900 proprietary Internet sites related to the home page of Americangoldandsilverexchange.com. This site, along with our existing locations in Texas, California and South Carolina, provides customers from all over the United States with a seamless and secure way to value and sell gold, silver, rare coins, jewelry, diamonds and watches.

Late in 2007, Superior Estate Buyers was launched to bring our unique expertise in the purchase of gold, silver, diamonds, rare coins and other collectibles to local markets with a team of traveling professionals for short-term buying events. .

Superior Precious Metals was also launched in late 2007 and functions as a retail precious metals arm of DGSE. Professional account managers provide a convenient way for individuals and companies to buy and sell precious metals and rare coins. This activity is supported by the internally developed account management and trading platform created as part of DGSE’s USBullionExchange.com precious metals system.

In June 2009 we sold the assets of National Jewelry Exchange, Inc. (our two pawn shops) to an unrelated third party.

1

Products and Services

Our jewelry operations include sales to both wholesale and retail customers. We sell finished jewelry, gem stones, and findings (gold jewelry components) and make custom jewelry to order. Jewelry inventory is readily available from wholesalers throughout the United States. In addition, we purchase inventory from pawn shops and individuals. Jewelry repair is also available to our customers in our all of our store locations.

Our bullion and rare coin trading operations buy and sell all forms of precious metals products including United States and other government coins, medallions, art bars and trade unit bars. Bullion and rare coin transactions are conducted at all of our store locations.

Bullion and rare coin products are purchased and sold based on current market price. The availability of precious metal products is a function of price as virtually all bullion items are actively traded. Precious metals sales amounted to 52.1% of total revenues for 2010, 50.0% in 2009 and 43.2% in 2008.

We have a jewelry super store located in Mt. Pleasant, South Carolina. The store operates through a wholly owned subsidiary, Charleston Gold and Diamond Exchange, Inc. (“CGDE”). CGDE operates in a leased facility located in Mt. Pleasant, South Carolina.

Our primary presence on the internet is through our websites DGSE.com, CGDEinc.com, SGBH.com, Superiorpreciousmetals.com, Superiorestatebuyers.com, USBullionexchange.com, Americangoldandsilvereschange.com, and Fairchildwatches.com. The DGSE.com web site serves as a corporate information site, a retail store where we sell our products and an auction site for jewelry and other products. The internet store functions as a CyberCashTm authorized site which allows customers to purchase products automatically and securely on line.

The SGBH.com website services as a primary rare coin marketing site and also includes a retail store.

Americangoldandsilverexchange.com provides customers from all over the United States with a simple and secure method to sell unwanted valuables by sending them directly to our corporate facilities for evaluation. Customers are provided with a firm purchase price which they can reject or accept for immediate payment.

Our internet activity also includes a web site, USBullionExchange.com, which allows customers unlimited access to current quotations for prices on approximately 200 precious metals, coins and other bullion related products. This web site allows customers to enter immediate real-time buy and sell orders in dozens of precious metal products. This functionality allows our customers to fix prices in real time and to manage their precious metals portfolios in a comprehensive way.

We also offer wholesale customers a virtual catalog of our fine watch inventory through our web site Fairchildwatches.com.

We did not have any customer or supplier that accounted for more than 10% of total sales or purchases during 2009 or 2008. However in 2010, 27.0% of our sales and 11.6% of our purchases were transactions with NTR Metals, LLC (“NTR”).

On May 25, 2010, we entered into a Closing Agreement, dated May 25, 2010 with NTR, a Texas limited liability company, and Dr. L.S. Smith, our CEO. Pursuant to the Closing Agreement and that certain Purchase and Sale Agreement (and Amendments thereto), dated January 27, 2010, by and among us and Stanford International Bank, Ltd. (“SIBL”), an entity organized under the laws of Antigua, we assigned our right to acquire three million (3,000,000) shares of our common stock, par value $0.01 per share (the “NTR Acquired Interest”), from SIBL to NTR, whereby NTR acquired the NTR Acquired Interest directly from SIBL for a cash purchase price of $3,600,000 paid to SIBL by NTR.

Simultaneously with the Closing, NTR granted to Dr. Smith a 4-year proxy (the “NTR Proxy”) on the NTR Acquired Interest. NTR will not be represented on our Board of Directors, nor will NTR be otherwise involved in the management of the Registrant. In addition, NTR has entered into a one-year Lock-Up Agreement on the NTR Acquired Interest. In exchange for NTR’s grant of the NTR Proxy, Dr. Smith granted to NTR an option (the “Option”) to acquire one million (1,000,000) shares of our common stock owned by Dr. Smith, at an exercise price of $6.00 per share for the first two years following the anniversary of the Closing. If the Option remains unexercised on the second anniversary following the Closing, then the exercise price shall increase to $10.00 per share for the third and fourth years following the anniversary of Closing. The NTR Proxy shall terminate, and the voting rights on the NTR Acquired Interest shall revert back to NTR, upon the occurrence of: 1) NTR’s exercise of the Option at any time during the four-year Option period; or 2) the death of Dr. Smith.

2

Pursuant to the Closing Agreement, NTR has been granted piggy-back registration rights with respect to those shares of the NTR Acquired Interest that remain restricted securities (the ”Remaining Shares”). The Remaining Shares may, in the event that we propose to register any of its securities for public sale under the Securities Act of 1933, as amended (the “Securities Act”), and upon timely written request from NTR, be included in the registration statement covering those securities being registered for sale by DGSE under the Securities Act.

Sales and Marketing

All of our activities rely heavily on local television, radio and print media advertising. Marketing activities emphasize our broad and unusual array of products and services and the attractiveness of its pricing and service.

We market our bullion and rare coin trading services through a combination of advertising in national coin publications, local print media, coin and bullion wire services and our internet web site. Trades are primarily with coin and bullion dealers on a "cash on confirmation" basis which is prevalent in the industry. Cash on confirmation means that once credit is approved the buyer remits funds by mail or wire concurrently with the mailing of the precious metals. Customer orders for bullion or rare coin trades are customarily delivered within three days of the order or upon clearance of funds depending on the customer's credit standing. Our backlogs for fabricated jewelry products were not significant as of December 31, 2010, 2009 and 2008.

Seasonality

The retail and wholesale jewelry business is seasonal. We realized 31.9%, 25.9% and 22.2% of our annual sales in the fourth quarters of 2010, 2009 and 2008, respectively.

While our bullion and rare coin business is not seasonal, management believes it is directly impacted by the perception of inflation trends. Historically, anticipation of increases in the rate of inflation has resulted in higher levels of interest in precious metals as well as higher prices for such metals. Our other business activities are not seasonal.

Competition

We operate in a highly competitive industry where competition is based on a combination of price, service and product quality. Our jewelry activities compete with numerous other retail jewelers in Dallas and Euless, Texas; Woodland Hills, California; and Mt. Pleasant, South Carolina and the surrounding areas.

The bullion and rare coin industry in which we compete is dominated by substantially larger enterprises which wholesale bullion, rare coin and other precious metal products.

We attempt to compete in all of our activities by offering high quality products and services at prices below that of our competitors and by maintaining a staff of highly qualified employees.

Employees

As of December 31, 2010, we employed 70 individuals, 66 of whom were full time employees.

Available Information

Our website is located at www.dgse.com. Through this website, we make available free of charge all of our Securities and Exchange Commission filings. In addition, a complete copy of our Code of Ethics is available through this website.

Discontinued Operations and Acquisitions

Discontinued Operations.

In December 2008 we decided to discontinue the live auction segment of the Company’s business activities. This decision was based on the substantial losses being incurred by this operating segment during 2008 and 2007. As a result, the operating results of the auction segment have been reclassified to discontinued operations for 2008 and 2009. During 2008 the auction segment incurred a pretax loss of $2,379,151 and during 2009 the auction segment incurred a pretax loss of $795,328. The 2009 loss is the last of the charges from the auction segment.

In June 2009 we sold the assets of National Jewelry Exchange, Inc. (our two pawn shops) to an unrelated third party for cash in the amount of $1,324.450. The proceeds were used to retire $400,000 of our bank debt and the balance was used for working capital. As a result, operating results from National Jewelry Exchange have been reclassified to discontinued operations for all periods presented.

In November 2009 we discontinued the operations of Superior Estate Buyers due to operating loss incurred during the first half of 2009 in the amount of $87,120.

As a result, operating results from these business segments have been reclassified to discontinued operations for all periods presented. As of December 31, 2010 there were no operating assets to be disposed of or liabilities to be paid in completing the disposition of these operations.

3

ITEM 1A. RISK FACTORS.

You should carefully consider the risks described below before making an investment decision. We believe these are all the material risks currently facing our business. Our business, financial condition or results of operations could be materially adversely affected by these risks. The trading price of our common stock could decline due to any of these risks, and you may lose all or part of your investment. You should also refer to the other information included or incorporated by reference in this report, including our financial statements and related notes.

Changes in customer demand for our products and services could result in a significant decrease in revenues.

Although our customer base commonly uses our products and services, our failure to meet changing demands of our customers could result in a significant decrease in our revenues.

Changes in governmental rules and regulations applicable to the specialty financial services industry could have a negative impact on our lending activities.

Our lending is subject to extensive regulation, supervision and licensing requirements under various federal, state and local laws, ordinances and regulations. New laws and regulations could be enacted that could have a negative impact on our lending activities.

Fluctuations in our inventory turnover and sales.

We regularly experience fluctuations in our inventory balances, inventory turnover and sales margins, yields on loan portfolios and pawn redemption rates. Changes in any of these factors could materially and adversely affect our profitability and ability to achieve our planned results.

Changes in our liquidity and capital requirements could limit our ability to achieve our plans.

We require continued access to capital, and a significant reduction in cash flows from operations or the availability of credit could materially and adversely affect our ability to achieve our planned growth and operating results. Similarly, if actual costs to build new stores significantly exceeds planned costs, our ability to build new stores or to operate new stores profitably could be materially restricted. The DGSE credit agreement also limits the allowable amount of capital expenditures in any given fiscal year, which could limit our ability to build new stores.

Changes in competition from various sources could have a material adverse impact on our ability to achieve our plans.

In the coins and other collectibles business, we will compete with a number of comparably sized and smaller firms, as well as a number of larger firms throughout the United States. Our primary competitors are American Numismatic Rarities, a comparably-sized coin auctioneer. Many of our competitors have the ability to attract customers as a result of their reputation and the quality collectibles they obtain through their industry connections. Additionally, other reputable companies that sell rare coins and other collectibles may decide to enter our markets to compete with us. These companies have greater name recognition and have greater financial and marketing resources than we do. If these auction companies are successful in entering the specialized market for premium collectibles in which we participate or if dealers and sellers participate less in our auctions, we may attract fewer buyers and our revenue could decrease.

4

Our earnings could be negatively impacted by an unfavorable outcome of litigation, regulatory actions, or labor and employment matters.

From time to time, we are involved in litigation, regulatory actions and labor and employment matters arising from our normal operations. There can be no assurance as to the ultimate outcome of any future actions and that they will not have a material adverse effect on our financial condition, results of operation or liquidity.

A failure in our information systems could prevent us from effectively managing and controlling our business or serving our customers.

We rely on our information systems to manage and operate our stores and business. Each store is part of an information network that permits us to maintain adequate cash inventory, reconcile cash balances daily and report revenues and expenses timely. Any disruption in the availability of our information systems could adversely affect our operation, the ability to serve our customers and our results of operations.

A failure of our internal controls and disclosure controls and procedures could have a material adverse impact on us and our investors’ confidence in our reported financial information.

Our management, including our Chief Executive Officer and Chief Financial Officer, does not expect that our disclosure controls or internal controls over financial reporting will prevent all errors or all instances of fraud. A control system, no matter how well designed and operated, can provide only reasonable, not absolute, assurance that the control system’s objectives will be met. Further, the design of a control system must reflect the fact that there are resource constraints, and the benefits of controls must be considered relative to their costs. Because of the inherent limitations in all control systems, no evaluation of controls can provide absolute assurance that all control issues and instances of fraud, if any, within our company have been detected. These inherent limitations include the realities that judgments in decision-making can be faulty, and that breakdowns can occur because of simple error or mistake. Controls can also be circumvented by the individual acts of some persons, by collusion of two or more people, or by management override of the controls. The design of any system of controls is based in part upon certain assumptions about the likelihood of future events, and any design may not succeed in achieving its stated goals under all potential future conditions. Over time, controls may become inadequate because of changes in conditions or deterioration in the degree of compliance with policies or procedures. Because of the inherent limitation of a cost-effective control system, misstatements due to error or fraud may occur and not be detected. If we fail to maintain a system of effective internal controls, it could have a material adverse effect on our business, financial position or operating results. Additionally, adverse publicity related to a failure in our internal controls over financial reporting could have a negative impact on our reputation and business.

This Annual Report on Form 10-K does not include an attestation report of the Company’s registered public accounting firm regarding internal control over financial reporting. Management’s report was not subject to attestation by the Company’s registered public accounting firm pursuant to temporary rules of the Securities and Exchange Commission that permit the Company to provide only management’s report in this Annual Report on Form 10-K.

5

Changes in general economic conditions could negatively affect loan performance and demand for our products and services.

A sustained deterioration in the economic environment could adversely affect our operations by reducing consumer demand for the products we sell.

Interest rate fluctuations could increase our interest expense.

Although the U.S. Federal Reserve halted a sustained period of regular interest rate hikes in August 2006, interest rates could rise which would, in turn, increase our cost of borrowing.

Our success depends on our ability to attract, retain and motivate management and other skilled employees.

Our future success and growth depend on the continued services of our key management and employees. The loss of the services of any of these individuals or any other key employee or contractor could materially affect our business. Our future success also depends on our ability to identify, attract and retain additional qualified personnel. Competition for employees in our industry is intense and we may not be successful in attracting or retaining them. There are a limited number of people with knowledge of, and experience in, our industry. We do not have employment agreements with many of our key employees. We do not maintain life insurance polices on many of our employees. Our loss of key personnel, especially without advance notice, or our inability to hire or retain qualified personnel, could have a material adverse effect on sales and our ability to maintain our technological edge. We cannot guarantee that we will continue to retain our key management and skilled personnel, or that we will be able to attract, assimilate and retain other highly qualified personnel in the future.

The voting power in our company is substantially controlled by a small number of stockholders, which may, among other things, delay or frustrate the removal of incumbent directors or a takeover attempt, even if such events may be beneficial to our stockholders.

On May 25, 2010, we entered into a Closing Agreement, dated May 25, 2010 with NTR Metals, LLC, a Texas limited liability company, and Dr. L.S. Smith, our CEO. Pursuant to the Closing Agreement and that certain Purchase and Sale Agreement (and Amendments thereto), dated January 27, 2010, by and among us and Stanford International Bank, Ltd. (“SIBL”), an entity organized under the laws of Antigua, we assigned our right to acquire three million (3,000,000) shares of our common stock, par value $0.01 per share (the “NTR Acquired Interest”), from SIBL to NTR, whereby NTR acquired the NTR Acquired Interest directly from SIBL for a cash purchase price of $3,600,000 paid to SIBL by NTR.

Simultaneously with the Closing, NTR granted to Dr. Smith a 4-year proxy (the “NTR Proxy”) on the NTR Acquired Interest. NTR will not be represented on our Board of Directors, nor will NTR be otherwise involved in the management of the Registrant. In addition, NTR has entered into a one-year Lock-Up Agreement on the NTR Acquired Interest. In exchange for NTR’s grant of the NTR Proxy, Dr. Smith granted to NTR an option (the “Option”) to acquire one million (1,000,000) shares of our common stock owned by Dr. Smith, at an exercise price of $6.00 per share for the first two years following the anniversary of the Closing. If the Option remains unexercised on the second anniversary following the Closing, then the exercise price shall increase to $10.00 per share for the third and fourth years following the anniversary of Closing. The NTR Proxy shall terminate, and the voting rights on the NTR Acquired Interest shall revert back to NTR, upon the occurrence of: 1) NTR’s exercise of the Option at any time during the four-year Option period; or 2) the death of Dr. Smith.

6

We could be subject to sales taxes, interest and penalties on interstate sales for which we have not collected taxes.

Superior has not collected California sales tax on mail-order sales to out-of-state customers, nor has it collected use tax on its interstate mail order sales. We believe that our sales to interstate customers are generally tax-exempt due to varying state exemptions relative to the definitions of being engaged in business in particular states and the lack of current Internet taxation. While we have not been contacted by any state authorities seeking to enforce sales or use tax regulations, we cannot assure you that we will not be contacted by authorities in the future with inquiries concerning our compliance with current statutes, nor can we assure you that future statutes will not be enacted that affect the sales and use tax aspects of our business.

We may incur losses as a result of accumulating inventory.

A substantial portion of the products that we sell comes from our own inventory. We purchased these products from dealers and collectors and assume the inventory and price risks of these items until they are sold. If we are unable to resell the products that we purchase when we want or need to, or at prices sufficient to generate a profit from their resale, or if the market value of the inventory of purchased products were to decline, our revenue would likely decline.

Our planned expansion and enhancement of our websites and internet operations may not result in increased profitability.

The satisfactory performance, reliability and availability of our website and network infrastructure are and will be critical to our reputation and our ability to attract and retain customers and technical personnel and to maintain adequate customer service levels. Any system interruptions or reduced performance of our website could materially adversely affect our reputation and our ability to attract new customers and technical personnel. We are in the process of development and/or enhancement of several portions of our websites that will offer content and auctions for rare coins that may have a lower average selling price than many of the rare coins in the markets we currently serve, and in the future we plan to integrate various of our websites. Continued development of our websites will require significant resources and expense. If the planned expansion of our websites does not result in increased revenue, we may experience decreased profitability.

7

Our websites may be vulnerable to security breaches and similar threats which could result in our liability for damages and harm to our reputation.

Despite the implementation of network security measures, our websites are vulnerable to computer viruses, break-ins and similar disruptive problems caused by internet users. These occurrences could result in our liability for damages, and our reputation could suffer. The circumvention of our security measures may result in the misappropriation of customer or other confidential information. Any such security breach could lead to interruptions and delays and the cessation of service to our customers and could result in a decline in revenue and income.

Changes to financial accounting standards and new exchange rules could make it more expensive to issue stock options to employees, which would increase compensation costs and may cause us to change our business practices.

We prepare our financial statements to conform with generally accepted accounting principles, or GAAP, in the United States. These accounting principles are subject to interpretation by the Public Company Accounting Oversight Board, the SEC and various other bodies. A change in those policies could have a significant effect on our reported results and may affect our reporting of transactions completed before a change is announced.

We are subject to new corporate governance and internal control reporting requirements, and our costs related to compliance with, or our failure to comply with existing and future requirements could adversely affect our business.

We may incur significant legal, accounting and other expenses as a result of our required compliance with certain regulations. More specifically, the Sarbanes-Oxley Act of 2002 (the “Sarbanes-Oxley Act”), as well as rules subsequently implemented by the SEC, impose various requirements on public companies. Our management and other personnel must devote a substantial amount of time to these compliance requirements. Moreover, these rules and regulations have increased our legal and financial compliance costs and make some activities more time-consuming and costly.

The Sarbanes-Oxley Act requires, among other things, that we maintain effective internal controls for financial reporting and disclosure controls and procedures. In particular, beginning with our year ended December 31, 2007, management was required to perform system and process evaluation and testing of the effectiveness of our internal controls over financial reporting, as required by Section 404(a) of the Sarbanes-Oxley Act. Section 404(b) of the Sarbanes-Oxley Act required companies to obtain auditor’s attestation related to their assessment of the effectiveness of our internal controls over financial reporting. The compliance deadline for smaller reporting companies to comply with Section 404(b) had been extended by the SEC to annual reports covering fiscal years ended on or after June 15, 2010, or in our case for our annual report covering our year ended December 31, 2010.

On July 21, 2010, President Obama signed into law the Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Wall Street Reform Act”). Section 989G of the Wall Street Reform Act expressly exempts issuers that are neither “large accelerated filers” nor “accelerated filers” (which includes smaller reporting companies) from the requirement contained in Section 404(b) of the Sarbanes Oxley Act to provide an auditor attestation of internal control over financial reporting.

Although we are no longer required to comply with Section 404(b), we remain subject to Section 404(a) (that is, management’s report on our internal controls over financial reporting). Our testing may reveal deficiencies in our internal controls over financial reporting that are deemed to be material weaknesses. As a result, our compliance with Section 404(a) may require that we incur substantial accounting expense and expend significant management efforts. We do not have an internal audit group, and we may need to hire additional accounting and financial staff with appropriate public company experience and technical accounting knowledge to ensure compliance with these regulations and/or to correct such material weaknesses. If we are not able to comply with the requirements of Section 404(a), or if we identify deficiencies in our internal controls over financial reporting, the market price of our common shares could decline, and we could be subject to sanctions or investigations by the SEC or other regulatory authorities, which would require additional financial and management resources.

8

The revolving credit facility with Texas Capital Bank, N.A. is collateralized by a general security interest in our assets. If we were to default under the terms of the credit facility, the lender would have the right to foreclose on our assets.

In December 2005, we entered into a revolving credit facility with Texas Capital Bank, N.A., which permits borrowings up to a maximum principal amount of $4.5 million. Borrowings under the revolving credit facility are collateralized by a general security interest in substantially all of our assets (other than the assets of Superior). As of December 31, 2010, approximately $4.5 million was outstanding under the term loan and revolving credit facility. If we were to default under the terms and conditions of the revolving credit facility, Texas Capital Bank would have the right to accelerate any indebtedness outstanding and foreclose on our assets in order to satisfy our indebtedness. Such a foreclosure could have a material adverse effect on our business, liquidity, results of operations and financial position.

We have not paid dividends on our common stock in the past and do not anticipate paying dividends on our common stock in the foreseeable future.

We have not paid common stock dividends since our inception and do not anticipate paying dividends in the foreseeable future. Our current business plan provides for the reinvestment of earnings in an effort to complete development of our technologies and products, with the goal of increasing sales and long-term profitability and value. In addition, our revolving credit facility with Texas Capital Bank currently restricts, and any other credit or borrowing arrangements that we may enter into may in the future restrict or limit, our ability to pay dividends to our stockholders.

9

ITEM 1B. UNRESOLVED STAFF COMMENTS.

None.

ITEM 2. PROPERTIES.

We own a 20,000 square foot facility at 11311 Reeder Rd, Dallas, Texas which houses retail and wholesale jewelry, bullion and rare coin trading operations and our principal executive offices. The land and buildings are subject to a mortgage maturing in August 2016, with a balance outstanding of approximately $2,165,167 as of December 31, 2010.

Our Euless, TX location is a 2,158 square foot facility which houses retail jewelry, bullion and rare coin trading operations. Our monthly lease payments at December 31, 2010 are $2,248 and the lease is due to expire June 30, 2015.

CGDE operates in a leased 2,367 square foot facility in Mt. Pleasant, South Carolina. The lease expires in May 2015 and requires monthly lease payments in the amount of $5,146.

Our Superior Galleries operations are located in an approximately 9,265 square foot storefront facility located at 20011 Ventura Boulevard, Woodland Hills, California. This facility includes administrative, customer support, gallery and retail space. The lease for this facility expires March 31, 2013. The average combined monthly rental rate is $33,064 including parking fees and rent of storage space.

We also maintain a resident agent office in Nevada at the office of our Nevada counsel, McDonald, Carano, Wilson, McClure, Bergin, Frankovitch and Hicks, 241 Ridge Street, Reno, Nevada 89505.

ITEM 3. LEGAL PROCEEDINGS.

From time to time, be involved in various claims, lawsuits, disputes with third parties, actions involving allegations of discrimination, or breach of contract actions incidental to the operation of its business. Except as set forth above, we are not currently involved in any such litigation which we believe could have a material adverse effect on our financial condition or results of operations, liquidity or cash flows.

On January 27, 2010, the Company and Stanford International Bank, LTD (‘SIBL”), which prior to the closing of certain settlement agreements discussed below was a beneficial owner of a significant equity interest in DGSE, a primary lender to a wholly owned subsidiary of DGSE and subject to certain agreements with DGSE and its Chairman, entered into a Purchase and Sale Agreement and a Debt Conversion Agreement to settle DGSE’s lawsuit against SIBL. On May 25, 2010, DGSE and SIBL and a third party entered in a closing agreement to finalize the settlement agreements upon the approval of the settlement by the United States District Court for the Northern District of Texas which has jurisdiction for the assets of SIBL. Upon closing of the transaction, SIBL terminated all agreements, converted all of its subsidiary's debt, interest and other expenses for 1,000 shares of DGSE common stock provided to its subsidiary, and sold 3,000,000 shares of common stock to DGSE’s assignee, NTR Metals for $3,000,000 under a Partial Assignment Agreement. Pursuant to the partial assignment of the Company’s rights as a Buyer to NTR under the Company-SIBL Purchase Agreement, NTR acquired directly from SIBL 3,000,000 Shares of the Company (the “NTR Acquired Interest”). The parties agreed that the remaining portion of the SIBL Equity Interest (i.e. 377,361 Shares) be transferred as designated by the Company. SIBL cancelled 422,814 additional warrants to purchase additional shares of DGSE as part of the settlement agreement. As a result of the transaction, the Company recognized a gain of $9,198,570 related to the cancellation of debt.

On February 26, 2010, Superior Galleries, Inc. (‘Superior’) entered into a settlement agreement for a lawsuit filed by its previous landlord, DBKK, LLC for $385,000 to be paid over three years bearing interest at 8%. The Company’s settlement with DBBK was a risk management decision based on an original claim in the amount of $806,000. The lawsuit resulted from a lease transaction entered into by certain officers of Superior. As of September 30, 2010, the Company has recorded $385,000 loss related to the settlement of this litigation in other (income) expense.

10

PART II

ITEM 5. MARKET FOR COMMON EQUITY AND RELATED STOCKHOLDER MATTERS.

On October 31, 2007, our Common Stock began trading on the NYSE Amex under the symbol “DGC” and is currently trading under the symbol “DGSE”. Previously, our Common Stock was traded on the NASDAQ Small CAP Market under the symbol “DGSE”. The following table sets forth for the period indicated, the per share high and low bid quotations as reported on NYSE Amex for our common stock. During the past three years, we have not declared any dividends with respect to our common stock. We intend to retain all earnings to finance future growth; accordingly, it is not anticipated that cash dividends will be paid to holders of common stock in the foreseeable future.

The Company entered into agreements to sell securities through an exempt offering to certain accredited investors in August 2010. The Company filed a Form D.) "Notice of Exempt Offering of Securities" in accordance with SEC regulations to report the offering. The private placement of units, with each unit consisting of (1) 24,286 shares of common stock and (2) $50,000 of indebtedness of the company, evidenced by notes convertible into common stock, for a purchase price of $100,000 per unit, generated aggregate of proceeds of $500,000. The shares of common stock were issued in October 2010.

The following quotations reflect inter-dealer prices without retail mark-ups, mark-downs or commissions and may not reflect actual transactions. High and low bid quotations for the last two years were:

|

2010

|

High

|

Low

|

||||||

|

Fourth Quarter

|

$ | 4.840 | $ | 3.520 | ||||

|

Third Quarter

|

4.020 | 2.410 | ||||||

|

Second Quarter

|

3.250 | 1.610 | ||||||

|

First Quarter

|

2.560 | 1.300 | ||||||

|

2009

|

High

|

Low

|

||||||

|

Fourth Quarter

|

$ | 1.750 | $ | 1.160 | ||||

|

Third Quarter

|

1.500 | 0.780 | ||||||

|

Second Quarter

|

1.200 | 0.760 | ||||||

|

First Quarter

|

1.950 | 0.760 | ||||||

On April 14, 2011, the closing sales price for our common stock was $5.20 and there were 595 shareholders of record.

Securities authorized for issuance under equity compensation plans.

We have granted options to certain officers, directors and key employees to purchase shares of our common stock. Each option vests according to a schedule designed by our board of directors, not to exceed four years. Each option expires 180 days from the date of termination of the employee or director. The exercise price of each option is equal to the market value of our common stock on the date of grant. These option grants have been approved by security holders.

The following table summarizes options outstanding as of December 31, 2010:

|

Plan Category

|

Number of securities to be issued upon exercise of options, warrants & rights

|

Weighted average exercise price of outstanding options, warrants & rights

|

Number of securities remaining available for future issuance under equity compensation plans

|

|||||||||

|

Equity compensation plans approved by security holders

|

1,498,134 | $ | 2.34 | 700,000 | ||||||||

|

Equity compensation plans not approved by security holders

|

None

|

-- |

None

|

|||||||||

|

Total

|

1,498,134 | $ | 2.34 | 700,000 | ||||||||

On June 27, 2006 stockholders of the Company approved the adoption of the 2006 Equity Incentive Plan (the “2006 Plan). During the year ended December 31, 2007, there were 130,000 options granted to our non-employee directors under this plan and, as a result, there are 700,000 shares available for future grants under the 2006 Plan.

11

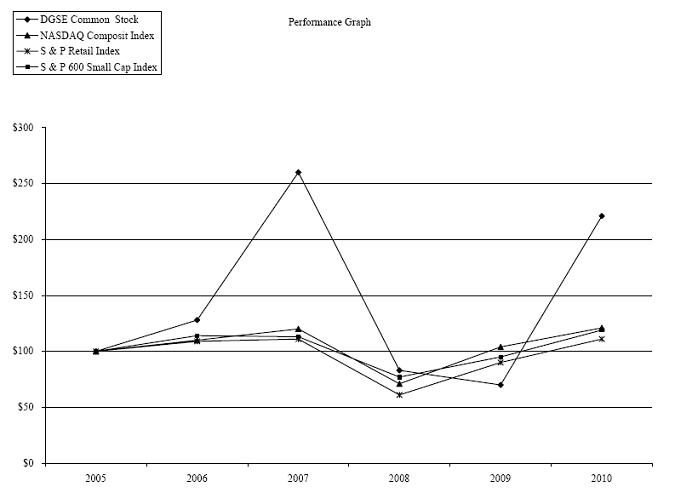

Stock Performance Table

The following table represents a comparison of the five year total return of our common stock to the NASDAQ Composite Index, the S&P 600 Small Cap Index and the S&P Retail Index for the period from January 1, 2006 to December 31, 2010. The comparison assumes $100 was invested on December 31, 2005 and dividends, if any, were reinvested for all years ending December 31.

|

Comparison of Five Year Cumulative Return

|

||||||||||||||||

|

Date:

|

DGSE Common Stock

|

NASDAQ Composite Index

|

S&P Retail Index

|

S&P 600 Small Cap Index

|

||||||||||||

|

2005

|

100 | 100 | 100 | 100 | ||||||||||||

|

2006

|

128 | 110 | 109 | 114 | ||||||||||||

|

2007

|

260 | 120 | 111 | 113 | ||||||||||||

|

2008

|

83 | 71 | 61 | 77 | ||||||||||||

|

2009

|

70 | 104 | 90 | 95 | ||||||||||||

|

2010

|

221 | 121 | 111 | 119 | ||||||||||||

12

ITEM 7. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS.

CAUTIONARY STATEMENT REGARDING RISKS AND UNCERTAINTIES THAT MAY AFFECT FUTURE RESULTS

Forward-Looking Statements

This Annual Report on Form 10-K, including Management's Discussion and Analysis of Financial Condition and Results of Operations, includes "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements generally can be identified by the use of forward-looking terminology, such as "may," "will," "would," "expect," "intend," "could," "estimate," "should," "anticipate" or "believe." We intend that all forward-looking statements be subject to the safe harbors created by these laws. All statements other than statements of historical information provided herein are forward-looking and may contain information about financial results, economic conditions, trends, and known uncertainties. All forward-looking statements are based on current expectations regarding important risk factors. Many of these risks and uncertainties are beyond our ability to control, and, in many cases, we cannot predict all of the risks and uncertainties that could cause our actual results to differ materially from those expressed in the forward-looking statements. Actual results could differ materially from those expressed in the forward-looking statements, and readers should not regard those statements as a representation by us or any other person that the results expressed in the statements will be achieved. Important risk factors that could cause results or events to differ from current expectations are described under the section “Risk Factors” and elsewhere in this report. These factors are not intended to be an all-encompassing list of risks and uncertainties that may affect the operations, performance, development and results of our business. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof. We undertake no obligation to release publicly the results of any revisions to these forward-looking statements which may be made to reflect events or circumstances after the date hereon, including without limitation, changes in our business strategy or planned capital expenditures, store growth plans, or to reflect the occurrence of unanticipated events.

Critical Accounting Policies and Estimates

Our significant accounting policies are disclosed in Note 1 of our consolidated financial statements. The following discussion addresses our most critical accounting policies, which are those that are both important to the portrayal of our financial condition and results of operations and that require significant judgment or use of complex estimates.

Inventories. Jewelry and other inventories are valued at the lower of cost or market. Bullion is valued at the lower-of-cost-or-market (average cost).

The Company acquires a majority of its retail jewelry inventory from individuals that is pre-owned. The Company acquires the jewelry based on its own internal estimate of the fair market value of the items offered for sale considering factors such as the current spot market prices of precious metals and current demand for the items offered for sale. Because the overall market value for precious metals fluctuates, these fluctuations could have either a positive or negative impact to the profitability of the Company. The Company monitors these fluctuations to evaluate any impairment to its retail jewelry inventory. See also “Critical Accounting Estimates”.

Impairment of Long-Lived and Amortized Intangible Assets. The Company performs impairment evaluations of its long-lived assets, including property, plant and equipment and intangible assets with finite lives, including the customer base acquired in the Superior acquisition, whenever business conditions or events indicate that those assets may be impaired. When the estimated future undiscounted cash flows to be generated by the assets are less than the carrying value of the long-lived assets, the assets are written down to fair market value and a charge is recorded to current operations. Based on our evaluations no impairment was required as of December 31, 2010.

Impairment of Goodwill and Indefinite-Lived Intangible Assets. Goodwill and indefinite-lived intangible assets are tested for impairment annually, or more frequently if events or changes in circumstances indicate that the assets might be impaired. The Company performs its annual review at the beginning of the fourth quarter of each fiscal year.

13

The Company evaluates the recoverability of goodwill by estimating the future discounted cash flows of the businesses to which the goodwill relates. Estimated cash flows and related goodwill are grouped at the reporting unit level. A reporting unit is an operating segment or, under certain circumstances, a component of an operating segment that constitutes a business. When estimated future discounted cash flows are less than the carrying value of the net assets and related goodwill, an impairment test is performed to measure and recognize the amount of the impairment loss, if any. Impairment losses, limited to the carrying value of goodwill, represent the excess of the carrying amount of a reporting unit’s goodwill over the implied fair value of that goodwill. In determining the estimated future cash flows, the Company considers current and projected future levels of income as well as business trends, prospects and market and economic conditions.

The Company cannot predict the occurrence of certain events that might adversely affect the carrying value of goodwill and indefinite-lived intangible assets. Such events may include, but are not limited to, the impact of the economic environment, a material negative change in relationships with significant customers, or strategic decisions made in response to economic and competitive conditions. See “Critical Accounting Estimates.”

Revenue Recognition. Revenue is generated from wholesale and retail sales of rare coins, precious metals, bullion and second-hand jewelry. The recognition of revenue varies for wholesale and retail transactions and is, in large part, dependent on the type of payment arrangements made between the parties. The Company recognizes sales on an F.O.B. shipping point basis.

The Company sells rare coins to other wholesalers/dealers within its industry on credit, generally for terms of 14 to 60 days, but in no event greater than one year. The Company grants credit to new dealers based on extensive credit evaluations and for existing dealers based on established business relationships and payment histories. The Company generally does not obtain collateral with which to secure its accounts receivable when the sale is made to a dealer. The Company maintains reserves for potential credit losses based on an evaluation of specific receivables and its historical experience related to credit losses. See “Critical Accounting Estimates”.

Revenues for monetary transactions (i.e., cash and receivables) with dealers are recognized when the merchandise is shipped to the related dealer.

The Company also sells rare coins to retail customers on credit, generally for terms of 30 to 60 days, but in no event greater than one year. The Company grants credit to new retail customers based on extensive credit evaluations and for existing retail customers based on established business relationships and payment histories. When a retail customer is granted credit, the Company generally collects a payment of 25% of the sales price, establishes a payment schedule for the remaining balance and holds the merchandise as collateral as security against the customer’s receivable until all amounts due under the credit arrangement are paid in full. If the customer defaults in the payment of any amount when due, the Company may declare the customer’s obligation in default, liquidate the collateral in a commercially reasonable manner using such proceeds to extinguish the remaining balance and disburse any amount in excess of the remaining balance to the customer.

Under this retail arrangement, revenues are recognized when the customer agrees to the terms of the credit and makes the initial payment. We have a limited-in-duration money back guaranty policy (as discussed below).

In limited circumstances, the Company exchanges merchandise for similar merchandise and/or monetary consideration with both dealers and retail customers, for which the Company recognizes revenue in accordance with FASB ASC 845-10-25, Nonmonetary Transactions. When the Company exchanges merchandise for similar merchandise and there is no monetary component to the exchange, the Company does not recognize any revenue. Instead, the basis of the merchandise relinquished becomes the basis of the merchandise received, less any indicated impairment of value of the merchandise relinquished. When the Company exchanges merchandise for similar merchandise and there is a monetary component to the exchange, the Company recognizes revenue to the extent of monetary assets received and determine the cost of sale based on the ratio of monetary assets received to monetary and non-monetary assets received multiplied by the cost of the assets surrendered.

14

The Company has a return policy (money-back guarantee). The policy covers retail transactions involving graded rare coins only. Customers may return graded rare coins purchased within 7 days of the receipt of the rare coins for a full refund as long as the rare coins are returned in exactly the same condition as they were delivered. In the case of rare coin sales on account, customers may cancel the sale within 7 days of making a commitment to purchase the rare coins. The receipt of a deposit and a signed purchase order evidences the commitment. Any customer may return a coin if they can demonstrate that the coin is not authentic, or there was an error in the description of a graded coin.

Revenues from the sale of consigned goods are recognized as commission income on such sale if the Company is acting as an agent for the consignor. If in the process of selling consigned goods, the Company makes an irrevocable payment to a consignor for the full amount due on the consignment and the corresponding receivable from the buyer(s) has not been collected by the Company at that payment date, the Company records that payment as a purchase and the sale of the consigned good(s) to the buyer as revenue as the Company has assumed all collection risk.

Allowance for Doubtful Accounts. The allowance for doubtful accounts requires management to estimate a customer’s ability to satisfy its obligations. The estimate of the allowance for doubtful accounts is particularly critical in the Company’s wholesale coin segment where a significant amount of the Company’s trade receivables are recorded. The Company evaluates the collectability of receivables based on a combination of factors. In circumstances where the Company is aware of a specific customer’s inability to meet its financial obligations, a specific reserve is recorded against amounts due to reduce the net recognized receivable to the amount reasonably expected to be collected. Additional reserves are established based upon the Company’s perception of the quality of the current receivables, including the length of time the receivables are past due, past experience of collectability and underlying economic conditions. If the financial condition of the Company’s customers were to deteriorate resulting in an impairment of their ability to make payments, additional reserves would be required.

Impairment of Goodwill and Indefinite-Lived Intangible Assets. In evaluating the recoverability of goodwill, it is necessary to estimate the fair value of the reporting units. The estimate of fair value of intangible assets is generally determined on the basis of discounted future cash flows. The estimate of fair value of the reporting units is generally determined on the basis of discounted future cash flows supplemented by the market approach. In estimating the fair value, management must make assumptions and projections regarding such items as future cash flows, future revenues, future earnings and other factors. The assumptions used in the estimate of fair value are generally consistent with the past performance of each reporting unit and are also consistent with the projections and assumptions that are used in current operating plans. Such assumptions are subject to change as a result of changing economic and competitive conditions. The rate used to discount estimated cash flows is a rate corresponding to the Company’s cost of capital, adjusted for risk where appropriate, and is dependent upon interest rates at a point in time. There are inherent uncertainties related to these factors and management’s judgment in applying them to the analysis of goodwill impairment. It is possible that assumptions underlying the impairment analysis will change in such a manner to cause further impairment of goodwill, which could have a material impact on the Company’s results of operations.

During the 4th quarter of 2008, given the sustained decline in the price of the Company’s Common Stock during 2008 when its share price approximated book value, continued operating losses within the auction segment, as well as further deterioration in credit markets and the macro-economic environment, the Company determined that the appropriate triggers had been reached to perform additional impairment testing on goodwill and its indefinite-lived intangible assets.

To derive the fair value of its reporting units, the Company performed extensive valuation analyses, utilizing both income and market approaches. Under the income approach, the Company determined fair value based on estimated future cash flows discounted by an estimated weighted-average cost of capital, which reflects the overall level of inherent risk of a reporting unit and the rate of return an outside investor would expect to earn. Estimated future cash flows were based on the Company’s internal projection models, industry projections and other assumptions deemed reasonable by management. For the impairment analysis, the Company used a weighted-average cost of capital of 20% and a terminal growth rate of 3%. Under the market approach, the Company evaluated the fair value of its reporting units based on the overall actual market capitalization trend of the Company as compared to the net book value of the Company. Changes in estimates or the application of alternative assumptions could produce significantly different results.

15

As a result of this analysis, $8,185,443 of goodwill was written off during the 4th quarter of fiscal 2008 relating to the goodwill resulting from the Superior Galleries acquisition. The evaluation of other long-lived intangible assets relating to the Superior Galleries acquisition were not written off due to new business generated from the Superior Galleries, Inc. through the establishment of two new entities, Superior Estate Buyers and Superior Precious Metals, which attracted approximately $9.8 million and $1.8 million, respectively, in revenues in their first full year of operations in 2008. These charges were driven by current projections and valuation assumptions that reflected the Company’s belief that the Superior Galleries, Inc. wholesale auction and coin segments would not sustain adequate growth and profitability to generate cash flow, especially in the current downtown in the economy.

The analysis of the wholesale watch sales division resulting from the acquisition of Fairchild with a carrying value of goodwill of $837,117 resulted in no impairment as its estimated future discounted cash flows significantly exceeded the net assets and related goodwill.

Income Taxes. Income taxes are estimated for each jurisdiction in which we operate. This involves assessing the current tax exposure together with temporary differences resulting from differing treatment of items for tax and financial statement accounting purposes. Any resulting deferred tax assets are evaluated for recoverability based on estimated future taxable income. To the extent that recovery is deemed not likely, a valuation allowance is recorded. See “Critical Accounting Estimates”.

The Company records deferred income tax assets and liabilities for differences between the book basis and tax basis of the related net assets. The Company records a valuation allowance, when appropriate, to adjust deferred tax asset balances to the amount management expects to realize. Management considers, as applicable, the amount of taxable income available in carryback years, future taxable income and potential tax planning strategies in assessing the need for a valuation allowance. The Company has recorded the net present value of the future expected benefits of the net operating loss (NOL) carryforward related to its subsidiary Superior Galleries, Inc. due to IRS loss limitation rules. The Company will require future taxable income to fully realize the net deferred tax asset resulting from the NOL.

Interest costs and penalties related to income taxes are classified as interest expense and general and administrative costs, respectively, in the Company’s consolidated financial statements. For the years ended December 31, 2010 and 2009, the Company did not recognize any interest or penalty expense related to income taxes. It is determined not to be reasonably likely for the amounts of unrecognized tax benefits to significantly increase or decrease within the next 12 months. The Company is currently subject to a three year statute of limitations by major tax jurisdictions. The Company and its subsidiaries file income tax returns in the U.S. federal jurisdiction.

16

Results of Operations

Comparison of the Years ended December 31, 2010 and 2009

Revenues decreased by $2,802,000 or 3.3%, in 2010. This decrease was primarily the result of a $3,082,000, or 22.0% decrease in rare coin and jewelry sales. The decreases in rare coin and jewelry sales were due to a sluggish retail environment where there appears to be less interest in rare coins as compared to bullion related products. Cost of goods sold as a percentage of sales increased slightly to 85.7% in 2010 from 85.6% in 2009 and gross margins decreased slightly to 14.3% in 2010 from 14.4% in 2009. This decrease was due to an increase in precious metal sales which have a lower margin than jewelry and rare coins revenues.

Selling, general and administrative expenses decreased $343,000 or 3.2% during the year. This decrease was primarily due to reduced advertising expenses. Depreciation and amortization increased by $84,000 during 2010 due to new assets being placed into service and the amortization of deferred financing costs associated with the renewal of our credit facility.

In May 2010, the Company undertook a complete accounting and financial reporting system conversion, replacing an older accounting system with a newer system that provides better reporting, functionality, and improved controls. Management determined the conversion requirements and the conversion process created multiple process and reporting errors in their general ledger and financial reporting modules inclusive of multiple book to physical and other inventory reconciling items, under reporting of customer deposits, and various unreconcilable errors identified when the Company performed its annual book to physical count adjustments at year end. The sum total of adjustments required to correct the effected account balances was $3,771,702 which was reflected as an adjustment to inventory impairment expense in the second quarter. These adjustments are reflected net of tax effects in our second quarter results that have been restated in the quarterly comparison in Note 19 of our financial statements. See also management’s discussion of the internal control deficiency which precipitated this reporting problem.

Other income during 2010 was a result of the transaction concluded with the Receiver in the matter of Stanford International Bank LTD as discussed in Legal Proceedings above.

In November 2008 we decided to discontinue the live auction segment of the Company’s business activities. This decision was based on the substantial losses being incurred by this operating segment during 2008. As a result, the operating results of the auction segment have been reclassified to discontinued operations for 2009 and 2008. During 2008 the auction segment incurred a pretax loss of $3,227,151which includes $848,000 related to the impairment of goodwill associated with the Superior acquisition in May 2007. During 2009 the auction segment incurred a pretax loss of $710,056.

In June 2009 we sold the assets of National Jewelry Exchange, Inc. (our two pawn shops to an unrelated third party for cash in the amount of $ 1,324.450. The proceeds were used to retire $400,000 of our bank debt and the balance was used for working capital. As a result, the operations results of this segment have been classified as discontinued operations.

In December 2009, the Company decided to discontinue operations of Superior Estate Buyers. This decision was based on the substantial losses being incurred by this component during 2009. As a result, the operating results of this segment have been reclassified to discontinued operations for 2009 and 2008. During 2009, Superior Estate Buyers incurred a pretax loss of $87,120.

As a result, operating results from these business segments have been reclassified to discontinued operations for all periods presented

Income tax expense is directly affected by the levels of pretax income and non-deductible permanent differences. The Company’s effective tax rate was (16.0%) and 31.5% for the year ended December 31, 2010 and 2009, respectively.

Comparison of the Years ended December 31, 2009 and 2008

Revenues decreased by $15,854,000 or 15.6%, in 2009. This decrease was primarily the result of a $2,652,000 or 5.8% decrease in the sale of precious metals products, a $11,958,000 or 32.6% decrease in retail jewelry sales and a $1,890,000, or 11.8% decrease in rare coin sales. The decreases in precious metals and rare coin sales were due to a reduced availability of precious metal products and the reduction of activity at Superior as a result of the discontinuance of the auction business segment. The decrease in jewelry sales was due to the sluggish retail environment. In addition, the discontinuance of the auction business segment and the sale of our pawn shops had an indirect effect on our retail sales. Cost of goods sold as a percentage of sales decreased to 85.6% in 2009 from 87.7% in 2008 and gross margins increased to 14.4% in 2009 from 12.3% in 2008. This increase was due to the decrease in precious metal sales which have a lower margin than jewelry and rare coins revenues.

17

Selling, general and administrative expenses increased $2,446,000 or 29.43% during the year. This increase was due to higher advertising and payroll related cost. Depreciation and amortization increased by $14,066 during 2009 due to new assets being placed into service. The decrease in interest expense was due to the reduction in debt outstanding and the non payment of the Superior related debt to Stanford International Bank resulting from the bank’s default under the loan agreement. Loss from discontinued operations was the result of the discontinuing the operations of our live

During 2008, the Company reflected $8,185,443 of goodwill relating to the acquisition of Superior Galleries. Inc. in May 2007. Under SFAS No. 142, the Company is required to undertake an annual impairment test at its year end or when there is a triggering event. In addition to the annual impairment review, there were a number of triggering events in the fourth quarter due to the significant operating losses of Superior and the impact of the economic downturn on Superior’s operations and the decline in the Company’s share price resulting in a substantial discount of the market capitalization to tangible net asset value. An evaluation of the recorded goodwill was undertaken, which considered two methodologies to determine the fair-value of the entity:

|

·

|

A market capitalization approach, which measure market capitalization at the measurement date.

|

|

|

·

|

A discounted cash flow approach, which entails determining fair value using a discounted cash flow methodology. This method requires significant judgment to estimate the future cash flow and to determine the appropriate discount rates, growth rates, and other assumptions.

|

Each of these the Company believes has merit, and resulted in the determination that goodwill was impaired. Accordingly, to reflect the impairment, the Company recorded a non-cash charge of $8,185,443, which eliminated the value of the goodwill related to Superior.

In November 2008 we decided to discontinue the live auction segment of the Company’s business activities. This decision was based on the substantial losses being incurred by this operating segment during 2008. As a result, the operating results of the auction segment have been reclassified to discontinued operations for 2009 and 2008. During 2008 the auction segment incurred a pretax loss of $3,227,151which includes $848,000 related to the impairment of goodwill associated with the Superior acquisition in May 2007. During 2009 the auction segment incurred a pretax loss of $710,056.

In June 2009 we sold the assets of National Jewelry Exchange, Inc. (our two pawn shops to an unrelated third party for cash in the amount of $ 1,324.450. The proceeds were used to retire $400,000 of our bank debt and the balance was used for working capital. As a result, the operations results of this segment have been classified as discontinued operations.

In December 2009, the Company decided to discontinue operations of Superior Estate Buyers. This decision was based on the substantial losses being incurred by this component during 2009. As a result, the operating results of this segment have been reclassified to discontinued operations for 2009 and 2008. During 2009, Superior Estate Buyers incurred a pretax loss of $87,120.

As a result, operating results from these business segments have been reclassified to discontinued operations for all periods presented

Income tax expense is directly affected by the levels of pretax income and non-deductible permanent differences related to the goodwill impairment. The Company’s effective tax rate was 31.5% and 23.1% for the year ended December 31, 2009 and 2008, respectively.

18

Liquidity and Capital Resources

During the three years ended December 31, 2010 cash flows from operating activities totaled ($1,798,418), $1,317,816, and ($1,013,482), respectively. Cash used in operating activities during 2010 was primarily the result of inventory purchases ($3,052,133) offset by an increase customer deposits, $335,859, an increase in accounts payable and accrued expenses, $86,438 and a decrease in prepaid expenses, $390,933. The increase in deposits was primarily the result of a 29% price increase in gold products and a significant increase in the demand for precious metal products.

During the three years ended December 31, 2010 cash flows from investing activities totaled ($73,141) $851,204, and ($1,222,178). The cash used in 2010 was the result of the purchase and installation of a new accounting system. The cash provided in 2009 was primarily due to the proceeds from the sale discontinued operations. The uses of cash in 2008 were primarily the result of building improvements ($1,130,602) during 2008.

During the three years ended December 31, 2010 cash flows from financing activities totaled $1,296,303, ($942,389) and $1,919,205. These cash flows were the result of borrowings and repayments of loans. In 2010, we also received $500,000 in proceeds from the issuance of common stock and convertible debt. The Company entered into agreements to sell securities through an exempt offering to certain accredited investors in August 2010. The Company filed a Form D.) "Notice of Exempt Offering of Securities" in accordance with SEC regulations to report the offering. The private placement of units, with each unit consisting of (1) 24,286 shares of common stock and (2) $50,000 of indebtedness of the company, evidenced by notes convertible into common stock, for a purchase price of $100,000 per unit, generated aggregate of proceeds of $500,000. The shares of common stock were issued in October 2010.

We expect capital expenditures to total approximately $150,000 during the next twelve months. It is anticipated that these expenditures will be funded from working capital. As of December 31, 2010 there were no commitments outstanding for capital expenditures.

In the event of significant growth in retail and or wholesale jewelry sales, the demand for additional working capital will expand due to a related need to stock additional jewelry inventory and increases in wholesale accounts receivable. Historically, vendors have offered us extended payment terms to finance the need for jewelry inventory growth and our management believes that we will continue to do so in the future. Any significant increase in wholesale accounts receivable will be financed under a new bank credit facility or from short-term loans from individuals.

Our ability to finance our operations and working capital needs are dependent upon management’s ability to negotiate extended terms or refinance its debt. We have historically renewed, extended or replaced short-term debt as it matures and management believes that we will be able to continue to do so in the near future.

From time to time, we have adjusted our inventory levels to meet seasonal demand or in order to meet working capital requirements. Management is of the opinion that if additional working capital is required, additional loans can be obtained from individuals or from commercial banks. If necessary, inventory levels may be adjusted in order to meet unforeseen working capital requirements.

On May 27, 2010, the Company announced that Texas Capital Bank has agreed to renew and increase the size of its current credit facility. The new facility is composed of a $3.5 million revolving note and a $1.0 million term loan provided immediate availability to finance current operations. The agreement was finalized and funded June 2, 2010. Borrowings under the revolving credit facility are collateralized by a general security interest in substantially all of our assets (other than the assets of Superior). As of December 31, 2010, approximately $4.5 million was outstanding under the term loan and revolving credit facility. If we were to default under the terms and conditions of the revolving credit facility, Texas Capital Bank would have the right to accelerate any indebtedness outstanding and foreclose on our assets in order to satisfy our indebtedness. Such a foreclosure could have a material adverse effect on our business, liquidity, results of operations and financial position. This credit facility matures in June 2011. As of December 31, 2010 the Company was not in full compliance of the loan covenants, however, management believes the non-compliance was cured as of March 31, 2011.

19